Académique Documents

Professionnel Documents

Culture Documents

Tata Motors - Krishna Kedia

Transféré par

Krishna Kedia100%(1)100% ont trouvé ce document utile (1 vote)

250 vues39 pagesRatio Analysis of Tata Motors (2009-14)

Titre original

Tata Motors_Krishna Kedia

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentRatio Analysis of Tata Motors (2009-14)

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

100%(1)100% ont trouvé ce document utile (1 vote)

250 vues39 pagesTata Motors - Krishna Kedia

Transféré par

Krishna KediaRatio Analysis of Tata Motors (2009-14)

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 39

PROJECT ON

RATIO ANALYSIS OF TATA MOTORS

AS A PART OF

PARTIAL FULFULLMENT OF

MBA

SUBMITTED BY:

KRISHNA KEDIA (012014008)

BATCH:

MBA 2014-16 (BLOCK-I)

MODULE:

FINANCIAL ACCOUNTING

MODULE LEADER:

MRS. MEGHNA DANGI

ACKNOWLEDGEMENT

I take this opportunity to express my profound gratitude and deep regards to my guide (Mrs.

Meghna Dangi) for her exemplary guidance, monitoring and constant encouragement throughout

the project.

I am obliged to my batch mates for the valuable information provided by them in their respective

fields. I am grateful for their cooperation during the period of my assignment.

--Krishna Kedia

TABLE OF CONTENTS

Topic Page Number

Executive Summary

1

Industry Overview

2

Company Overview

3-5

Ratio Analysis

1. Liquidity Ratios

Current Ratio

Quick Ratio

2. Turnover Ratios

Fixed Asset Turnover Ratio

Current Asset Turnover Ratio

Working Capital Turnover Ratio

Capital Employed Turnover Ratio

3. Solvency Ratios

Debt-Equity Ratio

Proprietary Ratio

4. Profitability Ratios

Gross Profit Margin

Net Profit Ratio

5. ROI Ratios

Return on Asset

Return on Capital Employed

Return on Equity

EPS & DRP

6-27

Conclusion 28

References 29-31

Annexures 32-35

EXECUTIVE SUMMARY

The automobile sector of any country contributes immensely towards national growth. Such is the

case in India where the Indian Automobile Industry accounts for almost 9% of the nations GDP.

Being the industry leader, Tata Motors has been the oldest and one of the most efficient performers

of this sector. An SBU owned by Tata Sons, Tata Motors has been one of the most preferred

options for the investors. Before making an investment, every investor would be interested in

knowing the past performance of the company, so as to predict their future returns and the risks

associated with the company. This report talks about the financial ratios of Tata Motors over the

period of last five years and tries to offer a birds eye view of the companys fundamentals till

date.

Tata Motors was not left unaffected by the global economic meltdown of 2007-08, which

overshadowed the automobile sector throughout the world. Since 2010-11, the performance of the

company has gone down substantially. One of the reasons was the drop in the sales by 24%, which

was caused due to an increases in the excise duty by the government. It was during this period

when Tata motors launched one of its most promising project, Tata Nano, which did not perform

as per the companys expectations. An increase in the fuel prices during this period added to the

companys woes, since it made the buyers more skeptical towards their purchases. The company

also made a big investments by acquiring Jaguar Land Rover during this period. The company did

bounce back after 2011, but has still struggling to build the momentum that they need to set

themselves to the path of profitability. The company has been struggling a little in terms of creating

assets for the business or generating profits for its investors. Still, the investors continue to show

faith in the company since the DPR of the company has been growing constantly. Thus, the

investors perceive it as a slow but steady growing stock which is bound to earn them great profits

if not immediately, but definitely. The company continues on this trail and looking at the current

performances of the company, it can been observed that the company will soon revive from the

impact of the economic depression and regain its momentum and again become one of the main

investment options for the potential investors.

INDUSTRY OVERVIEW

The Automotive industry is the key driver of any growing economy. A sound transportation system

plays a pivotal role in a countrys rapid economic and industrial development. The well-developed

Indian automotive industry ably fulfils this catalytic role by producing a wide variety of vehicles.

The automobile industry comprises automobile and auto component sectors. It includes passenger

cars; light, medium and heavy commercial vehicles; multi-utility vehicles such as jeeps, scooters,

motorcycles, three-wheelers and tractors; and auto components like engine parts, drive and

transmission parts, suspension and braking parts, and electrical, body and chassis parts.

Indias automotive industry is now worth $34 billion and expected to grow $145billion in another

ten years. The Indian automotive industry is growing at a very high rate with sales of more than

one million passenger vehicles per annum. The overall growth rate is 10-15 per cent annually.

India is the worlds second largest manufacturer of two-wheelers, fifth largest manufacturers of

commercial vehicles as well as largest manufacturer of tractors. It is the fourth largest passenger

car market in Asia and home to the largest motorcycle manufacturer. Major players in this sector

include Tata, Mahindra, Daewoo Motor India, Hyundai Motors India and General Motors India,

Maruti, Ashok Leyland, Bajaj, Hero Honda, Ford, Fiat and few other players.

The Indian auto components industry is worth $10 billion. Indigenous firms like Bharat Forge,

Sundaram Fasteners, Minda Industries and Gabrial India Ltd. are in the limelight. There is a boom

in the auto components segment because of strong demand and robust economy. Also, the industry

has strong forward and backward linkages with almost every other engineering segment. The

component production range includes engine parts 31%, drive transmission and steering parts

19%, suspension and braking parts 12%, electrical parts 10%, equipments 12%, body and chassis

9% and others 7%.

Indian companies are very optimistic. The Auto Components Manufacturers Association (ACMA)

along with McKinsey has pegged domestic demand for components at $20-25 billion in 2015 from

$1.4 billion in 2004-05. This would take the overall industry size to $40-45 billion by 2015 in

India. The Indian automotive industry has made rapid strides since de-licensing witnessing the

entry of several new manufacturers with state-of-the-art technology.

COMPANY OVERVIEW

Tata Motors was established in 1945 as Tata Engineering and Locomotive Co. Ltd. to manufacture

locomotives and other engineering products. It is India's largest automobile company, with

standalone revenues of Rs. 25,660.79 crores (USD 5.5 billion) in 200809. It is the leader in

commercial vehicles in each segment, and among the top three in passenger vehicles with winning

products in the compact, midsize car and utility vehicle segments. The company is the world's

fourth largest truck manufacturer, and the world's second largest bus manufacturer.

The company's 23,000 employees are guided by the vision to be 'best in the manner in which they

operate best in the products they deliver and best in their value system and ethics.'

Tata Motors' presence indeed cuts across the length and breadth of India. Over 4 million Tata

vehicles ply on Indian roads, since the first rolled out in 1954. The company's manufacturing base

in India is spread across Jamshedpur (Jharkhand), Pune (Maharashtra), Lucknow (Uttar Pradesh),

Pantnagar (Uttarakhand) and Dharwad (Karnataka). Following a strategic alliance with Fiat in

2005, it has set up an industrial joint venture with Fiat Group Automobiles at Ranjangaon

(Maharashtra) to produce both Fiat and Tata cars and Fiat powertrains. The company is

establishing a new plant at Sanand (Gujarat). The company's dealership, sales, services and spare

parts network comprises over 3500 touch points; Tata Motors also distributes and markets Fiat

branded cars in India.

Tata Motors, the first company from India's engineering sector to be listed in the New York Stock

Exchange (September 2004), has also emerged as an international automobile company. Through

subsidiaries and associate companies, Tata Motors has operations in the UK, South Korea,

Thailand and Spain. Among them is Jaguar Land Rover, a business comprising the two iconic

British brands that was acquired in 2008.

Tata Motors is also expanding its international footprint, established through exports since 1961.

The company's commercial and passenger vehicles are already being marketed in several countries

in Europe, Africa, the Middle East, South East Asia, South Asia and South America. It has

franchisee/joint venture assembly operations in Kenya, Bangladesh, Ukraine, Russia and Senegal.

The foundation of the company's growth over the last 50 years is a deep understanding of economic

stimuli and customer needs, and the ability to translate them into customerdesired offerings

through leading edge R&D. With over 2,000 engineers and scientists, the company's Engineering

Research Centre, established in 1966, has enabled pioneering technologies and products. The

company today has R&D centers in Pune, Jamshedpur, Lucknow, in India, and in South Korea,

Spain, and the UK.

In January 2008, Tata Motors unveiled its People's Car, the Tata Nano, which India and the world

have been looking forward to. The Tata Nano has been subsequently launched, as planned, in India

in March 2009. A development, which signifies a first for the global automobile industry, the Nano

brings the comfort and safety of a car within the reach of thousands of families. The standard

version has been priced at Rs.100, 000 (excluding VAT and transportation cost).

Designed with a family in mind, it has a roomy passenger compartment with generous leg space

and head room. It can comfortably seat four persons. Its monovolume design will set a new

benchmark among small cars. Its safety performance exceeds regulatory requirements in India. Its

tailpipe emission performance too exceeds regulatory requirements. In terms of overall pollutants,

it has a lower pollution level than twowheelers being manufactured in India today. The lean

design strategy has helped minimize weight, which helps maximize performance per unit of energy

consumed and delivers high fuel efficiency. The high fuel efficiency also ensures that the car has

low carbon dioxide emissions, thereby providing the twin benefits of an affordable transportation

solution with a low carbon footprint.

The years to come will see the introduction of several other innovative vehicles, all rooted in

emerging customer needs. Besides product development, R&D is also focusing on environment

friendly technologies in emissions and alternative fuels.

Through its subsidiaries, the company is engaged in engineering and automotive solutions,

construction equipment manufacturing, automotive vehicle components manufacturing and supply

chain activities, machine tools and factory automation solutions, highprecision tooling and plastic

and electronic components for automotive and computer applications, and automotive retailing

and service operations.

True to the tradition of the Tata Group, Tata Motors is committed in letter and spirit to Corporate

Social Responsibility. It is a signatory to the United Nations Global Compact, and is engaged in

community and social initiatives on labor and environment standards in compliance with the

principles of the Global Compact. In accordance with this, it plays an active role in community

development, serving rural communities adjacent to its manufacturing locations.

AWARDS & ACCOLADES

Tata Motors among Indias most Trusted Brand in cars

Tata Motors wins award at the Bangkok International Motor Expo

Tata Motors Investor Relations ranked first in India

Nirmal Gram Puraskar awarded to Potka panchayat.

Tata Motors bags the NDTV Profit Business Leadership Award 2008

Tata Motors awarded the Top Exporter Trophy by EEPC

CVBU Pune wins Rajiv Gandhi National Quality Award for 2007.

PCBU bags Handa Golden Key Award.

Tata Motors receives Uptime Champion Award 2007

Aggregates Business, CVBU, bags 'Best Supplier Award' from ECEL

'NDTV Profit' Business Leadership Award

Tata Motors bags National Award for Excellence in Cost Management.

Tata Motors' TRAKIT bags silver award for 'Excellence in Design'

Tata Motors Pune CVBU has bagged the 'Golden Peacock National Quality Award

Tata Motors was awarded four prestigious honours, at the 'CNBC TV18 Autocar.

Tata Motors chosen as India's Most Trusted Brand in Cars.

Business today selects Mr. P.P. Kadle as India's Best CFO in 2005.

Pune Foundry Division bags prestigious Green Foundry Award.

Tata Motors is 'Commercial Vehicle Manufacturer of the Year'.

ACE bags 'Best Commercial Vehicle Design' at the BBCTop Gear Awards.

Jamshedpur bags National Energy Conservation Award for the fourth consecutive year. Tata

Motors bags the prestigious' CIIEXIM Bank award' for business excellence.

Tata Motors receives JRD QV awards for Business Excellence.

'Car Maker of the Year' Award for Tata Motors.

Tata Motors is 'Commercial Vehicle Manufacturer of the Year'.

TNS Voice of the Customer Award for Indica Diesel.

'CFO of the Year Award 2004' awarded to Mr Praveen P Kadle, Executive Director

Tata Motors wins the prestigious 'Corporate Platinum' Award Tata Motors wins 'Golden

Peacock Award' for Corporate Social Responsibility.

RATIO ANALYSIS

LIQUIDITY RATIOS

It is the ratio that measures a companys ability to fulfill its short term debt obligations or the

ability of a company to pay off its short term liability, if and when they take a fall.

In case of Liquidity Ration, higher the ratio, higher is the margin of safety to pay off its current

liabilities and other short term borrowings. Liquidity ration greater than 1, signposts its sound

financial health.

The liquidity ratios are an outcome of dividing cash and other liquid assets (current assets) by the

short term borrowings (current liabilities). They show the number of times the short term debt

obligations are covered by the cash and liquid assets. If the value is superior to 1, it means the

short term obligations are abundantly covered.

The most common Liquidity Ratios are Current Ratio and Acid Test Ratio/Quick Ratio. The

aforementioned ratios are readily being used by short term creditors, bankers, government

agencies, Bankruptcy analysts and mortgage originators. Using these ratios they analyze and

forecast the financial wellbeing of a company and determine their stand accordingly.

CURRENT RATIO

It is the ratio that measures a companys ability to meet its debts over the period of next 12 months,

by comparing the companys current assets and current liabilities.

Current Ratio = Current Assets / Current Liabilities

2010 2011 2012 2013 2014

Current Assets 5,939.67 8,923.19 9,137.51 6,735.93 5,305.38

Current Liabilities 16,909.30 16,271.85 20,280.82 16,580.47 13,334.13

Current Ratio 0.351266463 0.54838202 0.45054934 0.40625688 0.39787973

INTERPRETATION

With an industrial average of 1.23, the average (over 5 years) current ratio of Tata Motors is 0.4

which is fairly low in immediate comparison. The ideal current ratio for automobile sector in India,

for the last decade, has been between 0.88-1.4. A low figure in Current ratio does not necessarily

mean that the company is underperforming, though it may raise some financial concerns for the

stakeholders of the company and may make the company less attractive for the investors. However,

a strong operating cash flow and the slow cash conversion cycle of the company provide a

reasonable explanation for its Current Ratio being low. The aforementioned graph depicts that the

Current Ratio of Tata Motors saw a quantum jump in 2010-11 from 0.35 to 0.54. However, since

then it has been moving at an even pace of 0.4 until the last financial year.

ACID TEST RATIO / QUICK RATIO

It is the ratio that indicates the companys ability to cover all its current liabilities using its current

or short term assets, without selling its inventory. Ideally, the Quick Ratio should be 1:1, however,

it differs from sector to sector. Quick ratio specifies whether the assets that can be quickly

converted into cash are sufficient to cover current liabilities.

Quick Ratio = Liquid Assets / Liquid Liabilities

0

0.1

0.2

0.3

0.4

0.5

0.6

2010 2011 2012 2013 2014

Current Ratio

2010 2011 2012 2013 2014

Quick Assets 1442.85 2280.9 4549.28 4334.96 3004.08

Quick Liabilities 13334.13 16580.47 20280.82 16271.85 16909.3

Quick Ratio 0.10820728 0.13756546 0.2243144 0.26640855 0.17765845

INTERPRETATION

The aforementioned graph depicts that the company is far from what is considered an ideal figure

for quick ratio which is 1:1. However, considering the industry average of 0.19, the company has

not been doing too badly either. This shows that the company relies too much on inventory or other

assets to pay its short-term liabilities. It also shows that the company has fast moving inventories.

In comparison to its immediate competitor, Mahindra & Mahindra, whose average quick ratio is

0.8, the company is a little down played with an average of 0.18.

0

0.05

0.1

0.15

0.2

0.25

0.3

2010 2011 2012 2013 2014

Quick Ratio

TURNOVER RATIOS

Turnover ratios are also acknowledged as activity or efficiency ratios. It often refers to the

companys ability to translate different accounts within their balance sheets into cash or sales.

Companies will normally try to turn their manufacture into cash or sales as fast as possible because

this will, in general, lead to greater revenues. Such ratios are frequently used when performing

fundamental analysis of the company.

There are various types of Turnover Ratios, namely:-

1. Inventory turnover ratio

2. Debtors turnover ratio

3. Average collection period

4. Total assets turnover ratio

5. Fixed assets turnover ratio

6. Capital employed turnover ratio

FIXED ASSET TURNOVER RATIO

Fixed assets turnover ratio is also called as the ratio of sales to fixed assets. It indicates how

efficiently the fixed assets are being used by the company. It measures the efficiency with which

the company has been using its fixed assets to generate sales.

Fixed Asset Turnover Ratio = Net Sales / Fixed Assets

2010 2011 2012 2013 2014

Net Sales 35,373.29 47,088.44 54,306.56 44,765.72 34,319.28

Fixed Assets 16,436.04 17,475.63

19,056.19

20,208.54 21,169.43

Fixed Asset

Turnover Ratio

2.15217838 2.69452031 2.84981206 2.21518823 1.62117166

INTERPRETATION

Since there are no standard guidelines about the best level of Fixed Asset Turnover Ratio, it must

be compared over the years for the same company. The company has not shown a symmetrical

performance in accordance to the industrial performance, with an average fixed asset turnover ratio

of 4.44. However, a low figure of fixed asset turnover ratio can be traced down to the fact that

either the sales of the company are fairly low or the company has made a huge investment recently,

which is indeed the case with Tata Motors. Since its purchase of Jaguar Land Rover in 2008, which

accounted for a huge overseas investment by the firm, the fixed asset turnover ratio arises from

just over 2. Subsequently, the figure skyrocketed until 2012 due to the overwhelming sales of Tata

Nano. It than took a nosedive due to a dip in the sales of automobile sector by 24% which hit the

company really bad. Further, the company also announce a major investment of 15000-2000 crores

in the heavy duty vehicle segment, which further pulled the figure for the fixed asset turnover ratio

to 1.6. However, this does not prove that the company has been performing badly since this ratio

is an arbitrary figure and not an absolute one.

0

0.5

1

1.5

2

2.5

3

2010 2011 2012 2013 2014

Fixed Asset Turnover Ratio

WORKING CAPITAL TURNOVER RATIO

It is a metric equating the reduction of working capital to generate of sales over a given period.

This provides some useful information as to how effectively a company is using its working capital

to generate sales. A company utilizes its working capital to fund operations and acquire inventory.

These operations and inventory are then converted into sales revenue for the company. The

working capital turnover ratio is used to analyze the relationship between the money used to fund

operations and the sales generated from these operations.

Working Capital turnover Ratio = Net Sales / Working Capital

2010 2011 2012 2013 2014

Net Sales 35,373.29 47,088.44 54,306.56 44,765.72 34,319.28

Working Capital 5,232.15 3,799.03 4,036.67 4,752.80 6,355.07

Working Capital

Turnover Ratio

6.76075609 12.3948587 13.4533068 9.41880996 5.40029929

0

2

4

6

8

10

12

14

16

2010 2011 2012 2013 2014

Working Capital Turnover Ratio

Series1

INTERPRETATION

The aforementioned graph shows an uneven working capital turnover ratio as recorded by the

company. In comparison to its immediate competitor, Mahindra & Mahindra, the company has a

fairly low value for its working capital turnover ratio. The primary reason for this is the

insufficiency of working capital with the company. Their current liabilities account for almost

double of their current assets. Also the accounts Receivables of the company is very high in

comparison to its competitors. Since 2012, the numbers took a nosedive, proving the in-efficiency

of the management in utilizing its working capital to generate sales and poor operational activities

of the company.

CAPITAL EMPLOYED TURNOVER RATIO

The capital employed turnover ratio reveals the association between the shareholders' investment

in the business and the turnover that the management has been able to generate from it. A high

capital turnover ratio designates the ability of the organization to achieve supreme sales with least

amount of capital employed. Higher the capital turnover ratio better it is.

Capital Employed Turnover Ratio = Net Sales / Capital Employed

2010 2011 2012 2013 2014

Net Sales 35,373.29 47,088.44 54,306.56 44,765.72 34,319.28

Capital Employed 14,520.39 18,379.64 10,356.82 16,823.06 20,358.05

Capital Employed

Turnover Ratio

2.43611156 2.56198924 5.24355545 2.66097369 1.68578425

Capital Employed (Total Assets - Current Liabilities)

2010 2011 2012 2013 2014

Total Assets 31429.69 34651.49 30637.64 33403.53 33692.18

Current Liabilities

16,909.30 16,271.85 20,280.82 16,580.47 13,334.13

Capital Employed 14,520.39 18,379.64 10,356.82 16,823.06 20,358.05

INTERPRETATION

The aforementioned graph shows a steady performance of the company in terms of Capital

Employed Turnover Ratio, except in year 2012. In 2012 the net sales of the company was

excessively high and was mainly propelled by the overwhelming increase of 136% in the sales

made by Jaguar Land Rover. Owing to this, Tata Motors was able to record a peak in its Capital

Employed Turnover Ratio.

0

1

2

3

4

5

6

2010 2011 2012 2013 2014

Capital Employed Turnover Ratio

Series1

SOLVANCY RATIOS

They measure the capacity of a company to compensate its long term debt and the interest on it.

Solvency ratios, help the business owner conclude the chances of the firm's long-term survival.

These ratios are of interest to long-term creditors and shareholders. These groups are concerned

with the long-term health and survival of business firms. Solvency ratios have to attest that

business can service their debt or pay the interest on their debt as well as pay the principal when

the debt matures.

DEBT-EQUITY RATIO

It is the ratio of total liabilities of a business to its shareholders' equity. It is a leverage ratio and

measures the degree to which the assets of the business are financed by the debts and the

shareholders' equity of a business.

Debt-Equity Ratio = Total Debts / Shareholders Fund

2010 2011 2012 2013 2014

Debt 16,625.91 14,638.19 11,011.63 14,268.69 14,515.53

Shareholder's

Fund

14,779.15 20,013.30 19,626.01 19,134.84 19,176.65

Debt Equity

Ratio

1.12495712 0.731423 0.561073 0.745692 0.756938

Shareholder's Fund (Share Capital + Reserves)

2010 2011 2012 2013 2014

Share Capital 570.6 637.71 634.75 638.07 643.78

Reserves

14,208.55 19,375.59 18,991.26 18,496.77 18,532.87

Shareholder's Fund

14,779.15 20,013.30 19,626.01 19,134.84 19,176.65

INTERPRETATION

The lower the value of debt equity ratio, the better it is since it a figure highlighting the amount of

assets provided by the shareholders and creditors. Thus it indicates the soundness of long-term

financial policies of the company. In comparison to an industrial average of 2.61, the Debt-Equity

ratio of Tata Motors if fairly low since it was highest recorded at 1.2 in 2010 and came down

substantially to 0.56 in 2012. Tata Motors achieved the aforementioned results by slashing down

their total debt figures from 16,625 crores to 11,011 crores. An increase in the sales of Jaguar Land

Rover by 136% is what propelled the company to achieve such overpowering results. Since then,

the Debt-Equity Ratio rose to 0.74 due to drop in sales of automobile in Indian markets due to

increase in excise duty which led to a drop in the sales by 24%.

PROPREITARY RATIO

Also known as Equity Ratio or the Net Worth to Total Assets Ratio, it is the ratio of shareholders'

funds to total assets. A high ratio indicates that the firm has adequate amount of equity to upkeep

the functions of the business.

Proprietary Ratio = Shareholders funds / Total Assets

0

0.2

0.4

0.6

0.8

1

1.2

2010 2011 2012 2013 2014

Debt Equity Ratio

Series1

2010 2011 2012 2013 2014

Shareholder's Equity

570.6 637.71 634.75 638.07 643.78

Total Assets

31429.69 34651.49 30637.64 33403.53 33692.18

Proprietary Ratio 0.01815481 0.018404 0.020718 0.019102 0.019108

INTERPRETATION

The Proprietary Ratio for Tata Motors is very low which indicates that the business may be making

use of too much debt or trade payables, rather than equity, to support operations.

0.0165

0.017

0.0175

0.018

0.0185

0.019

0.0195

0.02

0.0205

0.021

2010 2011 2012 2013 2014

Propreitory Ratio

Series1

PROFITABILITY RATIOS

It is a measure of profitability, which measures a company's performance. Profitability is the

ability to make a profit, and a profit is what is left over from income earned after the company

has deducted all costs and expenses related to earning the income

Types of Profitability Ratios:-

Common profitability ratios used in analyzing a company's performance include gross profit

margin (GPM), operating margin (OM), return on assets (ROA), return on equity (ROE), return

on sales (ROS), and return on investment (ROI).

GROSS PROFIT MARGIN

It shows the proportion of profits spawned by the sale of products or services, before selling and

administrative expenses. In addition, it reveals the capability of a business to create sellable

products in a cost-effective way. The ratio is of great significance, especially when traced on a

trend line, to see if a business can continue to provide products to the marketplace for which

customers are willing to pay.

Gross Profit ratio = Gross Profit / Net Sales

2010 2011 2012 2013 2014

Gross Profit Margin 8.47 7.01 4.73 -0.22 -8.59

-10

-8

-6

-4

-2

0

2

4

6

8

10

2010 2011 2012 2013 2014

Gross Profit Margin

Series1

INTERPRETATION

A business's ultimate goal is to raise its profit margins. However, decreasing the gross profit

margin temporarily may be beneficial in the long run. The company may decrease its gross profit

margin by lowering the cost of the goods it sells or by using higher quality, and thus more

expensive, materials to make the goods. Lower prices attract new customers, which may eventually

raise profit margins. Likewise, higher quality goods retains customers, which also can raise profit

margins in the future.

NET PROFIT RATIO

It is the ratio of after-tax profits to net sales. It discloses the remaining profit after all costs of

production, administration, and financing have been subtracted from sales, and income taxes

documented. As such, it is one of the finest measures of the overall performance of a firm,

particularly when shared with an evaluation of how well it is spending its working capital.

Net Profit Ratio = Net Profit / Net Sales

2010 2011 2012 2013 2014

Net Profit

2240.08 1811.82 1242.23 301.81 334.52

Net Sales

35373.29 47088.44 54306.56 44765.72 34319.28

Net Profit Ratio 0.063327 0.038477 0.022874 0.006742 0.009747

0

0.01

0.02

0.03

0.04

0.05

0.06

0.07

2010 2011 2012 2013 2014

Net Profit Ratio

Series1

INTERPRETATION

Owing to the poor performance of the automotive sector in India, the Net Profit Ratio has taken a

nosedive for Tata Motors. Since 2010, it has come down from 6% to 2% in 2012 and further

decreased to less than 1%. The paramount reason was the decrease in the sales by 24% due to a

hike in excise duty. Since 2009, the post-recession era, the economy is in a downturn causing it to

take a plunge which further led to reduction of sale and increase in the Input costs. Thus, the profit

margin of the company took a great hit.

OVERALL PROFITABILITY / ROI RATIOS

This ratio is also named as Return on Investments (ROI) or Return on Capital Employed

(ROCE). It shows the percentage of return on the total capital employed in the business. This ratio

processes the relationship between net profit before interest and tax and capital employed.

The objective of calculating this ratio is to find out how efficiently the long term funds supplied

by the creditors and the shareholders have been used.

RETURN ON ASSETS

It is the ratio of annual net income to total assets of a business during a financial year. It processes

efficiency of the business in using its assets to produce net income. It is an indicator of how

profitable a company is relative to its total assets. ROA gives an idea as to how efficient

management is at using its assets to generate earnings.

Return on Assets = Net Income / Total Assets

2010 2011 2012 2013 2014

Net Profit After Tax

2240.08 1811.82 1242.23 301.81 334.52

Total Assets

31429.69 34651.49 30637.64 33403.53 33692.18

Return on Assets 0.07127274 0.0522869 0.040546 0.00903527 0.00992871

0

0.01

0.02

0.03

0.04

0.05

0.06

0.07

0.08

2010 2011 2012 2013 2014

Return On Assets

Series1

INTERPRETATION

The aforementioned graph shows that the Return on Assets has constantly gown down since 2010

to 2014. It was mainly because of the fact that the net income of the company fell substantially

from 2,240 crores in 2010 to 334 crores in 2014 due to the poor performance of the automotive

sector, drop in the sales and increase in the excise duty.

RETURN ON CAPITAL EMPLOYED

Return on capital employed or ROCE is a profitability ratio that processes how efficiently a

company can spawn profits from its capital employed by equating net operating profit to capital

employed.

ROEC = EBIT / Capital Employed

2010 2011 2012 2013 2014

EBIT

4075.79 3580.22 2559.65 1562.69 311.72

Capital Employed

31,405.06 34,651.49 30,637.64 33,403.53 33,692.18

Return On Capital

Employed

0.13 0.10 0.08 0.05 0.01

Capital Employed (Equity Share Capital + Preference Share Capital + Reserves + Long

Tem Debts - Fictitious Assets)

2010 2011 2012 2013 2014

Equity Share Capital 570.6 637.71 634.75 638.07 643.78

Preference Share Capital 0 0 0 0 0

Long Term Debts 16625.91 14638.19 11011.63 14268.69 14515.53

Reserves

14,208.55 19,375.59 18,991.26 18,496.77 18,532.87

Capital Employed

31,405.06 34,651.49 30,637.64 33,403.53 33,692.18

INTERPRETATION

In the wake of demand slump due to prolonged slowdown in the economy, the company has not

been able to make adequate profits. Weak consumer sentiment, subdued infrastructure activity,

tight financing environment with high interest rate continued to impact the performance of the

automobile industry and the company. Though the profits have been dropping, the capital

employed has held its position firmly. This shows that the investors and other financial institutions

that have pooled in money, have positive sentiments regarding the company, which again reflects

the strong goodwill and strong fundamentals of the company. ROEC has come down from 13% to

almost 1% within a span of five years. Similar is the situation with the other automobile giants in

the Indian automotive sector since no player is immune from such macroeconomic factors

affecting their business.

RETUEN ON EQUITY

This ratio determines the amount of net income reverted as a percentage of shareholders equity.

Return on equity processes a corporation's profitability by enlightening how much profit a

company creates with the money shareholders have invested.

ROE = (NPAT Preference Dividend) / Equity Shareholders Fund

0.00

0.02

0.04

0.06

0.08

0.10

0.12

0.14

2010 2011 2012 2013 2014

Return on Capital Employed

Series1

2010 2011 2012 2013 2014

N.P.A.T - Preference

Dividend 2240.08 1811.82 1242.23 301.81 334.52

Equity Shareholder's Fund

14,779.15 20,013.30 19,626.01 19,134.84 19,176.65

Return On Equity 0.15 0.09 0.06 0.02 0.02

Shareholder's Fund (Share Capital + Reserves)

2010 2011 2012 2013 2014

Share Capital 570.6 637.71 634.75 638.07 643.78

Reserves

14,208.55 19,375.59 18,991.26 18,496.77 18,532.87

Shareholder's Fund

14,779.15 20,013.30 19,626.01 19,134.84 19,176.65

INTERPRETATION

The aforementioned graph depicts that the ROE of the company has come down substantially,

showing no signs of taking off again in the near future. The predominant reason behind this is the

dropping profits of the company, spearheaded by the prolonged economic depression and setback

of the Indian stock markets. The company has a beta of 1.61 which makes it very vulnerable under

0.00

0.02

0.04

0.06

0.08

0.10

0.12

0.14

0.16

2010 2011 2012 2013 2014

Return on Equity

Series1

adverse market conditions. A setback in the sales, increase in the excise duty for automobiles,

underperformance by Nano project is what led to a reduced figure of ROE. To revive from this

position, the company needs to increase their sales turnover, widen their margins on sales, avail

cheaper leverage and cut back on their taxes.

EARNING PER SHARE

EPS (Earning per Share) measures the profit earned per share by the shareholders. It is the portion

of a company's profit allotted to each outstanding share of common stock. Earnings per share

serves as a pointer of a company's profitability. Higher the value of EPS, higher is the

attractiveness of the stock to the investors.

EPS = (NPAT Preference Dividend) / Total No. of Equity Shares Outstanding

2010 2011 2012 2013 2014

N.P.A.T - Preference Dividend

2240.08 1811.82 1242.23 301.81 334.52

No. Of Equity Shares

Outstanding 5,705.58 6,346.14 31,735.47 31,901.16 32,186.80

EPS 0.39 0.29 0.04 0.01 0.01

0.00

0.05

0.10

0.15

0.20

0.25

0.30

0.35

0.40

0.45

2010 2011 2012 2013 2014

Earning Per Share

Series1

INTERPRETATION

From the aforementioned graph, it can be concluded that the EPS has come down from 0.39 to 0.1

since 2010 to 2014. There could be two possible reasons for decrease in the EPS of a company,

namely, drop in the profit levels or increase in the average number of equity shares outstanding.

Such is the case with Tata Motors, since profits in 2014 have come down to 15% of what it was in

the year 2010 and the average number of equity shares outstanding have increases six folds since

then. This is what has pushed down the levels foe EPS of the company. However, it does not prove

that the company has been performing badly, since EPS is an arbitrary figure which needs to be

compared both within the company and with the competitors, t6aking into consideration the factors

affecting the companys performance.

DIVIDEND PAYOUT RATIO

It is the ratio that depicts the percentage of earnings paid back to the shareholders in the form of

dividend. The amount that is held back by the company is called retained earnings, which is used

for further development of the company.

DPR = Dividend per Share / EPS

2010 2011 2012 2013 2014

Dividend Per Share

0.1506 0.2008 0.0404 0.0202 0.02015

EPS

0.39 0.29 0.04 0.01 0.01

Dividend Payout Ratio 0.39 0.69 1.01 2.02 2.02

0.00

0.50

1.00

1.50

2.00

2.50

2010 2011 2012 2013 2014

Dividend Payout Ratio

Series1

INTERPRETATION

From the aforementioned graph it can be concluded that the since 2010 the DPR has increases

substantially. The company has come a long way since then and the profits of the company have

not been stable either. Still, the company managed to ensure that its investors receive the returns

that they expect and deserve. This makes the company highly attractive in the eyes of the potential

investors who are looking to make an investment in growth stocks. This ratio is the opposite of the

plough-back ratio, in which the company re-invests the earnings that it makes. Since it a slow

growing company, investors expect a higher rate of DPR and the management has made sure that

the expectations of the investors are met by increasing the DPR from 0.69 to 2.02 within a span of

five years.

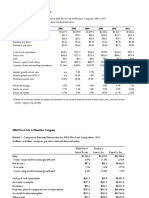

RATIO ANALYSIS SUMMARY

RATIO 2009-10 2010-11 2011-12 2012-13 2013-14

Current Ratio 0.35 0.55 0.45 0.40 0.39

Quick Ratio

0.108 0.137 0.224 0.266 0.177

Fixed Asset

Turnover Ratio

2.15 2.69 2.84 2.21 1.62

Working Capital

Turnover Ratio

6.76 12.39 13.45 9.41 5.40

Capital Employed

Turnover Ratio

2.43 2.56 5.24 2.66 1.68

Debt-Equity Ratio 1.12 0.73 0.56 0.74 0.75

Proprietary Ratio 0.018 0.018 0.02 0.019 0.019

G. P. Margin 8.47 7.01 4.73 -0.22 -8.59

N. P. Ratio 0.063 0.038 0.022 0.006 0.009

Return on Asset 0.07 0.05 0.04 0.009 0.009

Return on Capital

Employed

0.13 0.10 0.08 0.05 0.01

Return on Equity 0.15 0.09 0.06 0.02 0.02

Earnings Per Share

(EPS)

0.39 0.29 0.04 0.01 0.01

Dividend Payout

Ratio (DPR)

0.39 0.69 1.01 2.02 2.02

CONCLUSION

The Indian Automobile Industry has grown in leaps and bounds in the last decade. This is

particularly attributed to the rise in the income of the middle class, which consequently led to a

rise in the demand of personalized vehicles. Tata motors was one of the companies that occupied

a huge share of the pie. The company was doing fine doing until 2007, after which it saw a setback

due to the global economic meltdown. Such was the case with the other companies falling under

Indian Automobile Sector. However, since them, the company has revived and has come a long

way. The performance of the company has pepped up from where it was in 2009, which is quite

evident from the Ratio Analysis conducted in the aforementioned sections. This shows that the

fundamentals of the company are strong and the company is bound to perform better in the

foreseeable future.

The company may not be in the most ideal situation present since it is still feeling the after-shocks

of the economic meltdown on 2007-08 and has not been able to revive completely. The core

financial figures like the sales revenue, investment and the total liability of the company had been

impacted to a great extent which had sent a ripples effect, disturbing the other figures. However,

the downfall in the companys performance was not due to any internal factor but because of an

adverse market condition and since then the company has been trying to take off and has been

successful to some extent.

Even after all this, the management of the company has ensured that the shareholders of the

company are not at any disadvantage by disseminating the earnings evenly. Even though the net

profit has come down by 30%, the DPR ratio has been rising constantly. This is what has attracted

more and more investors towards the company. In comparison to its competitors, Tata Motors has

been performing formidably well and will continue to do so owing to its strong fundamentals and

work culture.

REFERENCES

Tata Motors Balance Sheet, Tata Motors Financial Statement & Accounts. 2014. Tata

Motors Balance Sheet, Tata Motors Financial Statement & Accounts. [ONLINE]

Available at:http://www.moneycontrol.com/financials/tatamotors/balance-sheet/TM03.

[Accessed 16 September 2014].

Tata Motors Profit & Loss account, Tata Motors Financial Statement & Accounts.

2014. Tata Motors Profit & Loss account, Tata Motors Financial Statement & Accounts.

[ONLINE] Available at:http://www.moneycontrol.com/financials/tatamotors/profit-

loss/TM03#TM03. [Accessed 16 September 2014].

Tata Motors Cash Flow, Tata Motors Financial Statement & Accounts. 2014. Tata

Motors Cash Flow, Tata Motors Financial Statement & Accounts. [ONLINE] Available

at:http://www.moneycontrol.com/financials/tatamotors/cash-flow/TM03#TM03.

[Accessed 16 September 2014].

Financial Analysis and Accounting Book of Reference: Statement of Financial Position |

IFRS Statements | IFRS Reports | ReadyRatios.com. 2014. Financial Analysis and

Accounting Book of Reference: Statement of Financial Position | IFRS Statements | IFRS

Reports | ReadyRatios.com. [ONLINE] Available

at:http://www.readyratios.com/reference/liquidity/#ref29. [Accessed 16 September 2014].

Google. 2014. Google. [ONLINE] Available

at:https://www.google.co.in/#q=current+ratio+definition. [Accessed 16 September 2014].

Industry Norms Key Business Ratios | Ratio Analysis | Credit Guru. 2014. Industry

Norms Key Business Ratios | Ratio Analysis | Credit Guru. [ONLINE] Available

at:http://www.creditguru.com/ratios/inr.htm. [Accessed 16 September 2014].

Current Ratio. 2014. Current Ratio. [ONLINE] Available

at:http://www.readyratios.com/reference/liquidity/current_ratio.html. [Accessed 16

September 2014].

. 2014. . [ONLINE] Available

at:http://www.ide.go.jp/English/Publish/Download/Jrp/pdf/154_ch6.pdf. [Accessed 16

September 2014].

Liquidity Ratios Definition | Investopedia. 2014. Liquidity Ratios Definition |

Investopedia. [ONLINE] Available

at:http://www.investopedia.com/terms/l/liquidityratios.asp. [Accessed 16 September

2014].

Quick Ratio interpretation | Liquidity ratio | Financial ratios. 2014. Quick Ratio

interpretation | Liquidity ratio | Financial ratios. [ONLINE] Available

at:http://www.ccdconsultants.com/documentation/financial-ratios/quick-ratio-

interpretation.html. [Accessed 16 September 2014].

Concept and Types of Turnover Ratios | Accounting-Management. 2014. Concept and

Types of Turnover Ratios | Accounting-Management. [ONLINE] Available

at:http://accountlearning.blogspot.in/2010/03/turnover-ratios.html. [Accessed 16

September 2014].

Tata Motors to invest Rs 1,500 crore on new trucks, buses in FY15 - Economic Times.

2014. Tata Motors to invest Rs 1,500 crore on new trucks, buses in FY15 - Economic

Times. [ONLINE] Available at:http://articles.economictimes.indiatimes.com/2014-03-

23/news/48491480_1_prima-range-pisharody-new-buses. [Accessed 16 September

2014].

A High Working Capital Turnover Ratio Indicates What? | Chron.com. 2014. A High

Working Capital Turnover Ratio Indicates What? | Chron.com. [ONLINE] Available

at:http://smallbusiness.chron.com/high-working-capital-turnover-ratio-indicates-what-

61036.html. [Accessed 16 September 2014].

Working capital turnover ratio | Accounting for Management. 2014. Working capital

turnover ratio | Accounting for Management. [ONLINE] Available

at:http://www.accountingformanagement.org/working-capital-turnover-ratio/. [Accessed

16 September 2014].

Debt-to-Equity Ratio Formula | Example | Analysis. 2014. Debt-to-Equity Ratio Formula

| Example | Analysis. [ONLINE] Available

at:http://accountingexplained.com/financial/ratios/debt-to-equity. [Accessed 16

September 2014].

Profitability Ratios Definition | Investopedia. 2014. Profitability Ratios Definition |

Investopedia. [ONLINE] Available

at:http://www.investopedia.com/terms/p/profitabilityratios.asp. [Accessed 16 September

2014].

Return on Assets (ROA) Ratio Formula | Example | Analysis. 2014. Return on Assets

(ROA) Ratio Formula | Example | Analysis. [ONLINE] Available

at:http://accountingexplained.com/financial/ratios/return-on-assets. [Accessed 16

September 2014].

Return on Assets (ROA) Definition | Investopedia. 2014. Return on Assets (ROA)

Definition | Investopedia. [ONLINE] Available

at:http://www.investopedia.com/terms/r/returnonassets.asp. [Accessed 16 September

2014].

Return on Capital Employed ROCE | Analysis | Formula | Example. 2014. Return on

Capital Employed ROCE | Analysis | Formula | Example. [ONLINE] Available

at:http://www.myaccountingcourse.com/financial-ratios/return-on-capital-employed.

[Accessed 16 September 2014].

Tata Motors expects 'no or inadequate' profit in 2013-14 - Moneycontrol.com. 2014. Tata

Motors expects 'no or inadequate' profit in 2013-14 - Moneycontrol.com. [ONLINE]

Available at:http://www.moneycontrol.com/news/business/tata-motors-expects-no-or-

inadequate-profit2013-14_1094736.html. [Accessed 16 September 2014].

Earnings per Share (EPS) - Explanation, Importance and Limitation. 2014. Earning Per

Share (EPS) - Explanation, Importance and Limitation. [ONLINE] Available

at: http://paulasset.com/earning-per-share/. [Accessed 16 September 2014].

Project Report & Profiles Automobile | NPCS. 2014. Project Report & Profiles

Automobile | NPCS. [ONLINE] Available

at:http://npcs.in/profiles/profiles/automobile/z,,2f,0,a/index.html. [Accessed 16

September 2014].

Tata Motors: Reports, Company History, Directors Report, Chairman's Speech, Auditors

Report of Tata Motors - NDTVProfit.com. 2014. Tata Motors: Reports, Company

History, Directors Report, Chairman's Speech, Auditors Report of Tata Motors -

NDTVProfit.com. [ONLINE] Available at: http://profit.ndtv.com/stock/tata-motors-

ltd_tatamotors/reports. [Accessed 16 September 2014].

ANNEXURES

Standalone Balance Sheet ------------------- in Rs. Cr. -------------------

Mar '14 Mar '13 Mar '12 Mar '11 Mar '10

12 mths 12 mths 12 mths 12 mths 12 mths

Sources Of Funds

Total Share Capital 643.78 638.07 634.75 637.71 570.60

Equity Share Capital 643.78 638.07 634.75 637.71 570.60

Share Application Money 0.00 0.00 0.00 0.00 0.00

Preference Share Capital 0.00 0.00 0.00 0.00 0.00

Reserves 18,532.87 18,496.77 18,991.26 19,375.59 14,208.55

Revaluation Reserves 0.00 0.00 0.00 0.00 24.63

Networth 19,176.65 19,134.84 19,626.01 20,013.30 14,803.78

Secured Loans 4,450.01 5,877.72 6,915.77 7,708.52 7,742.60

Unsecured Loans 10,065.52 8,390.97 4,095.86 6,929.67 8,883.31

Total Debt 14,515.53 14,268.69 11,011.63 14,638.19 16,625.91

Total Liabilities 33,692.18 33,403.53 30,637.64 34,651.49 31,429.69

Mar '14 Mar '13 Mar '12 Mar '11 Mar '10

12 mths 12 mths 12 mths 12 mths 12 mths

Application Of Funds

Gross Block 26,130.82 25,190.73 23,676.46 21,002.78 18,416.81

Less: Accum. Depreciation 10,890.25 9,734.99 8,656.94 7,585.71 7,212.92

Net Block 15,240.57 15,455.74 15,019.52 13,417.07 11,203.89

Capital Work in Progress 6,355.07 4,752.80 4,036.67 3,799.03 5,232.15

Investments 18,458.42 19,934.39 20,493.55 22,624.21 22,336.90

Inventories 3,862.53 4,455.03 4,588.23 3,891.39 2,935.59

Sundry Debtors 1,216.70 1,818.04 2,708.32 2,602.88 2,391.92

Cash and Bank Balance 226.15 462.86 1,840.96 2,428.92 612.16

Total Current Assets 5,305.38 6,735.93 9,137.51 8,923.19 5,939.67

Loans and Advances 4,374.98 5,305.91 5,832.03 5,426.95 5,248.71

Fixed Deposits 0.00 0.00 0.00 0.00 1,141.10

Total CA, Loans & Advances 9,680.36 12,041.84 14,969.54 14,350.14 12,329.48

Deffered Credit 0.00 0.00 0.00 0.00 0.00

Current Liabilities 13,334.13 16,580.47 20,280.82 16,271.85 16,909.30

Provisions 2,708.11 2,200.77 3,600.82 3,267.11 2,763.43

Total CL & Provisions 16,042.24 18,781.24 23,881.64 19,538.96 19,672.73

Net Current Assets -6,361.88 -6,739.40 -8,912.10 -5,188.82 -7,343.25

Miscellaneous Expenses 0.00 0.00 0.00 0.00 0.00

Total Assets 33,692.18 33,403.53 30,637.64 34,651.49 31,429.69

Contingent Liabilities 12,419.30 14,981.11 15,413.62 19,084.08 3,708.33

Book Value (Rs) 59.58 59.98 61.84 315.36 259.03

Standalone Profit & Loss account ------------------- in Rs. Cr. -------------------

Mar '14 Mar '13 Mar '12 Mar '11 Mar '10

12 mths 12 mths 12 mths 12 mths 12 mths

Income

Sales Turnover 34,319.28 44,765.72 54,306.56 47,088.44 38,173.39

Excise Duty 0.00 0.00 0.00 0.00 2,800.10

Net Sales 34,319.28 44,765.72 54,306.56 47,088.44 35,373.29

Other Income 3,262.00 1,662.33 -11.16 275.85 1,220.86

Stock Adjustments -303.35 143.60 623.84 354.22 606.63

Total Income 37,277.93 46,571.65 54,919.24 47,718.51 37,200.78

Expenditure

Raw Materials 26,040.59 33,764.40 41,081.79 35,047.05 25,366.12

Power & Fuel Cost 392.09 484.66 550.89 471.28 362.62

Employee Cost 2,877.69 2,837.00 2,691.45 2,294.02 1,836.13

Other Manufacturing Expenses 428.74 425.76 0.00 0.00 1,289.60

Selling and Admin Expenses 0.00 0.00 0.00 0.00 2,126.10

Miscellaneous Expenses 5,156.80 5,679.52 6,428.72 4,965.17 1,707.06

Preoperative Exp Capitalised 0.00 0.00 0.00 0.00 -740.54

Total Expenses 34,895.91 43,191.34 50,752.85 42,777.52 31,947.09

Mar '14 Mar '13 Mar '12 Mar '11 Mar '10

12 mths 12 mths 12 mths 12 mths 12 mths

Operating Profit -879.98 1,717.98 4,177.55 4,665.14 4,032.83

PBDIT 2,382.02 3,380.31 4,166.39 4,940.99 5,253.69

Interest 1,337.52 1,387.76 1,218.62 1,383.70 1,246.25

PBDT 1,044.50 1,992.55 2,947.77 3,557.29 4,007.44

Depreciation 2,070.30 1,817.62 1,606.74 1,360.77 1,033.87

Other Written Off 0.00 0.00 0.00 0.00 144.03

Profit Before Tax -1,025.80 174.93 1,341.03 2,196.52 2,829.54

Extra-ordinary items 0.00 0.00 0.00 0.00 0.00

PBT (Post Extra-ord Items) -1,025.80 174.93 1,341.03 2,196.52 2,829.54

Tax -1,360.32 -126.88 98.80 384.70 589.46

Reported Net Profit 334.52 301.81 1,242.23 1,811.82 2,240.08

Total Value Addition 8,855.32 9,426.94 9,671.06 7,730.47 6,580.97

Preference Dividend 0.00 0.00 0.00 0.00 0.00

Equity Dividend 648.56 645.20 1,280.70 1,274.23 859.05

Corporate Dividend Tax 93.40 79.03 183.02 192.80 132.89

Per share data (annualised)

Shares in issue (lakhs) 32,186.80 31,901.16 31,735.47 6,346.14 5,705.58

Earning Per Share (Rs) 1.04 0.95 3.91 28.55 39.26

Equity Dividend (%) 100.00 100.00 200.00 200.00 150.00

Book Value (Rs) 59.58 59.98 61.84 315.36 259.03

Cash Flow ------------------- in Rs. Cr. -------------------

Mar '14 Mar '13 Mar '12 Mar '11 Mar '10

12 mths 12 mths 12 mths 12 mths 12 mths

Net Profit Before Tax 334.52 301.81 1242.23 1811.82 2240.08

Net Cash From Operating Activities 2463.46 2258.44 3653.59 1505.56 6586.03

Net Cash (used in)/from

Investing Activities

2552.91 991.50 144.72 -2521.88 -11848.29

Net Cash (used in)/from Financing Activities -5033.81 -4045.69 -4235.59 1648.42 5348.49

Net (decrease)/increase In Cash and Cash

Equivalents

-6.89 -714.07 -432.50 635.87 86.23

Opening Cash & Cash Equivalents 205.57 919.64 1352.14 716.27 630.04

Closing Cash & Cash Equivalents 198.68 205.57 919.64 1352.14 716.27

Vous aimerez peut-être aussi

- KG - Value ChainDocument2 pagesKG - Value ChainKrishna KediaPas encore d'évaluation

- Ncor CorpDocument51 pagesNcor CorpKrishna KediaPas encore d'évaluation

- AlmDocument4 pagesAlmKrishna KediaPas encore d'évaluation

- Cover Page + AcknowledgementDocument2 pagesCover Page + AcknowledgementKrishna KediaPas encore d'évaluation

- KKDocument81 pagesKKKrishna KediaPas encore d'évaluation

- Garden Silk MillsDocument32 pagesGarden Silk MillsKrishna KediaPas encore d'évaluation

- Change Management - Research PaperDocument39 pagesChange Management - Research PaperKrishna KediaPas encore d'évaluation

- Garden Silk MillsDocument32 pagesGarden Silk MillsKrishna KediaPas encore d'évaluation

- Monopolystic CompetitionDocument4 pagesMonopolystic CompetitionKrishna KediaPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (120)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Literature Review Operations ManagementDocument4 pagesLiterature Review Operations Managementc5ry1f2g100% (1)

- PhonePe Statement Feb2024 Mar2024Document7 pagesPhonePe Statement Feb2024 Mar2024jtularam15Pas encore d'évaluation

- Warehouse Receipt and Collateral ManagementDocument50 pagesWarehouse Receipt and Collateral ManagementManoj BalPas encore d'évaluation

- IRB Board approves Q2 results, preferential issues to Cintra and GICDocument43 pagesIRB Board approves Q2 results, preferential issues to Cintra and GICslohariPas encore d'évaluation

- BME02.HM3C.chapter 2. Roa - GiovanniDocument4 pagesBME02.HM3C.chapter 2. Roa - Giovannigiovanni roaPas encore d'évaluation

- Stanley Nwador Data Analyst ResumeDocument3 pagesStanley Nwador Data Analyst ResumeHARSHAPas encore d'évaluation

- Business Plan SampleDocument11 pagesBusiness Plan SampleChristian Alejandrino100% (1)

- Basic Board of Directors FunctionsDocument2 pagesBasic Board of Directors FunctionsGSK SECURITY AND INVESTIGATION AGENCYPas encore d'évaluation

- General Order 11 Non Citizen Employment 4th Edition 2012Document21 pagesGeneral Order 11 Non Citizen Employment 4th Edition 2012shirleyPas encore d'évaluation

- VoucherDocument1 pageVoucherJeanette FerrolinoPas encore d'évaluation

- IIP Final ReportDocument40 pagesIIP Final ReportMiloni Desai (PGDM 18-20)Pas encore d'évaluation

- ABL Annual Report 2013Document270 pagesABL Annual Report 2013Muhammad Hamza ShahidPas encore d'évaluation

- Zoom CarDocument4 pagesZoom Carmahanth gowdaPas encore d'évaluation

- Accounting Cycle WorksheetDocument11 pagesAccounting Cycle Worksheettarikuabdisa0Pas encore d'évaluation

- Li & Fung - Final PresentationDocument26 pagesLi & Fung - Final PresentationapoorvsinghalPas encore d'évaluation

- Why Starbucks Failed in AustraliaDocument10 pagesWhy Starbucks Failed in AustraliaMalikul Ashtar100% (1)

- Financial Analysis: Unit 9Document20 pagesFinancial Analysis: Unit 9Đinh AnhPas encore d'évaluation

- Week 1 2 FME 321 Risk ManagmentDocument34 pagesWeek 1 2 FME 321 Risk ManagmentCheryl Diane Mae LumantasPas encore d'évaluation

- Banking Courses in GujaratDocument2 pagesBanking Courses in GujaratSivaramakrishna SobhaPas encore d'évaluation

- Human Resources Audit Provides Valuable Insights for Strategic PlanningDocument22 pagesHuman Resources Audit Provides Valuable Insights for Strategic PlanningRevathi RevathiPas encore d'évaluation

- HPCL Interview QuestionsDocument2 pagesHPCL Interview QuestionsShashank KumarPas encore d'évaluation

- Champikage WikramayaDocument4 pagesChampikage WikramayaNethaliAmarasiri75% (4)

- Order in The Matter of Capacious Farming Private LimitedDocument20 pagesOrder in The Matter of Capacious Farming Private LimitedShyam SunderPas encore d'évaluation

- The Relationship Between Human Resource Practices and Employee RetentionDocument244 pagesThe Relationship Between Human Resource Practices and Employee RetentiontemozPas encore d'évaluation

- A87ffmercedes Benz - Competitive Forces and Competitive StrategyDocument2 pagesA87ffmercedes Benz - Competitive Forces and Competitive Strategythuyanhvirgo0809100% (1)

- Manage production planning and scheduling with APS softwareDocument7 pagesManage production planning and scheduling with APS softwaresheebakbs5144100% (1)

- Online Quiz 4 Based FR Set ADocument6 pagesOnline Quiz 4 Based FR Set ARed AlbanoPas encore d'évaluation

- BA 99.1 Course OutlineDocument10 pagesBA 99.1 Course OutlineCharmaine Bernados BrucalPas encore d'évaluation

- Wild Wood Case StudyDocument6 pagesWild Wood Case Studyaudrey gadayPas encore d'évaluation

- Power, Function and Duties of Directors andDocument20 pagesPower, Function and Duties of Directors andHimanshu JainPas encore d'évaluation