Académique Documents

Professionnel Documents

Culture Documents

IBPS Syllabus

Transféré par

akashniranjaneTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

IBPS Syllabus

Transféré par

akashniranjaneDroits d'auteur :

Formats disponibles

1.

Reasoning -

Topic Expected

Number of

Questions

Seating Arrangement 10

Tabulation 5

Logical Reasoning 5-10

Syllogism 5

Blood Relations 5

Input Output 0-5

Coding Decoding 5

Alphanumeric Series 0-5

Ranking/Direction/Alphabet Test 0-5

Data Sufficiency 0-5

Coded Inequalities 5

Puzzle 5-7

2. English Language

Topic Expected

Number of

Questions

Reading Comprehension 10

Cloze Test 10

Fill in the blanks 0-5

Multiple Meaning/Error

Spotting

0-5

Paragraph Complete/

Sentence Correction

5

Para jumbles 5

Miscellaneous 5

3. Quantitative Aptitude

Topic Expected Number of

Questions

Simplification 5

Number Systems 3

Ratio & Proportion, Percentage 3

& Averages

Profit & Loss 2

Mixtures & Alligations 1-2

Simple Interest & Compound

Interest & Surds & Indices

1- 2

Work & Time 2

Time & Distance 2

Mensuration Cylinder,

Cone, Sphere

1-2

Sequence & Series 5

Permutation, Combination

& Probability

5

Data Interpretation 15

4. General Awareness -

Current Affairs

This would primarily focus on all news based items from various fields like sports, awards, summits, new appointments,

obituaries, Indian Defense, etc. Please be thorough with newspaper, preferably "THE HINDU".

Banking Awareness

Indian Financial System Overview of Financial Markets (Money Market, Capital Market, Forex Market, Credit

Market), Financial Intermediaries involved (like investment bankers, underwriters, stock exchanges, registrars,

depositories, custodians, portfolio managers, mutual funds, primary dealers, Authorised dealers, self regulatory

organizations, etc. Also read important committees and its recommendations.

History of Indian Banking Industry - (Pre Independence, Post Independence, Nationalisation), Structure of Indian

Banking, Types of Banks (Scheduled, Co-operatives), categorisation of Bank (Pvt, PSU, Foreign), NHB, SIDBI,

EXIM, NABARD, IDBI its role etc and concept of NBFC.

Regulatory Bodies like RBI, (RBI History/ Functions/ Roles/) SEBI, IRDA, PFRDA, FSDC, FMC etc its role

functions and fact based details

Monetary & Credit Policies who decides, basis of change and its relation with Inflation and other related issues &

Inflation (Types) CRR/ SLR/ Repo/ Re-Repo/Bank Rate etc.

Budget Basics and Current Union Budget Discussion of Budget related terminologies like GDP, Fiscal Deficit,

Various kinds of taxes, Government revenue model and spending etc. and discussion on Union Budget 2014. Also

major pointers for Rail Budget and Economic Survey to be read.

International Organisations/ Financial Institutions IMF, World Bank, ADB, UN related agencies, recent

development in them members heads etc functions, recent loans given by them to India or any country in the world

where Crisis is going on.

Capital Market & Money Market Concept, Types of Instruments they deal in like (1. Call/Notice Money 2.

Treasury Bills 3. Term Money, 4. Certificate of Deposit 5. Commercial Papers or Capital Market Instruments like

equity Shares, preference shares, or Debt segment like Debentures etc also talk about Stock Exchanges in India and

world.

Government Schemes All important schemes for ex. Bharat Nirman, Swavlamban, Swabhiman , All schemes

discussed in budget - the details like when was it introduced, important facts related to same, budgetary allocation etc.

Abbreviations and Economic terminologies - Frequently discussed in newspaper

Other important concepts like BASEL, Micro Finance, Base Rate, Negotiable Instruments, Credit Rating Agencies,

Financial Inclusions, Teaser Rates, GAAR, Priority Sector Lending and all other important concepts.

5. Computer Knowledge -

Module

No.

Details

1 Number System

2 History of Computers

3 Hardware

4 Software

5 Database (introduction)

6 Communication (Basic Introduction)

7 Networking (LAN, WAN)

8 Internet (Concept, History, working

environment, Application)

9 Security Tools, Virus, Hacker

10 MS Windows & MS Office

11 Logic Gates

Disclaimer: All information given above - syllabus, probable questions are based on independent analysis and

evaluation made by BankersAdda. We do not take responsibility for any decision that might be taken, based on this

information.

All the best!!

Read more: http://www.bankersadda.com/2014/09/ibps-po-2014-syllabus-and-pattern.html#ixzz3EbIME2Ne

Vous aimerez peut-être aussi

- Google AdsDocument1 pageGoogle AdsakashniranjanePas encore d'évaluation

- MBA Internal Exam Duty Chart MorningDocument2 pagesMBA Internal Exam Duty Chart MorningakashniranjanePas encore d'évaluation

- Best Mirrorless CamerasDocument1 pageBest Mirrorless CamerasakashniranjanePas encore d'évaluation

- Best DSLR CamerasDocument1 pageBest DSLR CamerasakashniranjanePas encore d'évaluation

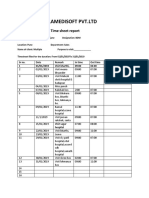

- Birlamedisoft PVT - LTD: Time Sheet ReportDocument1 pageBirlamedisoft PVT - LTD: Time Sheet ReportakashniranjanePas encore d'évaluation

- (XYZ Provides Information On The Same) : XYZ! What About PlacementsDocument1 page(XYZ Provides Information On The Same) : XYZ! What About PlacementsakashniranjanePas encore d'évaluation

- Project FinanceDocument8 pagesProject FinanceakashniranjanePas encore d'évaluation

- Pune student data list with detailsDocument6 pagesPune student data list with detailsakashniranjane0% (1)

- 2014MBA CutOff CAP1Document422 pages2014MBA CutOff CAP1Farooque PeerzadaPas encore d'évaluation

- SET NotificationDocument1 pageSET NotificationakashniranjanePas encore d'évaluation

- Job Description PPC Executive: Roles & ResponsibilitiesDocument2 pagesJob Description PPC Executive: Roles & ResponsibilitiesakashniranjanePas encore d'évaluation

- Proposed Project Implementation Plan - HospitalDocument1 pageProposed Project Implementation Plan - HospitalakashniranjanePas encore d'évaluation

- A Session On: Digital Marketing With Google AdsDocument18 pagesA Session On: Digital Marketing With Google AdsakashniranjanePas encore d'évaluation

- (XYZ Provides Information On The Same) : XYZ! What About PlacementsDocument1 page(XYZ Provides Information On The Same) : XYZ! What About PlacementsakashniranjanePas encore d'évaluation

- Library SoftwareDocument5 pagesLibrary SoftwareakashniranjanePas encore d'évaluation

- Sagar Suresh Gupta: Career ObjectiveDocument3 pagesSagar Suresh Gupta: Career ObjectiveakashniranjanePas encore d'évaluation

- Cancer Screening QuestionnaireDocument3 pagesCancer Screening QuestionnaireakashniranjanePas encore d'évaluation

- Report Guidelines 20-5-15Document17 pagesReport Guidelines 20-5-15akashniranjanePas encore d'évaluation

- A-5 Leaflet FRNT Back - Quanta V4.0 - HIS Plans - AkashDocument1 pageA-5 Leaflet FRNT Back - Quanta V4.0 - HIS Plans - AkashakashniranjanePas encore d'évaluation

- Timesheet FormDocument1 pageTimesheet FormakashniranjanePas encore d'évaluation

- Covering Letter Format For Job ApplicationDocument1 pageCovering Letter Format For Job ApplicationakashniranjanePas encore d'évaluation

- Birlamedisoft PVT - LTD: Time Sheet ReportDocument2 pagesBirlamedisoft PVT - LTD: Time Sheet ReportakashniranjanePas encore d'évaluation

- 2013 ITT Evaluation MatrixDocument12 pages2013 ITT Evaluation MatrixakashniranjanePas encore d'évaluation

- Section 1.1 Adopt - Assess - Implementation of Systems - 1Document8 pagesSection 1.1 Adopt - Assess - Implementation of Systems - 1akashniranjanePas encore d'évaluation

- 6 Maintenance Methodology & SLADocument14 pages6 Maintenance Methodology & SLAakashniranjanePas encore d'évaluation

- Training Strategy For ASHA Facilitators and ANMDocument27 pagesTraining Strategy For ASHA Facilitators and ANMakashniranjanePas encore d'évaluation

- References & Previous ImplementationsDocument5 pagesReferences & Previous ImplementationsakashniranjanePas encore d'évaluation

- Training Strategy For ASHA Facilitators and ANMDocument3 pagesTraining Strategy For ASHA Facilitators and ANMakashniranjanePas encore d'évaluation

- Training Strategy For ASHA Facilitators and ANMDocument3 pagesTraining Strategy For ASHA Facilitators and ANMakashniranjanePas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Ice Cream Industry SnapshotDocument5 pagesIce Cream Industry SnapshotGibin KollamparambilPas encore d'évaluation

- Mortgages and Charges Over Land PDFDocument49 pagesMortgages and Charges Over Land PDFKnowledge GuruPas encore d'évaluation

- New Prudential Guidelines July 1 2010 (Final)Document66 pagesNew Prudential Guidelines July 1 2010 (Final)tozzy12345Pas encore d'évaluation

- PE and VC Course BrochureDocument4 pagesPE and VC Course BrochureHamedbPas encore d'évaluation

- Chart of AccountsDocument4 pagesChart of Accountsjyllstuart100% (3)

- 12 CVP Analysis SampleDocument12 pages12 CVP Analysis SampleMaziah Muhamad100% (1)

- Cash Management ProjectDocument74 pagesCash Management ProjectDinesh Kumar Karur77% (78)

- Final AccountsDocument9 pagesFinal AccountsJack Martin100% (1)

- Brannigan FoodsDocument6 pagesBrannigan FoodsSandeep AdaveniPas encore d'évaluation

- Ethics Predetermined Overhead Rate and Capacity Pat MirandaDocument3 pagesEthics Predetermined Overhead Rate and Capacity Pat MirandaMargaret CabreraPas encore d'évaluation

- CACF Annual ReportDocument16 pagesCACF Annual Reportcn_cadillacmiPas encore d'évaluation

- Ca 09032011 BookDocument36 pagesCa 09032011 BookCity A.M.Pas encore d'évaluation

- Aptitude QN Set 4Document3 pagesAptitude QN Set 4priyajenatPas encore d'évaluation

- Final AqrDocument15 pagesFinal AqrCigdemSahin100% (2)

- Kraft Foods Inc Case AnalysisDocument24 pagesKraft Foods Inc Case Analysismylenevisperas50% (2)

- WILLIAMS COMPANIES INC 10-K (Annual Reports) 2009-02-25Document293 pagesWILLIAMS COMPANIES INC 10-K (Annual Reports) 2009-02-25http://secwatch.comPas encore d'évaluation

- Startup Summit Agenda - Chennai 2016Document8 pagesStartup Summit Agenda - Chennai 2016Srinivas YakkalaPas encore d'évaluation

- Thanks For Downloading This Sample Business: Your Business Is Unique. Your Business Plan Should Be TooDocument33 pagesThanks For Downloading This Sample Business: Your Business Is Unique. Your Business Plan Should Be TooEva LopenaPas encore d'évaluation

- E1.developments in The Indian Money MarketDocument16 pagesE1.developments in The Indian Money Marketrjkrn230% (1)

- Financial Statements of HSYDocument16 pagesFinancial Statements of HSYAqsa Umer0% (2)

- Act 701 Assignment 2Document3 pagesAct 701 Assignment 2Nahid HawkPas encore d'évaluation

- Fin333 Secondmt04w Sample QuestionsDocument10 pagesFin333 Secondmt04w Sample QuestionsSara NasPas encore d'évaluation

- BGR AR2015 CombinedDocument111 pagesBGR AR2015 Combinedarnold_samuel3848Pas encore d'évaluation

- Capital Structure & Financial Leverage Analysis of Software IndustryDocument13 pagesCapital Structure & Financial Leverage Analysis of Software Industryanuj surana100% (1)

- Present Value Analysis of Investment ProjectsDocument9 pagesPresent Value Analysis of Investment ProjectsKimora BrockPas encore d'évaluation

- Pre Qualifying ExamDocument14 pagesPre Qualifying ExamGelyn CruzPas encore d'évaluation

- Final Examinations Advanced Accounting and Financial ReportingDocument4 pagesFinal Examinations Advanced Accounting and Financial ReportingSheharyar HasanPas encore d'évaluation

- Making Decisions in the Oil and Gas Industry Using Decision Tree AnalysisDocument8 pagesMaking Decisions in the Oil and Gas Industry Using Decision Tree AnalysisSuta Vijaya100% (1)

- Dr. Mahalee's Meeting with Sophia CostaDocument22 pagesDr. Mahalee's Meeting with Sophia CostaManoj Kumar100% (3)

- Foreign Investment Act of 1991: Key Provisions of the Philippine Law on Foreign InvestmentDocument4 pagesForeign Investment Act of 1991: Key Provisions of the Philippine Law on Foreign InvestmentrheynePas encore d'évaluation