Académique Documents

Professionnel Documents

Culture Documents

How To Reduce Home Loan

Transféré par

baluchakpTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

How To Reduce Home Loan

Transféré par

baluchakpDroits d'auteur :

Formats disponibles

UNDERSTANDING HOME LOAN PREPAYMENT

Posted by Admin

No Comments

When one increases the tenure of their home loan, the amount of money that goes into payment of interest also

increases. This interest payment you make to the bank is your burden that one shall strive to reduce it as much as

possible. When one is prepaying the home loan it means he is paying extra principal component of home loan.

Prepayment does not reduce your EMI but it will allow you to close your home loan much earlier. By paying early you

are actually saving the interest payment. Buy prepayment become more effective if one is making prepayment in the

early phases of loan tenure. Assume that one is taking a home loan of say Rs 30,00,000 at rate of 10.5% per annum

for a period of 20 years. The proportion of principal verses interest during the tenure of 20 years will look like this.

So from this chart you can easily make out that in the first years of home loan payment, banks draw the interest

portion of your home loan more than the principal. In this article we will see how prepayment can make your pay-off

your home loan early and will also in turn save interest payment. But before that lets look at some basics.

HOW EMIS ON HOME LOAN IS CALCULATED.

The formula for EMI calculation is:

E = EMI

P = Principal

r = monthly rate of interest (Interest is 10.5% it means r = 10.5/12/100 =0.00875)

n = time in months

Lets take an example, home loan of say Rs 30,00,000 at rate of 10.5% per annum for a period of 20 years (240

months). The EMI in first year will be:

E = 30,00,000 x 0.00875 x [(1+0.00875)^240 / {(1+0.00875)^240}-1} = Rs 29,951 per month for next 20 years.

Before you decide to prepay your home loan, evaluate the requirement. If you are confused whether to use your extra

saving to do investment or for home loan prepayment, then here is the solution. If you are investing in stocks, then

probably your long term return will be close to 12% per annum. Compare this return with your home loan interest rate.

If home loan interest rate is higher than 12%, it means your should prepay your home loan first. But if the home loan

is more than 3% lower than your stock market averaged returns (say 12%) only then you decide to invest over

prepayment of home loan. Logic is to pay your costlier debt before making any investment.

WHY WE ARE SO CONCERNED ABOUT HOME

LOAN PREPAYMENT?

Home loan is probably the biggest loan amount a average middle class Indian will ever take in his lifetime.

Considering the fact that the loan amount is so big, so often people go for very long payment tenure of 15 to 20

years. So not only the loan amount is big but also the tenure is so long, this makes the interest burden like a

mountain. For example, for a home loan of say Rs 30 lakhs, for 20 years at rate of 10.5% per annum, one will pay

more than Rs 41 lakhs as interest. So in this case you can see that the interest portion is even bigger than the loan

amount itself. So it is a must for all loan takers to evaluate the possibility of reducing the interest burden. Home loan

prepayment is one effective way of reducing the interest burden. Lets see how much interest payment we can save in

total by making even small additional contributions to our EMI.

Lets take an example, home loan of say Rs 30,00,000 at rate of 10.5% per annum for a period of 20 years (240

months).

SL EMI (Rs) Extra Payment as

prepayment/

month (Rs)

Total Interest

Paid in 20 years

(Rs)

Savings (Rs) Years for Loan

to be 100% paid

1 29,951 0 41,88,335 0 20

2 29,951 500 39,23,348 2,64,968 19

3 29,951 1000 36,95,405 4,92,929 18.1

4 29,951 1500 34,96,554 6,91,781 17.3

5 29,951 2000 33,21,043 8,67,292 16.5

6 29,951 2500 31,64,653 10,23,681 15.8

7 29,951 3000 30,24,198 11,64,137 15.3

From this table you can see that, just by making extra payment of Rs 500/month you are able to save Rs 2.65 lakhs

and by making extra payment of Rs 3,000 you can save as high as Rs 11 lakhs in totality. Please note that by making

those extra payment you are paying nothing extra, you are just prepaying your home loan. If one is making extra

payment of Rs 500/month then they will prepay the home loan in 19 years instead of 20 years.

HOW TO PLAN HOME LOAN PREPAYMENT?

Not many of us will have that surplus cash to make a substantial lump sum payment on account of home loan

prepayment. So the better strategy will be to make small monthly payments (in addition to EMIs). Here we will see

that even small increment in monthly EMIs in tune of Rs 500 per month will also make you a huge long term saving

of interest. Not only interest saving, prepayment of home loan will also reduce the tenure of home loan.

Every time we make that extra payment of Rs 500/1000 per month, this amount reduces your principal component of

your home loan. So if your principal portion is reducing it means that it will indirectly reduce your interest burden (as

show in above table).

Before starting to make your EMI payment towards home loan always keep a note of two things (1) how much total

interest you are paying against your principal loan amount & (2) Break-up of principal and interest in each year of

your loan payment. As shown in the above chart, interest payment in first few tears are maximum and in later years

principal payment is maximum.

So if you are interested to get the dual benefits of prepayment, then extra payment shall be made in first few years

instead of later. Because if you are not making payment in initial years you are actually paying back all your interest

to bank. If you are making extra payment in later years you will only save the principal portion of your home loan.

SOME EASY TO REMEMBER TIPS RELATED

TO HOME LOAN PREPAYMENT

(1) If you are interest in prepayment of your home loan then start from the first few months. You will save more

interest that earlier you start.

(2) If you have loans on your credit card, personal loan and home loan, then you must start with the prepayment of

your costlier debt first. Credit Card should be your priority one, then personal loan and in the last home loan.

(3) Make sure that you have declared the interest and principal component of your loan to your income tax manager.

This can save you a lot on income tax.

(4) As per present directive of RBI, no bank can charge you prepayment penalty. So do not be fooled by banks if they

are asking you to pay fine for prepayment of your home loan.

Multi-purpose Loan Calculator (http://emicalculator.net/loan-calculator)

Loan Amount

10,00,000

-EMI

21,617.95

Interest Rate

10.75

%

EMI Scheme

Loan Tenure ------------------------------------------------------------------227months

Loan APR -----------------------------------------------------------------------10.31%

Total Interest Payable --------------------------------------------------------29,79,570

Total Payment (Principal + Interest + Fees & Charges) -------------53,39,570

Break-up of Total Payment :Principal 44.01% Interest 55.8% Fees & Charges 0.19%

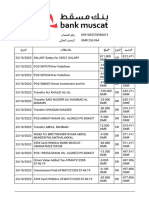

Schedule showing EMI payments starting from

May-14

Year Principal

(A)

Interest

(B)

Total Payment

(A + B)

Balance Loan Paid To Date

2014 28,071.42 1,59,754.82 1,87,826.24 23,21,928.58 1.19%

2015 45,856.28 2,35,883.08 2,81,739.36 22,76,072.30 3.15%

2016 50,783.77 2,30,955.59 2,81,739.36 22,25,288.53 5.31%

2017 56,240.75 2,25,498.61 2,81,739.36 21,69,047.79 7.70%

2018 62,284.10 2,19,455.26 2,81,739.36 21,06,763.68 10.35%

2019 68,976.85 2,12,762.51 2,81,739.36 20,37,786.83 13.29%

2020 76,388.77 2,05,350.59 2,81,739.36 19,61,398.06 16.54%

2021 84,597.13 1,97,142.23 2,81,739.36 18,76,800.93 20.14%

2022 93,687.53 1,88,051.83 2,81,739.36 17,83,113.40 24.12%

2023 1,03,754.74 1,77,984.62 2,81,739.36 16,79,358.66 28.54%

2024 1,14,903.72 1,66,835.64 2,81,739.36 15,64,454.94 33.43%

2025 1,27,250.71 1,54,488.65 2,81,739.36 14,37,204.23 38.84%

2026 1,40,924.46 1,40,814.90 2,81,739.36 12,96,279.77 44.84%

2027 1,56,067.51 1,25,671.85 2,81,739.36 11,40,212.26 51.48%

2028 1,72,837.77 1,08,901.59 2,81,739.36 9,67,374.49 58.84%

2029 1,91,410.08 90,329.28 2,81,739.36 7,75,964.41 66.98%

2030 2,11,978.07 69,761.29 2,81,739.36 5,63,986.34 76.00%

2031 2,34,756.21 46,983.15 2,81,739.36 3,29,230.13 85.99%

2032 2,59,981.97 21,757.39 2,81,739.36 69,248.16 97.05%

2033 69,248.50 1,186.34 70,434.84 0.00 100.00%

Vous aimerez peut-être aussi

- Vankaya SpecialDocument1 pageVankaya SpecialbaluchakpPas encore d'évaluation

- Developing A Workplace InductionDocument21 pagesDeveloping A Workplace InductionbaluchakpPas encore d'évaluation

- Hvac Design For Pharmaceutical FacilitiesDocument57 pagesHvac Design For Pharmaceutical FacilitiesbaluchakpPas encore d'évaluation

- 20141018a 006135009Document1 page20141018a 006135009baluchakpPas encore d'évaluation

- How To Pay Taxes OnlineDocument6 pagesHow To Pay Taxes OnlinebaluchakpPas encore d'évaluation

- 20141025a 007135003Document1 page20141025a 007135003baluchakpPas encore d'évaluation

- ISO Audit ChecklistDocument21 pagesISO Audit Checklistghostghost12380% (5)

- Modi in Modisun SquareDocument1 pageModi in Modisun SquarebaluchakpPas encore d'évaluation

- Induction ManualDocument12 pagesInduction Manualapi-261410470% (2)

- Guidance For Industry: Process Validation: General Principles and PracticesDocument22 pagesGuidance For Industry: Process Validation: General Principles and PracticesbaluchakpPas encore d'évaluation

- A Practical Guide To Construction, Commissioning and Qualification Documentation - and Its Critical Role in Achieving ComplianceDocument8 pagesA Practical Guide To Construction, Commissioning and Qualification Documentation - and Its Critical Role in Achieving ComplianceModPas encore d'évaluation

- Nü¿'Uû˝ V§Ƒñ„Èπ◊D©Â°J £Æ«Jûª Ææ'Çéπç!: Çjføáø˛Q Ñ«K Îëߪ'†'†O Ççvüµ¿V°Æü머 V°Æ¶Μº'ÛªyçDocument1 pageNü¿'Uû˝ V§Ƒñ„Èπ◊D©Â°J £Æ«Jûª Ææ'Çéπç!: Çjføáø˛Q Ñ«K Îëߪ'†'†O Ççvüµ¿V°Æü머 V°Æ¶Μº'ÛªyçbaluchakpPas encore d'évaluation

- HR Manual GaganDocument15 pagesHR Manual GaganbaluchakpPas encore d'évaluation

- Induction Manual TemplateDocument3 pagesInduction Manual TemplatebaluchakpPas encore d'évaluation

- Job Safety AnalysisDocument2 pagesJob Safety AnalysisbaluchakpPas encore d'évaluation

- 0662 Paper Code 662Document10 pages0662 Paper Code 662baluchakpPas encore d'évaluation

- Job Safety Analysis For Chilling PlantDocument2 pagesJob Safety Analysis For Chilling PlantbaluchakpPas encore d'évaluation

- Occupational Health+and+SafetyDocument17 pagesOccupational Health+and+SafetyIrfan AhmedPas encore d'évaluation

- On Duty Form - Permission Request FormDocument2 pagesOn Duty Form - Permission Request FormsivalenkaPas encore d'évaluation

- Bolier Saftey Analysis and ControlDocument4 pagesBolier Saftey Analysis and ControlbaluchakpPas encore d'évaluation

- S-Welding Lens and PpeDocument5 pagesS-Welding Lens and PpebaluchakpPas encore d'évaluation

- Chennai GuideDocument48 pagesChennai GuideJoseph PrashanthPas encore d'évaluation

- Operator Qualification PlanDocument92 pagesOperator Qualification PlanMohan Babu VengalathuriPas encore d'évaluation

- Scribd Download ListDocument1 pageScribd Download ListbaluchakpPas encore d'évaluation

- 0662 Paper Code 662Document10 pages0662 Paper Code 662baluchakpPas encore d'évaluation

- Warehouse ManagementDocument61 pagesWarehouse ManagementVi Vek77% (13)

- Kappa KathaDocument2 pagesKappa KathasgollavilliPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Congressional Record - House H104: January 6, 2011Document1 pageCongressional Record - House H104: January 6, 2011olboy92Pas encore d'évaluation

- In Organic We TrustDocument5 pagesIn Organic We Trustapi-511313050Pas encore d'évaluation

- Kiwi Little Things UK Granny Triangles Hat1 PDFDocument7 pagesKiwi Little Things UK Granny Triangles Hat1 PDFmammybeePas encore d'évaluation

- Advantages and Disadvantages of Free HealthcareDocument1 pageAdvantages and Disadvantages of Free HealthcareJames DayritPas encore d'évaluation

- Level 2 AfarDocument7 pagesLevel 2 AfarDarelle Hannah MarquezPas encore d'évaluation

- Formation Burgos RefozarDocument10 pagesFormation Burgos RefozarJasmine ActaPas encore d'évaluation

- DefaultDocument2 pagesDefaultBADER AlnassriPas encore d'évaluation

- George Moses Federal ComplaintDocument11 pagesGeorge Moses Federal ComplaintWXXI NewsPas encore d'évaluation

- ArggsDocument5 pagesArggsDaniel BrancoPas encore d'évaluation

- 4 Pollo V DAVIDDocument2 pages4 Pollo V DAVIDJoe RealPas encore d'évaluation

- BVP651 Installation ManualDocument12 pagesBVP651 Installation ManualAnonymous qDCftTW5MPas encore d'évaluation

- Andres Felipe Mendez Vargas: The Elves and The ShoemakerDocument1 pageAndres Felipe Mendez Vargas: The Elves and The ShoemakerAndres MendezPas encore d'évaluation

- Louis Vuitton: by Kallika, Dipti, Anjali, Pranjal, Sachin, ShabnamDocument39 pagesLouis Vuitton: by Kallika, Dipti, Anjali, Pranjal, Sachin, ShabnamkallikaPas encore d'évaluation

- Same Tractor Silver 80-85-90 105 160 180 Parts CatalogDocument17 pagesSame Tractor Silver 80-85-90 105 160 180 Parts Catalogalicebrewer210188ktm100% (64)

- Chapter 2-Futurecast Applied To TourismDocument5 pagesChapter 2-Futurecast Applied To TourismAsya KnPas encore d'évaluation

- Module 1 - Basic Topology and Router Setup: The Following Will Be The Common Topology Used For The First Series of LabsDocument9 pagesModule 1 - Basic Topology and Router Setup: The Following Will Be The Common Topology Used For The First Series of LabsHassan AwaisPas encore d'évaluation

- Material Cost 01 - Class Notes - Udesh Regular - Group 1Document8 pagesMaterial Cost 01 - Class Notes - Udesh Regular - Group 1Shubham KumarPas encore d'évaluation

- Hip Self Assessment Tool & Calculator For AnalysisDocument14 pagesHip Self Assessment Tool & Calculator For AnalysisNur Azreena Basir100% (9)

- Advent of Dawn Raids in India - A Case of Aggressive Anti-Trust Regime - Anti-Trust - Competition Law - IndiaDocument7 pagesAdvent of Dawn Raids in India - A Case of Aggressive Anti-Trust Regime - Anti-Trust - Competition Law - IndiaNitish GuptaPas encore d'évaluation

- Osayan - Argumentative Essay - PCDocument2 pagesOsayan - Argumentative Essay - PCMichaela OsayanPas encore d'évaluation

- Gerund Infinitive ParticipleDocument4 pagesGerund Infinitive ParticiplemertPas encore d'évaluation

- As SaaffatDocument39 pagesAs SaaffatAyesha KhanPas encore d'évaluation

- CSR-PPT-29 01 2020Document44 pagesCSR-PPT-29 01 2020Acs Kailash TyagiPas encore d'évaluation

- Caste Endogamy A Multidimensional Analogy of Caste in The Indian SocietyDocument12 pagesCaste Endogamy A Multidimensional Analogy of Caste in The Indian SocietyRakshith L1Pas encore d'évaluation

- Basic Survival Student's BookDocument99 pagesBasic Survival Student's BookIgor Basquerotto de CarvalhoPas encore d'évaluation

- Scott Mcmillan San Diego SanctionsDocument3 pagesScott Mcmillan San Diego SanctionsMcMillanLawLaMesaAlertPas encore d'évaluation

- Mohan ResearchDocument6 pagesMohan ResearchRamadhan A AkiliPas encore d'évaluation

- A List of The Public NTP ServersDocument11 pagesA List of The Public NTP ServersavinashjirapurePas encore d'évaluation

- Employee Engagement and Patient Centered Care PDFDocument8 pagesEmployee Engagement and Patient Centered Care PDFSrinivas GoudPas encore d'évaluation

- Atip Bin Ali V Josephine Doris Nunis & AnorDocument7 pagesAtip Bin Ali V Josephine Doris Nunis & Anorahmad fawwaz100% (1)