Académique Documents

Professionnel Documents

Culture Documents

GTAA 2014 FeasibilityStudy PDF

Transféré par

cizar0 évaluation0% ont trouvé ce document utile (0 vote)

224 vues63 pagesGTAA_2014_FeasibilityStudy.pdf

Titre original

GTAA_2014_FeasibilityStudy.pdf

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentGTAA_2014_FeasibilityStudy.pdf

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

224 vues63 pagesGTAA 2014 FeasibilityStudy PDF

Transféré par

cizarGTAA_2014_FeasibilityStudy.pdf

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 63

January 24, 2014

Mr. Howard Eng, P.E.

President and Chief Executive Officer

Greater Toronto Airports Authority

Toronto - Pearson International Airport

3111 Convair Drive

Toronto AMF Ontario L5P 1B2 Canada

Dear Mr. Eng:

AXIS Consulting Inc. (AXIS) is pleased to submit this Report of the Airport Consultant (the Report)

to the Greater Toronto Airports Authority (the GTAA) in conjunction with the planned filing by the

GTAA of a 2014 Short Form Base Shelf Prospectus (the Prospectus). AXIS understands that the

Report will not be included in the 2014 filing.

New activity forecasts have been prepared from 2014 through 2023 (the Forecast Period) based on the

most recent data available for passengers, aircraft movements, maximum takeoff weights and air cargo

tonnage. Key assumptions in this Reports forecast include:

A competitive domestic aviation market will be maintained over the forecast horizon.

The growth and sustainability of low fare airlines will continue to stimulate aviation demand in

the Greater Toronto Area (GTA).

Domestic, transborder and international traffic are expected to increase at moderate levels year

over year during the Forecast Period.

The costs of enhancing aviation security will not overly burden air carriers.

The Terminal 1 and 3 Enhancement Programs will be undertaken and will encompass demand

driven projects designed to provide a better flow of passengers, baggage and new commercial

retail offerings all designed to enhance the customer travel and service experience. Although the

Enhancement Programs will provide better access and connectivity for passengers, the Reports

forecast does not base future aviation activity growth solely on traffic stimulation based on the

Airports facility enhancements.

Based on the aviation activity forecasts prepared for and presented in this Report, the construction

of the sixth runway and Piers H and I will not be required during the Forecast Period.

Toronto - Pearson International Airport

January 24, 2014 - FINAL ii

The Airport currently has two commercial passenger terminals: Terminal 1 and Terminal 3, each of which

provides domestic, transborder and international service. The two terminals collectively offer 81 gates

with loading bridges (select loading bridges in Terminal 1 can accommodate the Airbus A380 aircraft) and

28 commuter gates. In total, the Airport has 155 aircraft parking positions available for air terminal

operations including 46 hardstand aircraft parking positions.

The Airports size and gate capacity have given the GTAA the ability to plan a short-to-medium term

strategy of making the facility a global connecting hub for Air Canada. Given its large Origin and

Destination (O&D) passenger base in addition to a growing number of international transfer passengers,

the Airport has the unique ability to connect travelers to six continents without having to expand its

existing facilities. The advent of new international carriers in the past 12 months such as Saudi Arabian

Airlines (Saudia) and Egyptair in addition to Air Canadas integration of Rouge to its international

airline network, has added new non-stop destinations and increased frequencies to existing points around

the globe.

The Airports objective of becoming a global hub has prioritized Airport capital programs and major

initiatives to adapt the current facilities to ease connections and the flow of passengers throughout. In

addition, the GTAA through the construction of additional retail space in Terminals 1 and 3 as well as

modifications to product offerings and higher priced merchandise, is expecting to drive non-aeronautical

commercial revenues from the current 8.0 percent to 15.0 percent of total non-aeronautical revenues by

2018 on an average annual compound basis.

On October 17, 2013, the GTAA entered into a Long Term Aeronautical Fees Agreement with Air

Canada (the AC LTA) which goes into effect J anuary 1, 2014, and covers an initial five year term

expiring December 31, 2018. Air Canada will pay a fixed amount to the GTAA in lieu of the GTAAs

standard aeronautical charges comprised of landing fees, general terminal charges and apron fees. For

each calendar year of the term, the AC LTA establishes certain passenger traffic thresholds for Air Canada

and its affiliates collectively. Provided that Air Canada and its affiliates achieve the cumulative passenger

threshold in a given year, Air Canada receives a rebate calculated based on the additional revenues

generated by incremental passenger growth at the Airport in excess of the threshold. The AC LTA

provides that Air Canada and the GTAA will collaborate in the development of certain specified service

level standards important to customer service and the development of a global hub.

The Terminal 3 Enhancement Program had an original approved capital budget of $406.8 million. As part

of the GTAAs 2013 strategic direction review, the capacity elements of the Terminal 3 Enhancement

Program were reviewed and the program has been modified accordingly. The revised capital budget for

the Terminal 3 Enhancement Program is $141.3 million and includes the following projects:

1. Retail improvements and related modifications to check-in and security screening layout;

2. Energy efficiency improvements;

3. Restoration of Pier A (formerly referred to as the Terminal 3 Satellite);

4. Improvements to baggage induction facilities and baggage screening system conversions; and

5. Other general refurbishment items.

Potential projects that will be scoped further in 2014 include: expansion of the restoration program,

relocating security in advance of U.S. Customs and Border Protection; additional baggage system

improvements and improved facilitation of passenger connections.

Toronto - Pearson International Airport

January 24, 2014 - FINAL iii

As part of the GTAAs 2013 strategic direction review, infrastructure projects for improvements to

Terminal 1 were identified and include:

1. Improved facilitation and flow for passengers connecting from International locations to Domestic

destinations;

2. Addressing regulatory requirements relating to baggage security screening; and

3. Relocating security in advance of U.S. Customs and Border Protection.

The full scope and implementation of these projects will be developed in 2014.

This Report was prepared to analyze the Airports ability to generate sufficient revenues during the

Forecast Period to permit the GTAA to make payments for operating and maintenance expenses, debt

service requirements, fund deposits and coverage requirements. The Report forecasts the economic and

demographic conditions of the GTA and discusses factors that affect aviation demand at the Airport based

on an independent forecast of passenger levels, aircraft movements, maximum aircraft takeoff weights and

air cargo tonnage. A financial analysis that covers revenues, expenses, capital costs, debt service, airline

requirements and that forecasts airline costs per enplaned passenger through the Forecast Period is also

included.

Based upon our analysis, it is the opinion of AXIS that:

The economic base of the GTA is strong and diverse and demonstrates a high demand for air

transportation service. Population, employment and personal income, all important variables in

deriving air service demand, are forecast to produce steady growth over the Forecast Period. The

GTA will continue to be a leading international commercial and financial center and maintain its

well-balanced and diversified economy.

The Airport will continue to be a major international gateway and hub with a substantial number

of airlines providing flights to all major domestic, U.S. and an increasing number of international

destinations through 2023. Total passenger traffic is forecast to increase from 36.7 million

passengers in 2014 to 47.0 million passengers in 2023 at an average annual compound growth rate

of 2.8 percent.

For the Forecast Period, domestic passenger traffic is forecast to increase at an average annual

compound growth rate of 2.2 percent. The Airport will remain a primary destination on both

transcontinental routes and the Toronto-Montreal-Ottawa triangle market.

Domestic passenger demand at the Airport will be stimulated by the growing presence of several

low fare carriers.

The Open Skies Agreement between Canada and the U.S. and the establishment of a U.S.

customs/immigration pre-clearance facility at the Airport will continue to facilitate increases in

transborder traffic. Transborder traffic is forecast to increase at an average annual compound

growth rate of 2.8 percent during the Forecast Period.

International traffic is forecast to increase at an average annual compound growth rate of 3.5

percent during the Forecast Period.

Toronto - Pearson International Airport

January 24, 2014 - FINAL iv

The air traffic and financial projections contained in this Report are based on what AXIS Consulting Inc.

believes to be reasonable evaluations of existing conditions, estimates of current conditions and estimates

of future conditions.

The Report should be read in its entirety in order to gain an understanding of the projections and their

underlying assumptions. The Airport Consultant has no responsibility to update this report for events and

circumstances occurring after the date of this Report.

Respectfully submitted

AXIS Consulting, Inc.

Toronto - Pearson International Airport

January 24, 2014 - FINAL v

TABLE OF CONTENTS

CHAPTER TITLE PAGE

I. ECONOMIC AND AIR TRAFFIC ANALYSIS 1

A. ECONOMIC CONDITIONS AND OUTLOOK 1

1. Aviation Industry Outlook 1

2. Drivers of Toronto Pearsons Future Activity 9

B. AIR CANADA LONG TERM AERONAUTICAL FEE AGREEMENT 17

1. Scope 17

2. Term 17

3. Fees 18

4. Airport Improvement Fee 18

5. Rebates 18

6. Non-Exclusivity 19

7. Reservation of GTAA Operational Rights 19

8. Events of Default and/or Termination 19

9. Service Level Standards 20

10. Assignment 20

C. FORECAST OF AVIATION ACTIVITY 20

1. Fleet Mix 21

2. Econometric Approach (Top Down) 23

3. Air Service Approach (Bottom Up) 23

4. Qualitative Approach 23

5. 2014 2023 Passenger Discussion and Forecast 24

6. 2014 2023 Aircraft Movements Discussion and Forecast 27

7. 2014 2023 Maximum Take-Off Weight Discussion and Forecast 27

8. 2014 2023 Air Cargo Discussion and Forecast 27

II. FUTURE AIRPORT CAPITAL PROGRAMS 32

A. TERMINAL 3 ENHANCEMENT PROGRAM 32

B. TERMINAL 1 ENHANCEMENT PROGRAM 32

C. AUTOMATED PEOPLE MOVER PROJ ECT 34

D. MAINTENANCE AND RESTORATION CAPITAL PROGRAM 34

E. FUTURE DEVELOPMENT 34

Toronto - Pearson International Airport

January 24, 2014 - FINAL vi

III. FINANCIAL ANALYSIS 36

A. AIRPORT FINANCIAL STRUCTURE 36

1. Rate Covenant 36

2. Rates and Charges Methodology 36

3. 2013 Change to Rates and Charges Methodology 37

B. FUNDING SOURCES 38

1. Bank Credit Facilities 39

2. Outstanding Bonds and Future Series Bonds 39

C. HISTORICAL FINANCIAL OPERATIONS 39

D. FORECAST OPERATING EXPENSES 42

1. Personnel Expenses 42

2. Non-Personnel Expenses 42

3. Ground Lease 44

4. Payments In Lieu of Real Property Taxes 44

E. FORECAST NON-AERONAUTICAL REVENUES 45

1. Concessions 45

2. Car Parking and Ground Transportation 47

3. Rental Revenues 47

F. FORECAST AIRPORT IMPROVEMENT FEES 47

G. FORECAST AERONAUTICAL REVENUES 47

1. Landing Fees and Other Services 49

2. General Terminal Charges 49

3. Apron Fees 49

H. FORECAST DEBT SERVICE AND FUND DEPOSITS 49

I. FORECAST AIRLINES COST PER ENPLANED PASSENGER 52

J . CASH FLOW PROJ ECTIONS 52

K. DEBT SERVICE COVERAGE 52

L. CONCLUSION 56

Toronto - Pearson International Airport

January 24, 2014 - FINAL vii

LIST OF TABLES

CHAPTER TITLE PAGE

I-1 North American Airline Mergers 2008 - Present 3

I-2 Comparison of Boeing and Airbus Global Market Forecasts 5

I-3 Comparison of Bombardier and Embraer Global market Forecasts 6

I-4 2013 Boeing and Airbus Aircraft Orders 7

I-5 Key Revenue Drivers of IATA 2013 Passenger & Freight Forecasts 8

I-6 Average Domestic Fares for Major Canadian Airports 14

I-7 2013 Peak Month Average Weekday Fleet Mix 22

I-8 Total Passenger Forecasts 26

I-9 Aircraft Movements Forecast 28

I-10 Maximum Takeoff Weight Forecast 29

I-11 Air Cargo Tonnage Forecast 30

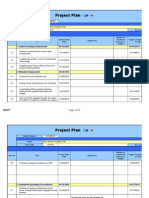

II-1 Sources and Uses of Funds 33

III-1 Selected Consolidated Audited Financial Information 41

III-2 Forecast Operating Expenses 43

III-3 Forecast Non-Aeronautical Revenues 46

III-4 Forecast Aeronautical Revenues 48

III-5 Annual Debt Service Requirements 50

III-6 Forecast Fund Deposit Requirements 51

III-7 Forecast Airline Cost Per Enplaned Passenger 53

III-8 Summary of Cash Flows 54

III-9 Application of Revenues and Debt Service Coverage 55

Toronto - Pearson International Airport

Chapter I Economic and Air Traffic Analysis 1

January 24, 2014 - FINAL

I. ECONOMIC AND AIR TRAFFIC ANALYSIS

Aviation activity at the TorontoPearson International Airport (the Airport or Pearson) depends

primarily on economic conditions and the network strategies of the airlines. Many factors operating at the

global, national and local levels will jointly determine the demand for air transportation. This section

outlines the economic conditions and outlook of the global airline industry and the drivers that define the

Airports future activity. The forecast period for this Report is from 2014-2023 (the Forecast Period).

A. ECONOMIC CONDITIONS AND OUTLOOK

The Economic and Air Traffic analysis Chapter for the Study outlines the economic conditions and

outlook of the aviation industry from a global perspective, defines the drivers on future traffic growth at

Pearson and presents a long-term forecast of air traffic volumes for the Airport. The forecast is an

independent analysis using mathematical relationships and trend analysis to provide the Greater Toronto

Airport Authority (GTAA) with the necessary guidance to implement long-term business planning

strategies and to help the airport derive future rates and charges. The Forecast Period details total

passengers broken down into the three travel sectors: domestic, transborder and international.

Additionally, a movements forecast is produced and disaggregated into three categories including

passenger services, charter services and general/aviation and other movements for the same time period as

passengers. This Study will project maximum takeoff weight (MTOW) and cargo demand measured in

tonnage for the Forecast Period.

1. Aviation Industry Outlook

Commercial aviation has weathered many downturns in the past. Yet recovery has followed

quickly as the industry reliably returned to its long-term growth rate of approximately 5.0 percent

per year. Despite uncertainties, 2012 passenger traffic rose 5.3 percent from 2011 levels. This

trend is expected to continue over the next 20 years, with world passenger traffic growing 5.0

percent annually according to the Boeing Co. (Boeing)

1

. Air cargo traffic has been moderating

after a peak period in 2010. Air cargo contracted by 1.5 percent in 2012. Expansion of emerging-

market economies will foster a growing need for fast, efficient transport of goods. Boeing

estimates growth for the air cargo industry at the 5.0 percent level annually through 2032.

Commercial aviation continues a lengthy process of evolution, changing the way airports relate to

their airlines and communities. It has staggered between a series of periodic crises and has not yet

emerged from the cyclical economic events of the past several years including a spike in the price

of oil and a weak revenue / yield environment. New and increased federally mandated screening

measures have further eroded the airlines operational reliability and the overall passenger

experience. After more than a decade recording multi-billion-dollar losses, United States (U.S.)

airlines appear to be reversing their financial losses based on mergers, acquisitions and new

business models that charge passengers for certain cost recovery fees beyond those that are

required by federal governments. As the global economy rebounds, travel demand has risen,

pushing load factors to record levels. Net profits in the second quarter of 2013 were solid for

North American carriers in a quarter that was particularly affected in 2012 by higher fuel prices.

WestJ et recorded earnings of Canadian dollars (C$) $44.7 million making it its 33

rd

consecutive

1

Boeing Current Market Outlook, 2013 - 2032

Toronto - Pearson International Airport

Chapter I Economic and Air Traffic Analysis 2

January 24, 2014 - FINAL

quarter of profitability

2

. Air Canada posted an adjusted profit of C$169.0 million in the second

quarter of 2013

3

.

In the U.S., United Airlines (United) reported earnings of U.S. dollars (US$) $469.0 million

4

,

Southwest of US$224.0 million

5

, Delta of US$685.0 million

6

and US Airways of US$287.0

million

7

.

From 2000 through 2009, U.S. airlines lost about US$60.0 billion and eliminated 160,000 jobs,

according to the Airlines for America (A4A). During that tumultuous decade, airlines were hit

with a series of events beyond their control: two recessions, the September 11, 2001 attacks, an

avian flu outbreak and rising fuel costs.

The industry was profitable in 2000, 2006 and 2007, during cyclical economic peaks. Those

growth years were masking the industry's underlying problems including high operational costs

and an over-supply of capacity. During 2008 and 2009, airlines lost a combined US$23.0 billion.

During that same time period, the airlines began aggressive cost-cutting plans aimed at fixing

many of the systemic issues which kept them unprofitable. Some of the cost-cutting measures

they adopted to return to profitability included:

Eliminating money-losing flights: With a recovery in travel demand, airlines raised ticket

prices for the smaller supply of seats, which consequently raised yields.

Grounding older, less gas efficient airplanes: As of year to date (YTD) 2013, there

are more than 1,000 commercial airplanes parked at six airports in the southwestern U.S.

according to the Center of Land Use Interpretation. These aircraft include older types

such as DC-9s and older generation Boeing 737s as well as widebodies such as Boeing

747s and MD-11s.

Adding ancillary fees: In 2010, airlines collected more than US$6.3 billion from ancillary

sources such as checked baggage, on-board purchases and ticket change fees. In 2012,

airlines earned US$27.1 billion from these fees, increasing this line of revenue by 330.0

percent in two years

8

.

Consolidating: Delta Air Lines (Delta) purchased Northwest Airlines (Northwest) in

2008 and United and Continental Airlines (Continental) merged in 2010. American

Airlines (American) and US Airways merged on December 9, 2013, and it will take

approximately 12-18 months to merge their operating certificates. In the low-cost sector,

Southwest Airlines purchased AirTran Airways in 2010. Collectively, these changes put

upward pressure on airfares. Table I-1 summarizes the airline mergers since 2008.

2

WestJ et, Media and Investor Relations, www.westjet.com

3

Air Canada, Investor Relations, www.aircanada.com

4

United Airlines Inc., Investor Relations, www.united.com

5

Southwest Airlines Co., Investor Relations, www.southwest.com

6

Delta Air Lines, Inc., Investor Relations, www.delta.com

7

American Airlines, Inc. represent earning for former US Airways Group, Investor Relations, www.aa.com

8

TTG Asia Media Pte Ltd, June 10, 2013

Toronto - Pearson International Airport

Chapter I Economic and Air Traffic Analysis 3

January 24, 2014 - FINAL

Merging Carriers HQs

Value ($

billions)

Status Background

Chicago $3.20 Complete

On August 27, 2010, the U.S. Department

of J ustice approved the merger. Share

holders of both companies approved the

deal on September 17, 2010. The

transaction was completed on October 1,

2010. Both carriers began to merge

operations in 2011 and a single operating

certificate was issued fromthe FAA in

2012.

Atlanta $17.70 Complete

On September 26, 2008, shareholders

announced they had approved the merger.

After a six-month investigation,

government economists concluded the

merger would likely drive down costs for

consumers without curbing competition.

On October 29, 2008, the United States

Department of J ustice approved the

merger.

Dallas $3.10 Complete

On September 27, 2010, Southwest

Airlines announced they would acquire

AirTran Airways for a total cost of $1.4

billion. By April 2013, the carriers merged

their itineraries in all Southwest and

AirTran cities (domestic and international).

Southwest anticipates that the integration

will be complete in late 2014.

Dallas $14.10

Awaiting

Regulatory

Approval

On February 14, 2013, American Airlines

and US Airways Group announced that

the two companies would merge. The deal

is expected to close in the third quarter of

2013, however, on August 13, 2013, a civil

suit was filed by the U.S. J ustice

Department, six state attorneys general,

and the District of Columbia over antitrust

concerns of the merger. If approved,

bondholders of American Airlines' parent

AMR will own 72% of the new company

and US Airways shareholders will own the

remaining 28% .

Sources:

United; American; USAirways; Southwest; Delta; Washington Post; Bloomberg; Money-CNN

Table I-1

Toronto - Pearson International Airport

North American Airline Mergers - 2008 to Present

Toronto - Pearson International Airport

Chapter I Economic and Air Traffic Analysis 4

January 24, 2014 - FINAL

a) Commercial Aircraft Demand

Boeing has forecast a long-term demand for 35,280 new airplanes, valued at US$4.8

trillion from 2013 until 2022

9

. Their projections identify 14,350 of these new airplanes

(41.0 percent of the total new deliveries) for the replacement of older, less efficient

airplanes, reducing the cost of air travel and decreasing carbon emissions. The remaining

20,930 airplanes will be for fleet growth and expansion of low-cost carriers in emerging

markets. The latest available data from Airbus SAS (Airbus) estimates that between

2013 and 2032, 27,347 new airplanes will be delivered

10

. Both of the manufacturers

predict most of these new orders will originate from the Asia/Pacific region in countries

such as China, Indonesia and Malaysia. Bombardier and Embraer, manufacturers of

mostly regional jets under 100 seats, have forecast their aircraft demand estimates. Based

on new, next generation aircraft which both manufacturers are currently planning and

testing, Bombardier has estimated the demand for their aircraft (now defined as seating 20

to 149 passengers) at 12,800 units between 2012 and 2031

11

. Embraer (which defines

their aircraft as seating 30 to 120 seats) estimates aircraft demand in their segment to be

6,794 units

12

. Table I-2 and Table I-3 show the demand for new aircraft as forecast by

these manufacturers divided by global region.

9

Boeing Current Market Outlook, 2013 - 2032

10

Airbus, Global Market Forecast, 2013 - 2032

11

Bombardier, Commercial Aircraft, Market Forecast, 2012-2031

12

Embraer Commercial Aviation, Embraer Market Outlook, 2012-2031

Toronto - Pearson International Airport

Chapter I Economic and Air Traffic Analysis 5

January 24, 2014 - FINAL

Key Economic Indicators

Boeing

1

Airbus

2

World Economy (GDP) 3.2% 3.2%

Airplane Fleet 3.6% 3.5%

Airline traffic (RPK) 5.0% 4.7%

Cargo Traffic (RTK) 5.0% 4.9%

New Airplane Demand by World Region

Boeing

1

Airbus

2

Asia Pacific 12,820 9,618

Europe 7,460 5,701

North America 7,250 5,851

Middle East 2,610 1,906

Latin America 2,900 2,085

CIS 1,170 1,229

Africa 1,070 957

Total 35,280 27,347

Note(s):

1/ BoeingCurrent Market Outlook, 2013 - 2032

2/ Airbus Global Market Forecast, 2012 - 2031

Source(s):

Boeing; Airbus

Table I-2

Toronto - Pearson International Airport

Comparison of Boeing and Airbus Global Market Forecasts

Toronto - Pearson International Airport

Chapter I Economic and Air Traffic Analysis 6

January 24, 2014 - FINAL

Key Economic Indicators

Bombardier

1

20-149 Seat Aicraft

Embraer

2

30-120 Seat Aicraft

World Economy (GDP) 3.3% 3.1%

Airplane Fleet 2.1% 3.2%

Airline traffic (RPK) n/a 5.0%

New Airplane Demand by World Region

Bombardier

1

20-149 Seat Aicraft

Embraer

2

30-120 Seat Aicraft

North America 4,730 2,195

Latin America 930 670

Africa & Middle East 970 515

Europe, Russia & CIS 2,240 1,905

China 2,220 1,005

Asia/Pacific 1,710 505

Total 12,800 6,795

Note(s):

1/ Bombardier AerospaceMarket Forecast, 2013 - 2032

2/ Embraer Market Outlook, 2012 - 2031

Source(s):

Bombardier; Embraer

Table I-3

Toronto - Pearson International Airport

Comparison of Bombardier and Embraer Global Market Forecasts

b) Aircraft Orders

Boeing and Airbus logged US$129.0 billion in aircraft orders at the Paris Air Show in J uly

2013

13

. Airbus sold 466 planes worth US$69.0 billion and Boeing 382 aircraft valued at

US$60.0 billion. In order to meet demand, both Boeing and Airbus are boosting

production to respond to the risk of longer delivery times. Airbus is planning output of 50

A320 new-engine option (NEO) aircraft per month by the year 2020 from their standard

production level of 42 Airbus A320s. Boeing is increasing monthly output of 737 aircraft

to 42 by 2014 from 35 in 2012 and unveiled its Boeing 737 MAX family as the successor

to the current Boeing 737 Next Generation (NG) family. In May 2013, WestJet ordered

10 Boeing 737-800NG aircraft for delivery in 2014 and 2015

14

. In September 2013,

WestJ et announced a definitive purchase agreement for 65 Boeing 737 MAX aircraft with

deliveries commencing in 2017. Air Canada has outstanding orders with Boeing for two

additional 777-300ERs, 15 787-8s and 22 787-9s

15

. In December 2013, Air Canada

announced its intention to acquire up to 109 Boeing 737 MAX aircraft to replace its

13

Speed News, Penton Media Inc., June 20, 2013

14

WestJ et, Press Release, www.wesjet.com

15

The Boeing Company, Commercial Airplanes, Orders and Deliveries, www.boeing,com

Toronto - Pearson International Airport

Chapter I Economic and Air Traffic Analysis 7

January 24, 2014 - FINAL

Airbus narrowbody fleet and a portion of the Embraer 190 fleet. A definitive order is yet

to be completed between Air Canada and Boeing. Table I-4 shows Boeing and Airbus

orders for 2013 year-to-date.

2013 Boeing Aircraft Orders

1

737 747 777 787 Total

2013 Gross Orders 758 5 37 83 883

Changes -94 -5 -8 -1 -108

2013 Net Orders 664 0 29 82 775

737 747 777 787 Total

2013 Airbus Aircraft Orders

2

A320 A330 A350 A380 Total

2013 Gross Orders 817 11 104 0 932

Changes -36 0 -4 -40

2013 Net Orders 781 11 100 0 892

Note(s):

1/ Boeingorders through August 6, 2013.

2/ Airbus orders through July 31, 2012.

Source(s):

Boeing; Airbus

Table I-4

Toronto - Pearson International Airport

2013 Boeing and Airbus Aircraft Orders

c) International Air Transport Association Perspective

The International Air Transport Association (IATA) upgraded its global outlook for the

airline industry to a US$12.7 billion profit in 2013 based on projected revenues of

US$711.0 billion

16

. This is US$2.1 billion better than the US$10.6 billion profit projected

in March of this year and an improvement on the US$7.6 billion profit generated in 2012.

According to IATA, oil prices are expected to average US$108/barrel (Brent Crude) in

2014, a little below the US$111.8 per barrel average for 2012, in part due to increasing

supply from North America. The outlook for global economic growth has deteriorated

slightly since March as the recession in Europe has proven to be deeper than expected.

The beneficial impact of lower fuel prices is expected to offset the adverse effect of

weaker economic growth, providing a moderate boost to industry profitability. Load

factors are estimated to average 80.3 percent by 2014, which would be a record high.

Overall passenger capacity in 2014 is projected to expand to 4.3 percent, which is less than

the 5.3 percent anticipated growth in demand for 2013. The worldwide industry is

expected to see demand grow faster than capacity. The tight supply and demand

conditions, however, will not lead to improved yields. Passenger yields are forecast to

grow at a rate of 0.3 percent in 2013. Table I-5 shows the historical key revenue drivers

utilized in its global outlook.

16

IATA Economics, Outlook, Financial Forecast 2013

Toronto - Pearson International Airport

Chapter I Economic and Air Traffic Analysis 8

January 24, 2014 - FINAL

2007 2008 2009 2010 2011 2012Estimate 2013 Forecast

World GDP growth 3.8% 1.7% -2.3% 3.9% 2.6% 2.1% 2.2%

Passenger traffic growth 7.5% 2.7% -2.4% 8.8% 6.2% 5.3% 5.3%

Cargo traffic growth 4.7% -0.7% -8.8% 19.4% -0.1% -1.1% 1.5%

Passenger yield growth 1.7% 8.2% 13.7% 9.6% 5.0% 3.5% 0.3%

Passenger load factor 74.9% 76.0% 76.0% 78.4% 78.4% 79.2% 80.3%

Source:

IATA

Table I-5

Toronto - Pearson International Airport

Key Revenue Drivers of IATA 2013 Passenger & Freight Forecasts

d) Airline Alliances

There are few large network carriers globally that do not belong to an alliance. Airlines

such as Gulf Air and Virgin Atlantic, which do not belong to a global alliance, have

indicated that alliances have significant anti-competitive elements and that membership

would be an artificial brake on their business plans. According to British Airways,

alliances exist only because of restrictions on mergers for which the three main global

groupings are a poor substitute

17

. Alliances provide air carriers revenue synergies, but

consolidation often increases near-term operating costs for the individual airline and the

alliances.

There are currently three major airline alliances across the globe:

One World: 12 members

SkyTeam: 19 members

Star Alliance: 27 members

For customers, the advantages of airline alliances include through-ticketing, reducing the

need to be in a myriad of frequent flyer programs with reciprocal points earning

recognition of Frequent Flyer elite status by partner airlines. There have been several

interesting recent moves influencing the traditional airline alliances:

Delta (Sky Team) which owns 49.0 percent of Virgin Atlantic (non-aligned) has

announced a joint venture on U.K.-U.S. flights;

Qantas has recently shifted a significant amount of business from its OneWorld

partner British Airways to non-aligned Emirates;

Consolidations and mergers are shifting alliance memberships (example: the US

Airways - American merger means US Airways will leave Star Alliance for OneWorld

and Continental Airlines (Continental) left SkyTeam just before its United merger to

join Star Alliance;

17

Bloomberg L.P., April 11, 2013, www.bloomberg.com

Toronto - Pearson International Airport

Chapter I Economic and Air Traffic Analysis 9

January 24, 2014 - FINAL

In March, 2013, after the merger of LAN Chile (One World) and TAM (Star

Alliance), the joint venture, LATAM, announced they chose OneWorld as their

unified alliance of choice;

Lufthansa is almost its own alliance with its European airline subsidiaries: Austrian

Airlines, Brussels Airlines and Swiss Air Lines;

Virgin Australia has a codeshare relationship with Delta (Sky Team) as well as

Singapore Airlines (Star Alliance) and Air New Zealand (Star Alliance).

Alliances arguably bring revenue benefits to those involved. Nevertheless, examples

above show that secondary alliances and agreements by individual network carriers

outside of their alliance parameters are more frequent and may result in a shift in alliance

structures into the future. Low-cost carriers are increasingly joining alliances, GOL

Linhas Aereas of Brazil, will be joining SkyTeam and J etstar Airlines of Australia will

join OneWorld. Air Canada is a founding member of the Star Alliance and the Airport

serves as a hub for hundreds of daily connections under code-share arrangements between

Air Canada and its partner airlines. WestJ et is not part of an alliance as of 2013, but, does

have code-share relationships with American Airlines, Air France, British Airways,

Cathay Pacific, China Eastern, Delta, J apan Airlines, KLM and Korean Air.

e) Air Cargo Industry

Air transportation trade group associations including IATA have been cautious about the

air cargo industrys outlook. IATA warns of potential future issues with cargo growth

which may affect long-term demand including the slow-down of emerging markets and

recent oil price spikes which may continue into the future. The ability of airlines to match

cargo capacity to demand is limited by the natural growth in belly capacity that occurs as

airlines respond to passenger demand. Despite the overall positive signs, cargo markets

remain depressed with IATA revising its 2013 growth to 0.9 percent from a previously

projected 1.5 percent growth rate. Cargo revenues are expected to show an US $8.0

billion decline to US$59.0 billion from their peak in 2011. In comparison, passenger

revenues expanded by US$68.0 billion to US$565.0 billion over the same period

according to IATA

18

. This performance reflects the impact on demand of the oil price

spike associated with the Syrian crisis and disappointing growth in several key emerging

markets. Profits in 2013 will be considerably better than the US$7.4 billion net profit of

2012 and the upward trend should continue into 2014.

2. Drivers of Toronto Pearsons Future Activity

Fuel prices and the economy have been the leading concerns of airlines worldwide followed

closely by over-capacity according to IATA

19

. Fuel price increases have been steady following a

strong spike that occurred in 2008. The industry has managed to adjust to the increases, but often

at the price of profitability, where fuel accounts typically for around 30.0 to 40.0 percent of airline

costs. Capacity management and higher load factors, combined with higher yields, have made

profitability possible.

18

IATA Economics, Outlook, Financial Forecast 2013

19

IATA Economics, Outlook, Financial Forecast 2013

Toronto - Pearson International Airport

Chapter I Economic and Air Traffic Analysis 10

January 24, 2014 - FINAL

On the global economic front, Asia has remained robust and is gearing up for further growth

throughout the forecast horizon, even faced with a slower global economy. Increased air service

and new aircraft orders have all indicated a heavy focus on China and Southeast Asian growth in

the past decade. Europes economic uncertainty has lowered most major international stock

market indices and austerity measures will likely end in the short-term future. Major banks have

erected barriers to protect themselves from shocks, making funding and financing more difficult.

For full-service, legacy airlines such as Air Canada, tight capacity control and the capture of high-

yield, traffic has been key to keeping pace with its peer airlines in the U.S. The legacy airlines are

aware they cannot significantly narrow the operating cost gap between themselves and the Low

Cost Carrier (LCCs) levels. Capacity reductions remain as one of a few options to protect

against losses. Airlines have only a limited capability to protect themselves against rising fuel

prices. Hedging has been an expensive and risky option prompting airlines to limit this strategy.

It is becoming more difficult to hedge fuel prices over the long-term limiting the threat of

prolonged oil price increases. If oil prices were to increase another US$30.00, there is a real

prospect that airlines will substantially reduce flights, with long-haul operations the most sensitive.

In todays more intensely competitive, price-sensitive market, airlines have become much more

precise in analyzing marginal or loss-producing routes, and implementing selective capacity cuts.

The reduction of flight frequency where possible, or complete route withdrawal where necessary,

can occur quickly, as soon as losses begins. If oil prices were in fact to increase to US$130.00,

this could result in as much as 15.0 to 20.0 percent reductions in long haul seat offerings. This

would not be evenly applied. Route yield profile will be a main determinant, with the first seats to

go from the predominantly leisure routes to tourism-based destinations reliant on long-haul origin

markets. Eventually, lower cost airline models might fill the breach in these markets, but there is

no clear evidence yet that long-haul low-cost operations are effective beyond nine hours flying

time. At that stage, fuel becomes such a high proportion of cost that differentials in other cost

areas pale by comparison.

Short-haul airlines with markedly lower costs (LCCs and others) have expanded and even

flourished while the full-service airlines have stood still. Carriers based in the Middle-East are

growing as fast as any group of airlines in history on long haul and with their yield profile are

probably best equipped to handle any future economic impacts.

a) Air Canada

Air Canada is defined as a legacy carrier and has undergone different restructuring plans

since 2000 to reduce its high operating costs. Air Canada carries the majority of

international and high yield corporate business travelers from its hub at Pearson. Air

Canadas cost structure has made the company particularly vulnerable to regular operating

risks. In addition, as with most legacy carriers, Air Canada is highly unionized and

susceptible to wage concession negotiations and strikes. After several difficult years

marked by labor unrest, the carrier boosted profitability by recording US$55.0 million in

net profit for 2012, its first annual profit since 2007. According to Air Canada, overall

capacity will grow by approximately 9.0 to 11.0 percent in 2014, in part due to the

delivery of the carriers first seven Boeing 787s. In December 2013, the carrier

announced an agreement with Boeing for orders for 33 Boeing 737 MAX 8 and 28 737

MAX 9 aircraft for deliveries starting in 2017. Air Canada also negotiated options and

purchase rights for an additional 48 Boeing 737 MAX aircraft.

Toronto - Pearson International Airport

Chapter I Economic and Air Traffic Analysis 11

January 24, 2014 - FINAL

Air Canada is focusing on transporting more business travelers from the U.S. to final

destinations in Asia and Europe, by transferring them through Pearson, Montreal and

Vancouver according to Toronto Star Newspapers Ltd

20

. This strategy could potentially

generate an additional US$400.0 million in gross revenue for the carrier.

The airline is adding capacity on Boeing 767 and Airbus 319 aircraft to be used on Air

Canada Rouge, a leisure airline that began service to Europe and leisure markets in the

Caribbean, Mexico and Central America, on J uly 1, 2013. The leisure carrier, which has a

strategy of competing with established charter carriers like Air Transat and Sunwing

Airlines, started operations with four aircraft with the ability to expand its fleet to 50

aircraft by the end of 2015.

b) Low-Cost Carriers

LCCs have succeeded internationally due to reduced expenses, flexible work forces, and

strict debt-management. They are usually limited to regional routes, with minimal

international capacity. There is a recent trend that is based on a new business model that

incorporates popular international and national destinations that preserve a lower operating

cost structure. Both WestJ et and Porter began as LCCs, and have since expanded

significantly. WestJ et is no longer solely regional, offering some select international

flights, and Porter has been looking closer at Western Canada and the North-Eastern U.S.

WestJ et reported its highest quarterly earnings since its founding recording a net income

rise of 33.3 percent to C$91.1 million in the first quarter of 2013. That compared with net

earnings of C$68.3 million or C$0.49 per share in the same period in 2012. Total revenue

was up 8.6 percent to C$967.2 million in the first quarter of 2013 compared to C$891.0

million in the first quarter of 2012. WestJ et is in the process of selling its oldest Boeing

737-700NG aircraft while agreeing with Boeing to purchase 10 737-800NG aircraft, with

deliveries in 2014 and 2015. WestJ et has deferred the delivery of five Boeing 737-700NG

aircraft from 2014 and 2015 to 2016 and 2017

21

.

Encore, a regional airline based in Calgary and wholly owned by WestJ et, commenced

operations on J une 24, 2013, using a fleet of Bombardier Dash 8 Q400s. Encore initially

launched service from its Calgary to Fort St. J ohn and Nanaimo, both in British Columbia,

followed by Brandon, Manitoba. Encore will eventually have two bases, with the eastern

base at Pearson. The carrier has ordered 17 Dash 8 Q400s from Bombardier and currently

has options for 25 additional aircraft

22

.

Porter has evolved over the years from a traditional LCC to a hybrid LCC/full service

carrier. The carrier takes full advantage of its LCC business model, but holds a virtual

monopoly over Billy Bishop Airport (Toronto City Centre Airport) where they have low

landing fees and less expensive, non-unionized labor. As a growing company, Porter will

be challenged by cautious expansion at the risk of allocating a large percentage of its

resources too broadly.

20

Toronto Star Newspapers Ltd., December 18, 2012, www.thestar.com

21

WestJ et, Media and Investor Relations, www.westjet.com

22

WestJ et, Press Release, www.wesjet.com

Toronto - Pearson International Airport

Chapter I Economic and Air Traffic Analysis 12

January 24, 2014 - FINAL

c) Broad-Based Challenges

Some of the global challenges facing the Canadian air traffic industry include variable

operating costs such as fuel prices and corporate debt borrowing. Specific challenges

imposed by the Canadian government include fees and taxes passed directly to Canadian

air travelers such as the Federal Excise Tax on Aviation Fuel, which Canadian carriers

argue to be an advantage to U.S. carriers. Other Canadian taxes such as the air travelers

security charge introduced after the attacks of September 11, 2001, increased federal

treasury tax collection from travelers by approximately 20.0 percent between 2000 and

2005. Since 2005, these various taxes and surcharges have increased at a rate more

commensurate with overall economic growth.

There has been a significant degree of internationalization of major airlines through inter-

corporate alliances. The result of this could be a global stratification of airlines where a

few leading global carriers would form the first tier followed by a group of national

carriers as second-tier airlines. Most legacy hub carriers such as Air Canada operate with

code-share partnerships within and outside of their global alliances. WestJ et, which is not

a member of a worldwide airline alliance, has code-share agreements with nine global air

carriers and interlines (baggage transfer agreements) with an additional 24 airlines.

d) Industry Competition

Competition rules in the airline industry are significant relative to other sectors. Foreign

ownership limits do not exist to the same degree in things like media and television

competition in Canada. Publicly traded carriers like WestJ et and Air Canada are expected

to increase foreign ownership restrictions from 25.0 percent to 49.9 percent.

e) Canada-U.S. Relations

Canada and the U.S. are currently the world's largest trading partners and share the world's

longest border. Recent difficulties have included repeated trade disputes, environmental

concerns, Canadian concern for the future of oil exports, issues of illegal immigration and

the threat of terrorism. Trade between the two countries has continued to expand in both

absolute and relative terms for the last two hundred years, but especially following the

1988 Free Trade Agreement (FTA) and the subsequent signing of the North American

Free Trade Agreement (NAFTA) in 1994.

Canada and the U.S. have three significant issues/events to see through during the 2013

2014 period: a new U.S. ambassador to assume the post in Ottawa, the decision on the

Keystone XL Pipeline and reciprocal official state visits by Prime Minister Stephen

Harper and President Barack Obama. Each of these events is an important element in the

bilateral relationship between the two nations. This Report maintains that the political,

economic and trade relations climate between Canada and the U.S. will remain positive

and trade will continue to grow throughout the Forecast Period.

f) Fuel Costs

In 2012, prices climbed to approximately US$100.00 a barrel for Brent Crude despite a

soft international economy and relatively weak demand for oil. According to BP, crude

Toronto - Pearson International Airport

Chapter I Economic and Air Traffic Analysis 13

January 24, 2014 - FINAL

oil consumption in developed countries declined by 1.2 percent in 2012 to record low

levels since 1995, but overall global consumption grew by 0.7 percent

23

.

Uncertainty in unstable political regions such as the Middle East is one factor that is

keeping buyers and speculators from large investments. Instability is not unusual for the

Middle East region, but heightened tensions in Syria, Libya, Turkey and Egypt in addition

to demonstrations quickly assembled through social media in the region have prompted

caution in the investment markets for crude oil.

Most expectations are for fuel prices to remain around current levels for 2013 according to

the U.S. Department of Energy

24

. A fuel price spike in 2014 or beyond could force

airlines to further reduce capacity on marginally profitable routes or to withdraw

completely. In the past full-service airlines may well have persisted with ailing routes, but

todays heightened levels of competition are prompting a greater focus on the short-term

bottom line.

g) Airline Yield

The public data on airfares is very limited. Statistics Canada has published evidence that

Pearson has higher airfares compared to other Canadian airports as shown in Table I-6.

The airlines will be especially reluctant to reduce services at high airfare markets that

produce higher airline yields during a period of weak traffic. High airfare markets are less

vulnerable to problems associated with poor airline earnings and are the most likely to

attract competition, Torontos high airfares were likely part of the attractions that induced

WestJ et to transfer its eastern Canada hub from Hamilton to Pearson in 2004. High

airfares show the potential for traffic stimulation. Should Pearson receive even stronger

domestic competition, its relatively high airfares would fall, further stimulating traffic

growth.

An appreciating Canadian Dollar has and will continue to make the Airport more desirable

to foreign airlines. There is little data available publicly on average international airfare

levels.

23

BP, Energy Outlook 2030 booklet, www.bp.com

24

U.S. Department of Energy, Annual Energy Outlook 2013 - Energy Information Administration, www.eia.gov

Toronto - Pearson International Airport

Chapter I Economic and Air Traffic Analysis 14

January 24, 2014 - FINAL

h) Currency

The Canadian dollar will hold near current levels through 2013 while seeing a rebound to

parity with the U.S. Dollar by the end of 2014 according to CIBC World Markets Inc

25

.

Historically, the Canada economy fared better than most industrial nations, but still

experienced a serious recession in 2008 and 2009. As a result, the central bank pushed

interest rates to record lows. In Canada, natural resources still make up less than half of

exports, with manufactured products still hanging on to a major role. The country's top

exports are oil, vehicles/parts and machinery. Disappointing growth in China and a shift

in its mix towards less resource-using sectors like services, have had a limited effect on

the Canadian economy given that China's import share in oil, Canada's export

heavyweight, remains limited. Other countries like Australia, heavy producers of iron-ore

mostly exported to China, have experienced a fall in export prices as a result of greater

commodities reliance, and specifically to goods tied to Chinese demand.

Canada's oil reliance brings its own vulnerabilities and according to CIBC, economists

expect crude oil to average US$98.00 per barrel in 2014, helped by improving global

growth, even if politics in the Middle East temper. Canada faces a potentially more

favorable external environment in the coming year, given its significant ties to the

improving U.S. homebuilding market. CIBC forecasts that the U.S. economy could see a

25

CIBC Monthly FX Outlook - CIBC World Markets, October 2013

2011-Q3 2011-Q4 2012-Q1 2012-Q2 Average

Calgary 173.40 183.50 174.10 178.40 177.35 $

Edmonton 166.10 175.20 170.70 173.50 171.38

Halifax 173.50 186.20 186.60 184.00 182.58

Montreal 186.10 191.10 189.40 192.50 189.78

Ottawa 184.40 195.90 190.90 201.40 193.15

Regina 173.30 183.50 174.70 180.50 178.00

Saskatoon 178.10 185.90 185.50 190.60 185.03

Toronto 204.60 217.50 215.50 213.90 212.88

Vancouver 204.40 212.30 208.30 204.70 207.43

Winnipeg 180.20 197.10 189.60 189.40 184.90

Source:

Stats CDA CANSIM Table 401-0003 "Domestic Air Fares, Selected Cities of Enplanement"

Table I-6

Toronto - Pearson International Airport

Average Domestic Fares for Major Canadian Airports

Toronto - Pearson International Airport

Chapter I Economic and Air Traffic Analysis 15

January 24, 2014 - FINAL

noticeable acceleration next year and projects growth of 3.3 percent vs. 1.8 percent in

2013.

i) Liberalization

Canadas Blue Sky policy, announced in the fall of 2006, outlined a process to ease the

entry barriers on international air services and have brought tangible benefits to Pearson.

In 2008, Iceland Air inaugurated nonstop services from Toronto to Reykjavik. A March

2009 agreement with Turkey allowed Turkish Airlines to begin nonstop Toronto-Istanbul

flights, limiting the airline to three flights weekly. The spring 2009 agreement with Korea

allowed Korean Air to boost nonstop Toronto-Seoul services to a daily flight. The

December 2009 agreement with the European Union (EU) not only liberalizes air

services to nineteen nations; it extends a liberal agreement to eight EU member states that

previously lacked any air service agreement with Canada. The agreement largely

eliminates routing, pricing, capacity and carrier designation constraints. In August 2011,

Canada and Brazil concluded an open skies agreement. In September 2011, negotiations

with J apan concluded with a greatly liberalized agreement that became effective in 2013.

In 2011, successful Canada-Mexico and Canada-Costa Rica negotiations led to expanded

air service agreements. In 2013, Saudia and Egypt Air announced new nonstop routes to

Pearson following an easing of bilateral restrictions.

The process of international liberalization remains incomplete, and situation-specific

impediments remain. Bilateral agreements still constrain frequencies between Canada and

the United Arab Emirates, Turkey and other countries. The bilateral agreement with

Singapore creates liberal rights only for all-cargo and nonstop passenger flights. Between

2011 and 2013, a larger degree of liberalization towards foreign-investment rights in the

Canadian air traffic industry has occurred. Canada, however, has been faced with a

number of challenges that are not conducive to further liberalization including a heavy tax

burden and intense competition.

j) New Aircraft

With the advent of a new classification of aircraft identified as Group VI, along with new

and fuel-efficient Group IV and V airplanes throughout the forecast horizon, there will be

a large number of new aircraft taking flight, particularly in the next 10-year period. These

aircraft include the 555-seat Airbus 380 (Group VI), the 250 to 290 seat Boeing 787

(Group V) and the 315 seat Airbus A350 XWB (Group V). Most of these aircraft to date

have been sold to foreign flag carriers. In Canada, Air Canada holds orders and options

for 15 Boeing 787-8 and 22 Boeing 787-9 aircraft. In the U.S., American, United and

Delta have orders for 110 Boeing 787-8 and Boeing 787-9 aircraft along with 208 options.

US Airways (ordered prior to the American merger), United Airlines and Hawaiian

Airlines have orders for 53 Airbus A350-800 and Airbus A350-900 aircraft along with 56

options.

A new group of narrow body aircraft in development will enter service in 2014. The

Bombardier C-Series will seat between 110 and 130 passengers and will have two

variants, the CS100 and CS300. In April 2013, Porter signed a conditional order for 12,

with options for an additional 18, C-Series CS100 aircraft. In the U.S., Republic Airways

has already committed to purchase 40 CS300 aircraft.

Toronto - Pearson International Airport

Chapter I Economic and Air Traffic Analysis 16

January 24, 2014 - FINAL

Airbus will introduce a new version of its 320 aircraft named the NEO (new engine

option). The A320neo will have improvements in fuel burn, maintenance costs and will

gain additional range. These combined improvements are projected to result in 15.0

percent less fuel consumption, 8.0 percent lower operating costs and a reduced noise

production. Airbus has logged over 2,300 orders as of August 2013, and first delivery is

scheduled for 2016

26

.

Similarly, Boeing launched the 737 MAX family of aircraft as a replacement of the

previous Boeing 737 Next Generation (NG) family. It will be the fourth generation of the

Boeing 737 family. The primary change is the use of the larger and more efficient CFM

International LEAP-1B engines. The airframe is to receive some modifications as well.

The Boeing 737 MAX is scheduled for first delivery in 2017 Boeing has firm orders for

the 737 MAX totaling 1,495 as of J uly 2013

27

.

k) Regional J ets

It is expected that a trend towards larger regional jets will continue while most of the

smaller regional jets will be retired from the Canadian airline fleet throughout the Forecast

Period. While demand for 70 to 90 seat aircraft continues to increase, it is expected that

the number of 50 seat regional jets in service will fall, increasing the average regional

aircraft size in 2014 and beyond. Given a production halt of 50-seat regional jets by major

manufacturers such as Embraer and Bombardier and the average age of these aircraft

(Embraer 145/140/135 and Canadair CRJ -200s) slowly increasing throughout the forecast

horizon, the average increase in regional jet size will continue.

l) Aerospace Manufacturers - Bombardier

In late-November 2009, Bombardier announced they would have to cut 715 jobs in the

Montreal area because of lack of interest for buying aircraft

28

. Unlike the major carriers,

aerospace manufacturers are going to take much longer to bounce back. It will

undoubtedly take time for the major carriers to be in the position to place orders for new

aircrafts, and it could be two or more years before aerospace manufacturers catch up with

the rest of the industry with the exception of those with large military contracts. The Q400

Turboprop has been a successful aircraft given its great efficiency and lower price than the

new generation regional jets. Demand for the Q400 has been supported by a broad range

of orders from return customers of earlier versions of the Dash-8 such as J azz, as well as

carriers in European countries and the Middle East. Bombardier has been diversifying

their interests and recently has been talking to major Middle Eastern airlines about

supplying 100 to 149 seat C-Series jets. While these are good linkages to be establishing,

the opportunities to capitalize on these offers will not be realized until major airlines are

well into the recovery process.

26

Airbus, Aircraft Families A320neo, www.airbus.com

27

The Boeing Company, Commercial Airplanes, Orders and Deliveries, www.boeing,com

28

Air Transport World, November 30, 2009, www.atwonline.com

Toronto - Pearson International Airport

Chapter I Economic and Air Traffic Analysis 17

January 24, 2014 - FINAL

m) Conclusion

The Greater Toronto Areas (GTA) well-balanced and diversified economy, large

population base, and attractiveness as a business and tourist destination should continue to

provide strong demand for air transportation services over the Forecast Period. In

addition, stable fuel costs, increased airline competition both on the domestic and

international fronts as well as an appreciating currency will provide for traffic growth at

Pearson throughout the Forecast Period. The Canadian air carrier industry has responded

to this positive outlook with large wide-body, narrow-body and regional aircraft orders

and the creation of two new subsidiary carriers for domestic and international leisure

customers.

The GTA continues to be the largest gateway to Canada and a leading international

destination. The cultural and social ties resulting from immigration will create economic

development that will support future air service demand. These factors make the GTA a

desirable place in which to live, visit and conduct business. With growth expected in

population, employment and personal income, the GTA is forecast to generate continued

demand for air transportation service through the Forecast Period.

B. AIR CANADA LONG TERM AERONAUTICAL FEES AGREEMENT

29

On October 17, 2013, the GTAA entered into a Long Term Aeronautical Fees Agreement with Air

Canada (the AC LTA). Pursuant to the AC LTA, Air Canada will pay a fixed amount (subject to certain

adjustments as permitted under the AC LTA) to the GTAA in lieu of the GTAAs standard aeronautical

charges (normally comprised of landing fees, general terminal charges and apron fees). The key terms of

the AC LTA are summarized below.

1. Scope

The AC LTA covers the aircraft movements of Air Canada, its wholly-owned subsidiaries, third

party air carriers with whom Air Canada has or enters into capacity purchase agreements and other

arrangements as may be mutually agreed to be included in the scope of the AC LTA (Air Canada

Family Members).

2. Term

The AC LTA comes into effect J anuary 1, 2014, and covers an initial five year term expiring

December 31, 2018. The term will be extended automatically for a further five years expiring

December 31, 2023, provided that (i) Air Canada Family Members collectively meet an agreed

passenger volume threshold during the 2018 calendar year, and (ii) the AC LTA has not otherwise

been terminated prior to the expiry of the initial term. The GTAA may, at its option, elect to

extend the initial term for the further five year period notwithstanding the applicable passenger

volume threshold has not been met.

29

GTAA

Toronto - Pearson International Airport

Chapter I Economic and Air Traffic Analysis 18

January 24, 2014 - FINAL

3. Fees

The AC LTA provides for the payment by Air Canada of a fixed annual aeronautical base fee, plus

applicable sales or other commodity taxes, over the term (including any extended term). In 2014,

the fixed annual aeronautical base fee is approximately $270.0 million, which reflects Air

Canadas proportionate share of the GTAA is forecasted 2014 aeronautical costs expected to be

incurred by the GTAA at the Airport, which costs would otherwise be recovered by the GTAA

through the imposition of landing fees, general terminal charges and apron fees. In subsequent

years, including any extension of the initial five year term, the prior years fee escalates by

approximately one percent (1.0 percent) annually.

The fixed annual aeronautical base fee may be increased or decreased in certain circumstances,

including if the GTAA elects to adjust any one or more of its then current published aeronautical

charges payable by the remainder of the air carrier community at the Airport for any reason,

including (without limitation) adjustments to address:

Unbudgeted or unanticipated increases or decreases in the GTAAs revenues (other than

reductions pursuant to the payment of rebates under the AC LTA), costs or capital

expenditures;

Increases or decreases in the GTAAs costs arising from changes in or restructuring of the

manner of provision of certain services at the Airport which are currently paid by the

remainder of the air carrier community operating at the Airport directly to third party service

providers as third party service fees; or

Other adjustments which the GTAA determines will be necessary in order to manage the level

of GTAA indebtedness in accordance with its requirements and objectives.

In the above circumstances, the GTAA determines the amount of additional or reduced funds

that it requires to raise through its aeronautical charges. Air Canadas fixed annual

aeronautical base fee is then adjusted by its proportionate share of the additional or reduced

funds accordingly (based on Air Canadas share of 2013 aviation traffic). The proportionate

share percentage remains unchanged throughout the term of the AC LTA.

4. Airport Improvement Fee

The GTAA expressly retains its right to increase or decrease the Airport Improvement Fee at any

time during the term of the AC LTA in its sole discretion.

5. Rebates

For each calendar year of the term, the AC LTA establishes certain passenger traffic thresholds for

the Air Canada Family Members collectively. Provided that the Air Canada Family members

achieve the cumulative passenger threshold in a given year, Air Canada shall receive a rebate

calculated based on the additional revenues generated by incremental passenger growth at the

Airport in excess of the threshold.

Toronto - Pearson International Airport

Chapter I Economic and Air Traffic Analysis 19

January 24, 2014 - FINAL

6. Non-Exclusivity

The GTAA is not prevented from or restricted in entering into other aeronautical rate agreements

with other air carriers operating or proposing to operate at the Airport on the same or on different

terms, or from offering and implementing incentive programs regarding aeronautical charges in its

sole discretion. If the GTAA enters into a fixed fee contract with another air carrier exceeding

certain parameters, the base fee in such other air carrier must be not less than a specified

percentage of the GTAA forecasted revenues from that other air carrier during the term of that

other agreement. Where the GTAA wishes to engage in an incentive program to the air carrier

community regarding aeronautical charges, the GTAA shall publish its program on its website.

The GTAA shall also publish and adhere to its standard rates and terms with respect to other

commercial arrangements for air carriers at the Airport (such as employee parking and commercial

space rentals).

7. Reservation of GTAA Operational Rights

The GTAA retains all rights to operate the Airport in such manner, as it deems appropriate, both

with respect to its development decisions and with respect to the operational procedures and plans

concerning its facilities. The AC LTA expressly provides that Air Canada has no interest in any

gates, counters, terminals or other GTAA facilities and that the GTAA is not obliged to provide or

construct any infrastructure or improvements or implement any particular operating procedures.

8. Events of Default and/or Termination

The AC LTA provides for certain customary events of default and rights of termination, and

expressly provides for additional rights of termination in certain circumstances, including the

following:

Air Canada may terminate the AC LTA without liability of either party if, at the end of a

calendar year, the fixed annual aeronautical base fee for that year (net of any permissible

adjustments and rebate earned by Air Canada) is greater than the amounts that would have

been paid by the Air Canada Family Members collectively if they had been paying the

GTAA on the basis of its thencurrent published tariffs in respect of aeronautical

charges;

Air Canada may terminate the AC LTA without liability of either party if the GTAA fails

to deliver (a) by J une 16, 2014, a draft airport development plan, including the GTAAs

facility allocation procedures in respect of common use assets, provided that such

termination right must be exercised so as to terminate the AC LTA prior to or on

December 31, 2014, and (b) by December 31, 2015, certain related facility improvements

for common use assets or its written plan for doing so, provided that such termination right

must be exercised so as to terminate the AC LTA prior to or on December 31, 2016;

The GTAA may terminate the AC LTA effective on or after December 31, 2019, if the Air

Canada Family Members fail to achieve agreed threeyear rolling average passenger

volume thresholds, beginning with the 2017-2019 period; and

If the GTAAs Ground Lease is terminated for any reason and the AC LTA is not assigned

to the federal government, the AC LTA shall be terminated as of the date of termination of

the Ground Lease.

Toronto - Pearson International Airport

Chapter I Economic and Air Traffic Analysis 20

January 24, 2014 - FINAL

9. Service Level Standards

The AC LTA provides that Air Canada and the GTAA shall collaborate in the development of

certain specified service level standards which the parties have identified as being important to

customer service and the development of a global hub. The GTAA and Air Canada will develop

the relevant metrics over a period of six months, with the eventual goal of achieving top quartile

performance as compared to mutually agreed comparator groups of airlines and airports. The

service level standards will be measured and improvement plans will be developed collaboratively,

with remedies available to promote improved service performance. The GTAA will be obliged to

impose (i) commensurate service level standards on ground handling service providers operating at

the Airport and other air carriers with longterm fee agreements and (ii) commensurate non-

binding service level standards on other air carriers operating at the Airport. Any payments to

other air carriers under incentive programs will only be payable if the air carriers achieve a certain

standard of performance. Ground handling companies who fail to comply with the standards shall

be subject to termination by the GTAA in its discretion.

10. Assignment

The GTAA may assign its rights and obligations under the AC LTA, without the prior approval of

Air Canada, to any person which:

Is able to grant the same rights with respect to the Airport and the fixed annual

aeronautical base fees as are granted by the GTAA pursuant to the AC LTA; or

Is the counterparty to the Ground Lease with Her Majesty and is the operator of the

Airport, and the GTAA may encumber such rights by way of security or assignment as

security to its lenders.

C. FORECAST OF AVIATION ACTIVITY

The forecasts of total passengers, aircraft movements, MTOW and air cargo tonnage presented below were

developed by AXIS for the purpose of this Study. Annual, quarterly, monthly and weekly aviation activity

was analyzed in constructing a 10-year forecast of the Airports aviation demand and the longer-term

prospects that are reasonably expected and driven by conventional aviation demand-drivers (e.g.,

population and PCPI). The forecast methodology employed regression analysis (top-down), air service

analysis (bottom-up) and a qualitative approach predominantly observing system-wide industry trends.

The economic environment in 2013 was taken into consideration, particularly the volatile socio-political

climate in the Middle East and North Africa and continuing Euro Zone debt crisis and austerity measures.

The forecast was based on continuing aviation demand recovery in the Canadian, U.S. and international

markets. The forecasts assume that airlines will continue to stress cost controls and the unbundling of

products and services, which were normally included in ticket prices in the past (i.e., checked-luggage

fees, onboard snacks for sale etc.). Pro-competitive policies will force the airlines to pass savings on to

customers and shippers.

Key assumptions for the Forecast Period include:

Long-term population growth will provide the basis for aviation demand in the GTA.

Pearson will remain the principal airport serving the GTA and will remain a competitive gateway

for international travel through the Forecast Period.

Toronto - Pearson International Airport

Chapter I Economic and Air Traffic Analysis 21

January 24, 2014 - FINAL

The GTA will remain a leading center of industry, innovation, education, and culture and will be

an important influence in the growth of international air traffic.

Domestic air carriers will face a competitive environment, resulting in average airfares that will

remain reasonable; low cost air carriers will maintain their presence at the Airport and grow at a

moderate rate.

Transborder routes will be adversely affected during the Forecast Period by a slowly recovering

U.S. economy.

Both transborder and international travel may grow due to international airline competition and

new trade liberalization. New travel opportunities should increase air service at Pearson.

Reform and liberalization of international aviation agreements on market entry will continue. The

most important agreements have already been liberalized. Restrictions on bilateral agreements

will continue to constrain growth at Pearson on a very case-specific basis.

Fuel supplies will remain available for air transportation, and the cost will be subject to short-term

volatility.

Aircraft will become more fuel efficient, quieter and more cost effective with lower emissions,

thereby reducing airline operating costs while increasing reliability.

1. Fleet Mix

The current fleet mix at Pearson, according to a published schedule provided by the GTAA via

Sabre Airline Solutions for a peak schedule in August 2013, is comprised mainly of narrow body

aircraft. The average number of departing seats per aircraft movement is 114 and the largest

number of departures is performed by the Bombardier CRJ -200 at 9.4 percent of total movements.

It is assumed that the fleet mix at Pearson will change throughout the forecast horizon with a

reduction in 50-seat regional jets and 37-seat DeHavilland Dash-8 aircraft and be replaced by

larger capacity aircraft types such as Embraer E-J ets, Canadair C-Series aircraft and Bombardier

Q-400 turboprops. Narrow body aircraft currently dominating the Airports fleet mix include the

Airbus 320, 319 and the Boeing 737-700 NG (accounting for 26.6 percent of the current fleet

mix), the majority of which comprise the domestic and regional fleets of Air Canada and WestJ et.

Most of these aircraft average a low to medium fleet age are optimally sized and have the best

flight economics to continue comprising the bulk of Pearsons fleet mix. Wide bodies comprised

10.1 percent of Pearsons total fleet mix in 2013. These aircraft are predominantly operated by Air

Canada to long-haul international destinations in Europe, Latin America and the Far East.

Additionally, the Airport hosts 32 foreign air carriers, excluding U.S. carriers, the majority of

which operate wide bodies including Boeing 777s, Airbus 330/340s and Boeing 787s to the

Airport. Table 1-8 shows the 2013 peak month average weekday fleet mix at Pearson.

Toronto - Pearson International Airport

Chapter I Economic and Air Traffic Analysis 22

January 24, 2014 - FINAL

Aircraft Type 2013 Fleet Mix Share (%)

Canadair Regional J et 9.4%

Airbus A319 9.1%

Airbus A320 9.0%

Boeing 737-700 8.6%

De Havilland DHC-8-100 Dash 8/8Q 8.5%

Embraer ERJ -190 7.6%

Boeing 737-800 5.9%

De Havilland DHC-8-400 Dash 8/8Q 5.2%

Embraer ERJ -175 4.6%

Beechcraft Beech 1900D 4.4%

Canadair Regional J et 700 3.9%

Boeing 737-600 3.7%

Boeing 767-300 3.3%

Airbus A321 3.1%

Canadair Regional J et 705 2.9%

BOEING 777-300ER 1.7%

Embraer ERJ -135/140/145 Regional J etF21 1.5%

Airbus A330-300 1.0%

Airbus A330-200 0.9%

Airbus A310-300 0.9%

BOEING 777-200LR 0.7%

Canadair Regional J et 900 0.7%

Embraer ERJ -145 Regional J et 0.7%