Académique Documents

Professionnel Documents

Culture Documents

Analysis of The Effect of Capital, Net Interest Margin, Credit Risk and Profitability in The Implementation of Banking Intermediation

Transféré par

Alexander DeckerTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Analysis of The Effect of Capital, Net Interest Margin, Credit Risk and Profitability in The Implementation of Banking Intermediation

Transféré par

Alexander DeckerDroits d'auteur :

Formats disponibles

European Journal of Business and Management www.iiste.

org

ISSN 2222-1905 !aper" ISSN 2222-2#$9 %nline"

&ol.'( No.2)( 201)

20

Analysis of the Effect of Capital, Net Interest Margin, Credit Risk

and Profitability in the Implementation of Banking

Intermediation

(t!dy "n Regional #e$elopment Bank All "$er Indonesia In %&'% (

*err+ ,-.mad Bu-.or+

E/0I1,S E-onomi-s 2ollege( Jl. !**. Mustopa No. $1 Bandung )012)( Indonesia

E-mail 3 a-.mad45u-.or+6+a.oo.-om

Abstract

1.e aim of t.is stud+ was to anal+7e t.e fa-tors t.at affe-t t.e implementation of 5an8ing intermediation in-lude

2apital( Net Interest Margin( 2redit 9is8 and !rofita5ilit+. 1.e met.ods used are des-ripti:e and :erifi-ati:e(

wit. se-ondar+ data from finan-ial statements all o:er 2' Indonesian 9egional ;e:elopment Ban8s as a resear-.

o5<e-t=s units. ;ata anal+sis te-.ni>ue is t.e multiple linear regression( .+pot.esis testing w.ile using t - test to

e?amine t.e effe-t of partial :aria5les and test - @ to e?amine t.e effe-t of :aria5les simultaneousl+ wit. a

signifi-an-e le:el of 5 A. Based on t.e results it is -on-luded t.at partial NIM and 9%, .a:e positi:e and

signifi-ant effe-ts on B;9. N!B .as positi:e effe-t 5ut no signifi-ant effe-t to B;9. C.ile t.e 2,9 .as

negati:e effe-t 5ut no signifi-ant effe-t to B;9. Simultaneousl+ 2,9( NIM( N!B and 9%, signifi-antl+

influen-e t.e le:el of influen-e of B;9 wit. )0.5 A w.ile t.e remaining 59.5A t.oug.t to 5e influen-ed 5+

ot.er :aria5les not e?amined in t.is stud+.

)ey*ords3 2apital ,de>ua-+ 9atioD 2,9D Boan to ;eposit 9atioD B;9D Net Interest MarginDNIMD Non-

!erforming BoansD N!BsD 9eturn on ,ssetsD 9%, .

'+ Backgro!nd

Ban8 as t.e depositor+ finan-ial institution .olds a :er+ important role in t.e e-onom+ of a -ountr+. Ban8

fa-ilitates t.e interests of sa:ers wit. 5orrowers t.roug. produ-ts and finan-ial ser:i-es it offers. ,sides from

t.ese a-ti:ities( 5an8s -an also pro:ide ser:i-es t.at fa-ilitate pa+ments traffi-. It -an not 5e denied t.at t.e role

of 5an8s w.i-. -an 5e used as a tool in setting monetar+ poli-+ is also t.e primar+ sour-e of -redit to most small

5usinesses and indi:iduals( w.i-. will ultimatel+ affe-t t.e e-onomi- growt. of a -ountr+ /o-.( 2000D Bu-.or+(

200'".1.e role t.at finan-ial institutions .a:e pla+ed in finan-ial intermediation and growt.( namel+ to mo5ili7e

sa:ings and allo-ate t.em to t.e most produ-ti:e and growt.-promoting a-ti:ities Ma.ran(2012". Ban8ing pla+s

su-. a ma<or role in -.anneling funds to 5orrowers wit. produ-ti:e in:estment opportunities. 1.is finan-ial

a-ti:it+ is important in ensuring t.at t.e finan-ial s+stem and t.e e-onom+ run smoot.l+ and effi-ientl+E

Mis.8in F Ea8ins( 200'". 1.e -om5ined effe-ts of finan-ial intermediation( w.i-. are t.e e?ternalit+ and inter-

se-toral fa-tor produ-ti:it+ differential effe-ts on e-onomi- growt. are signifi-antl+ positi:e and do not appear

to depend on t.e stage of e-onomi- de:elopment attained M.%. %dedo8un( 199#".

Intermediation fun-tion performed 5+ 5an8s t.roug. t.e pur-.ase of surplus funds from e-onomi- units

5usiness se-tor( go:ernment and indi:idual G .ouse.old" to 5e distri5uted to defi-it e-onomi- units *empel et

al.( 199)". In ot.er words( a finan-ial intermediation is t.e di:ersion of funds a-ti:ities from sa:ers ultimate

lenders" to t.e 5orrower t.e ultimate of 5orrowers". Implementation of finan-ial intermediation in 5an8ing -an

5e seen from t.e 5an8Hs a5ilit+ to transform t.e sa:ings are re-ei:ed primaril+ from .ouse.old e-onomi- units

into -redit or loans for -ompanies and ot.er parties to ma8e in:estments in 5uildings( e>uipment and ot.er

-apital goods 9ose( 2002".

In t.e -onte?t of IndonesiaHs e-onom+( t.e dominant role of 5an8s remains as -ompared to ot.er

finan-ial institutions. 1.is -an 5e seen from t.e mar8et s.are asset indi-ators of finan-ial industr+ t.roug. t.e

mont. of June 201$. Ban8s still dominate t.e mar8et s.are( w.i-. is e>ual to I#.2) A( followed 5+ '.1$A for

finan-e -ompanies( '.15 A for insuran-e -ompanies( 5.12 A for so-ial insuran-e -ompanies( 2.I0 A for pension

funds( 1.09 A for -orporate se-urities and mortgage of 0.5I A . Info5an8 9esear-. Bureau( 201$". Espe-iall+

wit. regard to 5an8ing assets in Indonesia( total assets to t.e position on Jul+ 201$( w.i-. .as rea-.ed 9p

).510(29 5illion in:ested largel+ in t.e form of loans of 9p $.0)5(5 1 trillion or 'I.52A Espe-iall+ wit. regard to

5an8ing assets( total assets to t.e position on Jul+ 201$( w.i-. .as rea-.ed 9p )510.29 5illion in:ested largel+ in

t.e form of loans of 9p $0)5.51 trillion or 'I.52 A Ban8 Indonesia( 201$". 1.e ratio of -redit to gross domesti-

produ-t J;!" of t.e Indonesian 5an8ing in 2011 onl+ amounted to 29.'A( is still relati:el+ low -ompared to

12#.'A for Singapore( 11I.$A for Mala+sia( #1.2A for 1.ailand and $1.)A for t.e !.ilippines. Indonesian

5an8ing t.oug. still relati:el+ low 5ut -ontri5ution of 5an8ing pla+ an important role in fa-ilitating t.e growt. of

t.e Indonesian e-onom+ Info5an8 9esear-. Bureau( 201$".

9egional ;e:elopment Ban8 B!;" in Indonesia was esta5lis.ed wit. t.e intent to pro:ide funding for

European Journal of Business and Management www.iiste.org

ISSN 2222-1905 !aper" ISSN 2222-2#$9 %nline"

&ol.'( No.2)( 201)

21

t.e implementation of lo-al de:elopment efforts in t.e framewor8 of National ;e:elopment Baw no. 1$ 19'2".

Bater in t.e de-ree of Ministr+ of Internal ,ffair No. '2 in 1999( affirmed t.at t.e prin-ipal tas8 of de:eloping

t.e e-onom+ and t.e B!; is mo:ing regional de:elopment( w.ile t.e fun-tion is3

1" !romoting t.e -reation of t.e le:el of e-onomi- growt. and regional de:elopment in order to impro:e t.e

standard of li:ing of t.e people

2" 1.e .older or a regional treasur+ and finan-ial management areas

$" %ne sour-e of re:enue.

*owe:er up to t.is time( in -arr+ing out its duties and fun-tions of t.e B!; still fa-es se:eral pro5lems( among

w.i-.3 limited -apitalD 5rand awareness -ommunit+ to B!; is still :er+ lowD >ualit+ of ser:i-e does not meet t.e

e?pe-tations of so-iet+ D >ualit+ and .uman resour-es -ompeten-ies .a:e not 5een standardi7edD inno:ation and

produ-t de:elopment is still limited D networ8s offi-e ser:i-es is still limited D not optimal strategi- partners.ipD

stru-ture of pu5li- funding is relati:el+ low D -omposition of t.e produ-ti:e loan portfolio is relati:el+ low( and

not -onsolidate information te-.nolog+ E8o Budiwi+ono ( 2012" .

,s one of t.e -ommer-ial 5an8s( B!; pla+s a :er+ important role in t.e e-onom+( espe-iall+ t.e

regional e-onom+. 1.e role is mainl+ seen .ow wide B!; -an appl+ intermediar+ fun-tion. Intermediation

fun-tion performed 5+ B!; t.roug. t.e pro-ess of pur-.asing t.e surplus funds from e-onomi- units 5usiness

se-tor( go:ernment and indi:idualG.ouse.old" to 5e distri5uted to defi-it e-onomi- units. In ot.er words( a

finan-ial intermediation is t.e di:ersion of funds a-ti:ities from sa:ers ultimate lenders" to t.e 5orrower t.e

ultimate of 5orrowers". %ne -ommonl+ used indi-ator to measure t.e implementation of 5an8ing intermediation(

is t.e ratio of loans to deposits or loans to deposits ratio B;9" *aruna( 2011D Bu-.or+( 200'". 1.e .ig.er t.is

ratio is( t.e 5etter it means t.at t.e 5an8 -ould -arr+ out intermediation fun-tion optimall+.

1.e B;9 a-.ie:ed 5+ t.e B!; to ;e-em5er 2012 is I#( 5IA lower t.an t.e national 5an8s #$.5#A"(

and ot.er groups su-. as state 5an8s I9.#)A"D pri:ate national 5an8s #1.5#A"D non-foreign e?-.ange 5an8s

#2.I$A"D <oint 5an8s 115.'$A" and foreign e?-.ange 5an8s 111.21A" Ban8 Indonesia( 201$". 1.e a-.ie:ed

low B;9 of B!; indi-ated t.at t.e implementation of 5an8ing intermediation 5+ B!; .as not 5een optimal.

1.e not optimal implementation of 5an8ing intermediation 5+ B!; is t.oug.t to in-lude t.e effe-t of t.e 2apital

,de>ua-+ 9atio 2,9"( Net Inerest Margin NIM"( Non !erforming Boan N!B"( and 9eturn on ,ssets 9%,".

Based on t.e p.enomenon a5o:e( t.e pro5lem in t.is resear-. -an 5e formulated into a resear-.

>uestion3 *ow t.e 2,9( NIM( N!B( and 9%, influen-e t.e implementation of 5an8ing intermediationK 1.is

stud+ aims to anal+se t.e fa-tors t.at affe-t t.e implementation of t.e intermediation fun-tion of 5an8s t.at

allegedl+ in-lude t.e effe-t of t.e 2,9( NIM( N!B and 9%,.

%+ ,iterat!re re$ie*

2.1. Definition, role, function and core activity of bank

Ban8 is a finan-ial institution w.ose main a-ti:it+ is re-ei:ing pu5li- deposits . 1.e funds will 5e

dis5ursed in t.e form of loans to -ommunities w.o need t.em. Besides ta8ing deposits and gi:ing loans( 5an8s

also pro:ide ot.er finan-ial ser:i-es.

,--ording to t.e Baw No. I of 1992 and amended 5+ Baw No. 10 of 199# a5out Ban8ing( 5an8s are

5usiness entities t.at raise funds from t.e pu5li- in t.e form of sa:ings and -.annel t.em to t.e -ommunit+ in

t.e form of -redit or ot.er forms in order to impro:e t.e li:ing standard of t.e people.

1.e role of 5an8s in t.e e-onom+ -an 5e e?pressed as L...5an8ing pla+s su-. a ma<or role in -.annelling

funds to 5orrowers wit. produ-ti:e in:estment opportunities( t.is finan-ial a-ti:it+ is important in ensuring t.at

t.e finan-ial s+stem and t.e e-onom+ run smoot.l+ and effi-ientl+E Mis.8in and Ea8ins( 200'". 1.e same is

e?pressed as follows L.....2ommer-ial 5an8s pla+ an important role in fa-ilitating e-onomi- growt.. %n a

ma-roe-onomi- le:el( t.e+ represent t.e primar+ -onduit of @ederal 9eser:e monetar+ poli-+. Ban8s deposit

represent t.e most li>uid form of mone+( su-. t.at @ederal 9eser:e efforts to -ontrol t.e nation=s mone+ suppl+

and le:el of aggregate e-onomi- a-ti:it+ do so 5+ -.anging t.e a:aila5ilit+ of -redit at 5an8s. %n a

mi-roe-onomi- le:el( -ommer-ial 5an8 represents t.e primar+ sour-e of -redit to most small 5usiness and man+

indi:idualsE /o-.( 2000". C.ile ot.er opinions a5out t.e role of t.e 5an8 are as follows3 L... , 5an8 -an 5e

defined in t.e term of3 1" t.e e-onomi-s fun-tion is ser:es( 2" t.e ser:i-es is offers its -ustomer( or $" t.e legal

5asis for its e?isten-e. 2ertainl+ 5an8 -an 5e identified 5+ t.e fun-tions t.e+ perform in t.e e-onom+( t.e+ are

in:ol:ed in transferring funds from sa:ers to 5orrowers finan-ial intermediation" and in pa+ing for goods and

ser:i-esE 9ose and *udgins( 200#"

@or t.e Indonesian 5an8ing 5an8 fun-tions listed in t.e Baw of t.e 9epu5li- of Indonesia No. I of 1992

and amended 5+ Baw No. 10 of 199# on Ban8ing( 5an8s are 5usiness entities t.at raise funds from t.e pu5li- in

t.e form of sa:ings and -.annel t.em to t.e pu5li- in t.e form of loans or ot.er forms in order to impro:e t.e

li:ing standard of t.e people. In ot.er parts of t.e a-t( t.e 5an8 also pro:ides a :ariet+ of ser:i-es and

-on:enien-es t.at in essen-e is to meet t.e needs of people of all finan-ial transa-tions. 1.e -ore a-ti:ities of a

5an8 as a finan-ial institution t.at are alwa+s asso-iated wit. t.e transa-tions or finan-ial a-ti:it+ t.at o--urred

European Journal of Business and Management www.iiste.org

ISSN 2222-1905 !aper" ISSN 2222-2#$9 %nline"

&ol.'( No.2)( 201)

22

in t.e -ommunit+ are3

1 intermediation ta8ing deposits and lending mone+"

2 disintermediation relin>uis.ing t.e intermediar+ de5torG-reditor position( w.ile retaining a M5ro8er= role"

$ -olle-tion and pa+ment s+stem( mone+ transmission

) foreign e?-.ange( foreign trade ser:i-es

5 parti-ipation in t.e mone+ and -apital mar8et 2ade( 199I"

2.2. Definition and factors of affecting banking intermediation

In simple terms t.e role of 5an8s in t.e e-onom+ is to fulfil t.e desire of ultimate 5orrowers and t.e ultimate

lenders. *owe:er( t.e role of 5an8s is a-tuall+ >uite -omple? 5e-ause t.ere are two interests 5eside ot.er

interests t.at must 5e met 5+ a 5an8 and t.at are t.ose of t.e owners and t.e go:ernment regulator". 1.us( a

5an8 must 5e a5le to 5alan-e t.e :arious interests ultimate 5orrowers( ultimate lenders( owners and regulators"

t.at are sometimes different *empel et al.( 199)". Ji:en t.at t.e 5an8ing se-tor is t.e intermediar+ 5etween

t.e parties t.at .a:e t.e e?-ess funds and t.ose w.o need t.e funds( t.e reallo-ation of pu5li- funds .as

important impli-ations for t.e mo:ement of t.e e-onom+ as a w.ole. 1.erefore( t.e role of 5an8s in t.e

e-onom+ is espe-iall+ from t.e e?tent to w.i-. t.e 5an8 -an appl+ its intermediar+ fun-tions. @inan-ial

intermediation is t.e pro-ess of 5u+ing funds from surplus e-onomi- units 5usiness se-tors( go:ernment and

indi:idualG.ouse.old" to 5e distri5uted to defi-it e-onomi- units *empel et al.( 199)". 1.e same is stated 5+

/idwell and !etterson 2000" w.i-. states t.at intermediation is t.e pro-ess of transformation or dire-t

pur-.ases of a -laim wit. a series of -.ara-teristi-s maturit+( denomination" of ;S0s and turn it into a -laim

indire-tl+ 5+ a different set of -.ara-teristi-s to 5e sold to SS0s. Meanw.ile( a--ording to Jardner 2000"(

intermediation is a pro-ess of transformation from se-ondar+ se-urities into primar+ se-urities. !rimar+

se-urities are t.e -laim of indi:iduals( go:ernment and non-finan-ial -ompanies( w.ile t.e se-ondar+ se-urities

are -laims against finan-ial institutions.

1.e implementation of finan-ial intermediation in 5an8ing -an 5e seen from t.e 5an8Hs a5ilit+ to

transform sa:ings re-ei:ed primaril+ from .ouse.old e-onomi- units into -redit or loans for -ompanies and

ot.ers to in:est in 5uildings( e>uipment and ot.er -apital goods 9ose( 2002". 1.e indi-ators -ommonl+ used to

measure t.e e?tent of intermediation 5+ t.e 5an8ing s+stem .as 5een implemented( namel+ 5+ loo8ing at t.e

ratio of loans to deposits 8nown as Boans to ;eposits 9atio B;9". ,n indi-ator to measure t.e wor8ings of t.e

5an8ing intermediation fun-tion is to loo8 at t.e Boan to ;eposit 9atio B;9". ,--ording Bu-.or+ 200'"(

B;9 ratio refle-ts t.e a5ilit+ of 5an8s to e?tend -redit and -olle-t pu5li- funds. 1.e .ig.er t.is ratio is( t.e

5etter it means t.at t.e 5an8 -ould -arr+ out intermediation fun-tion optimall+. &i-e :ersa( t.e lower t.is ratio

means t.e 5an8 in -arr+ing out its intermediar+ fun-tion is not optimal. Some of t.e -auses .a:e not 5een

optimal implementation of 5an8ing intermediation in t.e region( a--ording to resear-. 5+ Ban8 Indonesia is

-aused 5+3 t.e limited aut.orit+ of t.e 5an8 5ran-.es in de-iding loans( t.e effe-t of t.e finan-ial -ondition of

t.e internal 5ran-. of t.e -redit( t.e e?isten-e of alternati:e in:estment of funds( t.e 5usiness -limate in t.e

region( t.e pre-autionar+ prin-iple ,5dulla. and Suseno( 200$". In t.is stud+( t.e aut.ors estimates t.at not t.e

optimal implementation of t.e intermediar+ fun-tion B;9" 5+ B!; regional de:elopment 5an8" is -aused 5+

t.e following fa-tors 3 -apital 2,9"( -redit ris8 N!B" and profita5ilit+ 9%," .

2.2.1. Loan to deposit ratio

,s noted a5o:e t.at t.e B;9 is an indi-ator in t.e measurement of 5an8ing intermediation. ,--ording to t.e

resear-. result Bu-.or+ 200'" implementation of finan-ial intermediation fun-tion gi:e effe-t to 5an8ing

performan-e. 1.is means t.at 5an8s will .a:e good finan-ial performan-e if t.e 5an8 -ould appl+ its

intermediar+ fun-tion optimall+. @or 5an8s in Indonesia( a--ording to Ban8 Indonesia 2ir-ular Better No.

1$G2)G;!N! dated %-to5er 25

t.

( 2011 Su5<e-t 3 &aluation of Be:el 2ommer-ial Ban8 Soundness and t.e -ir-ular

letter No. 15G)1 G ;/M! Ja8arta( %-to5er 1

st

( 201$ Su5<e-t3 2al-ulation of Minimum statutor+ 9eser:ed

;emand ;eposit and 2ompulsor+ ;emand deposit 5+ Boan to ;eposit 9atio in 9upia.. Boan to ;eposit 9atio

.ereinafter referred to as t.e B;9 is t.e ratio of loans to t.ird parties in e?-.ange 9upia. and foreign -urran-+(

e?-luding loans to ot.er 5an8s( t.e deposits w.i-. in-lude demand deposits( sa:ings and time deposits in 9upia.

and foreign -urren-ies( e?-luding inter5an8 funds. 1.erefore( a 5an8Hs B;9 is determined 5+ t.e 5an8Hs a5ilit+ to

-olle-t and distri5ute funds to t.ird parties in t.e form of -redit. 1.e .ig.er t.e B;9 s.owed greater use of 5an8

deposits for lending( w.i-. means 5an8 .as 5een -apa5le to run intermediar+ fun-tion properl+. *owe:er( if t.e

B;9 is too .ig. -an also rise a li>uidit+ ris8 for 5an8s. 1.e implementation of finan-ial intermediation gi:es

effe-t to 5an8ing performan-e. 1.is means t.at 5an8s will .a:e good finan-ial performan-e if t.e 5an8 appl+ its

intermediar+ fun-tion optimall+.

2.2.2. The effect of CA of the LD

Intermediation fun-tion -an 5e implemented optimal+ if supported 5+ ade>uate -apital Bu-.or+( 200'".

European Journal of Business and Management www.iiste.org

ISSN 2222-1905 !aper" ISSN 2222-2#$9 %nline"

&ol.'( No.2)( 201)

2$

E:en t.oug. t.e funds -olle-ted 5+ t.e t.ird part+ is :er+ large( 5ut if not offset 5+ additional -apital t.e 5an8s

will 5e limited in e?tending -redit. Ban8 -apital is not onl+ important as a sour-e of funds to meet t.e needs of

t.e 5an8( 5ut t.e 5an8Hs -apital will affe-t management de-isions in t.e -reation of t.e rate of profit on t.e one

.and and t.e potential ris8s on t.e ot.er. If t.e 5an8Hs strong -apital t.e 5an8 .as a strong finan-ial. 0nder t.ese

-onditions( t.e role of -apital for 5an8s is :er+ important 5ot. as a 5uffer to a--ommodate t.e in-reased

une?pe-ted losses deri:ed from -redit( interest rate( li>uidit+ and operational ris8 as well in order to 5uild pu5li-

trust. 2apital pla+s a :er+ important role 2ulp( 2001"( namel+ as3

1" 5uffer loss -apital loss as a 5uffer"

2" in:estment Me-.anism -apital as an in:estment me-.anism".

1.e same opinion was e?pressed t.at t.e role of -apital in t.e 5an8 are3

1" as a tool for a-.ie:ing t.e optimal -apital stru-ture -apital as a means for a-.ie:ing t.e optimum -apital

stru-ture"

2" as se-urit+ guards 5an8 ris8 management in order to se-ure -apital a ssu5titute ris8 management for 5an8s to

ensure safet+" S-.roe-8( 2002".

Similarl+( a--ording to 9ose 2002" t.at t.e 5an8 -apital pla+s a :er+ important role in supporting t.e 5an8Hs

operations and :ia5ilit+ in t.e long term for 5an8. 1.e strengt. of a 5an8Hs -apital -an 5e measured 5+ t.e

minimum -apital ade>ua-+ ratio or t.e t.e 2,9. 2,9 is an indi-ator of t.e a5ilit+ of 5an8s to pro:ide funds

for e?pansion and a--epting ris8 loss -aused 5+ t.e operations of t.e 5an8. @or 5an8s in Indonesia( a--ording

!BI. 1)G1#G!BIG2012 No:em5er 2#

t.

2012 su5<e-t 3 Minimum 2apital ,de>ua-+ s.all 5e at t.e low as follows3

a. #A of t.e 9is8 Ceig.ted ,ssets 9C," for t.e Ban8Hs ris8 profile rating of 1

5. 9A to less t.an 10A of t.e 9C, for t.e ris8 profile of t.e Ban8 wit. a rating of 2

-. 10A to less t.an 11A of 9C, for t.e ris8 profile of t.e Ban8 wit. a rating of $

d. 11A to 1)A of 9C, for t.e ris8 profile of t.e Ban8 wit. a rating of ) or 5

1.e .ig.er t.e 2,9( t.e greater t.e finan-ial resour-es t.at are a5le to 5e used to support

implementation of t.e parti-ular -redit intermediation fun-tion. ,--ording to Soedarto 200)" and 5+ Budiawan

200#"( 2,9 .as a positi:e and signifi-ant impa-t on 5an8 -redit. ,nd a--ording to Bu-.or+ 200'"

implementation of finan-ial intermediation influen-e on t.e -apital stru-ture of t.e 5an8. 1.is means t.at t.e

5an8 in -arr+ing out t.e fun-tions of finan-ial intermediation( espe-iall+ in lending is needed an additional funds

from t.e pu5li- and supported 5+ ade>uate -apital. Nasirudin 2005" resear-. results s.owed t.at t.e le:el of

-apital ade>ua-+ signifi-ant effe-t on B;9 in 2entral Ja:a. 1.en( a--ording Siringoringo 2012" -apital stru-ture

simultaneousl+ affe-t t.e intermediation fun-tion Ban8. @urt.ermore( resear-. results 1ang8o 2012" s.owed

t.at t.e :aria5les 2,9 signifi-antl+ influen-e to B;9. Similarl+( t.e result resear-. of Sitorus 201$" entitled

Analysis of !actors influence of "on # $erforming Loans %"$Ls& at 'o $ublic (ank at )ndonesia *tock

+,change period 2--.#2-11( t.e result of t.e resear-. indi-ates t.at t.e 2apital ,de>ua-+ 9atio 2,9"(

influen-e t.e Boan to ;eposit 9atio B;9" . C.ile t.e stud+ results M5i7i 2012"( entitled An Analysis of the

)mpact of /inimum Capital e0uirements on Commercial (ank $erformance in 1imbab2e( findings re:ealed

t.at t.ere is a signifi-ant and positi:e relations.ip 5etween -ommer-ial 5an8 -apitali7ation and its performan-e.

0tari resear-. results and *ar+anto 2011" t.e results s.owed t.at 2,9 is not signifi-ant positi:e influen-e on

t.e B;9 wit. a signifi-an-e le:el of 0.192 N 0.050. ,nd t.e results of 1amtomo resear-. 2012" partiall+

2apital 9atio ,de>ua-+ positi:e and signifi-ant effe-t on B;9.

2.2.3. The +ffect of "et )nterest /argin %")/& of the Loan to Deposit atio %LD(

,s well as 9eturn %n ,ssets 9%,"( net interest margin NIM" 5eing one of t.e indi-ators t.at -an 5e

used to measure t.e performan-e of t.e 5an8 to generate profits of t.e management of earning assets or

produ-ti:e assets owned 5an8. NIM -al-ulated 5+ -omparing t.e interest in-ome to total earning assets.

@lu-tuations in mar8et interest rates will lead to .ig.er NIM rea-.ed t.e low 5an8. 1.erefore NIM ratios ma+

also refle-t t.e mar8et ris8( ie t.e ris8 t.at t.e 5an8 due to ad:erse -.anges in mar8et -onditions espe-iall+

interest rates. Mu<eri and Oounus 2009" suggested a related -on-ept is t.e net interest margin NIM" defined as

t.e differen-e 5etween interest e?penses and interest in-ome per unit of total 5an8 NIM assets. 1.e NIM is

treated as an important indi-ator of intermediation effi-ien-+ and t.e e?pe-tation is t.at NIM would de-line as

t.e 5an8ing industr+ matures and -ompetition strengt.ens.

1.e .ig.er t.e 5etter NIM( meaning t.at t.e 5an8 .as t.e potential gains deri:ed from t.e differen-e 5etween

interest in-ome resulted in in-reased earnings and -apital as one of t.e finan-ial resour-es t.at -an 5e used to

support intermediation fun-tion espe-iall+ t.e pro:ision of -redit. 9esear-. of Sitorus 201$" stated( t.e result of

t.e resear-. indi-ates t.at net interest margin NIM" influen-e t.e Boan to ;eposit 9atio B;9". C.ile t.e stud+

results ,sto.ar 2012"( t.e results s.owed interest t.at Net interest margin NIM" :aria5les -an not strengt.en

t.e influen-e of a :aria5le loan to deposit ratio to -.anges in foreign e?-.ange earnings on t.e 5an8 of 5an8s in

Indonesia.

European Journal of Business and Management www.iiste.org

ISSN 2222-1905 !aper" ISSN 2222-2#$9 %nline"

&ol.'( No.2)( 201)

2)

2.2.4. The effect of "$Ls of the LD

2redit is t.e greatest asset in:estment 5an8s. Similarl+( loan interest in-ome is t.e largest sour-e of re:enue for

5an8s. If t.e -redit returns fail t.en t.e a5ilit+ of 5an8s to pro:ide new loans will 5e disrupted. In addition to t.e

5an8Hs re:enue would also de-rease in interest in-ome due to non-re-eipt of -redit. Besides( t.e 5an8 also must

esta5lis. reser:es or pro:isions of pro5lem loans t.at ultimatel+ will redu-e t.e 5an8Hs -apital. 1.oug.( mu-.

-apital is needed for -redit e?pansion. 1.e redu-ed of 5an8s a5ilit+ to pro:ide -redit to interfere wit. t.e

implementation of t.e 5an8 intermediation. 2redit >ualit+ of a 5an8 is indi-ated 5+ t.e "$L. 1.us( N!B -an 5e

used to measure t.e a5ilit+ of 5an8s to cover t.e ris8 of default of loan repa+ment 5+ t.e de5tor. Based on Ban8

Indonesia 2ir-ular Better No. 1$G2)G;!N! on %-to5er 25t.( 2011 -on-erning t.e 2ommer-ial Ban8s( pro5lem

loans are loans to a t.ird part+ of non 5an8 -onsist of non performing loan su5 standard"( dou5tful and loss.

1.e .ig.er t.e le:el of N!Bs( t.e greater t.e -redit ris8 5orne 5+ t.e 5an8. N!B rate ma+ affe-t t.e le:el of

effi-ien-+ of 5an8s. 1.e resear-. /arim( 2.an and *assan 2010" states in Mala+sia and Singapore( -learl+

indi-ate t.at .ig.er non-performing loan redu-es -ost effi-ien-+. 1.erefore( 5an8s s.ould 5e a5le to press a low

N!B ratio so t.at t.e potential 5enefits to 5e gained will 5e e:en greater( 5e-ause 5an8s will sa:e t.e allowan-e

for -redit losses or allowan-e for non-performinf assets !!,!". 1.e low ,llowan-e !!,!" formed t.e greater

profita5ilit+ and ultimatel+ impro:e t.e 5an8Hs -apital. ,--ording to Sentausa 2009" -ited 5+ !ratama 2010"(

t.e amount of N!Bs to 5e one of t.e -auses of t.e diffi-ult+ 5an8s in lending. Similarl+( a--ording to *armanta

and E8ananda 2005" N!B is signifi-antl+ and negati:el+ related to 5an8 -redit. 1.erefore( a--ording to

Budiawan 200#" N!B .as effe-t negati:el+ and signifi-ant on 5an8 -redit. Meanw.ile( a--ording to Soedarto

200)"( N!Bs effe-t positi:el+ and signifi-ant on 5an8 -redit. C.ile t.e stud+ results of Nasirudin 2005"

s.owed t.at t.e :aria5le N!Bs .a:e a signifi-ant effe-t on B;9. 1.e resear-. results of 0tari and *ar+anto

2011" s.owed t.at N!B .as a signifi-ant negati:e influen-e on t.e B;9 wit. a signifi-an-e le:el of 0.000 P

0.050. 1.e same t.ing was stated 1amtomo 2012" and 1ang8o 2012" t.at N!B :aria5le effe-t negati:el+ and

signifi-ant on B;9. Meanw.ile( a--ording to ,l-,5edallat and ,l-S.u5iri 201$" resear-. .as empiri-all+

e?amined t.e determinants of -redit ris8 .eld 5+ Jordanian 5an8s o:er t.e 200' to 2010 periods 1.e -redit ris8

is one of t.e main ris8s t.at seriousl+ affe-t 5an8s= sta5ilit+. Meanw.ile( a--ording to Sitorus 201$" t.e result

of t.e resear-. indi-ates t.at t.e 2,9( 9%,( NIM and %E%I t.at totall+ influen-e t.e N!B.

2.2... The +ffect of 5A of the LD

Ban8 is is an organi7ation t.at -om5ines .uman effort and finan-ial resour-es to -arr+ out t.e fun-tions of t.e

5an8 in order to ser:e t.e needs of t.e -ommunit+ and to ma8e a profit for t.e owners of t.e 5an8 Jeorge

*empel( 1999". Ban8ing profits o5tained t.roug. 5an8 intermediation pro-ess. ,nal+sis of profita5ilit+ needs to

5e done to measure t.e le:el of 5usiness effi-ien-+ and profit a-.ie:ed 5+ a 5an8. 9atio -ommonl+ used to

measure and -ompare t.e performan-e of profita5ilit+ is 9%,. 9%, is t.e ma<or ratio used in anal+7ing 5an8

profita5ilit+. 9%, is used to assess t.e a5ilit+ of 5an8 management in managing all 5an8 assets to -reate re:enue

in t.e form of profit is -al-ulated 5+ -omparing net in-ome to a:erage total assets. 1.e .ig.er of t.e 9%,( so

5etter of t.e 5an8Hs management to generate profits. 1.e results stud+ of 0tari and *ar+anto 2011" s.owed t.at

9%, is not signifi-ant negati:e influen-e on t.e B;9 wit. a signifi-an-e le:el of 0.5'0N 0.050. C.ile

a--ording to 1amtomo 2012"( found t.at 9%, positi:e and signifi-ant effe-t on B;9.

2.3. 6ypothesis

Based on t.e relations.ip 5etween resear-. o5<e-ti:es and t.eoreti-al framewor8 to t.e formulation of

t.e resear-. pro5lem( t.e .+pot.esis are as follows3

*13 2,9 positi:el+ effe-t on B;9

*23 NIM positi:el+ effe-t on B;9

*$3 N!B negati:el+ effe-t on B;9

*)3 9%, positi:el+ effe-t on B;9

*53 2,9( NIM( N!B( 9%, effe-t on B;9

-+ Research method

3.1. esearch method

1.e met.ods used in t.is resear-. are des-ripti:e met.od and :erifi-ation met.od. ;es-ripti:e met.od

is a met.od used to anal+7e data in a wa+ to des-ri5e or depi-t t.e data t.at .as 5een -olle-ted as is wit.out

intending to appl+ general -on-lusions or generali7ations w.ile t.e :erifi-ation met.od is a met.od of resear-.

t.at aims to determine t.e relations.ip 5etween two or more :aria5les. 1.is :erifi-ation met.od is used to test

t.e trut. of a .+pot.esis. Influen-e or s.ape t.e -ausal relations.ip 5etween :aria5les Q and O -an 5e 8nown

from t.e resear-. met.od of :erifi-ation. Sugi+ono( 2009"

European Journal of Business and Management www.iiste.org

ISSN 2222-1905 !aper" ISSN 2222-2#$9 %nline"

&ol.'( No.2)( 201)

25

3.2. Type,data source, population, sample and data collection methods.

;ata used in t.is stud+ is se-ondar+ data ,ll Indonesian regional de:elopment 5an8s w.i-. in-lude 2,9( NIM(

N!B( 9%, and t.e B;9 were o5tained from t.e Indonesian Ban8ing Statisti-s and ;ata 2enter 2onsultant

E/%@IN !u5li-ations in 2012 -al-ulated >uarterl+". 1.e resear-. population was 2' regional de:elopment

5an8s B!;" ser:e as t.e o5<e-t of stud+. C.ile t.e o5<e-t is o5ser:ed finan-ial statements position ;e-em5er

$1st( 2012. ;ata -olle-tion met.od used was to stud+ t.e do-umentation. Stud+ of do-umentation is done wit.

t.e data -olle-tion and -lassifi-ation -ategor+ of written materials related to t.e resear-. pro5lem.

3.3. 5perational 7ariables

1.is stud+ uses t.e independent :aria5les( namel+ 2,9( NIM( N!B( 9%, and t.e dependent :aria5le is

t.e implementation of fun-tion 5an8ing intermediation as measured 5+ t.e B;9.

3.4. Analysis Techni0ues Data

1.e data anal+sis te-.ni>ue used in t.is stud+ is a multiple linear regression. @irst( it is tested to

determine w.et.er t.e assumptions of -lassi-al linear regression model doesn=t .a:e pro5lem of normalit+(

multi--ollinearit+( .etero-edastit+ and auto-orrelation. If all of t.em were fulfilled means t.at t.e model .as a

de-ent anal+sis used Ju<arati( 200$". 1o e?amine t.e .+pot.esis was used 1-test to determine statisti-al

signifi-an-e of t.e effe-t of independent :aria5les on t.e dependent :aria5le partial+( @-test to determine t.e

statisti-al signifi-an-e of t.e -oeffi-ient of multiple signifi-an-e or @-test to determine signifi-an-e of t.e

independent :aria5les on t.e dependent :aria5le simultaneousl+. ;ata pro-essing is done 5+ using t.e software

Statisti-al !a-8age for So-ial S-ien-e S!SS" :ersion 20.0 for Cindows. 1.e regression e>uation used is as

follows3

O R a S 8 9

1

S 8 9

2

S 8 9

3

S 8 9

4

S e

C.ere(

O R Boan to ;eposit 9atio B;9"

a R , -onstant w.i-. is t.e :alue of t.e :aria5le O w.en t.e :aria5le Q is 0 7ero"

8 R 2oeffi-ient of t.e regression line

Q

1

R 2apital ,de>ua-+ 9atio 2,9"

Q

2

R Net Interest Margin NIM"

Q

$

R Non !erforming Boans N!B"

Q

)

R 9eturn on ,ssets 9%,"

e R 9esidual

.+ Res!lt and disc!ssions

4.1. The development LD, CA, ")/, "$L and 5A regional development bank in )ndonesia

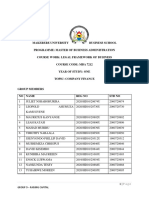

Based on data until ;e-em5er 2012( t.e de:elopment of B;9( 2,9( NIM( N!B and 9%, were a-.ie:ed 5+ 2'

regional de:elopment 5an8s operating in Indonesia see 1a5le 1" -an 5e des-ri5ed as follows3

1.e a:erage :alue of B;9 a-.ie:ed until ;e-em5er $1( 2012 amounted to I#.5IA. 1.at is B!; t.roug.out

Indonesia .a:e 5een a5le to appl+ t.e fun-tions of 5an8 intermediation t.roug. fund raising and lending of

I#.5IA( lower t.an t.e national 5an8s #$.5#A"( and ot.er groups su-. as state 5an8s I9.#)A"D pri:ate national

5an8s # 1.5#A"D non-foreign e?-.ange 5an8s #2.I$A"D <oint 5an8s 115.'$A" and foreign e?-.ange 5an8s

111.21A" Indonesian Ban8ing Statisti-s( 201$". But it is still in t.e range of B;9 determined 5+ Ban8

Indonesia( namel+3

1 t.e lower limit of t.e B;9 target 5+ I#A

2 t.e upper limit of t.e B;9 target3

a of 100A up to t.e date of ;e-em5er 1st( 201$

5 5+ 92A from t.e date of ;e-em5er 2nd( 201$.

1.e lowest :alue of B;9 at 55.IIA is a-.ie:ed 5+ B!; Sout. /alimantan( w.ile t.e .ig.est :alue of

B;9 at 11$.21A is a-.ie:ed 5+ B!; Sout. Sulawesi. 1.e a:erage :alue of 2,9 a-.ie:ed until t.e period

;e-em5er $1( 2012 amounted to 1#.$$A is a5o:e t.e minimum -apital re>uirement of #A as re>uired 5+ Ban8

Indonesia. 1.e .ig.est 2,9 at $2.29A was a-.ie:ed 5+ B!; 2entral Sulawesi and t.e lowest 2,9 at 12.$0A

was a-.ie:ed 5+ B!; ;/I Ja8arta". 1.erefore( t.e a:erage :alue of t.e 2,9 indi-ates t.at B!; still .as t.e

-apital a5ilit+ to in-rease intermediation fun-tion t.roug. lending distri5ution.

1.e a:erage :alue a-.ie:ed NIM period ;e-em5er $1

st

( 2012 amounted to I.'$A. 1.e .ig.est :alue

of 11.99A NIM was a-.ie:ed 5+ B!; Cest Nusa 1enggara and t.e lowest NIM of 5.15A a-.ie:ed 5+ t.e B!;

Sout. /alimantan. B+ loo8ing at t.e a:erage :alue of NIM is still a5o:e t.at re>uired 5+ Ban8 Indonesia

amounting to 2A. 1.is means t.at B!; 9egional ;e:elopment Ban8" is a5le to o5tain a positi:e interest

margin of t.e management of its assets. %f t.ese fa-tors indi-ate t.at t.e B!; still .as t.e a5ilit+ to impro:e t.e

European Journal of Business and Management www.iiste.org

ISSN 2222-1905 !aper" ISSN 2222-2#$9 %nline"

&ol.'( No.2)( 201)

2'

fun-tion of intermediation t.roug. lending.

1.e a:erage N!Bs :alue was 2.1$A a-.ie:ed 5+ period of ;e-em5er $1st( 2012. 1.e .ig.est N!B

:alue of ).)9A was a-.ie:ed 5+ B!; 2entral Sulawesi and t.e lowest N!Bs was 0.1IA a-.ie:ed 5+ B!; Cest

/alimantan. B+ loo8ing at t.e a:erage :alue of t.e N!B s.ows t.at t.e -redit ris8 was fa-ed 5+ B!; are at

moderate al5eit under toleran-e re>uired 5+ Ban8 Indonesia at $AT'A. It means 5eing a5le to -ontrol t.e ris8 of

B!; lending. Be-ause if N!Bs in-rease will disrupt t.e B!;=s a5ilit+ to impro:e t.e fun-tion of intermediation

t.roug. lending.

1.e a:erage 9%, :alue was 2.1$A a-.ie:ed 5+ period ;e-em5er $1st( 2012. 1.e .ig.est 9%, :alue

was 5.'2A a-.ie:ed 5+ t.e Cest Nusa 1enggara and t.e lowest 9%, was 1.2IA a-.ie:ed 5+ t.e Sout.

/alimantan. B+ loo8ing at t.e a:erage 9%, :alue s.ow t.at all B!; a5le to get profit from all t.eir assets. 1.e

a:erage 9%, :alue is a5o:e t.at re>uired 5+ Ban8 Indonesia at 1.25A. 1.is means t.at t.e in-ome earned from

B!; still .as t.e a5ilit+ to impro:e t.e fun-tion of intermediation t.roug. lending.

/abel ' 1.e de:elopment B;9( 2,9( NIM( N!B and 9%, regional de:elopment 5an8s in Indonesia

;e-em5er $1

st

( 2012 per-entage"

No. 9egional ;e:elopment Ban8s B;9 2,9 NIM N!B 9%,

1. ;/I - Ja8arta I$.50 12.$0 5.2' $.20 1.#I

2. Cest Ja:a I).09 1#.11 '.I' 2.0I 2.)'

$. 2entral Ja:a #2.'2 1).$# #.22 0.#0 2.I$

). ;IO- Jog+a8arta I1.#9 1).)0 9.02 0.#) 2.5'

5. East Ja:a #$.55 2'.5' '.)# 2.95 $.$)

'. ;I - ,-e. #9.#9 1I.#2 I.#I $.$0 $.''

I. Nort. Sumatera 101.90 1$.2) #.)9 2.#' 2.99

#. Cest Sumatera 100.$5 15.12 I.2' 2.'9 2.'5

9. Sout. Sumatera I5.9# 1$.55 '.50 '.#2 1.90

10. 9iau ''.)9 19.5' '.I2 2.95 2.95

11. Jam5i #2.29 2).)1 #.21 0.$$ $.5#

12. Beng8ulu 9$.2I 15.#) I.I0 0.22 $.)1

1$. Bampung 91.I$ 19.29 '.51 0.I) 2.#0

1). Bali #0.'0 1'.I9 I.50 0.5I ).2#

15. East Nusa 1enggara 9$.)5 1'.52 #.'I 1.20 $.'5

1'. Cest Nusa 1enggara 10#.)1 12.92 11.99 1.9# 5.'2

1I. !apua I1.'5 19.95 5.I1 0.#) 2.#1

1#. Malu8u I#.'1 1).I2 I.#5 2.'I $.25

19. Nort. Sulawesi 109.'2 1).I0 #.'' 0.#1 2.95

20. Sout. Sulawesi 11$.21 21.91 9.5$ 1.$9 $.99

21. 2entral Sulawesi 10I.2I $2.29 '.15 ).)9 1.59

22. Sout.east Sulawesi 92.02 22.5$ #.#9 1.$$ 5.10

2$. East /alimantan 5'.I# 20.#$ '.'5 I.)5 2.50

2). Cest /alimantan #'.#0 1'.#I 9.01 0.1I $.$$

25. Sout. /alimantan 55.II 1#.22 5.15 1.#$ 1.2I

2'. 2entral /alimantan I1.## 2$.I5 I.'I 0.#) $.)1

Minimum 55(II 12($0 5(15 0(1I 1(2I

Ma?imum 11$(21 $2(29 11(99 )()9 5('2

,:erage I#(5I 1#($$ I('$ 2(1$ $(10

*ource: Ban8ing Statisti-s Indonesia .ttp3GGwww.5i.go.idG downloaded Ma+( 9( 201$( pro-essed

and E8ofin 2onsulting 201$"

4.2. /ultiple linear regression analysis

Multiple linear regression anal+sis was used to determine 5asi-all+ dependen-e of dependent :aria5le wit. one

or more independent :aria5les( wit. t.e aim of estimating or predi-ting t.e a:erage of population data or a:erage

:alue of t.e dependent :aria5le 5ased on t.e :alue of t.e independent :aria5le 8nown Ju<arati( 200$". B+

regression anal+sis it -an 5e seen w.et.er t.ere is influen-e 5etween independent :aria5les wit. t.e dependent

:aria5le. 1.e results of multiple linear regression anal+sis in t.is stud+ -an 5e seen in 1a5le 2.

Based on 1a5le 2( t.e regression e>uation is as follows 3

LD R 0.)21 - 0$#Q

1

S 0.$55Q

2

S 0.'19Q

$

S 5.052Q

)

1.e e>uation a5o:e it -an 5e e?plained as follows3

European Journal of Business and Management www.iiste.org

ISSN 2222-1905 !aper" ISSN 2222-2#$9 %nline"

&ol.'( No.2)( 201)

2I

1. 2onstant :alue a" of 0.)21( w.i-. means a positi:e -onstant :alue. 1.is s.ows if t.e 2,9 Q

1

"( NIM Q

2

"(

N!B Q

$

" and 9%, Q

)

"( .as a :alue of 7ero( t.en t.e B;9 O" in-rease 5+ 0.)21

2. 9egression -oeffi-ient for t.e :aria5le 2,9 Q

1

" is -0.$#( indi-ating a negati:e t.e relations.ip 5etween t.e

2,9 Q

1

" wit. B;9 O"( meaning t.at if t.e addition of 2,9 Q

1

" for e:er+ one unit( assuming ot.er

:aria5les -onstant( t.e B;9 O" de-reased 5+ 0.0$#. ,nd :i-e :ersa( if t.ere is a redu-tion of 2,9 Q

1

" of

t.e unit it will in-rease t.e B;9 O" e>ual to 0.0$#.

$. 9egression -oeffi-ient for t.e :aria5le NIM Q

2

" is 0.$55( indi-ating a positi:e t.e relations.ip 5etween t.e

NIM Q

2

" wit. B;9 O"( meaning t.at if t.e addition of NIM Q

2

" for e:er+ one unit( assuming ot.er

:aria5les -onstant( t.e B;9 O" de-reased 5+ 0.$55. ,nd :i-e :ersa( if t.ere is a redu-tion of NIM Q

2

" of

t.e unit it will in-rease t.e B;9 O" e>ual to 0.$55.

). 9egression -oeffi-ient for t.e :aria5le N!B Q

$

" is 0.'19( indi-ating a positi:e relations.ip 5etween t.e N!B

Q

$

" wit. B;9 O"( meaning t.at if t.ere is additional N!B Q

$

" per unit( assuming ot.er :aria5les remain

t.e B;9 O" was redu-ed 5+ 0('19. ,nd :i-e :ersa if t.ere is a redu-tion in N!B Q

$

" of t.e unit it will

in-rease t.e B;9 O" e>ual to 0.'19

5. 9egression -oeffi-ient for t.e :aria5le 9%, Q

)

" is 5.052 w.i-. means it .as a positi:e :alue( it indi-ates t.e

dire-tion of t.e relations.ip 5etween 9%, Q

)

" wit. B;9 O"( meaning t.at if t.ere is additional 9%, Q

)

"

of one unit( assuming ot.er :aria5les remain t.e will add to t.e B;9 O" of 5.052. %t.erwise an+ su-.

redu-tion o--urred 9%, Q

)

" 5+ one per-ent t.en it will redu-e t.e B;9 O" e>ual to 5.052

/able % 1est results of multiple linear regression -oeffi-ients

a

Model

0nstandardi7ed 2oeffi-ients

Standardi7ed

2oeffi-ients t Sig.

B Std. Error Beta

1

2onstant" .)21 .09) ).)I5 .000

2,9 -.0$# .$0) -.12 -.12) .902

NIM .$55 .11' .$9# $.051 .00$

N!B -.'19 .I52 .0'9 .#22 .)15

9%, 5.052 2.0)1 .$15 2.)I' .015

a. ;ependent &aria5le3 B;9

Sum5er 3 %utput S!SS 20.0

..3. Analysis of correlation coefficient and coefficient of determination

2orrelation -oeffi-ient anal+sis was used to determine t.e dire-tion and t.e strong relations.ip among t.e t.ree

independent :aria5les. 1.ose are t.e :aria5le 2,9 Q

1

"( NIM Q

2

"( N!B Q

$

"( and 9%, Q

)

"( wit. B;9 as a

dependent :aria5le O". see ta5le $".

Based on 1a5le $( it -an 5e -on-luded t.at t.e :aria5le t.e 2,9 Q

1

"( NIM Q

2

"( N!B Q

$

"( and 9%, Q

)

"( wit.

B;9 dependent :aria5le .as a :alue of -orrelation r" 0.'$'( meaning t.at t.e -orrelation relations.ip le:el" t.e

2,9 Q

1

"( NIM Q

2

"( N!B Q

$

"( and 9%, Q

)

"( wit. B;9 dependent :aria5le O" are in strong -orrelation

Sugi+ono( 2009". C.ile t.e -oeffi-ient of determination anal+sis was used to determine t.e -ontri5ution effe-t

of 2,9 Q

1

"( NIM Q

2

"( N!B Q

$

"( and 9%, Q

)

"( wit. B;9 dependent :aria5le O" as a dependent :aria5le O"

e?pressed as a per-entage. ,nal+sis of t.e -oeffi-ient of determination is s>uaring t.e -orrelation :alue 9

2

" and

5ased on 1a5le $ t.at t.e 9

2

:alue was 0.)05. So w.en multiplied 5+ 100A( t.e -ontri5ution or effe-t of :aria5le

2,9 Q

1

"( NIMQ

2

"( N!BQ

$

"( and 9%, Q

)

"( wit. B;9 dependent :aria5le O" is )0.5A indi-ating t.at 2,9

Q

1

"( NIM Q

2

"( N!B Q

$

"( and 9%, Q

)

" a--ounted for )0.5A of t.e B;9 O"( w.ile t.e remaining 59.5A

t.oug.t to 5e influen-ed 5+ ot.er :aria5les not e?amined.

/able -. 1est results -orrelation -oeffi-ient and -oeffi-ient of determination model summar+

5

Model 9 9 S>uare ,d<usted 9 S>uare Std. Error of t.e Estimate

1 .'$'

a

.)05 .$#1 .100#9)'

Sum5er 3 %utput S!SS 20.0

4.4. $artial significance test %t#test&

1o e?amine .+pot.eses on t.e signifi-an-e of t.e partial model used t-test. It is intended to determine t.e

effe-t of independent :aria5les 2,9( NIM( N!B and 9%," partiall+ to t.e dependent :aria5le B;9".

!artiall+( t.e influen-e of t.e t.ree independent :aria5les to t.e B;9 as an independent :aria5les( s.own in t.e

1a5le ) partial test results t-test"( it -an 5e argued t.at3

European Journal of Business and Management www.iiste.org

ISSN 2222-1905 !aper" ISSN 2222-2#$9 %nline"

&ol.'( No.2)( 201)

2#

1. Effe-t of 2,9 on t.e B;9

!artial test results 5etween t.e 2,9 wit. an B;9 s.ows t.e t-test :alue of T 0.12) less t.an t-ta5le 1.9#$"

wit. a signifi-ant :alue of 0.902 w.i-. is 5elow 0.05. 1.is means t.at t.e 2,9 effe-ts on B;9. 1.us

.+pot.esis *1 stating 2,9 positi:e effe-t on B;9 is re<e-ted.

1.e test results are in line wit. pre:ious resear-. -ondu-ted 5+ 0tari and *ar+anto 2011" w.i-. states t.at

2,9 does not .a:e signifi-ant positi:e effe-t on t.e B;9 wit. a signifi-an-e le:el of 0.192 N 0.050.

*owe:er( -ontrar+ to t.e results of resear-. Soedarto 200)"D Nasirudin 2005"D Bu-.or+ 200'"D Budiawan

200#"D 1ang8o 2012"D 1amtomo 2012"D M5i7i 2012" and Sitorus 201$" w.i-. states t.at 2,9 .as

positi:e and signifi-ant effe-t as an indi-ator on t.e implementation of 5an8ing intermediation fun-tion.

2. Effe-t of Net Interest Margin NIM" of t.e Boan to ;eposit 9atio B;9".

!artial test results 5etween Net Interest Margin NIM" wit. loan to deposit ratio B;9" s.ows t.e t-:alue of

$.051-ount is greater t.an t-ta5le 1.9#$" wit. a signifi-ant :alue of 0.00$ w.i-. is 5elow 0.05. 1.is means

t.at t.e Net Interest Margin NIM" affe-t t.e Boan to ;eposit 9atio B;9". 1.us t.e .+pot.esis *2 w.i-.

states NIM positi:e effe-t on B;9 is a--epta5le. 1.e test results are in line wit. pre:ious resear-. -ondu-ted

5+ Sitorus 201$" w.i-. states t.at t.e result of t.e resear-. indi-ates t.at net interest margin NIM"

influen-e t.e Boan to ;eposit 9atio B;9". *owe:er( -ontrar+ to t.e ,sto.ar 2012" resear-. results( w.i-.

states t.at t.e results s.owed net interest :aria5les -annot strengt.en t.e influen-e of a :aria5le loan to

deposit ratio to -.anges in earnings on 5an8 foreign e?-.ange 5an8 in Indonesia.

$. Effe-t of N!B on t.e B;9

!artial test results 5etween N!B to B;9 s.ows t.e t-:alue of 0.#22 less t.an t.e t-ta5le 1.9#$" wit. a

signifi-ant :alue of 0.)1$ w.i-. is a5o:e 0.05. 1.is means t.at t.e N!B do not affe-t t.e B;9. 1.us t.e

.+pot.esis *$ w.i-. states N!B negati:el+ effe-t t.e B;9( is re<e-ted. 1.is mean N!B in B!; did not .a:e

a signifi-ant impa-t on t.e implementation of 5an8ing intermediation 5+ B!; 5e-ause t.e a:erage N!B rate

in B!; is relati:el+ small. N!B is relati:el+ small indi-ating t.at t.e -redit ris8 fa-ed 5+ small B!; as a

result of good -redit management. 1.e test results are in line wit. t.e resear-. results of Soedarto 200)" t.at

states N!Bs positi:e and 5ut not signifi-ant effe-t on 5an8 -redit. *owe:er( in -ontrast to pre:ious resear-.

-ondu-ted 5+ !ratama 2010"( *armanta and E8ananda 2005"( Nasirudin 2005"( 0tari and *ar+anto 2011"(

1amtomo 2012" and 1ang8o 2012" t.at partiall+( N!Bs :aria5le .as negati:e effe-t and signifi-ant to t.e

B;9. Meanw.ile( a--ording to Budiawan 200#" w.i-. states t.at N!B no signifi-ant and negati:e effe-t on

5an8 -redit.

). Effe-t of 9%, on B;9

!artial test results 5etween 9%, wit. t.e B;9 s.ows t.e t-test :alue of 2.)I' is greater t.an t-ta5le 1.9#$"

wit. a signifi-ant :alue of 0.015 w.i-. is 5elow 0.05. 1.is means t.at t.e 9%, effe-t on B;9. 1.us

.+pot.esis *) w.i-. states 9%, .as a positi:e effe-t on B;9 is a--epta5le. 1.e test results are in line wit.

pre:ious resear-. -ondu-ted 5+ 1amtomo 2012" w.i-. states t.at t.e 9%, .as positi:e and signifi-ant

effe-t on B;9. *owe:er( in -ontrast to t.e 0tari and *ar+anto 2011" w.i-. states t.e results s.owed t.at

9%, is not signifi-ant and .as negati:e effe-t on t.e B;9 wit. a signifi-an-e le:el of 0.5'0 N 0.050

/able .+ !artial test results t-test"

Model t--ount t-ta5le Sig ;es-ription

1

2onstant" 10.55' .000

2,9 -.12) 1.9#$ .902 Not Signifi-ant

NIM $.051 1.9#$ .00$ Signifi-ant

N!B .#22 1.9#$ .)1$ Not Signifi-ant

9%, 2.)I' 1.9#$ .015 Signifi-ant

a. ;ependent &aria5le3 B;9

Sum5er 3 %utput S!SS 20.0

4... *imultaneous significant test %!#test&

@ - test was -ondu-ted to determine t.e effe-t of independent :aria5les 2,9( NIM( N!B and 9%," toget.er

simultaneousl+" to t.e dependent :aria5le B;9". Simultaneous influen-e of t.e four independent :aria5les to

t.e independent :aria5les B;9 is s.own in 1a5le 5. Based on t.e results of t.e @-test -al-ulations in 1a5le 5(

@--ount was 1'.#$1 larger t.an t.e @-ta5le 2.''1" wit. a signifi-an-e :alue sig" of 0.000 is smaller t.an 0.05.

1.is means t.at t.e independent :aria5les 2,9( NIM( N!B and 9%," simultaneousl+ signifi-ant effe-t to

European Journal of Business and Management www.iiste.org

ISSN 2222-1905 !aper" ISSN 2222-2#$9 %nline"

&ol.'( No.2)( 201)

29

dependent :aria5le B;9". 1.us t.e *5 .+pot.esis w.i-. states 2,9( NIM( N!B and 9%, effe-t on B;9 is

a--epta5le. 1.e test results are in line wit. pre:ious resear-. -ondu-ted 5+ !ra+udi 2011" t.at t.e :aria5le

2,9( N!B( %E%I( 9%, and NIM wit. t.e @ test( simultaneousl+ affe-t t.e B;9. @urt.ermore( a--ording to

Siringoringo 2012" resear-. results( t.at is simultaneousl+ affe-t t.e -apital stru-ture of t.e Ban8

intermediation fun-tion. ,nd 1ang8o 2012" resear-. results( s.owed t.at t.e :aria5les 2,9 and N!B .a:e

signifi-antl+ influen-e on B;9( and N!B :aria5le .as a signifi-ant negati:e effe-t on B;9. Similarl+( t.e

results of resear-. Sitorus 201$" w.i-. states t.at t.e 2,9( 9%,( NIM and %E%I influen-e t.e B;9.

Nasirudin 2005" states t.at 2,9 and N!B .a:e a signifi-ant effe-t on B;9. C.ile 1amtomo 2012" found t.at

during t.e resear-. period partiall+( :aria5le of 2,9 and 9%, ratio is positi:e and signifi-ant effe-t on B;9 of

a -ompan+( N!Bs .as negati:e effe-t and signifi-ant on B;9 of a -ompan+( w.ile t.e t.ird part+ funds no

effe-t on B;9 of a -ompan+. 1.e resear-. results s.owed t.at t.e 2,9 :aria5les signifi-antl+ influen-e to

B;9 and N!B :aria5le and .as a signifi-ant negati:e effe-t on B;9. But a--ording to 0tari and *ar+anto

2011"( t.e results s.owed t.at t.e fi:e independent :aria5les 2,9( N!B( 9%,( %E%I and JCM" influen-e

5+ 2).)A against t.e le:el of li>uidit+ pro?+ B;( .and t.e 2,9 does not .a:e signifi-ant positi:e influen-e on

t.e B;9 wit. a signifi-an-e le:el of 0.192 N 0.050( N!B .as a signifi-ant negati:e influen-e on t.e B;9 wit. a

signifi-an-e le:el of 0.000 P 0.050. 9%, does not signifi-ant negati:e influen-e on t.e B;9 wit. a signifi-an-e

le:el of 0.5'0 N 0.050( and %E%I .as a signifi-ant positi:e effe-t on t.e B;9 wit. a signifi-an-e le:el of 0.001

P 0.050.

/abel 0 Simultaneous test results @-test"

AN"1A

a

Model Sum of S>uares df Mean S>uare @ Sig.

1

9egression .'#5 $ .1I1 1'.#$1 .000

5

9esidual 1.00# 100 .010

1otal 1.'9$ 10$

a. ;ependent &aria5le3 B;9

5. !redi-tors3 2onstant"( 9%,( 2,9( N!B( NIM

0+ C"NC,2I"N

Based on t.e 5a-8ground( t.e formulation of t.e pro5lem( .+pot.eses( met.ods and resear-. results and

dis-ussion( some -on-lusions -an 5e drawn as follows3

1. In 2012 B!; 9egional ;e:elopment Ban8" t.roug.out Indonesia are a5le to -arr+ out 5an8ing

intermediation fun-tion as measured 5+ t.e Boan to ;eposit 9atio B;9" of I#.5IA( still lower t.an t.e

national 5an8s and ot.er 5an8s( 5ut still wit.in t.e range of t.e B;9 is determined 5+ Ban8 Indonesia.

Bowest B;9 :alue rea-.ed 5+ t.e B!; Sout. /alimantan( w.ile t.e .ig.est B;9 :alue a-.ie:ed 5+ t.e

B!; Sout. Sulawesi.

2. Based on t.e test results partiall+ t.at :aria5le of NIM and 9%, .a:e positi:e and signifi-ant effe-ts to B;9.

N!B .as positi:e effe-t 5ut no signifi-ant effe-t to B;9. C.ile t.e 2,9 .as negati:e effe-t 5ut no

signifi-ant effe-t to B;9. C.ile 5ased on t.e test results simultaneousl+ t.at :aria5le of 2,9( NIM( N!B(

and 9%, signifi-antl+ influen-e to B;9 :aria5le

$. 1.e amount of t.e -ontri5ution or influen-e :aria5le of 2,9( N!B and 9%, to t.e dependent :aria5le of

B;9 is )0.5A w.ile t.e remaining 59.5A t.oug.t to 5e influen-ed 5+ ot.er :aria5les not e?amined in t.is

stud+.

RE3ERENCE

,5edafatta. Uu.air ,l-,5edallat and @aris Nasir ,l-S.u5iri( 201$. Analysis The Determinants of Credit isk in

;orfaianan (anking : An +mpirical *tudy. Journal Management 9esear-. and !ra-ti-e(&olume 5 Issue

$ G Septem5er 201$. pp3 21-$0. ISSN 20'I- 2)'2

,mriani( 9is8i @itri( 2012. Analysis of the +ffect of CA, "$L, 5A A"D ")/ Against LD 5n *tate#o2ned

(ank in )ndonesia $eriod 2--<#2-1-( 1.esis( Management ;epartment @a-ult+ of Business and

E-onomi-( *asanuddin 0ni:ersit+( Ma8asar

,sto.ar( 2012. The ole of "et )nterest /argin %")/& in *trengthen +ffect on the Loan to Deposit atio %LD&

of changes in +arnings 5n a Devisa (ank egistered in )ndonesian (ank 2--<#2--=. E-onomi- @o-us

Journal( S1IE E-onomi- S-.ool" !elita Nusantara Semarang( No. 1 &olume I( June 2012( ISSN

190I'$0).

Ban8 Indonesia( Ban8 Indonesia 9egulation !BI" No. 1)G1#G!BIG2012 on No:em5er 2#

t.

( 2012 on 1.e

Minimum 2apital ,de>ua-+ of 2ommer-ial Ban8s( 2apital for 2ommer-ial Ban8s *ead>uartered in

Indonesia.

European Journal of Business and Management www.iiste.org

ISSN 2222-1905 !aper" ISSN 2222-2#$9 %nline"

&ol.'( No.2)( 201)

$0

Ban8 Indonesia( 2ir-ular Better SE" No.1$G2)G;!N! on %-to5er 25

t.

( Su5<e-t 3 &aluation of Be:el 2ommer-ial

Ban8 Soundness

Ban8 Indonesia( 2ir-ular Better SE" No. 15G)1 G ;/M!( %-to5er 1

st

( 201$ Su5<e-t3 2al-ulation of Minimum

statutor+ 9eser:ed ;emand ;eposit and 2ompulsor+ ;emand deposit 5+ Boan to ;eposit 9atio in

9upia..

Ban8 Indonesia, !u5li-ation of Ban8ing @inan-ial Statement G www.5i.go.id G downloaded on @e5ruar+ )

t.

( 201$.

Ban8 Indonesia( Indonesian Ban8ing Statisti-s( &olume 11( No.. I( June 201$.a registered in Indonesian 5an8

Ban8 200'-2009( E-onomi- @o-us Journal( S1IE E-onomi- S-.ool" !elita Nusantara Semarang(

Edition No. 1 &olume I( Juni 2012( ISSN3 190I'$0)

Bu-.or+( *err+ ,-.mad( 200'. The )nfluence of !inancial )ntermediary !unction )mplementation, isk

/anagement Application and (ank Capital *tructure on (anking !inancial $erformance( ;isertasi

@a8ultas E8onomi( 0ni:ersitas !ad<ad<aran Bandung.

Bu-.or+( *err+ ,-.mad( 201). Analysis of factors affecting implementation of banking intermediation function:

study on regional development bank all over )ndonesia in 2-12. !ro-eeding SIB9 201) 2onferen-e on

Interdis-iplinar+ Business and E-onomi-s 9esear-.( It.-#t. @e5ruar+ 201)( /uala Bumpur( Mala+sia.

!aper No. /1)-15I( p. 1-22.

Budiwi+ono( E8o( 2012. ($D %egional Development (ank& !or *trength )n Accelerating )mplementation of

egional Autonomy: $rospects and $roblems( !apers !resented at t.e National Seminar on Indonesian

E-onomist ,sso-iation( Oog+a8arta( 2012.

Budiawan. 200#. Analysis of !actors Affecting the Distribution of Credit in ural (ank %($& Case *tudy at

(ank )ndonesia (an>armasin. 1.esis( Magister Management Stud+ !rogram of ;iponegoro 0ni:ersit+

Semarang

2ade( Eddie. 199I. /anaging (anking isk. Bondon 3 Jres.am Boo8s( 2am5ridge.

2ulp( 2.ristop.er B. 2001. The isk /anagement $rocess, (usiness *trategy and Tactics. New Oor8 3 Jo.n

Cille+ F Sons( In-.

E8ofin /onsulindo( Ban8ing F @inan-ial 2onsultans( 201$. Indi-ators and ;ire-tor+ of Indonesian Ban8ing in

2012( Ja8arta.

Jardner( Mona J.( ;i?ie B. Mills( Eli7a5et. S. 2ooperman( 2000. Managing @inan-ial Institutions 3 ,n

,ssetsGBia5ilit+ ,pproa-.. New Oor8 3 ;r+den !ress.

Jradd+( ;uane B.( ,ustin Spen-er( Cilliam *. Brunsen( 19#5. Commercial (anking and The !inancial *ervices

)ndustry. @irst Edition. &irginia 3 9eston !u5lis.ing 2ompan+ In-.( , !renti-e-*all 2ompan+.

Jranita( Jen /.arisa( 2011. )nfluence Analysis of deposits, CA, 5A, "$L, ")/, (5$5, )nterest ates,

)nflation and +,change ate Against LD %*tudies in "ational $rivate +,change (ank 2--2#2--=

period&. 1.esis in Ba-.elor !rogram E-onomi- @a-ult+ ;iponegoro 0ni:ersit+( Semarang

Ju<arati( ;amodar( 200$. Basi- E-onometri-( @ourt. Edition. NewOor8 3 M-. Jraw-*ill Boo8 2o.

*armanta and Ma.+us E8ananda. 2005. Disintermediation !unction $ost#Crisis (anking in )ndonesia 1==?:

!actor of Demand or *upply Loans, A /odel Approach to Dise0uilibrium. Bulletin of Monetar+

E-onomi-s and Ban8ing( Ban8 Indonesia( June 2005( &olume # No. 1( p 51 T I#.

*aruna( Mu.ammad ,uwalu( 2011. Determinant of Cost of !inancial )ntermediation in "igeria@s $re#

consolidated (anking *ector( ;epartment of ,--ounting,.madu Bello 0ni:ersit+( Uaria( Nigeria

*empel( Jeorge *.( Simonson ;onald J.( 2oleman ,lan B.(199). (ank /anagement Te,t and Cases( @ourt.

Edition. New Oor8 3 Jo.n Cile+ F Sons( In-.

/arim( Mo.d Uaini and So8-Jee 2.an( 200#. (ank +fficiency and "on $erforming Loans in /alaysia and

*ingapore( !ro-eeding of ,pplied International Business 2onferen-e 200#. !. 9)# T 95#.

/eputusan Menteri ;alam Negeri No. '2 +ear 1999 on Juidelines for %rgani7ation and Cor8 of 9egional

;e:elopment Ban8s

/idwell( ;a:id. S( 9i-.ard I. !etterson( 2000. @inan-ial Institution( Mar8et and Mone+. New Oor8 3 ;r+den

!ress.

/o-.( 1imot.+ C.(2000. (ank /anagement( International Edition. %rlando 3 1.e ;r+den !ress( *ar-ourt Bra-e

2ollege !u5lis.ers.

Ma.ran( *atim ,meer( 2012. !inancial )ntermediation and +conomic 'ro2th in *audi Arabia: An +mpirical

Analysis, 1=<A#2-1-. Journal Modern E-onom+ &olume $. Issue 5 Sept. 2012"3 p. '2'-')0.

M5i7i( 9angga 2012". An Analysis of the )mpact of /inimum Capital e0uirements on Commercial (ank

$erformance in 1imbab2e( International Journal of Independent 9esear-. and Studies T IJI9SISSN3

222'-)#1ID EISSN3 2$0)-'95$&ol. 1( No.) %-to5er( 2012" 12)-1$)

Mis.8in( @rederi- S. and Stanle+ J. Ea8ins( 200'. !inancial /arket B )nstitutions, @ift. Edition( New Oor8 3

!eaerson( ,ddison Cesle+

Nasirudin( 2005. Analysis of !actors Affecting the Loan to Deposit atio %LD& at ural (ank in egion ;ob

(ank )ndonesia *emarang. 1.esis Magister Management Stud+ !rogram of ;iponegoro 0ni:ersit+

European Journal of Business and Management www.iiste.org

ISSN 2222-1905 !aper" ISSN 2222-2#$9 %nline"

&ol.'( No.2)( 201)

$1

Semarang.

%8ta:iantari( Bu. !utu E8a and Ni Bu. !utu Ciagustini( +ffect of (anking isk To $rofitability on ural (anks

in (adung( E-onomi- @a-ult+ 0da+ana 0ni:ersit+( Bali( Indonesia

%dedo8un( M.%. 199#". !inancial intermediation and economic gro2th in developing countries( Journal of

E-onomi- Studies( &ol. 25 Issue 3 $ p. 20$ T 22).

!ratama( Bill+ ,rma( 2010. Analysis of !actors Affecting (ank Lending $olicy %*tudy on Commercial (anks in

)ndonesia $eriod 2--.#2--=&. 1.esis( Master !rogram in Management( ;iponegoro 0ni:ersit+(

Semarang

!ra+udi( ,rdit+a( 2011. $engaruh Capital Ade0uacy atio %CA&, "on $erforming Loan%"$L&, (5$5, eturn

5n Asset %5A& dan "et )nterest /argin%")/& terhadap Loan to Deposit atio %LD", VonlineW

.ttp3GGwww.papers.gunadarma.a-.idG inde?.p.pGmmanagementGarti-leG...G1)225 ( download Ma+( 9( 201$.

9ose( !eter( S.( 2002. Commercial (ank /anagement. 2.i-ago 3 9i-.ard ;. Irwin( In-.

9ose( !eter S. and S+l:ia *udgins( 200#. Ban8 Management F @inan-ial Ser:i-es( Si?t. Edition. M-. Jraw T

*ill International Edition( 2.i-ago.

S-.roe-8( Jer.ard( 2002. isk /anagement and 7alue Creation. New Jerse+ 3 Jo.n Cile+ F Son( In-.

Siringoringo( 9enniwat+( 2012". Characteristics and !unctions of (anking )ntermediation in )ndonesia.

Bulletin of Monetar+ E-onomi-s and Ban8ing( Ban8 Indonesia( &olume 15 No. 1( Jul+ 2012. p. '1 T

#$. JEB 2lassifi-ation 3 J21( J$2

Sitorus( &era Oo.ana( 201$. Analysis of !actors influence "on $erforming Loan %"$L& at 'o $ublic (ank at

)ndonesia *tock +,change period 2--. #2-11( X 201$ s-ien-egate.-.(!oint Software ,J( UYri-..

Soedarto( M. 200)" Analisis!aktor # !actor that Affects Distribution ural Credit (ank %($ %ural (ank&

Case *tudy in Cork Area (ank )ndonesia *emarang&, 1.esis Magister Management Stud+ !rogram

;iponegoro 0ni:ersit+ Semarang.

Sugi+ono 2009"( esearch /ethods, Ja8arta3 Salem5a Empat.

Supri+anto( E8o.B.( 2012". )ndonesian (anking Challenges in 2-13( Bureau of 9esear-. Info5an8( Ja8arta.

1amtomo( *and+ Set+o( and *ersugondo 2012. +ffect of CA, "$L, 5A Against LD )ndonesia (anking

Company( Students= Journal of ,--ounting and Ban8ing( Sti8u5an8 0ni:ersit+( Semarang( &olume 1(

No. 1( 2012. ( ,5stra-t( p. 1

1ang8o( Irene Bastr+ @ardani( 2012. Analysis of +ffect of Capital Ade0uacy atio %CA& and "on#$erforming

Loans %"$L& of the Loan to Deposit atio %LD& in the state#o2ned bank in )ndonesia( 1.esis

Management ;epartemen E-onomi- and Business @a-ult+( *asanudin 0ni:ersit+ Ma8asar.

0tari( Mita !u<i and *ar+anto( ,. Mul+o 2011". Analysis of +ffect of CA, "$L, 5A and (5$5 on LD

%Case *tudies in "ational $rivate +,change (ank in )ndonesia $eriod 2--.#2--A". 0ndergraduate

t.esis( ;iponegoro 0ni:ersit+ Semarang.

0ndang-0ndang B,C" No. I +ear 1992 as amended in B,C No. 10 199# on Ban8ing

0ndang-undang B,C" No. '2 +ear 1999 Main !ro:isions of t.e 9egional ;e:elopment Ban8s

#r+ 4erry Achmad B!chory, E, MM+ is a Be-turer of E/0I1,S E-onomi-s 2ollege Bandung( Indonesia.

*is last edu-ational degree is in t.e do-toral field of e-onomi-s from !ad<ad<aran 0ni:ersit+ in 200'. *e is also

a Be-turer in t.e Master of ,--ounting( Master of ,pplied E-onomi-s and Master Management programme in

!ad<ad<aran 0ni:ersit+ and Master Management programme in Islami- 0ni:ersit+ of Bandung and Bandung

Cid+atama 0ni:ersit+. ,s a 5an8ing pra-titioner( .e wor8ed in !1. Ban8 Ja5ar Banten sin-e 19I'. 1.e last

position .e .eld was as t.e ;ire-tor of 2omplian-e and 9is8 Management. *e is a mem5er of Indonesian

E-onomists ,sso-iation( Bran-. 2oordinator( Bandung Cest Ja:a( 1.e Institute of Internal ,uditors and 1.e

Indonesian Ban8ers ,sso-iation( and mem5er of t.e E?pert 2oun-il of Cest Ja:a E-onomi- @orum. *e .as

pu5lis.ed in national and international a--redited <ournals. *e wrote The (asics of (ank /arketing ISBN3

9I9.9I115.5.Q( 200'"( )ntroduction to (usiness ISBN3 9I9.9I115.#.#I( 200#"( /arketing /anagement ISBN3

9I#.'02.9'))9.1.$( 2010"D *trategic /anagement ISBN3 9#I.'029'))9.0.'( 2010"( and t.e /anagement of

!inancial )nstitutions ISBN3 9I#.'02.9'))9.5.1.( 2011".

The IISTE is a pioneer in the Open-Access hosting service and academic event

management. The aim of the firm is Accelerating Global Knowledge Sharing.

More information about the firm can be found on the homepage:

http://www.iiste.org

CALL FOR JOURNAL PAPERS

There are more than 30 peer-reviewed academic journals hosted under the hosting

platform.

Prospective authors of journals can find the submission instruction on the

following page: http://www.iiste.org/journals/ All the journals articles are available

online to the readers all over the world without financial, legal, or technical barriers

other than those inseparable from gaining access to the internet itself. Paper version

of the journals is also available upon request of readers and authors.

MORE RESOURCES

Book publication information: http://www.iiste.org/book/

IISTE Knowledge Sharing Partners

EBSCO, Index Copernicus, Ulrich's Periodicals Directory, JournalTOCS, PKP Open

Archives Harvester, Bielefeld Academic Search Engine, Elektronische

Zeitschriftenbibliothek EZB, Open J-Gate, OCLC WorldCat, Universe Digtial

Library , NewJour, Google Scholar

Vous aimerez peut-être aussi

- Asymptotic Properties of Bayes Factor in One - Way Repeated Measurements ModelDocument17 pagesAsymptotic Properties of Bayes Factor in One - Way Repeated Measurements ModelAlexander DeckerPas encore d'évaluation

- Availability, Accessibility and Use of Information Resources and Services Among Information Seekers of Lafia Public Library in Nasarawa StateDocument13 pagesAvailability, Accessibility and Use of Information Resources and Services Among Information Seekers of Lafia Public Library in Nasarawa StateAlexander DeckerPas encore d'évaluation

- Assessment of Relationships Between Students' Counselling NeedsDocument17 pagesAssessment of Relationships Between Students' Counselling NeedsAlexander DeckerPas encore d'évaluation

- Attitude of Muslim Female Students Towards Entrepreneurship - A Study On University Students in BangladeshDocument12 pagesAttitude of Muslim Female Students Towards Entrepreneurship - A Study On University Students in BangladeshAlexander DeckerPas encore d'évaluation

- Assessment of The Skills Possessed by The Teachers of Metalwork in The Use of Computer Numerically Controlled Machine Tools in Technical Colleges in Oyo StateDocument8 pagesAssessment of The Skills Possessed by The Teachers of Metalwork in The Use of Computer Numerically Controlled Machine Tools in Technical Colleges in Oyo StateAlexander Decker100% (1)

- Assessment of Some Micronutrient (ZN and Cu) Status of Fadama Soils Under Cultivation in Bauchi, NigeriaDocument7 pagesAssessment of Some Micronutrient (ZN and Cu) Status of Fadama Soils Under Cultivation in Bauchi, NigeriaAlexander DeckerPas encore d'évaluation

- Assessment of Knowledge, Attitude and Practices Concerning Food Safety Among Restaurant Workers in Putrajaya, MalaysiaDocument10 pagesAssessment of Knowledge, Attitude and Practices Concerning Food Safety Among Restaurant Workers in Putrajaya, MalaysiaAlexander DeckerPas encore d'évaluation

- Assessment of Housing Conditions For A Developing Urban Slum Using Geospatial AnalysisDocument17 pagesAssessment of Housing Conditions For A Developing Urban Slum Using Geospatial AnalysisAlexander DeckerPas encore d'évaluation

- Assessment of The Practicum Training Program of B.S. Tourism in Selected UniversitiesDocument9 pagesAssessment of The Practicum Training Program of B.S. Tourism in Selected UniversitiesAlexander DeckerPas encore d'évaluation

- Availability and Use of Instructional Materials and FacilitiesDocument8 pagesAvailability and Use of Instructional Materials and FacilitiesAlexander DeckerPas encore d'évaluation

- Assessment of Teachers' and Principals' Opinion On Causes of LowDocument15 pagesAssessment of Teachers' and Principals' Opinion On Causes of LowAlexander DeckerPas encore d'évaluation

- Barriers To Meeting The Primary Health Care Information NeedsDocument8 pagesBarriers To Meeting The Primary Health Care Information NeedsAlexander DeckerPas encore d'évaluation

- Applying Multiple Streams Theoretical Framework To College Matriculation Policy Reform For Children of Migrant Workers in ChinaDocument13 pagesApplying Multiple Streams Theoretical Framework To College Matriculation Policy Reform For Children of Migrant Workers in ChinaAlexander DeckerPas encore d'évaluation

- Are Graduates From The Public Authority For Applied Education and Training in Kuwaiti Meeting Industrial RequirementsDocument10 pagesAre Graduates From The Public Authority For Applied Education and Training in Kuwaiti Meeting Industrial RequirementsAlexander DeckerPas encore d'évaluation

- Assessment of Survivors' Perceptions of Crises and Retrenchments in The Nigeria Banking SectorDocument12 pagesAssessment of Survivors' Perceptions of Crises and Retrenchments in The Nigeria Banking SectorAlexander DeckerPas encore d'évaluation

- Analysis The Performance of Life Insurance in Private InsuranceDocument10 pagesAnalysis The Performance of Life Insurance in Private InsuranceAlexander DeckerPas encore d'évaluation

- Assessment of Productive and Reproductive Performances of CrossDocument5 pagesAssessment of Productive and Reproductive Performances of CrossAlexander DeckerPas encore d'évaluation

- Assessing The Effect of Liquidity On Profitability of Commercial Banks in KenyaDocument10 pagesAssessing The Effect of Liquidity On Profitability of Commercial Banks in KenyaAlexander DeckerPas encore d'évaluation

- Assessment For The Improvement of Teaching and Learning of Christian Religious Knowledge in Secondary Schools in Awgu Education Zone, Enugu State, NigeriaDocument11 pagesAssessment For The Improvement of Teaching and Learning of Christian Religious Knowledge in Secondary Schools in Awgu Education Zone, Enugu State, NigeriaAlexander DeckerPas encore d'évaluation

- Assessment in Primary School Mathematics Classrooms in NigeriaDocument8 pagesAssessment in Primary School Mathematics Classrooms in NigeriaAlexander DeckerPas encore d'évaluation

- Antibiotic Resistance and Molecular CharacterizationDocument12 pagesAntibiotic Resistance and Molecular CharacterizationAlexander DeckerPas encore d'évaluation

- Application of The Diagnostic Capability of SERVQUAL Model To An Estimation of Service Quality Gaps in Nigeria GSM IndustryDocument14 pagesApplication of The Diagnostic Capability of SERVQUAL Model To An Estimation of Service Quality Gaps in Nigeria GSM IndustryAlexander DeckerPas encore d'évaluation

- Assessment of Factors Responsible For Organizational PoliticsDocument7 pagesAssessment of Factors Responsible For Organizational PoliticsAlexander DeckerPas encore d'évaluation

- Application of Panel Data To The Effect of Five (5) World Development Indicators (WDI) On GDP Per Capita of Twenty (20) African Union (AU) Countries (1981-2011)Document10 pagesApplication of Panel Data To The Effect of Five (5) World Development Indicators (WDI) On GDP Per Capita of Twenty (20) African Union (AU) Countries (1981-2011)Alexander DeckerPas encore d'évaluation

- Analysis of Teachers Motivation On The Overall Performance ofDocument16 pagesAnalysis of Teachers Motivation On The Overall Performance ofAlexander DeckerPas encore d'évaluation

- Antioxidant Properties of Phenolic Extracts of African Mistletoes (Loranthus Begwensis L.) From Kolanut and Breadfruit TreesDocument8 pagesAntioxidant Properties of Phenolic Extracts of African Mistletoes (Loranthus Begwensis L.) From Kolanut and Breadfruit TreesAlexander DeckerPas encore d'évaluation

- An Investigation of The Impact of Emotional Intelligence On Job Performance Through The Mediating Effect of Organizational Commitment-An Empirical Study of Banking Sector of PakistanDocument10 pagesAn Investigation of The Impact of Emotional Intelligence On Job Performance Through The Mediating Effect of Organizational Commitment-An Empirical Study of Banking Sector of PakistanAlexander DeckerPas encore d'évaluation

- Analyzing The Economic Consequences of An Epidemic Outbreak-Experience From The 2014 Ebola Outbreak in West AfricaDocument9 pagesAnalyzing The Economic Consequences of An Epidemic Outbreak-Experience From The 2014 Ebola Outbreak in West AfricaAlexander DeckerPas encore d'évaluation

- Analysis of Frauds in Banks Nigeria's ExperienceDocument12 pagesAnalysis of Frauds in Banks Nigeria's ExperienceAlexander DeckerPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Applicability of IND AS: Phases of adoptionDocument2 pagesApplicability of IND AS: Phases of adoptionSamyu MemoriesPas encore d'évaluation

- Can We Claim HRA and Home LoanDocument5 pagesCan We Claim HRA and Home LoanBipin PatilPas encore d'évaluation

- G.R. No. 168274 FEBTC Vs Gold PalaceDocument4 pagesG.R. No. 168274 FEBTC Vs Gold PalaceJessie AncogPas encore d'évaluation

- Topic 2 Book of Prime Entry and Business DocumentsDocument7 pagesTopic 2 Book of Prime Entry and Business DocumentsHeavens MupedzisaPas encore d'évaluation

- Company Finance - Group 9Document20 pagesCompany Finance - Group 9TumwesigyePas encore d'évaluation

- Financial Asset Measurement and AmortizationDocument5 pagesFinancial Asset Measurement and AmortizationLara Jane Dela CruzPas encore d'évaluation

- Stocks and BondsDocument40 pagesStocks and BondsCharlie Anne PadayaoPas encore d'évaluation

- Curriculum Vitae For Modern MutumwaDocument4 pagesCurriculum Vitae For Modern MutumwaKudakwashe QuQu MaxinePas encore d'évaluation

- During The Current Year Ramirez Developers Disposed of Plant AssetsDocument1 pageDuring The Current Year Ramirez Developers Disposed of Plant Assetstrilocksp SinghPas encore d'évaluation

- Kombo WarrantDocument29 pagesKombo WarrantThe Valley IndyPas encore d'évaluation

- Fannie Mae - 2012 Servicing GuideDocument1 178 pagesFannie Mae - 2012 Servicing GuideudhayaisroPas encore d'évaluation

- Data1203 All PDFDocument288 pagesData1203 All PDFlehoangthuchienPas encore d'évaluation

- BDO VS METROBANK: A Comparison of the Philippines' Top BanksDocument30 pagesBDO VS METROBANK: A Comparison of the Philippines' Top BanksLara Mae D. Caido100% (1)

- Chapter 2 Cash and Cash EquivalentsDocument10 pagesChapter 2 Cash and Cash EquivalentsShe SalazarPas encore d'évaluation

- TYPES OF ACCOUNTSDocument20 pagesTYPES OF ACCOUNTSVERMA NEERAJ100% (1)

- T AccountDocument2 pagesT AccountSophia RamirezPas encore d'évaluation

- Fundamentals of Abm 1Document24 pagesFundamentals of Abm 1Rosa Divina ItemPas encore d'évaluation

- Welcome To Axis My Zone Credit Card 230709054304 574ae784Document8 pagesWelcome To Axis My Zone Credit Card 230709054304 574ae784Vansh KhetarpalPas encore d'évaluation

- Chapter 3 Auditors ResponsibilityDocument17 pagesChapter 3 Auditors ResponsibilityJay LloydPas encore d'évaluation

- Jose Espinoza water bill detailsDocument1 pageJose Espinoza water bill detailsJose EspinozaPas encore d'évaluation

- Bcom Piecemeal Distribution of CashDocument6 pagesBcom Piecemeal Distribution of CashNeelam SarojPas encore d'évaluation

- Step-by-step guide to Fico configuration in SAPDocument22 pagesStep-by-step guide to Fico configuration in SAPsap86% (7)

- RBI Policy - Key Challenges For The Banking SectorDocument4 pagesRBI Policy - Key Challenges For The Banking SectorRekha LohiaPas encore d'évaluation

- Quiz 4 ReceivablesDocument1 pageQuiz 4 ReceivablesPanda ErarPas encore d'évaluation

- Health Insurance Receipt 2022Document1 pageHealth Insurance Receipt 2022Vijay SekarPas encore d'évaluation

- 2 D. Problems RevaluationDocument77 pages2 D. Problems RevaluationPia Shannen OdinPas encore d'évaluation

- Credit and Collection PrelimsDocument7 pagesCredit and Collection PrelimsMeloy ApiladoPas encore d'évaluation

- (Accredited by NAAC With "A" Grade) (MBA - Approved by AICTE, New Delhi) (Affiliated To Bharathidasan University, Tiruchirappalli - 24)Document5 pages(Accredited by NAAC With "A" Grade) (MBA - Approved by AICTE, New Delhi) (Affiliated To Bharathidasan University, Tiruchirappalli - 24)Maria Monisha DPas encore d'évaluation

- Loan 1 PadmaraoDocument1 pageLoan 1 PadmaraoTnt SolutionsPas encore d'évaluation

- Cash Flow Indirect and DirectDocument2 pagesCash Flow Indirect and DirectKatherine Borja0% (1)