Académique Documents

Professionnel Documents

Culture Documents

Leroy PDF

Transféré par

jspector0 évaluation0% ont trouvé ce document utile (0 vote)

2K vues17 pagesLe Roy fire department, Inc. Was audited by the State Comptroller's office. The audit was entitled OVERSIGHT OF FIRE DEPARTMENT FINANCES. This audit's results and recommendations are resources for department officials.

Description originale:

Titre original

leroy.pdf

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentLe Roy fire department, Inc. Was audited by the State Comptroller's office. The audit was entitled OVERSIGHT OF FIRE DEPARTMENT FINANCES. This audit's results and recommendations are resources for department officials.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

2K vues17 pagesLeroy PDF

Transféré par

jspectorLe Roy fire department, Inc. Was audited by the State Comptroller's office. The audit was entitled OVERSIGHT OF FIRE DEPARTMENT FINANCES. This audit's results and recommendations are resources for department officials.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 17

DIVISION OF LOCAL GOVERNMENT

& SCHOOL ACCOUNTABILITY

OF F I C E O F T H E NE W Y O R K S T A T E CO M P T R O L L E R

Report of Examination

Period Covered:

January 1, 2012 December 10, 2013

2014M-25

Le Roy Fire

Department, Inc.

Oversight of Fire

Department Finances

Thomas P. DiNapoli

11

DIVISION OF LOCAL GOVERNMENT AND SCHOOL ACCOUNTABILITY

Page

AUTHORITY LETTER 2

INTRODUCTION 3

Background 3

Objective 3

Scope and Methodology 3

Comments of Department Ofcials and Corrective Action 4

OVERSIGHT OF FIRE DEPARTMENT FINANCES 5

Cash Disbursements and Receipts 5

Reported Cash 10

Recommendations 11

APPENDIX A Response From Department Ofcials 12

APPENDIX B Audit Methodology and Standards 14

APPENDIX C How to Obtain Additional Copies of the Report 15

APPENDIX D Local Regional Ofce Listing 16

Table of Contents

2

OFFICE OF THE NEW YORK STATE COMPTROLLER

2

State of New York

Ofce of the State Comptroller

Division of Local Government

and School Accountability

October 2014

Dear Fire Department Ofcials:

The Ofce of the State Comptroller works to identify areas where re department ofcials can improve

their operations and provide guidance and services that will assist them in making those improvements.

Our goals are to develop and promote short-term and long-term strategies to enable and encourage

re department ofcials to reduce costs, improve service delivery, and to account for and protect their

entitys assets.

Following is a report of our audit of the Le Roy Fire Department, entitled Oversight of Fire Department

Finances. This audit was conducted pursuant to Article V, Section 1 of the State Constitution and the

State Comptrollers authority as set forth in Article 3 of the General Municipal Law.

This audits results and recommendations are resources for Department ofcials to use in effectively

managing operations and in meeting the expectations of their constituents. If you have questions about

this report, please feel free to contact the local regional ofce for your county, as listed at the end of

this report.

Respectfully submitted,

Ofce of the State Comptroller

Division of Local Government

and School Accountability

State of New York

Ofce of the State Comptroller

33

DIVISION OF LOCAL GOVERNMENT AND SCHOOL ACCOUNTABILITY

Background

Introduction

Objective

Scope and

Methodology

The Le Roy Fire Department, Inc. (Department) provides re

protection services to the Village and Town of Le Roy in Genesee

County. The Department is comprised of members from the Oatka

Hose Company, Excelsior Hook and Ladder Company, and the

Chemical and Hose Company.

1

The Departments ofcers include, among others, a President, Vice-

President, Secretary, Treasurer, Chaplain, Department Chief, two

Assistant Chiefs, and a Board of Directors. The Board of Directors

generally consists of ve members, with one person from each re

company and two at-large members.

2

According to the bylaws, the Business Ofcers

3

have control and

management of the Departments nancial affairs. The Treasurers

duties include the maintenance of all bank accounts, accounting

records and reports. The Treasurer of the Department is, by law, also

the Treasurer of the Firemens Benevolent Association of the Village

of Le Roy. We also conducted an audit of the Firemens Benevolent

Association of the Village of Le Roy and issued a separate report,

Oversight of the Associations Foreign Fire Insurance Tax Moneys

(2014M-26).

The Departments revenue for the past three scal years 2011

through 2013 averaged about $3,400, primarily from fundraising

and donations. The average expenditures for the three years were

$2,400, for fundraiser prizes, antique re truck expenses, little league

sponsorship and donations.

The objective of our audit was to examine internal controls over

the Departments nancial operations and addressed the following

related question:

Are Department controls adequate to ensure that nancial

activity is properly recorded and reported and that Department

moneys are safeguarded?

We initially examined the Departments records and reports for the

period January 1, 2012 through December 10, 2013. Upon identifying

questionable transactions, we expanded our scope back to 2005.

____________________

1

Each of these companies has a separate Treasurer who is responsible for

maintaining nancial records for their respective companies.

2

At-large members can come from any of the Departments three re companies.

3

Business Ofcers include the Board of Directors, President, Vice-President,

Treasurer and Secretary.

4

OFFICE OF THE NEW YORK STATE COMPTROLLER

4

Comments of

Department Ofcials and

Corrective Action

We conducted our audit in accordance with generally accepted

government auditing standards (GAGAS). More information on such

standards and the methodology used in performing this audit are

included in Appendix B of this report.

The results of our audit and recommendations have been discussed

with Department ofcials and their comments, which appear

in Appendix A, have been considered in preparing this report.

Department ofcials generally agreed with our ndings and indicated

they planned to initiate corrective action.

The Departments Business Ofcers have the responsibility to

initiate corrective action. A written corrective action plan (CAP) that

addresses the ndings and recommendations in this report should

be prepared and forwarded to our ofce within 90 days. For more

information on preparing and ling your CAP, please refer to our

brochure, Responding to an OSC Audit Report, which you received

with the draft audit report. We encourage the Department to make

this plan available for public review.

55

DIVISION OF LOCAL GOVERNMENT AND SCHOOL ACCOUNTABILITY

Oversight of Fire Department Finances

The Departments Business Ofcers are responsible for establishing

adequate internal controls over cash receipts and disbursements.

The Business Ofcers should periodically review the Departments

nancial records to ensure that the Treasurer accurately records and

promptly deposits all cash receipts. They should also periodically

compare nancial transactions on bank statements and canceled check

images with the amounts recorded by the Treasurer as received and

disbursed. In addition, they should compare cash balances on bank

statements (as adjusted for deposits in transit and outstanding checks)

with the corresponding cash balances in the accounting records and

reported by the Treasurer in the annual nancial report.

The Business Ofcers did not establish adequate internal controls

over cash receipts and disbursements to ensure that Department

moneys were safeguarded. The Treasurer managed the Departments

funds with little or no oversight by any of the other Business

Ofcers. We found that the Treasurer made approximately $18,100

in questionable disbursements that were not supported by invoices or

authorized by the Departments membership. Of this amount, checks

totaling $7,866 were paid to the Treasurer, checks totaling $6,925

were paid to Total Quality Plus (a business purportedly owned by the

Treasurer), and electronic funds transfers totaling $3,307 were made

to a credit card company. In addition, cash receipts totaling almost

$2,600 were unaccounted for. Further, 14 transfers totaling $14,305

were made from the Le Roy Firemens Benevolent Associations

(Association) bank accounts to the Departments checking account,

and four unauthorized transfers totaling $8,600 were made from the

Department to the Association. The Department Treasurer is also

Treasurer of the Association. Ofcials from the Department and

Association told us that there should be no reason for transfers to

occur between these two organizations.

The Departments bank balance on October 10, 2013 was $7,824

less than the cash balance in the Treasurers accounting records.

Subsequently, the Treasurer made an unexplained deposit of $7,500

on October 24, 2013 to the Departments bank account, which

was composed entirely of cash. In November 2013, the President

of the Department accepted the Treasurers request for a leave of

absence pending the full resolution of our audit and any subsequent

investigation.

The Departments bylaws require that the Treasurer manage all

moneys received and disbursed by the Department and keep an

accurate record of all cash receipts and disbursements. The bylaws

Cash Disbursements

and Receipts

6

OFFICE OF THE NEW YORK STATE COMPTROLLER

6

require that the membership approve expenditures greater than $500

prior to payment. The bylaws also state that withdrawals can only be

made with the signature of any two of the following ofcers: President,

Vice-President or Treasurer. Also, no money can be withdrawn from

any bank unless authorized by Department ofcials at a regular,

annual or special meeting. Good management practice suggests that

Department ofcials issue press numbered duplicate receipts when

no other documentation to support the receipt of cash is available, and

deposit cash and checks received in a timely manner.

Cash Disbursements The Treasurer processed cash disbursements

with limited oversight by other Business Ofcers. Bank withdrawals

and expenditures over $500 were not authorized by the membership

and cash disbursement records were not accurate. We identied

questionable disbursements totaling $18,098 that were made by the

Treasurer from September 2007 through September 2013, as indicated

in Table 1. Of this amount, 19 checks totaling $7,866 were paid to

the Treasurer, nine checks totaling $6,925 were paid to Total Quality

Plus and ve electronic funds transfers totaling $3,307 were made to

a credit card company. None of these payments were supported by

invoices, included on the annual Treasurers report or approved by

other Business Ofcers or the membership as noted in the minutes.

The Department Secretary and former President told us that they

did not authorize any compensation to be paid to the Treasurer and

did not authorize Total Quality Plus to provide any services to the

Department. In addition, they did not provide the Treasurer with

a credit card or have knowledge of reimbursements made to the

Treasurer for any Department transactions for which the Treasurers

personal credit card would have been used.

77

DIVISION OF LOCAL GOVERNMENT AND SCHOOL ACCOUNTABILITY

Table 1: Questionable Disbursements

Date Disbursement Type/Payee Amount

9/18/2007 Check Treasurer $783

2/26/2008 Check Treasurer $218

9/9/2008 Check Treasurer $507

9/23/2010 Check Treasurer $425

12/21/2010 Check Treasurer $655

4/5/2011 Check Treasurer $650

7/18/2011 Check Treasurer $225

7/26/2011 Check Treasurer $279

8/30/2011 Check Treasurer $206

11/17/2011 Check Treasurer $503

4/11/2012 Check Treasurer $232

6/19/2012 Check Treasurer $759

6/20/2012 Check Treasurer $329

7/25/2012 Check Treasurer $335

9/5/2012 Check Treasurer $289

9/11/2012 Check Treasurer $215

11/6/2012 Check Treasurer $479

4/23/2013 Check Treasurer $165

9/4/2013 Check Treasurer $612

7/23/2009 Check Total Quality Plus $895

9/8/2010 Check Total Quality Plus $350

9/16/2010 Check Total Quality Plus $1,550

9/29/2010 Check Total Quality Plus $595

12/21/2010 Check Total Quality Plus $200

9/7/2011 Check Total Quality Plus $950

1/4/2012 Check Total Quality Plus $995

8/28/2012 Check Total Quality Plus $500

9/18/2012 Check Total Quality Plus $890

10/19/2010 EFT Credit Card Payment $578

11/8/2010 EFT Credit Card Payment $200

8/19/2011 EFT Credit Card Payment $212

9/7/2011 EFT Credit Card Payment $1,567

2/6/2012 EFT Credit Card Payment $750

Total $18,098

We reviewed the canceled check images and found that all 28 checks

included the purported signatures of the Treasurer and another

Department ofcial. We showed the canceled check images to the

former Department President, whose signature appeared on 23 of

these checks. He indicated that he did not recall signing these checks

and that the signature on the canceled check image did not appear to

be his. We attempted to contact two other former Presidents, including

the Treasurers son, whose signature appeared on the ve remaining

checks, but they did not return our calls.

8

OFFICE OF THE NEW YORK STATE COMPTROLLER

8

Cash Receipts We found ve instances where the amount recorded

as received in the Treasurers records was more than the amount

deposited. As indicated in Table 2, cash receipts totaling $2,592 are

unaccounted for.

Table 2: Cash Receipts

Date Description From Records

Treasurers

Report

Bank

Deposit

Difference

8/21/2010 Donation $2,420 $2,030 ($390)

7/9/2011 Parade Prize $35 $0 ($35)

8/18/2011 Fundraiser Rafe Ticket Sales $1,640 $1,440 ($200)

8/22/2011 Fundraiser Rafe Ticket Sales & Donations $3,665 $3,355 ($310)

8/31/2013 Fundraiser Proceeds $1,657 $0 ($1,657)

Unaccounted for Cash Receipts ($2,592)

The fundraising activity consisted primarily of an annual rafe at a

local camping resort. Department members who managed the rafe

told us they collected, counted and recorded the proceeds from the

event, then provided the cash and checks collected to the Treasurer,

who was responsible for making the bank deposit.

We also obtained deposit compositions for the Departments bank

accounts and compared them to the Treasurers records. As indicated

in Table 3, we found nine deposits totaling $2,290 of cash and checks

that were not included in the Treasurers records. The Department

Secretary was unable to explain these deposits. Department ofcials

did not issue duplicate receipts when they collected cash; therefore,

we are unsure of the source of the cash deposits and whether any

of the amounts deposited relate to the unaccounted for cash receipts

included in Table 2. The dates and the amounts of these deposits do not

align with any of the unaccounted for receipts previously discussed.

For example, the largest receipt ($1,657) that was not deposited was

for fundraiser proceeds recorded as received on August 31, 2013.

Unidentied cash after this date totaled $400, which was deposited

on October 16, 2013.

99

DIVISION OF LOCAL GOVERNMENT AND SCHOOL ACCOUNTABILITY

Table 3: Unrecorded Deposits

Date Composition Amount

3/7/2005 NA

a

$200

10/19/2007 Cash $100

4/7/2008 Cash $500

4/15/2010 Four Checks $355

10/12/2012 One Check $25

1/9/2013 Cash $310

2/12/2013 Cash $300

8/12/2013 Cash $100

10/16/2013 Cash $400

Total $2,290

a

A bank composition for this deposit was not

available due to its age. We are unsure if this

was cash or checks.

The four checks deposited on April 15, 2010 included three donations

of $50, $100 and $200, and one $5 check for a re report. The check

deposited on October 12, 2012 was an award from another Fire

Department which was labeled Best Pumper.

Transfers The Treasurer of the Department is also the Treasurer of

the Association. We found that 14 transfers totaling $14,305 were

made from the Associations bank accounts to the Departments

checking account. In addition, four transfers totaling $8,600 were

made from the Department to the Association. According to ofcials

from the Department and the Association, there should be no reason

for transfers to occur between these two organizations.

4

We found that

at least seven of the transfers from the Association to the Department

were likely made to ensure adequate moneys were on hand prior

to questionable disbursements being made to the Treasurer or his

business. The net effect of these transfers is that the Department may

owe the Association $5,705.

We asked the Treasurer about the questionable cash disbursements,

receipts and transfers. He stated that he provided all available

supporting documentation to us and that, on many occasions, he paid

for Department expenses with cash, personal checks and personal

credit cards and then reimbursed himself at a later date. He also

indicated that, on numerous occasions, he would transfer moneys as

needed to prevent overdrafts. However, he did not provide us with

any additional documentation to support these transactions.

____________________

4

The Departments bylaws state that no money shall be withdrawn from any

bank unless authorized at a regular, annual or special meeting. There was no

documentation in the minutes indicating the transfers were authorized by any of

the other Business Ofcers.

10

OFFICE OF THE NEW YORK STATE COMPTROLLER

10

Reported Cash The Treasurer should prepare and submit annual reports to the

Business Ofcers. These reports provide the Business Ofcers with

information necessary to monitor Department operations and give

other interested parties a summary of the Departments nancial

activities.

At the annual meeting held in April 2013, the Treasurer presented an

annual report of the Departments nancial activity to the membership.

The report listed receipts and disbursements from the prior calendar

year and a Statement of Accounts and Funds, which included the

Departments bank account balances. The minutes indicate that no one

present questioned any of the nancial information on the Treasurers

report. We reviewed year-end bank account balances dating back to

2005 and found that the amounts reported by the Treasurer were

consistently more than the corresponding balances found on the bank

statements (as adjusted for deposits in transit and outstanding checks)

since 2006, as indicated in Table 4.

The Business Ofcers did not compare transactions on the bank

statements with amounts recorded by the Treasurer, or cash balances

with the accounting records or annual report. Department ofcials

told us that bank statements were mailed to the Treasurers home and

that he always kept the bank statements and canceled checks there

and they never saw them.

Table 4: December 31 Bank Balance Comparison

Fiscal Year Per Treasurers

Report

Per Bank

Statements

Difference

2005 $4,939

a

$5,004 $65

2006 $5,834 $1,137 ($4,697)

2007 $4,899 $3,897 ($1,002)

2008 $4,812 $1,025 ($3,787)

2009 $4,301 $619 ($3,682)

2010 $5,263 $1,754 ($3,509)

2011 $8,717 $5,254 ($3,463)

2012 $8,315 $795 ($7,520)

2013

b

$8,247 $423 ($7,824)

a

A deposit of $4,947 in Foreign Fire Insurance Tax proceeds was made into

a Department bank account in 2005, but was not recorded on the 2005

annual report. If this deposit had been recorded on the annual report, the

difference would have been ($4,882).

b

General Ledger balance at October 10, 2013

The Departments bank balance on October 10, 2013 was $7,824

less than the cash balance in the Treasurers accounting records.

Subsequently, the Treasurer made an unexplained deposit of $7,500

on October 24, 2013

5

to the Department bank account, which was

____________________

5

We initially contacted the Treasurer, who agreed to meet with us on October 11,

2013. He did not make himself available on that date and instead provided the

Secretary with virtually none of the records we requested.

11 11

DIVISION OF LOCAL GOVERNMENT AND SCHOOL ACCOUNTABILITY

composed entirely of cash. When we questioned him regarding the

source of that cash, he stated that this was a return of funds that he

had invested for the Department. We found nothing in the minutes

to indicate that the Business Ofcers had authorized the Treasurer

to make any investments with Department funds. When we asked

for documentation to demonstrate what investments he had made, he

stated that where these funds were invested was irrelevant and that

the funds were always available for Department use.

The Business Ofcers should:

1. Investigate the questionable nancial transactions identied in this

report and take appropriate action to recover any misappropriated

moneys, as necessary;

2. Approve disbursements and transfers as required in the bylaws;

and

3. Periodically request and review bank statements and canceled

check images, comparing them with invoices and the Treasurers

accounting records.

Recommendations

12

OFFICE OF THE NEW YORK STATE COMPTROLLER

12

APPENDIX A

RESPONSE FROM DEPARTMENT OFFICIALS

The Department ofcials response to this audit can be found on the following page.

13 13

DIVISION OF LOCAL GOVERNMENT AND SCHOOL ACCOUNTABILITY

14

OFFICE OF THE NEW YORK STATE COMPTROLLER

14

APPENDIX B

AUDIT METHODOLOGY AND STANDARDS

We performed the following audit procedures to complete our audit objective:

Reviewed the Departments minutes and available documentation for information concerning

approval of disbursements and the annual Treasurers reports;

Reviewed the Departments bylaws to determine what guidelines were in place regarding

nancial activity;

Interviewed Department ofcials in regards to nancial operations, with a focus on the receipt,

deposit and disbursement practices and procedures;

Compared canceled checks, check images and activity noted on bank statements to Treasurer

reports, available receipts and invoices, and other Department records to determine the validity

of disbursements; and

Reviewed payments made to Department ofcials to determine if they were authorized.

We conducted this performance audit in accordance with GAGAS. Those standards require that we

plan and perform the audit to obtain sufcient, appropriate evidence to provide a reasonable basis

for our ndings and conclusions based on our audit objective. We believe that the evidence obtained

provides a reasonable basis for our ndings and conclusions based on our audit objective.

15 15

DIVISION OF LOCAL GOVERNMENT AND SCHOOL ACCOUNTABILITY

APPENDIX C

HOW TO OBTAIN ADDITIONAL COPIES OF THE REPORT

Ofce of the State Comptroller

Public Information Ofce

110 State Street, 15th Floor

Albany, New York 12236

(518) 474-4015

http://www.osc.state.ny.us/localgov/

To obtain copies of this report, write or visit our web page:

16

OFFICE OF THE NEW YORK STATE COMPTROLLER

16

APPENDIX D

OFFICE OF THE STATE COMPTROLLER

DIVISION OF LOCAL GOVERNMENT

AND SCHOOL ACCOUNTABILITY

Andrew A. SanFilippo, Executive Deputy Comptroller

Gabriel F. Deyo, Deputy Comptroller

Nathaalie N. Carey, Assistant Comptroller

LOCAL REGIONAL OFFICE LISTING

BINGHAMTON REGIONAL OFFICE

H. Todd Eames, Chief Examiner

Ofce of the State Comptroller

State Ofce Building - Suite 1702

44 Hawley Street

Binghamton, New York 13901-4417

(607) 721-8306 Fax (607) 721-8313

Email: Muni-Binghamton@osc.state.ny.us

Serving: Broome, Chenango, Cortland, Delaware,

Otsego, Schoharie, Sullivan, Tioga, Tompkins Counties

BUFFALO REGIONAL OFFICE

Jeffrey D. Mazula, Chief Examiner

Ofce of the State Comptroller

295 Main Street, Suite 1032

Buffalo, New York 14203-2510

(716) 847-3647 Fax (716) 847-3643

Email: Muni-Buffalo@osc.state.ny.us

Serving: Allegany, Cattaraugus, Chautauqua, Erie,

Genesee, Niagara, Orleans, Wyoming Counties

GLENS FALLS REGIONAL OFFICE

Jeffrey P. Leonard, Chief Examiner

Ofce of the State Comptroller

One Broad Street Plaza

Glens Falls, New York 12801-4396

(518) 793-0057 Fax (518) 793-5797

Email: Muni-GlensFalls@osc.state.ny.us

Serving: Albany, Clinton, Essex, Franklin,

Fulton, Hamilton, Montgomery, Rensselaer,

Saratoga, Schenectady, Warren, Washington Counties

HAUPPAUGE REGIONAL OFFICE

Ira McCracken, Chief Examiner

Ofce of the State Comptroller

NYS Ofce Building, Room 3A10

250 Veterans Memorial Highway

Hauppauge, New York 11788-5533

(631) 952-6534 Fax (631) 952-6530

Email: Muni-Hauppauge@osc.state.ny.us

Serving: Nassau and Suffolk Counties

NEWBURGH REGIONAL OFFICE

Tenneh Blamah, Chief Examiner

Ofce of the State Comptroller

33 Airport Center Drive, Suite 103

New Windsor, New York 12553-4725

(845) 567-0858 Fax (845) 567-0080

Email: Muni-Newburgh@osc.state.ny.us

Serving: Columbia, Dutchess, Greene, Orange,

Putnam, Rockland, Ulster, Westchester Counties

ROCHESTER REGIONAL OFFICE

Edward V. Grant, Jr., Chief Examiner

Ofce of the State Comptroller

The Powers Building

16 West Main Street Suite 522

Rochester, New York 14614-1608

(585) 454-2460 Fax (585) 454-3545

Email: Muni-Rochester@osc.state.ny.us

Serving: Cayuga, Chemung, Livingston, Monroe,

Ontario, Schuyler, Seneca, Steuben, Wayne, Yates Counties

SYRACUSE REGIONAL OFFICE

Rebecca Wilcox, Chief Examiner

Ofce of the State Comptroller

State Ofce Building, Room 409

333 E. Washington Street

Syracuse, New York 13202-1428

(315) 428-4192 Fax (315) 426-2119

Email: Muni-Syracuse@osc.state.ny.us

Serving: Herkimer, Jefferson, Lewis, Madison,

Oneida, Onondaga, Oswego, St. Lawrence Counties

STATEWIDE AUDITS

Ann C. Singer, Chief Examiner

State Ofce Building - Suite 1702

44 Hawley Street

Binghamton, New York 13901-4417

(607) 721-8306 Fax (607) 721-8313

Vous aimerez peut-être aussi

- Sample Church Audit ReportDocument5 pagesSample Church Audit Reportvrasshen580% (5)

- Summary of Richard A. Lambert's Financial Literacy for ManagersD'EverandSummary of Richard A. Lambert's Financial Literacy for ManagersPas encore d'évaluation

- N.S. Auditor General's January 2012 ReportDocument82 pagesN.S. Auditor General's January 2012 Reportnick_logan9361Pas encore d'évaluation

- Contract To Sell-Letter of IntentDocument4 pagesContract To Sell-Letter of IntentVj BrillantesPas encore d'évaluation

- Orient Fire District State Comptroller AuditDocument22 pagesOrient Fire District State Comptroller AuditTimesreviewPas encore d'évaluation

- Wallkill Hose Company Audit ReportDocument19 pagesWallkill Hose Company Audit ReportDaily FreemanPas encore d'évaluation

- North Castle AuditDocument13 pagesNorth Castle AuditCara MatthewsPas encore d'évaluation

- East Kingston Fire Company AuditDocument17 pagesEast Kingston Fire Company AuditDaily FreemanPas encore d'évaluation

- Eastchester Fire District: Internal Controls Over Financial OperationsDocument27 pagesEastchester Fire District: Internal Controls Over Financial OperationsCara MatthewsPas encore d'évaluation

- Mattituck Park District: Credit Cards and Segregation of DutiesDocument19 pagesMattituck Park District: Credit Cards and Segregation of DutiesSuffolk TimesPas encore d'évaluation

- Saratoga Springs City School District: Fund BalanceDocument13 pagesSaratoga Springs City School District: Fund BalanceBethany BumpPas encore d'évaluation

- Greenwich Central School District: Claims AuditingDocument12 pagesGreenwich Central School District: Claims AuditingBethany BumpPas encore d'évaluation

- Shandaken Payroll AuditDocument15 pagesShandaken Payroll AuditDaily FreemanPas encore d'évaluation

- Dutchess County AuditDocument15 pagesDutchess County AuditDaily FreemanPas encore d'évaluation

- Stephentown Audit by NYS ComptrollerDocument19 pagesStephentown Audit by NYS ComptrollereppelmannrPas encore d'évaluation

- Leon County District School Board: For The Fiscal Year Ended June 30, 2011Document85 pagesLeon County District School Board: For The Fiscal Year Ended June 30, 2011ChrisPas encore d'évaluation

- Mount Pleasant AuditDocument14 pagesMount Pleasant AuditCara MatthewsPas encore d'évaluation

- Audit Finds Irregularities at Guilderland Golf CourseDocument20 pagesAudit Finds Irregularities at Guilderland Golf CoursecathleencrowleyPas encore d'évaluation

- CPA EXAM QsDocument29 pagesCPA EXAM QsbajujuPas encore d'évaluation

- Spring Valley AuditDocument19 pagesSpring Valley AuditCara MatthewsPas encore d'évaluation

- Audit Report: ADMINISTRATIVE AND INTERNAL ACCOUNTING CONTROLS OVER THE OFFICE REVOLVING FUNDDocument31 pagesAudit Report: ADMINISTRATIVE AND INTERNAL ACCOUNTING CONTROLS OVER THE OFFICE REVOLVING FUNDjon_ortizPas encore d'évaluation

- Accounting and MonitoringDocument47 pagesAccounting and MonitoringslowcouchPas encore d'évaluation

- Audit of Lee County Commissioner ExpendituresDocument9 pagesAudit of Lee County Commissioner ExpendituresNews-PressPas encore d'évaluation

- Pamelia AuditDocument21 pagesPamelia AuditWatertown Daily TimesPas encore d'évaluation

- New Suffolk Audit, Dec. 2013Document29 pagesNew Suffolk Audit, Dec. 2013Grant ParpanPas encore d'évaluation

- Copenhagen Volunteer Fire 2021 114Document19 pagesCopenhagen Volunteer Fire 2021 114Jeff NelsonPas encore d'évaluation

- Week 5Document48 pagesWeek 5BookAddict721Pas encore d'évaluation

- CPA EXAM QsDocument34 pagesCPA EXAM QsYaj CruzadaPas encore d'évaluation

- Case StudyDocument6 pagesCase StudyErik PetersonPas encore d'évaluation

- Grand Jury Report On Internal Audit DivisionDocument7 pagesGrand Jury Report On Internal Audit DivisionThe Press-Enterprise / pressenterprise.comPas encore d'évaluation

- Saratoga Springs Housing Authority AuditDocument43 pagesSaratoga Springs Housing Authority AuditDavid LombardoPas encore d'évaluation

- Everett School District Audit Exit Conference DocumentDocument6 pagesEverett School District Audit Exit Conference DocumentJessica OlsonPas encore d'évaluation

- Central Davis Sewer District 2011 AuditDocument26 pagesCentral Davis Sewer District 2011 Auditapi-257848573Pas encore d'évaluation

- Maricopa Cty 6-30-05 Mangmt Ltr1Document16 pagesMaricopa Cty 6-30-05 Mangmt Ltr1tonygoprano2850Pas encore d'évaluation

- Audit of Mohonasen School DistrictDocument11 pagesAudit of Mohonasen School DistrictDavid LombardoPas encore d'évaluation

- Central Davis Sewer District 2012 Audited StatementsDocument28 pagesCentral Davis Sewer District 2012 Audited Statementsapi-257848573Pas encore d'évaluation

- North Green BushDocument23 pagesNorth Green BushjfrancorecordPas encore d'évaluation

- Problems Chapter 7Document9 pagesProblems Chapter 7Trang Le0% (1)

- Entrance Conference Document - 2013 SSD AuditsDocument4 pagesEntrance Conference Document - 2013 SSD AuditsJulian A.Pas encore d'évaluation

- CDCR Letter To State ControllerDocument1 pageCDCR Letter To State ControllerLakeCoNewsPas encore d'évaluation

- Wheeler VilleDocument16 pagesWheeler VilleBethany BumpPas encore d'évaluation

- Wolf Kathryn Dentistar CaseDocument4 pagesWolf Kathryn Dentistar Caseapi-239635502Pas encore d'évaluation

- Audit 4-30-12 2Document12 pagesAudit 4-30-12 2api-163536539Pas encore d'évaluation

- Saratoga CoDocument16 pagesSaratoga CoDennis YuskoPas encore d'évaluation

- Internal Audit For Nueces Co. Justices of The PeaceDocument36 pagesInternal Audit For Nueces Co. Justices of The PeacecallertimesPas encore d'évaluation

- General Brown Financial Report - Nov. 2014Document16 pagesGeneral Brown Financial Report - Nov. 2014Watertown Daily TimesPas encore d'évaluation

- NYS Comptroller - Wayne Cty. Healthcare EligibilityDocument14 pagesNYS Comptroller - Wayne Cty. Healthcare EligibilityerikvsorensenPas encore d'évaluation

- Off-Ledger Bank Account Study 2018 - 0Document12 pagesOff-Ledger Bank Account Study 2018 - 0Lin ChrisPas encore d'évaluation

- 2018BreathittFFES PRDocument11 pages2018BreathittFFES PRWYMT TelevisionPas encore d'évaluation

- Distrust, Disagreements, DysfunctionDocument25 pagesDistrust, Disagreements, DysfunctionRuth SchneiderPas encore d'évaluation

- AIS, CPA Material, Revenue CycleDocument29 pagesAIS, CPA Material, Revenue CycleDamien LeePas encore d'évaluation

- Leon County District School Board: For The Fiscal Year Ended June 30, 2014Document83 pagesLeon County District School Board: For The Fiscal Year Ended June 30, 2014ChrisPas encore d'évaluation

- NPO Acct ManualDocument26 pagesNPO Acct ManualdavidkongPas encore d'évaluation

- OPP ITO Appendix CDocument4 pagesOPP ITO Appendix Cishmael daroPas encore d'évaluation

- State Comptroller's Audit of The The Hendrick Hudson School District's Financial ConditionDocument11 pagesState Comptroller's Audit of The The Hendrick Hudson School District's Financial ConditionCara MatthewsPas encore d'évaluation

- Financial Review GuideDocument17 pagesFinancial Review GuideAngelPas encore d'évaluation

- Company, Against The Client Involving Possible Defective Products. It Is Probable That TheDocument5 pagesCompany, Against The Client Involving Possible Defective Products. It Is Probable That TheLucy AnaPas encore d'évaluation

- Audited ReportDocument34 pagesAudited Reportcares_2012Pas encore d'évaluation

- Audit of Account ReceivablesDocument18 pagesAudit of Account ReceivablesnaniappoPas encore d'évaluation

- 00 555Document129 pages00 555Giora RozmarinPas encore d'évaluation

- Pennies For Charity 2018Document12 pagesPennies For Charity 2018ZacharyEJWilliamsPas encore d'évaluation

- Joseph Ruggiero Employment AgreementDocument6 pagesJoseph Ruggiero Employment AgreementjspectorPas encore d'évaluation

- Cornell ComplaintDocument41 pagesCornell Complaintjspector100% (1)

- IG LetterDocument3 pagesIG Letterjspector100% (1)

- State Health CoverageDocument26 pagesState Health CoveragejspectorPas encore d'évaluation

- Film Tax Credit - Quarterly Report, Calendar Year 2017 2nd Quarter PDFDocument8 pagesFilm Tax Credit - Quarterly Report, Calendar Year 2017 2nd Quarter PDFjspectorPas encore d'évaluation

- Federal Budget Fiscal Year 2017 Web VersionDocument36 pagesFederal Budget Fiscal Year 2017 Web VersionjspectorPas encore d'évaluation

- Opiods 2017-04-20-By Numbers Brief No8Document17 pagesOpiods 2017-04-20-By Numbers Brief No8rkarlinPas encore d'évaluation

- Oag Sed Letter Ice 2-27-17Document3 pagesOag Sed Letter Ice 2-27-17BethanyPas encore d'évaluation

- NYSCrimeReport2016 PrelimDocument14 pagesNYSCrimeReport2016 PrelimjspectorPas encore d'évaluation

- Abo 2017 Annual ReportDocument65 pagesAbo 2017 Annual ReportrkarlinPas encore d'évaluation

- Inflation AllowablegrowthfactorsDocument1 pageInflation AllowablegrowthfactorsjspectorPas encore d'évaluation

- 2017 08 18 Constitution OrderDocument27 pages2017 08 18 Constitution OrderjspectorPas encore d'évaluation

- Teacher Shortage Report 05232017 PDFDocument16 pagesTeacher Shortage Report 05232017 PDFjspectorPas encore d'évaluation

- SNY0517 Crosstabs 052417Document4 pagesSNY0517 Crosstabs 052417Nick ReismanPas encore d'évaluation

- Siena Poll March 27, 2017Document7 pagesSiena Poll March 27, 2017jspectorPas encore d'évaluation

- Class of 2022Document1 pageClass of 2022jspectorPas encore d'évaluation

- 2017 School Bfast Report Online Version 3-7-17 0Document29 pages2017 School Bfast Report Online Version 3-7-17 0jspectorPas encore d'évaluation

- Hiffa Settlement Agreement ExecutedDocument5 pagesHiffa Settlement Agreement ExecutedNick Reisman0% (1)

- Activity Overview: Key Metrics Historical Sparkbars 1-2016 1-2017 YTD 2016 YTD 2017Document4 pagesActivity Overview: Key Metrics Historical Sparkbars 1-2016 1-2017 YTD 2016 YTD 2017jspectorPas encore d'évaluation

- 16 273 Amicus Brief of SF NYC and 29 Other JurisdictionsDocument55 pages16 273 Amicus Brief of SF NYC and 29 Other JurisdictionsjspectorPas encore d'évaluation

- Youth Cigarette and E-Cigs UseDocument1 pageYouth Cigarette and E-Cigs UsejspectorPas encore d'évaluation

- Schneiderman Voter Fraud Letter 022217Document2 pagesSchneiderman Voter Fraud Letter 022217Matthew HamiltonPas encore d'évaluation

- 2016 Local Sales Tax CollectionsDocument4 pages2016 Local Sales Tax CollectionsjspectorPas encore d'évaluation

- Voting Report CardDocument1 pageVoting Report CardjspectorPas encore d'évaluation

- Darweesh Cities AmicusDocument32 pagesDarweesh Cities AmicusjspectorPas encore d'évaluation

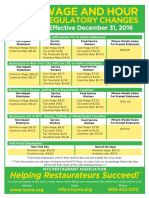

- Wage and Hour Regulatory Changes 2016Document2 pagesWage and Hour Regulatory Changes 2016jspectorPas encore d'évaluation

- p12 Budget Testimony 2-14-17Document31 pagesp12 Budget Testimony 2-14-17jspectorPas encore d'évaluation

- Review of Executive Budget 2017Document102 pagesReview of Executive Budget 2017Nick ReismanPas encore d'évaluation

- Pub Auth Num 2017Document54 pagesPub Auth Num 2017jspectorPas encore d'évaluation

- KMI 30 IndexDocument27 pagesKMI 30 IndexSyed NomaanPas encore d'évaluation

- Fashion Retail Merchandising Retail Visit ReportDocument6 pagesFashion Retail Merchandising Retail Visit Reportchins1289Pas encore d'évaluation

- 2023 HSC Business StudiesDocument22 pages2023 HSC Business StudiesSreemoye ChakrabortyPas encore d'évaluation

- MGT657 Chapter 7Document49 pagesMGT657 Chapter 7adamPas encore d'évaluation

- The Compact For Responsive and Responsible Leadership: A Roadmap For Sustainable Long-Term Growth and OpportunityDocument1 pageThe Compact For Responsive and Responsible Leadership: A Roadmap For Sustainable Long-Term Growth and OpportunityMiguel AugustoPas encore d'évaluation

- OTHM L5 Diploma in Tourism and Hospitality Management Spec 2022 09 NewDocument31 pagesOTHM L5 Diploma in Tourism and Hospitality Management Spec 2022 09 Newajaya nathPas encore d'évaluation

- Strategic Choice: Group 1 Eugenio - Fernandez - Gabito - Goño - Iglopas - RamosDocument14 pagesStrategic Choice: Group 1 Eugenio - Fernandez - Gabito - Goño - Iglopas - Ramosjethro eugenioPas encore d'évaluation

- Financial Statement Analysis and Security Valuation 5th Edition by Penman ISBN Test BankDocument16 pagesFinancial Statement Analysis and Security Valuation 5th Edition by Penman ISBN Test Bankcindy100% (24)

- Death of Big LawDocument55 pagesDeath of Big Lawmaxxwe11Pas encore d'évaluation

- Mag BudgetDocument120 pagesMag BudgetPriya SinghPas encore d'évaluation

- GTE Financial Capacity Matrix (S) - Title & Name (2021)Document4 pagesGTE Financial Capacity Matrix (S) - Title & Name (2021)Anupriya RoyPas encore d'évaluation

- A Survey Paper - PM 1.0Document5 pagesA Survey Paper - PM 1.0Aswin KrishnanPas encore d'évaluation

- HRP Case StudyDocument1 pageHRP Case Studymruga_123Pas encore d'évaluation

- SalvoDocument8 pagesSalvoAlamgir HossainPas encore d'évaluation

- CF Final Group 3Document8 pagesCF Final Group 3Armyboy 1804Pas encore d'évaluation

- REACTIONDocument3 pagesREACTIONVhia ParajasPas encore d'évaluation

- Huntersvsfarmers 131204084857 Phpapp01Document1 pageHuntersvsfarmers 131204084857 Phpapp01Charles BronsonPas encore d'évaluation

- GPS vs. TJX Financial AnalysisDocument12 pagesGPS vs. TJX Financial AnalysisBen Van NestePas encore d'évaluation

- Standalone Accounts 2008Document87 pagesStandalone Accounts 2008Noore NayabPas encore d'évaluation

- Group 10 - ABC Case Study Corelio PrintingDocument10 pagesGroup 10 - ABC Case Study Corelio Printingmuhammad ifwatPas encore d'évaluation

- Tomato ProductsDocument5 pagesTomato ProductsDan Man100% (1)

- ENVYSION Commodity Strategy Fund PresentationDocument17 pagesENVYSION Commodity Strategy Fund PresentationNicky TsaiPas encore d'évaluation

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument5 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceSandesh Pujari100% (1)

- Quality Cost SummaryDocument2 pagesQuality Cost SummaryirfanPas encore d'évaluation

- A Study On Credit Risk Management at Canara BankDocument10 pagesA Study On Credit Risk Management at Canara BankBhaswani33% (6)

- The History of The Philippine Currency: Republic Central CollegesDocument8 pagesThe History of The Philippine Currency: Republic Central CollegesDaishin Kingsley SesePas encore d'évaluation

- Fountil BriefDocument28 pagesFountil BriefRAJYOGPas encore d'évaluation

- PRABHAVATHI Form26QBDocument2 pagesPRABHAVATHI Form26QBPrakash BattalaPas encore d'évaluation