Académique Documents

Professionnel Documents

Culture Documents

Uti Mutual Fund

Transféré par

prashantgoruleTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Uti Mutual Fund

Transféré par

prashantgoruleDroits d'auteur :

Formats disponibles

SUMMER TRAINING PRO1ECT REPORT

ON

AWARENESS OF MUTUAL FUND AS AN INVESTMENT TOOL

AMONG PUBLIC SECTOR BANKS INVESTORS

Submitted in partial fulfillment of the requirement for the award of

Degree of Master of Business Administration

By Gautam Buddh Technical University, Lucknow

By:

TUSHAR SRIVASTAVA

Roll No.:1112470152

MBA (Batch 2011-2013), 3

rd

semester

Under the supervision of

Mr. ANKUR TYAGI

Senior Manager (PSU Banking Channel)

UTI MUTUAL FUND

Faculty Mentor

Ms. NAMITA NIGAM

Associate Professor

INSTITUTE OF COOPERATIVE CORPORATE MANAGEMENT, RESEARCH & TRAINING,

21/467, RING ROAD, INDIRA NAGAR, LUCKNOW-226016

- 1 -

DECLARATION

I, TUSHAR SRIVASTAVA, student of M.B.A. here by declare that the project report

titled AWARENESS OF MUTUAL FUND AS AN INVESTMENT TOOL AMONG

PUBLIC SECTOR BANKS INVESTORSis completed under the guidance of Mr.

ANKU !"A#I, is my original $or%.

!he imperial findings in this report are based on the data collected by me. !his project

has not been submitted to GAUTAM BUDDH TECHNICAL UNIVERSITY,

LUCKNOW or any other uni&ersity for the purpose of compliance of any

re'uirement of any e(amination or degree.

)lace* LUCKNOW

+ate*,,,,,, (TUSHAR SRIVASTAVA)

- - -

Acknowledgements

)resenting a .ummer !raining project of this type is an arduous tas%, demanding a lot of

time. I cannot in full measure reciprocate the %indness sho$n and contribution made by

&arious persons in this endea&our. I $ill remember all of them $ith gratitude.

I must, ho$e&er, especially ac%no$ledgement / my special sincere than%s

to$ards Mr. An%ur !yagi 0.enior Manager of U!I Mutual 1und2 for gi&ing me a chance

to ta%e this project and for his &aluable guidance, $hich helped me on all those points,

$hich I needed to include in, $ith full intensity.

I am e(tremely gratified to Asst.)rof. Ms. Namita Nigam $ho $as e(tremely

helpful in offering his professional e(pertise and besto$ing me practical %no$ledge in

all spheres related to the $hole organi3ation $or%ing.

I am appreciati&e to this organi3ation for full co-operation, support and moti&ation that

helped me a lot in completing my summer training project here.

I am al$ays beholden to the almighty #od, for al$ays being $ith me and

sho$ing me the right $ays, my family, for al$ays doing fa&ours to me and my friends

and colleagues consistently helped $ith encouragement and criticism throughout the

project $or%, for al$ays lifting my sights to higher &ision.

- 4 -

ABSTRACT

In fe$ years Mutual 1und has emerged as a tool for ensuring one5s financial $ell being.

Mutual 1unds ha&e not only contributed to the India gro$th story but ha&e also helped

families tap into the success of Indian Industry. As information and a$areness is rising

more and more people are enjoying the benefits of in&esting in mutual funds. !he main

reason of number of retail mutual fund in&estors remaining small is that three in ten

people do not %no$ that mutual funds e(ist. !he tric% for con&erting a person $ith no

%no$ledge of mutual funds to a ne$ Mutual 1und customer is to understand $hich of

the potential in&estors are more li%ely to buy mutual funds, to create an in&estment need

among such people and to use the right arguments in the sales process.

Mutual funds are seemingly the easiest and the least stressful $ay to in&est in the

stoc% mar%et. 6uiet a large amount of money has been in&ested in mutual funds

during the past fe$ years. Any in&estor $ould li%e to in&est in a reputed Mutual 1und

organi3ation. U!I is one such organi3ation that pro&ides a better o&er&ie$ of the

Mutual 1und industry. Understanding the attitude of in&estors on their in&estment

$ould help the company to increase their profits. In U!I they belie&e that the

in&estors attitude $ould result in profits.

!he research $as done on the topic 77A8A9N9.. :1 MU!UA; 1UN+ A.

AN IN<9.!M9N! !::; AM:N# )U=;I> .9>!: =ANK5. IN<9.!:.?.

!he study aims at analysing the attitude of the in&estors to$ards U!I Mutual 1unds.

!he project in&ol&es a study of mutual fund industry and e&aluating and suggesting

measures to create the a$areness among unit ban% in&estor about mutual funds of U!I

Mutual fund and also to identify the strong as $ell as the $ea% points so that an

appropriate sales pitch could be de&eloped. !he sales pitch highlighted features i.e.

first Mutual 1und Industry in India, largest In&estors si3e and )ast )erformance. !he

data $as collected $ith the help of a 'uestionnaire. !he sample si3e considered for the

study $as 1@@ $herein all the samples $ere colleted by in&estors )ublic ban%

In&estors in ;uc%no$.

- A -

OB1ECTIVE OF THE STUDY

!his project aims to identify 7A8A9N9.. :1 MU!UA; 1UN+ A. AN

IN<9.!M9N! !::; AM:N# )U=;I> .9>!: =ANK5. IN<9.!:.? for the

BU!I Mutual 1unds5, to %no$ ho$ much people are a$are of mutual fund as

in&estment option specially union ban%s public sectors in&estors. A modest attempt

has been made to study and understand the beha&ior and perception of the target

audience, about mutual funds and their a$areness.

!his project is tending to find out that $hat actually the mutual fund is, history

regarding it, its types and other facts and figures related to it. .ome points are listed

belo$ $hich can be considered as the objecti&e of this project topic*-

1ind out the attitude of customers to$ards Mutual 1unds.

1ind out the proportion of people $ho are much a$are and ha&e a

%no$ledge about mutual fund.

!o gi&e the %no$ledge and create a$areness about U!I Mutual 1und.

!o identify acti&ities that has the greatest potential benefits in

increasing the net$or%.

!o disco&er $hat is of most concern to your client, and therefore the

greatest ris% of loosing them.

!o learn the reasons your clients stay to continue and impro&e in these

areas.

Co$ to impro&e your organi3ation $ith the specific feedbac% from the

tool and become more attracti&e to current and potential clients

.

- D -

Mutual Fund Industry

Introduction

!he Indian mutual fund industry is one of the fastest gro$ing sectors in the

Indian capital and financial mar%ets. !he origin of mutual fund industry in India is

$ith the introduction of the concept of mutual fund by U!I in the year 1EF4. !hough

the gro$th $as slo$, but it accelerated from the year 1EGH $hen non-U!I players

entered the industry.In the past decade, Indian mutual fund industry had seen a

dramatic impro&ement, both 'uality$ise as $ell as 'uantity$ise. =efore, the

monopoly of the mar%et had seen an ending phase, the Assets Under Management

0AUM2 $as s. FHbn. !he pri&ate sector entry to the fund family rose the AUM to s.

AH@ bn in March 1EE4 and till April -@@A, it reached the height of 1,DA@ bn.

)utting the AUM of the Indian Mutual 1unds Industry into comparison, the

total of it is less than the deposits of .=I alone, constitute less than 11I of the total

deposits held by the Indian ban%ing industry.

!he mutual fund industry in India has seen dramatic impro&ements in 'uantity as $ell

as 'uality of product and ser&ice offerings in recent years. Mutual funds assets under

management gre$ by EFI bet$een the end of -@@1 and June -@@H and as a result it

rose from GI of #+) to 1DI. !he industry has gro$n in si3e and manages total assets

of more than K4@4D1 million. :f the &arious sectors, the pri&ate sector accounts for

nearly E1I of the resources mobili3ed sho$ing their o&er$helming dominance in the

mar%et. Indi&iduals constitute EG.@AI of the total number of in&estors and contribute

U. K1-@F- million, $hich is DD.1FI of the net assets under management.

Mutual 1und Industry in its true spirit rooted in a free mar%et and oriented to$ards

competiti&e functioning $ith the dedicated goal of ser&ice to the in&estors can be said

to ha&e settled in India only in 1EE4. Co$e&er the industry too% its roots much earlier

$ith the setting up of the Unit !rust in India 0U!I2 in 1EFA by the #o&ernment of

India. +uring the last 4F years, U!I has gro$n to be a dominant player in the industry

- F -

$ith assets of o&er s.H-, 444.A4 >rores as on March 41, -@@@. !he U!I is go&erned

by a special legislation, the Unit !rust of India Act, 1EF4. In 1EGH public sector ban%s

and insurance companies $ere permitted to set up mutual funds and accordingly since

1EGH, F public sector ban%s ha&e set up mutual funds.

Also the t$o Insurance companies ;I> and #I> established mutual funds. .ecurities

9(change =oard of India 0.9=I2 formulated the Mutual 1und 0egulation2 1EE4,

$hich for the first time established a comprehensi&e regulatory frame$or% for the

mutual fund industry. .ince then se&eral mutual funds ha&e been set up by the pri&ate

and joint sectors.

8CA! A9 MU!UA; 1UN+.L

CONCEPT:

A Mutual 1und is a trust that pools the sa&ings of a number of in&estors $ho share a

common financial goal. !he money thus collected is then in&ested in capital mar%et

instruments such as shares, debentures and other securities. !he income earned

through these in&estments and the capital appreciations reali3ed are shared by its unit

holders in proportion to the number of units o$ned by them. !hus, a Mutual 1und is

the most suitable in&estment for the common man as it offers an opportunity to in&est

in a di&ersified, professionally managed bas%et of securities at a relati&ely lo$ cost.

- H -

DEFINITION:

7Mutual funds are collective savings and investment vehicles $here sa&ings of small

0or sometimes big2 in&estors are pooled together to in&est for their mutual benefit and

returns distributed proportionately?. )ooling of money ensures that small in&estors get

the benefit of ad&ice and e(pertise that is normally a&ailable only to &ery large

in&estors.

7A mutual fund is an investment that pools your money $ith the money of an

unlimited number of other in&estors. In return, you and the other in&estors each o$n

shares of the fund. !he fundMs assets are in&ested according to an in&estment objecti&e

into the fundMs portfolio of in&estments. Aggressi&e gro$th funds see% long-term

capital gro$th by in&esting primarily in stoc%s of fast-gro$ing smaller companies or

mar%et segments. Aggressi&e gro$th funds are also called capital appreciation

funds.

Mutual funds are an e(cellent $ay to in&est in stoc%s, bonds and other securities. !hey

are a good choice of in&estment because*

!hey are managed by professional money managers, so most of the in&estment

research is done for you. 0Most in&estors don5t ha&e the time or %no$-ho$ to

do all the necessary research.2

"ou di&ersify your in&estment ris% by o$ning shares in a mutual fund, instead

of buying indi&idual stoc%s or bonds directly.

- G -

!ransaction costs are often lo$er than $hat you $ould pay if you in&ested in

indi&idual securities 0the mutual fund buys and sells large amounts of securities

at a time2.

1or those $ho are not adept at understanding the stoc% mar%et, the tas% of

generating superior returns at similar le&els of ris% is arduous to say the least. !his is

$here Mutual 1unds come into picture.

- E -

Growth of Mutual Fund Business in India

!he Indian Mutual fund business has passed through three phases. !he first phase $as

bet$een 1EFA and 1EGH, $hen the only player $as the Unit !rust of India, $hich had

a total asset of s. F,H@@N- crores at the end of 1EGG. !he second phase is bet$een

1EGH and 1EE4 during $hich period G funds $ere established 0F by ban%s and one

each by ;I> and #I>2. !he total assets under management had gro$n to s. F1,@-GN-

crores at the end of 1EEA and the number of schemes $ere 1FH. !he third phase began

$ith the entry of pri&ate and foreign sectors in the Mutual fund industry in 1EE4.

Kothari )ioneer Mutual fund $as the first fund to be established by the pri&ate sector

in association $ith a foreign fund. !he share of the pri&ate players has risen rapidly

since then.

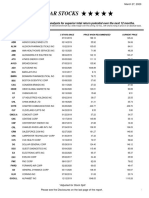

Within a short period of seven years after 1993 the growth statistics of the

business of Mutual Funds in India is given in the table below:

.teady gro$th of mutual fund business in India in the four decades from 1EFA, $hen

U!I $as set up is gi&en in the table belo$*

Period

(Year)

Aggregate

Investment

In Crores of

Rupees

Period

(Year)

Aggregate

Investment

In Crores of

Rupees

1EFA-FE FD 1EE--E4 AFEGG.@-

1EFE-HA 1H- 1EE4-EA F14@1.-1

1EHA-HE A@- 1EEA-ED HD@D@.-1

1EHE-GA 1-F1 1EED-EF G1@-F.D-

1EGF-GH ADF4.FG 1EEF-EH G@D4E.@@

1EGH-GG FH4G.G1 1EEH-EG FGEGA.@@

1EGG-GE 14ADD.FD 1EEG-EE F4AH-.@@

1EGE-E@ 1E11@.E- 1EEE-@@ 1@HEFF.1@

1EE@-E1 -4@F@.AD -@@@-@1 E@DGH.@@

1EE1-E- 4HAG@.-@ -@@1-@- EADH1.@@

- 1@ -

Mutual funds- A =I91 history *

!he formation of Unit !rust of India mar%ed the e&olution of the Indian mutual

fund industry in the year 1EF4. !he primary objecti&e at that time $as to attract the

- 11 -

small investors and it $as made possible through the collecti&e efforts of the

#o&ernment of India and the eser&e =an% of India. !he history of mutual fund

industry in India can be better understood di&ided into follo$ing phases*

First Phase - 1964-87 Establishment and Growth of Unit Trust of India):

Unit !rust of India enjoyed complete monopoly $hen it $as established in the

year 1EF4 by an act of )arliament. U!I $as set up by the eser&e =an% of India and it

continued to operate under the regulatory control of the =I until the t$o $ere de-

lin%ed in 1EHG and the entire control $as transferred in the hands of Industrial

+e&elopment =an% of India 0I+=I2. U!I launched its first scheme in 1EFA, named as

Unit .cheme 1EFA 0U.-FA2, $hich attracted the largest number of in&estors in any

single in&estment scheme o&er the years.

U!I launched more inno&ati&e schemes in 1EH@s and G@s to suit the needs of

different in&estors. It launched U;I) in 1EH1, si( more schemes bet$een 1EG1-GA,

>hildrenMs #ift #ro$th 1und and India 1und 0IndiaMs first offshore fund2 in 1EGF,

Mastershare 0InidaMs first e'uity di&ersified scheme2 in 1EGH and Monthly Income

.chemes 0offering assured returns2 during 1EE@s. =y the end of 1EGH, U!IMs assets

under management gre$ ten times to s FH@@ crores

Second Phase - 1987-1993 (Entry of Public Sector Funds):

1EGH mar%ed the entry of non- U!I, public sector mutual funds set up by public sector

ban%s and ;ife Insurance >orporation of India 0;I>2 and #eneral Insurance

>orporation of India 0#I>2. .=I Mutual 1und $as the first non- U!I Mutual 1und

established in June 1EGH follo$ed by >anban% Mutual 1und 0+ec GH2, )unjab

National =an% Mutual 1und 0Aug GE2, Indian =an% Mutual 1und 0No& GE2, =an% of

India 0Jun E@2, =an% of =aroda Mutual 1und 0:ct E-2. ;I> established its mutual fund

in June 1EGE $hile #I> had set up its mutual fund in +ecember 1EE@.

- 1- -

At the end of 1EE4, the mutual fund industry had assets under management of s.AH,

@@A crores.

Third Phase - 1993-2003 09ntry of )ri&ate .ector 1unds2

8ith the entry of pri&ate sector funds in 1EE4, a ne$ era started in the Indian mutual

fund industry, gi&ing the Indian in&estors a $ider choice of fund families. Also, 1EE4

$as the year in $hich the first Mutual 1und egulations came into being, under $hich

all mutual funds, e(cept U!I $ere to be registered and go&erned. !he erst$hile

Kothari )ioneer 0no$ merged $ith 1ran%lin !empleton2 $as the first pri&ate sector

mutual fund registered in July 1EE4.

!he 1EE4 .9=I 0Mutual 1und2 egulations $ere substituted by a more comprehensi&e

and re&ised Mutual 1und egulations in 1EEF. !he industry no$ functions under the

.9=I 0Mutual 1und2 egulations 1EEF.

!he number of mutual fund houses $ent on increasing, $ith many foreign mutual

funds setting up funds in India and also the industry has $itnessed se&eral mergers

and ac'uisitions. As at the end of January -@@4, there $ere 44 mutual funds $ith total

assets of s. 1, -1,G@D crores. !he Unit !rust of India $ith s.AA, DA1 crores of assets

under management $as $ay ahead of other mutual funds.

Fourth Phase - since February 2003

In 1ebruary -@@4, follo$ing the repeal of the Unit !rust of India Act 1EF4 U!I $as

bifurcated into t$o separate entities. :ne is the .pecified Underta%ing of the Unit

!rust of India $ith assets under management of s.-E, G4D crores as at the end of

January -@@4, representing broadly, the assets of U. FA scheme, assured return and

certain other schemes.

!he .pecified Underta%ing of Unit !rust of India, functioning under an administrator

and under the rules framed by #o&ernment of India and does not come under the

pur&ie$ of the Mutual 1und egulations.

- 14 -

!he second is the U!I Mutual 1und ;td, sponsored by .=I, )N=, =:= and ;I>. It is

registered $ith .9=I and functions under the Mutual 1und egulations. 8ith the

bifurcation of the erst$hile U!I $hich had in March -@@@ more than s.HF, @@@

crores of assets under management and $ith the setting up of a U!I Mutual 1und,

conforming to the .9=I Mutual 1und egulations, and $ith recent mergers ta%ing

place among different pri&ate sector funds, the mutual fund industry has entered its

current phase of consolidation and gro$th.

As at the end of .eptember, -@@A, there $ere -E funds, $hich manage assets of

s.1D41@G crores under A-1 schemes.

2003-2004: A retrospect *

!his year $as e(tremely e&entful for mutual funds. !he aggressi&e competition in the

business too% its toll and t$o more mutual funds bit the dust. Alliance decided to

remain in the ring after a highly public bidding $ar did not yield an acceptable price,

$hile Ourich has been sold to C+1> Mutual. !he gro$th of the industry continued to

be corporate focused barring a fe$ initiati&es by mutual funds to e(pand the retail

base. ;arge money brought $ith it the problems of lo$ retention and conse'uently

lo$ profitability, $hich is one of the problems plaguing the business. =ut at the same

time, the industry did see spectacular gro$th in assets, particularly among the pri&ate

sector players, on the bac% of the continuing debt bull run. 9'uity did not find fa&or

- 1A -

$ith in&estors since the mar%et $as lac%-luster and performances of funds, barring a

fe$, $ere 'uite disappointing for in&estors. !he other aspect of this issue is that

institutional in&estors do not usually fa&or e'uity. It is largely a retail segment product

and $ithout retail depth, most mutual funds ha&e been unable to tap this mar%et. !he

tables gi&en belo$ are a snapshot of the AUM story, for the industry as a $hole and

for debt and e'uity separately.

- 1D -

):. / >:N. :1 IN<9.!IN# IN MU!UA; 1UN+.*

The Advantages of Investing in a Mutual Fund:

1)Professional Management: !he in&estor a&ails of the ser&ices of e(perienced and

s%illed professionals $ho are bac%ed by a dedicated in&estment research team $hich

analyses the performance and prospects of companies and selects suitable in&estments

to achie&e the objecti&es of the scheme.

2)Diversification: Mutual 1unds in&est in a number of companies across a broad

cross-section of industries and sectors. !his di&ersification reduces the ris% because

seldom do all stoc%s decline at the same time and in the same proportion. "ou achie&e

this di&ersification through a Mutual 1und $ith far less money than you can do on

your o$n.

3)Convenient Administration: In&esting in a Mutual 1und reduces paper$or% and

helps you a&oid many problems such as bad deli&eries, delayed payments and

unnecessary follo$ up $ith bro%ers and companies. Mutual 1unds sa&e your time and

ma%e in&esting easy and con&enient.

4)Return Potential: :&er a medium to long-term, Mutual 1unds ha&e the potential to

pro&ide a higher return as they in&est in a di&ersified bas%et of selected securities.

5)Low Costs: Mutual 1unds are a relati&ely less e(pensi&e $ay to in&est compared to

directly in&esting in the capital mar%ets because the benefits of scale in bro%erage,

custodial and other fees translate into lo$er costs for in&estors.

6)Liquidity: In open-ended schemes, you can get your money bac% promptly at net

asset &alue related prices from the Mutual 1und itself. 8ith close-ended schemes, you

can sell your units on a stoc% e(change at the pre&ailing mar%et price or a&ail of the

facility of direct repurchase at NA< related prices $hich some close-ended and

inter&al schemes offer you periodically.

- 1F -

7)Transparency: "ou get regular information on the &alue of your in&estment in

addition to disclosure on the specific in&estments made by your scheme, the

proportion in&ested in each class of assets and the fund managerMs in&estment strategy

and outloo%.

8)Flexibility: !hrough features such as regular in&estment plans, regular $ithdra$al

plans and di&idend rein&estment plans, you can systematically in&est or $ithdra$

funds according to your needs and con&enience.

9)Well Regulated: All Mutual 1unds are registered $ith .9=I and they function

$ithin the pro&isions of strict regulations designed to protect the interests of in&estors.

!he operations of Mutual 1unds are regularly monitored by .9=I.

Drawbacks of mutual funds

12 Fluctuating Returns: Mutual funds are li%e many other in&estments $ithout a

guaranteed return* there is al$ays the possibility that the &alue of your mutual fund

$ill depreciate. Unli%e fi(ed-income products, such as bonds and !reasury bills,

mutual funds e(perience price fluctuations along $ith the stoc%s that ma%e up the

fund. 8hen deciding on a particular fund to buy, you need to research the ris%s

in&ol&ed just because a professional manager is loo%ing after the fund, that doesnMt

mean the performance $ill be stellar.

Another important thing to %no$ is that mutual funds are not guaranteed by the U...

go&ernment, so in the case of dissolution, you $onMt get anything bac%. !his is

especially important for in&estors in money mar%et funds. Unli%e a ban% deposit, a

mutual fund $ill be insured by the 1ederal +eposit Insurance >orporation 01+I>2.

2)Diversification* Although di&ersification is one of the %eys to successful in&esting,

many mutual fund in&estors tend to o&erdi&ersify. !he idea of di&ersification is to

- 1H -

reduce the ris%s associated $ith holding a single securityP o&erdi&ersification 0also

%no$n as di$orsification2 occurs $hen in&estors ac'uire many funds that are highly

related and, as a result, donMt get the ris% reducing benefits of di&ersification.

At the other e(treme, just because you o$n mutual funds doesnMt mean you are

automatically di&ersified. 1or e(ample, a fund that in&ests only in a particular industry

or region is still relati&ely ris%y.

3)Cash, Cash and More Cash: As you %no$ already, mutual funds pool money from

thousands of in&estors, so e&eryday in&estors are putting money into the fund as $ell

as $ithdra$ing in&estments. !o maintain li'uidity and the capacity to accommodate

$ithdra$als, funds typically ha&e to %eep a large portion of their portfolios as cash.

Ca&ing ample cash is great for li'uidity, but money sitting around as cash is not

$or%ing for you and thus is not &ery ad&antageous.

4)Costs: Mutual funds pro&ide in&estors $ith professional management, but it comes

at a cost. 1unds $ill typically ha&e a range of different fees that reduce the o&erall

payout. In mutual funds, the fees are classified into t$o categories* shareholder fees

and annual operating fees.

!he shareholder fees, in the forms of loads and redemption fees are paid directly by

shareholders purchasing or selling the funds. !he annual fund operating fees are

charged as an annual percentage usually ranging from 1-4I. !hese fees are assessed

to mutual fund in&estors regardless of the performance of the fund. As you can

imagine, in years $hen the fund doesnMt ma%e money, these fees only magnify losses.

5)Misleading Advertisements: !he misleading ad&ertisements of different funds can

guide in&estors do$n the $rong path. .ome funds may be incorrectly labeled as

gro$th funds, $hile others are classified as small cap or income funds. !he .ecurities

and 9(change >ommission 0.9>2 re'uires that funds ha&e at least G@I of assets in

the particular type of in&estment implied in their names. Co$ the remaining assets

arein&ested is up to the fund manager.

- 1G -

Co$e&er, the different categories that 'ualify for the re'uired G@I of the assets may

be &ague and $ide-ranging. A fund can therefore manipulate prospecti&e in&estors by

using names that are attracti&e and misleading. Instead of labeling itself a small cap, a

fund may be sold as a Qgro$th fundQ. :r, the Q>ongo Cigh-!ech 1undQ could be sold

$ith the title QInternational Cigh-!ech 1undQ.

6)Evaluating Funds: Another disad&antage of mutual funds is the difficulty they

pose for in&estors interested in researching and e&aluating the different funds. Unli%e

stoc%s, mutual funds do not offer in&estors the opportunity to compare the )N9 ratio,

sales gro$th, earnings per share, etc. A mutual fundMs net asset &alue gi&es in&estors

the total &alue of the fundMs portfolio less liabilities, but ho$ do you %no$ if one fund

is better than anotherL

1urthermore, ad&ertisements, ran%ings and ratings issued by fund companies only

describe past performance. Al$ays note that mutual fund descriptionsNad&ertisements

al$ays include the tagline Qpast results are not indicati&e of future returnsQ. =e sure

not to pic% funds only because they ha&e performed $ell in the past - yesterdayMs big

$inners may be todayMs big losers.

7)Taxes* 8hen ma%ing decisions about your money, fund managers donMt consider

your personal ta( situation. 1or e(ample, $hen a fund manager sells a security, a

capital-gains ta( is triggered, $hich affects ho$ profitable the indi&idual is from the

sale. It might ha&e been more ad&antageous for the indi&idual to defer the capital

gains liability.

- 1E -

INTRODUCTION TO THE COMPANY

UTI MUTUAL FUNDS

Vision

!o be the most )referred Mutual 1und.

Our mission is to make UTI Mutual Fund:

!he most trusted brand, admired by all sta%eholders

!he largest and most efficient money manager $ith global presence

!he best in class customer ser&ice pro&ider

!he most preferred employer

!he most inno&ati&e and best $ealth creator

A socially responsible organisation %no$n for best corporate go&ernance

Genesis

Jan 1A, -@@4 is $hen U!I Mutual 1und started to pa&e its path follo$ing the

&ision of U!I Asset Management >ompany ;imited, $ho has been appointed by the

U!I !rustee >ompany ;imited for managing the schemes of U!I Mutual 1und and

the schemes transferredNmigrated from the erst$hile Unit !rust of India.

!he U!I Asset Management >ompany pro&ides professionally managed bac%

office support for all business ser&ices of U!I Mutual 1und 0e(cluding fund

management2 in accordance $ith the pro&isions of the In&estment Management

Agreement, the !rust +eed, the .9=I 0Mutual 1unds2 egulations and the objecti&es

of the schemes. .tate-of-the-art systems and communications are in place to ensure a

seamless flo$ across the &arious acti&ities underta%en by U!IM1.

- -@ -

U!I AM> is a registered portfolio manager under the .9=I 0)ortfolio

Managers2 egulations, 1EE4 on 4rd 1ebruary -@@A, for underta%ing portfolio

management ser&ices and also acts as the manager and mar%eter to offshore funds

through its 1@@ I subsidiary, U!I International ;imited, registered in #uernsey,

>hannel Islands.

Assets under Management

U!I Asset Management >ompany presently manages a corpus of o&er s.

DF,GDA >rores as on 41st +ec -@@H 0source* $$$.amfiindia.com2 . U!I Mutual 1und

has a trac% record of managing a &ariety of schemes catering to the needs of e&ery

class of citi3enry. It has a nation$ide net$or% consisting HE U!I 1inancial >entres

0U1>s2 and U!I International offices in ;ondon, +ubai and =ahrain. 8ith a &ie$ to

reach to common in&estors at district le&el, 4 satellite offices ha&e also been opened in

select to$ns and districts.

!hey ha&e $ell-'ualified, professional fund management teams, $ho ha&e

been highly empo$ered to manage funds $ith greater efficiency and accountability in

the sole interest of unit holders. !he fund managers are also ably supported $ith a

strong in-house securities research department. !o ensure better management of funds,

a ris% management department is also in operation.

Reliability

U!IM1 has consistently reset and upgraded transparency standards. All the branches,

U1>s and registrar offices are connected on a robust I! net$or% to ensure cost-

effecti&e 'uic% and efficient ser&ice. All these ha&e e&ol&ed U!I Mutual 1und to

position as a dynamic, responsi&e, restructured, efficient and transparent .9=I

compliant entity.

- -1 -

Work culture :

8e belie&e in pro&iding an en&ironment that encourages employees to achie&e and

fulfil personal goals and that of the company. 8hen the combined force of both, the

employees and the company flo$ in one direction, there is ample amount of

possibilities, opportunities and gro$th. !he $or% culture at U!I Mutual 1und is

simple R $or% is priority and the rest follo$s. :ur relationship $ith our employees

$or%s both $ays, they gi&e their best and $e gi&e them the best, $e stri%e the right

balance at $or%.

Employee Benefits

>ompetiti&e salaries

>omfortable $or% en&ironment

>areer opportunities

Insurance benefits

ecreational amenities

- -- -

Organization Structure

UTI AMC Structure

- -4 -

U!I Asset Management >ompany ;td. 0U!I AM>2 has been promoted by .tate =an%

of India, ;ife Insurance >orporation of India, )unjab National =an% and =an% of

=aroda, each holding -DI of the paid up capital. U!I AM> is the in&estment manager

to the schemes of U!I Mutual 1und. It also manages offshore funds and pro&ides

support to the .pecified Underta%ing of the Unit !rust of India.

It is the holding company for U!I <enture 1unds Management >ompany $hich

manages &enture funds and U!I International ;td., $hich mar%ets offshore funds to

o&erseas in&estors. U!I AM> is a .9=I registered Portfolio Manager bearing

registration number INP 000000860 and offers +iscretionary, Non-+iscretionary and

Ad&isory ser&ices to Cigh Net 8orth clients, >orporate and Institution

Unit Trust of India $as created by the U!I Act passed by the )arliament in

1EF4.1or more than t$o decades it remained the sole &ehicle for in&estment in the

capital mar%et by the Indian citi3ens. In mid- 1EG@s public sector ban%s $ere allo$ed

to open mutual funds. !he real &ibrancy and competition in the M1 industry came

$ith the setting up of the egulator .9=I and its laying do$n the M1 egulations in

1EE4.U!I maintained its pre-eminent place till -@@1, $hen a massi&e decline in the

mar%et indices and negati&e in&estor sentiments after Ketan )are%h scam created

doubts about the capacity of U!I to meet its obligations to the in&estors. !his $as

further compounded by t$o factorsP namely, its flagship and largest scheme U. FA

$as sold and re-purchased not at intrinsic NA< but at artificial price and its Assured

eturn .chemes had promised returns as high as 1GI o&er a period going up to t$o

decades..SS

1earing a run on the institution and possible impact on the $hole mar%et

#o&ernment came out $ith a rescue pac%age and change of management in

-@@1..ubse'uently, the U!I Act $as repealed and the institution $as bifurcated into

t$o parts .U!I Mutual 1und $as created as a .9=I registered fund li%e any other

mutual fund. !he assets and liabilities of schemes $here #o&ernment had to come out

$ith a bail-out pac%age $ere ta%en o&er directly by the #o&ernment in a ne$ entity

called .pecified Underta%ing of U!I, .UU!I. .UU!I holds o&er -HI sta%e A(is

- -A -

=an%. In order to distance #o&ernment from running a mutual fund the o$nership $as

transferred to four institutionsP namely .=I, ;I>, =:= and )N=, each o$ning -DI.

>ertain reforms li%e impro&ing the salary from ).U le&els and effecting a <. $ere

carried out U!I lost its mar%et dominance rapidly and by end of -@@D,$hen the ne$

share-holders actually paid the consideration money to #o&ernment its mar%et share

had come do$n to close to 1@IS

A ne$ board $as constituted and a ne$ management inducted. .ystematic

study of its problems role and functions $as carried out $ith the help of a reputed

international consultant. 1resh talent $as recruited from the pri&ate mar%etP

organi3ational structure $as changed to focus on ne$ly emerging in&estor and

distributor groups and massi&e changes in in&estor ser&ices and funds management

carried out. :nce again U!I has emerged as a serious player in the industry. .ome of

the funds ha&e $on famous a$ards, including the =est Infra 1und globally from

;ipper. U!I has been able to benchmar% its employee compensation to the best in the

mar%et, has introduced )erformance elated )ayouts and 9.:)s.

!he U!I Asset Management >ompany has its registered office at* U!I !o$er,

#n =loc%, =andra - Kurla >omple(, =andra 09ast2, Mumbai - A@@@D1.It has o&er H@

schemes in domestic M1 space and has the largest in&estor base of o&er E million in

the $hole industry. It is present in o&er AD@ districts of the country and has 1@@

branches called U!I 1inancial >enters or U1>s. About D@I of the total I1As in the

industry $or% for U!I in distributing its productsS India )osts, ).U =an%s and all the

large )ri&ate and 1oreign =an%s ha&e started distributing U!I products. !he total

a&erage Assets Under Management 0AUM2 for the month of June -@@G $as s. D4@

billion and it ran%ed fourth. In terms of e'uity AUM it ran%ed second and in terms of

9'uity and =alanced .chemes AUM put together it ran%ed 1I.! in the industry. !his

measure indicates its re&enue- earning capacity and its financial strength.

=esides running domestic M1 .chemes U!I AM> is also a registered portfolio

manager under the .9=I 0)ortfolio Managers2 egulations. It runs different portfolios

for is CNI and Institutional clients. It is also running a .haria >ompliant portfolio for

- -D -

its :ffshore clients. U!I tied up $ith .hinsei =an% of Japan to run a large si3e India-

centric portfolio for Japanese in&estors.

1or its international operations U!I has set up its 1@@I subsidiary, U!I

International ;imited, registered in #uernsey, >hannel Islands. It has branches in

;ondon, +ubai and =ahrain. It has set up a Joint <enture $ith .hinsei =an% in

.ingapore. !he J< has got its license and has started its operations.

In the area of alternate assets, U!I has a 1@@I subsidiary called U!I <entures

at =angalore !his company runs t$o successful funds $ith large international

in&estors being acti&e participants. U!I has also launched a )ri&ate 9'uity

Infrastructure 1und along $ith C.C Nord =an% of #ermany and .hinsei =an% of

Japan.

- -F -

SWOT Analysis of UTI Mutual Fund

Strengths of UTI-MF

8ell-positioned to capitali3e on fa&orable macro-economic conditions

and industry dynamics.

;arge focused asset manager $ith di&erse fund offerings, e(perienced

fund managers and record of steady AUM gro$th.

A scheme for e&ery class of citi3enry

=road and stable client base and multiple distribution channels.

.trong brand recognition

)rofitable structure benefiting from large si3e, automated and integrated

systems, and high proportion of e'uity and balancedNhybrid funds.

1irst in the industry in terms of 9'uity and =alanced .chemes AUM

9(perienced professional management and $ell established state-

sponsors $ith access to ).U business opportunities.

Weakness:

)oor ser&ice conditions

;ess penetration in rural areas

AUM $ise A

th

in number

Opportunity

.tability through increased brand a$areness, mar%et penetration and

.er&ice offerings

- -H -

Cigh untapped mar%et in the semi urban and rural areas

Increased sa&ing habit among people pro&ides a great opportunity for

funds mobili3ation

:ther emerging opportunities in the financial mar%ets

Threats:

Increased competition among local AM>5s

!hreat of increased entry of 1oreign players in the industry

Cigh le&el of &olatility of the stoc% mar%et

ising inflation could reduce sa&ings of people and thus in&estments

Things you are unaware about UTI-MF:

1A@ U!I 1inancial >enters 0U1>s2 across India.

1@ million In&estor base

4E@@@ T Indi&idual 1inancial Ad&isors 0AM1I >ertified2.

AD@ T :ffices of >hief epresentati&es / >hief Agents at +istrict

/!alu%a le&el out of F@A districts of India.

International :ffices at ;ondon, +ubai, =ahrain / .ingapore

!ie ups $ith ).U =an%s, .elect )ri&ate =an%s, leading distribution

houses / India )ost across the country.

- -G -

U!I Mastershare $as the first e'uity mutual fund scheme to be launched

in India in 1EGF / has declared a di&idend e&ery year.

In 1EH1, U!I launched the first Unit ;in%ed Insurance )lan

U!I >hildren5s >areer )lan enabling financial planning specifically for

your >hild5s future 0;aunched in 1EE42.

U!I Mutual 1und has a fully automated and integrated system for

managing its entire in&estment management process

After its I):, U!I Mutual 1und $ould become the first asset

management company in India to pro&ide 9.:)s to all its employees

.ince 1st 1ebruary -@@4, U!I Mutual 1und has paid out more than s.

FH@@ >rore 0U.K 1.FG billion2 as di&idend

1irst to facilitate transactions through N.9 0;aunched in No&ember

-@@E2

.elected by #:I as one of three asset managers to pro&ide )ortfolio

Management .er&ices 0)M.2 to the National In&estment 1und 0QNI1Q2.

.elected by )1+A for )ension 1unds management under the Ne$

)ension .ystem

- -E -

Micro )ension initiati&e $ith .98A =an%, >:M)19+, .C9)C9+,

MAAN+9.CI.

Cas started Mu%hyamantri Kanya .ura%sha "ojna $ith #o&t. of =ihar.

Manage offshore and foreign institutional in&estor 0Q1IIQ2 funds as $ell

as &enture capital and pri&ate e'uity funds.

U!I has tie up $ith .hinsei =an% of Japan for running a large si3e India-

centric portfolio for Japanese in&estors.

PRODUCTS OF UTI MUTUAL FUND

- 4@ -

Equity schemes

U!I =an%ing .ector 1und U!I >ontra 1und

U!I >>) Ad&antage U!I +"1

U!I 9nergy 1und U!I 9'uity 1und

U!I 9'uity !a( .a&ings )lan U!I Infrastructure 1und

U!I ;eadership 9'uity 1und U!I Master Inde( 1und

U!I Master plus Unit .cheme U!I Master share Unit

.cheme

U!I Master <alue 1und U!I Mid-cap 1und

U!I MN> 1und U!I Nifty Inde( 1und

U!I :pportunities 1und U!I )harma / Cealthcare

1und

U!I .under U!I .er&ices Industries

1und

U!I !op 1@@ 1und U!I !ransportation /

;ogistics 1und

U!I 8ealth =uilder 1und-.eriesII

- 41 -

Debt schemes

U!I =ond 1und .U!I 1i(ed Maturity )lan

U U!I 1loting ate 1und .U!I #ilt Ad&antage 1und

U U!I #-.ec 1und .U!I ;i'uid 1und

U U!I !reasury Ad&antage 1und .U!I Mahila Unit .cheme

U U!I-MI.-Ad&antage )lan .U!I-Money Mar%et 1und

. U!I-Monthly Income .cheme .U!I->!.

.U!I-<ariable In&estment .cheme-I;)

Balanced Schemes

U!I =alanced 1und

. U!I-children5s >areer )lan 0U!I->>)2

. U!I-etirement =enefit )ension 1und 0U!I-=)2

. U!I-Unit ;in%ed Insurance )lan 0U!I-U;I)2

Liquid Schemes

U!I Money Mar%et 1unds

U!I ;i'uid >ash )lan

U!I ;i'uid Ad&antage 1und

Most Opted Schemes by Investors

+i&idend "ield 1und

U!I Mastershare Unit .cheme

Unit ;in%ed Insurance )lan 0U;I)2

- 4- -

Awards received by UTI Mutual Fund

UTI Mahila Unit Scheme has been ranked as the Best Fund over a period

o ive years and has won !ipper Fund "wards #$%%- India under the

category o Mi&ed "sset I'( )onservative

UTI )hildrens )areer Balanced *lan has been ranked as the Best Fund

over a period o ten years and has won !ipper Fund "wards #$%%-

India under the category o Mi&ed "sset I'( )onservative

UTI AMC 's CMO has won MYKM Stars of Industry

Youth Icon Award from 94.3 Radio FM.

The Best Large Cap Fund by Morningstar Fund

Awards (India) -2011.

UTI MF has won the Financial Leadership Awards 2011 for Most

Innovative Investor Education Initiative Swatantra from Bloomberg

UTV Source

Mr Amandeep Chopra and Mr Manish 1oshi have been adjudicated as

the Best Debt Fund Managers of the Year 2010 by Business Standard

Source Business Standard - 25th March 2011

UTI CCP Advantage Fund has won the Business World - Best Mutual

Fund Awards as the Best Hybrid Equity Oriented Fund for the year

2010. Source

Second time in a row+ UTI Mutual Fund has been awarded the

,Most Investor-Friendly Fund -ouse o the .ear/ by )'B)-

T0%1-)(ISI! Mutual Fund "wards #$%%2

Mr 1aideep Bhattacharya, Chief Marketing Officer, UTI AMC 's

- 44 -

CMO has won MYKM Stars of Industry Youth Icon Award from

94.3 Radio FM Source

UTI Dividend Yield Fund has been adjudged the The Best Large Cap

Fund by Morningstar Fund Awards (India) -2011. Source

UTI "M) has won the 3olden *eacock Innovation "ward #$%%

or its Investor 4ducation initiative ,Swatantra/2

UTI "M) has won the )ustomer and Brand !oyalty "ward #$%%

or its Investor 4ducation initiative ,Swatantra/2

UTI MF wins # )'B) T0 %1- )(ISI! Mutual Funds "wards #$%$

UTI Mutual Fund wins 5 I)(" Mutual Funds "wards #$%$

UTI Mutual Fund has won three International Best of the Best

Awards-2010 from Asia Asset Management...

Harsha Upadhyaya has received an Award from Outlook Money

Awards -2010 as the Best Fund Manager (Equity) - Runner - Up...

UTI MF wins )'B) T0%1-)(ISI! "ward

UTI MF wins CNBC TV18-CRISIL Award...

!ipper Fund "wards$6-UTI Mahila Unit-7 yrs

!ipper Fund "wards$6-UTI Mahila Unit-8 yrs

UTI MF sweeps I)(" mutual und "ward #$$6

Loyalty Awards - 2009

UTI MF sweeps ICRA mutual fund Award 2009...

UTI MF wins the Best Debt Fund House Award..

UTI AMC gets 3 International Awards...

UTI MF CNBC Award 2009...

UTI Mutual Fund sweeps ICRA mutual fund Award 2009...

Loyalty Awards - 2009 ...

UTI MF wins the Best Debt Fund House Award...

- 4A -

Top Performing Infrastructure Fund - Income...

UTI MF wins the Best 9ebt Fund -ouse "ward

Golden Peacock Innovative Award-2008

Golden Peacock Innovative Product/Service Award-2008...

Lipper Fund Awards09-UTI Mahila Unit-5 yrs...

Lipper Fund Awards09-UTI Mahila Unit-3 yrs...

(eaders 9igest Trusted Brand #$$12

!ipper Fund "wards - 3ul #$$1

Readers Digest Trusted Brand 2008...

Lipper Fund Awards - Gulf 2008...

Top Performing Infrastructure Fund - Income ...

Brand loyalty Awards 2008...

Brand loyalty Awards 2008...

Four ICRA 7 Star Gold Award...

Four ICRA 5 Star Award...

ICRA Mutual Fund Award 2007...

Lipper Fund Awards 2007...

CRISIL-CNBC-TV18-Mutual Fund of the year Award 2007...

ICRA Mutual Fund Award 2006...

Lipper Fund Awards...

CNBC-TV18-BNP Par-ibas Mutual Fund of the year Award 2006...

CNBC-TV18-BNP Par-ibas Mutual Fund of the year Award...

ICRA online Mutual Fund Award: UTI NIFTY INDEX FUND won the

award for the year 2004...

CNBC India Mutual Fund of the Year Award...

UTI Nifty Index Fund wins Gold at ICRA Online...

- 4D -

UTI Dynamic Equity Fund wins Silver at ICRA Online...

UTI Growth Value Fund has been ranked by CRISIL...

is% <s e$ard

Ca&ing understood the basics of mutual funds the ne(t step is to build a successful

in&estment portfolio. =efore you can begin to build a portfolio, one should understand

some other elements of mutual fund in&esting and ho$ they can affect the potential

&alue of your in&estments o&er the years.

!he first thing that has to be %ept in mind is that $hen you in&est in mutual funds,

there is no guarantee that you $ill end up $ith more money $hen you $ithdra$ your

in&estment than $hat you started out $ith. !hat is the potential of loss is al$ays there.

!he loss of &alue in your in&estment is $hat is considered ris% in in&esting.

9&en so, the opportunity for in&estment gro$th that is possible through in&estments in

mutual funds far e(ceeds that concern for most in&estors. Cere5s $hy.

- 4F -

At the cornerstone of in&esting is the basic principal that the greater the ris% you ta%e,

the greater the potential re$ard. :r stated in another $ay, you get $hat you pay for

and you get paid a higher return only $hen youMre $illing to accept more &olatility.

is% then, refers to the &olatility -- the up and do$n acti&ity in the mar%ets and

indi&idual issues that occurs constantly o&er time. !his &olatility can be caused by a

number of factors -- interest rate changes, inflation or general economic conditions.

It is this &ariability, uncertainty and potential for loss, that causes in&estors to $orry.

8e all fear the possibility that a stoc% $e in&est in $ill fall substantially. =ut it is this

&ery &olatility that is the e(act reason that you can e(pect to earn a higher long-term

return from these in&estments than from a sa&ings account.

+ifferent types of mutual funds ha&e different le&els of &olatility or potential price

change, and those $ith the greater chance of losing &alue are also the funds that can

produce the greater returns for you o&er time. .o ris% has t$o sides* it causes the &alue

of your in&estments to fluctuate, but it is precisely the reason you can e(pect to earn

higher returns.

"ou might find it helpful to remember that all financial in&estments $ill fluctuate.

!here are &ery fe$ perfectly safe ha&ens and those simply donMt pay enough to beat

inflation o&er the long run.

- 4H -

!ypes of ris%s

All in&estments in&ol&e some form of ris%. >onsider these common types of ris% and

e&aluate them against potential re$ards $hen you select an in&estment.

Market Risk At times the prices or yields of all the securities in a particular mar%et

rise or fall due to broad outside influences. 8hen this happens, the stoc% prices of

both an outstanding, highly profitable company and a fledgling corporation may be

affected. !his change in price is due to Qmar%et ris%Q. Also %no$n as systematic ris%.

Inflation Risk .ometimes referred to as Qloss of purchasing po$er.Q 8hene&er

inflation rises for$ard faster than the earnings on your in&estment, you run the ris%

that youMll actually be able to buy less, not more. Inflation ris% also occurs $hen prices

rise faster than your returns.

Credit Risk In short, ho$ stable is the company or entity to $hich you lend your

money $hen you in&estL Co$ certain are you that it $ill be able to pay the interest

you are promised, or repay your principal $hen the in&estment maturesL

- 4G -

Interest Rate Risk >hanging interest rates affect both e'uities and bonds in many

$ays. In&estors are reminded that QpredictingQ $hich $ay rates $ill go is rarely

successful. A di&ersified portfolio can help in offsetting these changes.

Exchange risk A number of companies generate re&enues in foreign currencies and

may ha&e in&estments or e(penses also denominated in foreign currencies. >hanges in

e(change rates may, therefore, ha&e a positi&e or negati&e impact on companies $hich

in turn $ould ha&e an effect on the in&estment of the fund.

Investment Risks !he sectoral fund schemes, in&estments $ill be predominantly in

e'uities of select companies in the particular sectors. Accordingly, the NA< of the

schemes are lin%ed to the e'uity performance of such companies and may be more

&olatile than a more di&ersified portfolio of e'uities.

Changes in the Government Policy >hanges in #o&ernment policy especially in

regard to the ta( benefits may impact the business prospects of the companies leading

to an impact on the in&estments made by the fund

An industriesM %ey asset is often the personnel $ho run the business i.e. intellectual

properties of the %ey employees of the respecti&e companies. #i&en the e&er-changing

comple(ion of fe$ industries and the high obsolescence le&els, a&ailability of

'ualified, trained and moti&ated personnel is &ery critical for the success of industries

in fe$ sectors. It is, therefore, necessary to attract %ey personnel and also to retain

them to meet the changing en&ironment and challenges the sector offers. 1ailure or

inability to attractNretain such 'ualified %ey personnel may impact the prospects of the

companies in the particular sector in $hich the fund in&ests.

- 4E -

- A@ -

9.9A>C +9.I#N AN+

M9!C:+:;:#"

A research design is the detailed blueprint used to guide a research study to$ard its

objecti&es.

!he process of designing a research study in&ol&es many interrelated decisions. !he

most significant decision is the choice of research approach, because it determines

ho$ the information $ill be obtained.

!o design something also means to ensure that the pieces fit together. !he

achie&ement of this fit among objecti&e, research approach, and research tactics is

- A1 -

inherently an iterative process in $hich earlier decisions are constantly reconsidered

in light of subse'uent decisions.

Research design

+efining the purpose of research

+etermining the data re'uired and their resources.

A 6uestionnaire $as designed to get detailed information.

1ace to face inter&ie$s $as ta%en $ere conducted to get the re'uired

information.

Analysis of +ata

+ra$ing >onclusions

.uggestionsN ecommendation

esearch Methodology*

Title of the Project Study:

A project study conducted for AWARENESS OF MUTUAL FUND AS AN

INVESTMENT AMONG PUBLIC SECTOR BANKS INVESTORS

Project Duration: -- 45 Days

- A- -

esearch Methodology is a $ay to systematically sol&e the problem. It may be

understood as a science of studying ho$ research is done scientifically. In it $e

study the &arious steps that are generally adopted by the researcher in studying his

research problem along $ith logic behind them. It is necessary for the researcher to

%no$ not only the research methodsNtechni'ues but also the methodology used.

esearchers not only need to %no$ ho$ to de&elop certain indices or tests, ho$ to

calculate mean or median or mode, ho$ to apply particular research techni'ues but

must also %no$ $hich of these methods or techni'ues are rele&ant and $hat $ould

they mean and indicate and $hy esearch process consists of series of actions or

steps necessary to effecti&ely carry out the research.

!he project $as a uni'ue e(perience for me for trac%ing do$n information from

&arious types of people and all through it is a &ast learning process. !here $ere

se&eral things that I had made out and learnt out of this project of mine.

Problem of the Project:

!he problem of this project is to %no$ that ho$ much public ban%5s in&estors are

a$are about the mutual fund and $hy they prefer ban%5s to in&est and them far a$ay

from mutual funds industry and $hether they are 'uite a$are about mutual fund or

not.

Approach to the problem:

All the objecti&es $ere ta%en into account before preparing the 'uestionnaire. !he

'uestionnaire $as prepared on scientific basis, deliberately hidden 'uestions $ere

as%ed to get the re'uired information.

=esides this, e(tensi&e research $as done. Information $as e(tracted from other sites

of different companies and &arious other mutual fund associations.

- A4 -

!hough complete focus $as %ept, to broaden the hori3on of research topic, attempt

$as made to %no$ the opportunities and threats related to other players in mutual

funds.

Strategic planning for the Research:

!o familiari3e $ith a business organi3ation.

!o familiari3e $ith the different departments in the organi3ation and

their functioning.

!o enable to understand ho$ the %ey business process are carried out in

organi3ations.

Understand ho$ information is used in organi3ation for decision ma%ing at &arious

le&els.

!o %no$ the history about the company.

!o get clear cut idea about the management and administration.

!o %no$ about the industrial relation in the company.

!o analy3e the strength and $ea%ness.

!o get clear cut idea about the &arious departments and functions.

!o gi&e findings and solutions.

!o relate theory $ith practice.

Problem Definition

- AA -

A problem e(ists $hen the decision-ma%er faces uncertainty regarding $hich action

to adopt in the situation. If only one action is a&ailable 0or none at all2 or if there is

certainty about the outcomes of the alternati&es, there really is no problem.

Defining a problem is a situation where:

1) The decision-maker has not yet determined how to exploit an opportunity or

2) There are difficulties that are currently faced or are anticipated.

RESEARCH DESIGN

A research design is the detailed blueprint used to guide a research study to$ard its

objecti&es. !he process of designing a research study in&ol&es many interrelated

decisions. !he most significant decision is the choice of research approach, because it

determines ho$ the information $ill be obtained. !o design something also means to

- AD -

ensure that the pieces fit together. !he achie&ement of this fit among objecti&e,

research approach, and research tactics is inherently an iterative process in $hich

earlier decisions are constantly reconsidered in light of subse'uent decisions.

!he function of research design is to pro&ide for collection of rele&ant e&idence $ith

minimal e(penditure of time effort and money.

!he follo$ing methodology $as adopted for the study purpose*

Type of research *

+escripti&e and 'ualitati&e research designs $ere used $hile conducting the project.

.ampling +esign $as ta%en by the researcher as the esearch design.

!he major purpose of the study is to describe the state of affairs as it e(ists at present.

Research Method/Technique:

In the project report the researcher used follo$ing techni'ues $hile conducting his

study*

Analysis of documents

.ur&ey Method* A mar%et sur&ey $as done on <AI:U. )U=;I> =ANK..

Inter&ie$ 0)ersonal2* =oth open and closed ended 0unstructured2 'uestions

$ere as%ed $hile ta%ing some information from the In&estors of the ban%s at

;U>KN:8.

6uestionnaire 0.tructured2* A structured designed comprehensi&e 'uestionnaire $as

framed and )rotested for data collection from the customer of mobile +ata collection

sources

Research Data

+ata is the %ey acti&ity of mar%eting research. !he design of the data collecting

method is bac%bone of research design.

+ata can be obtained from t$o important sources, namely*

- AF -

1. )rimary +ata

-. .econdary +ata

+ata >ollection !echni'ue*

1. PRIMARY !"RCE

Survey method:

Definition:

.ur&ey research is one of the most important areas of measurement in applied social

research. !he broad area of sur&ey research encompasses any measurement

procedures that in&ol&e as%ing 'uestions of respondents.

Types of surveys:

.ur&eys can be di&ided into t$o broad categories* the questionnaire and the

interview.

6uestionnaires are usually paper-and-pencil instruments that the respondent

completes.

!he inter&ie$er based on $hat the respondent says completes inter&ie$s.

Questionnaires:

- AH -

Mail survey: $hen a respondent recei&es a 'uestionnaire by mail it is %no$n as mail

sur&ey.

Advantages:

!hey are relati&ely ine(pensi&e to administer.

"ou can send the e(act same instrument to a $ide number of people.

!hey allo$ the respondent to fill it out at their o$n con&enience.

Disadvantages:

esponse rates from mail sur&eys are often &ery lo$.

Mail 'uestionnaires are not the best &ehicles for as%ing for detailed $ritten

responses.

Group-administered questionnaire:

A sample of respondents is brought together and as%ed to respond to a structured

se'uence of 'uestions.

!raditionally, 'uestionnaires $ere administered in-group settings for con&enience.

!he researcher could gi&e the 'uestionnaire to those $ho $ere present and be

fairly sure that there $ould be a high response rate

If the respondents $ere unclear about the meaning of a 'uestion they could as% for

clarification.

And, there $ere often organi3ational settings $here it $as relati&ely easy to

assemble the group 0in a company or business, for instance2.

Selecting the survey method:

- AG -

.electing the type of sur&ey you are going to use is one of the most critical decisions

in many social research conte(ts. "ou ha&e to use your judgment to balance the

ad&antages and disad&antages of different sur&ey types.

1ollo$ing are the issues that the researcher must loo% into before conducting a

research.

Sampling issues:

8hat data is a&ailableL 8hat information do you ha&e about your sampleL

+o you %no$ their current addressesL !heir current phone numbersL Are

your contact lists up to dateL

>an your respondents be locatedL

8ho is the respondent in your studyL If the specific indi&idual is una&ailable is the

researcher $illing to inter&ie$ anotherL

Are response rates li%ely to be a problemL

Questions:

8hat types of 'uestions can be as%edL Are they personal or re'uire a detailed

ans$erL

>an 'uestion se'uence be controlledL

"our sur&ey is one $here you can construct in ad&ance a reasonable

se'uence of 'uestionsL :r, are you doing an initial e(ploratory study $here

you may need to as% lots of follo$-up 'uestions that you canMt easily

anticipate.

>ost is often the major determining factor in selecting sur&ey type. "ou

might prefer to do personal inter&ie$s, but canMt justify the high cost of

- AE -

training and paying for the inter&ie$ers. "ou may prefer to send out an

e(tensi&e mailing but canMt afford the postage to do so.

+o you ha&e the facilities 0or access to them2 to process and manage your studyL

In phone inter&ie$s, do you ha&e $ell-e'uipped phone sur&eying facilitiesL 1or

focus groups, do you ha&e a comfortable and accessible room to host the groupL

+o you ha&e the e'uipment needed to record and transcribe responses

.ome types of sur&eys ta%e longer than others. +o you need responses

immediately 0as in an o&ernight public opinion poll2L Ca&e you budgeted

enough time for your study to send out mail sur&eys and follo$-up

reminders, and to get the responses bac% by mailL Ca&e you allo$ed for

enough time to get enough personal inter&ie$s to justify

Types of questions:

.ur&ey 'uestions can be di&ided into t$o broad types: structured and unstructured

Dichotomous Questions:

8hen a 'uestion has t$o possible responses, $e consider it dichotomous.

.ur&eys often use dichotomous 'uestions that as% for a "esNNo, !rueN1alse or

AgreeN+isagree response.

E.g. please enter your gender

Male female

#. EC!$%ARY !"RCE

- D@ -

SECONDARY DATA:

econdary data are data that $ere de&eloped for some purpose other than helping to

sol&e the problem at hand. .econdary data can be gathered 'uic%ly and is ine(pensi&e

as compared to primary data. 9&en $hen reports or publications are ordered, the time

in&ol&ed is generally less than the time re'uired to collect original data.

A thorough search on secondary data $ill often pro&ide sufficient information to

resol&e the problem. In some cases $here the secondary data cannot sol&e the

problem, they can often help to structure the problem and eliminate some &ariables

from consideration. :r, it may be possible to utili3e the secondary data in conjunction

$ith primary data.

.econdary data can pro&ide a complete or partial solution to many problems and help

in structuring other problems. !hey tend to cost substantially less than primary data

and can be collected in less time also.

Problems Encountered with Secondary Data

=efore secondary data are applied to a particular mar%eting problem, their rele&ance

and accuracy must be assessed.

ele&ancy refers to the e(tent to $hich the data fits the information needs of research

problem. 9&en $hen the data co&ers the same general topic as that re'uired by the

research problem, they may not fit the re'uirements of the problem.

!hree general problems reduce the rele&ance of data that $ould other$ise be useful.

!hey are*

!here is often a difference in the units of measurement. 9.g. many retail decisions

re'uire detailed information on the characteristics of the population $ithin their

- D1 -

trade area. Co$e&er, the a&ailable population statistics may focus on countries,

cities or census tracts that do not match the trade area of the retail outlet.

!he second general problem that can reduce rele&ancy of secondary data is the

definition of classes. 9.g. a manufacturer may ha&e a product that appeals to

children G to 1- years old. If a&ailable secondary data are based on age categories

D to E and 1@ to 1A, the firm $ill ha&e a hard time utili3ing it.

!he final major factor that is affecting rele&ancy is time. #enerally, research

problems re'uire current, if not future, data. Most secondary data, on the other

hand, ha&e been in e(istence for some time.

E.g. complete census reports are not available for several years. Data are

frequently collected one to three years prior to its publication.

Accuracy is the second major concern of the user of secondary data. !he real

problem is not inaccuracyP it is the difficulty of determining ho$ inaccurate the

data is li%ely to be.

8hile using secondary data, the original source should be used if possible. !his is

important because, the original report is generally more complete than the second

or third reports. .econdly using original source allo$s the data to be e(amined in

conte(t and may pro&ide a better basis for assessing the competence and

moti&ation of the collector.

Sources of Secondary Data:

!here are t$o general sources of secondary data R internal sources and external

sources. Internal data are a&ailable $ithin the firm $hereas e(ternal sources pro&ide

data that are de&eloped outside the firm.

Internal Sources:

Internal sources include sales record, sales force reports, operating statements,

budgets, pre&ious research reports and the li%es. !he most useful type of internal

- D- -

information is generally sales data. =ut, unfortunately many companies do not collect

or maintain sales data in the manner that allo$s the researcher to tap their full

potential. .uch records, if properly utili3ed, allo$s the researcher to isolate profitable

and unprofitable customers, territories, and product lines, to identify de&eloping trends

and perhaps to measure the effects of manipulations of mar%eting mi( &ariables.

Internal data must be collected in a usable format and must be analy3ed to be of &alue.

Many firms ha&e useful but unutili3ed data. =y changing the format of collection

forms 0sales in&oices, salesman call reports, etc2 other useful data can be often

collected. !hey are a&ailable and ine(pensi&eP internal data are the best information

buy.

External Sources

Numerous sources e(ternal to the firm may produce data rele&ant to the firm5s

re'uirements. !here are four types of general e(ternal secondary information, they

are*

)ublished sources, and

8ebsites.

Published Sources

!here is &irtually endless array of periodicals, boo%s, dissertations, ne$spapers and

the li%e, that contain information rele&ant to mar%eting decisions.

Channel information is a&ailable to the firm at four le&els R manufacturers,

intermediaries, retailers and consumers. A manufacturers sales and shipment are

generally a&ailable only through the firms o$n internal records. !herefore, although a

firm can monitor its o$n acti&ities at this le&el, it can only infer the output of other

manufacturing firms.

At the intermediary or $holesale le&el, se&eral syndicated firms pro&ide information

on the flo$ of products and brands to retail outlets. .tore audits pro&ide data on the

mo&ement of brands through retail outlets.

- D4 -

)rospects and scope of research*

Area wise Identifying Potential Prospective distributors, which leads to increase

the business.

THE PROSPECTS:

!he .tarting point is e&eryone $ho might concei&ably buy the product

that is called s&s'ects and from these the company determines the most li%ely

- DA -

Marketing planning and information system

Marketing planning and information system

Planning system

.trategic plans

!actical plans

Planning system

.trategic plans

!actical plans

Information system

+atabase

+..

Information system

+atabase

+..

1. Agree on Research Purpose

1. Agree on Research Purpose

)roblems or opportunities

+ecision alternati&es

esearch users

)roblems or opportunities

+ecision alternati&es

esearch users

2. Establish Research Objectives

2. Establish Research Objectives

esearch 'uestions

Cypotheses

=oundaries of study

esearch 'uestions

Cypotheses

=oundaries of study

ESTIMATE

THE VALUE OF

INFORMATION

Is benefit >

cost?

ESTIMATE

THE VALUE OF

INFORMATION

Is benefit >

cost?

DO NOT

CONDUCT MR

DO NOT

CONDUCT MR

4. Design the research

4. Design the research

>hoose among alternati&e research approaches

.pecify the sampling plan

+esign the e(periment

+esign the 'uestionnaire

>hoose among alternati&e research approaches

.pecify the sampling plan

+esign the e(periment

+esign the 'uestionnaire

5. Collect the data

5. Collect the data

6. Prepare and analyze the data

6. Prepare and analyze the data

7. Report the research results and provide strategic

recommendations.

7. Report the research results and provide strategic

recommendations.

'ros'ects $hich it hopes to con&ert into first time customers then repeat customers

and then clients.

RESEARCH

PROCESS: STEPS:

- DD -

Suspects

Prospects

First Time Customers

Repeat Customers

Clients

Disqualified Prospects

Members

Advocates

Partners

Inactive or ex customers

LIMITATION OF THE PRO1ECT:

Many constraints $ere in&ol&ed in doing this study. .ome of them are*-

- DF -

!he most signified limitation has been the indi&iduals in&ol&ed in this study

had a little e(perience.

!he sample si3e selected for the sur&ey $as too small as compared to large

population.

!he project $as carried out only in the Jaipur city so findings on data

gathered can be best true for Jaipur only and not applicable to other parts of

state and country.

:ur reliance $as made on the primary data.

!ime and money are critical factors limiting this study.

!he data pro&ided by the prospects may not be 1@@I correct as they too ha&e

their limitations.

1inding and suggestion ha&e been gi&en from personal point of &ie$.

+ue to $or% pressure, detailed interaction $ith the chartered accountants and

ta( consultants $as not possible.

.ome people $ere not $illing to disclose the in&estment profile.

!he baseness $as being ta%en care of.

!he area of sample $as decided after ta%ing into consideration the major

factors li%e*

A&ailability of in&estors

Approachability.

!ime a&ailable $ith in&estor for interaction, etc.

Area of Sample:

!he areas co&ered up in this sur&ey $as ;U>KN:8

Selection of units under study:

- DH -

Article I. AREA OF LUCKNOW WHERE SURVEY IS DONE

12 #omti nagar

-2 Kapoorthala

42 Indira nagar

A2 Cajaratganj

D2 Aliganj

Source list (Sampling Frame):

GOVERNMENT EMPLOYEES: 28

NON GOVT EMPLOYEES: 62

BUSINESS MAN: 47

OTHERS: 13

Sample size: 150

Sampling Procedure: Probability Sampling (Simple Random Sampling

+ata analysis and interpretation*

Que.1) Personal Details:

(a). Name:-

- DG -

(b). Add: -

(c).Contact No:-

(d). Age:-

(e). Qualification:-

(f). Occupation. Pl tick (\)

Govt. Sec 28 respondents

Pvt. Sec 62 respondents

Business 47 respondents

Agriculture & Others 13 respondents

Interpretation: 1irst 'uestion $as to determine -G participants $ere in go&t sector,

F- participants $ere in p&t sector, AH participants $ere in business and 14 participants

$ere in agriculture

Que.2) What is your education qualification?

a. under graduate

b. Graduate

- DE -

c. PG

d. any other

Ans:- (a) 32

(b) 57

(c) 38

(d) 23

Interpretation: .econd 'uestion $as to determine the educational 'ualification of

1D@ participants, in $hich 4- participants $ere under graduate, DH $ere graduate, 4G

participants $ere post graduate and -4 $ere other degree holder

3. What is your monthly family income approximately? Pl tick (\).

(a)Up to Rs.10, 000

(b)Rs. 10,001 to 15,000

- F@ -

(c)Rs. 15,001 to 30,000

(d)Rs. 30,001 and above

Ans:- (a) 35

(b) 51

(c) 39

(d) 25

Interpretation: !hird 'uestion $as to determine monthly family income of

participants among $hich -4I participants monthly family income is upto rs. 1@,@@@,

4DI participants monthly family income is 1@,@@1 to 1D,@@@, -DI participants

monthly family income is 1D,@@1 to 4@,@@@ and 1HI participants monthly family

income is 4@,@@@ / abo&e. !hat5s sho$s ma(imum participants belong 1@,@@@ to

1D,@@@

Que.4) What kind of investments you prefer most? Pl tick (\). All applicable.

a. Saving account

b. Fixed deposits

- F1 -

c. Insurance

d. Mutual Fund

e. Post Office-NSC, etc f. Shares/Debentures g. Gold/ Silver h. Real Estate

I. PPF

j. PF

Interpretation: 1ourth 'uestion $as to determine the in&estments preference o

participants so on the basis of graph $e can say that ma(imum people prefer to in&est

in sa&ing account and fi(ed deposit because in these in&estment there are less ris% in

comparison to other

Que.5) While investing your money, which factor you prefer most?

a. Company reputation

b. Liquidity

- F- -

c. Low Risk

d. High Return

e. Any one

Interpretation: 1ifth 'uestion $as to determine that during the in&estment $hat the

things that participants consider are high return, lo$ ris%, li'uidity, company

reputation and other. :n the basis of research $e can say that first preference is high

return, second one is li'uidity and third one is lo$ ris%.

Que.6) Have you ever invested your money in mutual fund?

a. Yes

b .No

- F4 -

Ans:- a) 91

b) 59

1. Interpretation: .i(th 'uestions $as to chec% that ho$ many participants ha&e

in&ested their money in mutual fund and ho$ many ha&e not, among 1D@

participants A@I participants ha&e in&ested and F@I ha&e not. !hat sho$s many

people are not a$are about mutual fund.

7. Where do you find yourself as a mutual fund investor?

a. Totally ignorant ]

b. Partial knowledge of mutual funds ]

- FA -

c. Aware only of any specific scheme in which you invested ]

d. Fully aware ]

Ans:- a) 27

b) 70

c) 36

d) 17

Interpretation: !his 'uestions $as to determine the a$areness of mutual fund among

participants that sho$s AFI are partially a$are about mutual fund and rest are totally

ignorant, a$are only of any specific scheme and fully a$are.

8. In which kind of mutual you would like to invest?

a. Public ]

- FD -

b. Private ]

Ans:- a) 95

b) 45

Interpretation: !his 'uestion $as to determine $hether the participants in&est their

money in public sector or in pri&ate sector. F4I participants are li%e to in&est in

pri&ate sector and only 4HI participants li%e to in&est in public sector

9. How do you come to know about Mutual Fund?

a. Advertisement

b. Peer Group

- FF -

c. Banks

d. Financial Advisors

Ans:- a) 33

b) 42

c) 48

d) 27

Interpretation: !his 'uestion $as to determine $hat are the sources of information

about mutual fund among participants on the basis of graph 44 participants $as a$are

by ad&ertisement, A- participants by peer group, AG participants by ban%s and -H by

financial ad&isors.

10. Which mutual fund scheme have you used?

a. Open-ended

b. Close-ended

c. Liquid fund

- FH -

d. Growth fund

-. Interpretation: !his 'uestion $as to determine $hich mutual fund scheme ha&e

participants used. :n the basis of 'uestionnaires AE participants use open-ended

and -1 participants use close-ended, A- participants use li'uid fund and 4G

participants use gro$th fund.

Que.11) if not invested in Mutual Fund then why?

a. Not aware of MF

b. Higher risk

- FG -

c. Not any specific reason

Interpretation: !his 'uestion $as to determine that if participants not in&ested in

Mutual fund then $hyL @n the basis of primary data F1 participants not in&ested in

mutual fund due to una$areness of mutual fund, AE participants not in&ested in mutual

fund due to high ris% and AE participants not in&ested in mutual fund because of not

any specific reason.

Que.12) Which feature of the mutual funds allure you most?

a. Diversification ]

b. Better return and safety ]

- FE -

c. Reduction in risk and transaction cost ]

d. Regular Income ]

e. Tax benefit ]

Interpretation: !his 'uestion $as to chec% that $hich feature of the mutual funds

allure the participants most and -D participants in&est in mutual fund due to

di&ersification, 4- in&est due to better return, AA in&est in&ested due to reduction in

ris% and transaction costs. 4F participants in&ested due to regular income and 14

in&ested because of ta( benefit.

Que.13) In which Mutual Fund you have invested? Please tick (\). All applicable.

a. SBIMF

- H@ -

b. UTI

c. HDFC

d. Reliance

e. ICICI prudential funds

f. 1M mutual fund