Académique Documents

Professionnel Documents

Culture Documents

Business History Review

Transféré par

Adam HarrisDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Business History Review

Transféré par

Adam HarrisDroits d'auteur :

Formats disponibles

BUSINESS HISTORY REVIEW

Winter 2007 BOOK REVIEW

Investment Banking: Institutions, Politics, and Law. By Alan D. Morrison and William J.

Wilhelm Jr. New York: Oxford University Press, 2007. xiii + 341 pp. Index, notes,

bibliography, tables, figures. Cloth, $45.00. ISBN: 0-199-29657-X.

Reviewed by Ranald Michie

This historical account of the growth and development of investment banks from their

origins in the eighteenth century to the present day is largely culled from a reading of the

standard works on both individual firms and investment banking generally. Although the

authors acknowledge this in the text, they have not attempted to add value by comparing

and contrasting practices in different financial centers or by exploring the reasons behind,

and the consequences of, the existence of powerful and independent investment banks in

some countries and not in others. Instead, they focus almost exclusively on the United

States, particularly in their coverage of the nineteenth and twentieth centuries. Thus, it is

events in the United States, whether financial crises, public opinion, technological

change, economic analysis, or government intervention, that they view as crucial to the

way that investment banks evolved. Although the importance of the changing

international environment and the contribution made by foreigners, especially European

Jews, are acknowledged, these factors are barely explored. The question of why German

Jews have played such a major role in the history of investment banking, while operating

largely outside their own country, continues to puzzle me, for example.

However, the authors do add value to the subject when they relate investment

banking to its wider political, social, and legal environment. Not only are they familiar

with recent economic thinking on the subject of investment banking; they have also

acquainted themselves with other areas, such as constitutional history and the laws of

property. An introductory chapter, in which they discuss the current importance and

operation of U.S. investment banks, is followed by two theoretical chapters that identify

the fundamental and specific contributions made by investment banks to the working of a

capitalist economy. These are described as twofold. First, there was the position that

investment banks occupied at the center of an information network, enabling them to link

Copyright © President and Fellows of Harvard College

BUSINESS HISTORY REVIEW

Winter 2007 BOOK REVIEW

investors and borrowers. Second, there was an acquired reputation for expertise and

honesty, as this created the trust without which sophisticated financial transactions would

have been rendered nearly impossible. Neither conclusion is a surprise, but the authors do

provide them with a theoretical basis and explicit justification. Thus, the fear that an

unsuccessful outcome would damage their reputations helps to explain the established

investment banks’ reluctance of to move into new areas. Nevertheless, investment

banking remained both competitive and responsive, as it was always possible for new

entrants to establish themselves by responding to changing demands despite the

established firms’ advantage of contacts and reputation. The trade-off between taking a

risk and preserving a reputation was a fine judgment in many cases, and the successful

investment banks were those who got it right, whether by skill or luck.

The next five chapters follow the history of investment banking largely in the

United States, both to support the theoretical conclusions drawn and to develop an

understanding of the various forces at work. These chapters improve as they become

more modern. The earlier chapters tend to be superficial, especially when they are

dealing with developments outside the United States. What is lost by this heavy U.S.

orientation are the nature and timing of developments elsewhere. Both government

borrowing and the finance of international trade were of great importance for investment

banking, as were the different relations that existed between various countries and their

commercial banks and stock exchanges. It cannot be assumed that investment banks in

the United States were unaffected by circumstances in other countries, where major

events like the two world wars were much more disruptive of financial systems.

Conversely, other countries escaped the legislative consequences of the Wall Street crash

in the shape of the Securities and Exchange Commission and the Glass–Steagall Act. A

glance at what was happening abroad in those years would have helped to identify the

unique aspects in the development of U.S. investment banks that were to make them so

powerful today.

The survey culminates in a discussion of U.S. investment banks toward the end of

the twentieth century that looks at how their operations have been changed by technology

and training. With computing technology, each investment bank can now process much

more information, while the application of mathematical techniques to investment

Copyright © President and Fellows of Harvard College

BUSINESS HISTORY REVIEW

Winter 2007 BOOK REVIEW

analysis has eliminated the importance of accumulated experience. The consequence for

investment banks was that they could become both much bigger in terms of their

operations and much more exposed to direct competition as reputation came to matter

less. These issues are considered in the final two chapters, presented in lieu of a formal

conclusion, that examine how investment banks have coped with their transition from

small partnerships to large companies and have tried to determine what the future holds

for them. It would appear that the historical component of the book is somewhat

secondary to its focus on the current state of U.S. investment banking. There is, for

example, no mention of history in the title.

This book does provide a useful introduction to questions of how U.S. investment

banks reached the position they occupy today. Its explicit coverage of some elements in

that history, notably networking and reputation, emphasizes their importance. This should

encourage others to examine reputation and networks, both over time and between

countries, so as to test their relative importance in the face of other factors at work, such

as the ravages of war, the expulsion of Jews, the nationalization of banks, and the

collapse of international trade and investment. Possibly the dominant position of U.S.

investment banks today is simply the result of their location in the United States rather

than in Europe!

Ranald Michie is a financial historian at the University of Durham who has written

extensively on both securities markets and the City of London. His most recent works are

The London Stock Exchange: A History (1999) and The Global Securities Market: A

History (2006). He has also edited a volume with Philip Williamson, The British

Government and the City of London in the Twentieth Century (2004).

Copyright © President and Fellows of Harvard College

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

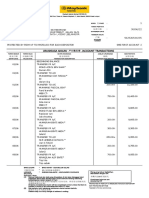

- LC3831230078AA Fin.700 2303306226342Document4 pagesLC3831230078AA Fin.700 2303306226342Mahesa JenarPas encore d'évaluation

- Consortium AdvancesDocument10 pagesConsortium Advancesmedhekar_renukaPas encore d'évaluation

- CH 7 SourcesDocument6 pagesCH 7 Sourcesmanoj kashyapPas encore d'évaluation

- Chase E-Statement FebruaryDocument4 pagesChase E-Statement February76xzv4kk5vPas encore d'évaluation

- Case DigestsDocument4 pagesCase DigestsJustine Jay Casas LopePas encore d'évaluation

- Anatomy of TISHMAN SPEYER Real Estate Racketeering Scheme: MORTGAGE AGREEMENT "Stuyvesant Town"Document163 pagesAnatomy of TISHMAN SPEYER Real Estate Racketeering Scheme: MORTGAGE AGREEMENT "Stuyvesant Town"StuyvesantTownFraudPas encore d'évaluation

- Universidad Iberoamericana - Unibe-: Disbursement RecordDocument2 pagesUniversidad Iberoamericana - Unibe-: Disbursement Recordodontologia unibePas encore d'évaluation

- Toy World IncDocument10 pagesToy World IncHàMềm100% (1)

- Transfer Pag Ibig Loan2Document2 pagesTransfer Pag Ibig Loan2Christopher LaputPas encore d'évaluation

- MBBcurrent 562526534235 2022-06-30 PDFDocument6 pagesMBBcurrent 562526534235 2022-06-30 PDFmuhamad faidzalPas encore d'évaluation

- Latest BillDocument3 pagesLatest Billrostyn160% (5)

- E00a6 Non Performance Assets - HDFC BankDocument62 pagesE00a6 Non Performance Assets - HDFC BankwebstdsnrPas encore d'évaluation

- Cash ManagementDocument79 pagesCash ManagementVinayaka Mc100% (3)

- The Money Supply and FedDocument13 pagesThe Money Supply and FedAbdul HayeePas encore d'évaluation

- Nitin Gadkari Makes An Offer For Bengaluru's Peripheral Ring Road That Karnataka Cannot RefuseDocument13 pagesNitin Gadkari Makes An Offer For Bengaluru's Peripheral Ring Road That Karnataka Cannot RefuseLathaVijendraPas encore d'évaluation

- Seduction of ACSA SAA and TransnetDocument8 pagesSeduction of ACSA SAA and TransnetPhilile NkwanyanaPas encore d'évaluation

- Account Statement 211021 200122Document37 pagesAccount Statement 211021 200122Prasad100% (1)

- Money & Banking (ECON 310) : Final Exam Review QuestionsDocument5 pagesMoney & Banking (ECON 310) : Final Exam Review QuestionskrizzznaPas encore d'évaluation

- Euro Currency Deposits: Aakash Bafna (Tybms A) 9100108Document3 pagesEuro Currency Deposits: Aakash Bafna (Tybms A) 9100108Akash BafnaPas encore d'évaluation

- Cash CE Bank Recon POC PCFDocument8 pagesCash CE Bank Recon POC PCFemman neriPas encore d'évaluation

- I. Understanding The Client'S Business and Industry The ClientDocument2 pagesI. Understanding The Client'S Business and Industry The Clienthanna jeanPas encore d'évaluation

- BankingDocument17 pagesBankingritzbajaj412052Pas encore d'évaluation

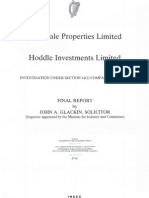

- Glackin 1Document64 pagesGlackin 1thestorydotiePas encore d'évaluation

- Plan de EstudiosDocument27 pagesPlan de EstudiosRobertoPas encore d'évaluation

- Yökdil Sosyal 2018 SonbaharDocument20 pagesYökdil Sosyal 2018 SonbaharJackson LewisPas encore d'évaluation

- Pag Ibig WeaccessDocument486 pagesPag Ibig Weaccessgo goPas encore d'évaluation

- Sales Finals Reviewer - ChanDocument79 pagesSales Finals Reviewer - ChanLenvicElicerLesigues100% (1)

- User Manual Oracle FLEXCUBE Direct Banking Retail InquiriesDocument39 pagesUser Manual Oracle FLEXCUBE Direct Banking Retail Inquiriesasafoabe4065Pas encore d'évaluation

- ISO20022 MDRPart1 PaymentsInitiation 2016 2017 v2Document88 pagesISO20022 MDRPart1 PaymentsInitiation 2016 2017 v2arunsdharanPas encore d'évaluation

- Loan PolicyDocument5 pagesLoan PolicyAyesha FarooqPas encore d'évaluation