Académique Documents

Professionnel Documents

Culture Documents

A1 Online Stock Tips

Transféré par

rajnishtrifidCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

A1 Online Stock Tips

Transféré par

rajnishtrifidDroits d'auteur :

Formats disponibles

30 SEPTEMBER14

www.trifidresearch.com

S

S

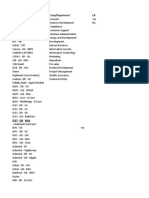

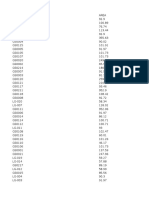

INDEX VALUE CHANGE %

SENSEX 26597 -29 -0.11

NIFTY 7958 -9 -0.12

BANK NIFTY 15473 -134 -0.86

INDIA VIX 13.38

0.46 3.53

CATEGORY BUY SELL NET

FII 2643.78 2493.68 150.1

DII 1323.36

1088.84

234.52

BIG BULLS ACTIVITY

MARKET GOSSIPS FOURTH UMPIRE

Markets hovered around their

resistance levels and mainly moved

in a tight range for most of the

session; finally ended the volatile

session on a flat note with negative

bias. Nifty future is taking constant

resistance around 214 day EMA of

8026 and needs to close above it to

break the upper consolidation of

8060. While, intraday support is

seen in the range of 7970-7930.

Volatile movements are expected

due to RBI Monetary Policy in the

coming session.

TREND: SIDEWAYS

SUPPORT : 7970 & 7930

RESISTANCE: 8060 & 8100

MARKET POSITIONS

Sensex, Nifty end down ahead

of RBI policy review; IT gains.

Cox & Kings surged 11% on

Modi's visa plans.

Pharma stocks rallied; CNX

Pharma index hits fresh high.

TCS gains 3% on receiving best

technology provider award in

US.

HUL dips: Morgan Stanley cuts

on 'lofty' valuations.

SCRIPS @ TARGETS

B/S SL1 T1 T2 T3

AMBUJACEM B 217 216 218 219 220

HEXAWARE B 201.50 200.50 202.50 203.50 204.50

SCRIPS @ TARGETS

B/S SL1 T1 T2 T3

TVSMOTOR B 231.50 229.20 233.80 236.10 238.50

UPL

B 350 346.50 353.50 357 360.50

SCRIPS CLOSE R2 R1 S1 S2

RELIANCE FUT 943.25 1020 980 900 860

ONGC FUT 409.95 419 414 405 400

TATA STEEL FUT 470.50 480 475 465 460

SBI FUT 2459.90 2540 2500 2410 2370

INFY FUT 3727.45 3810 3770 3690 3650

NIL.

OPEN INTEREST 26-SEPT-13 29-SEPT-14 CHANGE IN OPEN

INTEREST

%

NIFTY

16409700 15503850 -905850 -5.52

FUTURE

CASH

PIVOT TABLE

FUTURES & OPTIONS DATA

SCRIPS IN F&O BAN FOR TRADE

A STEP AHEAD

WWW.TRIFIDRESEARCH.COM

DISCLAIMER

Vous aimerez peut-être aussi

- Excellent Equity Tips & News PortalDocument4 pagesExcellent Equity Tips & News PortalrajnishtrifidPas encore d'évaluation

- Online Stock Tips For BeginnersDocument4 pagesOnline Stock Tips For BeginnersrajnishtrifidPas encore d'évaluation

- Trifid Research - Equity Tips For BeginnersDocument4 pagesTrifid Research - Equity Tips For BeginnersrajnishtrifidPas encore d'évaluation

- Equity Tips To Bost Your TradingDocument4 pagesEquity Tips To Bost Your TradingrajnishtrifidPas encore d'évaluation

- Online Commodity Tips For BeginnersDocument3 pagesOnline Commodity Tips For BeginnersrajnishtrifidPas encore d'évaluation

- Equity Tips For Intelligent Market TraderDocument4 pagesEquity Tips For Intelligent Market TraderrajnishtrifidPas encore d'évaluation

- Excellent Weekly MCX Tips & News PortalDocument6 pagesExcellent Weekly MCX Tips & News PortalrajnishtrifidPas encore d'évaluation

- Excellent Weekly Equity Tips & News PortalDocument6 pagesExcellent Weekly Equity Tips & News PortalrajnishtrifidPas encore d'évaluation

- Excellent Weekly Currency Tips & News PortalDocument5 pagesExcellent Weekly Currency Tips & News PortalrajnishtrifidPas encore d'évaluation

- Weekly Free Equity Trading Tips & NewsDocument6 pagesWeekly Free Equity Trading Tips & NewsrajnishtrifidPas encore d'évaluation

- Free Equity Trading Tips and Market NewsDocument4 pagesFree Equity Trading Tips and Market NewsrajnishtrifidPas encore d'évaluation

- Currency Trading Tips For BeginnersDocument5 pagesCurrency Trading Tips For BeginnersrajnishtrifidPas encore d'évaluation

- Investment Tips On Equity MarketDocument4 pagesInvestment Tips On Equity MarketrajnishtrifidPas encore d'évaluation

- Accurate Equity Tips ProviderDocument4 pagesAccurate Equity Tips ProviderrajnishtrifidPas encore d'évaluation

- Weekly Free Commodity Trading Tips & NewsDocument6 pagesWeekly Free Commodity Trading Tips & NewsrajnishtrifidPas encore d'évaluation

- To Find Live Equity Tips and Equity Market NewsDocument4 pagesTo Find Live Equity Tips and Equity Market NewsrajnishtrifidPas encore d'évaluation

- Equity Tips and Online Market NewsDocument4 pagesEquity Tips and Online Market NewsrajnishtrifidPas encore d'évaluation

- To Find Free Stock Tips For BeginnersDocument4 pagesTo Find Free Stock Tips For BeginnersrajnishtrifidPas encore d'évaluation

- Equity Tips For Professional TradersDocument4 pagesEquity Tips For Professional TradersrajnishtrifidPas encore d'évaluation

- Profitable Free Stock Tips of Stock MarketDocument4 pagesProfitable Free Stock Tips of Stock MarketrajnishtrifidPas encore d'évaluation

- Morning Free MCX Market NewsDocument3 pagesMorning Free MCX Market NewsrajnishtrifidPas encore d'évaluation

- MCX Trading Tips For BeginnersDocument6 pagesMCX Trading Tips For BeginnersrajnishtrifidPas encore d'évaluation

- Morning Free Stock Market NewsDocument4 pagesMorning Free Stock Market NewsrajnishtrifidPas encore d'évaluation

- Weekly Stock Tips and Market NewsDocument6 pagesWeekly Stock Tips and Market NewsrajnishtrifidPas encore d'évaluation

- Equity Tips and News For Online Market TraderDocument4 pagesEquity Tips and News For Online Market TraderrajnishtrifidPas encore d'évaluation

- Weekly MCX Tips and Market NewsDocument6 pagesWeekly MCX Tips and Market NewsrajnishtrifidPas encore d'évaluation

- Free Stock Tips & News For Non Risky TradingDocument4 pagesFree Stock Tips & News For Non Risky TradingrajnishtrifidPas encore d'évaluation

- On Time With High Accuracy Free Stock TipsDocument4 pagesOn Time With High Accuracy Free Stock TipsrajnishtrifidPas encore d'évaluation

- Stock Tips by The Trifid ExpertDocument4 pagesStock Tips by The Trifid ExpertrajnishtrifidPas encore d'évaluation

- Weekly Stock Tips and Market NewsDocument6 pagesWeekly Stock Tips and Market NewsrajnishtrifidPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- FHPL Hospital ListDocument4 pagesFHPL Hospital ListSimranjeet SinghPas encore d'évaluation

- 64 MCQs - SEBIDocument19 pages64 MCQs - SEBImohamed mowafeyPas encore d'évaluation

- Summer Internship Project Report On Overview Study of Stock Exchange Market of India at - CompressDocument63 pagesSummer Internship Project Report On Overview Study of Stock Exchange Market of India at - CompressAryaman Solanki100% (2)

- At Last A Clean Sweep Negative Week: Market MovementDocument8 pagesAt Last A Clean Sweep Negative Week: Market MovementDhruv ParikhPas encore d'évaluation

- Motilal Oswal Securities Limited Analysis of Derivative and Stock MarketDocument104 pagesMotilal Oswal Securities Limited Analysis of Derivative and Stock MarketJitendra Virahyas100% (3)

- A Study On Investors Perception Towards Sharemarket in Sharekhan LTDDocument9 pagesA Study On Investors Perception Towards Sharemarket in Sharekhan LTDEditor IJTSRDPas encore d'évaluation

- R. Wadiwala: Morning NotesDocument7 pagesR. Wadiwala: Morning NotesRWadiwala SecPas encore d'évaluation

- S&P CNX Nifty SecDocument48 pagesS&P CNX Nifty SecMehul J VachhaniPas encore d'évaluation

- Handbook On Stock Market in IndiaDocument10 pagesHandbook On Stock Market in IndiaAmit SinhaPas encore d'évaluation

- TimeSheet Daily Task Tracker v1.1 NewDocument399 pagesTimeSheet Daily Task Tracker v1.1 NewTestPas encore d'évaluation

- Index Numbers - A Statistical Tool for Measuring Economic ChangesDocument19 pagesIndex Numbers - A Statistical Tool for Measuring Economic Changesgeorge booksPas encore d'évaluation

- DOLAT Capital - Dissecting FMCG ValuationsDocument24 pagesDOLAT Capital - Dissecting FMCG ValuationsTheloopunPas encore d'évaluation

- Auto UpdatedDocument8 pagesAuto UpdatedAmitesh AgrawalPas encore d'évaluation

- Bombay Stock ExchangeDocument16 pagesBombay Stock ExchangeabhasaPas encore d'évaluation

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument20 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceTavamani Gracy J.Pas encore d'évaluation

- Geand MallDocument8 pagesGeand Mallkksingh007indiaPas encore d'évaluation

- MPDocument4 pagesMPJohn BestPas encore d'évaluation

- Market Holiday - Is The Stock Market Closed For Trading Tomorrow - The Economic TimesDocument11 pagesMarket Holiday - Is The Stock Market Closed For Trading Tomorrow - The Economic TimesSam vermPas encore d'évaluation

- GIC to invest $100 mn in Godrej office projectDocument4 pagesGIC to invest $100 mn in Godrej office projectHansaraj ParidaPas encore d'évaluation

- Ketan Parekh: The Rise and Fall of the Bombay BullDocument31 pagesKetan Parekh: The Rise and Fall of the Bombay Bullolkp151019920% (1)

- Fundamental and Technical Analysis of Selected Companies With Reference To Automobile Companies in IndiaDocument83 pagesFundamental and Technical Analysis of Selected Companies With Reference To Automobile Companies in IndiaShahzad SaifPas encore d'évaluation

- FINANCE and ACCOUNTING - An Ultimate Book of Accounting Basics and Financial Management. Financial Analysis Have Done Through Latest Financial Statements ... Leading Manufacturing Company FYE DEC 2019Document794 pagesFINANCE and ACCOUNTING - An Ultimate Book of Accounting Basics and Financial Management. Financial Analysis Have Done Through Latest Financial Statements ... Leading Manufacturing Company FYE DEC 2019abhinesh243Pas encore d'évaluation

- Sharkhan Valueguide 2016Document68 pagesSharkhan Valueguide 2016Nitesh BajajPas encore d'évaluation

- Major Indian stock exchangesDocument2 pagesMajor Indian stock exchangesGinni MehtaPas encore d'évaluation

- Reimbursement LetterDocument2 pagesReimbursement LetterDr Diana MosesPas encore d'évaluation

- Bombay Stock Exchange (BSE)Document15 pagesBombay Stock Exchange (BSE)Kumar DoddamaniPas encore d'évaluation

- IDirect MarketStrategy 2023Document43 pagesIDirect MarketStrategy 2023Harris AliyarPas encore d'évaluation

- 3 Weekly Tight Closing (WTC), Technical Analysis ScannerDocument4 pages3 Weekly Tight Closing (WTC), Technical Analysis ScannerDeepak KansalPas encore d'évaluation

- Major ProjectDocument80 pagesMajor ProjectAllan RajuPas encore d'évaluation

- Multibagger PDFDocument23 pagesMultibagger PDFDAYAMOY APLPas encore d'évaluation