Académique Documents

Professionnel Documents

Culture Documents

FX Declaration Format From Borrower

Transféré par

Janani Parameswaran67%(3)67% ont trouvé ce document utile (3 votes)

3K vues3 pagesRBI Declaration format

Titre original

Fx Declaration Format From Borrower

Copyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentRBI Declaration format

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

67%(3)67% ont trouvé ce document utile (3 votes)

3K vues3 pagesFX Declaration Format From Borrower

Transféré par

Janani ParameswaranRBI Declaration format

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 3

1

(In the letter head of borrower entity)

INDICATIVE FORMAT OF DECLARATION FOREIGN EXCHANGE EXPOSURES (to be read along

with Notes given on last page of format)

To,

Mr. _________________________

Kotak Mahindra Bank Ltd

__________________________

____________________________

(May be addressed specifically to KMBL or as To whomsoever it may concern meant for use

of several banks).

Subject: SUBMISSION OF PARTICULARS OF FOREIGN EXCHANGE EXPOSURES AND

UN-HEDGED EXPOSURES AMOUNT

This is with regard to RBI circular no. DBOD.No.BP.BC. 85 /21.06.200/2013-14 dt.15

th

January, 2014 and clarifications issued by RBI vide circular no.DBOD.No.BP.BC.116 /

21.06.200 / 2013-14 dt.3

rd

June, 2014.

In accordance with the above mentioned stipulations and clarifications of RBI, the required

data is furnished below.

Position date: ____________

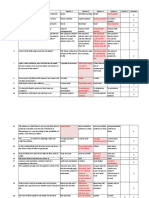

Statement showing particulars foreign exchange exposures and un-hedged portion:

(Monthly or quarterly as applicable)

(INR value in crores)

Particulars

Total amt.

(INR)

Hedged

amt. (INR)

Un-hedged exposure - FC and INR

values

Currency FC in Mn

INR value

(Book value)

Trade and other payables outstanding (a)

Foreign currency loan borrowings

outstanding (b)

Receivables/recoverables outstanding (c )

Net amount - existing - (short) / long

(c- a-b)

Maturity tenor-wise break-up of un-hedged existing foreign exchange exposures:

(Quarterly)

(INR value in crores)

Particulars Maturity buckets for residual tenor

Up to

1 yr

Up to 2

yrs

Up to

3 yrs

Up to

4 yrs

Up to

5 yrs

Over

5 yrs Total

Trade and other payables outstanding (a)

Foreign currency loan borrowings

outstanding (b)

Receivables/recoverables outstanding (c )

Net amount - existing - (short) / long

(c- a-b)

2

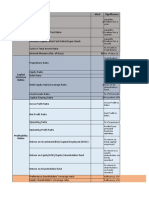

Natural hedge available from future transactions:

Maturity tenor-wise break-up of highly probable un-hedged foreign exchange cash flows

from highly probable future transactions: (optional) (see note h given on last page)

(Quarterly)

(INR value in crores)

Particulars Maturity buckets for residual tenor

Up to

1 yr

Up to 2

yrs

Up to

3 yrs

Up to

4 yrs

Up to

5 yrs

Over

5 yrs Total

Outflows: (a)

Import payments

Others (to specify)

Inflows: (b)

Export earnings

Others (to specify)

Net amount - existing - (short) / long

(inflows Minus outflows)

EBID (after tax) data: The EBID figures as defined by RBI, i.e. Profit after Tax +

Depreciation + Interest on debt + Lease Rentals (if any), are given below:

Particulars Amount

(Rs.in crores)

EBID (after tax) for 12 months ending with reported QE ___________

audited or limited audit results (specify if available)

EBID (after tax) as per audited / limited review audit conducted (specify

as applicable) financial statements for latest audited accounting YE

____________

For ___________________________

(Authorized Signatory)

Name of signatory: _____________________

Designation of signatory:_________________

3

Notes for filling the specified formats of information:

a) Foreign currency value for un-hedged exposures may be given currency wise, or only

in USD equivalent value as permitted by RBI.

b) Advances taken from overseas customers may be included under Trade and other

payables outstanding head.

c) Advances given to overseas suppliers may be included under Receivables /

Recoverables outstanding head.

d) More descriptive heads of payables/receivables may be added by inserting more rows

in above given tabular formats.

e) Total un-hedged exposure value given in tenor-wise table should tally with the

summary table given above.

f) Packing Credit in Foreign Currency (PCFC) loans outstanding against specific export

orders to be recovered in foreign currency, is treated as naturally hedged, since the

PCFC would be cleared out of export proceeds of the order. Hence PCFC liability may

be excluded from the un-hedged foreign exchange exposures value by indicating such

fact.

g) Foreign currency deposits (like EEFC) placed with banks may be shown under

Receivables / Recoverables head.

h) Maturity tenor-wise break-up of un-hedged foreign exchange flows may be given in

respect of highly probable future transactions, i.e. in respect of transactions for

which there is no outstanding foreign exchange exposure as on reported date. This is

optional (not mandatory) on the part of borrower entity. This is for the purpose of

considering natural hedge available from such cash flows from future transactions.

Ex: Export sales revenue and Imports based on past track record; bulk export order

received & pending execution which may provide more export revenue than what

past record suggests; new forex loan availed after reporting date) repayments of

which may be natural hedge against export earnings of predominantly export oriented

entity. Such net inflows / outflows can act as natural hedge against existing

outstanding foreign exchange exposures.

**********

Vous aimerez peut-être aussi

- Artificial Intelligence: Friend or Foe?Document6 pagesArtificial Intelligence: Friend or Foe?Pankita TibrewalaPas encore d'évaluation

- Superintendent ContractsDocument21 pagesSuperintendent ContractsThe Salt Lake TribunePas encore d'évaluation

- Aishwarya Viva - PPT ProjectDocument71 pagesAishwarya Viva - PPT Projectaishwarya damlePas encore d'évaluation

- MIRPM Prospectus & Syllabus Autonomous-1Document30 pagesMIRPM Prospectus & Syllabus Autonomous-1Kanchan DewalPas encore d'évaluation

- SODEXOv SEIU-Complaint2011Document130 pagesSODEXOv SEIU-Complaint2011Stern BurgerPas encore d'évaluation

- Iso 21009-2-2015Document20 pagesIso 21009-2-2015ali kajbafPas encore d'évaluation

- BSC Magazine Exclusive July Monthly GA MCQs FinalDocument50 pagesBSC Magazine Exclusive July Monthly GA MCQs Finalshikharv90Pas encore d'évaluation

- SP March 2022Document3 pagesSP March 2022Niranjan JadhavPas encore d'évaluation

- HITRUST Policies - Network Security Management ProcedureDocument8 pagesHITRUST Policies - Network Security Management ProcedureMebrat WorkuPas encore d'évaluation

- DEBATE - Should College Students Have Credit CardsDocument6 pagesDEBATE - Should College Students Have Credit CardsJofred Collazo CarrilloPas encore d'évaluation

- SOA-QPS5 Consultation PaperDocument22 pagesSOA-QPS5 Consultation PaperKaKiPas encore d'évaluation

- Modelling of Core Noise From Power TransformerDocument62 pagesModelling of Core Noise From Power TransformerNguyễn HiềnPas encore d'évaluation

- Outlaws - Manual - PCDocument47 pagesOutlaws - Manual - PCdiegoPas encore d'évaluation

- Final Signed Audited Accounts 21-22 - Updated Draft 5Document34 pagesFinal Signed Audited Accounts 21-22 - Updated Draft 5Martin AllenPas encore d'évaluation

- Income Tax Bba 5 Sem QuestionDocument18 pagesIncome Tax Bba 5 Sem QuestionArun GuptaPas encore d'évaluation

- FM (3 Files Merged)Document43 pagesFM (3 Files Merged)Priyanka MahajanPas encore d'évaluation

- (+61 8) 8228 3664 Admissions@ichm - Edu.au Ichm - Edu.auDocument11 pages(+61 8) 8228 3664 Admissions@ichm - Edu.au Ichm - Edu.auajayPas encore d'évaluation

- SRS Document - Dhaval PaswalaDocument8 pagesSRS Document - Dhaval PaswalaQIT HarikaPas encore d'évaluation

- A Machine Learning Model For Average Fuel Consumption in Heavy VehiclesDocument59 pagesA Machine Learning Model For Average Fuel Consumption in Heavy Vehiclesmastanrao kalePas encore d'évaluation

- Edelweiss Crossover Opportunities Fund - Series II - December 2018Document2 pagesEdelweiss Crossover Opportunities Fund - Series II - December 2018Ashish Agrawal100% (1)

- Fundamentals of Auditing and Assurance ServicesDocument11 pagesFundamentals of Auditing and Assurance ServicesABIGAIL DAYOTPas encore d'évaluation

- Stuvia 521677 Summary Strategy An International Perspective Bob de Wit 6th Edition PDFDocument86 pagesStuvia 521677 Summary Strategy An International Perspective Bob de Wit 6th Edition PDFRoman BurbakhPas encore d'évaluation

- Samsung AQV09 12 UGAN Service ManualDocument93 pagesSamsung AQV09 12 UGAN Service ManualbrianPas encore d'évaluation

- 3.1. Basic Puzzles About Financial Structure Around The WorldDocument75 pages3.1. Basic Puzzles About Financial Structure Around The WorldNhatty WeroPas encore d'évaluation

- JavabietDocument37 pagesJavabietVINAYAKA.KPas encore d'évaluation

- 2UL37A5 - 00 - Masterys BC 15-20 - Manual GBDocument48 pages2UL37A5 - 00 - Masterys BC 15-20 - Manual GBmanoledan81Pas encore d'évaluation

- Satyendra TiwariDocument4 pagesSatyendra Tiwarihr mancomPas encore d'évaluation

- TicketsDocument2 pagesTicketsTeam UPPas encore d'évaluation

- Quiz QuizDocument5 pagesQuiz QuizPMK PUPas encore d'évaluation

- Online Kit For EmigrantDocument13 pagesOnline Kit For EmigrantMohamed ShafiPas encore d'évaluation

- Accounting For Liabilities, Provisions and Contingencies LiabilityDocument13 pagesAccounting For Liabilities, Provisions and Contingencies LiabilitySkyleen Jacy VikePas encore d'évaluation

- Exemplu CVDocument2 pagesExemplu CVAdrian CapatinaPas encore d'évaluation

- Funding and Listing Numerical Questions: S.no. TopicDocument22 pagesFunding and Listing Numerical Questions: S.no. Topicvarad dongrePas encore d'évaluation

- ApplicationDocument2 pagesApplicationVinay SharmaPas encore d'évaluation

- C Sharp NotesDocument172 pagesC Sharp Notespoojya dwarakaPas encore d'évaluation

- Screenco v. Scott Septic - ComplaintDocument14 pagesScreenco v. Scott Septic - ComplaintSarah BursteinPas encore d'évaluation

- CH 4 - Efficient Market HypothesesDocument48 pagesCH 4 - Efficient Market HypothesesNurul Khaleeda binti KamalPas encore d'évaluation

- Voluntary Petition For Non-Individuals Filing For BankruptcyDocument15 pagesVoluntary Petition For Non-Individuals Filing For BankruptcyPadawan LearnerPas encore d'évaluation

- Analysis of Brand Image, Beauty Vlogger, Availability in The Marketplace, Green Product, and Product Benefit On Purchase Decision of Wardah's Day Cream Skincare ProductDocument12 pagesAnalysis of Brand Image, Beauty Vlogger, Availability in The Marketplace, Green Product, and Product Benefit On Purchase Decision of Wardah's Day Cream Skincare ProductInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- PadulohandHumirasHardiPurba JEMIS 2020Document13 pagesPadulohandHumirasHardiPurba JEMIS 2020Mohit DayalPas encore d'évaluation

- Capgemini GCLP EnglishDocument30 pagesCapgemini GCLP EnglishDhivyaprakash NPas encore d'évaluation

- 300+ REAL TIME E-Banking Objective Questions & AnswersDocument31 pages300+ REAL TIME E-Banking Objective Questions & Answersbarun vishwakarmaPas encore d'évaluation

- Minions - The Rise of Gru (2022) Dual Audio (Hindi-EngliDocument8 pagesMinions - The Rise of Gru (2022) Dual Audio (Hindi-EngliMr. DuedullPas encore d'évaluation

- Bank of Baroda - Properties Scheduled For Mega E-Auction On 28th July 2021Document36 pagesBank of Baroda - Properties Scheduled For Mega E-Auction On 28th July 2021Anil Kumar YadavPas encore d'évaluation

- MNBC - PART - 4 - Soil and FoundationDocument96 pagesMNBC - PART - 4 - Soil and FoundationRamkumar KumaresanPas encore d'évaluation

- Mechanical Permit: Office of The Building OfficialDocument2 pagesMechanical Permit: Office of The Building OfficialCrystal TutorPas encore d'évaluation

- Junior Assistant NotificationDocument7 pagesJunior Assistant NotificationNDTVPas encore d'évaluation

- RBIDocument32 pagesRBIAjay SinghPas encore d'évaluation

- Risk Management and Behavioral Finance: Financial Markets, Institutions and Risks, Volume 2, Issue 2, 2018Document17 pagesRisk Management and Behavioral Finance: Financial Markets, Institutions and Risks, Volume 2, Issue 2, 2018Rabaa DooriiPas encore d'évaluation

- Avanse App Form PDFDocument4 pagesAvanse App Form PDFSuresh DhanasekarPas encore d'évaluation

- Financing Mental Health Care in Sri LankaDocument40 pagesFinancing Mental Health Care in Sri LankajudyjeyakumarPas encore d'évaluation

- Challan AxisDocument3 pagesChallan AxisSumit Darak50% (2)

- 80 Python Interview Questions & AnswersDocument23 pages80 Python Interview Questions & AnswersMahmoud ElhadyPas encore d'évaluation

- Muthoot Finance NCD Application Form Mar 2012Document8 pagesMuthoot Finance NCD Application Form Mar 2012Prajna CapitalPas encore d'évaluation

- Examples of Transformational in OrgDocument11 pagesExamples of Transformational in OrgSrishti GaurPas encore d'évaluation

- Merchant Banking and Financial Services AssignmentsDocument8 pagesMerchant Banking and Financial Services AssignmentsAnkit JugranPas encore d'évaluation

- ElverdaderotextorraDocument2 pagesElverdaderotextorrandeahproPas encore d'évaluation

- Mrunal Dandagavane Sip Final ReportDocument69 pagesMrunal Dandagavane Sip Final ReportAndrew PottsPas encore d'évaluation

- NGIF HBA FAQs 0 PDFDocument6 pagesNGIF HBA FAQs 0 PDFAtul KumarPas encore d'évaluation

- Form Ecb: InstructionsDocument5 pagesForm Ecb: Instructionsanon_511852843Pas encore d'évaluation

- SB-130001001533082 of MAHALAKSHMI R SB-003001000232862 of THE RAJA VEDHA KAVYA PATA INR 1200.00Document1 pageSB-130001001533082 of MAHALAKSHMI R SB-003001000232862 of THE RAJA VEDHA KAVYA PATA INR 1200.00Janani ParameswaranPas encore d'évaluation

- Using Cashprojection 1752 1752 14200 9.5 9.5 3550 21300 2641 2641 4500 2336 2336 6150 1358 1358 30750 82 82 2900 2900 514 50 3422 - 700Document5 pagesUsing Cashprojection 1752 1752 14200 9.5 9.5 3550 21300 2641 2641 4500 2336 2336 6150 1358 1358 30750 82 82 2900 2900 514 50 3422 - 700Janani ParameswaranPas encore d'évaluation

- VitalityDocument1 pageVitalityJanani ParameswaranPas encore d'évaluation

- Fetal Ultrasound: Diablo Valley Perinatal AssociatesDocument2 pagesFetal Ultrasound: Diablo Valley Perinatal AssociatesJanani ParameswaranPas encore d'évaluation

- Om Namasivya: Play Kitchen Dress Jewel OthersDocument4 pagesOm Namasivya: Play Kitchen Dress Jewel OthersJanani ParameswaranPas encore d'évaluation

- Trimester 1 Veg SI Mealplanner1 inDocument1 pageTrimester 1 Veg SI Mealplanner1 inJanani ParameswaranPas encore d'évaluation

- Chor Ionic Vill Us SamplingDocument2 pagesChor Ionic Vill Us SamplingJanani ParameswaranPas encore d'évaluation

- Questioner For Drop BoxDocument1 pageQuestioner For Drop BoxJanani ParameswaranPas encore d'évaluation

- Self Processing Only For Dependents, Then Please Mention It Clearly in This SheetDocument2 pagesSelf Processing Only For Dependents, Then Please Mention It Clearly in This SheetJanani ParameswaranPas encore d'évaluation

- Trimester 1 Veg SI Mealplanner2 IN PDFDocument1 pageTrimester 1 Veg SI Mealplanner2 IN PDFJanani ParameswaranPas encore d'évaluation

- Head of Finance Operations JD 130416Document4 pagesHead of Finance Operations JD 130416Janani ParameswaranPas encore d'évaluation

- How To Fill DS-160Document33 pagesHow To Fill DS-160Janani ParameswaranPas encore d'évaluation

- Union Budget 2017-18: Janani P FinanceDocument17 pagesUnion Budget 2017-18: Janani P FinanceJanani ParameswaranPas encore d'évaluation

- FX Rate ChartDocument23 pagesFX Rate ChartJanani ParameswaranPas encore d'évaluation

- San Diego Trip PlanDocument2 pagesSan Diego Trip PlanJanani ParameswaranPas encore d'évaluation

- PoetsDocument1 pagePoetsJanani ParameswaranPas encore d'évaluation

- The Hindu: Letters To Editor - Metro Plus-Shahnaz Metro Plus - Reader's Mail - Educational Plus - Young WorldDocument2 pagesThe Hindu: Letters To Editor - Metro Plus-Shahnaz Metro Plus - Reader's Mail - Educational Plus - Young WorldJanani ParameswaranPas encore d'évaluation

- CPA Review School of The Philippines ManilaDocument4 pagesCPA Review School of The Philippines ManilaSophia PerezPas encore d'évaluation

- Preserbasyon Kulturang Tradisyon at WikaDocument9 pagesPreserbasyon Kulturang Tradisyon at Wikamarianne capina de jesus100% (1)

- Bank Trade Program OverviewDocument8 pagesBank Trade Program OverviewSuryaPas encore d'évaluation

- Financial Statement AnalysisDocument8 pagesFinancial Statement AnalysiszhangxuPas encore d'évaluation

- Chapter 7 Workout SheetDocument14 pagesChapter 7 Workout Sheetanh sy tranPas encore d'évaluation

- CECDocument4 pagesCECJyoti Berwal0% (3)

- Ratio AnalysisDocument26 pagesRatio AnalysisDeep KrishnaPas encore d'évaluation

- Revised Co-Maker Policy Word DocsDocument4 pagesRevised Co-Maker Policy Word DocsAko C IanPas encore d'évaluation

- Answer KeyDocument305 pagesAnswer KeyIsabela Quitco100% (4)

- HFOF Letter To Ivy ClientsDocument1 pageHFOF Letter To Ivy ClientsAbsolute ReturnPas encore d'évaluation

- The Yield CurveDocument14 pagesThe Yield CurveAmirPas encore d'évaluation

- PT Mobilindo Armada Cemerlang 2016 Billingual FinalDocument43 pagesPT Mobilindo Armada Cemerlang 2016 Billingual FinalDevi Triyanti TjongPas encore d'évaluation

- AFM 2021-23 End-Term QuestionDocument2 pagesAFM 2021-23 End-Term QuestionNimish TarikaPas encore d'évaluation

- Cvitanic CH 1 Fin1Document27 pagesCvitanic CH 1 Fin1Camila Florencio JaraPas encore d'évaluation

- Assignment: Financial Management: Dividend - MeaningDocument4 pagesAssignment: Financial Management: Dividend - MeaningSiddhant gudwaniPas encore d'évaluation

- Joint Venture Accounts Solved ProblemsDocument5 pagesJoint Venture Accounts Solved ProblemsAnonymous duzV27Mx350% (2)

- Series A, B, C Funding: How It WorksDocument2 pagesSeries A, B, C Funding: How It WorksSachin KhuranaPas encore d'évaluation

- Tewodros AlemuDocument113 pagesTewodros AlemuDagnachew TsegayePas encore d'évaluation

- Homework Week 1 Dawna Berry Acc401 Professor Peter Mcdanel 1-18-2013Document6 pagesHomework Week 1 Dawna Berry Acc401 Professor Peter Mcdanel 1-18-2013Dawna Lee BerryPas encore d'évaluation

- Stock MarketDocument24 pagesStock MarketRig Ved100% (2)

- Audit of The Capital Acquisition and Repayment CycleDocument32 pagesAudit of The Capital Acquisition and Repayment CycleCyndi SyifaaPas encore d'évaluation

- Digos Central Adventist Academy, IncDocument3 pagesDigos Central Adventist Academy, IncPeter John IntapayaPas encore d'évaluation

- Mindtree ISDocument6 pagesMindtree ISAswini Kumar BhuyanPas encore d'évaluation

- AnswerQuiz - Module 8Document4 pagesAnswerQuiz - Module 8Alyanna AlcantaraPas encore d'évaluation

- Hindustan Zinc LimitedDocument7 pagesHindustan Zinc Limitedxia89627Pas encore d'évaluation

- Capital Market Regulations (LW 4411)Document9 pagesCapital Market Regulations (LW 4411)Aayushi PriyaPas encore d'évaluation

- International Capital MarketsDocument11 pagesInternational Capital MarketsAmbika JaiswalPas encore d'évaluation

- M & ADocument6 pagesM & AiluaggarwalPas encore d'évaluation

- Meseret FeteneDocument22 pagesMeseret FeteneGetaneh YenealemPas encore d'évaluation

- Accounting MidtermDocument14 pagesAccounting Midtermazade azamiPas encore d'évaluation