Académique Documents

Professionnel Documents

Culture Documents

AHS FC Debt Restructure Sep 22 2014

Transféré par

Action Alameda News0 évaluation0% ont trouvé ce document utile (0 vote)

144 vues18 pagesAlameda Health System debt restructure presentation, September 22, 2014

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentAlameda Health System debt restructure presentation, September 22, 2014

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

144 vues18 pagesAHS FC Debt Restructure Sep 22 2014

Transféré par

Action Alameda NewsAlameda Health System debt restructure presentation, September 22, 2014

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 18

Alameda Health System

Debt Restructure Plan

September 22, 2014

1

Agenda

1. Primary Issue: AHS Accounts Receivable

2. Reasonable Level of Debt: Moodys Medians

3. AHS Request for Debt Restructure

4. Proposed Debt Service Schedule

5. Supplemental Reimbursement Seasonality

6. Fiscal 2015 Debt Forecast

7. Required Operating Performance

8. Current Financial Performance and Position

9. Performance Improvement Plan

2

AHS current cash situation is largely the result of accounts

receivable increase due to system conversion in July 2013.

These funds can be recovered.

3

-

20,000,000

40,000,000

60,000,000

80,000,000

100,000,000

120,000,000

140,000,000

160,000,000

AHS Accounts Receivable

AHS NPR - Invision AHS NPR - Signature AHS NPR - Soarian

SLH NPR - Meditech AHD NPR - Meditech

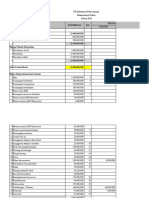

AHS Credit Ratios vs. Moodys Medians

Comments

1. AHS has the overall size to qualify as an

investment grade credit.

2. Total Debt is reasonable in relation to

our Total Revenue at 24.2%. The

median is 39% to 45%.

3. However, Days in Cash and Debt to

Capitalization are far below

requirements.

4. AHS requires sustained profitability to

build equity and cash reserves.

5. An EBIDA Margin target of 8% to 10% is

recommended.

4

Moody's Medians ($,000) AHS Baa1 Baa2

Performance

Total Revenues 807,300 $ 454,440 $ 272,384 $

Net Income (37,938) $ 21,104 $ 8,725 $

EBIDA (9,282) $ 47,319 $ 24,255 $

Net Margin -4.7% 3.8% 3.5%

EBIDA Margin -1.1% 7.8% 8.8%

Liquidity

Days in Cash 2 149 140

Cash to Debt 3% 91% 86%

Leverage

Debt to Total Revenue 24.2% 38.9% 45.5%

Debt to Capitalization 117.0% 47.4% 49.3%

Debt Restructure Request

AHS is requesting support for a restructure of the Agreement to achieve a level

of total debt service that can be carried by operations:

The $195 million negative balance to be restructured as Term Debt,

and to be repaid by 2034.

The Pension Obligation Bond payment schedule to be restructured.

The plan allows AHS to make the $7 million annual hospital

replacement building debt service payments starting in 2019.

The Flexible Maximum Policy to be maintained, allowing AHS to go

above the annual targets during the year.

5

Proposed Debt Service Schedule requires AHS to generate $20+ million

of free cash flow per year, plus requirements for CapEx and Reserves.

6

-

5,000,000

10,000,000

15,000,000

20,000,000

25,000,000

2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035

AHS Annual Debt Service Payments

AHS LT Debt POB HRB Debt Service

The exact structure of the Debt Service is under discussion.

7

TOTAL DEBT PAYMENTS AHS OUTSTANDING DEBT - at June 30

AHS LT Debt POB

HRB Debt

Service

Total AHS

Debt Service AHS LT Debt PBO

HRB Debt

Service

Total AHS

Debt Service

2014 - - - - 2014 195,000,000 59,071,286 119,000,000 373,071,286

2015 5,000,000 3,000,000 - 8,000,000 2015 190,000,000 56,071,286 119,000,000 365,071,286

2016 6,000,000 3,500,000 - 9,500,000 2016 184,000,000 52,571,286 119,000,000 355,571,286

2017 6,000,000 4,000,000 - 10,000,000 2017 178,000,000 48,571,286 119,000,000 345,571,286

2018 6,000,000 4,500,000 - 10,500,000 2018 172,000,000 44,071,286 119,000,000 335,071,286

2019 6,000,000 5,000,000 7,000,000 18,000,000 2019 166,000,000 39,071,286 112,000,000 317,071,286

2020 7,500,000 5,500,000 7,000,000 20,000,000 2020 158,500,000 33,571,286 105,000,000 297,071,286

2021 7,500,000 6,000,000 7,000,000 20,500,000 2021 151,000,000 27,571,286 98,000,000 276,571,286

2022 7,500,000 6,500,000 7,000,000 21,000,000 2022 143,500,000 21,071,286 91,000,000 255,571,286

2023 7,500,000 7,000,000 7,000,000 21,500,000 2023 136,000,000 14,071,286 84,000,000 234,071,286

2024 7,500,000 7,000,000 7,000,000 21,500,000 2024 128,500,000 7,071,286 77,000,000 212,571,286

2025 7,500,000 7,071,286 7,000,000 21,571,286 2025 121,000,000 - 70,000,000 191,000,000

2026 10,000,000 - 7,000,000 17,000,000 2026 111,000,000 - 63,000,000 174,000,000

2027 10,000,000 - 7,000,000 17,000,000 2027 101,000,000 - 56,000,000 157,000,000

2028 10,000,000 - 7,000,000 17,000,000 2028 91,000,000 - 49,000,000 140,000,000

2029 15,000,000 - 7,000,000 22,000,000 2029 76,000,000 - 42,000,000 118,000,000

2030 15,000,000 - 7,000,000 22,000,000 2030 61,000,000 - 35,000,000 96,000,000

2031 15,000,000 - 7,000,000 22,000,000 2031 46,000,000 - 28,000,000 74,000,000

2032 15,000,000 - 7,000,000 22,000,000 2032 31,000,000 - 21,000,000 52,000,000

2033 15,000,000 - 7,000,000 22,000,000 2033 16,000,000 - 14,000,000 30,000,000

2034 16,000,000 - 7,000,000 23,000,000 2034 - - 7,000,000 7,000,000

2035 - - 7,000,000 7,000,000 2035 - - - -

195,000,000 59,071,286 119,000,000 373,071,286

The Flexible Maximum Policy is important to maintain due to the variability of

the receipt of Supplemental Reimbursement during the year.

8

-

5,000,000

10,000,000

15,000,000

20,000,000

25,000,000

30,000,000

35,000,000

40,000,000

45,000,000

7/4/14 8/4/14 9/4/14 10/4/14 11/4/14 12/4/14 1/4/15 2/4/15 3/4/15 4/4/15 5/4/15 6/4/15

AHS Cash Receipts Projection

Net Patient Service Revenue Supplemental Revenue

AHS Supplemental Reimbursement Cash Forecast vs. Budget

Comments

1. The Forecast is Cash, the Budget is

Accrual, and there are timing

differences.

2. Jul Dec 2014 = $122 million.

3. Jan Jun 2015 = $180 million.

9

2015 FCST 2015 Budget

27

28 Medi-Cal Waiver fy14 (not net of IGT) 10,000,000

29 IGT: Medi-Cal Waiver fy14 (2,500,000)

30 Medi-Cal Waiver fy15 (not net of IGT) 120,450,000 84,000,000

31 IGT: Medi-Cal Waiver fy15 (35,222,500) -

32 IGT: MCD Mgd Care (trauma funds used) - -

33 HealthPac 38,870,546 34,040,728

34 Measure A Tax Revenue 94,700,275 95,270,496

35 Hospital Fee 2,500,000 -

36 Trauma Subsidy 5,300,000 6,210,717

37 FQHC PPR Recon (fy10,fy11,fy12) 700,000 -

38 FQHC PPS Recon fy13 3,200,000 -

39 Medi-Cal Mgd Care supplemental (rate range) 44,927,824 7,000,000

40 IGT: MCD Mgd Care rate range (26,548,438) -

41 Medi-Cal Mgd Care AB85 newly eligible (rate range) 15,754,631 14,000,000

42 SPD-Mgd Care SB208 (not net of IGT) fy14 25,700,000 9,375,000

43 IGT: SPD fy14 (17,800,802) -

44 SPD-Mgd Care SB208 (not net of IGT) fy15 - -

45 SPA Physician Supplemental 3,800,000 7,000,000

46 SNF Supplemental 4,500,000 5,000,000

47 Medi-Cal Admin Adjustment (MAA) 1,877,039 -

48 Medi-Care/Medical Settlements - 5,950,152

49 AB915 Supplemental 2,500,000 3,000,000

50 Other Miscellaneous receipts / Grants 7,308,394 12,923,070

51 Other Revenue 61,500 58,000

52 AARA Incentive - Meaningful Use 2,500,000 2,424,000

53 DSRIP 23,036,400

54 DSRIP - HIV Category 5 - 2,559,600

55 SUBTOTAL - Reimbursement 302,578,469 311,848,163

Based on our current Cash Forecast, the Term Debt can be reduced to at

or below $190 million by June 2015, but will go as high as $220 million

during the year.

10

-$15,000,000

-$10,000,000

-$5,000,000

$0

$5,000,000

$10,000,000

$15,000,000

$20,000,000

$25,000,000

$30,000,000

$35,000,000

$40,000,000

7

/

1

1

/

1

4

8

/

1

1

/

1

4

9

/

1

1

/

1

4

1

0

/

1

1

/

1

4

1

1

/

1

1

/

1

4

1

2

/

1

1

/

1

4

1

/

1

1

/

1

5

2

/

1

1

/

1

5

3

/

1

1

/

1

5

4

/

1

1

/

1

5

5

/

1

1

/

1

5

6

/

1

1

/

1

5

AHS System Totals

Operating Accounts Accounts Payable

$150,000,000

$160,000,000

$170,000,000

$180,000,000

$190,000,000

$200,000,000

$210,000,000

$220,000,000

$230,000,000

2

0

1

5

F

C

S

T

7

/

4

/

1

4

7

/

2

5

/

1

4

8

/

1

5

/

1

4

9

/

5

/

1

4

9

/

2

6

/

1

4

1

0

/

1

7

/

1

4

1

1

/

7

/

1

4

1

1

/

2

8

/

1

4

1

2

/

1

9

/

1

4

1

/

9

/

1

5

1

/

3

0

/

1

5

2

/

2

0

/

1

5

3

/

1

3

/

1

5

4

/

3

/

1

5

4

/

2

4

/

1

5

5

/

1

5

/

1

5

6

/

5

/

1

5

6

/

2

6

/

1

5

AHS Debt Forecast

2015 FORECAST

County LOC Balance CURRENT LOC LIMIT

LOC with FLEX MAX

To meet the County obligations, as well as provide funds for operations,

routine capital and growth, AHS needs to increase annual cash flow to

approximately $50 million per year.

11

-

10,000,000

20,000,000

30,000,000

40,000,000

50,000,000

60,000,000

70,000,000

80,000,000

2

0

1

5

2

0

1

6

2

0

1

7

2

0

1

8

2

0

1

9

2

0

2

0

2

0

2

1

2

0

2

2

2

0

2

3

2

0

2

4

2

0

2

5

2

0

2

6

2

0

2

7

2

0

2

8

2

0

2

9

2

0

3

0

2

0

3

1

2

0

3

2

2

0

3

3

2

0

3

4

2

0

3

5

Projected Cash Flow

Accounts Receivable Acceleration

MedAssets Performance Improvement

Plan

Revenue Cycle Improvement Plan

Baseline Financial Plan

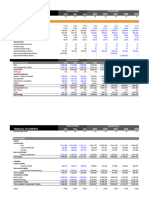

AHS Current Run Rate is ($36) million per year

Comments

1. Adjusted Discharges are 3.1% below

budget.

2. Gross Charges are 4.2% below budget,

Net Revenue 8.2%, or $12 million below.

3. Collection Ratio below budget; payer

mix and targeted improvements not yet

achieved.

4. Expenses $5 million favorable, or 3.4%

5. AHS Net Loss of $5.3 million, or 4.8%.

6. SLH Net Loss of $1.3 million, or 12.4%.

7. AH Net Income of $254k, or 1.7%.

8. Consolidated Net Loss of $6.3 million

for July and August, or 4.7%.

12

Actual Budget Variance % Variance

Inpatient service revenue 222,511 237,482 (14,971) -6.3%

Outpatient service revenue 114,219 114,616 (397) -0.3%

Professional service revenue 42,793 44,014 (1,221) -2.8%

Gross patient service revenue 379,523 396,112 (16,589) -4.2%

Deductions from revenues (299,129) (305,300) 6,171 -2.0%

Net patient service revenue 80,394 90,812 (10,418) -11.5%

Net operating revenue 134,550 146,591 (12,041) -8.2%

Total operating expense 140,849 145,841 4,992 3.4%

Income (6,323) $ 683 $ (7,006) $ -1025.8%

Operating Margin -4.7% 0.5%

Collection % 21.2% 22.9%

Total discharges 2,931 3,088 (157) -5.1%

Total patient days 25,925 25,656 269 1.0%

ALOS 8.85 8.31 1 6.5%

ADC 418 414 4 1.0%

Adjusted patient days 39,233 38,038 1,194 3.1%

Adjusted discharges 4,436 4,578 (143) -3.1%

Net revenue per adj discharge 30.33 32.02 (2) -5.3%

Expense per adj discharge 31.75 31.85 0 0.3%

Income per adj discharge (1.43) 0.15 (2) -1055.6%

Paid Full time equivalents 3,682 3,902 220 5.6%

Paid FTE's per adjusted occupied bed 5.82 6.36 1 8.5%

Salaries, benefits & registry % of net revenue71% 67% (0) -6.2%

Year-To-Date

Consolidated Balance Sheet Excerpts

Comments

1. Operating cash has declined to $5.0

million.

2. Accounts receivable continue to climb,

reaching $149 million.

3. Available restricted funds have been

brought into operations.

4. And Accounts Payable have increase to

$65.8 million over the last two months.

Cash available to pay vendors has been

very low.

5. The negative balance with the County

was $198.7 million at the end of August.

13

LIABILITIES & NET ASSETS

Working Capital Loan - Current Portion $0 $0 $0

Accounts Payable 65,806 56,599 51,078

Compensation Related Liabilities 37,909 34,508 42,909

Estimated third-party settlements payable 79,299 75,911 74,148

Due to County of Alameda & State 15,462 14,310 12,886

Other Payables 27,234 27,086 26,424

TOTAL CURRENT LIABILITIES 225,710 208,414 207,446

Self Insurance Liability 20,352 20,352 20,352

Working Capital Loan - Long-term Portion 198,734 193,574 192,566

Pension and Postemployment 60,876 59,876 58,876

Other Long-term Liabilities 11,808 11,808 11,808

TOTAL LONG TERM LIABILITIES 291,770 285,610 283,601

Current

Month Prior Month FY 2014

ASSETS

Current assets:

Cash & Cash Equivalents $5,040 $8,420 $22,885

Cash Held in Trust 30 30 43

Net Patient Receivables 149,122 141,695 141,601

Due from County of Alameda & Others 73,786 66,484 64,108

Inventories 5,632 5,742 5,649

Prepaid expenses 2,236 2,774 2,429

Other receivables 143,098 130,200 114,767

TOTAL CURRENT ASSETS 378,944 355,344 351,482

Restricted Cash Hospital Fee 0 2,389 7,389

Cash Held Board Designated 23,287 23,287 23,287

TOTAL RESTRICTED CASH 23,287 25,677 30,677

AHS to implement a comprehensive and focused plan to improve

operating performance; including revenue cycle improvement, cash

reduction, supplemental reimbursement, growth, and philanthropy.

1. Current run rate (subject to refinement),

is a negative $36 million annually.

2. Revenue Cycle Improvement are

estimated at $20 to $25 million.

3. Efficiency gains will need to be $20 to

$25 million.

4. DPH Status for SLH and AH may take a

year.

5. AB85 Supplemental Medi-Cal may take

a year.

6. Assumed Revenue Growth - $12 million.

7. Philanthropy - $10 million.

8. Other Sources?

9. The result would be annual free cash

flow of $50+ million, sufficient to meet

our obligations to the County.

14

Improvement Plan - DRAFT Annual

Operating Loss - Current (36,000,000) $

Revenue Cycle Improvement 24,000,000

Efficiency Gains 24,000,000

DPH Status - SLH and AH 8,000,000

AB85 Supplemental MediCal 8,000,000

Growth 12,000,000

Philanthropy 10,000,000

Other Support -

Operating Gain - Target 50,000,000 $

Accounts Receivable Recapture 60,000,000 $

Discussion

15

Revenue Cycle Improvement Program

16

The major activities that need to be completed are:

Reorganize Patient Financial Services to have dedicated units for Hospital,

Clinic and Professional. Organize workgroups by payer, establish and

monitor collection targets, establish a Denials/Follow Up unit, and work down

aged A/R.

Complete MediCal billing certification for SLH and AH, and Medicare

certification for the FQHCs.

Improve Professional Billing through Clinical Documentation, Charge

Capture, Coding, and alignment of incentives.

Improve FQHC Revenue by improving productivity through opening up the

schedules, specialty referral authorizations, improve front end registration

information, and improved charge capture and billing.

Implement our managed care contracting strategy to cover all affiliates with

all payers with appropriate rates and terms.

MedAssets BETTER II Performance Improvement

17

Managed Care Contracting and Capitation

18

The major activities in process:

Brought the contracting function in-house, promoted a new Director of

Contracting, retained an external expert, and relocated Provider Enrollment

to Contracting.

Completed inventory of existing contracts, rates, and terms.

Assessed AHS current contract terms, rates and conditions and developed

preferred structure.

In active negotiation with:

Blue Cross

Kaiser

Alameda Alliance for Health

In negotiation to convert contract to capitation or shared risk.

Gathering data to analyze the DOFR, rates, and terms.

Analyzing system support requirements.

Vous aimerez peut-être aussi

- Wealth Management Services of HDFC BankDocument63 pagesWealth Management Services of HDFC BankSURYA100% (1)

- Week 1 MSTA Notes PDFDocument93 pagesWeek 1 MSTA Notes PDFMohd Najmi HuzaiPas encore d'évaluation

- Testing Point FigureDocument4 pagesTesting Point Figureshares_leonePas encore d'évaluation

- Desirable Corporate Governance: A CodeDocument16 pagesDesirable Corporate Governance: A CodesiddharthanandPas encore d'évaluation

- Forecast Costing MiningDocument59 pagesForecast Costing MiningOki AnriansyahPas encore d'évaluation

- Case 5Document12 pagesCase 5JIAXUAN WANGPas encore d'évaluation

- Factors Affecting Property Value PDFDocument2 pagesFactors Affecting Property Value PDFJennifer100% (1)

- Feasibility Final V2Document7 pagesFeasibility Final V2Sohail MahmoodPas encore d'évaluation

- PRED 3210 Chapter 4Document8 pagesPRED 3210 Chapter 4Jheny PalamaraPas encore d'évaluation

- Spinning Project FeasibilityDocument19 pagesSpinning Project FeasibilityMaira ShahidPas encore d'évaluation

- Dividend Decision Analysis at Zen MoneyDocument100 pagesDividend Decision Analysis at Zen MoneyRoji0% (1)

- Chapter 2 Cost Concepts and The Cost Accounting Information SystemDocument44 pagesChapter 2 Cost Concepts and The Cost Accounting Information Systemelite76Pas encore d'évaluation

- 2019 Blue Book Combined PDFDocument311 pages2019 Blue Book Combined PDFhilton magagadaPas encore d'évaluation

- d11 DFG Part K Development PDFDocument535 pagesd11 DFG Part K Development PDFwaheedPas encore d'évaluation

- Investment Model For 1 MW Solar PlantDocument5 pagesInvestment Model For 1 MW Solar PlantRAViPas encore d'évaluation

- City of Fort St. John - Pandemic Effect On The Operating Budget, March 2020Document4 pagesCity of Fort St. John - Pandemic Effect On The Operating Budget, March 2020AlaskaHighwayNewsPas encore d'évaluation

- 2.0 Mba 670 GMDocument6 pages2.0 Mba 670 GMLauren LoshPas encore d'évaluation

- Product Review Flexible Endowment Plan (FEP)Document12 pagesProduct Review Flexible Endowment Plan (FEP)kayode AdebayoPas encore d'évaluation

- MA Submit-3Document19 pagesMA Submit-3KaiQiPas encore d'évaluation

- PR 53Document8 pagesPR 53viswadevassociates.tvmPas encore d'évaluation

- BILLS 112hconres112ehDocument70 pagesBILLS 112hconres112ehMichael PancierPas encore d'évaluation

- Adesoye, Adeniji-Scena - CorrectDocument11 pagesAdesoye, Adeniji-Scena - CorrectAdesoye AdenijiPas encore d'évaluation

- Pratik Project Report (Bank OD)Document6 pagesPratik Project Report (Bank OD)Raghu RangrejPas encore d'évaluation

- Analisis de AmazonDocument6 pagesAnalisis de AmazonFrancisco MuñozPas encore d'évaluation

- Income Statement - Annual - As Originally ReportedDocument4 pagesIncome Statement - Annual - As Originally ReportedAnkurPas encore d'évaluation

- Receipts Estimates and Spending CeilingDocument3 pagesReceipts Estimates and Spending CeilingrejieobsiomaPas encore d'évaluation

- Bsbfim601 Manage Finances Prepare BudgetsDocument9 pagesBsbfim601 Manage Finances Prepare BudgetsAli Butt100% (4)

- Itsa Excel SheetDocument7 pagesItsa Excel SheetraheelehsanPas encore d'évaluation

- Wilmington NC City Council Ordinance To Increase Employee CompensationDocument5 pagesWilmington NC City Council Ordinance To Increase Employee CompensationJamie BouletPas encore d'évaluation

- Medical ShopDocument11 pagesMedical ShopVeerabhadreshwar Online CenterPas encore d'évaluation

- SamigroupDocument9 pagesSamigroupsamidan tubePas encore d'évaluation

- HotelDocument4 pagesHotelSoumitraPas encore d'évaluation

- Supershop Fianal For Balance SheetDocument21 pagesSupershop Fianal For Balance SheetMohammad Osman GoniPas encore d'évaluation

- Aqua Chilled - MARKETING PLAN DraftDocument4 pagesAqua Chilled - MARKETING PLAN DraftKyle TimonPas encore d'évaluation

- 20201111report Financial Report December 2020 TheresidencesatbrentDocument18 pages20201111report Financial Report December 2020 TheresidencesatbrentChaPas encore d'évaluation

- Magma Minerals Case StudyDocument6 pagesMagma Minerals Case StudyJoyce De LunaPas encore d'évaluation

- Sighthill Consultancy Business ProposalDocument8 pagesSighthill Consultancy Business ProposalHumphrey OyatsiPas encore d'évaluation

- Financial and Physical Targets of The Rice Program Not Fully AchievedDocument47 pagesFinancial and Physical Targets of The Rice Program Not Fully AchievedOrlando V. Madrid Jr.Pas encore d'évaluation

- Bsbfim601 FNDocument19 pagesBsbfim601 FNKitpipoj PornnongsaenPas encore d'évaluation

- PROPOSED BUDGET ESTIMATES For The Year Ending December 31, 2023 (Blue Book)Document565 pagesPROPOSED BUDGET ESTIMATES For The Year Ending December 31, 2023 (Blue Book)Thembinkosi BhonkwanePas encore d'évaluation

- Project Report Ca SignDocument9 pagesProject Report Ca SignRavindra JondhalePas encore d'évaluation

- Main Tables (Lower Version)Document2 pagesMain Tables (Lower Version)vishalbharatshah2776Pas encore d'évaluation

- 2013 Proposed BudgetDocument339 pages2013 Proposed BudgetMichael PurvisPas encore d'évaluation

- Chapter 6 PDFDocument23 pagesChapter 6 PDFreyPas encore d'évaluation

- Utkarsh DraftDocument15 pagesUtkarsh DraftshubhenduPas encore d'évaluation

- Invoice-27 MOA-4 Rekap PDFDocument1 pageInvoice-27 MOA-4 Rekap PDFdeeb1987Pas encore d'évaluation

- Main TablesDocument1 pageMain Tablesvishalbharatshah2776Pas encore d'évaluation

- PSA Mock Questionnov 2019 PDFDocument31 pagesPSA Mock Questionnov 2019 PDFmaterials downloadPas encore d'évaluation

- Kertas Kerja (Yesaya Ab 92 Ol RS 2) - Susper A - PPH BadanDocument7 pagesKertas Kerja (Yesaya Ab 92 Ol RS 2) - Susper A - PPH BadanRayentPas encore d'évaluation

- Case Study FinalDocument47 pagesCase Study FinalVan Errl Nicolai SantosPas encore d'évaluation

- Option B ProjectionsDocument6 pagesOption B ProjectionsCedric JohnsonPas encore d'évaluation

- WVU's Budget For FY 2024Document37 pagesWVU's Budget For FY 2024Anna SaundersPas encore d'évaluation

- PR 117 Part 2Document9 pagesPR 117 Part 2viswadevassociates.tvmPas encore d'évaluation

- Dermatology Express LLC - Confidential Year 1 RevenueDocument9 pagesDermatology Express LLC - Confidential Year 1 RevenueBob SpoontPas encore d'évaluation

- Management Report Q1 FY2022-23.xlsx - 052349Document25 pagesManagement Report Q1 FY2022-23.xlsx - 052349Christina TuwonikePas encore d'évaluation

- All Number in Thousands)Document7 pagesAll Number in Thousands)Lauren LoshPas encore d'évaluation

- State Budget FY23-24Document117 pagesState Budget FY23-24Roxanne WerlyPas encore d'évaluation

- Cost of The Project: M/S Sarala Fly Ash BricksDocument6 pagesCost of The Project: M/S Sarala Fly Ash BricksGOUTAM GOSWAMIPas encore d'évaluation

- Laporan Keuangan GGRM (2014 S.D. 2016)Document4 pagesLaporan Keuangan GGRM (2014 S.D. 2016)Eriko Timothy GintingPas encore d'évaluation

- Brunswick County Feasibility Report-2nd Draft 9-16-19Document48 pagesBrunswick County Feasibility Report-2nd Draft 9-16-19Johanna Ferebee StillPas encore d'évaluation

- Lra 2014 1Document2 pagesLra 2014 1Muhammad RahardianPas encore d'évaluation

- F - Analysis - HorizontalDocument14 pagesF - Analysis - Horizontaljaneferrarin551Pas encore d'évaluation

- LIC S Jeevan Rekha 512N211V01Document4 pagesLIC S Jeevan Rekha 512N211V01Ramu448Pas encore d'évaluation

- DCF Practice ProblemDocument4 pagesDCF Practice Problemshairel-joy marayagPas encore d'évaluation

- Santo Nino Executive Summary 2015Document6 pagesSanto Nino Executive Summary 2015mocsPas encore d'évaluation

- SA4567Summary (7 29)Document1 pageSA4567Summary (7 29)api-27836025Pas encore d'évaluation

- Capital BudgetingDocument14 pagesCapital BudgetingbhaskkarPas encore d'évaluation

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionD'EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionPas encore d'évaluation

- Alameda POA LetterDocument1 pageAlameda POA LetterAction Alameda NewsPas encore d'évaluation

- Joel Spencer ClaimDocument4 pagesJoel Spencer ClaimAction Alameda NewsPas encore d'évaluation

- Measure L1 Rebuttals To Arguments For and AgainstDocument2 pagesMeasure L1 Rebuttals To Arguments For and AgainstAction Alameda NewsPas encore d'évaluation

- City of Alameda Street Repair 2016Document1 pageCity of Alameda Street Repair 2016Action Alameda NewsPas encore d'évaluation

- City of Alameda Ginsburg Case June 2016Document27 pagesCity of Alameda Ginsburg Case June 2016Action Alameda NewsPas encore d'évaluation

- Presentation REVISED 1Document27 pagesPresentation REVISED 1Action Alameda NewsPas encore d'évaluation

- Alameda Unified 2014 Teachers PayDocument30 pagesAlameda Unified 2014 Teachers PayAction Alameda NewsPas encore d'évaluation

- Principles of AgreementDocument4 pagesPrinciples of AgreementAction Alameda NewsPas encore d'évaluation

- 2016 Bay Area Council Survey ResultsDocument17 pages2016 Bay Area Council Survey ResultsAction Alameda NewsPas encore d'évaluation

- Rent Survey Summary April 3, 2016Document1 pageRent Survey Summary April 3, 2016Action Alameda NewsPas encore d'évaluation

- Matt Sridhar Letter To Alameda City CouncilDocument4 pagesMatt Sridhar Letter To Alameda City CouncilAction Alameda NewsPas encore d'évaluation

- Alameda NAS FOST2 December 2015Document144 pagesAlameda NAS FOST2 December 2015Action Alameda NewsPas encore d'évaluation

- Central Banking and Financial RegulationsDocument9 pagesCentral Banking and Financial RegulationsHasibul IslamPas encore d'évaluation

- Cash Management-Models: Baumol Model Miller-Orr Model Orgler's ModelDocument5 pagesCash Management-Models: Baumol Model Miller-Orr Model Orgler's ModelnarayanPas encore d'évaluation

- Fraud in Banking SectorDocument30 pagesFraud in Banking SectorRavleen Kaur100% (1)

- Chapter 9: Consolidation: Controlled Entities: ACCT6005 Company Accounting Tutorial QuestionsDocument5 pagesChapter 9: Consolidation: Controlled Entities: ACCT6005 Company Accounting Tutorial QuestionsujjwalPas encore d'évaluation

- ANTARMANA - Sale AA 1936 23 24 173713 - 1688213236Document2 pagesANTARMANA - Sale AA 1936 23 24 173713 - 1688213236gyan chand kumawatPas encore d'évaluation

- Sales Invoice: Customer InformationDocument1 pageSales Invoice: Customer InformationRaghavendra S DPas encore d'évaluation

- RE 01 11 Pre Sold Condo Units SolutionsDocument5 pagesRE 01 11 Pre Sold Condo Units SolutionsAnonymous bf1cFDuepPPas encore d'évaluation

- Bhavesh Jadav BB 1Document7 pagesBhavesh Jadav BB 1bhaveshjadavPas encore d'évaluation

- Mmm-List of DocsDocument8 pagesMmm-List of Docsmadhukar sahayPas encore d'évaluation

- In The United States Bankruptcy Court For The District of Delaware in Re:) Chapter 11 Pacific Energy Resources LTD., Et Al.,') Case No. 09-10785 (KJC) ) (Jointly Administered) Debtor.)Document67 pagesIn The United States Bankruptcy Court For The District of Delaware in Re:) Chapter 11 Pacific Energy Resources LTD., Et Al.,') Case No. 09-10785 (KJC) ) (Jointly Administered) Debtor.)Chapter 11 DocketsPas encore d'évaluation

- SIMPLE and COMPOUND INTEREST 11Document69 pagesSIMPLE and COMPOUND INTEREST 11Jay QuinesPas encore d'évaluation

- 1000 Assets: Account # Account NameDocument24 pages1000 Assets: Account # Account NameGomv ConsPas encore d'évaluation

- Meta Reports Fourth Quarter and Full Year 2022 Results 2023Document12 pagesMeta Reports Fourth Quarter and Full Year 2022 Results 2023Fady EhabPas encore d'évaluation

- NCB Financial Group (NCBFG) - Unaudited Financial Results PDFDocument22 pagesNCB Financial Group (NCBFG) - Unaudited Financial Results PDFBernewsAdminPas encore d'évaluation

- Business Plan For Machinery Rental and Material SupplyDocument8 pagesBusiness Plan For Machinery Rental and Material SupplyAbenetPas encore d'évaluation

- Capital Budgeting Practices A Study of Companies Listed On The Colombo Stock Exchange Sri LankaDocument9 pagesCapital Budgeting Practices A Study of Companies Listed On The Colombo Stock Exchange Sri LankamhldcnPas encore d'évaluation

- TallyPrime Essential Level 2Document26 pagesTallyPrime Essential Level 2Lavanya TPas encore d'évaluation

- Introduction On HDFC BankDocument3 pagesIntroduction On HDFC BankAditya Batra50% (2)

- Exhaustive List of Analytics Companies in IndiaDocument4 pagesExhaustive List of Analytics Companies in IndiagoodthoughtsPas encore d'évaluation

- B1 How To Deal With Money LIU006: WWW - English-Practice - atDocument1 pageB1 How To Deal With Money LIU006: WWW - English-Practice - atIoana-Daniela PîrvuPas encore d'évaluation

- Institute and Faculty of Actuaries: Subject CT1 - Financial Mathematics Core TechnicalDocument5 pagesInstitute and Faculty of Actuaries: Subject CT1 - Financial Mathematics Core TechnicalfeerererePas encore d'évaluation