Académique Documents

Professionnel Documents

Culture Documents

Kevinhaggerty 062210

Transféré par

mr12323Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Kevinhaggerty 062210

Transféré par

mr12323Droits d'auteur :

Formats disponibles

MARKETS TRADE WITH

GEOMETRIC SYMMETRY

COPYRIGHT 2010 BY RAVEN CAPITAL

MANAGEMENT LTD

2

CORE FRAMEWORK

MARKETS TRADE WITH GEOMETRIC SYMMETRY AND A

NATURAL ORDER THAT CAN BE QUANTIFIED IN ALL TIME

FRAMES

MARKETS GET EXTENDED TO EXTREMES DUE TO CROWD

PSYCHOLOGY AND THE HERD MENTALITY

VOLATILITY REVERTS TO THE MEAN

MARKETS TRADE IN SQUARE ROOT RELATIONSHIPS

HIGH PROBABILITY REVERSAL ZONES CAN BE IDENTIFIED

WITH A POSITIVE MATHEMATICAL EXPECTATION OF

SUCCESS

3

THE PRIMARY TOOLS

The primary tools that I find most valuable

in identifying high probability key price and

time zones are:

1. SQUARE ROOT RELATIONSHIPS

2. FIBONACCI RATIOS, RETRACEMENTS,

EXTENSIONS, NUMBER SERIES

3. Pi [3.1416]

4

PRIMARY TOOL GUIDELINES

It is difficult to predict with any high degree

of success the extent or duration of a move

You can identify when a market hits a key

price and time zone where it will either

reverse, consolidate before accelerating to

the next zone, or just trade right through the

zone

This is why I always anticipate these zones in

advance, because when a market nears these

potential turning points you must look to

other technical evidence to see if a reversal

is indeed supported

5

SQUARE OF 9

Markets trade geometrically over time

Markets trade in square root relationships that

measure both price and time

The actual Square of 9 is essentially a square root

calculator, but I will explain how to accomplish

most of the same benefits using a regular

calculator

The objective is to calculate the Square of 9 levels

that are on the Gann Angles of 45, 90, 135, 180,

225, 270, 315, and 360 degrees

6

SQUARE OF 9

The scale below lists the Factors that represent the Gann major angles

Factors Angles

0.25 45

0.50 90

0.75 135

1.00 180

1.25 225

1.50 270

1.75 315

2.00 360

The best results are when you measure from significant market highs

and lows using the .25 point multiples, but you should also measure

using 1/8 point increments because sometimes markets will be in sync

with the 1/8 point factors.

7

SQUARE OF 9

CALCULATION

1. Square Root of 667 = 25.826343

2. 25.826343 + .25 = 26.076343

3. 26.076343 Squared = 680 [45 Deg Angle]

The factor for the 45 Deg Angle price is .25, and

you would use the same calculation to find

the other angles using the specific factors for

each different angle

8

SQUARE OF 9

The factors remain the same, but the multiples

increase

The .25 factor is the .45 Angle, and 2.00 is the 360

Deg Angle, just as 2.25 is the 45 Degree Angle and

4.00 is the 360 Deg Angle as the multiples increased

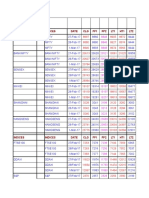

My Square Root calculator on the next page shows

the multiple progressions using a specific price to

measure future price levels, the same as you would

do using the actual Square of 9

These same levels can be used to measure time.

9

10

11

12

SQUARE OF 9

The 10/11/07 bull market high was 1576, and the 360 Deg angle

measured from 769 is 1578.54 [factor of 12.00]

There are 1827 calendar days from the 10/10/02 769 low to the

10/11/07 1576 high, and the 180 Deg angle [factor 15.00] from

769 is 1826, so price and time were in sync, which is always

very strong symmetry

The 360 Deg angle [factor 14.00] from 769 is 1741, and 1741

measured in time from 10/10/02 is 7/17/07

The 7/16/07 SPX high was 1556, which declined -11.9% to the

1371 8/16/07 low

The 315 Deg angle [factor 11.75] from 769 is 1558.74 so there

was price and time symmetry

13

Square of 9

The Sept 1929 to July 1932 -90% SPX bear market depression

low was 4.40

You will get better results when you move the decimal for lower

price stocks, and in the case of the SPX that would be 440 as

the starting value.

The 90 Deg angle from 440 [factor 18.50] is 1558.37 and 135 Deg

angle [factor 18.75] is 1578.17, so you see the consistent

square root symmetry from any level to key market turning

points

The decimal is also moved for high price markets like the INDU

and Treasury Bonds

When starting with the 14,198 INDU high the starting value is

141.98, and using the 1/8 point scale you get a 6465 angle value

versus the 3/6/09 6470 bear market low, as you can see on the

next slide.

14

SQUARE OF 9

15

FIBONACCI

As market technicians you are well aware of the

Fibonacci basics and number series, but you might

have doubts as to how important it is in your overall

market evaluation

I find the Fibonacci principles to be invaluable in my

work to identify high probability market turning

points

I am a believer, based on experience , in the adage

that Fibonacci rules Price, and Pi rules Time

16

FIBONACCI

The following chart of my Fibonacci

Calculator highlights the specific

retracement, extension, and ratio levels that I

find to be the most valuable in identifying

key price and time zones

Keep in mind, it is the combined symmetry of

Fibonacci, Pi, and Square of 9 relationships

that will be most beneficial to your market

evaluations

17

FIBONACCI CALCULATOR

18

19

FIBONACCI

The previous SPX chart for the 2002 bull market Fib

shows the 1576 high, and the high prior to that is the

7/16/07 1556 high. I failed to mark it, but it has

significant longer term square root symmetry.

10/10/02 [769] -7/17/07 = 1741 CD

The square root of 769 +14.00 [factor 360 deg] =1741

The 7/16/07 1556 high declined -11.9% to the 8/16/07

1371 low

3/24/00 [1553] -7/16/07 [1556] = 2670 CD

The square root of 1553 +12.25 [factor 45 deg] =2669

20

FIBONACCI

The next chart highlights the long term

Fibonacci RT symmetry from 1576 to

the 1982, 1974, and 1932 lows

The SPX 665-605 zone was probably

the most symmetrical reversal zone of

all time, which resulted in the 667 3/6/09

bear market low

21

22

FIBONACCI

The next chart outlines the Fib RT symmetry

from the 667 low to the 1219.80 high.

It also highlights the Fib ratio symmetry from

the 10/10/08 840 and 11/21/08 741 lows to the

3/6/09 667 low

Fib RT levels are in play both ways, and can

act as both resistance then support on a

pullback

23

24

FIBONACCI

The next SPX chart highlights the

symmetry of price and time using both

Fibonacci and Square Root

relationships

25

26

FIBONACCI

Markets will often trade in sync with the

Fibonacci number series

[3,5,8,13,21,34,55,89,144,233,377,610,

987,1597] etc

The Gann Angles are also very

significant for anticipating key time

dates and they are:

45, 90,135,180, 225, 270, 315, 360

27

28

Pi 3.1416

Pi is one of the most common

constants in all mathematics, and is the

circumference of any circle divided by

its diameter

Pi is the most powerful tool to

determine longer term time symmetry,

especially when used with the 8.6 year

cycle developed by Martin Armstrong

29

8.6 YEAR CYCLE

It is a global business cycle model, but it also very

precise for catching significant market turns in all

kinds of different markets

Armstrong discovered this cycle and it is known as

the Economic Confidence Model

Pi [3.1416] x 1000 = 3141 days which is the 8.6 year

cycle

Armstrong starts the cycle at 1929.75, so you can

start there and calculate the subsequent 8.6 year

cycles and see the precision of major events

30

8.6 YEAR CYCLE

Armstrong determined that the 8.6 year cycle exists in nature.

He sites 3 examples which are:

1. From 1989-365AD [1624 years] there were 63 major earthquakes

and 1624/63 =25.77777778 [3 x 8.6 = 25.8]

2. There were 26 financial panics in the 224 years from 1683-1907

and 224/26 =8.6153846

3. The 8.6 year frequency is also found in the Precession of the

Equinoxes on which the Mayans based their long calendar,

which is slightly less than 26,000 years, and 25,800

years is 3,000 8.6 year cycles

31

8.6 YEAR CYCLE

The 8.6 frequency is also in sync with

Fibonacci in that 224/26 =8.615384615,

and 8/13 is 0.615384615 which is the

same decimal of the 8.6 year

calculation.

Also, the square root of 5 =2.24 and

2.24 x 100 =224 years

32

8.6 YEAR CYCLE

The 8.6 year cycle breaks down into 3

individual waves with a time duration of 2.15

and 1.075 year periods for 1 leg

Six Waves of 8.6 years combine to form the

51.6 year major cycle

The chart of the Economic Confidence Model

on the next slide demonstrates the 8.6 year

wave cycles from 2002.85 through 2028.65

33

34

8.6 YEAR CYCLE

For a cycle to be valid it has to be consistent over all time

periods like 8.6 years, months, weeks, and even days and

hours for day traders

The 8.6 year cycle using the full and half multiples of 8.6 from

previous significant market highs and lows is what you will use

for identifying key market turns, both major and minor, in

addition to the Economic Confidence Model dates, which are

measured from 1929.75

Pi [3.1416] has been used like Fib ratios to measure price and

time, but in the 8.6 year cycle you move the decimal and you

look at periods of 3.14 years and months, in addition to 31.4

years and 31.4 months. The multiples of Pi are also used the

same as it is with the 8.6 cycle

35

8.6 YEAR CYCLE

In the next few slides I will highlight the symmetry of

the 8.6 year cycle and Pi measurements.

1987 low-3/24/00 1553 top = 3141 TD

7/20/98 low-2/24/07 [Sat] = 3141 CD, and the 1462

2/22/07 high declined -6.7% to 1364

The 10/10/02 769 low-2/23/07 is 1597 CD, which is a

Fib number count, so the combination of 3141 and

1597 was strong symmetry

36

8.6 YEAR CYCLE

The 10/4/74 bear market low to the 3/6/09 bear

market 667 low is 12,572 TD and 4 x 3141 = 12564 TD

[ 4 x3141.6 = 12566 TD]

The Sept 1929 high to the July 1932 Depression low

was 34.4 mo [4 x 8.6]

The 9/16/29 high to the 7/20/98 bull market high was

25,144 CD [8 x 3141]

1981.35 [last 51.6 year cycle] +17.2 years [2 x 8.6]

is 1998.55, which is the 7/20/98 bull cycle high

37

8.6 YEAR CYCLE

17.2 months [2x8.6] from the 10/11/07 1576 bull market high to

the 3/6/09 bear market 667 low is 3/10/09, which is just 2 TD

past the 3/6 667 low [3/6 was a Friday]

13 months from the march 667 low to the April 2010 1219.80

high, followed by a decline to a 1040.78 low as of 5/25/10

The 13 months is Fib number symmetry, and the .618RT from

667 to 1576 is 1229, so that is significant price and time

symmetry, especially in a market that was +83% from the 667

low

Continued on next slide

38

8.6 YEAR CYCLE

All of this symmetry was anticipated long in advance, and at the

1219.80 high and .618RT zone the market was extremely extended

by any measure, so it was a very high probability turning point

The NYA topped out first on 4/15/10, and the rest of the major

indexes on 4/26/10

There was also very significant April symmetry based on the 8.6

year Economic Confidence Model chart

2007.15 +3.14 years = 2010.29 = 4/15/10

2009.3 +1.075 = 2010.375 = 4/17/10

9/11/01 4/18/10 = 3141 CD

39

8.6 YEAR CYCLE

From the 1932.72 depression low to 2010.1 is

77.4 years [9 x 8.6]

The 2010.1 SPX low was 1044.50 on 2/5/10,

so it was a low with powerful long term

symmetry

1998.55 was the previous 8.6 cycle date prior

to the 2007.15 date [8.6] It was the exact

7/20/98 1190.58 bull cycle high

40

8.6 YEAR CYCLE

The Great Depression was a 13 year decline

from 1929-1942

The 13 year decline was followed by a 17.2

[2x8.6] year rally into the 1966 high when the

Dow first hit 1000

From the lowest monthly close in 1970 there

was a 31.4 month rally into the high of

1/11/73 establishing the major high for the

1970s

41

8.6 YEAR CYCLE

The 51.6 year [6 x 8.6] major cycle date is

1981.35 which is the exact 4/27/81 bull

market top in the Dow

The 4/27/81 high preceded the decline to the

8/9/82 bear market low

The 1982 cycle low was the beginning of the

secular bull market that ran just over 17.2

years to the 3/24/00 SPX 1553 secular bull

market high

42

8.6 YEAR CYCLE

The Nikkei hit its all-time high on 1989.95

which is an 8.6 year cycle date

The index hit its most recent low 13 years

later in early 2003, and its most recent high

on the 2007.15 cycle date, which is 17.2

years from 1989.95 [2 x 8.6]

On a monthly level that is 206.4 months or

[4 x 51.6]

43

8.6 YEAR CYCLE

There was a 17.2 month decline in

interest rates from June 2007 to Dec

2008 as the $TYX went from a 54.08

high to a low of 25.18 in the flight to so

called quality

The next to bottom in March 2009 after

a 17.2 month decline was the equity

market

44

8.6 YEAR CYCLE

The 2000 NASDAQ bubble top was

preceded by a 17.2 [2 x 8.6] month

advance from the 1998 bear market low

The 2000 bubble top was followed by a

Pi decline of 31.4 months into the 2002

bear market low

45

KEY POINT

There is much more to this subject matter, but

certainly not enough time to cover it all today.

I have highlighted the basics of the primary tools

that I favor to measure price and time, in order to

identify high probability market turning points

It was a shot gun approach because I wanted to

show you in many different examples that it is not

about coincidence because the markets do trade

geometrically

46

SUGGESTIONS

I use a simple but effective date calculator that you can purchase for $25 at

www.leithauserresearch.com

The calculator enables you set up your own Sequences like the Fibonacci

number series, Gann angle series etc, as well the normal days between dates,

days until a specific date, day of the week etc

It enables you to calculate both calendar and trading dates

If you would like my Square of 9 calculator I will email the file to you [gratis]

and you can save it to your desktop. You can email your request to me at

haggs91@yahoo.com

I have followed Martin Armstrong since he first started publishing over 30

years ago. I suggest you Google him and it will lead you to a fascinating story

that is quite hard to believe, but you will find his essays compelling.

Use the combination of Fibonacci, Square Root, and Pi to enhance your work

Vous aimerez peut-être aussi

- The Simplified Theory of The Time Factor in Forex TradingD'EverandThe Simplified Theory of The Time Factor in Forex TradingPas encore d'évaluation

- Harnessing Explosive Moves Using Gann: Jeff Greenblatt Mta Webinar MARCH 30, 2011Document82 pagesHarnessing Explosive Moves Using Gann: Jeff Greenblatt Mta Webinar MARCH 30, 2011veneet99Pas encore d'évaluation

- SQ of 9 FormulaDocument8 pagesSQ of 9 FormulaJeff Greenblatt100% (2)

- Timing Solutions for Swing Traders: Successful Trading Using Technical Analysis and Financial AstrologyD'EverandTiming Solutions for Swing Traders: Successful Trading Using Technical Analysis and Financial AstrologyPas encore d'évaluation

- Wouldn't You Like to Know Where the Stock Market is Heading?D'EverandWouldn't You Like to Know Where the Stock Market is Heading?Pas encore d'évaluation

- William Ganns Square of NineDocument12 pagesWilliam Ganns Square of NineAntonio Carlos Belfort50% (2)

- Fibonacci Trader The Professional Gann Swing Plan 2002 Robert KrauszDocument8 pagesFibonacci Trader The Professional Gann Swing Plan 2002 Robert Krauszapi-373285167% (3)

- The Angles of Time Samada Salam Edit Samer BaddarDocument32 pagesThe Angles of Time Samada Salam Edit Samer Baddarvishal gandhi100% (1)

- Don't: TradersworldDocument64 pagesDon't: Tradersworldkhangphongnguyengmai100% (1)

- William Gann Life StoryDocument1 pageWilliam Gann Life StorysankarjvPas encore d'évaluation

- Smart Charting Tools in Timing SolutionDocument53 pagesSmart Charting Tools in Timing SolutionDinesh CPas encore d'évaluation

- The Tillman MethodDocument5 pagesThe Tillman MethodssPas encore d'évaluation

- TD Sequential and Ermano Me TryDocument70 pagesTD Sequential and Ermano Me Trynikesh_prasadPas encore d'évaluation

- Triple 40 Timing ModelDocument29 pagesTriple 40 Timing ModelBrandi WallacePas encore d'évaluation

- Murrey Math 01 BookDocument266 pagesMurrey Math 01 BookDaniel100% (1)

- DC Trading ManualDocument14 pagesDC Trading ManualaciestraderPas encore d'évaluation

- Square Root TheoryDocument11 pagesSquare Root TheoryRachit Arora100% (3)

- Multiple Time Frames in Trading PDFDocument2 pagesMultiple Time Frames in Trading PDFturtlespiritflutesPas encore d'évaluation

- Ehlers (Measuring Cycles)Document7 pagesEhlers (Measuring Cycles)chauchauPas encore d'évaluation

- Trade The CyclesDocument24 pagesTrade The CyclesHilal Halle Ozkan83% (6)

- Basic Backtesting in Excel - Issues With Data - Adam H GrimesDocument6 pagesBasic Backtesting in Excel - Issues With Data - Adam H Grimesenghoss77Pas encore d'évaluation

- A New Method of Forecasting Trend Change DatesDocument8 pagesA New Method of Forecasting Trend Change DatesArc Angel M100% (1)

- George Bayer Page1Document14 pagesGeorge Bayer Page1paparock34Pas encore d'évaluation

- Market Cycle Timing and Forecast 2016 2017 PDFDocument22 pagesMarket Cycle Timing and Forecast 2016 2017 PDFpravinyPas encore d'évaluation

- 2014 ForecastDocument139 pages2014 ForecastWillyPas encore d'évaluation

- Understanding The Gann StudiesDocument5 pagesUnderstanding The Gann StudiesElizabeth John RajPas encore d'évaluation

- Murrey Math 2Document4 pagesMurrey Math 2Loose100% (1)

- Greenblatt Jeff (Educated Analyst Article 2010) Squaring Range and Time With Current ConditionsDocument8 pagesGreenblatt Jeff (Educated Analyst Article 2010) Squaring Range and Time With Current Conditionshofrath100% (1)

- Regnault, J. (1863) - Law On The Square Root of Time (2 P.)Document2 pagesRegnault, J. (1863) - Law On The Square Root of Time (2 P.)enrick71Pas encore d'évaluation

- Fdocuments - in Annual-ForecastsDocument4 pagesFdocuments - in Annual-ForecastsRoshanPas encore d'évaluation

- Walker, Myles Wilson - Super Timing Trading With Cycles (2003) PDFDocument5 pagesWalker, Myles Wilson - Super Timing Trading With Cycles (2003) PDFJoy JPas encore d'évaluation

- TS - Vector 2Document6 pagesTS - Vector 2cannizzo45091100% (1)

- S D Vol2 No23 2 1 PDFDocument10 pagesS D Vol2 No23 2 1 PDFcannizzo45091Pas encore d'évaluation

- Perfect Storm: TradersworldDocument64 pagesPerfect Storm: TradersworldtmangrolaPas encore d'évaluation

- David Jennings Code Snippets & How To's Stock Trade Station, & AIQ)Document550 pagesDavid Jennings Code Snippets & How To's Stock Trade Station, & AIQ)Young Su ParkPas encore d'évaluation

- (1953) Mathematical Formula For Market PredictionsDocument32 pages(1953) Mathematical Formula For Market PredictionsRavi VarakalaPas encore d'évaluation

- Treasury Bonds A Longer Term Perspective: by Robert R. LussierDocument31 pagesTreasury Bonds A Longer Term Perspective: by Robert R. LussierGajini Satish100% (1)

- Michael S Jenkins - Square The Range Trading System 2012 - Searchable - Part1 PDFDocument35 pagesMichael S Jenkins - Square The Range Trading System 2012 - Searchable - Part1 PDFOvi Say25% (4)

- 3087year Master CycleDocument6 pages3087year Master Cyclemichele.siciliano4467Pas encore d'évaluation

- Gann Grids Ultra 6.0 Charting ApplicationDocument141 pagesGann Grids Ultra 6.0 Charting ApplicationSnehlata Soni0% (1)

- Turning Point AnalysisDocument9 pagesTurning Point AnalysisGokuPas encore d'évaluation

- TradersWorld Issue 68Document116 pagesTradersWorld Issue 68anudoraPas encore d'évaluation

- Gann Swing Chart For NseDocument3 pagesGann Swing Chart For NsePravin Yeluri100% (1)

- Walter - The Power of Oscillator Cycle CombinationsDocument226 pagesWalter - The Power of Oscillator Cycle Combinationsjmherrera00100% (5)

- Advanced Get - Tips & TricksDocument9 pagesAdvanced Get - Tips & Tricksadoniscal100% (3)

- Good Man Wave TheoryDocument20 pagesGood Man Wave TheorySantoso Adiputra Mulyadi100% (2)

- Median Line Research Greg Fisher PDFDocument78 pagesMedian Line Research Greg Fisher PDFAlberto Castillón50% (2)

- Forex Wave Theory: A Technical Analysis for Spot and Futures Curency Traders: A Technical Analysis for Spot and Futures Curency TradersD'EverandForex Wave Theory: A Technical Analysis for Spot and Futures Curency Traders: A Technical Analysis for Spot and Futures Curency TradersPas encore d'évaluation

- Day Trading Using the MEJT System: A proven approach for trading the S&P 500 IndexD'EverandDay Trading Using the MEJT System: A proven approach for trading the S&P 500 IndexPas encore d'évaluation

- Face Facts America!: Looking Ahead to 1950D'EverandFace Facts America!: Looking Ahead to 1950Évaluation : 2.5 sur 5 étoiles2.5/5 (3)

- Millard on Channel Analysis: The Key to Share Price PredictionD'EverandMillard on Channel Analysis: The Key to Share Price PredictionÉvaluation : 5 sur 5 étoiles5/5 (1)

- Quantum Trading: Using Principles of Modern Physics to Forecast the Financial MarketsD'EverandQuantum Trading: Using Principles of Modern Physics to Forecast the Financial MarketsÉvaluation : 5 sur 5 étoiles5/5 (2)

- Chifbaw Oscillator User GuideDocument12 pagesChifbaw Oscillator User GuideHajar Aswad KassimPas encore d'évaluation

- Indices Indices Date CLG FP1 FP2 LT1 HT1 LT2Document34 pagesIndices Indices Date CLG FP1 FP2 LT1 HT1 LT2mr12323Pas encore d'évaluation

- The Revelation of HellDocument18 pagesThe Revelation of HellEric Dacumi100% (12)

- HEAVEN AND THE ANGELS by H.A. BakerDocument138 pagesHEAVEN AND THE ANGELS by H.A. Bakermannalinsky100% (3)

- Deepak Chopra The 7 Laws of SuccessDocument6 pagesDeepak Chopra The 7 Laws of Successmr12323Pas encore d'évaluation

- The Power of Habit - Charles DuhiggDocument5 pagesThe Power of Habit - Charles DuhiggmanargyrPas encore d'évaluation

- Deepak Chopra The 7 Laws of SuccessDocument6 pagesDeepak Chopra The 7 Laws of Successmr12323Pas encore d'évaluation

- Pro Finance Group Inc.: GraphDocument1 pagePro Finance Group Inc.: Graphmr12323Pas encore d'évaluation

- Revision of Pension (c116063)Document1 pageRevision of Pension (c116063)mr12323Pas encore d'évaluation

- Nifty Super Trend Back Test Results 2008 To 2013Document176 pagesNifty Super Trend Back Test Results 2008 To 2013mr12323Pas encore d'évaluation

- Details of Daily Margin Applicable For F&O Segment (F&O) For 18.07.2018Document5 pagesDetails of Daily Margin Applicable For F&O Segment (F&O) For 18.07.2018mr12323Pas encore d'évaluation

- At ActiveDocument3 pagesAt Activemr12323Pas encore d'évaluation

- Astro PreditDocument1 pageAstro Preditmr12323Pas encore d'évaluation

- Tims Trading MaximsDocument1 pageTims Trading Maximsmr12323Pas encore d'évaluation

- GN 5 38Document1 pageGN 5 38mr12323Pas encore d'évaluation

- Addition 03.2013. TS LSFA BS PDFDocument1 pageAddition 03.2013. TS LSFA BS PDFmr12323Pas encore d'évaluation

- GN 5 41Document1 pageGN 5 41mr12323Pas encore d'évaluation

- ProFx 4 User Manual PDFDocument20 pagesProFx 4 User Manual PDFMelque ResendePas encore d'évaluation

- 0510 ColeDocument21 pages0510 Colemr12323Pas encore d'évaluation

- BitcoinsDocument45 pagesBitcoinsSwadhin Sonowal100% (1)

- Cheatsheet Fib ElliottDocument12 pagesCheatsheet Fib ElliottYano0% (1)

- Scope of AnatomyDocument25 pagesScope of Anatomymr12323Pas encore d'évaluation

- Chart Pattern Dashboard Indicator User Guide: Chartpatterndashboard - Ex4Document4 pagesChart Pattern Dashboard Indicator User Guide: Chartpatterndashboard - Ex4mr12323100% (1)

- Chart Pattern Dashboard Indicator User Guide: Chartpatterndashboard - Ex4Document4 pagesChart Pattern Dashboard Indicator User Guide: Chartpatterndashboard - Ex4mr12323100% (1)

- Barclay and Hendershott-Price Discovery and Trading After HoursDocument33 pagesBarclay and Hendershott-Price Discovery and Trading After HoursPulkit GoelPas encore d'évaluation

- Traders World 20101Document10 pagesTraders World 20101satish sPas encore d'évaluation

- Tradeonix 2.0: (An Updated Version of Tradeonix)Document17 pagesTradeonix 2.0: (An Updated Version of Tradeonix)mr12323100% (1)

- F9D1 ManualDocument18 pagesF9D1 Manualmr12323Pas encore d'évaluation

- WolfeWaveDashboard UserGuideDocument4 pagesWolfeWaveDashboard UserGuidemr12323Pas encore d'évaluation

- Trading Manual PDFDocument24 pagesTrading Manual PDFmr12323Pas encore d'évaluation

- WB Model Stock FT Collins IBD PDFDocument194 pagesWB Model Stock FT Collins IBD PDFSarut Beer100% (3)

- Beams - AdvAcc11 - Chapter 8Document32 pagesBeams - AdvAcc11 - Chapter 8DiditPas encore d'évaluation

- Evidence From China On The Value Relevance of Operating Income vs. Below-The-Line ItemsDocument26 pagesEvidence From China On The Value Relevance of Operating Income vs. Below-The-Line ItemsSyiera Fella'sPas encore d'évaluation

- Balance Sheet & P&LDocument66 pagesBalance Sheet & P&LAnish GhoshPas encore d'évaluation

- Synopsis - Stock Market Book - FDocument1 pageSynopsis - Stock Market Book - Fkhantil ShahPas encore d'évaluation

- Secrets of Financial Astrology by Kenneth MinDocument2 pagesSecrets of Financial Astrology by Kenneth MinaachineyPas encore d'évaluation

- NSE Sub BrokersDocument3 pagesNSE Sub BrokersShaikh EbrahimPas encore d'évaluation

- SEBI Circular On Total Expense RatioDocument2 pagesSEBI Circular On Total Expense RatioRachita JiwrajkaPas encore d'évaluation

- SEBI Order Earth EximDocument18 pagesSEBI Order Earth EximShakti SinghPas encore d'évaluation

- Investments Notes (Lecture 1)Document33 pagesInvestments Notes (Lecture 1)JoelPas encore d'évaluation

- Ketan Parekh AccountDocument20 pagesKetan Parekh AccountdhruvinPas encore d'évaluation

- Two InvestingDocument18 pagesTwo InvestingDavid Briggs100% (3)

- BFIN 3321 Final Exam - Louder BackDocument4 pagesBFIN 3321 Final Exam - Louder BackDenounce GovPas encore d'évaluation

- Bulls On Wall StreetDocument50 pagesBulls On Wall StreetKushal RaoPas encore d'évaluation

- Funding of Mergers & TakeoversDocument31 pagesFunding of Mergers & TakeoversMohit MohanPas encore d'évaluation

- 14th Annual Report For 2008-09Document75 pages14th Annual Report For 2008-09Vinod PinglePas encore d'évaluation

- Sports Arbitrage Guide 04 - The CalculationsDocument5 pagesSports Arbitrage Guide 04 - The CalculationsSports Arbitrage World100% (1)

- Sahara Scam by ArchitaDocument18 pagesSahara Scam by ArchitaRaman KapoorPas encore d'évaluation

- Irr, Pi, NPV, TemplatesDocument1 pageIrr, Pi, NPV, TemplatesBobbyNicholsPas encore d'évaluation

- The Trader's Edge, Grant NobleDocument127 pagesThe Trader's Edge, Grant NobleGedas SendrauskasPas encore d'évaluation

- Axis Triple Advantage Fund Application FormDocument8 pagesAxis Triple Advantage Fund Application Formrkdgr87880Pas encore d'évaluation

- Investment Analysis and Portfolio ManagementDocument102 pagesInvestment Analysis and Portfolio ManagementPankaj Bhasin88% (8)

- Management of Banks & Financial ServicesDocument22 pagesManagement of Banks & Financial ServicesSnehalPas encore d'évaluation

- NPV ModelDocument6 pagesNPV ModelCamilo LacouturePas encore d'évaluation

- Lecture 6 International Capital Budgeting TwoDocument22 pagesLecture 6 International Capital Budgeting TwoSiva Naga Aswini B100% (1)

- Ratio AnalysisDocument8 pagesRatio AnalysisRenz Abad0% (1)

- Budget Hotel Vs Luxury HotelDocument4 pagesBudget Hotel Vs Luxury HotelMohammed Yasir QidwaiPas encore d'évaluation

- Public Notice On Mutual Funds and Unit Trusts Managed by Fund Management Companies Whose Licences Have Been RevokedDocument2 pagesPublic Notice On Mutual Funds and Unit Trusts Managed by Fund Management Companies Whose Licences Have Been RevokedKweku ZurekPas encore d'évaluation

- Carrefour Case QuestionsDocument2 pagesCarrefour Case QuestionswyfgthPas encore d'évaluation

- Securities OutlineDocument58 pagesSecurities OutlineJonDoePas encore d'évaluation