Académique Documents

Professionnel Documents

Culture Documents

Creating Strategic Windows

Transféré par

Dhawal Rathor0 évaluation0% ont trouvé ce document utile (0 vote)

12 vues7 pagesStrategic Window

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentStrategic Window

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

12 vues7 pagesCreating Strategic Windows

Transféré par

Dhawal RathorStrategic Window

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 7

Creating Strategic Windows:

The Increasing Role of Subsidiary Boards in Japanese, European, and

North American MNCs

Mark P. Kriger, Northeastern University

ABSTRACT

Little research has been done to date on the role of

subsidiary boards in MNCs. A two-phase survey

research design yielded responses from 89 subsidiaries

in 36 MNCs based in Europe, North America, and Japan.

Results indicate an increasingly active use of these

boards in advisory, environmental sensing, and

strategic roles.

INTRODUCTION

In the last several years the use of subsidiary boards

of directors in multinational corporations has become

increasingly active. A number of forces of change

have been occurring: ( D a marked increase in the

number of joint ventures and consortia between MNCs

whose parent corporations are based in the three

primary regions of North America, Europe, and Japan

(Harrigan, 1985); (2) the need for multinationals to

understand more closely the local political, economic,

and social forces in host countries; and (3) the

increasing trend of making boards of directors

responsible for corporate crises.

this paper reports on the forces behind the changing

roles of these boards and the advantages and disad-

vantages of having active subsidiary boards. It also

raises some larger philosophical issues about how

multinationals are to govern far-flung and complex

relationships in host countries where the representa-

tion of local issues is being voiced with greater

concern by host country governments and interest

groups.

tions and their environments, fbne of the preceding

studies, however, examine the role of subsidiary

boards as intermediaries between host country pres-

sures and international MNC strategic pressures.

Leksell and Undgren (1982) exanine the role of sub-

sidiary boards (SBs) of directors in wholly and partly

owned foreign subsidiaries of Swedish MNCs. Their

findings are highly suggestive, but are limited to a

Semple of six Swedish MNCs with approximately four

affiliates from each.

Indeed, until recently, most references to subsidiary

boards have often included descriptions such as

"dunmy board" or "captive board," conjuring up the

image of an artificial governance body which has been

mainly kept in existence to comply with local laws and

regulations. As a result, there has been very little

available literature on the subject. Mak (1982),

Leksell and Lindgren (1982), and Hedlund (1980) are

the only recently published works known to the author.

Lately, the question of whether subsidiary boards of

directors are underutilized resources has begun to

surface. The topic has recently sparked interest

within foruns which specialize in the study of

board-related issues. The Conference Board in the

Uhited States, PRO NED (Promotion of Nan-Executive

Directors) in England, and The International

Management Institute in Switzerland have been some of

the more active forums. Why this interest? Could

there, after all, be more to subsidiary boards than

meet the eye? Our answer is an emphatic YES! , based

upon interviews with executives and directors and on a

survey of 210 multinational corporations.

SUBSIDIARY BOARD PROJECT

PREVIOUS AND RELATED RESEARCH

A number of organizational researchers have portrayed

the existence of multiple tensions within multi-

national corporations (MNCs), i.e., corporations with

parent company headquarters in one country and sub-

stantial sales in foreign subsidiaries. Dsz, et al.

(1981) report on the constraints which exist in MNCs

between host country demands and global competitive

pressures for integrated strategies. Bartlett (1982)

exanines the quest for the ideal structural fit for

companies engaged in a strategy of internationaliza-

tion and notes the existence of two simultaneous

demands: (1) the demand for greater national respon-

siveness, and (2) the pressure for more integrated

operations and centrally controlled decisions result-

ing from the strategic imperative of increased global

efficiency.

The preceding authors, as well as Grieco (1982),

Prahalad (1976), and Stopford and Wells (1972), all

add international dimensions to the dual but con-

tingent demands for differentiation of local sub-units

and integration of those sub-units noted in the

Lawrence and Lorsch (1967) classic study of organiza-

In the spring of 1984, a survey was designed by the

author in conjunction with Patrick J.J. Rich, the CEO

and Chairman of Alcan Aluninum (Europe) and distribut-

ed by Harvard Business Review to the CEOs of 210 MNCs.

The purpose of this survey was to examine in detail

three broad questions:

1. Is the role of board of directors in subsidaries

of multinational corporations changing, and if so,

in what way?

2. What are the forces behind such changes in role?

3. What are the characteristics of an active and

useful subsidiary board?

A subsidiary will be defined as an incorporated legal

entity in which the parent corporation owns a con-

trolling interest, possessing legal liability dis-

tinct from the parent. An effective controlling

interest by the parent may occur, in some instances,

with less than 50? ownership if the remaining

ownership is either widely held or shared by a nunber

of owners unlikely to vote as a block.

92

It w a s h y p o t h e s i z e d t h a t t h e r e w e r e v a r i a t i o n s in t h e

a c t i v e u s e o f s u b s i d i a r y b o a r d s d e p e n d i n g u p o n a n u m -

b e r o f f a c t o r s i n c l u d i n g : t h e c o u n t r y o f t h e p a r e n t

c o m p a n y o f t h e s u b s i d i a r y ; t h e t y p e o f i n d u s t r y ; t h e

l o c a l l e g a l , e c o n o m i c , s o c i a l a n d m a r k e t c o n d i t i o n s o f

the h o s t c o u n t r y o f t h e s u b s i d i a r y ; a n d t h e p e r s o n a l

m a n a g e m e n t s t y l e s o f t h e C E O s r e s p e c t i v e l y o f t h e

p a r e n t and s u b s i d i a r y c c m p a n i e s .

As a r e s u l t , a c o m p r e h e n s i v e s u r v e y w a s d e s i g n e d w h i c h

asked a r a n g e o f q u e s t i o n s ( 1 7 0 in t o t a l ) a b o u t s u b -

s i d i a r y b o a r d s ( S B s ) . I h i s " h e a d q u a r t e r " o r " p a r e n t "

s u r v e y w a s t h e n m a i l e d t o t h e C E O s o f 2 1 0 M N C s l o c a t e d

in N o r t h A n e r i c a , J a p a n , a n d E u r o p e . In a d d i t i o n t o

the p a r e n t s u r v e y w e i n c l u d e d t h r e e s u r v e y s t o b e

m a i l e d o n t o t h e C E O s o f t h r e e r e p r e s e n t a t i v e s u b s i -

d i a r i e s . T h i s s u r v e y f o r t h e s u b s i d i a r y w a s n e a r l y

i d e n t i c a l t o t h e p a r e n t s u r v e y e x c e p t t h a t s o m e

q u e s t i o n s f o c u s e d o n l y o n t h e p a r t i c u l a r s u b s i d i a r y

and n o t o n t h e M N C a s a w h o l e .

In a l l , 3 6 p a r e n t c o m p a n i e s a n d 89 f o r e i g n s u b s i -

d i a r i e s in 3 0 c o u n t r i e s r e s p o n d e d w i t h c o m p l e t e d

s u r v e y s . A n o t h e r 5 0 p a r e n t c o m p a n i e s r e s p o n d e d w i t h

l e t t e r s o f r e g r e t o r d e t a i l e d r e s p o n s e s w h i c h t h e y

felt a s u r v e y w o u l d n o t e a s i l y c a p t u r e . A l l o f t h e

HNCs a r e w i t h i n t h e t o p 2 5 0 i n s a l e s o n t h e F o r t u n e

" 5 0 0 " l i s t i n g s for U . S . and F o r e i g n I n d u s t r i a l

C o r p o r a t i o n s in 1 9 8 3 . T h e i n i t i a l s a m p l e o f 2 1 0

c o m p a n i e s w a s c o n s t r u c t e d t o c o m p r i s e H N C s w i t h t o t a l

r e v e n u e s l a r g e r t h a n $ 1 b i l l i o n , f o r e i g n r e v e n u e s

g r e a t e r t h a n 2 5 ? o f t h e t o t a l , a n d w i t h s u b s i d i a r i e s

in at l e a s t h a l f a d o z e n d i f f e r e n t c o u n t r i e s ( s e e

Table 1 ) .

T A B L E 1

O v e r v i e w o f t h e C o m p a n i e s in t h e S u r v e y

P a r e n t C o m p a n i e s

Number o f e m p l o y e e s

1983 t o t a l r e v e n u e s

T o t a l n u m b e r o f

s u b s i d i a r i e s

R e s u l t s o f t h e S u r v e y

L o w H i g h M e d i a n

8 , 0 0 0 3 7 0 , 0 0 0 1(0,000

$1 $ 3 5 $ K . 1

b i l l i o n b i l l i o n b i l l i o n

1(00 63

A n u m b e r o f H N C s p o i n t e d t o p r o l o n g e d e x p e r i e n c e w i t h

a c t i v e s u b s i d i a r y b o a r d s . T h e s e M N C s l o o k a t t h e i r

e f f o r t s t o i m p r o v e t h e q u a l i t y a n d s c o p e o f a c t i v i t i e s

of t h e i r s u b s i d i a r y b o a r d s a s a w o r t h w h i l e i n v e s t m e n t .

The s u r v e y i n d i c a t e s t h a t t h i s u t i l i t a r i a n p o i n t o f

v i e w , t h e v a l u i n g o f a c t i v e s u b s i d i a r y b o a r d s , i s

s p r e a d i n g , b u t at d i f f e r e n t r a t e s d e p e n d i n g o n w h e t h e r

the p a r e n t c o r p o r a t i o n i s h e a d q u a r t e r e d in E u r o p e ,

North A n e r i c a o r J a p a n a n d t h e l o c a l s i t u a t i o n f a c i n g

the s u b s i d i a r y . L e t u s t a k e a c l o s e r l o o k f i r s t a t

s o m e o f t h e q u a l i t a t i v e r e s p o n s e s .

The e x e c u t i v e s a n d c h a i r m e n o f t h e M N C s r e c e i v i n g t h e

p a r e n t c o m p a n y s u r v e y w e r e a s k e d t o r e s p o n d t o t h e

q u e s t i o n : " W h a t d o y o u s e e a s t h e a d v a n t a g e s o r d i s -

a d v a n t a g e s o f h a v i n g a s u b s i d i a r y w i t h a n a c t i v e

b o a r d ? "

The e x e c u t i v e v i c e p r e s i d e n t o f o n e J a p a n e s e m u l t i -

n a t i o n a l in c o n s u n e r e l e c t r o n i c s r e p l i e d ,

"We t h i n k , it i s t o o u r a d v a n t a g e t o h a v e an a c t i v e

board in o u r s u b s i d i a r y , b e c a u s e o f t h e f o l l o w i n g :

1 . An a c t i v a t e d b o a r d c a n g i v e m o r e c o n c r e t e i n s t r u c -

t i o n s t o o f f i c e r s c o n c e r n i n g b o t h r e s p o n s i b i l i t y

a n d m a n a g e m e n t .

2 . A m e m b e r o f a b o a r d , w h o o b t a i n s a f a i r k n o w l e d g e

o f t h e p r e s e n t s i t u a t i o n o f t h e c o m p a n y , c a n

p e r f o r m t h e f u n c t i o n o f a s i n c e r e a d v i s i n g a g e n t .

3 . A n a c t i v a t e d b o a r d c a n e n c o u r a g e o f f i c e r s t o h a v e

a g r e a t e r i n t e r e s t ( i n t h e c o r p o r a t i o n ) a n d a

s t r o n g s e n s e o f r e s p o n s i b i l i t y . "

In a s i m i l a r v e i n , t h e e x e c u t i v e v i c e p r e s i d e n t o f a

S w e d i s h M N C in t h e h e a v y m a n u f a c t u r i n g o f i n d u s t r i a l

a n d c o n s u n e r p r o d u c t s r e s p o n d e d t h a t a n a c t i v e s u b -

s i d i a r y b o a r d c o u l d :

1 . " P r e s e n t a n i n d e p e n d e n t v i e w o n h o w t h e s u b s i -

d i a r y ' s b u s i n e s s s h o u l d b e c o n d u c t e d w i t h t h e g o a l

o f m a k i n g t h e s u b s i d i a r y b o t h a b u s i n e s s s u c c e s s

a n d a g o o d c o r p o r a t e c i t i z e n in i t s h o s t n a t i o n .

2 . C o u n s e l t h e s u b s i d i a r y ' s m a n a g e m e n t o n i t s r e l a -

t i o n s w i t h p e r s o n n e l , f i n a n c i a l i n s t i t u t i o n s ,

g o v e r r m e n t a l b o d i e s , a n d t h e p u b l i c .

3 . P e r i o d i c a l l y a p p r a i s e t h e p e r f o n n a n c e o f t h e s u b -

s i d i a r y ' s m a n a g e m e n t , p r i m a r i l y t h r o u g h r e v i e w o f

i t s f i n a n c i a l r e p o r t s .

H . C o u n s e l t h e c o m p a n y r e g a r d i n g l o c a l c o m p e n s a t i o n

s t a n d a r d s . "

T r e n d s i n S B R o l e s

T h e s u r v e y i n d i c a t e s a n u n b e r o f t r e n d s a s r e g a r d s

b o a r d r o l e s o f i n t e r e s t t o m a n a g e r s o f s u b s i d i a r i e s

a n d p a r e n t c o m p a n y m u l t i n a t i o n a l s . C o m p a n i e s p a r t i c i -

p a t i n g in t h e s u r v e y w e r e a s k e d t o r a t e t h e i m p o r t a n c e

o f s u b s i d i a r y b o a r d r o l e s f o r t h r e e t i m e p e r i o d s ( t h e

p a s t 5 - 1 0 y e a r s , t h e p r e s e n t , a n d t h e n e x t 5 - 1 0 y e a r s

u s i n g a L i k e r t s c a l e r a n g i n g f r o m 1 = " V e r y L o w " t o

5= " V e r y H i g h " w i t h 3 = " M o d e r a t e I m p o r t a n c e " a n d a " 0 "

r e s p o n s e f o r "lfo I m p o r t a n c e . " T h e 8 9 s u b s i d i a r y

r e s p o n d e n t s r e p o r t a n i n c r e a s i n g a c t i v a t i o n o f t h e

b o a r d r o l e , a s w e m o v e f r o m t h e p a s t t o p r e s e n t t o

f u t u r e ( s e e T a b l e 2 ) . T h e m o s t i m p o r t a n t o f t h e s e

r o l e s a r e :

1 . A d v i s i n g l o c a l m a n a g e m e n t (X = 3 . 3 2 ; X . = 3 . 7 6 ;

P = . O O O ) ; P

2 . E n s u r i n g c o m p l i a n c e w i t h l o c a l l e g a l r e q u i r e m e n t s

( X p = 3 . 3 6 ; 5(j.=3.51; P = . O 1 ) ;

3 . P r o v i d i n g k n o w l e d g e o f l o c a l e c o n o m i c , p o l i t i c a l ,

a n d s o c i a l c o n d i t i o n s (X = 3 . 3 7 ; X ^ = 3 . 6 6 ; P = . O O O ) ;

H . F a c i l i t a t i n g c o n t a c t w i t h l o c a l l e a d e r s a n d i n s t i -

t u t i o n s ( X = 3 . 0 0 ; 5?j.=3.36; P = . O O O ) .

M a r k e d d i f f e r e n c e s a l s o o c c u r w h e n w e l o o k at t h e

l o c a t i o n s o f t h e p a r e n t c o m p a n i e s . J a p a n e s e m u l t i -

n a t i o n a l s w h e n c o m p a r e d t o N o r t h A m e r i c a n and E u r o p e a n

M N C s d i s p l a y s o m e c l e a r d i f f e r e n c e s in t e r m s o f t h e

i m p o r t a n c e o f r o l e s o f s u b s i d i a r y b o a r d s o v e r t i m e .

C o m p a n i e s in t h e s u r v e y w e r e a s k e d , " W h a t i m p o r t a n c e

in M N C s , in g e n e r a l , d o y o u t h i n k t h e r o l e o f t h e

s u b s i d i a r y b o a r d w i l l h a v e in t h e n e x t 5 t o 1 0 y e a r s ? "

S u b s i d i a r i e s o f N o r t h A m e r i c a n ( C a n a d i a n and U . S . )

f i r m s r e s p o n d e d t h a t t h e S B r o l e w i l l b e o f " m o d e r a t e "

i m p o r t a n c e w h e r e a s t h e s u b s i d i a r i e s o f J a p a n e s e M N C s

P a i r e d c o m p a r i s o n s o f d i f f e r e n c e s b e t w e e n m e a n s w e r e

c o m p u t e d v i a t w o - t a i l e d t - t e s t s .

93

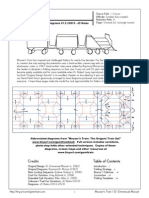

TABLE 2

Importance of Subsidiary Board Roles

By Time Period

In the Past/ ^ Present/ In the

Present Future next 5 to past 5 to present Present Future

10 years P= 1981 P= 10 years

A. ADVISING, APPROVING, APPRAISING LOCAL MANAGEMENT

1. Advising local management.

2. Approving budgets and short-term plans of the

subsidiary.

3. Monitoring operating performance and corrective

measures in the subsidiary.

1). Appraising the subsidiary's top management performance

and top officers' compensation.

B. LOCAL COUNTRY CONTACTS AND CONDITIONS

1. Facilitating the establishment of contacts with local

leaders and institutions.

2. Ensuring compliance with local legal requirements.

3. Providing knowledge of local economic, political, and

social conditions.

14. Appraising and minimizing the subsidiary's political

risk.

3.06

2.11

2.52

2.03

(.01)

(.01)

(.05)

3.32

2.66

2.78

2.26

(.000)

(.000)

(.000)

(.000)

3.76

2.97

3.03

2.52

2.87

3.27

3.22

2.1)1 (.01)

3.00

36

37

2.69

(.000)

(.01)

(.000)

(.000)

3.36

3.51

3.66

3.01

C. STRATEGIC PLAN PARTICIPATION

1. Participating in drawing up the subsidiary's strategic

plan.

2.12 (.01) 2.16 (.000)

D. ETHICAL ISSUES

1. Supervising the subsidiary's ethical conduct. 2.70 2.82 (.01) 2.97

^P=The probability that the mean values for past and present, present and future are not

Paired comparisons of differences between means were computed via twD-tailed t-tests.

^X^="Historical," in the past 5 to 10 years; X ="Present" ; X.="Future," in the next 5 to

n * P ^

significantly different.

10 years.

reported that the subsidiary board role will be "high"

in importance in the future: (X,=3.O8; X =3.29;

X,=3.71; F=2.80; P=.O3) .^

J

Examining more closely ten different specific roles we

find that J apanese MNCs see all of the roles as higher

in importance than European and North American MNCs

(see Table 3 ) .

Several roles are particularly salient according to

the J apanese survey participants:

1. Approximating budgets and short-term plans of the

subsidiary (X,=1.07; F=8.31; P=.OO1) ;

J

2. Monitoring operating performance and corrective

measures (X,=3.61; F=3.58; P=.O3) ;

J

3. Participating in drawing up the subsidiary's

strategic plan (X,=3.71; F=8.18; P=.OO1) ;

J

1. Appraising and minimizing the subsidiary's

political risk (X =3.61; F=1.50; P=.O1) .

Previous researchers have found that American sub-

sidiaries enjoy much less autonomy in decision making

Analysis of variance of responses by geographic ori-

gin of parent company was performed to test for sig-

nificant differences among means for (forth America,

European, and J apanese MNCs.

than European or J apanese subsidiaries (Negandhi and

Baliga, 1979; 1981) . This difference in level of

autonomy also extends to the board level. Thus,

J apanese MNCs see active use of these boards as man-

dated by law, as legally responsible, and as important

mechanisms for understanding local country conditions.

In contrast, [forth American MNCs appear to be lagging

the J apanese in the use of these boards as strategic

and operational windows to cope with some of the

multiple uncertainties at local country levels.

European MNCs also lag behind the J apanese in the use

of these boards, but are slightly ahead of the North

Americans. An exception, however, is the Swedish MNCs

who are closer to the J apanese in their use of subsi-

diary boards to understand local situations. This has

been found to be mandated by explicit policy decisions

from the Swedish parent companies. ^

DISCUSSION OF FINDINGS

In many ways the evolution of the role of foreign sub-

sidiary boards is closely tied to the quality of MNC

activities around the world and to host country pre-

occupation with these activities. Below we examine a

few of the significant forces which are at work in

changing the roles and responsibilities of the subsi-

diary board.

TABLE 3

Importance of Subsidiary Board Roles

By Region

F Statistic Level of

A E J

America Europe Japan of Significance

(NrtO) (N=35) (Nrit) Significance P=

A. ADVISING, APPROVING. APPRAISING LOCAL MANAGEMENT

1. Advising local management.

2. Approving budgets and short-term plans of the

subsidiary.

3. tonitoring operating perfonnance and corrective

measures in the subsidiary.

i(. Appraising the subsidiary's top management

performance and top officers' compensation.

5. Deciding the anount to remit as dividends.

B. LOCAL COUNTRY CONTACTS AND CONDITIONS

1. Facilitating the establishment of contacts with

local leaders and institutions.

2. Identifying and responding to concerned stakeholders

(e.g., environmentalists and consumer groups).

2. Ensuring compliance with local legal requirements.

3. Providing knowledge of local economic, political, and

social conditions.

1. Appraising and minimizing the subsidiary's political

risk.

C. STRATEGIC PLAN PARTICIPATION

3.18

2.65

2.60

1.83

2.18

2.JI9

1.63

3.15

3.08

3.18

2.56

2.61

2.33

1.92

2.92

1.31

3.00

3.39

3.69

1.07

3.61

3.29

3.13

2.92

3.00

1.08

3.77

1.70

8.31

3.58

5.03

5.85

1.16

9.91

2.51

1.69

.001

.03

.009

.001

.0001

.09

2.53 2.31 3.61

1.50 . 01

1. Part i ci pat i ng in drawing up the subsi di ar y' s s t r at egi c 2.20

plan.

D. ETHICAL ISSUES

1. Supervising the s ubs i di ar y' s et hi cal conduct.

2.65

2.25

2.72

3.71

3.57

8.18

2.13

.001

P=the probability that the observed means are not significantly different.

Director Liability and Ethics

A number of recent "corporate debacles" (e.g., Lock-

heed in Japan; Hitachi in the United States) in the

area of corporate ethics have vividly brought the

point home that executive expediency or a misguided

sense of priorities can sometimes overwhelm the sense

of ethics of a management group. It is essential that

support for ethical conduct be given to subsidiary

executives in the field. A subsidiary board, which is

mandated to ensure that ethical considerations are

fully taken into account, can be of immeasurable help.

As a consequence, as MNCs look at decisions to

rationalize their international system and consider

comparative economics they are closing down manufac-

turing facilities in one country and shifting produc-

tion to more efficient subsidiaries from an overall

system point of view. The presence of a strong subsi-

diary board which can discuss such policy decisions

with the parent company can help to bring about alter-

natives which are more sensitive to host country needs

and strike a workable compromise.

Stakeholder Interests

In addition, increasingly diverse groups are claiming

an interest in influencing the decision.-making pro-

cesses of MNCs because their decisions affect them in'

one way or another. As a result, consuner protection

groups, environmentalists, and public interest groups

all addressing themselves to a multitude of specializ-

ed issues and political activists (e.g., objecting to

the apartheid policies of South Africa) have increas-

ingly emerged. They are putting challenges at the

doorsteps of subsidiary and parent company boards

alike. Responsiveness to legitimate claims, informa-

tion and education, and policy statements to correct

misrepresentations all require close coordination of

effort between the parent company and subsidiaries.

For example, while an MNC might be attacked by anti-

apartheid groups in North America, it might be the

representatives on the South African subsidiary board

who have to make sure that more enlightened personnel

policies are pursued.

Consistent with this is the finding in our survey that

"director's liability" is rated by subsidiary's of

Japanese MNCs to be an important reason behind changes

in the role of subsidiary boards (X =1.87, 5Cp=2.22;

!fj = 3.50; F=1.58; P=.OOO1). In addition, "local legal

and regulatory pressures" are rated by all subsidaries

sampled to be moderately high to high in importance as

factors behind subsidiary board activation (!(, = 3.51;

3(p.=3.5O; X =3.77). Increasingly, subsidiary directors

are viewed as an additional means to understand and

stay on top of local host country situations.

Changing Economic Conditions

In the 198O's, many countries are experiencing slower

economic growth rates which are being accompanied by

painful structural adjustments in their less competi-

tive industrial sectors. Conversely, some countries

95

are outperforming the average, creating industrial

opportunities. This diversity of national development

scenarios is having a series of impacts on subsidiar.-

ies, their boards, and their relations with the parent

company. As a result, two other factors emerge as

reasons for cnanges in subsidiary board roles:

1. Parent corporations (particularly in Europe and

Japan) increasingly are recognizing that_change

might be beneficial to the corporation (X^=3.11;

X^::3.33; X, = 3.71; F=2.H2; P=.O2);

2. Explicit policy decisions by the parent company to

activate the board (X =2.87; Xg=3.3t; Xj=3.57;

F=1.65; P=nonsignificant).

Subsidiaries and their boards operating in a vulnera-

ble industry or a particularly sluggish economic

environment are having to be particularly vigilant

with regard to their company's performance and the

actions required to improve at a time when a parent

company night be unable to provide financial assist-

ance in case of trouble. In such a situation, the

directors of a sutosidiary often discover the meaning

of "director's responsibility," together with the need

to have the authority required to discharge that

responsibility.

Local Laws and Regulations

Many of the forces described above have either found

or will find their formal expression in laws, regula-

tions, and company codes of conduct. Below are a few

examples:

1. OECD voluntary guidelines for MNCs in Europe

stress the need for MNCs to give "due consider-

ation to those (member) countries' aims and

priorities with regards to economic and social

progress." The guidelines also deal with dis-

closure of information, competition, financing,

taxation, employment and industrial relations.

2. Legislation in many countries increasingly addres-

ses the issue of the structure and composition of

boards of directors and apply "ipso facto" to

local subsidiaries of an MNC (e.g., workers'

representation on boards in Scandinavian countries

and the German two-tier board with workers' repre-

sentation on the supervisory board).

3. The extent of directors' liability in the United

States, which is in practice much greater than

anywhere else, is having an increasing impact on

the composition of boards of directors of foreign

subsidiaries in the Uhited States.

CONCLUSION

The forces described above are eliciting a corporate

response to deal with a multitude of challenges posed

to the governance systems of MNCs. The proactive use

of subsidiary boards is a mechanism for both coping

with local legal and political pressures and for in-

creasing the access to information about local econo-

mic developments. Much depends upon the internal

processes of these boards and their ongoing relation-

ships with local governments. If managed properly,

the relationship between subsidiary and host govern-

ment can become a "plus" for both sides.

Thus, we find two major sets of forces at work in the

activation of SBs:

1. Strategic considerations of trying to understand

local host country changes as early as possible

and, in the process, not overlooking channels for

early learning of those changes, i.e., "strategic

windows."

2. Ftiilosophical considerations that the subsidiary

board of directors of a foreign MNC should include

the representation of key, locally prominent,

people to help create "windows of understanding"

between host countries and foreign subsidiaries.

Only selective MNCs are currently structured to take

advantage of these considerations. Furthermore, many

CEOs of subsidiaries and parent companies do not feel

"comfortable" with active subsidiary boards, ftowever,

the proactive use of subsidiary boards is increasing,

requiring in those instances an enlightened sensitivi-

ty to the balancing of global and regional strategies,

operating styles, and governance bodies.

REFERENCES

Barlett, C.A. 1982. Multinational organization:

Where to after the structural stages? Working Paper

HBS-82-60, Harvard University, Graduate School of

Business Administration, Cambridge.

Doz, I.L., Bartlett, C.A., and Prahalad, C.K. 1981.

Global competitive pressures and host country demands:

Managing tensions in MNCs. California Management

Review, 23(3):63-71.

Grieco, J.M. 1982. Between dependency and autonomy:

India's experience with the international computer

industry. International Organization, 36(3):6O9-632.

Harrigan, K.R. 1985. Strategies for Joint ventures.

Lexington, MA: D.C. Heath and Company.

Hedlund, G. 1980. The role of foreign subsidiaries in

strategic decision making in Swedish multinational

corporations. Journal of Strategic Management,

1:23-36.

Lawrence, P.R. and Lsrsch, J.W. 1967. Organization and

Environment. Boston, MA: Harvard Business School,

Division of Research.

Leksell, L. and Lindgren, U. 1982. The board of

directors in foreign subsidiaries. Journal of

International Business Studies. Spring/Summer, 27-38.

Mak, J.H. 1982. Subsidiary boards in transition.

Unpublished draft report. International Management

Institute, Geneva, Switzerland.

Negandhi, A.R. and Baliga, B.R. 1979. Quest for

survival and growth: A comparative study of American,

European and Japanese multinationals. New Yprk:

Praeger.

Negandhi, A.R. and Baliga, B.R. 1981. Tables are

turning: German and Japanese multinationals in the

United States. Cambridge, MA: Oelgeschlager, Gunn &

Hain Publishers.

Prahalad, C.K. 1976. Strategic choices in diversified

MNCs. Harvard Business Review, 54(10:67-78.

Stopford, J.M. and Wells, L.T., Jr. 1972. Managing

the multinational enterprise. New York: Basic Books.

96

Vous aimerez peut-être aussi

- Disarmament: The Human Factor: Proceedings of a Colloquium on the Societal Context for Disarmament, Sponsored by Unitar and Planetary Citizens and Held at the United Nations, New YorkD'EverandDisarmament: The Human Factor: Proceedings of a Colloquium on the Societal Context for Disarmament, Sponsored by Unitar and Planetary Citizens and Held at the United Nations, New YorkPas encore d'évaluation

- Jurnal Tuters SPTDocument5 pagesJurnal Tuters SPTHasanPas encore d'évaluation

- Unep Study Guide Polmun 2023Document16 pagesUnep Study Guide Polmun 2023rlewand72Pas encore d'évaluation

- Jaba Biofeedback and Rational-Emotive Therapy 00104-0126Document14 pagesJaba Biofeedback and Rational-Emotive Therapy 00104-0126ALEJANDRO MATUTEPas encore d'évaluation

- Whenever: Water A Error Con-A Not To Extracts Sugar Sugars WereDocument6 pagesWhenever: Water A Error Con-A Not To Extracts Sugar Sugars WereDivya NaiduPas encore d'évaluation

- Traumatic Retinal DetachmentsDocument4 pagesTraumatic Retinal DetachmentsNuur Ijj'lalPas encore d'évaluation

- Expression in Escherichia Coli of Chemically Synthesized Genes For Human InsulinDocument5 pagesExpression in Escherichia Coli of Chemically Synthesized Genes For Human InsulinursnationPas encore d'évaluation

- Interim Report (Viral)Document2 pagesInterim Report (Viral)Akshay BhattPas encore d'évaluation

- NSIT Solar Car Project BrochureDocument11 pagesNSIT Solar Car Project BrochureVidet JaiswalPas encore d'évaluation

- Flight of the Hummingbird: A Parable for the EnvironmentD'EverandFlight of the Hummingbird: A Parable for the EnvironmentÉvaluation : 4 sur 5 étoiles4/5 (1)

- Cases in Economic Development: Projects, Policies and StrategiesD'EverandCases in Economic Development: Projects, Policies and StrategiesÉvaluation : 3 sur 5 étoiles3/5 (1)

- Aldehyde Tanning of LeatherDocument4 pagesAldehyde Tanning of LeatherNgô Văn CườngPas encore d'évaluation

- PavementDocument10 pagesPavementJanneth BluePas encore d'évaluation

- Accounting and The Construction of The Governable PersonDocument31 pagesAccounting and The Construction of The Governable PersonPascalis HwangPas encore d'évaluation

- NSIT Solar Car Brochure 2013-14Document13 pagesNSIT Solar Car Brochure 2013-14Videt JaiswalPas encore d'évaluation

- High Pressure Phase Behaviour of Multicomponent Fluid MixturesD'EverandHigh Pressure Phase Behaviour of Multicomponent Fluid MixturesPas encore d'évaluation

- Indus Valley, Harappan CivilizationDocument9 pagesIndus Valley, Harappan CivilizationayandasmtsPas encore d'évaluation

- Opposition 91: Cancer 1 (A Furled and An Unfurled Flag Displayed From A Vessel) and Capricorn 1 (An Indian Chief Demanding Recognition)Document3 pagesOpposition 91: Cancer 1 (A Furled and An Unfurled Flag Displayed From A Vessel) and Capricorn 1 (An Indian Chief Demanding Recognition)StarlingPas encore d'évaluation

- Jesuit Extreme Oath of Induction Vertical FileDocument17 pagesJesuit Extreme Oath of Induction Vertical FileTruth Press MediaPas encore d'évaluation

- Critintsyn PDFDocument288 pagesCritintsyn PDFmeannaPas encore d'évaluation

- Direct Measuremet of Forces BTW Surfaces in Liquids at Molecular LevelDocument3 pagesDirect Measuremet of Forces BTW Surfaces in Liquids at Molecular LevelrajanOrajanPas encore d'évaluation

- A R Estricted-D Omain M Ultilateral Test Approach To The Theory of International ComparisonsDocument62 pagesA R Estricted-D Omain M Ultilateral Test Approach To The Theory of International ComparisonsmarhelunPas encore d'évaluation

- Methane Production by Terrestrial ArthropodsDocument5 pagesMethane Production by Terrestrial ArthropodsmhamedfoaadPas encore d'évaluation

- Oesophageal Candidiasis After Omeprazole Therapy ArticleDocument2 pagesOesophageal Candidiasis After Omeprazole Therapy ArticleJon SandersonPas encore d'évaluation

- Mooser's Train - Emmanuel MooserDocument13 pagesMooser's Train - Emmanuel Mooserneweli100% (1)

- Thorax E-BookDocument4 pagesThorax E-BookRuth KusnadiPas encore d'évaluation

- Nancy Neef Et Al. - Impulsivity in Students With Serious Emotional Disturbance: The Interactive Effects of Reinforcer Rate, Delay and QualityDocument16 pagesNancy Neef Et Al. - Impulsivity in Students With Serious Emotional Disturbance: The Interactive Effects of Reinforcer Rate, Delay and QualityIrving Pérez MéndezPas encore d'évaluation

- 1985-06 Taconic Running Life June 1985Document16 pages1985-06 Taconic Running Life June 1985TaconicArchivePas encore d'évaluation

- Appl. Microbiol. 1968 Mundt 1326 30Document6 pagesAppl. Microbiol. 1968 Mundt 1326 30Samuel Gaytan RamirezPas encore d'évaluation

- Log 1 Page 6Document10 pagesLog 1 Page 6FarmerMeeksPas encore d'évaluation

- Neal EmeraldDocument63 pagesNeal EmeraldPRASINIZEVRAPas encore d'évaluation

- Financial DeepeningDocument13 pagesFinancial DeepeningMd. Saiful IslamPas encore d'évaluation

- Capstonefinal11 29 04Document63 pagesCapstonefinal11 29 04engrfahadkhanPas encore d'évaluation

- Hello To AlvaroDocument3 pagesHello To AlvaroAustePas encore d'évaluation

- Offline File Pushing To Mediation PDFDocument7 pagesOffline File Pushing To Mediation PDFBizura SarumaPas encore d'évaluation

- Board Notice 10 of 2014: No. 37262 Government Gazette, 31 January 2014Document7 pagesBoard Notice 10 of 2014: No. 37262 Government Gazette, 31 January 2014bellydanceafrica9540Pas encore d'évaluation

- Plant Physiol.-1976-Magyarosy-486-9 PDFDocument4 pagesPlant Physiol.-1976-Magyarosy-486-9 PDFnormanwillowPas encore d'évaluation

- Caffeine and Alcohol InteractionDocument8 pagesCaffeine and Alcohol Interactionwalter slowPas encore d'évaluation

- Cancer of The Nose and Paranasal Sinuses in Industry PDFDocument4 pagesCancer of The Nose and Paranasal Sinuses in Industry PDFShirakawa AlmiraPas encore d'évaluation

- Jejunal and Ileal Calcium Absorption in Patients With Chronic Renal DiseaseDocument6 pagesJejunal and Ileal Calcium Absorption in Patients With Chronic Renal DiseaseDannieCiambelliPas encore d'évaluation

- Amplitude-Induction Gradient of A Small Human Operant in An Escape-Avoidance SituationDocument3 pagesAmplitude-Induction Gradient of A Small Human Operant in An Escape-Avoidance SituationALEJANDRO MATUTEPas encore d'évaluation

- Magnesium Absorption in The Human Small IntestineDocument7 pagesMagnesium Absorption in The Human Small IntestineDannieCiambelliPas encore d'évaluation

- Burlington's Unbriddled GrowthDocument14 pagesBurlington's Unbriddled GrowthChuck MorsePas encore d'évaluation

- W. Fowler - Guitar Patterns For ImprovisationDocument28 pagesW. Fowler - Guitar Patterns For ImprovisationnikotragedyPas encore d'évaluation

- Lesson Plan 2Document4 pagesLesson Plan 2jessaPas encore d'évaluation

- Buckardt v. Albertson's Inc., 10th Cir. (2007)Document16 pagesBuckardt v. Albertson's Inc., 10th Cir. (2007)Scribd Government DocsPas encore d'évaluation

- Duration,: Reports System TemporaryDocument9 pagesDuration,: Reports System Temporaryamrit403Pas encore d'évaluation

- Asbestos School 1980Document3 pagesAsbestos School 1980Bruno ThiemePas encore d'évaluation

- Can Do Correlation Table SmallDocument2 pagesCan Do Correlation Table SmallNanda Farayun RalufziePas encore d'évaluation

- Howald2014 Teaching FestivalDocument1 pageHowald2014 Teaching FestivalDave HallmonPas encore d'évaluation

- Variation in Neonatal Death Rate and Birth Weight in The United States and Possible Relations To Environment Radiation, Geology and AltitudeDocument24 pagesVariation in Neonatal Death Rate and Birth Weight in The United States and Possible Relations To Environment Radiation, Geology and AltitudeWilliam ScottPas encore d'évaluation

- A New Eigenvalue Solver For Solving Eigenvalue Problems in Structural EngineeringDocument5 pagesA New Eigenvalue Solver For Solving Eigenvalue Problems in Structural EngineeringInternational Journal of Engineering Research & ManagementPas encore d'évaluation

- Biomathematics in 1980: Papers presented at a workshop on biomathematics: current status and future perspective, Salerno, April 1980D'EverandBiomathematics in 1980: Papers presented at a workshop on biomathematics: current status and future perspective, Salerno, April 1980Pas encore d'évaluation

- Dennis Sansom PDFDocument2 pagesDennis Sansom PDFAymenAhmadPas encore d'évaluation

- Chapter 3 and 4 For Character Information ModuleDocument21 pagesChapter 3 and 4 For Character Information ModuleMark Joseph P. GaniaPas encore d'évaluation

- Draft Savage Worlds - RWBYDocument38 pagesDraft Savage Worlds - RWBYMad Hat World100% (1)

- Global Trends in Service ExcellenceDocument3 pagesGlobal Trends in Service ExcellenceShiela Mae Mapalo-Rapista100% (1)

- Employee Disciplinary FormDocument3 pagesEmployee Disciplinary FormThanh ThuyPas encore d'évaluation

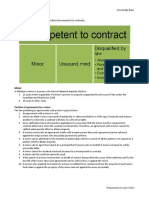

- Competency To Contract: MinorDocument4 pagesCompetency To Contract: MinorZeeshan BakaliPas encore d'évaluation

- Law of Persons NotesDocument8 pagesLaw of Persons NotesSummer90% (61)

- Eng10 1stQrt Week7Document23 pagesEng10 1stQrt Week7Aira Monica PlancoPas encore d'évaluation

- Triskelion Magna CartaDocument47 pagesTriskelion Magna Cartafullbar9Pas encore d'évaluation

- Role in The SocietyDocument1 pageRole in The SocietyChristian VillaPas encore d'évaluation

- The 19 Century Philippines: Changes in Its Designated AspectsDocument4 pagesThe 19 Century Philippines: Changes in Its Designated AspectsMarvic AboPas encore d'évaluation

- Juristic PersonDocument3 pagesJuristic Personpoonam kumariPas encore d'évaluation

- Matthew Carter Criminal ChargesDocument13 pagesMatthew Carter Criminal ChargesKim BurrowsPas encore d'évaluation

- Male Friendship and Sodomy in Twelfth Night PDFDocument7 pagesMale Friendship and Sodomy in Twelfth Night PDFbethanyPas encore d'évaluation

- Organizational Change and DevelopmentDocument43 pagesOrganizational Change and Developmentbushra83% (6)

- Qualities That Can Make Good LeadersDocument10 pagesQualities That Can Make Good LeadersMansoor AliPas encore d'évaluation

- IX - Cambridge - Unit Asessment - Business - Chapter 7Document3 pagesIX - Cambridge - Unit Asessment - Business - Chapter 7Edu TainmentPas encore d'évaluation

- Riots and Gangs V 2.0Document14 pagesRiots and Gangs V 2.0Clarissa DamayoPas encore d'évaluation

- Prospectus Crèche - TT EnglishDocument1 pageProspectus Crèche - TT EnglishPradines MameloPas encore d'évaluation

- Passion Profile Quiz Thriver 2Document9 pagesPassion Profile Quiz Thriver 2Jherzey Denyz NicartPas encore d'évaluation

- Imd F90D BrochureDocument9 pagesImd F90D BrochureSunnyPas encore d'évaluation

- Unit 5 8605Document25 pagesUnit 5 8605Saiqa Ashrif AshrifPas encore d'évaluation

- 01-Approaches To StrategyDocument24 pages01-Approaches To StrategyDimuthuSuranjanaPas encore d'évaluation

- Contract of Lease BALAIDocument3 pagesContract of Lease BALAINikki Ventosa MendozaPas encore d'évaluation

- MK Gandhi and Indian Democr̥acyDocument7 pagesMK Gandhi and Indian Democr̥acyAminesh GogoiPas encore d'évaluation

- Jean-Paul Sartre - Republic of SilenceDocument2 pagesJean-Paul Sartre - Republic of SilenceLaletraqPas encore d'évaluation

- 2022 Quality of Life Report - Calgary FoundationDocument24 pages2022 Quality of Life Report - Calgary FoundationDarren KrausePas encore d'évaluation

- Moral LeadersDocument3 pagesMoral LeadersKeab Sun YatsunPas encore d'évaluation

- Behavioral and Organizational Issues in Management Accounting and Control SystemsDocument3 pagesBehavioral and Organizational Issues in Management Accounting and Control SystemsCha ChaPas encore d'évaluation

- Writing An Explanatory SynthesisDocument13 pagesWriting An Explanatory SynthesisAnita WatiPas encore d'évaluation