Académique Documents

Professionnel Documents

Culture Documents

IAT Phaco Yag

Transféré par

Aneesh KallumgalCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

IAT Phaco Yag

Transféré par

Aneesh KallumgalDroits d'auteur :

Formats disponibles

S.

Saravanan

Developed By

These materials are supported, in part, by the International Eye Foundation with assistance from the U.S. Agency for International Development

Cooperative Agreement No.: FAO-A-00-99-00053-00.

Comments & Suggestion

Faculty Member

Lions Aravind Institute of Community Ophthalmology

Madurai - 625 020, India

Aravind Eye Care System

Investment Analysis Tool

Home Introduction IAT Phaco IAT Yag IAT Cash Flow Glossary Help

Aravind Eye Care System

Cooperative Agreement No.: FAO-A-00-99-00053-00.

Name of the Hospital

With this tool you can:

* Find the pay back period for the equipment based on the workload and charges

4) Consultants involved in resource mobilization and utilization for eye care delivery

Instruction for use:

Kindly open and print the following Manual in Word document - this manual will guide you to use this program.

Manual for IAT

* Estimate the price/charge for the patients? Whether to charge at the market price or based on the actual cost (cost analysis)?

* Find the Profitability & feasibility of purchasing a equipment

* Estimate the annual patient load required to pay back the loan in a given period of time (1year, 2 year, etc)? Or estimate how many patients should the hospital mobilize to effectively utilise the

procured equipment?

Indented User:

1) Any hospital planning to purchase Phaco/yag.

2) Funding agencies to support the capital purchases.

3) Individuals and private practitioners

Rs.

1,000,000

50,000

50,000

50,000

1,150,000

8 Years

10%

Cost Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10

24,000 24,000 26,400 29,040 31,944 35,138 38,652 42,517 46,769 - -

2,000 2,000 2,200 2,420 2,662 2,928 3,221 3,543 3,897 - -

10,000 10,000 11,000 12,100 13,310 14,641 16,105 17,716 19,487 - -

10,000 10,000 11,000 12,100 13,310 14,641 16,105 17,716 19,487 - -

1,250 168,750 204,188 247,067 298,951 361,731 437,694 529,610 640,828 - -

214,750 254,788 302,727 360,177 429,079 511,778 611,102 730,469 - -

5000

10%

30%

90%

10%

5000

10%

Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10

135 149 163 180 198 217 239 263 - -

5,000 5,500 6,050 6,655 7,321 8,053 8,858 9,744 - -

Investment Analysis Tool

Home Introduction IAT Phaco IAT Yag IAT Cash Flow Glossary

Charges for the Procedure each year

Aravind Eye Care System

Cooperative Agreement No.: FAO-A-00-99-00053-00.

Help

Name of the Hospital

IOL surgery

Insurance

Maintenance incl. Service contract

Electricity

Cost per procedure (Cons & others)

Reccuring cost - Variable

Total Initial Investment

Life time of Equipment

Total recurring cost

Additional Charges for the Procedure

% increase in charges each year

No.of Procedures per year

Phaco surgery

Annual Growth Rate

Breakup of Procedure

Paying Patients among cataract surgery

Capital Cost

Recurring cost

Recurring cost - variable

Manpower cost

Annual Inflation Rate (Fixed &

vaiable cost)

Annual Admission for Cataract

surgery

Cost of the Equipment

Ancillary Equipments

Other contingencies - space,

restructuring, furnishing, etc

Provision for working capital - Spares

& Supplies

Rs.

800,000

50,000

50,000

50,000

950,000

7 Years

10%

Cost Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10

24,000 24,000 26,400 29,040 31,944 35,138 38,652 42,517 - - -

2,000 2,000 2,200 2,420 2,662 2,928 3,221 3,543 - - -

10,000 10,000 11,000 12,100 13,310 14,641 16,105 17,716 - - -

10,000 10,000 11,000 12,100 13,310 14,641 16,105 17,716 - - -

1,250 375,000 453,750 549,038 664,335 803,846 972,653 1,176,911 - - -

421,000 504,350 604,698 725,561 871,194 1,046,737 1,258,402 - - -

5000

10%

%

4%

100

4000

10%

Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10

300 330 363 399 439 483 531 - - -

4,000 4,400 4,840 5,324 5,856 6,442 7,086 - - -

Recurring cost - fixed

Glossary

Cooperative Agreement No.: FAO-A-00-99-00053-00.

Help

Name of the Hospital

Aravind Eye Care System

Referred patients for yag laser/year

Recurring cost - variable

Manpower cost

Recurring cost

Provision for working capital - Spares

& Supplies

Total Initial Investment

Life time of Equipment

Annual Inflation Rate (Fixed &

Investment Analysis Tool

Home Introduction IAT Phaco IAT Yag IAT Cash Flow

Capital Cost

Cost of the Equipment

Ancillary Equipments

Other contingencies - space,

restructuring, furnishing, etc

Total recurring cost

Annual Cataract surgery with IOL

Maintenance incl. Service contract

Electricity

Cost per procedure (Consumables)

Insurance

Annual Growth Rate

Breakup of Procedure

Hospital Patients requiring yag laser

No.of Procedures per year

Charges for the Procedure each year

Additional Charges for the Procedure

% Increase in Charges each year

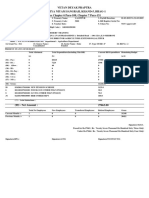

Cash Flow Projection

INPUTS units

Investment

Purchase price of equipment Rs. 950,000

Depreciable life of of equipment years 7

Financing

Loan amount as % of purchase price % 100%

Interest rate on loan % 10%

Taxes

Marginal tax rate % 0%

Discount rate % 10%

units Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10

Initial investment Rs. 950,000

Revenue Rs. 1,200,000 1,452,000 1,756,920 2,125,873 2,572,307 3,112,491 3,766,114 - - -

Recurring Costs - Fixed Rs. 46,000 50,600 55,660 61,226 67,349 74,083 81,492 - - -

Recurring costs - Variable Rs. 375,000 453,750 549,038 664,335 803,846 972,653 1,176,911 - - -

Total Recurring costs Rs. 421,000 504,350 604,698 725,561 871,194 1,046,737 1,258,402 - - -

Operating revenue Rs. 779,000 947,650 1,152,223 1,400,312 1,701,112 2,065,754 2,507,712 - - -

Equipment depreciation Rs. 135,714 135,714 135,714 135,714 135,714 135,714 135,714 - - -

Profit before intrest & taxes Rs. 643,286 811,936 1,016,508 1,264,598 1,565,398 1,930,040 2,371,997 - - -

Interest Rs. 95,000 95,000 95,000 95,000 95,000 95,000 95,000 - - -

Profit before taxes Rs. 548,286 716,936 921,508 1,169,598 1,470,398 1,835,040 2,276,997 - - -

Taxes Rs. - - - - - - - - - -

Net income Rs. 548,286 716,936 921,508 1,169,598 1,470,398 1,835,040 2,276,997 - - -

+ Depreciation Rs. 135,714 135,714 135,714 135,714 135,714 135,714 135,714 - - -

Rs. (950,000) 684,000 852,650 1,057,223 1,305,312 1,606,112 1,970,754 2,412,712 - - -

Discount factor # 1 1.10 1.21 1.33 1.46 1.61 1.77 1.95 2.14 2.36 2.59

Discounted cash flows Rs. (950,000) 621,818 704,669 794,307 891,546 997,269 1,112,439 1,238,103 - - -

INVESTMENT ANALYSIS Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10

Payback Period

Cummulative cash flow Rs. (950,000) (266,000) 586,650 1,643,873 2,949,184 4,555,296 6,526,051 8,938,762 - - -

Part of year in pay-back period 1.00 0.31 -0.55 -1.26 -1.84 -2.31 -2.70 0.00 0.00 0.00

Part of year in pay-back period 1.00 0.31 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

Payback Period Years

INTERNAL RATE OF RETURN (IRR) %

PV of future net cash flows Rs.

NPV of investment Rs. Accept Project

Cooperative Agreement No.: FAO-A-00-99-00053-00.

Help

Name of the Hospital

Aravind Eye Care System

yag Investment Decision for

Net cash inflow from

operations

CASH FLOW

PROJECTIONS

5,410,151

131%

93%

6,360,151

Investment Analysis Tool

Home Introduction IAT Phaco IAT Yag IAT Cash Flow Glossary

Relevant Surgery for = Yes = No Payment Estimate Relevant Non-Relevant

Page 5 of 6

Help

Name of the Hospital

Aravind Eye Care System

Net Present Value (NPV): NPV analysis takes future cash flows and discounts them to their present day value

Positive NPV's are profitable investment ventures while negative NPV's are money losers. Therefore as a rule of thumb if NPV >0 accept investment proposal and if NPV<0 reject

investment proposal

Internal Rate of Return (IRR): It is derivated of NPV. The IRR of an investment is the rate at which the discounted cash flows in the future equal the value of the investment today.

Investment Decisions: The term "Investment" is used to represent the capital outlays made in a variety of situations.

Why Cash Flow: Accounting Profits, as reported in the income statement, are a short-term measurement of an investment in a time frame shorter than the life of the investment, wheras cash flow

analysis is a technique used to evaluate individual projects over the life of the project

Investment Analysis Tool

Home Introduction IAT Phaco IAT Yag IAT Cash Flow Glossary

Depreciation: Depreciation, which appears in income statements, is not relevant in cashflow analysis. Depreciation is an accounting allowance that says that if a piece of equipment has a useful life

of five years then one fifth of the cost in each year of use can be deducted from income.

Pay Back Period: This is the period of time required to recover the initial capital outlay from out of the cashflow generated by the investment. Pay Back Period = Cash Outlay (Investment)/Annual

Cash Inflow

Cash Flow Analysis Vs NPV Technique: Cash flow analysis determines the flows and the NPV technique values them in todays Rupee. In that way different projects can be compared regardless

of timing

Time Value of Money: One rupee today is more valuable than one rupee received a year hence

Cooperative Agreement No.: FAO-A-00-99-00053-00.

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Principles of Accounting, Volume 1 - Financial Accounting PDFDocument1 055 pagesPrinciples of Accounting, Volume 1 - Financial Accounting PDFThanh Huyền Nguyễn64% (11)

- Airtel Bill PDFDocument3 pagesAirtel Bill PDFAneesh KallumgalPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- A Synopsis ON "Study On Tax Planning of 10 Assesses"Document6 pagesA Synopsis ON "Study On Tax Planning of 10 Assesses"hemant100% (1)

- Corporate Finance and ValueDocument1 pageCorporate Finance and Valueapi-3721037Pas encore d'évaluation

- Melanie Company Unit Contribution Margin AnalysisDocument2 pagesMelanie Company Unit Contribution Margin AnalysisAllen CarlPas encore d'évaluation

- SL - No Activity Ccet: AcademicDocument6 pagesSL - No Activity Ccet: AcademicAneesh KallumgalPas encore d'évaluation

- Organization: Name: Designation: Month & Year of Joining: Experience in Leotech: Technical LLCDocument1 pageOrganization: Name: Designation: Month & Year of Joining: Experience in Leotech: Technical LLCAneesh KallumgalPas encore d'évaluation

- Cinemakottakaprelims 130220104153 Phpapp01 PDFDocument51 pagesCinemakottakaprelims 130220104153 Phpapp01 PDFAneesh KallumgalPas encore d'évaluation

- Organization: Name: Designation: Month & Year of Joining: Experience in Leotech: Technical LLCDocument2 pagesOrganization: Name: Designation: Month & Year of Joining: Experience in Leotech: Technical LLCAneesh KallumgalPas encore d'évaluation

- Notes: January February MarchDocument13 pagesNotes: January February MarchAchik Ridzuwan AchikPas encore d'évaluation

- Reetika GuptaDocument6 pagesReetika GuptaAneesh KallumgalPas encore d'évaluation

- Bookshop TrackerDocument186 pagesBookshop TrackerAneesh KallumgalPas encore d'évaluation

- Ijmt ISSN: 2249-1058: Customer Loyalty Towards Kiranas in Competitive Environment A Case StudyDocument20 pagesIjmt ISSN: 2249-1058: Customer Loyalty Towards Kiranas in Competitive Environment A Case StudyAneesh KallumgalPas encore d'évaluation

- Plan BDocument2 pagesPlan BAneesh KallumgalPas encore d'évaluation

- Statutory Obligations Details (Annex 5)Document8 pagesStatutory Obligations Details (Annex 5)Aneesh KallumgalPas encore d'évaluation

- Sales Support Staff Profile for Leotech OrganizationDocument1 pageSales Support Staff Profile for Leotech OrganizationAneesh KallumgalPas encore d'évaluation

- Staff Advance On Salary AgreementDocument1 pageStaff Advance On Salary AgreementAneesh KallumgalPas encore d'évaluation

- Manpower Requisition Form TemplateDocument2 pagesManpower Requisition Form TemplateAneesh KallumgalPas encore d'évaluation

- Lead Processing Cell Register As On 31.07.14Document2 pagesLead Processing Cell Register As On 31.07.14Aneesh KallumgalPas encore d'évaluation

- Organization: Name: Designation: Month & Year of Joining: Experience in Leotech: Technical LLCDocument2 pagesOrganization: Name: Designation: Month & Year of Joining: Experience in Leotech: Technical LLCAneesh KallumgalPas encore d'évaluation

- Wintech India Services Organization StructureDocument2 pagesWintech India Services Organization StructureAneesh KallumgalPas encore d'évaluation

- Organization: Name: Designation: Month & Year of Joining: Experience in Leotech: Technical LLCDocument3 pagesOrganization: Name: Designation: Month & Year of Joining: Experience in Leotech: Technical LLCAneesh KallumgalPas encore d'évaluation

- Sales Support Staff Profile for Leotech OrganizationDocument1 pageSales Support Staff Profile for Leotech OrganizationAneesh KallumgalPas encore d'évaluation

- Organizational GOALSDocument2 pagesOrganizational GOALSAneesh KallumgalPas encore d'évaluation

- Organization: Name: Designation: Month & Year of Joining: Experience in Leotech: Technical LLCDocument2 pagesOrganization: Name: Designation: Month & Year of Joining: Experience in Leotech: Technical LLCAneesh KallumgalPas encore d'évaluation

- Organization: Name: Designation: Month & Year of Joining: Experience in Leotech: Technical LLCDocument2 pagesOrganization: Name: Designation: Month & Year of Joining: Experience in Leotech: Technical LLCAneesh KallumgalPas encore d'évaluation

- Example of A HospitalDocument1 pageExample of A HospitalAneesh KallumgalPas encore d'évaluation

- CLASS Competencies BLD PRGDocument1 pageCLASS Competencies BLD PRGAneesh KallumgalPas encore d'évaluation

- SL No Date Name of Customer Place Distance (Up & Down)Document4 pagesSL No Date Name of Customer Place Distance (Up & Down)Aneesh KallumgalPas encore d'évaluation

- Work Stream of DeptsDocument43 pagesWork Stream of DeptsAneesh KallumgalPas encore d'évaluation

- Initiativs TrackerDocument5 pagesInitiativs TrackerAneesh KallumgalPas encore d'évaluation

- BD RNRDocument4 pagesBD RNRAneesh KallumgalPas encore d'évaluation

- JspanDocument35 pagesJspanSatish FreddyPas encore d'évaluation

- SM Notes For IPCCDocument10 pagesSM Notes For IPCCShyam Tanna50% (2)

- A Study of Working Capital Management Efficiency of India Cements LTDDocument4 pagesA Study of Working Capital Management Efficiency of India Cements LTDSumeet N ChaudhariPas encore d'évaluation

- 6th Sessiom - Audit of Investment STUDENTDocument17 pages6th Sessiom - Audit of Investment STUDENTNIMOTHI LASEPas encore d'évaluation

- Pre-Feasibility Study on UPS and Stabilizer Assembling UnitDocument23 pagesPre-Feasibility Study on UPS and Stabilizer Assembling UnitRaza Un NabiPas encore d'évaluation

- Internship Report On MBLDocument102 pagesInternship Report On MBLNazish Sohail100% (2)

- CH 09 SMDocument54 pagesCH 09 SMapi-234680678100% (2)

- Csec Poa January 2014 p2Document13 pagesCsec Poa January 2014 p2Renelle RampersadPas encore d'évaluation

- Apple Corporate Social ResponsibilityDocument7 pagesApple Corporate Social ResponsibilityLorenzo Wa NancyPas encore d'évaluation

- Cash Flow Statement: Final ExamDocument4 pagesCash Flow Statement: Final ExamAiman Abdul QadirPas encore d'évaluation

- Practice QuestionsDocument5 pagesPractice Questionsnks_5Pas encore d'évaluation

- Responsibility Accounting and Profitability RatiosDocument13 pagesResponsibility Accounting and Profitability RatiosKhrystal AbrioPas encore d'évaluation

- Estate of W. R. Olsen, Deceased, Kenneth M. Owen and First National Bank of Minneapolis, Co-Executors, and Hazel D. Olsen v. Commissioner of Internal Revenue, 302 F.2d 671, 1st Cir. (1962)Document6 pagesEstate of W. R. Olsen, Deceased, Kenneth M. Owen and First National Bank of Minneapolis, Co-Executors, and Hazel D. Olsen v. Commissioner of Internal Revenue, 302 F.2d 671, 1st Cir. (1962)Scribd Government DocsPas encore d'évaluation

- Tugas Latihan Chapter 10 Dan 11Document2 pagesTugas Latihan Chapter 10 Dan 11Arnalistan EkaPas encore d'évaluation

- DocumentDocument5 pagesDocumentMadan ChaturvediPas encore d'évaluation

- Araullo vs. Aquino (G.R. No. 209287)Document494 pagesAraullo vs. Aquino (G.R. No. 209287)MaryPas encore d'évaluation

- 3 Analysis of Foreign Financial StatementsDocument32 pages3 Analysis of Foreign Financial StatementsMeselech Girma100% (1)

- Epiphone Limited Lifetime WarrantyDocument4 pagesEpiphone Limited Lifetime WarrantybaalkaraPas encore d'évaluation

- Q& A 1Document6 pagesQ& A 1Mohannad HijaziPas encore d'évaluation

- Poverty ArticleDocument10 pagesPoverty ArticleAbdullah UmerPas encore d'évaluation

- Cristine Dominico - Exercises On The Topics Discussed On May 29, 2021Document17 pagesCristine Dominico - Exercises On The Topics Discussed On May 29, 2021Tin Bernadette DominicoPas encore d'évaluation

- FIN600 Module 3 Notes - Financial Management Accounting ConceptsDocument20 pagesFIN600 Module 3 Notes - Financial Management Accounting ConceptsInés Tetuá TralleroPas encore d'évaluation

- PartnershipDocument92 pagesPartnershipMary Louise VillegasPas encore d'évaluation

- Investor Guide to Mutual Fund TypesDocument34 pagesInvestor Guide to Mutual Fund TypesAmit PasiPas encore d'évaluation

- MusharkaDocument33 pagesMusharkaDaniyal100% (1)

- Accounting for Wasting AssetsDocument17 pagesAccounting for Wasting AssetsShaina Santiago AlejoPas encore d'évaluation

- TAX05 - First Preboard ExaminationDocument13 pagesTAX05 - First Preboard ExaminationMIMI LAPas encore d'évaluation