Académique Documents

Professionnel Documents

Culture Documents

Here Are The Entries Made by AP

Transféré par

Irfan Mohammad0 évaluation0% ont trouvé ce document utile (0 vote)

45 vues4 pagesHere Are the Entries Made by AP

Titre original

Here Are the Entries Made by AP

Copyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentHere Are the Entries Made by AP

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

45 vues4 pagesHere Are The Entries Made by AP

Transféré par

Irfan MohammadHere Are the Entries Made by AP

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 4

Here are the entries made by AP.

Transaction Natural Account Debit Credit

Invoice Accounting (Inv

directly in AP)

Expense $100

Accounts Payable $100

Invoice from Purchasing Accrual $100

Accounts Payable $100

Invoice Cancellation Accounts Payable $100

Expense $100

Payment is made Accounts Payable $100

Cash $100

Void a payment Cash $100

Accounts Payable $100

Pre-Payment is made Prepayment $100

Cash $100

Item is received after Pre-

Payment

Expense $100

Prepayment $100

Debit Memo Accounts Payable $100

Expense $100

Credit Memo Accounts Payable $100

Expense $100

Here are the entries made by FA.

Transaction Natural Account Debit Credit

Asset is added Asset Cost $100

Asset Clearing $100

Asset Depreciation Depreciation Expense $100

Accumulated

Depreciation

$100

Asset Retirement

W/o proceeds and W/o

removal cost

Accumulated

Depreciation

$60

Gain/Loss $40

Asset Cost $100

Asset Retirement

With Proceeds, W/o Cost

of removal

Accumulated

Depreciation

$60

Gain/Loss $40

Gain/Loss $10

Proceeds from Sale $10

Asset Cost $100

Asset Retirement -

With Cost of removal

Accumulated

Depreciation

$60

Gain/Loss $40

Gain/Loss $5

Cost of removal Clearing $5

Asset Cost $100

Simple Accounting Entries in Receivables

Standard Transaction

Receivables a/c Dr

To Revenue a/c Cr

To Tax a/c Cr

To freight Cr

Revenue recognization Invoice with rules (in 1

st period of rule)

Bill in Advance Receivables a/c Dr

To Revenue a/c Cr

To Tax a/c Cr

To freight Cr

In each period when revenue is recognized

Unearned revenue a/c Dr

To revenue Cr

Invoice With rules

Bill in Arrears Unbilled Receivables a/c Dr

To revenue a/c Cr

In each period when revenue is recognized

Receivables a/c Dr

To Unbilled Receivables a/c Cr

To Tax a/c Cr

To freight Cr

Debit memo Entry Receivables a/c Dr

To Revenue a/c Cr

To Tax a/c Cr

To freight Cr

Credit memo Entry

Against Invoice, chargebackRevenue a/c Dr

Tax a/c Dr

Freight Dr

To Receivables a/c Cr

When credit memo adjusted with Invoice, Chargeback,

Receivables a/c Dr

To Receivables a/c Cr

Credit memo against commitmentRevenue a/c Dr

To Receivables a/c Cr

On a/c Credit Revenue a/c Dr

Tax a/c Dr

Freight Dr

To Receivables a/c Cr

Deposit Entry Receivables a/c Dr

To unearned Revenue a/c Cr

Receivables a/c Dr

To Revenue a/c Cr

To Tax a/c Cr

To Freight a/c Cr

Adjustment on Invoice against deposit Unearned revenue a/c Dr

To Receivables a/c Cr

Guarantee Entry Unbilled receivables

To unearned Revenue a/c Cr

Adjustment on Invoice against on GuaranteeReceivables a/c Dr

To Revenue a/c Cr

To Tax a/c Cr

To Freight a/c Cr

Unearned revenue a/c Dr

To unbilled Receivables a/c Cr

Charge back Entry CB Adjustment a/c Dr

To Receivables a/c Cr

CB a/c Dr

To CB Adjustment a/c Cr

Adjustments of Charge back

Positive adjustment Receivables a/c Dr

To Adjustment a/c Cr

Negative adjustmentAdjustment a/c Dr

To Receivables a/c Cr

Posted by Natchirajan Shen

Simple Accounting Entries in Purchasing

At the time of receiving

Material value a/c Dr

To Inventory AP accrual account Cr

At the time of invoice Inventory AP accrual a/c Dr

To AP liability a/c Cr

At the time of Payment AP liability a/c Dr

To Cash Clearing a/c Cr

At the time of Clearing Cash clearing a/c Dr

To Cash a/c Cr

Stock sent to the sub inventory Material a/c Dr

To receiving a/c Cr

Goods in TransitGoods in transit a/c Dr

To Inventory AP accrual a/c Cr

Receiving of Stock Receiving a/c Dr

To Inventory AP accrual a/c Cr

Inspection of stockInspection a/c Dr

To Receiving a/c CR

Material a/c Dr

To inspection a/c CR

Encumbrance for requisition, PO, Invoice PO charge account a/c Dr

To reserve for Encumbrance a/c Cr

Vous aimerez peut-être aussi

- Economic & Budget Forecast Workbook: Economic workbook with worksheetD'EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetPas encore d'évaluation

- P2P & O2C (Entries)Document9 pagesP2P & O2C (Entries)hari koppalaPas encore d'évaluation

- Entries and Adjustments in Different Books of AccountsDocument34 pagesEntries and Adjustments in Different Books of AccountsSHEKHAR SUMITPas encore d'évaluation

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)D'EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Évaluation : 3.5 sur 5 étoiles3.5/5 (17)

- Accounting Entry (CIN)Document3 pagesAccounting Entry (CIN)Nilesh KumarPas encore d'évaluation

- P2P AccountingDocument22 pagesP2P AccountingHimanshu MadanPas encore d'évaluation

- Accounting 101: Learn Cost Accounting From A To ZD'EverandAccounting 101: Learn Cost Accounting From A To ZPas encore d'évaluation

- SCM Accounting EntriesDocument2 pagesSCM Accounting EntriespriyatondonPas encore d'évaluation

- Accounting Entries For Payables and ReceivablesDocument2 pagesAccounting Entries For Payables and Receivableskotesh kumPas encore d'évaluation

- What Should Be My Accounting Entry in ProcurementDocument3 pagesWhat Should Be My Accounting Entry in ProcurementkalkikaliPas encore d'évaluation

- Bookkeeping: Learning The Simple And Effective Methods of Effective Methods Of Bookkeeping (Easy Way To Master The Art Of Bookkeeping)D'EverandBookkeeping: Learning The Simple And Effective Methods of Effective Methods Of Bookkeeping (Easy Way To Master The Art Of Bookkeeping)Pas encore d'évaluation

- Accounts Payable JournalDocument16 pagesAccounts Payable JournalDebashis1982Pas encore d'évaluation

- O2C Cycle With Accounting EntriesDocument3 pagesO2C Cycle With Accounting Entriessudharsan49100% (1)

- Consignment JournalDocument2 pagesConsignment JournalkamalkavPas encore d'évaluation

- Payables: When We Receive The Goods in The Staging Area The Accounting Entry Would Be (MAS) / (GRN)Document15 pagesPayables: When We Receive The Goods in The Staging Area The Accounting Entry Would Be (MAS) / (GRN)VK SHARMAPas encore d'évaluation

- SAP Accounting EntriesDocument7 pagesSAP Accounting EntriesJessica AlvarezPas encore d'évaluation

- Practical 1Document31 pagesPractical 1Rohit ReddyPas encore d'évaluation

- 04 Accounting Study NotesDocument4 pages04 Accounting Study NotesJonas ScheckPas encore d'évaluation

- Payables: P2P EntiresDocument20 pagesPayables: P2P EntiresVK SHARMAPas encore d'évaluation

- SAP Accounting EntriesDocument8 pagesSAP Accounting Entriesprodigious84Pas encore d'évaluation

- ERP AC FlowsDocument5 pagesERP AC FlowsanurgPas encore d'évaluation

- Purchase Vs Consumption Based Accounting Accounting Entries in SapDocument10 pagesPurchase Vs Consumption Based Accounting Accounting Entries in SapAAPS ACGSPas encore d'évaluation

- ConsignmentDocument11 pagesConsignmentprince1900Pas encore d'évaluation

- Journal Entry For Credit Purchase and Cash PurchaseDocument4 pagesJournal Entry For Credit Purchase and Cash PurchaseramakrishnaraoPas encore d'évaluation

- Types of Transaction: Being Name of Person's Cheque Returned ChequeDocument2 pagesTypes of Transaction: Being Name of Person's Cheque Returned ChequeDipendra GiriPas encore d'évaluation

- CH 4 Acc106Document36 pagesCH 4 Acc106Mas Ayu0% (1)

- AccountingfinancebankersDocument43 pagesAccountingfinancebankersPervez KhanPas encore d'évaluation

- Accounting IntroductionDocument4 pagesAccounting Introductionpranav1931129Pas encore d'évaluation

- Profit and Loss P&L Statement StatementDocument3 pagesProfit and Loss P&L Statement StatementShreepathi AdigaPas encore d'évaluation

- AR AccountingDocument16 pagesAR AccountingKingshuk100% (1)

- GL For CinDocument11 pagesGL For Cinrohit12345aPas encore d'évaluation

- AR AccountingDocument6 pagesAR AccountingNestor BoscanPas encore d'évaluation

- Accounting EntriesDocument9 pagesAccounting Entrieswalips1Pas encore d'évaluation

- Accounting Cycle QuizDocument4 pagesAccounting Cycle QuizLucille Gacutan AramburoPas encore d'évaluation

- Control Accounts NotesDocument7 pagesControl Accounts NotesRithvik SangilirajPas encore d'évaluation

- O2C Cycle With Accounting EntriesDocument3 pagesO2C Cycle With Accounting EntriesMAHESH CHOWDARYPas encore d'évaluation

- O2C Cycle With Accounting EntriesDocument3 pagesO2C Cycle With Accounting EntriesMAHESH CHOWDARYPas encore d'évaluation

- Oracle Question AnswerDocument44 pagesOracle Question AnswerVijay PatelPas encore d'évaluation

- P2P and Assets EntriesDocument7 pagesP2P and Assets Entriessudheer1112Pas encore d'évaluation

- Accounting EntriesDocument16 pagesAccounting EntriesphonraphatPas encore d'évaluation

- CMA Part 1 Unit 2 (2021)Document116 pagesCMA Part 1 Unit 2 (2021)athul16203682Pas encore d'évaluation

- Journal Entry Debit and Credit ConventionDocument2 pagesJournal Entry Debit and Credit ConventionSandy Y SandysanthoshkumarPas encore d'évaluation

- P2Pay Setup From Scratch - ScreenshotDocument8 pagesP2Pay Setup From Scratch - ScreenshotKrawal1981Pas encore d'évaluation

- Inventory Accounting EntriesDocument10 pagesInventory Accounting EntriesswayamPas encore d'évaluation

- Dse BafsDocument24 pagesDse BafsAlfred LeePas encore d'évaluation

- Sushil MundadaDocument20 pagesSushil Mundada1986anuPas encore d'évaluation

- For Domestic Procurement of Raw Material: Accounting Entry in ProcurementDocument3 pagesFor Domestic Procurement of Raw Material: Accounting Entry in ProcurementleaderinU9Pas encore d'évaluation

- Basics of Accounting Till Balance SheetDocument39 pagesBasics of Accounting Till Balance Sheetjayti desaiPas encore d'évaluation

- Oracle Applications EBSDocument34 pagesOracle Applications EBSyramesh77Pas encore d'évaluation

- Accounting Entries in ModulesDocument88 pagesAccounting Entries in ModulesSuresh Joshi100% (2)

- Sap Accounting EntriesDocument9 pagesSap Accounting Entriesswayam100% (1)

- Sapficenvatentries 140726041259 Phpapp01Document5 pagesSapficenvatentries 140726041259 Phpapp01Biranchi MishraPas encore d'évaluation

- ERP AC FlowsDocument5 pagesERP AC FlowsanurgPas encore d'évaluation

- Accounting EntriesDocument5 pagesAccounting Entriesshreya9962Pas encore d'évaluation

- Account PostingDocument16 pagesAccount Postinganiruddha_2012Pas encore d'évaluation

- ACCA F3 CH#5: Sale Returns, Purchases Returns, Discounts Practice NotesDocument11 pagesACCA F3 CH#5: Sale Returns, Purchases Returns, Discounts Practice NotesMuhammad AzamPas encore d'évaluation

- CIR v. Aichi ForgingDocument1 pageCIR v. Aichi ForgingVanya Klarika NuquePas encore d'évaluation

- ACC 111 Chapter 7 Lecture NotesDocument5 pagesACC 111 Chapter 7 Lecture NotesLoriPas encore d'évaluation

- InvoiceDocument1 pageInvoiceAnurag SharmaPas encore d'évaluation

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed Depositssaurav katarukaPas encore d'évaluation

- US Internal Revenue Service: f1040 - 1996Document2 pagesUS Internal Revenue Service: f1040 - 1996IRSPas encore d'évaluation

- Clubbing of Income Lecture 2.9Document15 pagesClubbing of Income Lecture 2.9Sabarish SPas encore d'évaluation

- Internal Revenue Allotment DependencyDocument10 pagesInternal Revenue Allotment DependencyRheii EstandartePas encore d'évaluation

- Annuity Calculator: Withdrawal PlanDocument2 pagesAnnuity Calculator: Withdrawal PlanThanga PandiPas encore d'évaluation

- Gmail - Booking Confirmation On IRCTC, Train - 04666, 18-Sep-2021, CC, JUC - NDLSDocument1 pageGmail - Booking Confirmation On IRCTC, Train - 04666, 18-Sep-2021, CC, JUC - NDLSKhawaish MittalPas encore d'évaluation

- M4 Tax Planning Practice QuestionsDocument32 pagesM4 Tax Planning Practice Questionsapi-3814557Pas encore d'évaluation

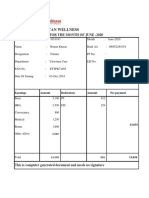

- Hindustan Wellness: Pay Slip For The Month of June - 2020Document3 pagesHindustan Wellness: Pay Slip For The Month of June - 2020ManishPas encore d'évaluation

- Bir Gcash FaqsDocument14 pagesBir Gcash FaqsCharisse Martha Leyba100% (1)

- DBM Compensation Policy Guidelines No. 98-1 (Page 1 of 2)Document1 pageDBM Compensation Policy Guidelines No. 98-1 (Page 1 of 2)Rej Francisco100% (1)

- SR No. PG No.: 1 2 Executive Summary 3 History 4 Objective 5 Product 6 Bank in India 7 StrengthDocument16 pagesSR No. PG No.: 1 2 Executive Summary 3 History 4 Objective 5 Product 6 Bank in India 7 Strengthpriyadsouza196Pas encore d'évaluation

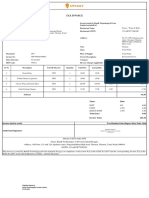

- Invoice PDFDocument1 pageInvoice PDFDhingra shellyPas encore d'évaluation

- Sadaki Perth Class Registration 1Document2 pagesSadaki Perth Class Registration 1Anonymous O3igFXhPas encore d'évaluation

- Pay Slip Components: Covance Pty LimitedDocument1 pagePay Slip Components: Covance Pty LimitedAndrés PatiñoPas encore d'évaluation

- STD FF Check Input File LayoutDocument2 pagesSTD FF Check Input File LayoutAjayPas encore d'évaluation

- IELM 7016 Second in Course Assignment Part1 PDFDocument4 pagesIELM 7016 Second in Course Assignment Part1 PDFKA LOK CHANPas encore d'évaluation

- VAT Accounting Computation and Double EntryDocument31 pagesVAT Accounting Computation and Double EntryEdewo James JeremiahPas encore d'évaluation

- Taco 0067596020700018Document1 pageTaco 0067596020700018Meera CompanyPas encore d'évaluation

- Mepco Full BillDocument1 pageMepco Full BillIftakhar HussainPas encore d'évaluation

- StatementOfAccount 6354576294 02012024 172901Document5 pagesStatementOfAccount 6354576294 02012024 172901sugumarPas encore d'évaluation

- CA Finals Notes On Custom Valuation 02VEX0GHDocument8 pagesCA Finals Notes On Custom Valuation 02VEX0GHAnshul SinghalPas encore d'évaluation

- Reservation Information Itinerary ID: Total You Will Receive: IDR 1346400Document2 pagesReservation Information Itinerary ID: Total You Will Receive: IDR 1346400Achmad Furqon SyaifullahPas encore d'évaluation

- Account Statement From 1 Jan 2018 To 31 Dec 2018: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument5 pagesAccount Statement From 1 Jan 2018 To 31 Dec 2018: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalancePraveen Kumar pkPas encore d'évaluation

- Hotel Ms DiantiDocument2 pagesHotel Ms DiantiUsman BisnisPas encore d'évaluation

- Appendix 43 - CDRegDocument2 pagesAppendix 43 - CDRegSta. Maria ESPas encore d'évaluation

- ZOHO Corporation Pte LTD: Tax Invoice Tax InvoiceDocument1 pageZOHO Corporation Pte LTD: Tax Invoice Tax InvoiceNairo Julian Rodriguez BallesterosPas encore d'évaluation

- 1.1 Slides - Income Statements - Components and Format of An Income Statement PDFDocument13 pages1.1 Slides - Income Statements - Components and Format of An Income Statement PDFascentcommercePas encore d'évaluation

- Getting to Yes: How to Negotiate Agreement Without Giving InD'EverandGetting to Yes: How to Negotiate Agreement Without Giving InÉvaluation : 4 sur 5 étoiles4/5 (652)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!D'EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Évaluation : 4.5 sur 5 étoiles4.5/5 (14)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)D'EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Évaluation : 4.5 sur 5 étoiles4.5/5 (15)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineD'EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlinePas encore d'évaluation

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindD'EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindÉvaluation : 5 sur 5 étoiles5/5 (231)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesD'EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesPas encore d'évaluation

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsD'EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsÉvaluation : 5 sur 5 étoiles5/5 (1)

- Financial Accounting For Dummies: 2nd EditionD'EverandFinancial Accounting For Dummies: 2nd EditionÉvaluation : 5 sur 5 étoiles5/5 (10)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)D'EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Évaluation : 4 sur 5 étoiles4/5 (33)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)D'EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Évaluation : 4.5 sur 5 étoiles4.5/5 (5)

- The Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingD'EverandThe Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingÉvaluation : 4.5 sur 5 étoiles4.5/5 (760)

- Project Control Methods and Best Practices: Achieving Project SuccessD'EverandProject Control Methods and Best Practices: Achieving Project SuccessPas encore d'évaluation

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsD'EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsPas encore d'évaluation

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsD'EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsÉvaluation : 4 sur 5 étoiles4/5 (7)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeD'EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeÉvaluation : 4 sur 5 étoiles4/5 (21)

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCD'EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCÉvaluation : 5 sur 5 étoiles5/5 (1)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItD'EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (14)

- Controllership: The Work of the Managerial AccountantD'EverandControllership: The Work of the Managerial AccountantPas encore d'évaluation

- Your Amazing Itty Bitty(R) Personal Bookkeeping BookD'EverandYour Amazing Itty Bitty(R) Personal Bookkeeping BookPas encore d'évaluation

- How to Measure Anything: Finding the Value of "Intangibles" in BusinessD'EverandHow to Measure Anything: Finding the Value of "Intangibles" in BusinessÉvaluation : 4.5 sur 5 étoiles4.5/5 (28)

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsD'EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsÉvaluation : 4 sur 5 étoiles4/5 (4)

- Ratio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetD'EverandRatio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetÉvaluation : 4.5 sur 5 étoiles4.5/5 (14)