Académique Documents

Professionnel Documents

Culture Documents

Evaziunea Fiscala

Transféré par

Girba EmiliaTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Evaziunea Fiscala

Transféré par

Girba EmiliaDroits d'auteur :

Formats disponibles

The Journal of Socio-Economics 35 (2006) 813835

Dynamic behaviour in tax evasion:

An experimental approach

Luigi Mittone

Department of Economics, Computable and Experimental Economics Laboratory,

University of Trento, Via Inama 5, 38100 Trento, Italy

Received 11 April 2005; accepted 21 November 2005

Abstract

This paper investigates, from an experimental perspective, tax payer behaviour, specically focusing on

three main topics related to tax evasion. First analysed are the effects of a repetitive dynamic choice process on

subjects attitude towards risk. Second, the effects of psychological moral constraints on taxpayer behaviour

are examined. Finally the effect of context upon behaviour is analysed. The results from eight experiments

conrmthe importance of the psychological factors in determining taxpayer behaviour and showthe complex

dynamics that agents activate in order to cope with risk.

2006 Published by Elsevier Inc.

JEL classication: H26; C91; D81

Keywords: Experimental Economics; Tax evasion; Moral constraints; Gamblers fallacy; Subjective representation of

probability

1. Preamble

The core of this paper consists of the results obtained from a programme of experiments

conducted at the Computable and Experimental Economics Laboratory of the University of Trento

(CEEL), the intention being to analyse the inuences exerted by psychological factors on tax

evasion.

The psychological dimension of tax evasion has been analysed from many perspectives, start-

ing as early as the 1960s. The rst psychological aspect of tax evasion investigated in the literature

Tel.: +39 0461 882213; fax: +39 0461 882222.

E-mail address: luigi.mittone@economia.unitn.it.

1053-5357/$ see front matter 2006 Published by Elsevier Inc.

doi:10.1016/j.socec.2005.11.065

814 L. Mittone / The Journal of Socio-Economics 35 (2006) 813835

is the effect played by the degree of fairness of the scal system. Starting from empirical observa-

tions, many authors (e.g. Adams, 1965; Thibaut et al., 1974) reached the conclusion that the degree

of compliance with the scal rules is inuenced by the perceived fairness of the rules themselves.

More precisely, this psychological device of self-restraint seemed strongly correlated with the

nature of the exchange relationships between the agents. In the specic case of tax evasion the

exchange is between the tax-payer and the state, and therefore the degree of effectiveness of the

mechanism of individual self-restraint fails when the tax-system becomes too oppressive, (i.e.,

when it is perceived as unfair).

Among the most interesting experiments carried out on scal fairness one can mention Spicer

and Lee Becker (1980).

1

The purpose of their experiment was to examine the relationship between

the perception of inequity in the tax system and tax evasion. The aim was to verify if the amount

of taxes evaded increases among victims of inequity and decreases among its beneciaries, the

intention being to clarify whether the perception of inequity effectively increases evasion or

whether it is instead only one way to rationalise illegal behaviour.

The game consisted of a tax game lasting 10 monthly periods in which the subjects were

confronted by hypothetical decisions on tax evasion. Participating in the experiment were 57

students from the University of Colorado, 21 males and 36 females, aged between 21 and 29.

At the beginning of the game the participants were told that:

- each player would receive the same wage at the beginning of every month;

- each of them had to decide how much of his/her wage to declare and then pay the relative tax;

- in each period, randomly selected participants would be audited and if the tax paid was less

than the sum due, nes equal to 15 times the amount of tax evaded would be inicted. The

participants were informed that there was 1 chance in 15 of being audited, and that audits were

made only on taxes evaded in that period.

The objective of each participant was to maximize his/her net income (gross income taxes

paid nes), on which basis a money reward was distributed at the end of the game. The subjects

were also given additional false information on average tax rates in order to induce some of them

to feel that they were being treated unfairly. All the subjects were informed that their tax rate was

40%. Then, 19 of them were told that the average rate was 65%, while a further 19 were told that

the average rate was 15%. The remaining 19 subjects were told the truth (i.e., that all participants

paid at the same rate). When the 10 periods had passed, a questionnaire was administered to the

subjects in order to ascertain their perception of, and attitude towards, tax evasion.

The results indicate that on average, the subjects evaded 23.13% of the taxes payable, and

that the percentage of evasion was higher among those who had been told that they had to pay

at a higher-than-average rate, and lower among those informed that they would be paying at a

lower-than-average rate.

Other authors have investigated different psychological mechanisms. In particular, Baldry

(1985, 1986) tried to verify the discouraging effects produced when the tax declarations are made

public and when the experimental design takes the form of a real world situation. Baldrys main

results are that when tax declarations are kept private, evasion increases, while it decreases when

tax declarations are public and that subjects behaviour changes if they are asked to take decisions

in a context which resembles a gambling game as opposed to a real world situation.

1

See also Becker (1968) and Becker et al. (1987). A classic reference on the tax evasion topic is Cowell (1990).

L. Mittone / The Journal of Socio-Economics 35 (2006) 813835 815

The relevance of the experimental context has also been analysed by Webley and Halstead

(1986). Webley and Halsteads experiment sought to investigate, how coording in the

instructionsthe context of the situationinuences tax evasion behaviour, taking account of

the fact that, in general, a tax experiment can be interpreted in at least four different ways: (i) as

an optimisation problem, (ii) as a game, (iii) as a simulation of income declarations, (iv) as a psy-

chological experiment. The results from the rst experiments carried out by Webley and Halstead

are not very robust because of the small number of subjects involved, nevertheless the majority

of the subjects declared that they behaved in an almost total articial way, feeling to be involved

not in a real world situation but in a sort of videogame. Further research done by the same authors

and reported in the same article conrms the sensitivity of subjects to the experimental context,

highlighting the important role of the psychological dimension in tax evasion experiments.

Another experiment related to the psychological factors here considered, is by Alm et al.

(1992a,b),

2

which reports the effects of introducing a public good. Financing a public good using

the tax yield produces a negative but weakly signicant effect on tax evasion in their experiment.

Contemporaneously, the authors report the existence of some forms of free riding strategy. Alm

et al. conclude that public programmes that make individuals aware of the benets nanced by

their tax payments may be one tool for generating greater compliance (p. 111).

Many other psychological dimensions of tax evasion have also been treated in the literature

and in particular by applied psychologists. Looking to this stream of literature the most explored

topic is the effect played by social and personal justication on scal behaviour. These studies are

focused on the psychological mechanismthat the subjects activate when they decide to evade. For

example, the subjects are encouraged to evade when they perceive themselves to be poor even if

they believe that the scal systemis broadly fair. This line of research is quite far methodologically

from the approach used here, and therefore it is not useful to analyse this topic deeply.

The experiments discussed in this paper take the hint from the results obtained in Bosco and

Mittone (1997). More precisely, the aimhere pursued is to verify the role of tax yield redistribution

as was already tested in Bosco and Mittone. The assumption behind the introduction of tax yield

redistribution is that the subjects incur a (Kantian) moral cost from the awareness that they are

stealing their contribution to the tax yield from the other participants.

Three main results emerge from the experiments originally carried out by Bosco and Mittone:

(a) Subjects perception of the risk of being detected and punished, and their attitude towards

this, changed according to the way in which the probability of being audited is dened in

the experiments, (i.e., if subjects received precise or vague information about the probability

of being audited).

3

When subjects received imprecise information on this probability, the

number of evaders increased, and this happened despite the fact that the subjects declared an

expected value from evasion which was lower than the sure choice (pay taxes).

(b) The second experimental device (i.e., redistribution of the tax yield) signicantly reduced tax

evasion.

(c) Publicising the results from the scal audits showed no effect.

These results, inpart, conrmthe ndings alreadybrieyseeninthe discussiononthe literature.

For example, the deterrent effect produced by the distribution of the tax yield was similar to that

2

On a similar topic can also be seen Alm et al. (1992a,b).

3

In the rst experiment the subjects were unaware of the audit probability, while in the second one the subjects knew

that three members of each group of 16 participants would be audited.

816 L. Mittone / The Journal of Socio-Economics 35 (2006) 813835

produced by the public good provision described in Webley and Halstead (1986). On the other

hand, the reactions of the subjects to the different ways in which the audit probability was dened

are not conrmed (nor rejected) in the literature.

2. Introduction: the hypotheses to test

Bosco and Mittone (1997) raises important issues in a one-shot environment which need for

further examination in a repeated choice framework: a number of questions which were explored

by using a set of repeated choices experiments have been extracted from the insights yielded by

the one-shot experiments:

(Q1) Does the possibility of playing more than once change subjects attitude towards risk and

consequently towards scal evasion?

(Q2) Does the moral constraint introduced in the one-shot experiments (i.e., tax yield redistribu-

tion) play any role in a repeated choices framework?

(Q3) Can one identify a learning process which teaches subjects how to cope with risk?

(Q4) Does the context (the simulation of a scal environment) have any effect on subjects

behaviour?

It is clear from the questions just listed that the focus of the experiments discussed in what

follows was the intersection between the psychological costs of tax evasion and the risk component

embodied in the decision to evade. More precisely, one must bear in mind that the psychological

constraint included in the experiments discussed here (the tax yield redistribution) may directly

inuence computation of expected monetary value of evasion. Supposing, therefore, that the

taxpayers utility depends only on money,

4

we may write the usual tax evasion expected value

EV

e

formula:

EV

e

= (1 )[1 t(1 )]Y +[1 t P()t]Y (1)

where Y is income before taxation; is the percentage of tax evaded ( =0 if the taxpayer is

perfectly honest, =1 if the taxpayer is perfectly dishonest); is the probability that evasion will

be discovered; t is the tax rate; P() is the punishment scheme which links the surcharge to the

amount of evasion.

5

The taxpayers problem, given [1], is simply a matter of comparing between the value of EV

e

and the net income after taxation. When EV

e

=(1t)y the taxpayers choice is conventionally

assumed by expected utility theory to be between risk aversion and risk attraction.

How does [1] change if we include the tax yield redistribution? Recalling the assumption that

the tax payers utility depends only on her/his net income, and following the traditional approach

to tax evasion theory, we may hypothesise that Rthat is, the amount of money redistributed after

taxationis a function of the tax payers attitude towards risk, of total income and of t. More

precisely if we assume:

4

As well known the traditional theoretical treatment of tax payer behaviour can be found in the seminal Allingham and

Sandmos paper (1972) and in many other works that followed it, e.g. Yitzhaki (1974), Chung (1976), and more recently

Yaniv (1994).

5

I assume that the penalty rate is imposed on evaded tax, an institutional feature common to many developed countries.

L. Mittone / The Journal of Socio-Economics 35 (2006) 813835 817

[A1] t is a xed rate,

[A2] the government redistributes the tax yield by simply dividing the total amount of money

collected from taxes (without including the nes paid by evaders detected by the scal audits)

into equal parts among tax payers,

[A3] the punishment system is the same for every taxpayer.

We may state that R will depend only on the total income and on the average prevailing attitude

towards risk. Eq. (1) therefore becomes:

EV

eR

= (1 )[l t(1 )]Y +[1 tP()t]Y +R (2)

where:

R = K

n

i=1

(1

i

)tY

i

n

and (i =1, . . ., n) is the total number of taxpayers.

Inspection of Eq. (1) and (2) shows that the nature of the taxpayers decision problem is

basically the same with or without redistribution. More precisely, and still assuming a risk-neutral

taxpayer, one may expect to observe a different decision, moving from the without-redistribution

context to that with redistribution, only when the ratio between the value of the sure choice (pay

taxes) and the value of the uncertain choice (to evade) becomes greater than one as a consequence

of the amount of money redistributed. The amount of sure income, in fact, rises as a consequence

of redistribution; and therefore the original ratio (1t)Y/EV

e

of the without-redistribution lottery

changes, becoming [(1t)Y+R]/EV

eR

. It is to be noted that the value of R can only be estimated

by the individual taxpayer, given that it is highly unrealistic to assume that s/he could have sure

information about the behaviour of the other taxpayers. Hence, it follows that the only way to

compute the value of the sure choice is to assume that none of the other tax payers will pay. The

value of the sure income for taxpayer j therefore becomes [(1t)Y

j

+tY

j

ln] and in a similar way

EV

eR

changes as well.

This is the case from the neoclassical microeconomic theory point of view, but as was easily

predictable,

6

many of the behaviours observed in the experiments reported here are difcult to

explain, either from this standpoint or from that of other theories, even when they developed from

experimental data.

7

To answer the questions listed at the beginning of this section, eight dynamic

experiments were run.

3. The lottery structure of the dynamic experiments

The dynamic experiments were run using a computer-aided game designed for this specic

purpose. Thirty subjects participated in each experiment: 15 men and 15 women, all undergraduate

students from the Faculty of Economics of the University of Trento. All the experiments were

6

There is a large body of experimental literature one the failures of the expected utility theory. Among the most

interesting studies are in my opinion those by Tversky and Kahneman (1979, 1992). There is an almost equally large

amount of literature on scal evasion from an experimental perspective: for a review and a sort of textbook on the topic

see Webley et al. (1991).

7

Among the most interesting of such theories I shall only cite the well-known prospect theory by Tversky and Kahneman

(1979).

818 L. Mittone / The Journal of Socio-Economics 35 (2006) 813835

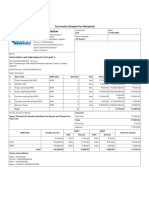

Fig. 1. Expected values for the dynamic experiments. P1: income =0.52, tax =20%, audit probability =6%;

P2: income =0.52, tax =30%, audit probability =10%; P3: income =0.52, tax =40%, audit probability =10%; P4:

income =0.52, tax =40%, audit probability =15%; P5: income =0.52/0.36, tax =40%, audit probability =15%; P6:

income =0.36, tax =40%, audit probability =15%.

of the same length (60 rounds) and they were run by taking the variables that enter the lottery

structure as constants. The values for the lottery were the following:

(a) income0.51 Euro cents from round 1 until round 48, 0, 36 Euro cents from round 49 to 60;

(b) tax rate20% from round 1 until round 10, then 30% from round 11 until round 30, and

nally 40% from round 31 until the end;

(c) tax audit probability6% from round 1 until round 21, then 10% from round 22 until round

40, and nally 15% from round 41 until the end;

(d) feesthe amount of the tax evaded plus a fee equal to the tax evaded multiplied by 4.5; the

tax audit had effect over the current round and the previous three rounds.

At the beginning of the experimental programme have been done two independent random

drawings to determine the sequence of the tax audit accordingly to point c). These two sequences

have been used for all the experiments and applied to two subgroups of participants.

To approximate a real life situation more closely, the tax audit was extended over a period

of four rounds in the base experiment. For this reason, and as the lottery structure changed

during the experiment, computation of the expected value from evasion was rather complex.

To calculate the expected values for the different lotteries, a simple program produced using

Mathematica

was used. The graphic result from the numeric solution is shown in Fig. 1, in

which the horizontal axis represents the tax paid and the vertical axis represents the expected

value from evasion. Fig. 1 demonstrates that the lottery structure for the dynamic experiments

was always unfair. As the lottery used in the one-shot experiments was a more than fair lottery, it

was expected that the percentage of evaders in the dynamic experiments would be smaller than

it was in the one-shot ones. Obviously this consideration was valid only for the rst round of

the game.

4. The design of the experiments

The experimental subjects were recruited through announcements on the bulletin board

of the Faculty of Economics. The subjects personal data were collected by the staff of the

Computable and Experimental Economics Laboratory. The total number of the experimental

subjects who participated in the eight experiments discussed here was 240. All the subjects

L. Mittone / The Journal of Socio-Economics 35 (2006) 813835 819

Fig. 2. The probability wheel.

were undergraduate students. The use of undergraduate students as experimental subjects in an

experiment on tax evasion could imply some perplexities on the transferability of the results

to the real world. Nevertheless, the use of university students as experimental subjects is very

common in Experimental Economics and the topic here analyzed can be considered perfectly

well known.

During the experiment the players were not allowed to communicate, and they received infor-

mation only from the computer screen, which showed the following items of information:

(a) the total net income earned by the player since the beginning of the game,

(b) gross income in the active round,

(c) the amount of taxes to pay in the active round,

(d) the number of the active round.

The subjects were divided into two groups, and they underwent separately a scal audit in

correspondence to the rounds randomly drawn at the beginning of the experimental programme

(specically rounds 13, 31, 34, 48, 54, 58 for the rst group, and rounds 3, 24, 27, 40, 46, 50 for

the second group).

Afurther information device took the formof a snap interruption: the computer screen changed

and a message appeared which informed the subjects that the audit probability would change

after three rounds (this item of information kept the subjects constantly informed on the rel-

evant parameters of the lottery). When each subject had read the information on the screen

and had taken her/his decision, s/he entered via the computer keyboard, the amount of money

that s/he had decided to pay and then waited to see if s/he had been extracted for a scal

investigation.

Finally, introduced into one version of the standard experiment was a visual device intended to

help the experimental subjects in evaluating the probabilistic nature of their choices. This device

was a red and white wheel shown in Fig. 2.

The white sector of the wheel shows the probability of being audited: in each round the subjects

could see the wheel rotate. If it stopped with the arrow in correspondence with the white sector

they were inspected. Conversely, when the wheel stopped with the arrow in correspondence with

820 L. Mittone / The Journal of Socio-Economics 35 (2006) 813835

the red sector they were not audited. Obviously, as the probability of being audited increased, so

did the surface area of the white sector.

As said, the dynamic experiments were designed to test some specic hypotheses. For this

purpose, the following changes were made to the original design:

DY1 is the standard (base) experiment;

DY1 0 is the standard experiment but with no retroactive tax audits (this obviously implies that

the lottery structure for this experiment is simpler and fairer than that described in the previous

section);

DY1 10 is the standard experiment but with a tax audit extended over the last 10 rounds (this

time the situation is the reverse of DY1 0: the lottery is less fair than the lottery used in the

standard DY1);

DY1 W is identical to the standard experiment but with the adoption of a visual device, the

red and white wheel showing the subjects their probability of being audited;

DY2 is the same as DY1 but with the introduction of the tax yield redistribution (which was

one of the moral factors investigated in the one-shot experiments);

DY3 is the same as DY2, except that the tax yield is used to nance the provision of a public

good, the public good was the creation of a scholarship fund that was really built up at the end

of the experimental programme;

DY4 is exactly identical to the standard experiment, except that it is designed as a generic

gamble and every reference to the scal environment is eliminated (I shall call this the gamble

experiment for convenience);

DY5 is the only experiment with a different lottery structure and a different timing of the scal

audits.

5. Experiment results

Some basic results obtained are reported in Table 1.

The main consideration arising from Table 1 (the DY5 data are not reported because the

experimental design was different from the others) concerns the total tax yield collected at the

end of the experiments and the instances of evasion (the total number of times subjects decided

to evade during the whole experiment). The differences among the experiments with the same

lottery structure (i.e., experiments DY1; DY1 W; DY2; DY3 and DY4) conrm the importance

of the tax yield redistribution as a moral constraint already tested in the one-shot experiments

(Bosco and Mittone, 1997). Furthermore a similar result is obtained by the experiment with a

Table 1

Evaders and tax yield (repeated choices experiments)

Experiment Instances of evasion (max 1800) Total tax yield (Euro)

DY1 951 0.2

DY1 0 1250 0.13

DY1 10 869 0.21

DY1 W 1037 0.19

DY2 499 0.25

DY3 715 0.24

DY4 1012 0.2

L. Mittone / The Journal of Socio-Economics 35 (2006) 813835 821

Fig. 3. Standard experiment (DY1). Tax payments (averages rst group).

public good nanced from the tax yield. Both the experiments with these psychological, moral,

devices (DY2 and DY3) produced a higher tax yield than was collected in the two versions of the

standard experiment with scal audit retroactivity extended over 3 rounds (DY1 and DY1 W),

and in the gamble experiment (DY4). Similarly, also the number of evaders was noticeably lower

in the experiments with redistribution (499) and with a public good (715) than it was in those

with no moral constraint (respectively, 951 evaders for DY1, 1037 for DY1 W and 1012 for the

gamble experiment). These results therefore seem to conrm the anti-evasion effect exerted by a

psychological factor implied by the redistribution of the tax yield either in the form of money or

as a public good.

The results obtained from the visual probability experiment (DY1 W) seemingly point to the

conclusion that the inclusion of the probability wheel does not change the results substantially.

The number of instances of evasion is in fact slightly higher in the experiment with the wheel but

the total tax yield collected is lower.

The graphs from experiment DY1 are given in Figs. 3 and 4, which show the dynamics of

subjects choices.

Two considerations arise: the rst is that it is rather difcult to interpret these choices in

the light of traditional expected utility theory; the second is that the evolution of the aggre-

gate choices is apparently unaffected by modications to the lottery structure. If the usual Von

Neumann Morgenstern approach is used to interpret the dynamic observed, a very unrealis-

tic hypothesis must be introduced, namely that there is a large proportion of subjects who

are risk neutral and who consequently choose the amount of money to pay in each round at

random.

Aclearer picture of the subjects behaviour, with respect to the probability of being audited and

ned, is given by Figs. 5 and 6, which show the average expected values computed by using the

lotteries chosen by the two sub-groups of subjects that participated in the standard experiment.

8

It is evident that the expected values for both the sub-groups are always lower than the value

8

The lottery chosen by the subjects can be easily computed by substituting for in (1) the amount of money that they

actually decided to evade.

822 L. Mittone / The Journal of Socio-Economics 35 (2006) 813835

Fig. 4. Standard experiment (DY1). Tax payments (averages second group).

of the corresponding sure choice (i.e., to pay taxes), and the amount of money evaded seemed

unrelated to the trend of the expected values. By contrast, there is a negative correlation between

the amount of money evaded and the value of the sure choice (the linear correlation coefcient

between the value of the sure choice and the average tax paid by the rst group of subjects is

0.48 Euro cents and 0.36 Euro cents for the second group, with a signicance level of 0.000

for the rst coefcient and 0.004 for the second). This relationship is coherent with expected

utility theory because is rational to evade less when the value of the sure choice is high and more

when it decreases, assuming a constant risk propensity.

An even better picture of this phenomenon is provided by Table 2, which reports the average

tax evaded per round and the extent to which subjects tend to increase their evasion when the

sure choice decreases. It is evident that as the value of the sure choice decreases, the average tax

evaded increases.

Fig. 5. Standard experiment (DY1). Expected values from lottery (averages rst group).

L. Mittone / The Journal of Socio-Economics 35 (2006) 813835 823

Fig. 6. Standard experiment (DY1). Expected values from lottery (averages second group).

On the other hand, and this time in contrast to expected utility theory, the expected value from

evasion is negatively correlated with the amount of tax evaded. The linear correlation coefcients

computed for these variables are 0.2735 for the rst group of subjects (with a signicance level

of 0.03) and 0.2097 for the second group (with a signicance level of 0.1). We have just seen

that in order to justify the dynamics reported by Figs. 3 and 4 from the expected utility theory

perspective, we must assume that the subjects chose randomly. Now, explanation of the inverse

correlation between tax evasion and expected value from evasion requires a different assumption:

that is, we must hypothesise that the subjects risk propensity changes with each round, and that

it is negatively correlated with the expected value from evasion.

By combining the existence of an apparently rational behaviour, based on the inverse rela-

tionship between the sure choice value and the amount of tax evaded, with the continuously

changing structure of the subjects choices, one may suppose that some form of adaptive dynamic

behaviour is taking place. It seems that the subjects ignore the trend of the expected value from

evasion (maybe because it is too difcult to compute) and that they explore the space of their

alternatives by changing their choices in each round.

Returning to Figs. 3 and 4, one notes another important aspect of the results obtained which may

in some way support this latter consideration. Even if the trends are highly unstable and apparently

follow some sort of random walk, there is a sort of constancy in the rounds immediately after a

scal audit, which is almost always followed by a systematic increase in tax evasion. This increase

generally has its lowest peak in correspondence to the round immediately after the scal audit, and

Table 2

Sure choice and tax evaded (experiment DY1)

Round Average tax evaded (Euro) Sure choice (Euro)

First sub-group Second sub-group

110 0.028 0.034 0.413

1130 0.058 0.051 0.361

3148 0.078 0.059 0.309

4960 0.085 0.064 0.154

824 L. Mittone / The Journal of Socio-Economics 35 (2006) 813835

sometimes lasts for more than one round. This shall be called the bomb crater effect

9

(BCE):

the subjects decide to evade immediately after a scal audit because they believe that it cannot

happen twice in the same place (time). Sometimes this effect may have some sort of echo, so that

some subjects persist in evading for two or three rounds after the audit. The echo effect seems to

be inuenced in some way (i.e., it is more or less compressed in time) by the different systems of

scal audits introduced into the experiment, that is to say, by the audit retroactivity extent (from

0 to 10 rounds before the active round when the audit effectively took place).

Looking at similar effects reported by literature on behaviour under uncertainty, there are some

similarities with the so called gamblers fallacy (GF). The GF is related to a form of distortion

produced by the subjects perception of the probability distribution of an uncertain event, due to

specic sequences of observations. For example, imagine that a gambler is betting on red or black

inroulette. After a longsequence of black, her/his expectancyof the occurrence of redincreases. As

well known, the probability of red and black is always the same, independently from any possible

sequence of occurrences, but the gambler feels that the red becomes increasingly more likely.

The results reported by our experiments show that the behaviour of the subjects, although

inuenced by some form of distortion in the perception of the probability distributionand

therefore belonging to the GF class of phenomenaare quite different from those described by

GF. In fact, the experimental subjects do not behave in a way which is coherent with the behaviour

predicted by the gamblers fallacy.

According to GF, one expects that after many rounds without scal inspection, the subjects

should reduce the amount of evasion because they should overestimate the probability of being

investigated. This phenomenon should produce a progressive reduction in the amount of tax

evasion with some form of regular negative trend. Looking at Figs. 3 and 4, it is clear that no

form of regular trend is apparent; on the contrary the subjects continuously change their pattern

of behaviour.

A way to control the statistical signicance of the absence of systematic trends in the data is to

compute an autocorrelation function. This statistic can be done only for sets of data that include

at least 45 rounds. An example of these statistics is reported in Appendix B (Fig. B.1).

Computing the autocorrelation statistics for all the experiments almost any signicant trend

emerges from the data.

The only kind of regularity reported by the data is the underestimation of the probability of

being investigated immediately after a specic event, i.e., a scal audit. This means that the

subjects decisions are unaffected by the sequence of occurrences that happen before the crucial

event, which is the only relevant explanatory variable. A possible explanation of the subjective

underestimation of the audit probability after being inspected is that this event is weighted by the

experimental subjects in a special way. That is to say that the subjects modify their psychological

representation of the probability of another audit in a way which is strongly inuenced by specic

experiences that they do during the experiment. Unfortunately, this hypothesis cannot be tested

using our data because the experiment was not designed to investigate on this kind of phenomena.

The bomb crater effect can be found in all the experiments here discussed and a way to check

for its signicance is shown by the graphs and the statistics reported in Figs. 7 and 8.

The graph of Fig. 7 plots data from DY1 and shows a comparison between the medians of

the percentage of tax paid immediately before and after a scal audit. Post =0 and Post =1 are,

9

The term derives from the First World War: during bombardments, soldiers would take shelter in bomb craters in the

belief that it was impossible for a bomb to fall in the same place twice.

L. Mittone / The Journal of Socio-Economics 35 (2006) 813835 825

Fig. 7. Two-sample comparison (DY1).

respectively, the median percentage of tax paid in the round before the tax audit and in the round

after the tax audit. Looking to the graph and to the statistic reported on the bottomof the gures one

can see the median of the percentage of tax paid in the round before the tax audit is much higher

than the median after the tax audit. This difference is statistically signicant (p-value =0.0000).

A further conrmation of this result is evident in Fig. 7. Here, a plot of the frequency distributions

of the percentages of tax paid in the pre-audit round (Post =0) and post-audit round (Post =1)

Fig. 8. Density traces (DY1).

826 L. Mittone / The Journal of Socio-Economics 35 (2006) 813835

Table 3

MannWhitney and Kolmogorov statistics

Experiment Median Average rank MannWhitney

(p-value)

Kolmogorov

(p-value)

Post =0 Post =1 Post =0 Post =1

DY1 0.645833 0.0 149.047 211.953 9.97344E-11 0.0

DY1 0 0.645833 0.0 148.256 212.744 9.97344E-11 0.0

DY1 10 1.0 0.333333 150.639 210.361 8.88444E-9 0.0

DY1 W 0.75 0.135 154.025 206.975 5.23938E-7 0.0

DY2 1.0 1.0 157.189 203.811 4.01713E-7 0.0

DY3 1.0 0.75 144.703 216.297 3.14904E-12 0.0

DY4 1.0 0.3875 151.264 209.736 2.44937E-8 0.0

DY5 1.0 1.0 171.836 189.164 0.0696157 0.0

from DY1 is presented two samples. Looking at the two frequency distributions, it is clear that

the probability that no tax is paid at all is much higher when a scal audit has been just carried

out. Moreover, the two distributions have only one point of intersection. To intersect only once

means that the two distributions have a signicantly different trend towards all the observation.

This intuition is conrmed by the Kolmogorov-Smirnov test which is statistically signicant.

A summary of the median value, average rank, and the MannWhitney and Kolmogorov tests

for all sessions is reported in Table 3.

The data reported by Table 3 show that the value of the median computed for the samples

Post =1 is almost always lower than the median computed for the samples Post =0. Moreover,

the MannWhitney and the Kolmogorov tests are always signicant suggesting the values of the

distributions of the two samples are signicantly different in all the experiments. Two experiments,

DY2 and DY5 show the same median for the two samples. There are different reasons why the

medians are equal.

Looking at the average ranks of the two samples (Post =0 and Post =1) of the experiment DY2

one can notice that they are different. Dissimilar average ranks signal an inhomogeneous structure

of the values for the two samples, more precisely the sample Post =0 has always lower value than

sample Post =1 (see Fig. B.2 in the Appendix B).

On the other hand, regarding DY5 the similar median values are a consequence of the different

experimental design used for this experiment. The aim of this experiment was to investigate the

effects produced by learning processes. The reduction of the BCE in this experiment is mainly

due to the characteristics of the design adopted (see further explanation in this respect).

Concluding BCE is inuenced neither by the tax yield redistribution, nor by the context, nor by

the scal audit system adopted, nor by the method used to inform the experimental subjects of the

probability of their being investigated (i.e., using numberspercentagesor the visual device).

It can thus be assumed to be some sort of mental representation of probability activated by the

subjects. One can test whether experience modies this mental representation of probability by

examining the behaviour of the subjects belonging to the separate sub-groups of each experiment.

As just said, those involved in experiments DY1, DY1 W, DY2, DY3 and DY4 were all audited

simultaneously during two sequences of rounds, i.e., sequence A: rounds 13, 31, 34, 48, 54, 58,

and sequence B: rounds 3, 24, 27, 40, 46, 50. The main difference between the two sequences

concerns the moment in the experiment when the rst audit takes place. In sequence A, the rst

audit comes after a quite long period of game-playing (round 13), while in sequence B it occurs

at the beginning of the experiment (round 3).

L. Mittone / The Journal of Socio-Economics 35 (2006) 813835 827

Table 4

Evaders and tax yields of the sub-groups

Experiment No. of evaders Total tax yield (Euro)

DY1 rst sub-group 502 0.096

DY1 second sub-group 449 0.106

DY1 W rst sub-group 604 0.088

DY1 W second sub-group 433 0.104

DY2 rst sub-group 275 0.122

DY2 second sub-group 224 0.133

DY3 rst sub-group 436 0.112

DY3 second sub-group 279 0.128

DY4 rst sub-group 502 0.102

DY4 second sub-group 510 0.103

Table 4 shows the amount of money paid by the subjects belonging to the two subgroups of

each experiment. One notes that being subjected to an audit at the beginning of the experiment

produces a sort of risk aversion effect. The members of the rst subgroups (sequence A) always

evade more, and consequently pay less, than the members of the second subgroups (sequence B).

The only, and very interesting, exception to this rule is experiment DY4i.e., the experiment that

was designed as a game and not as taking place in a real world context.

To investigate the apparent phenomenon of learning to be risk adverse requires the introduction

of experiment DY5, the results of which are given in Figs. 9 and 10.

It is evident from Figs. 9 and 10 that, in experiment DY5, the scal audits were concentrated

in the second half of the experiment for the subjects belonging to the rst group, and in the rst

half for the subjects belonging to the second group. The structure of the lottery in DY5 was kept

constant for the entire experiment in order to isolate the effects produced only by the audit timing.

The result is quite clear. Those subjects who learned in the rst half of their experimental lives that

scal audits are very uncommon became risk takers (the total tax yield for them was only 0.091

Euro cents, while the total tax yield for the subjects belonging to the second sub-group was 0.117

Fig. 9. Special audits experiment (DY5). Tax payments (averages rst group).

828 L. Mittone / The Journal of Socio-Economics 35 (2006) 813835

Fig. 10. Special audits experiment (DY5). Tax payments (averages second group).

Euro cents). Subjects in the rst group had a strong propensity to evade taxes, which persisted

when they moved into the second half of their experimental lives, when the probability of being

audited increased dramatically. The tax yield of the rst 30 rounds was only slightly lower than

the tax yield for the following 30 rounds. By contrast, the subjects in the second group learned

that scal audits were very frequent and consequently also learned to be risk adverse, maintaining

this virtuous behaviour for the entire experiment. These subjects paid 0.057 Euro cents in the rst

30 rounds and paradoxically more (0.060 Euro cents) in the second part of the experiment, when

they were never investigated.

It is worth noting that in experiment DY5, the gamblers fallacy phenomenon cannot be used

to interpret the data. In fact the behaviour of the experimental subjects should be completely

reversed if they followed the gamblers fallacy scheme of choice. A long run of scal inspections

should produce a constant increase in the propensity to evade because the subjects should forecast

a low probability of being audited. On the contrary, the experience of being continuously inves-

tigated generates an overestimation of the probability of being audited and therefore reduces the

propensity to evade.

As pointed out there was an exception to the rule that the members of the rst subgroups always

evaded more than the members of the second subgroups. This exception was experiment DY4,

where the subjects belonging to the two subgroups adopted almost identical behaviours, or more

precisely, reversed the rule by evading more (510 evaders) in the rst sub-group and less (502

evaders) in the second sub-group. This phenomenon introduces one of the topics addressed by

the dynamic experiments, namely the role played by the experimental context. The point is this:

did the subjects really perceive the context that we tried to reproduce (i.e., a tax payer problem)

or did they behave as if they were playing a video game? Furthermore, it should be borne in

mind that this suspicion is reinforced by the fact that the dynamic experiments were carried out

using computers. One way to investigate this issue is to compare the results obtained from the

standard experiment with the results reported from the gamble experiment, because they were

perfectly identical in their lottery structure. The results from both the experiments are plotted in

Fig. 11.

L. Mittone / The Journal of Socio-Economics 35 (2006) 813835 829

Fig. 11. Number of evaders standard experiment (DY1) and gamble (DY4).

At rst glance, the plots shown in Fig. 11 might suggest that the behaviour of the subjects of

the two experiments were very similar. Nonetheless, closer examination of the trends reveals that

the behaviour was not identical. In fact, if we look at the rst 13 rounds we nd that the number

of evaders in the standard experiment was always lower (except for rounds 5 and 12 where the

number of evaders was the same for both experiments) than the number of evaders in the gamble

experiment. On running the MannWhitney test to verify whether the difference in the number

of evaders in the rst 13 rounds is statistically signicant between the two groups of subjects, we

may reject with a 0.002 level of signicance the null hypothesis that the two samples come from

populations with the same distributions.

The data collected from the experiments do not provide a certain explanation for this phe-

nomenon, but a reasonable one is forthcoming from consideration of the role played by the scal

audits (or by the corresponding drawing of the gamble experiment). After the rst 13 rounds, all

the subjects in both sub-groups of each experiment experienced one inspection (or drawing). The

rst sub-groups at round 13 and the second sub-groups at round 3. The interesting point is that the

effect of this experience apparently modied the risk attitude only of the participants in the gamble

experiment. In other words, it seems that at the beginning of the experiment the subjects involved

in the gamble experiment were more risk-takers than were the subjects of the standard experiment,

but this attitude changed after they experienced the rst drawing, and became almost identically

distributed among the participants in both experiments. This change in the risk attitude of the

participants in the gamble experiment suggests that there is some form of relationship between

the different experimental contexts and the attitude towards risk. At the same time, the risk attitude

seemed to be inuenced in accordance with the experimental context, by the experience of being

extracted for audit.

These considerations highlight another interesting point concerning the nature of the relation-

ship that ties the risk attitude to the subjective representation of probability. In all the dynamic

experiments the probability of being audited was a known datum, and it should therefore be taken

as objective information (this is also the reason why it is correct to talk of taking decisions

830 L. Mittone / The Journal of Socio-Economics 35 (2006) 813835

under conditions of risk, instead of uncertainty). However, it is not possible to exclude the

hypothesis that the experimental subjects do not treat this data within the correct computational

frame. The well known probabilistic paradoxes discovered by relatively simple experiments (most

notably the Allais paradox and the Ellsberg paradox), demonstrate that even when all the proba-

bilistic properties of a decisional problem are perfectly known the subjects may commit logical

errors.

Table 5

Summary of the aggregate results from the repeated choices experiments

Experiment Risk attitude Psychological effects

DY1 objective probability; unfair lot-

tery (3 rounds of retroactivity for the

scal audits)

(1) Higher number of evaders than

the one-shot experiments

Correlation between the sure

choice value and evasion

(2) Complex dynamic of choices Non correlation between the gain

expected from evasion and

observed behaviour

(3) Bomb crater effect

DY1 0 objective probability; unfair

lottery (no retroactivity for the scal

audits)

(1) Higher number of evaders than in

DY1

(2) Complex dynamic of choices

(3) Bomb crater effect

DY1 10 objective probability; unfair

lottery (10 rounds of retroactivity for

the scal audits)

(1) Almost identical number of

evaders as in DY1

(2) Complex dynamic of choices

(3) Bomb crater effect

DY1 W objective probability; unfair

lottery; probability wheel

(1) Almost identical number of

evaders as in DY1

(2) Complex dynamic of choices

(3) Bomb crater effect

DY2 objective probability; unfair lot-

tery; tax yield redistribution

(1) Complex dynamic of choices Tax yield redistribution reduces

evasion

(2) Bomb crater effect

DY3 objective probability; unfair lot-

tery; public good

(1) Complex dynamic of choices The production of a public good

reduces evasion but to a lesser

extent than tax yield

redistribution

(2) Bomb crater effect

DY4 gamble experiment (1) Complex dynamic of choices The gamble context increases

risk taking initially

(2) Bomb crater effect The learning process is different

if compared with the learning

process accomplished in the tax

evasion context

DY5 objective probability; unfair lot-

tery; articial audits

(1) Complex dynamic of choices Learn to be risk adverse after

being audited on participating in

a drawing

(2) Bomb crater effect

L. Mittone / The Journal of Socio-Economics 35 (2006) 813835 831

6. Conclusions

The main conclusions reached by analysing the data are summarised in Table 5.

Table 5 shows that the most robust results concern the effect of tax yield redistribution and

of audits (the bomb crater effect), while all the other devices introduced in the experiments

exerted less impact on the behaviour of the experimental subjects. Both the psychological deterrent

produced by the moral constraint embodied in the tax yield redistribution (and in the public good

provision) and the particular reaction produced by the tax audit experience can be viewed, from

a normative perspective, as devices to reduce evasion. Obviously, this conclusion requires further

analysis.

More generally, the results fromthese experiments are highly instructive for study of behaviour

under conditions of risk/uncertainty. The complex mix of substantial rationality (in the neoclas-

sical meaning of the term) and of bounded rationality (in Herbert Simons sense) used by the

experimental subjects to cope with the risky choice to evade warrants further investigation.

From an economic point of view the results obtained highlight the weakness of a theoretical

approach exclusively based on an assumption of substantial rationality. The results here reported

allowto conclude that the tax payers choices are in some way inuenced by a mix of subjectively

rational expectationsmainly built on personal previous experiencesand of psychological fac-

tors. To model this cognitive process is a very arduous task and probably does not take to any

general result. Nevertheless, some strong regularities has emerged from the data collected. The

most important among these regularities are the importance of the individual storyearly experi-

ences of tax audit are more inuencing than later onesand the bomb crater effect. By combining

these two insights one can design quite effective normative tools. For example seemed more effec-

tive to monitor the tax payers at the beginning of their productive activitieswhen they start to

produce some incomethan later and it is important to make close audits to contrast the negative

effects produced by the BCE attitude.

Acknowledgements

The experiments described here are the result of team work involving many members of the

Experimental andComputational Economics Laboratoryof the Universityof Trento, andtheywere

part of my Ph.D. thesis. I amgrateful to all of the team, my especial thanks going to my friend Paolo

Patelli, who authored the software used in the dynamic experiments, and to Alessandra Gaburri

who gave me a substantial help in the practical organisation of the experiments. I would like to

thank also Rob Moir and two anonymous referees for their useful comments and suggestions. As

usual, all responsibility for errors or omissions is mine alone.

Appendix A. Instructions for the subjects (translated from the Italian)

These are the general instructions given to the participants of the experiments DY1, DY1 W,

DY2, DY3, DY5:

This game is about the behaviour of tax payers. The game is computer aided, the software

that you will use is pre-built, and there will be no direct intervention by the researchers during the

experiment. The results of your choices will be collected only when the experiment has nished,

and they will remain anonymous.

The game simulates a real world environment. It comprises several rounds which represent

different time periods (for example years). In each period you will receive a round income (which

832 L. Mittone / The Journal of Socio-Economics 35 (2006) 813835

at the end will be your reward for the work you have done). In each period you will also be

required to pay a tax, but you can decide to evade part of this tax, or even all of it. Regardless of

your choice, you may be investigated at any moment during the game, and if you have evaded

in one or more of the last four rounds you must pay the taxes evaded plus a ne. The inspection

may never take place, and it is decided and performed only by the computer, without any direct

intervention by the researchers.

All relevant information will be provided directly on the computer screen, and you must not

communicate with anyone during the whole experiment.

At the beginning of the experiment your probability to be audited during the active round is 6%

and is independent from the probability that other people would be investigated. This means that

in any given round no subject is audited (some subjects are audited or all subjects are audited). The

probability can change during the experiment but you will be informed thorough the computer

screen before this change takes place.

This is an example of the ne that you would pay if you decided to evade and are audited:

Round Round gross income Audit Tax to pay Tax evaded Round net income Fine Total net income

9 0.52 NO 0.15 0 0.36 0 3.05

10 0.52 NO 0.15 0.10 0.41 0 3.41

11 0.52 NO 0.15 0.10 0.46 0 3.82

12 0.52 SI 0.15 0

a

1.24 4.29

13 0.52 SI 0.15 0.15

b

0.13 3.36

a

You have been audited, the audit analyses the last four rounds. As you evaded 0.103 Euro cents in round 11 and 0.103

Euro cents in round 10 you must pay 0.206 Euro cents (0.103 +0.103) plus the ne, which is six times the amount evaded,

i.e., 0.206 6 =1.239 Euro. Your reward in this round is therefore 0.929 Euro cents and the ne will be subtracted

from your nal reward. The nal reward cannot be negative so your worst possible result is to nish the experiment

without any money reward.

b

The tax evasions that have been detected and ned in a previous round cannot be ned twice. At round 13 the tax

evasions of round 11 and 10 are not considered in computing the ne that will be computed only for round 13, i.e.,

0.154 6 =0.929 Euro cents. In the case that the experiment should nish at round 13 your nal reward should be

3.356 +0.516 0.154 0.929 =2.789 Euro.

This is the sequence that you must follow in each round of the game:

(1) write your secret code, that you will see on the computer screen, on the small sheet piece of

paper that you will receive at the beginning of the experiment, you will use the secret code

to be paid at the end of the experiment;

(2) get the information about your round income and the tax to pay;

(3) decide the amount of tax to pay (between zero and the total amount required) and write it in

the appropriate window of the computer screen;

(4) press the enter key.

If you do not perform the entire routine, the computer will not allow you to pass to a new

round, and you will have to repeat everything.

End of instructions: The instructions for the experiments DY1 0 and DY1 10 are identical to

those just reported with the only obvious modication of the different audit retroactivity. The

instructions for experiment DY1 W contained the explanation of the meaning and functioning of

the probability wheel.

The experimental subjects of DY4 experiment received this modied instructions:

L. Mittone / The Journal of Socio-Economics 35 (2006) 813835 833

This game is about gambling. The game is computer aided, the software that you will use is

pre-built, and there will be no direct intervention by the researchers during the experiment. The

results of your choices will be collected only when the experiment has nished, and they will

remain anonymous.

The game simulates a pure game environment: there are several rounds representing different

game shots. In each round you will receive an amount of money to play with (which at the end

will be your reward). In each period you must decide either to bet some of this money or to

save it. Regardless of your choice, you may be pulled out at any moment of the game, and if

you have decided to bet in one or more of the last four rounds you will lose the bet and have to

pay a penalty. The extraction may never take place, and it is decided and performed only by the

computer, without any direct intervention by the researchers.

All relevant information will be provided directly on the computer screen, and you must not

communicate with anyone during the whole experiment.

At the beginning of the experiment your probability to be pulled out during the active round is

6% and is independent from the probability that other people would be extracted. This means that

in a given round can happen that none subject is pulled out, or, on the opposite, that all subjects are

extracted. The probability can change during the experiment but you will be informed thorough

the computer screen before that this change should take place.

This is an example of the ne that you should pay if you decided to bet and would be

extracted:

Round Round money Extraction Money to bet Money actually bet Round net win Penalty Total win

9 0.52 NO 0.15 0 0.36 0 3.05

10 0.52 NO 0.15 0.10 0.41 0 3.41

11 0.52 NO 0.15 0.10 0.46 0 3.82

12 0.52 SI 0.15 0

a

1.24 4.29

13 0.52 SI 0.15 0.15

b

0.13 3.36

a

You have been extracted; the extraction regards the last four rounds. As you betted 0.103 Euro cents in round 11 and

0.103 Euro cents in round 10 you must pay 0.206 (0.103 +0.103) plus the penalty, which is six times the amount betted,

i.e., 0.206 6 =1.239 Euro. Your win in this round is therefore 0.929 Euro cents and the penalty will be subtracted from

your nal reward. The nal reward cannot be negative so your worst possible result is to nish the experiment without

any money reward.

b

The bets that have been detected and penalised in a previous round cannot be penalised twice. At round 13 the

bets of round 11 and 10 are not considered in computing the penalty that will be computed only for round 13, i.e.,

0.154 6 =0.929 Euro cents. In the case that the experiment should nish at round 13 your nal reward should be

3.356 +0.516 0.154 0.929 =2.789 Euro cents.

This is the sequence that you must follow in each round of the game:

(1) write your secret code, that you will see on the computer screen, on the small sheet piece of

paper that you will receive at the beginning of the experiment, you will use the secret code

to be paid at the end of the experiment;

(2) get the information about your round income and the money that you can bet;

(3) decide the amount of the bet (between zero and the total amount) and write it in the appropriate

window of the computer screen;

(4) press the enter key.

If you do not perform the entire routine, the computer will not allow you to pass to a new

round, and you will have to repeat everything.

834 L. Mittone / The Journal of Socio-Economics 35 (2006) 813835

Appendix B

See below Fig. B.1

Column Lag in Fig. 7 reports the time lag on which the autocorrelation is computed. Col-

umn Autocorr shows the correlation value, column Standerr the autocorrelation variability and

Box-Ljung the value of the autocorrelation test. Column Prob indicates the value of correlation

Fig. B.1. Autocorrelation experiment DY1 group 0.

Fig. B.2. Two-sample comparison (DY2).

L. Mittone / The Journal of Socio-Economics 35 (2006) 813835 835

signicance (it is signicant if p <0.05). The picture in the middle of the gure shows the auto-

correlation values and the condence levels. Each time that an autocorrelation value exceeds the

condence levels, then the correlation is statistically signicant.

References

Adams, J.S., 1965. Inequity in social exchange. In: Berkowitz, L. (Ed.), Advances in Experimental Social Psychology.

Academic Press, New York, pp. 167299.

Allingham, M.G., Sandmo, A., 1972. Income tax evasion: a theoretical analysis. Journal of Public Economics 1, 323338.

Alm, J., Mc Clelland, G.H., Schulze, W.D., 1992a. Why do people pay taxes? Journal of Public Economics 48, 2138.

Alm, J., Jackson, B.R., Mckee, M., 1992b. Estimating the determinants of taxpayer compliance with experimental data.

National Tax Journal 1, 107114.

Baldry, J.C., 1985. Income tax evasion and the tax schedule: some experimental results. Public Finance 42, 357383.

Baldry, J.C., 1986. Tax evasion is not a gamble: a report on two experiments. Economic Letters 22, 333335.

Becker, G., 1968. Crime and punishment: an economic approach. Journal of Political Economy 76, 169217.

Becker, W.H., Buchner, H.J., Sleeking, S., 1987. The impact of public transfer expenditures on tax evasion: an experimental

approach. Journal of Public Economics 34, 243252.

Bosco, L., Mittone, L., 1997. Tax evasion and moral constraints: some experimental evidence. Kyklos vol.50 (3), 297324.

Chung, P., 1976. On complaints about high taxes: an analytical note. Public Finance 31, 3647.

Cowell, F.A., 1990. Cheating the Government. MIT Press, Cambridge MA.

Spicer, M.W., Lee Becker, L.A., 1980. Fiscal inequity and tax evasion: an experimental approach. National Tax Journal

2, 171175.

Thibaut, J., Friedland, N., Walker, L., 1974. Compliance with rules: some social determinants. Journal of Personality and

Social Psychology 30 (6), 792801.

Tversky, A., Kahneman, D., 1979. Prospect theory: an analysis of decision under risk. Econometrica 47, 263291.

Tversky, A., Kahneman, D., 1992. Advances in prospect theory: cumulative representation of uncertainty. Journal of Risk

and Uncertainty 5, 297323.

Webley, P., Halstead, S., 1986. Tax evasion on the micro: signicant simulations or expedient experiments? Journal of

Interdisciplinary Economics 1, 87100.

Webley, P., Robben, H., Elffers, H., Hessing, D., 1991. Tax Evasion: An Experimental Approach. University Press,

Cambridge.

Yaniv, G., 1994. Tax evasion and the income tax rate: a theoretical re-examination. Public Finance 49, 107112.

Yitzhaki, S., 1974. A note on income tax evasion: a theoretical analysis. Journal of Public Economics 3, 201202.

Vous aimerez peut-être aussi

- 2014 Slepian Ambady Novel Metaphors Cognition PDFDocument6 pages2014 Slepian Ambady Novel Metaphors Cognition PDFGirba EmiliaPas encore d'évaluation

- Mitroff Et Al 2004 Nothing Compares 2 Views Change Blindness Can Occur Despite Preserved Access To The Changed Information.Document14 pagesMitroff Et Al 2004 Nothing Compares 2 Views Change Blindness Can Occur Despite Preserved Access To The Changed Information.Girba EmiliaPas encore d'évaluation

- Barenholtz Et AlDocument9 pagesBarenholtz Et AlGirba EmiliaPas encore d'évaluation

- Attention Seeing and Change BlindnessDocument28 pagesAttention Seeing and Change BlindnessGirba EmiliaPas encore d'évaluation

- Casasanto&Lupyan AdHocConcepts 2015Document24 pagesCasasanto&Lupyan AdHocConcepts 2015Girba EmiliaPas encore d'évaluation

- Embodied Cognition ShapiroDocument34 pagesEmbodied Cognition ShapiroGirba EmiliaPas encore d'évaluation

- ASHP Guidelines On Pharmacist-ConductedDocument3 pagesASHP Guidelines On Pharmacist-ConductedGirba Emilia100% (1)

- Disability and Inclusive EducationDocument32 pagesDisability and Inclusive EducationGirba EmiliaPas encore d'évaluation

- 1 s2.ddd0 S1053811913001717 MainDocument10 pages1 s2.ddd0 S1053811913001717 MainGirba EmiliaPas encore d'évaluation

- A CBT Case Formulation Framework For Treatment of Anxiety DisordersDocument13 pagesA CBT Case Formulation Framework For Treatment of Anxiety DisordersGirba Emilia50% (2)

- The Self-Objectification QuestionnaireDocument1 pageThe Self-Objectification QuestionnaireGirba EmiliaPas encore d'évaluation

- Change BlindnessDocument8 pagesChange BlindnessGirba EmiliaPas encore d'évaluation

- Barrett, Grimm, Robins, Wildschut, Sedikides Music-Evoked Nostalgia. Affect, Memory, and PersonalityDocument14 pagesBarrett, Grimm, Robins, Wildschut, Sedikides Music-Evoked Nostalgia. Affect, Memory, and PersonalityGirba EmiliaPas encore d'évaluation

- DMQ RDocument8 pagesDMQ RGirba EmiliaPas encore d'évaluation

- Raise Your Hand If You Think I Am Attractive: Second and Fourth Digit Ratio As A Predictor of Self-And Other-Ratings of AttractivenessDocument9 pagesRaise Your Hand If You Think I Am Attractive: Second and Fourth Digit Ratio As A Predictor of Self-And Other-Ratings of AttractivenessGirba EmiliaPas encore d'évaluation

- The Roles of Persistence and Perseveration in PsychopathologyDocument12 pagesThe Roles of Persistence and Perseveration in PsychopathologyGirba EmiliaPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Introduction To AccountingDocument6 pagesIntroduction To AccountingKathlyn BesaPas encore d'évaluation

- Case C-132/88 Commission V GreeceDocument7 pagesCase C-132/88 Commission V GreeceJane Chan Ee NinPas encore d'évaluation

- Heavy Metal and Tube India PVT LTD Unit 1 - 272 - 17-06-2022Document1 pageHeavy Metal and Tube India PVT LTD Unit 1 - 272 - 17-06-2022pragnesh prajapatiPas encore d'évaluation

- Water BillDocument1 pageWater Billjyshele darosaPas encore d'évaluation

- Jean Keating's Prison TreatiseDocument41 pagesJean Keating's Prison Treatise:Lawiy-Zodok:Shamu:-ElPas encore d'évaluation

- Trial Balance 2020Document13 pagesTrial Balance 2020Wilton MwasePas encore d'évaluation

- 3rd BOCE MinutesDocument8 pages3rd BOCE MinutesKrishna Kanth KPas encore d'évaluation

- 519 986 1 SMDocument17 pages519 986 1 SMvenipin416Pas encore d'évaluation

- Portfolio Summary: Chetan Vijayrao KaleDocument2 pagesPortfolio Summary: Chetan Vijayrao KaleChetan KalePas encore d'évaluation

- Assignment: Government Municipel Degree College FaisalabadDocument28 pagesAssignment: Government Municipel Degree College FaisalabadARASTOO K KHYALPas encore d'évaluation

- Operations Management: Location StrategiesDocument18 pagesOperations Management: Location StrategiesRavi JakharPas encore d'évaluation

- Company Profile For One Water Bottling Mfg.Document5 pagesCompany Profile For One Water Bottling Mfg.John BaptistPas encore d'évaluation

- Questions Leb Grou2Document7 pagesQuestions Leb Grou2Rohit VermaPas encore d'évaluation

- Project: Topic: "Document11 pagesProject: Topic: "InnaInushiPas encore d'évaluation

- Apple Blossom Answers 1Document20 pagesApple Blossom Answers 1Willie Jolly78% (9)

- TEST FAR670 - OCT2022 (NACAB10B) - 10 Dec 2022Document3 pagesTEST FAR670 - OCT2022 (NACAB10B) - 10 Dec 2022Fatin AqilahPas encore d'évaluation

- Exim Project ReportDocument70 pagesExim Project ReportMrinal KakkarPas encore d'évaluation

- Domondon Based Tax ReviewerDocument77 pagesDomondon Based Tax ReviewerGenevieve Penetrante100% (1)

- Invoice 222374 Bhagat Enterprises District VBD Officer DumkaDocument2 pagesInvoice 222374 Bhagat Enterprises District VBD Officer DumkaITCT EDUCATIONPas encore d'évaluation

- Skop LI DDPW UTMDocument7 pagesSkop LI DDPW UTMIzzuddin FauziPas encore d'évaluation

- Test Bank For Corporate Finance The Core, 5e Jonathan BerkDocument13 pagesTest Bank For Corporate Finance The Core, 5e Jonathan Berksobiakhan52292Pas encore d'évaluation

- Instant Download Ebook PDF Federal Tax Research 11th Edition by Roby Sawyers PDF ScribdDocument41 pagesInstant Download Ebook PDF Federal Tax Research 11th Edition by Roby Sawyers PDF Scribdotis.zahn448100% (48)

- API MidtermDocument4 pagesAPI MidtermsimranPas encore d'évaluation

- Investment Banking Using ExcelDocument2 pagesInvestment Banking Using Excelrex_pprPas encore d'évaluation

- Tax Q&A - Employment IncomeDocument5 pagesTax Q&A - Employment IncomeHadifli100% (1)

- To What Extent Is The Government Responsible For The Increasing Divide Between The Rich and The Poor.Document11 pagesTo What Extent Is The Government Responsible For The Increasing Divide Between The Rich and The Poor.Tazeen FatimaPas encore d'évaluation

- Synthesis EssayDocument6 pagesSynthesis Essayapi-254149514Pas encore d'évaluation

- Example Withholding TaxDocument2 pagesExample Withholding TaxRaudhatun Nisa'Pas encore d'évaluation

- 2019 Budget: Full SpeechDocument174 pages2019 Budget: Full SpeechThe Independent GhanaPas encore d'évaluation