Académique Documents

Professionnel Documents

Culture Documents

Tax Saving Schemes

Transféré par

asha010112Description originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Tax Saving Schemes

Transféré par

asha010112Droits d'auteur :

Formats disponibles

Best investment options under Section 80C

to save tax

PPF

Rating: *****

The PPF is an all-time favourite investment option and the Budget has only made it more attractive by

enhancing the annual investment limit to Rs 1.5 lakh. The PPF offers investors a lot of flexibility. You

can open an account in a post office branch or a bank. The maximum investment of Rs1.5 lakh in a year

can be done as a lump sum or as instalments on any working day of the year. Just make sure you invest

the minimum Rs 500 in your PPF account in a year, otherwise you will be slapped with a nominal, but

irksome, penalty of Rs 50. Though the PPF account matures in 15 years, you can extend it in blocks of

five years each. The PPF is useful for risk-averse investors, self-employed professionals and those not

covered by the EPF.

ELSS funds

Rating: *****

Equity-linked saving schemes (ELSS) have the shortest lock-in period of three years among all the tax-

saving options under Section 80C. But this should not be the most important reason for investing in this

avenue. Being equity funds, these schemes can generate good returns for investors over the long term.

The minimum investment in ELSS funds is very low. Though regular equity mutual funds have a minimum

investment of Rs 5,000, you can put in as little as Rs 500 in an ELSS scheme. Unlike a Ulip, pension plan

or an insurancepolicy, there is no compulsion to continue investments in subsequent years. To make

most of ELSS funds, stagger your investment over a period of time instead of putting a large sum at one

go.

Ulips

?Rating: ****

The 2010 guidelines have made Ulips more customer-friendly. A new online Ulip

launched by HDFC Life charges only 1.35 per cent for fund management. There is no

other charge except for the risk cover provided by the policy. This makes the

click2invest policy even cheaper than direct mutual funds. Keep in mind that a Ulip

yields good results only if held for at least 10-12 years.

NPS

Rating: ****

Its low-cost structure, flexibility and other investor-friendly features make the New

Pension Scheme an ideal investment vehicle for retirement planning. The scheme

scores high on flexibility. The minimum investment of Rs 6,000 can be invested as a

lump sum or in instalments of at least Rs 500. There is no limit. The investor also

decides the allocation to equity, corporate bonds and gilts. Be ready for a lot of legwork

before you can buy.

Bank FDs and NSCs

Rating: ***

Don't get misled by the high interest rates offered on the 5-year bank fixed deposits.

Interest income is fully taxable so the post-tax yield may not be as high as you think. In

the 20 per cent and 30 per cent income tax brackets, it is not as attractive as the yield of

the tax-free PPF.

Life Insurance plans

Rating: **

Though the Irda guidelines for traditional plans have made insurance policies more

customer-friendly, they are still the worst way to save tax. The tax saving is only meant

to reduce the cost of insurance. It is not the core objective of the policy.

Pension plans

Rating: *

The charges of pension plans offered by life insurers are significantly higher than those

of the NPS. The difference can snowball into a wide gap over the long term. The other

problem is that annuity income is still not tax-free, which makes pension plans rather

unattractive for retirees.

SCSS

Rating: ****

This assured return scheme is the best tax-saving avenue for senior citizens. However,

the Rs 15 lakh investment limit somewhat curtails its utility. The interest rate is 100

basis points above the 5-year government bond yield. The interest is paid on 31 March,

30 June, 30 September and 31 December, irrespective of when you start investing.

How much more you need to save under

Section 80 C

The Budget has raised the maximum deduction under Section 80C, but this should not make you invest

at random.

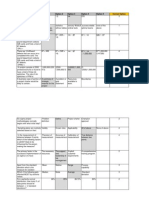

Here are the Section 80C investments of four typical taxpayers. Only one of them actually needs to invest

more to save tax. Before you make the additional investment of Rs 50,000, use the column at the end to

calculate how much more you need to invest for saving tax.

10 best tax-saving investments

Multiple options. Contradictory advice. And a deadline that's approaching fast. Many

taxpayers find themselves in this situation at the beginning of the year when they have

to make tax-saving investments.

Are you also confused? Before you make a choice, go through our cover story to know

which is the best option for you. We have ranked 10 of the most common investments

under Section 80C on five basic parameters: returns, safety, flexibility, liquidity and

taxability. Every investment has its pros and cons.

The PPF may not have a very high return, but its tax-free status, flexibility of investment

and liquidity by way of loans and withdrawals, gives it the crown in our beauty pageant.

Equity-linked saving schemes come in second because of their high returns, flexibility,

liquidity and tax-free status. However, traditional insurance policies, an all-time favourite

of Indian taxpayers, manage the ninth place because of the low returns they offer and

their rigidity.

Some readers might be surprised that the much reviled Ulips are in the third place. The

Ulip remains a mystery and its returns are seldom tracked. We checked Morningstar's

data on Ulips and found that the returns have not been very good in the past 1-5 years.

Even so, it can be a useful instrument for the smart investor who shifts his money

between equity and debt without incurring any tax.

We have tried to separate the chaff from the grain by assigning a star rating to the

various tax-saving options. Whether you are a novice or a seasoned investor, you will

find it useful. It will help you cut through the clutter and choose the investment option

that best suits your financial situation.

1. PPF

RETURNS: 8.7% (for 2013-14)

This all-time favourite became even more attractive after the interest rate was linked to

bond yields in the secondary market.

The PPF is our top choice as a tax saver in 2014. It scores well on almost all

parameters. This small saving scheme has always been a favourite tax-saving tool, but

the linking of its interest rate to the bond yield in the secondary market has made it even

better. This ensures that the PPF returns are in line with the prevailing market rates.

This year, the PPF will earn 8.7 per cent, 25 basis points above the average benchmark

yield in the previous fiscal year. The benchmark yield had shot up in July and has

mostly remained above 8.5 per cent in the past six months. Although the yield is unlikely

to sustain at the current levels, analysts don't expect it to fall below 8.25 per cent within

the next 2-3 months. So it is reasonable to expect that the PPF rate would be hiked

marginally in 2014-15.

The PPF offers investors a lot of flexibility. You can open an account in a post office

branch or a bank. However, the commission payable to an agent for opening this

account has been discontinued, so you will have to manage the paperwork yourself.

The good news is that some private banks, such as ICICI Bank, allow online

investments in the PPF accounts with them. There's flexibility even in the quantum and

periodicity of investment.

The maximum investment of Rs 1 lakh in a year can be done as a lump sum or as

instalments on any working day of the year. Just make sure you invest the minimum Rs

500 in your PPF account in a year, otherwise you will be slapped with a nominal, but

irksome, penalty of Rs 50. Though the PPF account matures in 15 years, you can

extend it in blocks of five years each. However, this facility is no longer available to

HUFs.

The PPF also offers liquidity to the investor. If you need money, you can withdraw after

the fifth year, but withdrawals cannot exceed 50 per cent of the balance at the end of

the fourth year, or the immediate preceding year, whichever is lower. Also, only one

withdrawal is allowed in a financial year.

You can also take a loan against the PPF, but it cannot exceed 25 per cent of the

balance in the preceding year. The loan is charged at 2 per cent till 36 months, and 6

per cent for longer tenures. Till a loan is repaid, you can't take more. If you dip into your

PPF account, be sure to put back the amount at the earliest. Withdrawing from long-

term savings is not a good strategy if you do it frequently. It can dent your overall

retirement planning.

The PPF is especially useful for risk-averse investors, self-employed professionals and

those not covered by the Employees Provident Fund and other retiral benefits.

2. ELSS FUNDS

RETURNS: 17.5 per cent (Past five years)

The potential for high returns, wide choice of funds and flexibility make these funds a

good tax-saving option for equity investors.

Equity-linked saving schemes (ELSS) have the shortest lock-in period of three years among all the tax-

saving options under Section 80C. However, this should not be the most important reason for investing in

this avenue. Being equity funds, these schemes can generate good returns for investors over the long

term. In the past five years, this category has created wealth for investors with average returns of 17.5

per cent.

However, this potential to earn high returns comes with a higher risk. There is no

guarantee that your investment will generate positive returns after the 3-year lock-in

period. The category has generated an average return of 2 per cent in the past three

years. Even the best performing funds have churned out disappointing returns. The

returns will naturally mirror the performance of the stock markets. Therefore, only

investors who have the stomach for a roller-coaster ride should consider this option.

Should investors avoid ELSS now, especially since the stock market is close to its all-

time high? Not really, because the stock market has returned to the previous high after

a 6-year gap and, therefore, is not overvalued at all. "Since the stock market is

reasonably valued now, ELSS should generate good returns for investors who can

remain invested for 5-7 years," says Gajendra Kothari, managing director and CEO,

Etica Wealth Management.

Though the large-cap Sensex and Nifty are at higher levels, the mid-cap and small-cap

indices are at much lower levels. This means there is enough value in midcap stocks,

which should help the fund managers do well in the coming years. Selecting the right

scheme is crucial since there is significant variation in the returns of different schemes.

Though past performance is an important parameter, also take into account the track

record of the fund house and fund manager. Once you select a scheme, decide whether

you want to go for the dividend or growth option. There is no difference in the tax

treatment of the two options. The decision should be based on the cash-flow

requirements of the investor. If you opt for the dividend option of the fund, you might get

some portion of the money back within 1-2 months. Dividends from mutual funds are

tax-free so there is no tax liability as well. Avoid the dividend reinvestment option for

ELSS schemes because the lock-in period will prevent you from exiting fully.

Though the ELSS funds invest in equities, they are different from other open-ended

diversified equity funds. Due to the lock-in period, the ELSS fund manager does not

have to worry about redemption pressure from investors. This gives him the freedom to

invest in shares as per his conviction and hold them for longer periods.

In the past few years, the ELSS category has consistently outperformed the large and

midcap sub-category of diversified equity funds (see graphic).

ELSS funds offer tremendous flexibility to investors. As mentioned earlier, the 3-year

lock-in period is the shortest. Since there is no tax on gains from equity funds after a

year, an investor can safely recycle his investments every three years and claim tax

benefits on the reinvested amount.

Young taxpayers, who have taken huge loans and don't have enough surplus to save

tax, will find these schemes very useful. If you can help it, don't exit the scheme after

three years just because lock-in period is over. Studies show that equities give better

returns in the long term. The minimum investment is also very low.

Though regular equity mutual funds have a minimum investment of Rs 5,000, you can

put in as little as Rs 500 in an ELSS scheme. Unlike a Ulip, pension plan or an

insurance policy, there is no compulsion to continue investments in subsequent years.

Since ELSS funds are a high-risk investment and their NAVs are volatile, you need to

stagger your investment over a period of time instead of going for a lump-sum

investment at the end of the financial year. This is more important at this juncture when

the benchmark indices are trading close to their all-time high levels.

Your best option is to take the SIP route. This may not be possible now because you

have less than three months before the 31 March deadline. At best, you can split the

investment into three tranches. Before you take the plunge, remember that your

investment should be guided by your overall asset allocation. If your exposure to

equities is lower than what you want, go for the ELSS fund. If your portfolio already has

too much equity, avoid investing in these funds.

BRIGHT IDEA: Don't invest a lump sum. Split investments in ELSS funds into three

SIPs starting from January till March.

3. RGESS: An avoidable option for the first-time equity investor

The RGESS allows first-time equity investors earning up to Rs 12 lakh a year additional

tax savings under the newly introduced Section 80 CCG. If you invest in the RGESS

options, you can claim a deduction of 50 per cent of the invested amount. The

maximum investment is Rs 50,000, so the maximum deduction availed of can be Rs

25,000. This is over and above the Rs 1 lakh limit available under Section 80C.

The scheme permits investments in the BSE-100 or CNX 100 shares, shares of

Maharatna, Navratna or Miniratna PSUs, or in designated equity mutual funds and

ETFs. Should you invest in it to avail of this benefit? We would not advise investing

directly in shares just to claim tax deduction. In fact, the first-time investors are better off

taking the mutual fund route.

If you do opt for any RGESS fund or ETF, your investment is locked in for three years

(fixed lock-in period during the first year, followed by a flexible lock-in period for the two

subsequent years). Under the flexible lock-in option, you are allowed to sell your

RGESS shares or mutual funds units and reinvest the proceeds in any other RGESS

instrument. This will enable you to get rid of the underperforming investments and shift

to better options. However, in the absence of an SIP facility, you are exposed to market

timing.

Also, the maximum tax saving you can get through this scheme is Rs 7,725 for those in

the 30 per cent income tax bracket. In the 20 per cent bracket, the maximum saving is

Rs 5,150, while you save only Rs 2,575 in the 10 per cent bracket. This is not much

considering the risk you are taking by investing in equities. Besides, investors will also

need to open a demat account to invest in the RGESS, which would incur annual

charges.

4. ULIPs

RETURNS: 7.2-11.8 per cent (Past five years)

Don't go by the past record. The new Ulip is a good way to invest in the equity and debt

markets for tax-free returns.

There's a good reason why this most hated investment is so high on our rating scale.

For many policyholders, Ulips denote the costly mistake they made a few years ago.

But that was a different era, when companies were gobbling up 50-60 per cent of the

premium in the first few years in the guise of charges.

The 2010 guidelines have reformed the Ulip, turning it into a more customer-friendly

investment. Though a Ulip should not be your first insurance policy, you can consider

buying one as an investment that also helps you save tax. Of course, it also offers a life

cover, but the stress is on investment, not protection. Don't buy a Ulip (or any other

insurance policy, for that matter) if you are not sure whether you can continue paying

the premium for the entire term. If you end it prematurely, be ready to pay surrender

charges.

Your insurance policy should not impinge on other financial commitments. It's easy to

set aside a big sum when you are young because your liabilities are limited, but this

changes and expenses shoot up when you start a family or buy assets. If the premium

is very high, the policyholder may find it difficult to pay it year after year.

Under the new Ulip rules, you cannot take a premium holiday. If you stop paying the

premium, the policy will be discontinued. Also, you need to take a long-term view when

you buy an insurance plan. A Ulip will yield good results only if you hold it for at least

10-12 years. Before that, the plan may not be able to recover the charges levied in the

first few years. This is why short-term plans of 5-10 years usually give poor results,

which pushes investors to dump them within 3-4 years of buying.

Buyers must also understand that a Ulip is not necessarily an equity-linked investment.

You can also invest your Ulip corpus in debt funds. Right now, debt funds are looking

attractive because of the possibility of a drop in bond yields, while the equity markets

are looking overheated. Instead of investing in the equity option, put your corpus in the

debt fund.

You can start shifting the money to the equity fund when the prospects look rosier. Only

a Ulip allows you to switch from debt to equity, or vice versa, without incurring any

capital gains tax. It is best to invest in a plain vanilla Ulip that allows you to choose your

investment mix and also offers online transaction facilities.

BRIGHT IDEA: Opt for the liquid or debt fund and then shift to the equity option as per

your reading of the market.

5. VOLUNTARY PF

RETURNS: 8.5 per cent (for 2013-14)

This little used option is available only to salaried taxpayers covered by the Employees'

Provident Fund.

The contribution to the Employees' Provident Fund (EPF) is a compulsory deduction, as

also an automatic tax saver. However, you can contribute more than 12 per cent of your

basic salary that flows into the EPF every month. This voluntary contribution will earn

the same rate of interest, will fetch you the same tax benefits under Section 80C and

the maturity corpus will also be tax-free.

A key disadvantage is the limited liquidity that the Provident Fund offers. You cannot

access the money till you retire. A one-time withdrawal is allowed in special

circumstances, such as medical emergency, purchase or construction of a house, or a

child's marriage. However, it may not be possible to opt for the VPF at this juncture.

Companies typically ask their employees to submit the VPF mandate at the beginning of

the financial year. Ask your company if you can start contributing to the VPF from this

month onwards. Once you have opted for the deduction, you cannot discontinue it till

the end of the financial year, except in extraordinary circumstances. While the VPF gets

tax deduction and the maturity corpus is also tax-free, you will have to pay tax on the

interest if you withdraw the money within five years. So, opt for it only if you are sure

that you can remain invested for the long term.

Another drawback is the possibility of a lower interest rate for the PF in the coming

years. The rate is announced by the EPFO Trust after examining the interest earned by

the EPF corpus. It is likely to be 8.5 per cent for the current financial year, but there is

no certainty that this will be maintained over the longer term.

Contributing to the VPF is suitable for taxpayers in their 50s, who want to aggressively

save for their retirement but don't want to invest in market-linked options or tax-

inefficient fixed deposits.

BRIGHT IDEA: Channelise at least 10 per cent of your increment to the VPF every

year. The higher savings will not pinch you.

6. SENIOR CITIZEN'S SAVING SCHEME

RETURNS: 9.2 per cent (for 2013-14)

This remains the best way for retirees to save tax, though the Rs 15 lakh investment

limit is a damper.

With four stars, this assured return scheme is the best tax-saving avenue for senior

citizens. However, the Rs 15 lakh investment limit somewhat curtails its utility as a tax-

saving option. The interest rate is 100 basis points above the 5-year government bond

yield.

Unlike the PPF, the change in interest rate does not affect the existing investments.

This year, the interest rate has been cut by a marginal 10 basis points to 9.2 per cent.

Many grey-haired investors may not be enthused by this. Banks are offering up to 10

per cent to senior citizens right now, almost 50-60 basis points higher than what they

give to regular customers.

There's a good reason for this pampering. Senior citizens have a bulk of their

investments in fixed deposits, which makes them prized customers for banks. So, if you

do not consider the tax deduction under Section 80C, this option is not as lucrative as

bank FDs. However, as a tax-saving tool, the scheme scores over bank fixed deposits

and NSCs because the quarterly payment of the interest provides liquidity to the

investor. The interest is paid on 31 March, 30 June, 30 September and 31 December,

irrespective of when you start investing.

This aspect of the SCSS, and the fact that it is an ultra safe scheme backed by the

government, makes it an ideal option for retired taxpayers looking for a steady stream of

income. Though the interest earned is fully taxable, retired people usually don't have a

high tax liability. Keep in mind that the basic tax exemption for senior citizens is higher

at Rs 2.5 lakh. For very senior citizens, it is even higher at Rs 5 lakh.

The only glitch is the Rs 15 lakh investment limit per individual. If a person parks Rs 15

lakh of his retiral benefits in the scheme, he will be able to claim deduction for only Rs 1

lakh. Although the scheme is for senior citizens (60 years), even those above 55 years

can invest if they have taken voluntary retirement. Retired defence personnel can join

irrespective of their age if they fulfil other conditions.

BRIGHT IDEA: If you have Rs 15 lakh to invest in the scheme, stagger the investments over 2-

3 years to claim more tax benefits.

7. NEW PENSION SCHEME

RETURNS: 4.2-10.2 per cent (past 3 years)

The low-cost retire

ment product is a good option fro those saving for retirement, but watch out for the

limited liquidity it offers.

Its low-cost structure, flexibility and other investor-friendly features make the New

Pension Scheme an ideal investment vehicle for retirement planning. However, even

though the fund management charges have been raised from the ridiculously unviable

0.0009 per cent to a more reasonable 0.25 per cent, the pension fund managers are not

hardselling the scheme.

If you want to save tax through the NPS this year, be ready to do a lot of legwork and

paperwork before you can get to invest in this unique pension plan. The returns from the

NPS funds are a mixed bag (see table).

While the returns from the E class (equity) funds are in line with the market returns,

those from the G class (gilt) funds are quite a disappointment. Government employees,

who have a chunk of their pension funds in the G class schemes of LIC Pension Funds

and SBI Pension Funds, would be especially hit. The redeeming feature is the high

returns churned out by the C class (corporate bond) funds. However, these bonds carry

a higher risk.

The scheme scores high on flexibility. The minimum annual contribution is Rs 6,000,

which can be invested as a lump sum or in instalments of at least Rs 500. There is no

upper limit. The investor also decides the percentage of the corpus that goes into

equity, corporate bonds and government securities, the only limitation being the 50 per

cent cap on exposure to equity.

One of the most outstanding features of the NPS is the 'lifecycle fund'. It is meant for

those who are not financially aware or can't manage their asset allocation themselves. It

is also the default option for someone who has not indicated the desired allocation for

his investments. Under this option, the investor's age decides the equity exposure. The

50 per cent allocation to equity is reduced every year by 2 per cent after the investor

turns 35, till it comes down to 10 per cent. This is in keeping with the strategy to opt for

a higher-risk, higher-return portfolio mix earlier in life, when there is ample time to make

up for any possible black swan event.

Gradually, as the investor approaches retirement, he moves to a more stable fixed-

return, low-risk portfolio. This automatic rejigging of the asset allocation is a unique

feature of the NPS. No other pension plan or asset allocation mutual fund offers such a

facility to investors. There are a few funds based on age, but they are one-size-fits-all

solutions, not customised to the individual's age.

Another positive feature of the NPS is the wide choice of funds for the investor. Though

you can switch from one fund manager to the other only once in a year, it is still better

than investing in a Ulip or a pension plan where you are stuck with the same fund

manager for the rest of the tenure. IDFC Pension Fund quit the NPS last year, but two

well-regarded entities HDFC Pension Fund and DSP Blackrock Pension Fund

have joined the club.

Another unique feature of the NPS is the tax benefit it offers under the newly added

Section 80 CCD(2). Under this section, if an employer contributes 10 per cent of the

salary (basic salary plus dearness allowance) to the NPS account of the employee, the

amount gets tax exemption of up to Rs 1 lakh. This is over and above the Rs 1 lakh tax

deduction under Section 80C. It's a win-win situation for both because the employer

also gets tax benefit under Section 36 I (IV) A for his contribution.

By putting in money in the NPS, the employer can provide an additional tax benefit to

the employee by simply reorganising the salary structure without incurring any

additional cost to the company (CTC). The wart in the NPS is the lack of liquidity. You

cannot access the funds before you turn 60. On maturity, at least 40 per cent of the

corpus must be used to buy an annuity. Some see this as a positive feature that

prevents premature withdrawals.

BRIGHT IDEA: Get your company to opt for the Section 80CCD(2), under which you

can save more tax trhough the NPS.

8. NSCs AND BANK FDs

RETURNS: 8.5-9.75 per cent

They appear attractive, but taxability of income takes away some of the sheen from

these instruments.

There are many misconceptions about bank fixed deposits in the minds of investors.

Many think that up to Rs 10,000 interest from bank deposits is tax-free, as announced in

the budget two years ago. This is not true. The newly introduced Section 80TTA gives a

deduction of up to Rs 10,000 on interest earned in the savings bank account, not on

fixed deposits and recurring deposits.

Also, the nomenclature 'tax-saving deposits' means you save tax under Section 80C. It does not mean

that these deposits are tax-free. The interest earned on deposits is fully taxable at the normal tax rate

applicable to you. You have to mention this interest under the head 'Income from other sources' in your

income tax return. Keep in mind that this tax is payable every year on the interest that accrues in that

financial year, even though you get the amount on maturity.

So don't get misled by the high interest rates offered on the 5-year bank fixed deposits. The post-tax yield

may not be as high as you think. In the 20 per cent and 30 per cent income tax brackets, it is not as

attractive as the yield of the tax-free PPF.

The second misconception is that there is no need to pay tax if TDS has been deducted by the

bank. You may have to pay tax even if TDS has been deducted. TDS is only 10 per cent (20 per

cent if you haven't submitted your PAN details), and if you are in the 20-30 per cent bracket, you

need to pay additional tax. Ignore mentioning the interest income in your return at your peril.

The TDS is credited to your PAN and reported to the tax authorities. If there is a mismatch in the

TDS details in the tax records and in your return, you will surely get a tax notice.

The Central Board of Direct Taxes has a computer-aided scrutiny system (CASS),

which flags any discrepancy in the tax return filed. Check the TDS in your Form 26AS,

which has details of the tax deducted on your behalf. It can be easily checked online. It

is easier if you have a Net banking account with any of the 35 banks that offer this

facility. Otherwise, you can go to the official website of the Income Tax Department and

click on 'View your tax credit'. The first-time users will have to register, but it takes less

than 5 minutes to log on and view your details.

The interest on NSCs is also taxable but very few taxpayers include it in their returns.

However, with the integration of tax records, a taxpayer may not be able to escape the

tax net easily. For instance, if you have claimed tax deduction under Section 80C for

investments in NSCs or FDs in one year, the tax department may want to know why the

interest earned is not reflecting in your tax returns for subsequent years.

BRIGHT IDEA: Don't try to avoid the TDS by investing in FDs of different banks. You

will have to pay the tax later anyway.

9. LIFE INSURANCE POLICIES

RETURNS: 5.5-7.5 per cent

Despite the revised guidelines, insurance plans are still not a good investment. Only HNI investors will

find the tax-free corpus appealing.

Though the Irda guidelines for traditional plans have made insurance policies more

customer-friendly by ensuring a higher surrender value and larger life covers, they are

still the worst way to save tax. The tax saving is only meant to reduce the cost of

insurance. It is not the core objective of the policy. Money-back and endowment

insurance policies score low on the flexibility scale. Once you buy a policy, you are

supposed to keep paying the premium for the rest of the term. This can be a problem if

you took the policy only to save tax.

However, these policies are not as illiquid as they appear. You can easily get a loan

against your endowment policy from the LIC. The terms are quite lenient and repayment

can be done at your convenience. Insurance companies claim their products offer the

triple advantage of life cover, long-term savings and tax benefits. That's not true.

Traditional plans give a low life cover of 10 times the premium.

For a cover of Rs 25 lakh, you will have to spend Rs 2.5 lakh a year. They also give

niggardly returns. The internal rate of return (IRR) for a 10-year policy comes to around

5.75 per cent. For longer terms of 15-20 years, the IRR is better at 6.5-7.5 per cent. As

for the tax benefit, there are simpler and more cost-effective ways to save tax, such as

5-year bank FDs and NSCs. If the taxability of the income worries you, go for the tax-

free PPF.

However, traditional insurance policies still make a lot of sense for the HNI investor who is more

concerned about the tax--free corpus under Section 10(10d) than the deduction under Section

80C. Even for such investors, a Ulip will make more sense as they will have control over the

investment mix. The opacity of the traditional plan is best avoided, but your agent might not be

very keen to sell you a Ulip this year because his commission has been cut to 6-7 per cent of

the premium.

10. PENSION PLANS

RETURNS: 7-10 per cent

After a hiatus of 2-3 years, pension plans are making a comeback, but the high charges mean

lower returns for investors.

Pension plans offered by life insurance companies made a comeback in 2013.

However, the charges of these plans are significantly higher than those of the NPS.

While the NPS has a fund management charge of 0.25 per cent, a typical pension plan

from a life insurance company charges almost 3-4 per cent. This difference can

snowball into a wide gap over the long term, reducing the returns of the pension plan

investor by a significant margin.

Insurers argue that the low-cost NPS is good only on paper because there are so many

hurdles to investing in the scheme. A pension plan from an insurer is costlier but you

don't have to go around in circles trying to invest in it. That's true to a great extent. Even

after four years of launch and offering additional tax benefits, the NPS has not been

able to attract investors in hordes. However, the solution is not a high-cost pension plan.

A few mutual funds also have pension plans. The Templeton India Pension Plan is one

of the oldest schemes in the market and offers deduction under Section 80C. It is a

debt-oriented fund that invests 30-40 per cent of its corpus in equities and the rest in

debt. But at 10.7 per cent, its 5-year annualised returns are nothing to gloat about. A

better option would be a combination of an ELSS scheme and any of the debt

instruments that offer tax deduction.

BRIGHT IDEA: It is not a good idea to invest a large sum in the equity option at one go.

Opt for the liquid or debt fund instead.

ULIPs 2.0: Why you should buy these

insurance-cum-investment plans now

They were once the most bought financial product. Then Ulips became the most reviled

investment, forcing a string of reformatory measures. Now these investment-cum-insurance

plans have changed once again to become a low-cost investment option. In fact, some of the

Ulips introduced in recent months are cheaper than the direct plans of mutual funds.

We won't be surprised if this evokes an angry response from readers. Ulip became a

four-letter word due to the high charges levied by insurance companies and rampant

mis-selling by distributors. In some cases, the charges were as high as 80% of the

premium in the first year. Distributors lured gullible investors by not revealing the high

charges and showcasing only the returns offered by the market-linked product.

The Insurance Regulatory and Development Authority (Irda) clamped down in 2010,

capping the annualised charges of Ulips at 2.25% for the first 10 years of holding. The

charges were fixed at this rate because it was the average cost charged by competing

products such as mutual funds. With no incentive left for distributors, Ulip sales plunged

after the Irda guidelines came into effect. Though Ulips had become a very cost-

effective investment, nobody was buying them because nobody was selling them.

In recent months, insurance companies have sweetened the deal for investors by

reducing the charges even further. The Bajaj Allianz Future Gain plan does not levy

premium allocation charges if the annual investment is Rs 2 lakh and above. The

Edelweiss Tokio Wealth Accumulation Plan doesn't have policy administration charges.

Some Ulips, such as Aviva i-Growth and ICICI Prudential Elite Life II, don't have lower

charges but compensate long-term investors with 'loyalty additions'. "The plan works out

cheaper because we return the money to the long-term investors," says Rishi Piparaiya,

director, marketing & direct sales, Aviva Life Insurance.

But the Click2invest plan from HDFC Life is a game changer for the segment. The only

charge it levies is an annual fund management fee of 1.35% of the corpus value. There

is also a mortality charge but that is for the life cover offered to the policyholder. The low

charges make the Click2invest plan cheaper than even the direct plan of a diversified

equity fund. For instance, the direct plan of the largest equity scheme, HDFC Equity

Fund, charges an expense ratio of 1.5% per year. "The Click2invest plan is costefficient

and, therefore, comparable with the direct plans of mutual funds," says Sanjay Tripathy,

senior EVP, marketing and product, HDFC Life (Click here for interview).

Some readers may pooh-pooh the idea of saving a sliver on costs. After all, a 0.15%

saving on costs makes a difference of only Rs 150 on an investment of Rs 1 lakh. While

this may seem small, the difference in the cost can balloon into substantial savings in

the long term (see graphic). As the graphic shows, the difference in the corpus value of

various levels of returns is not very substantial in the initial years, but in 30 years, even

a 0.5% difference in returns will widen the gap between 9.5% returns and 9% by Rs

15.4 lakh.

Shed your aversion to Ulips

This transformation of Ulips from a costly bundled product to a low-cost option has led

to a change of heart among financial planners as well. For long, they have advised

clients to keep insurance and investment separate. "We used to advise against mixing

insurance and investment because of the high costs of Ulips. A combination of mutual

funds for investment and term plans for life insurance worked out to be cheaper," says S

Sridharan, head of financial planning, FundsIndia.com. "However, low-cost products like

this will be suitable for investors who want to combine insurance with investments," he

adds.

He's not alone. With more low-cost Ulips on the anvil (at least two companies are

awaiting Irda's approval for their low-cost Ulips), many financial planners are changing

their tune. "The Click2invest plan from HDFC Life is a good product. We are

recommending it to our clients," says Jaya Nagarmat from Investor Shoppe. Tanvir

Alam, founder & CEO of Fincart goes a step further. "This Ulip will give the mutual fund

industry a run for its money," he says

Indeed, it is time to get rid of the historical aversion to Ulips and look at them through the prism

of lower charges. This will not be easy because a lot of investors have been scarred by their

experience with Ulips. Many have lost money due to the doublespeak of distributors and the

failure (or unwillingness) of insurance companies to redress their grievances. Policyholders lost

money even though the markets were shooting up. Buyers didn't realise that even though their

funds went up by 15-20% in a year, they were suffering losses because only 40-50% of their

money was actually invested in the first 2-3 years. "The new Ulips are facing the baggage of old

Ulips," says Yashish Dahiya, CEO and co-founder Policybazaar.com.

The tax advantage

While the low charges of new Ulips make them attractive, the main advantage is the

seamless and tax-efficient transfer from debt to equity, and vice versa. This switching

may be for varied reasons, including rebalancing the portfolio or even timing the

markets by savvy investors. "Though retail investors may not have the bandwidth to

switch on the basis of market views, people who are aware can make use of this facility

without any tax incidence," says Alam. Turn to page 16 to know how you can use your

Ulip to gain from the volatility in stock markets.

It is important to note that Ulip is not just about equities. Smart investors can also move

within debt, shifting to long duration funds when interest rates are expected to go down

and moving to short-term funds when rates are on the rise. If mutual fund investors do

this, they will have to pay tax on the shortterm and long-term capital gains made on the

fund. Since Ulips are insurance plans, the gains and maturity proceeds are tax-free

under Section 10(10d). However, the sum assured must be at least 10 times the annual

premium for this tax benefit.

The lay investors who follow a fixed asset allocation and don't tweak their investments

too much can use the switching facility to rebalance their portfolios. Financial planners

say that rebalancing should be done at least once a year. For example, their equity

allocation might have surged due to the recent rise in the market and, therefore, they

should shift some portion of the corpus out of equity funds to debt funds. Similarly, if the

equity allocation goes down drastically during a bear phase, they may shift back from

debt to equity. Financial planners also advise investors to shift from equity to the safety

of debt well ahead of their important goals. This prevents any disturbance for the goal

due to a sudden crash in the stock markets.

This year's budget has changed the tax rules for debt funds. The minimum holding

period has been increased from 1 year to 3 years. Debt fund investors will have to pay a

higher tax if they rebalance by shifting out of debt within three years of investing.

However, there will be no tax in case of Ulips.

Investors should note that insurance companies allow only a limited number of free

switches. While some Ulips allow unlimited free switches, others permit only 4-12 free

switches in a year. There is a Rs 100-250 charge for every switch beyond the free limit.

Check how many switches your Ulip allows before you start rebalancing your portfolio.

Like banks, insurance companies also charge you less if you do the transaction online.

For example, HDFC Click2invest charges `250 per additional switch if done offline and

only Rs 25 if the same is executed online.

Decoding the charges The charge structure of Ulips is not as straightforward as that of

mutual funds. There is a premium allocation charge, a policy administration charge and

a fund management charge. There is also the mortality charge for the life cover offered

by the plan. The 2010 Irda guidelines say that the combined charge cannot be more

than 2.25% a year in the first 10 years. They have also capped the fund management

fee at 1.35% per annum, though many Ulips are charging less than that on their short-

term debt schemes.

The mortality charge differs across Ulips. Some plans offer either the sum assured or

the fund value on death. These are Type I Ulips and their mortality charges go down as

the fund value goes up. The Type II Ulips offer both, the fund value as well as the sum

assured. Obviously the mortality charges are higher in such plans.

Unlike the premium of term plans, which is fixed for the entire term, the mortality

charges of Ulips keep rising as the policyholder gets older. However, there is no need to

worry because the term plan premium is calculated on the basis of the average age of

the policy term. This means the mortality charges of the Ulip will be lower than that of

the term plan in the initial years and higher in the later years. Over the entire term, the

cost will get averaged.

Though Ulips offer a cover to policyholders, the benefit may be a drag for those who are

interested purely in investment. The lowcost Ulips are, therefore, Type I plans that will pay either

the fund value or the sum assured. Here's how it will work. Suppose a person buys a Ulip with a

Rs 1 lakh premium for 20 years. The plan will give him a cover of Rs 10 lakh (10 times the

annual premium), but the insurance company will charge mortality premium for only Rs 9 lakh

since the total risk for the company is Rs 9 lakh. With every annual payment of the premium, the

risk of the company will come down, reducing the mortality charge. When the fund value of the

Ulip exceeds the sum assured, the plan will stop deducting mortality charges and the entire

premium will go into investment.

Another way to reduce the impact of mortality charges is to buy the policy in the name

of your spouse or child. Income from investments made in the name of a spouse or a

child are subject to clubbing provisions, but since the maturity proceeds from Ulips are

tax-free, you don't have to worry about that. You can also go for single premium Ulips,

with an insurance cover of only 1.25 times the premium. However, the maturity

proceeds of such a plan will not be covered under Section 10 (10D) and will be taxable

in your hand.

Performance of Ulip funds While the charges of the new Ulips are low, it is equally

important to look at their performance. If the fund manager is able to generate an

additional 5% return, why not pay an extra 1% to him. It won't make any sense to invest

just to save on charges. We looked at the performance of Ulip funds and mutual fund

schemes of the same categories across different time periods and found that the returns

were more or less similar. In some categories, like large-cap equity funds and small-

and mid-cap equity funds, the mutual funds have done marginally better than Ulip funds.

But in case of debt-oriented mutual funds and debt funds, Ulips have scored higher

returns. Interestingly, equity mutual funds were able to generate good returns even

though they have higher expense ratios. This could be because the mutual funds were

selling based on their scheme performance, while the Ulips were pushed by agents

because of higher commissions. The debt-oriented hybrid funds and debt funds, where

intense competition has pushed down the costs, mutual funds did better than the Ulip

schemes.

However, investors should note that this is only a comparison of the change in the

funds' NAVs. The actual returns for the investor may be different because insurance

companies don't deduct the annual policy administration charges from the NAVs, but

reduce the number of units. Under the new schemes, where there are no policy

administration charges, the comparability has improved. The allocation charge, which is

similar to the entry load of mutual funds, is another hitch in this comparison. That too is

not levied by some of the new Ulips.

Apart from the lower charges, seamless rebalancing, tax efficiency and good

performance of schemes, there are other reasons why you should buy a Ulip now. First,

the Irda guidelines have turned Ulips more customer friendly and brought transparency

to the charge structure. Now they have to give benefit illustration showing the gross and

net yield upfront on top. Second is the flexibility and ease with which you can transact.

Almost all companies allow online access, and switching and managing your policy has

become very easy.

Put your money in right schemes to save on

tax

Investors are wary of investing in tax-saving mutual funds(equity-linked savings schemes

or ELSS in mutual fund parlance) this tax-planning season, say financial advisors. The abysmal

performance of these schemes in the past three years and the current higher level of the market

are cited as the reasons for investor disinterest.

One can avail of tax deduction of upto 1 lakh under section 80 C by investing in options like ELSS, ppf,

NSE, Tax saving 5-yr bank fixed deposits

According to Value Research, a mutual fund tracking entity, ELSS funds, as a category,

have given a mere 0.33% returns in the last three years. With the tax planning season

beginning in December, most companies ask their employees to submit investment

declarations around this time.

Investors can avail of a tax deduction of up to Rs 1 lakh under Section 80C by investing

in a host of options like ELSS, tax-saving 5-year bank fixed deposits, the Public

Provident Fund (PPF) or National Savings Certificate (NSC), among others.

"Investors, who invested in ELSS three years ago, are disappointed with lower returns.

Clearly, they are not keen to invest in tax-saving mutual funds again and they prefer to

invest in either PPF or tax saving bank deposits," says Abhishek Gupta, certified

financial planner, Moat Wealth Advisors. Investors have also become cautious about

investing in stocks due to weak economic fundamentals say experts.

"Since investors have not made money for three years, they have turned risk averse,

and want to protect capital," says Anup Bhaiya, MD and CEO, Money Honey Financial

Services. That is the main reason why many investors would flock to PPF or tax-saving

bank deposits.

Invest as per asset allocation However, experts frown upon such "random" tax-planning

exercise. They argue that investors should consider tax planning as part of their overall

financial plan and choose products accordingly. They say picking tax planning

instruments on the basis of past performance alone won't help one reach the right

conclusions.

"Make a financial plan based on your earnings, liabilities and goals. This financial plan

will tell you how much money would go into various assets like equity, debt or gold.

Some part of the equity portion of this plan could go into ELSS," says Mukund Seshadri,

founder, MSV Financial Planners. Advocates of ELSS also claim that it is the right time

to get into stocks due to attractive valuations.

"The Sensex trades at a P/E of 18 times, making valuations attractive and leaving scope

for appreciation over a 3-5-year period," says Rupesh Bhansali, head

(distribution), GEPL Capital. Experts also say that investors should also try to find out

the details of the product they are investing. For example, consider the case of these

disenchanted investors opting for PPF or 5-year bank deposits.

Chances are that most of them haven't thought about the different lock-in periods in

these options. "If you have a time-frame of five years, opt for tax-saving bank deposits.

Opt for PPF only if you can wait for 15 years," says Abhishek Gupta.

Sure, you can withdraw from PPF after five years, but for some specific purposes only.

Also, you have to keep your PPF account alive by investing a minimum ofRs 500 every

year. Currently, a tax-saving deposit in SBI for five years will give you an interest rate of

9%, while PPF gives you 8.7%.

However, financial planners suggest you keep tax treatment in mind while making

these investments, as interest income is taxed differently. "Interest earned from PPF is tax free,

whereas interest income from bank FDs and NSCs are taxable. Hence, if you are in the 30% tax

bracket, PPF may be a better investment from a tax perspective," says Harshvardhan Roongta,

chief financial planner, Roongta Securities.

Vous aimerez peut-être aussi

- Systematic Investment PlanDocument28 pagesSystematic Investment PlanPankaj Pawar0% (1)

- What Is Risk?: Investment Pattern On The Basis of Risk Profile of InvestorsDocument4 pagesWhat Is Risk?: Investment Pattern On The Basis of Risk Profile of InvestorsBharath KNPas encore d'évaluation

- Mutual Fund ProjectDocument35 pagesMutual Fund ProjectKripal SinghPas encore d'évaluation

- Systematic Investment Plan (SIP)Document3 pagesSystematic Investment Plan (SIP)rupesh_kanabar160486% (7)

- Report On Tax Saving SchemesDocument16 pagesReport On Tax Saving SchemesDivya Vishwanadh100% (1)

- A Study of Investors Perception Towards SBI Mutual Funds in Jalgaon DistrictDocument4 pagesA Study of Investors Perception Towards SBI Mutual Funds in Jalgaon DistrictAbdul Kadir ArsiwalaPas encore d'évaluation

- LIC Mutual FundDocument127 pagesLIC Mutual FundShikha PradhanPas encore d'évaluation

- Systematic Investment PlanDocument75 pagesSystematic Investment PlanDeepak SinghPas encore d'évaluation

- BISHAL'sDocument20 pagesBISHAL'sBishal PaulPas encore d'évaluation

- India Infoline (Awarness About The Mutual Fund)Document95 pagesIndia Infoline (Awarness About The Mutual Fund)c_nptl50% (2)

- Chapter 2Document66 pagesChapter 2amitPas encore d'évaluation

- Mutual FundDocument85 pagesMutual FundAishwarya AwatePas encore d'évaluation

- Summer Project Report On Comparative Analysis of Broking Companies and Financial Performance of Edelweiss Broking LTDDocument71 pagesSummer Project Report On Comparative Analysis of Broking Companies and Financial Performance of Edelweiss Broking LTDSatyendraSinghPas encore d'évaluation

- 2.1 Industry Profile: Mutual FundDocument16 pages2.1 Industry Profile: Mutual FundAbdulRahman ElhamPas encore d'évaluation

- Executive Summary RaviDocument2 pagesExecutive Summary RaviAditya Verma0% (1)

- ASSET ALLOCATION IN FINANCIAL PLANNING SAlilDocument31 pagesASSET ALLOCATION IN FINANCIAL PLANNING SAlilSalil TimsinaPas encore d'évaluation

- Comparative Study On MF and FDDocument6 pagesComparative Study On MF and FDamrita thakur100% (1)

- Blackbook Project On Mutual FundsDocument88 pagesBlackbook Project On Mutual Fundssun1986Pas encore d'évaluation

- SBI Mutual FundDocument88 pagesSBI Mutual FundSubramanya Dg100% (1)

- Performance Evaluation of Mutual Funds" Conducted at EMKAY GLOBAL FINANCIAL SERVICES PRIVATE LTDDocument74 pagesPerformance Evaluation of Mutual Funds" Conducted at EMKAY GLOBAL FINANCIAL SERVICES PRIVATE LTDPrashanth PBPas encore d'évaluation

- Study of Mutual FundDocument106 pagesStudy of Mutual Fundmadhumaddy20096958Pas encore d'évaluation

- Project On Mutual FundsDocument75 pagesProject On Mutual FundsParag MorePas encore d'évaluation

- Reliance Mutual FundDocument32 pagesReliance Mutual Fundshiva_kuttimma100% (1)

- of SbiDocument31 pagesof SbiSarbjeet Aujla33% (3)

- Investment Avenue Research PaperDocument3 pagesInvestment Avenue Research Paperdeepika gawas100% (1)

- CONSUMER PERCEPTION UTI-Mutual-FundDocument70 pagesCONSUMER PERCEPTION UTI-Mutual-FundMD PRINTING PRESS PRINTING PRESSPas encore d'évaluation

- Investment Pattern of Investors QuestionnaireDocument19 pagesInvestment Pattern of Investors QuestionnaireVinita Solanki 24Pas encore d'évaluation

- Portfolio Management and Mutual Fund Analysis PDFDocument53 pagesPortfolio Management and Mutual Fund Analysis PDFRenuprakash Kp75% (4)

- Comparison Between Some Debt Equity & Mutual FundsDocument20 pagesComparison Between Some Debt Equity & Mutual FundsJayesh PatelPas encore d'évaluation

- "Mutual Funds Is The Better Investments Plan": Master of Business AdmimistrationDocument18 pages"Mutual Funds Is The Better Investments Plan": Master of Business AdmimistrationJay Prakash Khampariya100% (1)

- Project Report On Portfolio ManagementDocument6 pagesProject Report On Portfolio Managementanunazanu100% (1)

- A Study On Investment Pattern of Investor in Mutual Funds: Mr. Ismayil Paisal KhanDocument19 pagesA Study On Investment Pattern of Investor in Mutual Funds: Mr. Ismayil Paisal KhanVandita KhudiaPas encore d'évaluation

- Perception of People Towards Investment and VariousDocument20 pagesPerception of People Towards Investment and Variouscgs005Pas encore d'évaluation

- Data Analysis & Its InterpretationDocument23 pagesData Analysis & Its InterpretationBharat MahajanPas encore d'évaluation

- Analysis of Uti Mutual Fund With Reliance Mutual FundDocument64 pagesAnalysis of Uti Mutual Fund With Reliance Mutual FundSanjayPas encore d'évaluation

- Mutual FundsDocument37 pagesMutual FundsGokul KrishnanPas encore d'évaluation

- Income Tax Saving SchemesDocument14 pagesIncome Tax Saving Schemesanindya_kunduPas encore d'évaluation

- Performance of Mutual Fund Selected SachemsDocument25 pagesPerformance of Mutual Fund Selected SachemsprashantPas encore d'évaluation

- A Study On Mutual Funds in IndiaDocument40 pagesA Study On Mutual Funds in IndiaYaseer ArafathPas encore d'évaluation

- Investing in Banking Sector Mutual Funds - An OverviewDocument5 pagesInvesting in Banking Sector Mutual Funds - An OverviewarcherselevatorsPas encore d'évaluation

- RamanDocument50 pagesRamanAlisha SharmaPas encore d'évaluation

- Icici Prudential ReportDocument70 pagesIcici Prudential Reportrahulsogani123Pas encore d'évaluation

- Uti Mutual FundDocument87 pagesUti Mutual FundTushar Srivastava100% (1)

- Project Report On Mutual Funds Trends in IndiaDocument41 pagesProject Report On Mutual Funds Trends in IndiaChirag Gohil100% (1)

- Portfolio MGMT SynopsisDocument3 pagesPortfolio MGMT Synopsiskhushbookhetan0% (1)

- Project PPT in Mutual Fund SipDocument13 pagesProject PPT in Mutual Fund SipNARASIMHA REDDYPas encore d'évaluation

- Project On Mutual FundsDocument75 pagesProject On Mutual FundstahirPas encore d'évaluation

- Effectiveness of SIP in MF - Payal MittalDocument64 pagesEffectiveness of SIP in MF - Payal MittalSudipa Routh0% (1)

- A Comparitive Study On Mutual FundsDocument58 pagesA Comparitive Study On Mutual Fundsarjunmba119624Pas encore d'évaluation

- Performance Evaluation of Elss Schemes of Mutual Funds-Project by ShivaniDocument53 pagesPerformance Evaluation of Elss Schemes of Mutual Funds-Project by Shivanicutepie0671% (7)

- Various Investment AvenuesDocument59 pagesVarious Investment Avenuesagarwal_vinay85315088% (8)

- Bhavesh Sawant Bhuvan DalviDocument8 pagesBhavesh Sawant Bhuvan DalviBhuvan DalviPas encore d'évaluation

- Project On Demat Account FinalDocument70 pagesProject On Demat Account FinalBHARAT0% (1)

- IIFL Project 2010Document112 pagesIIFL Project 2010695269100% (3)

- Knowledge InitiativeDocument12 pagesKnowledge InitiativeGopalRawatGopalPas encore d'évaluation

- Best Bank Fixed DepositsDocument9 pagesBest Bank Fixed DepositsAkanksha SrivastavaPas encore d'évaluation

- Tax Saving SchemesDocument12 pagesTax Saving Schemesshashikumarb2277Pas encore d'évaluation

- How To Save Tax in 2013: Your Guide To Planning: Are You Ready For Risk?Document2 pagesHow To Save Tax in 2013: Your Guide To Planning: Are You Ready For Risk?Zaid KhanPas encore d'évaluation

- The Stock Markets Have Reached Dizzying HeightsDocument6 pagesThe Stock Markets Have Reached Dizzying HeightsAmber ManochaPas encore d'évaluation

- Lotus - AdditionalDocument13 pagesLotus - Additionalasha010112Pas encore d'évaluation

- Yellow BeltDocument34 pagesYellow Beltasha010112Pas encore d'évaluation

- Aptitude Questions: Dare TJDocument16 pagesAptitude Questions: Dare TJasha010112Pas encore d'évaluation

- CNC Mumbai AddDocument1 pageCNC Mumbai Addasha010112Pas encore d'évaluation

- Task 3 Mallika KalleDocument1 pageTask 3 Mallika KalleMallika KallePas encore d'évaluation

- Chicago (Poem) - Wikipedia, The Free EncyclopediaDocument1 pageChicago (Poem) - Wikipedia, The Free EncyclopediaSolipsisticCatPas encore d'évaluation

- Knowledge Bank ORIGINAL 2Document18 pagesKnowledge Bank ORIGINAL 2Prakarsh SharmaPas encore d'évaluation

- Articles of Confederation EssayDocument2 pagesArticles of Confederation Essayapi-251089957Pas encore d'évaluation

- Which Is The Best Answer For 'Why Sales' in An Interview - QuoraDocument1 pageWhich Is The Best Answer For 'Why Sales' in An Interview - QuoraJaisal NangruPas encore d'évaluation

- Churachandpur - Project ProfileDocument19 pagesChurachandpur - Project ProfileAmusers100% (2)

- Arrowroot Advisors Advises Reach Analytics On Its Sale To Datadecisions GroupDocument2 pagesArrowroot Advisors Advises Reach Analytics On Its Sale To Datadecisions GroupPR.comPas encore d'évaluation

- H.A.C.E.R.: APV Board Member Files Complaint Against The APVDocument8 pagesH.A.C.E.R.: APV Board Member Files Complaint Against The APVJohn PerezPas encore d'évaluation

- BAM PPT 2011-09 Investor Day PDFDocument171 pagesBAM PPT 2011-09 Investor Day PDFRocco HuangPas encore d'évaluation

- How Brand Community Practices Create ValueDocument23 pagesHow Brand Community Practices Create ValueOdnooMgmr0% (1)

- Bath and Shower in India PDFDocument8 pagesBath and Shower in India PDFVishal SinghPas encore d'évaluation

- Ghaleb CV Rev1Document5 pagesGhaleb CV Rev1Touraj APas encore d'évaluation

- AbcdefghijkDocument13 pagesAbcdefghijkGaurav DwivediPas encore d'évaluation

- Digital TwinDocument35 pagesDigital TwinpPas encore d'évaluation

- Cs2353 Cse Ooad 2marksDocument19 pagesCs2353 Cse Ooad 2marksVjay NarainPas encore d'évaluation

- SWOT AnalysisDocument9 pagesSWOT AnalysisAnjali SinghPas encore d'évaluation

- Introduction To FranchisingDocument45 pagesIntroduction To FranchisingAmber Liaqat100% (2)

- Advertising in PakistanDocument11 pagesAdvertising in PakistanWaleed UQPas encore d'évaluation

- Success Strategies in IslamicDocument21 pagesSuccess Strategies in IslamicMaryamKhalilahPas encore d'évaluation

- Television Quality AssuranceDocument4 pagesTelevision Quality AssurancepartibanPas encore d'évaluation

- Recognition Journey ExamplesDocument4 pagesRecognition Journey ExamplesJosie SpencerPas encore d'évaluation

- Assignment No 1: Role of Business LetterDocument5 pagesAssignment No 1: Role of Business LetterSAIMA SHAHZADIPas encore d'évaluation

- OSCM Assessment AnalysisDocument8 pagesOSCM Assessment AnalysisShanmathi ArumugamPas encore d'évaluation

- Individual Assignment - Customer Relationship ManagementDocument15 pagesIndividual Assignment - Customer Relationship ManagementBING JUN HOPas encore d'évaluation

- Butlers ChocolatesDocument2 pagesButlers ChocolatesIshita JainPas encore d'évaluation

- 1205 Sfa 08WDocument8 pages1205 Sfa 08WomareiPas encore d'évaluation

- Excel 2013: Pivot TablesDocument18 pagesExcel 2013: Pivot TablesKhuda BukshPas encore d'évaluation

- Organizational Learning Agility: in This Case StudyDocument28 pagesOrganizational Learning Agility: in This Case StudyharshadaPas encore d'évaluation

- 02 Task Performance 1Document4 pages02 Task Performance 1Justine Mae QuintosPas encore d'évaluation

- China-Pakistan Economic Corridor Power ProjectsDocument9 pagesChina-Pakistan Economic Corridor Power ProjectsMuhammad Hasnain YousafPas encore d'évaluation