Académique Documents

Professionnel Documents

Culture Documents

Fixed Asset Register Sample

Transféré par

Visas Siva0 évaluation0% ont trouvé ce document utile (0 vote)

322 vues59 pagesFixed Assets

Copyright

© © All Rights Reserved

Formats disponibles

XLS, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentFixed Assets

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme XLS, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

322 vues59 pagesFixed Asset Register Sample

Transféré par

Visas SivaFixed Assets

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme XLS, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 59

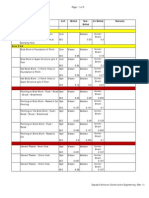

Excel Skills | Fixed Assets Register Template

About this template

This comprehensive template enables users to compile a complete fixed assets register which incorporates an unlimited number of fixed asset classes

and categories; facilitates recording additions, disposals, revaluations and impairments; automatically calculates monthly and year-to-date

depreciation charges; calculates tax values based on user defined tax codes; calculates deferred tax balances and includes a comprehensive

automated journal report. The template has been designed specifically for the requirements of I!" but can also be used to compile a simple fixed

asset register which is only based on historical costs.

About our unique templates

#ur unique, practical templates produce results that are more comparable to software solutions than regular $xcel templates. %ost $xcel templates

only contain limited functionality but our templates produce complex automated reports based on limited user input. &ou also don't need advanced

$xcel s(ills in order to use our templates - all our templates only require basic user input and include comprehensive step by step instructions.

About this sample file

This $xcel document is only a sample of the fixed assets register template. )e*ve created this sample to enable customers to view the layout and

features of this template. &ou will therefore not be able to use this version of the template - the full version of the template can only be downloaded

after buying the template or a full membership of the $xcel "(ills website.

Our full membership includes:

+ ,ccess to all -./ of our unique $xcel templates

+ 012 days access to our 0../ $xcel video tutorials

Excel Skills | Fixed Assets Register Template

About this template

This comprehensive template enables users to compile a complete fixed assets register which incorporates an unlimited number of fixed asset classes

and categories; facilitates recording additions, disposals, revaluations and impairments; automatically calculates monthly and year-to-date

depreciation charges; calculates tax values based on user defined tax codes; calculates deferred tax balances and includes a comprehensive

automated journal report. The template has been designed specifically for the requirements of I!" but can also be used to compile a simple fixed

asset register which is only based on historical costs.

About our unique templates

#ur unique, practical templates produce results that are more comparable to software solutions than regular $xcel templates. %ost $xcel templates

only contain limited functionality but our templates produce complex automated reports based on limited user input. &ou also don't need advanced

$xcel s(ills in order to use our templates - all our templates only require basic user input and include comprehensive step by step instructions.

About this sample file

This $xcel document is only a sample of the fixed assets register template. )e*ve created this sample to enable customers to view the layout and

features of this template. &ou will therefore not be able to use this version of the template - the full version of the template can only be downloaded

after buying the template or a full membership of the $xcel "(ills website.

Our full membership includes:

+ ,ccess to all -./ of our unique $xcel templates

+ 012 days access to our 0../ $xcel video tutorials

u! this template

click here

Excel Skills | Fixed Assets Register Template

About this template

This comprehensive template enables users to compile a complete fixed assets register which incorporates an unlimited number of fixed asset classes

and categories; facilitates recording additions, disposals, revaluations and impairments; automatically calculates monthly and year-to-date

depreciation charges; calculates tax values based on user defined tax codes; calculates deferred tax balances and includes a comprehensive

automated journal report. The template has been designed specifically for the requirements of I!" but can also be used to compile a simple fixed

asset register which is only based on historical costs.

About our unique templates

#ur unique, practical templates produce results that are more comparable to software solutions than regular $xcel templates. %ost $xcel templates

only contain limited functionality but our templates produce complex automated reports based on limited user input. &ou also don't need advanced

$xcel s(ills in order to use our templates - all our templates only require basic user input and include comprehensive step by step instructions.

About this sample file

This $xcel document is only a sample of the fixed assets register template. )e*ve created this sample to enable customers to view the layout and

features of this template. &ou will therefore not be able to use this version of the template - the full version of the template can only be downloaded

after buying the template or a full membership of the $xcel "(ills website.

Our full membership includes:

+ ,ccess to all -./ of our unique $xcel templates

+ 012 days access to our 0../ $xcel video tutorials

Excel Skills | Fixed Assets Register Template

About this template

This comprehensive template enables users to compile a complete fixed assets register which incorporates an unlimited number of fixed asset classes

and categories; facilitates recording additions, disposals, revaluations and impairments; automatically calculates monthly and year-to-date

depreciation charges; calculates tax values based on user defined tax codes; calculates deferred tax balances and includes a comprehensive

automated journal report. The template has been designed specifically for the requirements of I!" but can also be used to compile a simple fixed

asset register which is only based on historical costs.

About our unique templates

#ur unique, practical templates produce results that are more comparable to software solutions than regular $xcel templates. %ost $xcel templates

only contain limited functionality but our templates produce complex automated reports based on limited user input. &ou also don't need advanced

$xcel s(ills in order to use our templates - all our templates only require basic user input and include comprehensive step by step instructions.

About this sample file

This $xcel document is only a sample of the fixed assets register template. )e*ve created this sample to enable customers to view the layout and

features of this template. &ou will therefore not be able to use this version of the template - the full version of the template can only be downloaded

after buying the template or a full membership of the $xcel "(ills website.

Our full membership includes:

+ ,ccess to all -./ of our unique $xcel templates

+ 012 days access to our 0../ $xcel video tutorials

u! this template

click here

Register for a full membership

click here

3age 0 of 24

Excel Skills | Fixed Assets Register Template

Instructions

The following sheets are included in this template5

Template Set"up

Asset Classes

###$excel"skills$com

This comprehensive template enables users to compile a complete fixed assets register which incorporates an unlimited

number of fixed asset classes and categories; facilitates recording additions, disposals, revaluations and impairments;

automatically calculates monthly and year-to-date depreciation charges; calculates tax values based on user defined tax

codes; calculates deferred tax balances and includes a comprehensive automated journal report. The template has been

designed specifically for the requirements of I!" but can also be used to compile a simple fixed asset register which is only

based on historical costs.

Note: This template only accommodates depreciation calculations on a straight line basis. If you therefore need to calculate

depreciation on a reducing balance or other depreciation basis, the template will unfortunately not be suitable for your

requirements.

Set"up - the input cells on this sheet enable you to customi6e the template for your business. &ou can enter your business

name, select a year end period, specify an income tax percentage, maintain the default fixed asset classes, maintain the

default fixed asset categories and maintain the default tax codes. , complete list of user input error codes are also included

on this sheet for information purposes.

Assets - this sheet enables users to create a unique asset code for all fixed assets and the columns with the light blue

column headings contain all the comprehensive, automated calculations that form part of the fixed asset register. 7ser input

is limited to entering an asset identification number, asset description, asset type, asset category and tax code. The period

for which the fixed asset register is compiled is determined by the review date that is specified at the top of the sheet.

Transact - all asset transactions need to be recorded on this sheet. ,sset transactions include acquisitions, revaluations and

disposals. 7ser input is limited to entering the transaction date, transaction type, asset number, supplier, document number,

transaction amount, asset lifetime, residual value and proceeds on disposal. The columns with light blue column headings

contain the formulas that form the basis of all the calculations that are required in order to produce a comprehensive,

accurate fixed asset register.

%ategor! - this sheet contains a fixed assets summary which is based on the fixed asset categories that are created on the

"et-up sheet. 8o user input is required on this sheet and 0. fixed asset categories are accommodated. ,dditional fixed asset

categories can be added by simply copying the formulas in the last row into the required number of additional rows.

%lass - this sheet contains a fixed assets summary which is based on the asset classes that are created on the "et-up

sheet. 8o user input is required on this sheet and a maximum of 0. asset classes are accommodated.

&ournals - this sheet contains an automated journal report for all fixed asset transactions. The journal report can be

compiled on a monthly or year-to-date basis and is based on the account numbers that are specified in the asset category

set-up on the "et-up sheet. The journal report accommodates 0. asset categories but additional categories can be added by

simply copying the formulas in the last row into the required number of additional rows.

The template can be customi6ed for your business by editing the default business details, asset categories, asset classes

and tax codes on the "et-up sheet. The business name that is entered in cell 92 is used as a heading on all the other

sheets, the year-end month that is selected in cell 9: is used in order to calculate year-to-date balances and the income tax

percentage that is specified in cell 94 is used to calculate deferred tax balances.

The template includes 1 default fixed asset classes which can be customi6ed in the cell range from cell ,;0 to cell <;=. The

default asset class codes in column , and the default asset class descriptions in column < can be amended and you can add

additional asset classes by simply inserting a new row between the first and last class codes, entering a new code for the

asset class in column , and entering a description for the new class in column <.

Note: All new asset classes must be inserted above the !! asset class code and a ma"imum of #$ asset classes can be

accommodated in the template.

3age - of 24

Excel Skills | Fixed Assets Register Template

Instructions

###$excel"skills$com

3age 2 of 24

Excel Skills | Fixed Assets Register Template

Instructions

###$excel"skills$com

Asset Categories

Ta" Codes

The asset classes that are created on the "et-up sheet should be representative of the asset classes that are included on

the financial statements. "ome businesses however require more asset classes than what is disclosed on the financial

statements in order to accommodate separate allocation in the business accounts. )e have therefore created separate

asset categories for this purpose.

The template includes ;; asset categories which can be customi6ed in the cell range from cell ,>0 to cell ?00. $ach asset

category contains a unique code in column ,, is lin(ed to an asset class in column <, contains a description in column 9 and

contains an account number in each of the columns from column @ to ?.

The asset category codes can be in any format but we suggest using a combination of letters and numbers as illustrated with

the default category codes. $ach category that is created will be included separately on the 9ategory sheet and needs to be

lin(ed to one of the asset class codes in cells ,;0 to ,;= by selecting the appropriate asset class code from the list box in

column <. The asset categories are therefore in fact sub classes of the main asset classes that are included on the financial

statements.

The account numbers that need to be entered in columns @ to ? are included in the automated journal report on the Aournal

sheet. ,ll fixed asset journals are therefore based on the asset categories that are created which means that a separate

asset category is required for each fixed asset account group or depreciation cost centre. The accounts that need to be

entered in each column are better described as follows5

+ Cost - the general ledger accounts that are entered in this column reflect the cost or gross carrying value of each asset

category. These accounts should therefore be balance sheet accounts.

+ Accum %epr - the accounts in this column reflect the accumulated depreciation that has been written off against each asset

category. These accounts should therefore be balance sheet accounts.

+ %epr - the total depreciation charges for each asset category is allocated to the accounts in this column. These accounts

should therefore be income statement accounts.

+ &evalue - if a revaluation reserve is created after an asset revaluation, the revaluation surpluses for each asset category

are allocated to these accounts. "eparate revaluation reserve accounts can be added for each category or a single account

can be used for all fixed assets by simply entering the same account number for all asset categories. The accounts that are

specified should be balance sheet accounts.

+ Impairment - if an asset is valued at less than the current net carrying value, the impairment amounts for each asset

category are allocated to these accounts. &ou can use separate impairment accounts for each asset category or enter the

same account for all categories in order to allocate all asset impairment amounts to the same account. The accounts that are

specified should be income statement accounts because asset impairment amounts are written off to the income statement.

+ 'rofit - if assets are sold, the profits or losses on the disposal of assets are allocated to the accounts that are specified in

this column. &ou can again use a single account for all asset categories or enter separate accounts for each asset category.

These accounts should be income statement accounts.

+ %ef Ta" () - enter the accounts to which deferred tax assets or liabilities should be allocated. In most instances, only one

balance sheet account is used for this purpose but you can specify separate accounts if you want to be able to view the

deferred tax asset or liability for each asset category separately.

+ %ef Ta" I) - enter the accounts to which deferred tax charges for the year should be allocated. In most instances, only one

income statement account is used for this purpose but you can specify separate accounts if you want to be able to view the

deferred charges for each asset category separately.

Note: All new asset categories must be inserted above the !! asset category code. The template accommodates #$ asset

categories on the Category sheet but you can add additional asset categories on this sheet by simply copying the formulas in

the last row into the appropriate number of additional rows. An unlimited number of asset categories are therefore

accommodated.

3age 1 of 24

Excel Skills | Fixed Assets Register Template

Instructions

###$excel"skills$com

The template includes ;. default tax codes in the cell range from cell ,0= to A-: but you can add as many additional tax

codes as required. The tax codes are used to calculate the tax allowances that can be claimed for each fixed asset and the

tax values at the beginning and the end of each financial year. These tax balances are then used in order to calculate the

deferred tax balances and charges for each financial year.

3age : of 24

Excel Skills | Fixed Assets Register Template

Instructions

###$excel"skills$com

Input *rror Codes

Asset Set"up

, single alphabetical letter is used as the tax code in column , and a description for each tax code can be entered in column

9. ,ll the tax codes that are created on the "et-up sheet are available for selection in column on the ,ssets sheet.

Note: +ou can create additional ta" codes by inserting a new row anywhere between the first and last rows, entering a new

ta" code in column A and specifying the appropriate annual ta" percentages.

9olumn < in the tax codes section contains a list box which enables users to specify whether appropriation needs to be

applied in the tax allowance calculations for the particular tax code. If appropriation is applied Bthe C&esC option is selectedD, it

means that the tax allowance calculation will ta(e the effect of partial years into account. If appropriation is not applicable

Bthe C8oC option is selectedD, the tax allowance will be based on a full year regardless of when an asset is acquired.

*"ample: An asset with a cost of ,$,$$$ is acquired in %ecember by a business with a -ebruary year.end. The ta" code that

is assigned to the asset is ( which has No appropriation specified in column ( and a ta" percentage of /$0 in year ,. A full

year1s ta" allowance will therefore be written off in %ecember 2and each subsequent year3 which means that the ta"

allowance for the first year would be /,$$$.

If the ta" code of the asset had been A 2which has a +es option in column (3 and the ta" percentage in the first year is also

/$0, it means that the ta" allowance in the first year would only be ###.## 2,$,$$$ " /$0 E ,/ " /3. This is because

appropriation would apply and the ta" allowance calculation will therefore only include / months.

The tax allowance percentages in column @ to F are used to calculate the appropriate tax allowance amounts for the assets

that are lin(ed to the particular tax codes. &ou will therefore only be able to specify tax percentages for 2 years and if a

longer period is applicable, the year 2 percentage will be used for all subsequent annual periods until an asset is fully written

off for tax purposes.

*"ample: If a ta" code is created for buildings and a ta" allowance percentage of /0 is applicable, the year , to 4 ta"

percentages need to be entered as /0 and the year 4 percentage 2which is /03 will be applied to all the annual periods after

year 4. This means that a ta" allowance of /0 per year will be written off until the asset is fully written off after 4$ years.

Note: The 4+ Total and A- columns contain formulas which should be copied for all new ta" codes that are added to the )et.

up sheet. It is imperative that these formulas are copied for all new ta" codes otherwise some of the ta" calculations may not

be accurate.

The 2& Total column contains the total percentage value of the tax allowance percentages that are entered in the &ear ; to 2

columns and will automatically be highlighted in red if the value exceeds ;..G. The maximum percentage that can be written

off on an asset is ;..G - if you therefore specify tax allowances of more than ;..G, only the tax allowances that ma(e up

the first ;..G will be ta(en into account in determining the appropriate tax values of the asset. The , column contains an

appropriation value which is based on the selection in column <.

The input error codes at the bottom of the "et-up sheet are included for information purposes only and provide users with a

reason for the error codes that may be encountered when entering transactions on the ,ssets and Transact sheets. These

error codes are covered in more detail in the $rror 9odes section of these instructions.

3age = of 24

Excel Skills | Fixed Assets Register Template

Instructions

###$excel"skills$com

$ach individual fixed asset must be added to the ,ssets sheet by assigning an asset number to the fixed asset. The ,ssets

sheet is in actual fact a comprehensive fixed asset register which contains all the individual assets that form part of the fixed

assets register. ,ll fixed asset transactions need to be recorded on the Transact sheet and the 9ategory and 9lass sheets

contains summaries of all the appropriate asset groups.

3age 4 of 24

Excel Skills | Fixed Assets Register Template

Instructions

###$excel"skills$com

, unique asset number must be created for each fixed asset on the ,ssets sheet. &ou can use any asset numbering

convention but we strongly recommend using a combination of letters and numbers as illustrated in our example data. )e

have used an asset numbering convention which starts with two letters followed by a hyphen and five numbers. The letters

can be used to distinguish between different asset categories or classes.

Note: All fi"ed assets must be added to the Assets sheet by assigning a unique asset code to the particular asset. The

acquisition of the asset then needs to be recorded on the Transact sheet after which the appropriate values will be reflected

on the Assets sheet. 5sers therefore need to create asset codes for all their assets and record acquisition transactions for all

assets on the Transact sheet.

,ll the columns on the ,ssets sheet with yellow column headings require user input while the columns with light blue column

headings contain formulas which should be copied for each new asset that is added to the sheet. The following user input is

required on the ,ssets sheet5

Asset 'umber - enter a unique asset number for each fixed asset in this column. @uplicate asset numbers may result in

inaccurate calculations and it is therefore imperative that each fixed asset has a unique asset number. "imilar assets or

asset components can be distinguished by adding a CH;C and CH>C at the end of the asset number.

Asset () 'umber - enter an asset identification number in this column. This number should preferably be applied to the

asset in order to facilitate physical verification of assets and assist in identifying each fixed asset that is included in the fixed

asset register.

)escription - enter a comprehensive description of the asset in this column. The asset description should enable users to

easily identify the asset and should assist users in distinguishing between similar assets.

Asset T!pe - select an asset type from the list box. This column assists in identifying leased assets and the list boxes in this

column therefore include an owned and leased option.

%ategor! - select an asset category from the list box in this column. ,ll the asset categories that are created on the "et-up

sheet are available for selection. $ach asset needs to be lin(ed to an asset category which is lin(ed to an asset class in the

,sset 9ategory section on the "et-up sheet.

Tax %ode - select a tax code from the list box in this column. ,ll the tax codes that are created on the "et-up sheet are

available for selection.

Note: All the contents on the Assets sheet should form part of a continuous cell range otherwise some assets may not be

included in the template calculations. The Assets sheet should therefore not contain any blan6 rows between rows that

contain data.

,ll the columns with light blue column headings contain calculations which are based on the review date that is entered in

cell $>. The date that is entered in this cell therefore determines which transactions are included in the asset balance and

depreciation calculations. It is therefore imperative that you enter the correct date in this cell when reviewing the fixed asset

register.

The cell range from cell F> to cell ?> displays the appropriate year-to-date B&T@D and month-to-date B%T@D from and to

dates which are in effect based on the review date that is specified in cell $>. 8ote that all the template calculations are

based on month end dates - even if you enter a review date that does not fall on a month end, the template calculations will

still include all the transactions and depreciation calculations for the entire month.

The &T@ periods are determined based on the year-end period that is selected in cell 9: on the "et-up sheet. ,ll the &T@

asset balances and depreciation calculations will therefore be calculated automatically based on the review date and the

year-end period that has been specified.

Note: The review date ma6es it easy to roll the template forward or bac6 for any subsequent or previous month and all the

template calculations are updated automatically. +ou can therefore simply enter a new date in cell */ and all the calculations

on all the sheets in the template are automatically updated.

3age ;. of 24

Excel Skills | Fixed Assets Register Template

Instructions

###$excel"skills$com

The ,ssets sheet contains 2> calculated columns which all have light blue column headings. The calculations in these

columns are all based on the transactions that are entered on the Transact sheet and some of the calculations are for

information purposes only while others form an integral part of the fixed asset register. )e'll now briefly cover the purpose of

each calculated column5

3age ;; of 24

Excel Skills | Fixed Assets Register Template

Instructions

###$excel"skills$com

The following columns are included for information purposes only:

Assets at Cost:

Error %ode - if there is a problem with the input in any of the user input columns, an error code will be displayed in this

column. !efer to the "et-up sheet for a description of each error code and to the $rror 9ode section of these instructions for

more information about the reason for the error code that is displayed.

%lass - this column contains the asset class that the asset is lin(ed to. The asset class is determined by the asset category

that is selected in column $ and each asset category is lin(ed to a single asset class in the ,sset 9ategory section on the

"et-up sheet.

Acquisition )ate - the asset acquisition date is displayed in this column. ,fter creating an asset number, an acquisition

transaction needs to be recorded on the Transact sheet in order to record the acquisition of the asset. If an acquisition

transaction has not been recorded for the particular asset, this column will contain an CaddIC message.

*ast Trn )ate - this column contains the date of the last transaction that has been recorded for the appropriate asset. If no

transaction has been recorded, the column will contain an CaddIC message which indicates that an asset acquisition

transaction still needs to be recorded.

%urrent Trn )ate - this column contains the date of the last transaction for the asset that is dated before the &T@ To @ate

which is displayed in cell I>. It therefore represents the last transaction that has been recorded before the current period end.

*ast +, Trn )ate - this column contains the date of the last transaction for the asset that is dated before the &T@ rom @ate

which is displayed in cell F>. It therefore represents the last transaction that has been recorded before the end of the

previous financial period.

*ast +- Trn )ate - this column contains the date of the last transaction for the asset that is dated before the %T@ rom

@ate which is displayed in cell A>. It therefore represents the last transaction that has been recorded before the end of the

previous month.

)isposal )ate - if an asset has been disposed of, the date of disposal as per the Transact sheet will be displayed in this

column. 8ote that a disposal transaction has to be recorded on the Transact sheet for all asset disposals.

+roceeds on )isposal - if an asset has been disposed of, the proceeds on disposal as per the Transact sheet will be

displayed in this column.

.istorical %ost - the historical cost of all assets that have been acquired before the end of the current financial period is

displayed in this column. The historical cost is defined as the transaction amount of the acquisition transaction that is

recorded on the Transact sheet for the particular asset.

Acti/e *ifetime - the lifetime that has been recorded on the Transact sheet for the most recent transaction that is dated

before the current period end is displayed in this column.

Acti/e Res 0alue - the residual value that has been recorded on the Transact sheet for the most recent transaction that is

dated before the current period end is displayed in this column.

Tax %ost - the tax cost of the asset is displayed in this column. The tax cost is the same as the historical cost of the asset.

This column will only contain a value if the asset has been acquired before the current period end.

%urrent Tax 1 - the tax allowance percentage for the current period is displayed in this column. This percentage is

dependent on the tax code that has been selected in column and the annual tax percentages that have been defined for

the particular tax code on the "et-up sheet. If a tax code has not been selected in column , a CcodeJC message will be

displayed in this column.

Elapsed -onths +, - the value in this column indicates the number of months that have elapsed since the acquisition of the

asset up to the end of the previous financial period. , value will only be displayed for assets that have not been disposed of

before the end of the previous financial period.

Elapsed -onths %, - the value in this column indicates the number of months that have elapsed since the acquisition of the

asset up to the end of the current financial period. , value will only be displayed for assets that have not been disposed of

before the end of the current financial period.

Elapsed -onths +- - the value in this column indicates the number of months that have elapsed since the acquisition of the

asset up to the end of the previous month. , value will only be displayed for assets that have not been disposed of before the

end of the previous month.

Opening alance - the opening cost or gross carrying value of the asset at the beginning of the current financial period is

included in this column.

Additions - if an asset has been acquired during the current financial period, the cost of the asset is included in this column.

The cost of the asset is entered as the transaction amount when recording an acquisition type transaction on the Transact

sheet.

3age ;> of 24

Excel Skills | Fixed Assets Register Template

Instructions

###$excel"skills$com

Accumulated %epreciation:

Total Net Carrying 7alue:

&evaluation &eserve:

Income )tatement Items:

Re/aluations - if an asset has been revalued during the current financial period, the adjustment in the gross carrying value

Bor the cost of the asset if the asset has not been revalued previouslyD is included in this column. 8ote that this adjustment is

only calculated based on the gross carrying value of the asset - if you want to recalculate the revaluation surplus or

impairment, the !evaluation column in the ,ccumulated @epreciation section also needs to be ta(en into account.

)isposals - if an asset has been disposed of during the current financial period, the gross carrying value Bor the cost of the

asset if the asset has not been revalued previouslyD is included in this column as a negative value. This effectively means

that the gross carrying value of the asset is removed from the fixed asset register.

(mpairment - if an asset has been revalued during the current financial period at a value that is lower than the current net

carrying value, the impairment amount is included in this column. 8ote that in some instances, a negative value may also be

displayed in the !evaluations column which will be offset by a negative value in the !evaluations column in the ,ccumulated

@epreciation section. This is simply because the impairment is calculated based on the net carrying value which therefore

necessitates adjustments to the 9ost and ,ccumulated @epreciation values in order to adjust the gross carrying value Bthe

9ost sectionD to the correct values after revaluation.

%losing alance - the closing cost or gross carrying value of the asset at the end of the current financial period is included

in this column.

Opening alance - the opening accumulated depreciation balance of the asset at the beginning of the current financial

period is included in this column.

)epreciation " %ost - the year-to-date depreciation on the historical cost of the asset is included in this column. The

amounts in this column are calculated on the Transact sheet. or revalued assets, only the portion of the depreciation that

relates to the historical cost of the asset will be included in this column.

)epreciation " Re/aluation - the year-to-date depreciation on the revaluation of the asset is included in this column. The

amounts in this column are calculated by deducting the depreciation on the historical cost of the asset from the total year-to-

date depreciation. <oth of these amounts are calculated on the Transact sheet. If an asset has not been revalued, the value

in this column will be nil.

)epreciation " Total - the total year-to-date depreciation on the asset is included in this column. ,ll the amounts in this

column are calculated on the Transact sheet.

Re/aluations - if an asset has been revalued during the current financial period, the accumulated depreciation as at the date

of the revaluation is included in this column as a negative value. This is because we write off the accumulated depreciation to

a revaluation reserve and this value together with the revaluation adjustment in the 9ost section form the revaluation surplus

for an asset.

)isposals - if an asset has been disposed of during the current financial period, the accumulated depreciation as at the date

of the disposal is included in this column as a negative value. This effectively means that the accumulated depreciation of the

asset is removed from the fixed asset register.

%losing alance - the closing accumulated depreciation balance of the asset at the end of the current financial period is

included in this column.

%losing %arr!ing 0alue - the difference between the closing cost Bor gross carrying valueD of an asset and the closing

accumulated depreciation balance is included in this column. The amounts in this column reflect the Cboo( valueC of an asset

at the end of the financial period.

Opening alance - the amounts in this column reflect the revaluation reserve opening balances at the beginning of the

current financial period.

Re/aluation Surplus - if an asset has been revalued during the current financial period at a value that is higher than its net

carrying value at the date of revaluation, the revaluation surplus is included in this column. 8ote that if an asset is revalued at

a value that is less than its net carrying value, an asset impairment amount will be included in the Impairment )rite-#ffs

column and the revaluation surplus will be nil.

)epreciation " Re/aluation - the total year-to-date depreciation on any revaluations that may have been made to an asset

in the past is included in this column. This means that we effectively write-off the depreciation on revaluations against the

revaluation reserve balance instead of allocating these depreciation amounts to the income statement.

%losing alance - the amounts in this column reflect the revaluation reserve closing balances at the end of the current

financial period.

3age ;0 of 24

Excel Skills | Fixed Assets Register Template

Instructions

###$excel"skills$com

(mpairment 2rite"Offs - if an asset has been revalued during the current financial period at a value that is lower than its net

carrying value at the date of revaluation, the asset impairment amount is included in this column. 8ote that if an asset is

revalued at a value that is higher than its net carrying value, a revaluation surplus will be included in the !evaluation !eserve

section and the asset impairment amount will be nil.

3age ;- of 24

Excel Skills | Fixed Assets Register Template

Instructions

###$excel"skills$com

Current 8onth %epreciation:

Carrying 7alue at 9istorical Cost:

Ta" 7alues:

%eferred Ta"ation:

+rofit 3 4*oss5 on )isposal - if an asset has been disposed of during the current financial period, the profit or loss on

disposal as at the date of the disposal is included in this column. The profit or loss on disposal is calculated as the difference

between the proceeds on disposal which is recorded on the Transact sheet and the net carrying value Bboo( valueD of the

asset. If the asset that is sold has been revalued, any revaluation reserve that may exist on the date of disposal is also

included in the profit or loss calculation.

%ost - this column includes the depreciation on the historical cost of an asset for the current month. The appropriate month

is determined by the review date that is specified in cell $>. The current month depreciation on historical cost is calculated on

the Transact sheet. 8ote that this column will only contain a value if the historical cost of an asset has not been fully

depreciated.

Re/aluation - this column includes the depreciation on any revaluations that may have been performed on an asset and is

calculated as the difference between the total depreciation for the current month and the depreciation based on the historical

cost of an asset.

Total - this column includes the total depreciation of an asset for the current month. The appropriate month is determined by

the review date that is specified in cell $>. The current month total depreciation is calculated on the Transact sheet. 8ote that

this column will only contain a value if the gross carrying value Bor historical cost for assets that have not been revaluedD of

an asset has not been fully depreciated.

Opening alance - this column includes the boo( value of an asset based only on historical cost calculations at the

beginning of the current financial period.

,T) -o/ement - this column includes the &T@ movement in the boo( value of an asset based only on historical cost

calculations. ,ll revaluations are ignored for the purpose of this calculation.

%losing alance - this column includes the boo( value of an asset based only on historical cost calculations at the end of

the current financial period.

-T) -o/ement - this column includes the %T@ movement in the boo( value of an asset based only on historical cost

calculations. ,ll revaluations are ignored for the purpose of this calculation.

Opening alance - this column includes the tax value of the appropriate asset at the beginning of the current financial

period. ,ll tax value balances are calculated by deducting the appropriate tax allowances Bbased on the tax code that is

selected in column D from the tax cost Bhistorical costD of an asset.

,T) -o/ement - this column contains the &T@ movement in the tax value of an asset. or most assets that have been

acquired before the beginning of the financial period, these amounts will equal the tax allowances for the period. If an asset

has been acquired during the current financial period, the &T@ movement will equal the cost of the asset less the appropriate

tax allowances for the period. If an asset has been disposed of during the current financial period, the &T@ movement will

equal the opening tax value.

%losing alance - this column includes the tax value of the appropriate asset at the end of the current financial period. ,ll

tax value balances are calculated by deducting the appropriate tax allowances Bbased on the tax code that is selected in

column D from the tax cost Bhistorical costD of an asset.

-T) -o/ement - this column contains the %T@ movement in the tax value of an asset. or most assets that have been

acquired before the beginning of the current month, these amounts will equal the tax allowances for the period. If an asset

has been acquired during the current month, the %T@ movement will equal the cost of the asset less the appropriate tax

allowance for the month. If an asset has been disposed of during the current month, the %T@ movement will equal the tax

value at the beginning of the month.

Opening alance - this column includes the deferred tax balance at the beginning of the current financial period. @eferred

tax balances are calculated as the difference between the carrying values at historical cost and the tax values multiplied by

the appropriate tax rate which is specified on the "et-up sheet. 3ositive values represent deferred tax assets and negative

values represent deferred tax liabilities.

,T) -o/ement - this column includes the &T@ movement in the deferred tax balances.

%losing alance - this column includes the deferred tax balance at the end of the current financial period. @eferred tax

balances are calculated as the difference between the carrying values at historical cost and the tax values multiplied by the

appropriate tax rate which is specified on the "et-up sheet. 3ositive values represent deferred tax assets and negative

values represent deferred tax liabilities.

-T) -o/ement - this column includes the %T@ movement in the deferred tax balances.

3age ;2 of 24

Excel Skills | Fixed Assets Register Template

Instructions

###$excel"skills$com

3age ;1 of 24

Excel Skills | Fixed Assets Register Template

Instructions

###$excel"skills$com

Recording Asset Transactions

,ll the column headings on the ,ssets sheet contain a filter selection arrow. These selection arrows indicate that the ilter

feature has been activated on the sheet. The ilter feature can be used to filter the data on the sheet in order to display only

certain asset records on the sheet.

)e have also included totals above all the column headings that contain amounts. These totals have been calculated by

using the "7<T#T,K function which means that if the data on the sheet is filtered, the totals that are calculated will only

include the filtered records. The ilter feature can therefore be used to obtain totals based on the filter criteria that are

specified by the user and also enables users to view the detailed fixed asset records that ma(e up the summary totals on the

9ategory and 9lass sheets.

*"ample: If you want to obtain the fi"ed asset register totals for all leased assets, you can simply clic6 the selection arrow

ne"t to the Asset Type column heading and select the :eased option. The sheet will be filtered and only the leased assets

will be visible on the sheet. The totals will also only include the leased assets.

*"ample: If you want to view the detailed asset records that ma6e up one of the category or class totals on the Category or

Class sheets, simply clic6 the filter selection arrow ne"t to the Category or Class column headings 2column * or column 93

and select the appropriate category or class. The sheet will be filtered and only the asset records for the selected category or

class will be visible on the sheet. The totals will also only include the appropriate amounts for the selected category or class.

Note: After reviewing the filtered data, you need to clear the filter in order to display all the asset records on the sheet. A filter

can be cleared by simply clic6ing the selection arrow ne"t to the appropriate column heading again and clic6ing the )elect

All option.

,s we've mentioned before, some column headings contain yellow cell bac(grounds, while other column headings contain

light blue cell bac(grounds. The columns with yellow cell bac(grounds require user input and the columns with light blue cell

bac(grounds contain formulas which should be copied for all new assets that are added to the sheet. This is imperative

because the accuracy of all template calculations is dependent on recording assets correctly. ,fter entering all the required

data in the user input columns, please therefore ma(e absolutely sure that the formulas in the calculated columns have been

copied into all the new rows that have been added to the sheet.

,ll asset transactions must be recorded on the Transact sheet. There are basically 0 types of transactions that can be

recorded namely acquisitions, disposals and revaluations. ,n asset transaction can be recorded by entering the required

data into the user input columns - the column headings of all user input columns contain a yellow cell bac(ground while the

column headings with a light blue cell bac(ground indicate that these columns contain formulas which should be copied for

all new transactions that are added to the sheet.

Note: &ecording an asset number on the Assets sheet will have no effect in terms of recording the cost of an asset in the

fi"ed asset register. An acquisition transaction needs to be recorded on the Transact sheet for each fi"ed asset that is

acquired before the appropriate asset values will be included in the fi"ed asset register on the Assets sheet and the

summaries on the Category and Class sheets.

Note: All the contents on the Transact sheet should form part of a continuous cell range otherwise some transactions may

not be included in the template calculations. The Transact sheet should therefore not contain any blan6 rows between rows

that contain data.

The following user input is required in the user input columns on the Transact sheet Bthe columns with yellow column

headingsD5

Transaction )ate - enter the date of the transaction.

3age ;: of 24

Excel Skills | Fixed Assets Register Template

Instructions

###$excel"skills$com

Transaction T!pe - select the transaction type from the list box. The ,9L option should be selected for all asset

acquisitions, the @I" option should be selected for all asset disposals and the !$M option should be selected for all

revaluations of fixed assets.

Asset 'umber - select the appropriate asset number of the asset to which the transaction relates from the list box in this

column. ,ll the asset numbers that have been added to the ,ssets sheet will be available for selection. &ou therefore need to

create an asset number for the appropriate fixed asset on the ,ssets sheet before you will be able to record any transactions

for the particular fixed asset.

3age ;= of 24

Excel Skills | Fixed Assets Register Template

Instructions

###$excel"skills$com

Supplier - enter the name of the supplier from which the asset has been acquired. If a disposal transaction is recorded, you

can enter the name of the customer in this column. or revaluations, you can simply enter C8oneC.

)ocument 'umber - enter the document number of a supporting document which will enable you to trace the transaction

bac( to its supporting documentation. or acquisitions, this should be the supplier invoice number and for disposals, the

customer invoice number. or revaluations, you can simply enter text li(e C!evalueC.

Amount - enter the transaction amount in this column. or acquisitions, the supplier invoice amount should be entered

exclusive of any sales tax that may be applicable. or disposals, a nil amount should be entered in this column. or

revaluations, the value of the asset should be entered in this column - this should be the new value of the fixed asset and not

the difference between the valuation and the previous historical cost or gross carrying amountI

*ifetime in ,ears - enter the estimated lifetime of the asset in years for all acquisition and revaluation transactions in this

column. or disposals, enter a nil value in this column. 8ote that if an asset should not be depreciated, a nil lifetime also

needs to be specified in this column.

Residual 0alue - this value should be the estimated valuation of an asset at the end of the lifetime that is specified in the

previous column. If the asset will have no value at the end of its estimated lifetime, enter nil. , nil value should also be

entered for all disposal transactions.

+roceeds on Sale - if a disposal transaction is being recorded, enter the proceeds on the disposal of the asset in this

column. The proceeds should equal the total amount that is received for the asset. If an asset is being scrapped, enter nil in

this column. , nil value should also be entered for all acquisition and revaluation transactions.

The Transact sheet also includes 0= calculated columns - the column headings of all the calculated columns contain a light

blue cell bac(ground. ,ll of these columns contain formulas which should be copied for all new transactions that are added

to the sheet. )e'll now briefly cover the purpose of each calculated column5

Error %ode - if there is a problem with the input in any of the user input columns, an error code will be displayed in this

column. !efer to the "et-up sheet for a description of each error code and to the $rror 9ode section of these instructions for

more information about the reason for the error code that is displayed.

%ategor! - the asset category is loo(ed up on the ,ssets sheet based on the asset number that is specified in column 9.

This column is included for information purposes only.

Transaction )ate () - the formula in this column assigns a time to each transaction date based on the row number of the

transaction. This means that each transaction will have a unique date even if two transactions that relate to the same asset

are recorded on the same date.

+re/ious Trn )ate - this column indicates the date of the previous transaction for the specified asset number. If there is no

previous transaction for the asset, a date of ;4..H.;H.. will be displayed.

'ext Trn )ate - this column contains the next transaction date for the selected asset. If there is no transaction after the

current transaction, the day after the &T@ To date on the ,ssets sheet will be included in this column.

)epr End )ate - this column contains the date on which the depreciation period for the transaction will end. This date is

determined by adding the lifetime of the asset to the transaction date.

)epr ,T) From )ate - the date from which the current financial period depreciation is calculated is included in this column.

8ote that if there is a subsequent transaction for an asset, a date of ;4..H.;H.. or the &T@ rom date may be included in

this column.

)epr ,T) To )ate - the date up to which the current financial period depreciation is calculated is included in this column.

8ote that if there is a subsequent transaction for an asset, a date of ;4..H.;H.. or the &T@ rom date may be included in

this column.

)epr ,T) -onths - this column includes the number of months on which the &T@ depreciation for the particular transaction

is based.

Transaction Amount - this column contains the transaction amount that is specified in column .

Asset .istorical %ost - this column contains the historical cost of the appropriate asset. The historical cost is defined as the

transaction amount of the acquisition transaction that is recorded for an asset.

%urrent *ifetime - the current lifetime of the asset as specified in column N is included in this column.

%urrent Residual - the current residual value of the asset as specified in column F is included in this column.

+re/ious )eemed %ost - the gross carrying value of the previous transaction for the selected asset is included in this

column.

+re/ious Residual 0alue - the residual value that was specified in the previous transaction for the selected asset is included

in this column.

3age ;4 of 24

Excel Skills | Fixed Assets Register Template

Instructions

###$excel"skills$com

+re/ious *ifetime - the previous lifetime that was specified in the previous transaction for the selected asset is included in

this column.

%urrent Accum )epr - the total accumulated depreciation that has been written off between the previous transaction date

and the current transaction date for the selected asset is included in this column.

3age >. of 24

Excel Skills | Fixed Assets Register Template

Instructions

###$excel"skills$com

%urrent %arr!ing 0alue - the amounts in this column are calculated as the difference between the previous deemed cost

and the current accumulated depreciation.

Accum )epr: %ost - the accumulated depreciation based only on the historical cost of the asset which has been written off

between the previous transaction date and the current transaction date for the selected asset is included in this column.

Accum )epr: Re/aluation - the difference between the total accumulated depreciation and the accumulated depreciation

based on only the historical cost of the asset is included in this column and represents the accumulated depreciation that has

been written of on the revaluations that have been applied to the selected asset between the previous transaction date and

the current transaction date.

Accum )epr: Re/ 6+, - the accumulated depreciation on revaluations as at the beginning of the financial period is included

in this column.

+re/ious Re/aluation - this column contains the revaluation reserve balance before ta(ing any effect that the current

transaction may have on the revaluation reserve balance into account.

Re/aluation Surplus - if the selected transaction is a revaluation and the transaction amount that is specified in column is

greater than the current carrying value in column ,,, the revaluation surplus amount is included in this column. 8ote that this

calculation may also be influenced by any previous impairments that may have been recorded against the selected asset

number.

%urrent Re/aluation - this column includes the revaluation reserve balance after ta(ing the effect of the current transaction

into account.

+re/ious (mpairment - this column contains the total of any impairment amounts that have been recorded for the selected

asset Bbefore ta(ing the effect that the current transaction may haveD into account.

(mpairment 0alue - if the selected transaction is a revaluation and the transaction amount that is specified in column is

less than the current carrying value in column ,,, the asset impairment amount is included in this column as a positive

value. If an asset is revalued at a value that is greater than the current carrying value and an asset impairment was

previously recorded for the selected asset, the impairment will be reversed to the extent that the revaluation reserve is

greater than the previous impairment value and the amount of the reversal will be reflected as a negative value in this

column.

+rofit 3 4*oss5 on )isposal - if the selected transaction is a disposal, the profit or loss on the disposal of the asset is

included in this column. The profit or loss is calculated by deducting the current carrying value of the asset from the proceeds

on disposal that is recorded in column I. 8ote that if the revaluation reserve for the asset is greater than nil, the revaluation

reserve will also be included in the calculation of the profit or loss on disposal. This means that the reserve balance is

effectively released when an asset is disposed of.

,T) Total )epreciation - the &T@ total depreciation for the asset is calculated in this column. This calculation is based on

the gross carrying value of the asset, the lifetime of the asset and the &T@ depreciation months which is calculated in column

!.

,T) Total )epr at %ost - the calculation in this column forms part of the &T@ depreciation on the historical cost of an asset

which is calculated in column ,%.

,T) %ost )epreciation - the &T@ depreciation on the historical cost of the asset is calculated in this column. This

calculation is based on the historical cost of the asset, the current lifetime of the asset and the &T@ depreciation months

which is calculated in column !.

Accum )epr at +, %ost al - the calculations in this column forms part of the calculation of the accumulated depreciation

on the historical cost of an asset as at the beginning of the financial period.

Accum )epr at %ost +, - the calculations in this column forms part of the calculation of the accumulated depreciation on

the historical cost of an asset as at the beginning of the financial period.

)epr: %ost b! Transaction - the calculations in this column indicate how much of the historical cost of an asset is

depreciated as a result of each transaction. This calculation forms an integral part of the &T@ and accumulated depreciation

on historical cost calculations.

-T) Total )epreciation - this column includes the calculation of the total %T@ depreciation. 8ote that the month to which

the calculation is applied is determined by the review date that is entered in cell $> on the ,ssets sheet.

Accum )epr Total at +- - the amounts in this column reflect the total accumulated depreciation as at the beginning of the

current month. This calculation forms part of the total depreciation for the current month calculation.

-T) Total )epr at %ost - the calculation in this column forms part of the calculation of the depreciation on historical cost for

the current month.

3age >; of 24

Excel Skills | Fixed Assets Register Template

Instructions

###$excel"skills$com

-T) %ost )epreciation - this column contains the calculation of the depreciation on the historical cost of an asset for the

current month. 8ote that the current month is determined by the review date that is specified in cell $> on the ,ssets sheet.

3age >> of 24

Excel Skills | Fixed Assets Register Template

Instructions

###$excel"skills$com

Error %odes

Accum )epr %ost at +- - this calculation reflects the accumulated depreciation on the historical cost of an asset as at the

beginning of the current month. The calculation forms an integral part of the calculation of the depreciation on historical cost

for the current month.

Note: ;nly one acquisition transaction can be recorded for each asset because an asset can only be acquired once. If an

asset is scrapped 2which is recorded as a disposal3 and subsequently needs to be added bac6 to the fi"ed asset register, a

new asset number should be used for this purpose. The recording of duplicate asset acquisitions will result in an input error

in the *rror Code column and may also result in inaccurate template calculations.

Note: All the depreciation, accumulated depreciation, ta" allowance and deferred ta" calculations that form part of the fi"ed

asset register are automated and you therefore do not need to record any transactions in order to record any of these

amounts. Also note that all the automated calculations in this template are based on the review date that is specified on the

Assets sheet. +ou can therefore roll the template forward for subsequent periods or bac6 to previous periods by simply

changing the review date on the Assets sheet.

,ll the column headings on the Transact sheet contain a filter selection arrow. These selection arrows indicate that the ilter

feature has been activated on the sheet. The ilter feature can be used to filter the data on the sheet in order to display only

certain asset records on the sheet.

,s we've mentioned before, some column headings contain yellow cell bac(grounds while other column headings contain

light blue cell bac(grounds. The columns with yellow column headings require user input and the columns with light blue

column headings contain formulas which should be copied for all new transactions that are added to the sheet. This is

imperative because the accuracy of all template calculations is dependent on recording transactions correctly. ,fter entering

the required data in the user input columns, please ma(e absolutely sure that the formulas in the calculated columns have

been copied into all the new rows that have been added to the sheet.

The following error codes may result from inaccurate input on the ,ssets and Transact sheets and will be displayed in the

$rror 9ode columns on the appropriate sheet. The heading of the affected input column will also be highlighted in orange in

order to indicate that an error is present in the appropriate column5

< *, . this error code means that a duplicate asset number has been created on the Assets sheet. If you delete the row that

contains the duplicate asset number, the error is resolved.

< */ . this error code means that the asset category that needs to be selected in column * on the Assets sheet is blan6 or

does not e"ist. )elect a valid asset category from the list bo" in order to resolve the error. Note that all the asset categories

that are included on the )et.up sheet are included in the list bo".

< *# . this error code means that the asset number that needs to be selected in column C on the Transact sheet is blan6 or

does not e"ist. )elect a valid asset number from the list bo" in order to resolve the error. Note that all the asset numbers that

are recorded on the Assets sheet are included in the list bo".

< *= . this error code means that the transaction type that needs to be selected in column ( on the Transact sheet is blan6

or does not e"ist. )elect a valid transaction type from the list bo" in order to resolve the error. Note that this error may also

be displayed in you attempt to record a transaction for an asset that has been disposed of previously. ;nce a disposal is

recorded for an asset 2even if the asset has only been scrapped and not actually disposed of3, any subsequent transactions

need to be recorded by using a new asset number.

< *4 . this error code means that more than one acquisition transaction has been recorded for the same asset. An asset can

only be acquired once. If you therefore need to bring the asset bac6 into the fi"ed asset register after perhaps recording a

disposal transaction, a new asset number must be used.

< *> . this error code means that an invalid transaction amount has been recorded for the selected transaction type. All

transaction amounts should be recorded as positive amounts and a nil transaction amount needs to be entered for all

disposal transactions.

3age >0 of 24

Excel Skills | Fixed Assets Register Template

Instructions

###$excel"skills$com

< *? . this error code means that an invalid lifetime has been recorded for the selected transaction type. All asset lifetimes

should be recorded as positive values and a nil value needs to be entered for all disposal transactions. Note that you can

also enter a nil value for acquisition or revaluation type transactions but this means that the asset will not be depreciated.

3age >- of 24

Excel Skills | Fixed Assets Register Template

Instructions

###$excel"skills$com

%alculation -ethodolog!

Additions

%isposals

< *@ . this error code means that an invalid residual value has been recorded for the selected transaction type. All residual

values should be recorded as positive values and a nil residual value needs to be entered for all disposal transactions. Note

that the residual value of an asset can also not be greater than the transaction amount that is entered in column -.

< *A . this error code means that an invalid proceeds on disposal amount has been recorded for the selected transaction

type. All proceeds on disposal amounts should be recorded as positive values and you only need to record an amount in this

column if a disposal type transaction is recorded. Note that the proceeds on the disposal of an asset can never be less than

nil 2even if a loss is made on the disposal of an asset3 because the proceeds equal the amount that is received after selling

the asset. A nil value may however need to be entered if an asset is scrapped without any compensation being received.

< *,$ . this error code means that a revaluation or disposal type transaction has been recorded for the appropriate asset on

the Transact sheet before an acquisition transaction has been recorded. The first step after adding an asset number to the

Assets sheet should be to record an acquisition transaction for the asset on the Transact sheet even if the asset has been

donated to the business 2use a transaction amount of nil3.

< *,, . this error code means that the ta" code that needs to be selected in column - on the Assets sheet is blan6 or does

not e"ist. )elect a valid ta" code from the list bo" in order to resolve the error. Note that all the ta" codes that are recorded

on the )et.up sheet are included in the list bo".

Note: Input errors may result in inaccurate template calculations and it is therefore imperative that all errors are resolved

before reviewing the fi"ed asset register balances and processing any general ledger Bournal entries.

In this section of the instructions, we'll cover the calculation methodology that is applied in order to compile a fixed asset

register with this template. )e cover all the different types of transactions that are included in the template and we'll explain

the reasoning behind how each type of transaction is incorporated into the template calculations.

ixed asset additions are included in the fixed asset register in the month of the acquisition and also depreciated from the

month of acquisition. ,ll fixed asset additions need to be recorded as acquisition type transactions on the Transact sheet in

order to include the assets in the fixed asset register. ,cquisitions are usually recorded in the primary accounting system by

allocating the addition to the appropriate fixed asset account and crediting the ban( or accounts payable control account.

or the purpose of our automated journal report, fixed asset additions are allocated to the fixed asset cost account that is

specified for the appropriate fixed asset category on the "et-up sheet and credited against the <an( account.

ixed assets that are disposed of are removed from the fixed asset register in the month of the disposal. ,ll disposals need

to be recorded as disposal type transactions on the Transact sheet. The gross carrying value of the asset is deducted from

the opening balance and the accumulated depreciation on the asset is deducted from the accumulated depreciation as at the

end of the month before the disposal.

Note: Assets that are disposed of are not depreciated in the month of the disposal. This means that no depreciation is

calculated for the month in which the asset is disposed of. This approach is followed in order to offset the calculation of

depreciation from the first month of acquisition.

The proceeds on the disposal of the asset are recorded on the Transact sheet when the disposal transaction is recorded.

The difference between this amount and the net carrying value of the asset Bhistorical cost or gross carrying value less

accumulated depreciationD constitutes the profit or loss on the disposal of the asset.

3age >2 of 24

Excel Skills | Fixed Assets Register Template

Instructions

###$excel"skills$com

Note: If an asset is scrapped, the asset can be removed from the fi"ed asset register by recording a disposal type transaction

on the Transact sheet and entering a nil value in the 'roceeds column 2column I3.

3age >1 of 24

Excel Skills | Fixed Assets Register Template

Instructions

###$excel"skills$com

&evaluations

If an asset has been revalued previously and a revaluation reserve still exists for the asset, the revaluation reserve is

released against the profit or loss account. This means that the net effect will be that the profit or loss on disposal is

calculated based on the historical cost of the asset and that no further adjustments are required in order to reflect the profit

or loss on disposal net of any revaluations that may have been made to the asset.

In terms of the automated journal report, the gross carrying value of the asset is credited against the cost account that is

specified for the particular fixed asset category on the "et-up sheet and debited against the profit or loss account that is also

specified on the "et-up sheet. The accumulated depreciation is debited against the accumulated depreciation account that is

specified on the "et-up sheet and credited against the profit or loss account.

The proceeds on disposal of the asset is debited against the ban( account and credited against the profit or loss account. If

there is a revaluation reserve on the date of disposal, the balance of the revaluation reserve is debited against the

revaluation reserve account and credited against the profit or loss account.

The template facilitates recording an unlimited number of revaluations for an unlimited number of fixed assets. ,ll fixed asset

revaluations need to be recorded on the Transact sheet by selecting the revaluation transaction type. !evaluations are

accounted for in the month in which the transaction date falls and are also depreciated based on the revalued amounts from

the transaction month.

)hen you revalue an asset, the previous cost Bor gross carrying amount for assets that have been revalued previouslyD and

the accumulated depreciation on the asset up to the month before the revaluation are written off to either a revaluation

reserve account or an asset impairment account depending on whether a revaluation surplus or asset impairment results

from the revaluation. This means that immediately after the revaluation, the asset will be reflected at the revalued amount

with no accumulated depreciation.

If the revaluation amount is greater than the net carrying value Bhistorical cost or gross carrying value less accumulated

depreciationD, the revaluation results in a revaluation surplus which is allocated to a revaluation reserve account. If the sum

of the revaluation amount and any revaluation reserve which may still exist for the asset is less than the net carrying value,

the result of the revaluation is an asset impairment.

Note: All asset impairments are written off immediately to the income statement by allocating the impairment amount against

the profit or loss for the period.

Note: If the result of the revaluation transaction is a revaluation surplus but an asset impairment write.off has previously been

allocated to the income statement for the particular asset, the previous asset impairment is reversed by allocating a credit to

the income statement and the remainder of the revaluation surplus 2if any3 is allocated to the revaluation reserve account.

The revaluation reserve account and the asset impairment account for each fixed asset category needs to be specified on

the "et-up sheet. The revaluation reserve account should be a balance sheet account in the equity account group and the

asset impairment account should be an income statement account.

In terms of the automated journal report, the difference between the previous gross carrying value Bor historical costD and the

revaluation amount is adjusted against the asset cost account and the revaluation reserve account. The accumulated

depreciation balance as at the date of revaluation is debited against the accumulated depreciation account and credited

against the revaluation reserve account.

The net result of these two journal entries will be that the asset cost account is adjusted to the revaluation amount, the

accumulated depreciation is adjusted to a nil value and the revaluation surplus is credited to the revaluation reserve account

Bif the revaluation amount is greater than the previous net carrying value of the assetD.

3age >: of 24

Excel Skills | Fixed Assets Register Template

Instructions

###$excel"skills$com

%epreciation

Note: &evaluation surpluses are calculated based on the net carrying value of an asset which in turn is calculated by

deducting the accumulated depreciation from the gross carrying value 2or historical cost3 of the asset in the Assets at Cost

section on the fi"ed asset register. The amounts that are calculated in the &evaluation columns may therefore appear a bit

confusing because the gross carrying value in the cost section may need to be reduced 2shown as a negative amount3 in

order to adBust the gross carrying value to the revaluation amount but the net result of the revaluation 2sum of the

&evaluation columns in both the cost and accumulated depreciation sections3 may still result in a revaluation surplus. This is

because the accumulated depreciation 2which is always a credit balance3 is also allocated to the revaluation reserve account

and also needs to be ta6en into account when reviewing the amounts in the &evaluation columns.

If the revaluation results in an asset impairment Bwhich means that the revaluation amount is less than the net carrying value

of the assetD, the accumulated depreciation as at the date of the revaluation is again debited against the appropriate

accumulated depreciation account and credited to the revaluation reserve account but an equal amount is credited against

the asset cost account and debited against the revaluation reserve account.

The net result of these two journal entries is that the asset cost account is adjusted to the net carrying value of the asset

because the accumulated depreciation is in effect written off against the asset cost account. , separate journal entry then

credits the asset cost account and debits the impairment write-off account that is specified for the appropriate asset category

on the "et-up sheet.

Note: If a revaluation on an asset therefore results in an asset impairment, you can e"pect to see equal negative values in

the &evaluation columns in both the cost and accumulated depreciation sections on the fi"ed asset register 2which equals

the accumulated depreciation on the asset as at the date of revaluation3 and the amount of the impairment write.off in the

Impairment column in the cost section of the fi"ed asset register.

Note: If a previous impairment on an asset is reversed as a result of a subsequent revaluation surplus, the impairment

reversal amount will be included in the Impairment column in the cost section of the fi"ed asset register as a positive amount.

,ll the depreciation calculations that form part of the fixed asset register which is compiled with this template are automated