Académique Documents

Professionnel Documents

Culture Documents

Case 1-2 and 2-2

Transféré par

amitsemt0 évaluation0% ont trouvé ce document utile (0 vote)

17 vues3 pagesKim kuller and music mart

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentKim kuller and music mart

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

17 vues3 pagesCase 1-2 and 2-2

Transféré par

amitsemtKim kuller and music mart

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 3

Amit Kumar

Roll no. X003-14

Kim Fuller Case 1-2

Answer 1

Accounting information Non Accounting information

L & OE as mentioned above Market Demand of product

Depreciation of 1 old Truck , 1 New Truck, 1 PC, 1

Grinding machine + cash

Services from Accountant Zimmer

Cost of Purchase of accounting software Efficiency of the worker and truck driver

Salary to be paid to two worker and one driver

Interest to be paid to the bank

Income statement

Cost of supplies and parts necessary to run and

maintain the business

Answer 2

Opening balance Sheet on February 2011

Assets Liabilities and OE

Current assets Liabilities

Cash from self +10,000

Cash from family +90,000 Credit or A/P to bank 1,12,000

Cash down payment -50,000

Total current asset (A) =50,000

Fixed assets OE

1 old Truck , 1 New

Truck, 1 PC, 1 Grinding

machine

65,000 1 old Truck , 1 New

Truck, 1 PC, 1 Grinding

machine + cash

75,000

warehouse 1,62,000 Family 90,000

Total Fixed asset (B) 2,27,000 Total Owner's Equity 1,65,000

Total Asset (A+B) 2,77,000 Total L& OE 2,77,000

Total Owner's

Equity

1,65,000

Answer 3

a) Fuller should prepare the income and closing balance sheet monthly as he will need to pay monthly

EMI amount.

Answer 4

a) Appreciation of the warehouse

b) He should know the EMI amount, the depreciating amount for the fixed assets

c) Monthly wages of the two workers and one driver.

d)Cost of the supplies and parts to keep the business running

e) Incase new inventory is needed to replace the completely depreciated asset or break down beyond

repair, the purchase cost of replacement machinery should be in account

Case 2-2

Music Mart, Inc

Transaction Asset 1 Asset 2 Asset 3 Asset 4 Asset 5 Total

Assets

[7]=

[2]+

[3]

+[4]+

[5]+[6]

OE Liabilities L&OE

= [8]+

[9]

+[10]+

[11]

[1] [2] [3] [4] [5] [6] [8] [9] [10] [11]

Cash Inventory A/R Pre paid

insurance

Land RE Paid in

Capital

Notes

payable

Creditors

or A/p

Page 43 for

Jan 4

33250 4500 250 25000 12500

T1 5000 5000

T2 2300 -1500 800

T3 -1700 2620 920

T4

-1224 1224

T5 -6000

24000 18000

T6 3000 -12000 -9000

T7

0 0 0 0 0 0 0

T8

-1000 -1000

T9

-750 -750

T10 0 0 0 0 0 0 0

T11 -6000 -6000

T12

1310 -850 460

Transaction

total

25636 4700 2620 1224 12000 46180 680 25000 6500 14000 46180

Therefore, Balance sheet on 4 January is

Assets Liabilities and OE

Current assets Liabilities

Cash 25636 Notes Payable 6500

Inventory 4700 Account payable 14000

Account Receivable 2620

Total current asset (A) 32956 Total Liability 20500

Fixed assets OE

Pre paid insurance 1224 Paid in capital 25000

Land 12000 Retained Earnings 680

Total Fixed asset (B) 13224 Total Owner's Equity 1,65,000

Total Asset (A+B) 46180 Total L& OE 46180

Vous aimerez peut-être aussi

- Case Study 4 3 Copies ExpressDocument7 pagesCase Study 4 3 Copies Expressamitsemt100% (2)

- Case 6-2Document6 pagesCase 6-2amitsemtPas encore d'évaluation

- Case 4-1 PC DepotDocument5 pagesCase 4-1 PC Depotamitsemt67% (3)

- Chap 003Document19 pagesChap 003amitsemt100% (1)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5782)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Managing dextrose therapyDocument2 pagesManaging dextrose therapySanket TelangPas encore d'évaluation

- Four Big Secrets of A Happy FamilyDocument67 pagesFour Big Secrets of A Happy FamilySannie RemotinPas encore d'évaluation

- Face ReadingDocument31 pagesFace ReadingGnana Guru100% (4)

- 320Document139 pages320Ashish SharmaPas encore d'évaluation

- Plot and analyze exponential population growth modelDocument16 pagesPlot and analyze exponential population growth modelPatricia KalambaPas encore d'évaluation

- Osce Top TipsDocument20 pagesOsce Top TipsNeace Dee FacunPas encore d'évaluation

- Clay Minerals Including Related Phyllosilicates: Interdisciplinary Research and Inward IntegrationDocument16 pagesClay Minerals Including Related Phyllosilicates: Interdisciplinary Research and Inward Integrationbashir DarPas encore d'évaluation

- GKB Data Analytics Mandate Part 2Document9 pagesGKB Data Analytics Mandate Part 2Vilma TejadaPas encore d'évaluation

- High Pressure Check Valves 150119Document6 pagesHigh Pressure Check Valves 150119Nilesh MistryPas encore d'évaluation

- 67 Golden Rules For Successful LifeDocument2 pages67 Golden Rules For Successful Lifeviveksharma51100% (1)

- Analisis API 1160Document201 pagesAnalisis API 1160Francisco SánchezPas encore d'évaluation

- Color Code Personality TestDocument4 pagesColor Code Personality TestJopsi100% (1)

- Civil TechnologyDocument2 pagesCivil TechnologyLeonicia MarquinezPas encore d'évaluation

- Section 4 QuizDocument2 pagesSection 4 QuizRizki Rian AnugrahaniPas encore d'évaluation

- Arslan CVDocument18 pagesArslan CVAwais NaeemPas encore d'évaluation

- Lectures SSY1352019Document307 pagesLectures SSY1352019S Awais Ahmed100% (2)

- Objective Questions and Answers in Chemical Engineering DR Ram Prasad PDFDocument4 pagesObjective Questions and Answers in Chemical Engineering DR Ram Prasad PDFManpreet Singh100% (1)

- Appendix Preterism-2 PDFDocument8 pagesAppendix Preterism-2 PDFEnrique RamosPas encore d'évaluation

- Kriging: Fitting A Variogram ModelDocument3 pagesKriging: Fitting A Variogram ModelAwal SyahraniPas encore d'évaluation

- Ingersoll Rand Nirvana 7.5-40hp 1brochureDocument16 pagesIngersoll Rand Nirvana 7.5-40hp 1brochureJPas encore d'évaluation

- RADIALL - RP66393 Plug With Backshell CapDocument1 pageRADIALL - RP66393 Plug With Backshell CapIlaiarajaPas encore d'évaluation

- A HELI 0022 V1 01 Rev1Document5 pagesA HELI 0022 V1 01 Rev1CuongDolaPas encore d'évaluation

- VERTICAL CYLINDRICAL VESSEL WITH FLANGED FLAT TOP AND BOTTOMDocument1 pageVERTICAL CYLINDRICAL VESSEL WITH FLANGED FLAT TOP AND BOTTOMsandesh sadvilkarPas encore d'évaluation

- Olivier Clement - Persons in Communion (Excerpt From On Human Being)Document7 pagesOlivier Clement - Persons in Communion (Excerpt From On Human Being)vladnmaziluPas encore d'évaluation

- Nano-C ENDocument1 pageNano-C ENMartín CoronelPas encore d'évaluation

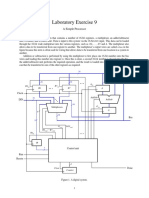

- Laboratory Exercise 9: A Simple ProcessorDocument8 pagesLaboratory Exercise 9: A Simple ProcessorhxchPas encore d'évaluation

- MoRTH CompleteDocument725 pagesMoRTH CompleteSekharmantri Sitapati85% (71)

- Ashok Kumar CVDocument2 pagesAshok Kumar CVimex_ashokPas encore d'évaluation

- Fault Code: 352 Sensor Supply 1 Circuit - Voltage Below Normal or Shorted To Low SourceDocument3 pagesFault Code: 352 Sensor Supply 1 Circuit - Voltage Below Normal or Shorted To Low SourceFernando AguilarPas encore d'évaluation

- Lineas de Inyeccion 320c MaaDocument3 pagesLineas de Inyeccion 320c MaaHAmir Alberto Mojica MojicaPas encore d'évaluation