Académique Documents

Professionnel Documents

Culture Documents

Further Regression Topics

Transféré par

thrphys1940Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Further Regression Topics

Transféré par

thrphys1940Droits d'auteur :

Formats disponibles

1/35

EC114 Introduction to Quantitative Economics

19. Further Regression Topics I

Marcus Chambers

Department of Economics

University of Essex

13/15 March 2012

EC114 Introduction to Quantitative Economics 19. Further Regression Topics I

2/35

Outline

1

Dummy Variables

2

Chow Tests

Reference: R. L. Thomas, Using Statistics in Economics,

McGraw-Hill, 2005, sections 14.1 and 14.2.

EC114 Introduction to Quantitative Economics 19. Further Regression Topics I

Dummy Variables 3/35

Sometimes the variables we want to use cant be

measured in a precise quantitative way.

We therefore have to introduce qualitative factors into the

analysis.

For example, suppose we want to study the demand for

beef over time.

We might consider the regression model

Q

t

= + Y

t

+

t

, t = 1, . . . , n,

where Q is per-capita demand for beef, Y is per-capita

disposable income, and the t subscript denotes the time

period which indexes observations.

EC114 Introduction to Quantitative Economics 19. Further Regression Topics I

Dummy Variables 4/35

Suppose that we suspect the nature of demand for beef to

change in certain periods because of a scare due to mad

cow disease (Creutzfeld-Jakob disease, or CJD).

How can we deal with such a qualitative factor?

The approach we will follow introduces a dichotomous or

dummy variable such that, in period t,

D

t

= 1 when consumers fear getting CJD,

D

t

= 0 when consumers do not fear getting CJD.

We shall see how such variables can be used in a

regression model to allow the parameters of the model to

change in certain periods.

We shall also consider tests of whether the parameters are

constant over the entire sample or whether they change in

the way described above.

EC114 Introduction to Quantitative Economics 19. Further Regression Topics I

Dummy Variables 5/35

Suppose we have monthly data on the demand for beef for

5 years (n = 60).

Furthermore suppose that we know that the CJD fear is

particularly relevant for the 12 months of the second year

and for the rst 6 months of the third year.

We can then dene a dummy variable for the relevant

period as:

D

t

= 1 for t = 13, . . . , 30,

D

t

= 0 for all other t.

This variable enters the data set as a series of zeros and

ones and is treated like any other variable.

Note that we can only construct D

t

if we have information

on the period affected by the CJD scare.

EC114 Introduction to Quantitative Economics 19. Further Regression Topics I

Dummy Variables 6/35

We can allow for the CJD scare to affect the intercept, ,

simply by including D

t

as an additional explanatory

variable:

Q

t

= + D

t

+ Y

t

+

t

, t = 1, . . . , n.

When D

t

= 0 (no CJD scare) the model reduces to

Q

t

= + Y

t

+

t

.

But during the CJD scare, D

t

= 1 and so

Q

t

= ( + ) + Y

t

+

t

,

the intercept becoming + (and we would probably

expect < 0 so that demand falls for given Y during the

CJD scare).

EC114 Introduction to Quantitative Economics 19. Further Regression Topics I

Dummy Variables 7/35

Suppose we run this regression and obtain

Q

t

= 25 12D

t

+ 0.02Y

t

.

This implies that during the CJD scare (setting D

t

= 1)

Q

t

= 13 + 0.02Y

t

,

while when there is no CJD scare (setting D

t

= 0)

Q

t

= 25 + 0.02Y

t

.

This effect is illustrated in the following diagram:

EC114 Introduction to Quantitative Economics 19. Further Regression Topics I

Dummy Variables 8/35

The presence of the dummy variable enables the

estimated demand equation to shift downwards during the

CJD scare.

Note, however, that the slope remains unaffected.

EC114 Introduction to Quantitative Economics 19. Further Regression Topics I

Dummy Variables 9/35

The shift in the demand equation, allowing different

demand equations in the different periods, was obtained by

estimating a single equation.

It means that we can test whether the shift is signicant by

carrying out a t-test for the signicance of the dummy

variables D

t

.

So, to test H

0

: = 0 against H

A

: = 0 we could use

TS =

t

n3

under H

0

,

where

denotes the estimated coefcient on D

t

and s

is

its standard error.

EC114 Introduction to Quantitative Economics 19. Further Regression Topics I

Dummy Variables 10/35

However, it is nevertheless possible that the effect of the

CJD scare is on the marginal propensity to consume beef

out of income i.e. on the parameter .

This situation might appear to be a bit more complicated

but it is also straightforward to handle.

Instead of including the variable D

t

by itself in the

regression, we now include the product of D

t

with Y

t

in the

regression i.e. we include the variable Y

t

D

t

.

It is easy to construct a new variable in regression software

that is the product of two variables.

For example, in Stata, if D and Y are the two variables, we

can use the command:

gen yd=y

*

d

to generate the product.

EC114 Introduction to Quantitative Economics 19. Further Regression Topics I

Dummy Variables 11/35

The starting point is now given by the equation

Q

t

= + Y

t

+ Y

t

D

t

+

t

.

When D

t

= 0 it follows that Y

t

D

t

= 0 and we have the

original equation

Q

t

= + Y

t

+

t

,

while when D

t

= 1 it follows that Y

t

D

t

= Y

t

and we obtain

Q

t

= + ( + )Y

t

+

t

.

If < 0 and + > 0 the intercept remains unchanged but

the slope falls while remaining positive.

EC114 Introduction to Quantitative Economics 19. Further Regression Topics I

Dummy Variables 12/35

Suppose we run this regression and obtain

Q

t

= 25 + 0.02Y

t

0.01Y

t

D

t

.

This implies that during the CJD scare (setting D

t

= 1)

Q

t

= 25 + 0.01Y

t

,

while when there is no CJD scare (setting D

t

= 0)

Q

t

= 25 + 0.02Y

t

.

This effect is illustrated in the following diagram:

EC114 Introduction to Quantitative Economics 19. Further Regression Topics I

Dummy Variables 13/35

The presence of the product dummy Y

t

D

t

results in the

slope of the estimated equation changing.

Note that the intercept remains unchanged.

EC114 Introduction to Quantitative Economics 19. Further Regression Topics I

Dummy Variables 14/35

We can, of course, allow both the intercept and the slope

to change at the same time.

This requires adding both D

t

and Y

t

D

t

to the regression:

Q

t

= +

1

D

t

+ Y

t

+

2

Y

t

D

t

+

t

.

When D

t

= 0 it follows that Y

t

D

t

= 0 and we have the

original equation

Q

t

= + Y

t

+

t

,

while when D

t

= 1 it follows that Y

t

D

t

= Y

t

and we obtain

Q

t

= ( +

1

) + ( +

2

)Y

t

+

t

.

We can generalise this to any multiple linear regression.

EC114 Introduction to Quantitative Economics 19. Further Regression Topics I

Dummy Variables 15/35

Example. Consider the logarithmic money demand model

ln(M) =

1

+

2

ln(G) +

where M denotes the money stock and G denotes GDP.

Data set 9.1 in Thomas contains observations for 30

countries in 1985 and we shall split the sample into those

countries with GDP<$4,000 and those with GDP>$4,000.

We can dene an appropriate dummy variable:

D = 1 if GDP<$4,000,

D = 0 if GDP>$4,000.

We shall run regressions to see if the intercept and/or

slope are different for countries in these two ranges of

GDP per head.

Including the dummy variable yields:

EC114 Introduction to Quantitative Economics 19. Further Regression Topics I

Dummy Variables 16/35

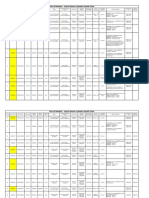

. regress lm lg d

Source | SS df MS Number of obs = 30

-------------+------------------------------ F( 2, 27) = 119.10

Model | 57.8613015 2 28.9306507 Prob > F = 0.0000

Residual | 6.5585244 27 .242908311 R-squared = 0.8982

-------------+------------------------------ Adj R-squared = 0.8906

Total | 64.4198259 29 2.22137331 Root MSE = .49286

------------------------------------------------------------------------------

lm | Coef. Std. Err. t P>|t| [95% Conf. Interval]

-------------+----------------------------------------------------------------

lg | .9030628 .132545 6.81 0.000 .6311029 1.175023

d | -.4534076 .3644604 -1.24 0.224 -1.201219 .2944033

_cons | -1.519285 .3323406 -4.57 0.000 -2.201191 -.8373782

------------------------------------------------------------------------------

The dummy variable is statistically insignicant and so

there does not appear to be any difference in the intercept

between these two groups.

Including the variable D ln(G) yields:

EC114 Introduction to Quantitative Economics 19. Further Regression Topics I

Dummy Variables 17/35

. regress lm lg dlg

Source | SS df MS Number of obs = 30

-------------+------------------------------ F( 2, 27) = 116.31

Model | 57.7200283 2 28.8600142 Prob > F = 0.0000

Residual | 6.69979758 27 .248140651 R-squared = 0.8960

-------------+------------------------------ Adj R-squared = 0.8883

Total | 64.4198259 29 2.22137331 Root MSE = .49814

------------------------------------------------------------------------------

lm | Coef. Std. Err. t P>|t| [95% Conf. Interval]

-------------+----------------------------------------------------------------

lg | 1.089832 .0828707 13.15 0.000 .9197953 1.259869

dlg | -.1650309 .1697023 -0.97 0.339 -.5132313 .1831695

_cons | -1.958399 .1146874 -17.08 0.000 -2.193718 -1.72308

------------------------------------------------------------------------------

The product variable is also statistically insignicant

suggesting no difference in the slope parameter (income

elasticity of money demand) between the two groups of

countries.

EC114 Introduction to Quantitative Economics 19. Further Regression Topics I

Dummy Variables 18/35

Dummy variables are widely used in Econometrics.

In cross-sections they can be used to represent things

such as:

gender: D = 1 if female, D = 0 if male;

employment status: D = 1 if employed,

D = 0 if unemployed;

marital status: D = 1 if married,

D = 0 if unmarried.

In time series dummies can be used to represent things

such as:

season: D

j

= 1 if quarter j,

D

j

= 0 otherwise (j = 1, . . . , 4);

particular event: D = 1 during wartime,

D = 0 otherwise.

EC114 Introduction to Quantitative Economics 19. Further Regression Topics I

Chow Tests 19/35

It is also possible to test whether coefcients in a

regression remain constant over two pre-specied

sub-samples using the Chow test for parameter stability.

Suppose we split the sample of n observations into two

sub-samples, the rst containing n

1

observations, the

second containing n

2

observations, where n

1

+n

2

= n.

Suppose, in the rst sub-sample, we have the population

regression

E(Y) =

1

+

2

X

2

+ . . . +

k

X

k

,

while in the second sub-sample we have the population

regression

E(Y) =

1

+

2

X

2

+ . . . +

k

X

k

.

EC114 Introduction to Quantitative Economics 19. Further Regression Topics I

Chow Tests 20/35

The null hypothesis of interest is

H

0

:

1

=

1

,

2

=

2

, . . . ,

k

=

k

,

i.e. that the coefcients are the same in the two

sub-samples.

The alternative hypothesis is

H

A

:

j

=

j

for at least one j.

We need to conduct three regressions and obtain the sum

of squared residuals, SSR, from each regression.

EC114 Introduction to Quantitative Economics 19. Further Regression Topics I

Chow Tests 21/35

The required regressions are as follows:

Regression 1: use the n

1

observations, obtain SSR

1

;

Regression 2: use the n

2

observations, obtain SSR

2

;

Regression 3: use all n observations, obtain SSR

p

.

Regression 3 is sometimes known as a pooled regression

because all the observations have been pooled together.

There are two versions of the Chow test.

The rst version compares all three values of SSR, while

the second compares either SSR

1

or SSR

2

with SSRp.

EC114 Introduction to Quantitative Economics 19. Further Regression Topics I

Chow Tests 22/35

The rst test statistic is

TS =

(SSR

p

SSR

1

SSR

2

)/k

(SSR

1

+ SSR

2

)/(n

1

+n

2

2k)

F

k,n

1

+n

2

2k

under H

0

.

The usual decision rule applies:

if TS > F

0.05

reject H

0

in favour of H

A

;

if TS < F

0.05

do not reject H

0

,

where F

0.05

is the 5% critical value from the F

k,n

1

+n

2

2k

distribution.

This test assesses whether the gain from estimating two

separate regressions, rather than the pooled regression, is

statistically signicant (as measured by comparing SSR

p

with SSR

1

+SSR

2

).

EC114 Introduction to Quantitative Economics 19. Further Regression Topics I

Chow Tests 23/35

The second test statistic is

TS =

(SSR

p

SSR

1

)/n

2

SSR

1

/(n

1

k)

F

n

2

,n

1

k

under H

0

.

The usual decision rule applies:

if TS > F

0.05

reject H

0

in favour of H

A

;

if TS < F

0.05

do not reject H

0

,

where F

0.05

is the 5% critical value from the F

n

2

,n

1

k

distribution.

This test is sometimes known as a predictive failure test,

because it is assessing whether the additional n

2

observations included in the pooled regression result in a

statistically signicant proportionate change in SSR.

EC114 Introduction to Quantitative Economics 19. Further Regression Topics I

Chow Tests 24/35

In time series applications the second sub-sample of n

2

observations follows chronologically from the rst

sub-sample of n

1

observations, so there is a clear ordering

of the observations.

In cross-sections, however, there is often no unique

ordering, and so the roles of the two sub-samples can be

reversed, resulting in the test statistic

TS =

(SSR

p

SSR

2

)/n

1

SSR

2

/(n

2

k)

F

n

1

,n

2

k

under H

0

.

In this case the n

2

observations are taken as the reference

point, which wouldnt make sense with time series.

EC114 Introduction to Quantitative Economics 19. Further Regression Topics I

Chow Tests 25/35

Another way to think of the Chow test is in terms of dummy

variables.

Let D denote the following dummy variable:

D = 1 if sub-sample 1 (n

1

observations),

D = 0 if sub-sample 2 (n

2

observations).

We can then dene the population regression

E(Y) =

1

+

2

X

2

+ . . . +

k

X

k

+

1

D +

2

(DX

2

) + . . . +

k

(DX

k

).

In sub-sample 1, we have

E(Y) = (

1

+

1

) + (

2

+

2

)X

2

+ . . . + (

k

+

k

)X

k

,

while in sub-sample 2 we have

E(Y) =

1

+

2

X

2

+ . . . +

k

X

k

.

EC114 Introduction to Quantitative Economics 19. Further Regression Topics I

Chow Tests 26/35

The differences in the coefcients between the two

sub-samples are captured by the

j

parameters.

If the

j

are all zero then there are no differences.

We can therefore consider our test of parameter stability as

being a test of

H

0

:

1

= 0,

2

= 0, . . . ,

k

= 0

against H

A

: at least one

j

= 0.

We can carry out an F-test of these k restrictions by

running just two regressions, as follows:

EC114 Introduction to Quantitative Economics 19. Further Regression Topics I

Chow Tests 27/35

Regression 1 is the unrestricted regression

Y =

1

+

2

X

2

+ . . . +

k

X

k

+

1

D +

2

(DX

2

) + . . . +

k

(DX

k

) + ;

from this we need the SSR, denoted SSR

U

.

Regression 2 is the restricted regression

Y =

1

+

2

X

2

+ . . . +

k

X

k

+ ;

from this we need SSR

R

.

We then construct the test statistic

TS =

(SSR

R

SSR

U

)/k

SSR

U

/(n 2k)

F

k,n2k

under H

0

and apply the usual decision rule.

EC114 Introduction to Quantitative Economics 19. Further Regression Topics I

Chow Tests 28/35

Example. Lets return to the money demand example,

where we divided the countries into those with

GDP>$4000 per head and those with GDP<$4000 per

head

We shall conduct Chow tests of whether the regression

parameters are different between these two groups we

begin with the pooled regression

. regress lm lg

Source | SS df MS Number of obs = 30

-------------+------------------------------ F( 1, 28) = 232.11

Model | 57.4853608 1 57.4853608 Prob > F = 0.0000

Residual | 6.93446511 28 .247659468 R-squared = 0.8924

-------------+------------------------------ Adj R-squared = 0.8885

Total | 64.4198259 29 2.22137331 Root MSE = .49765

------------------------------------------------------------------------------

lm | Coef. Std. Err. t P>|t| [95% Conf. Interval]

-------------+----------------------------------------------------------------

lg | 1.04467 .068569 15.24 0.000 .9042126 1.185127

_cons | -1.912253 .104309 -18.33 0.000 -2.12592 -1.698586

------------------------------------------------------------------------------

EC114 Introduction to Quantitative Economics 19. Further Regression Topics I

Chow Tests 29/35

The two sub-sample regressions are:

. regress lm lg if g<4

Source | SS df MS Number of obs = 19

-------------+------------------------------ F( 1, 17) = 38.52

Model | 10.6102646 1 10.6102646 Prob > F = 0.0000

Residual | 4.6831173 17 .275477489 R-squared = 0.6938

-------------+------------------------------ Adj R-squared = 0.6758

Total | 15.2933819 18 .849632328 Root MSE = .52486

------------------------------------------------------------------------------

lm | Coef. Std. Err. t P>|t| [95% Conf. Interval]

-------------+----------------------------------------------------------------

lg | .9226822 .148673 6.21 0.000 .6090096 1.236355

_cons | -1.970365 .1216961 -16.19 0.000 -2.227121 -1.713609

------------------------------------------------------------------------------

. regress lm lg if g>4

Source | SS df MS Number of obs = 11

-------------+------------------------------ F( 1, 9) = 3.52

Model | .714288023 1 .714288023 Prob > F = 0.0934

Residual | 1.8267651 9 .2029739 R-squared = 0.2811

-------------+------------------------------ Adj R-squared = 0.2012

Total | 2.54105312 10 .254105312 Root MSE = .45053

------------------------------------------------------------------------------

lm | Coef. Std. Err. t P>|t| [95% Conf. Interval]

-------------+----------------------------------------------------------------

lg | .7237502 .3858088 1.88 0.093 -.1490099 1.59651

_cons | -1.117129 .8758755 -1.28 0.234 -3.098497 .864239

------------------------------------------------------------------------------

EC114 Introduction to Quantitative Economics 19. Further Regression Topics I

Chow Tests 30/35

For the rst test we nd that

SSR

p

= 6.9345, SSR

1

= 4.6831, SSR

2

= 1.8268

with n

1

= 19, n

2

= 11 and k = 2.

The test statistic is

TS =

(SSR

p

SSR

1

SSR

2

)/k

(SSR

1

+ SSR

2

)/(n

1

+n

2

2k)

=

(6.9345 4.6831 1.8268)/2

(4.6831 + 1.8268)/(19 + 11 4)

= 0.8479.

Under H

0

(that the coefcients are the same in the two

sub-samples) TS has an F

2,26

distribution, and so

F

0.05

= 3.3690.

As TS = 0.8026 < 3.3690 we are unable to reject H

0

.

EC114 Introduction to Quantitative Economics 19. Further Regression Topics I

Chow Tests 31/35

For the second test we have

SSR

p

= 6.9345, SSR

1

= 4.6831, SSR

2

= 1.8268

with n

1

= 19, n

2

= 11 and k = 2.

The test statistic is

TS =

(SSR

p

SSR

1

)/n

2

SSR

1

/(n

1

k)

=

(6.9345 4.6831)/11

(4.6831)/(19 2)

= 0.7430.

Under H

0

(that the coefcients are the same in the two

sub-samples) TS has an F

11,17

distribution, and so

F

0.05

2.4153 (the values for F

10,17

and F

12,17

are 2.4499

and 2.3807, respectively).

As TS = 0.7430 < 2.4153 we are unable to reject H

0

.

EC114 Introduction to Quantitative Economics 19. Further Regression Topics I

Chow Tests 32/35

We can also conduct the second test by reversing the roles

of the two sub-samples, by computing

TS =

(SSR

p

SSR

2

)/n

1

SSR

2

/(n

2

k)

=

(6.9345 1.8268)/19

(1.8268)/(11 2)

= 1.3244.

Under H

0

(that the coefcients are the same in the two

sub-samples) TS has an F

19,9

distribution, and so

F

0.05

2.9365 (this is actually the value for F

20,9

).

As TS = 1.3244 < 2.9365 we are once more unable to reject

H

0

.

EC114 Introduction to Quantitative Economics 19. Further Regression Topics I

Chow Tests 33/35

Finally, lets compute the alternative version of the rst test

using dummy variables, dening D = 1 for countries with

GDP<$4,000.

The unrestricted regression is:

. regress lm lg d dlg

Source | SS df MS Number of obs = 30

-------------+------------------------------ F( 3, 26) = 77.10

Model | 57.9099435 3 19.3033145 Prob > F = 0.0000

Residual | 6.5098824 26 .250380092 R-squared = 0.8989

-------------+------------------------------ Adj R-squared = 0.8873

Total | 64.4198259 29 2.22137331 Root MSE = .50038

------------------------------------------------------------------------------

lm | Coef. Std. Err. t P>|t| [95% Conf. Interval]

-------------+----------------------------------------------------------------

lg | .7237502 .4285011 1.69 0.103 -.1570464 1.604547

d | -.8532358 .979691 -0.87 0.392 -2.867019 1.160548

dlg | .198932 .4513347 0.44 0.663 -.7287999 1.126664

_cons | -1.117129 .9727969 -1.15 0.261 -3.116742 .8824836

------------------------------------------------------------------------------

EC114 Introduction to Quantitative Economics 19. Further Regression Topics I

Chow Tests 34/35

We therefore have SSR

R

= 6.5099 while our earlier results

give SSR

U

= 6.9345; also, k = 2 and n = 30.

The test statistic is

TS =

(6.9345 6.5099)/2

6.5099/(30 4)

= 0.8479;

this is exactly the same value as the rst Chow statistic we

computed!

In fact, it is possible to prove that the two statistics are

identical.

Because TS has an F

2,26

distributions under H

0

(as before),

we know the 5% critical value is 3.3690 and the test result

is the same (do not reject H

0

).

We have actually carried out exactly the same test but by a

slightly different approach.

EC114 Introduction to Quantitative Economics 19. Further Regression Topics I

Summary 35/35

Summary

Dummy variables

Chow tests

Next week:

Heteroskedasticity, autocorrelation and dynamic models

EC114 Introduction to Quantitative Economics 19. Further Regression Topics I

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Constrained Maximisation IV Lagrange FunctionDocument26 pagesConstrained Maximisation IV Lagrange Functionthrphys1940Pas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Linear Equarions - Economic ApplicationsDocument41 pagesLinear Equarions - Economic Applicationsthrphys1940Pas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- National AccountingDocument20 pagesNational Accountingthrphys1940Pas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Introduction To MacroeconomicsDocument10 pagesIntroduction To Macroeconomicsthrphys1940Pas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Linear Equarions - Economic ApplicationsDocument41 pagesLinear Equarions - Economic Applicationsthrphys1940Pas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Optimization With More Than One VariableDocument37 pagesOptimization With More Than One Variablethrphys1940Pas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Constrained Maximisation IIDocument47 pagesConstrained Maximisation IIthrphys1940Pas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Constrained Maximisation IV - ExamplesDocument28 pagesConstrained Maximisation IV - Examplesthrphys1940Pas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Firm Theory and DualityDocument44 pagesFirm Theory and Dualitythrphys1940Pas encore d'évaluation

- Partial DifferentationDocument32 pagesPartial Differentationthrphys1940Pas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Total DifferentationDocument33 pagesTotal Differentationthrphys1940Pas encore d'évaluation

- Linear Equations - SupplementDocument12 pagesLinear Equations - Supplementthrphys1940Pas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Constrained Maximisation IDocument35 pagesConstrained Maximisation Ithrphys1940Pas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Optimization With More Than One Variable IIDocument32 pagesOptimization With More Than One Variable IIthrphys1940Pas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- Methods of Economic Nalysis IIDocument38 pagesMethods of Economic Nalysis IIthrphys1940Pas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Methods of Economic AnalysisDocument26 pagesMethods of Economic Analysisthrphys1940Pas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Further Probability TopicsDocument27 pagesFurther Probability Topicsthrphys1940Pas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- Quadratic EquationsDocument33 pagesQuadratic Equationsthrphys1940Pas encore d'évaluation

- Hypothesis TestingDocument27 pagesHypothesis Testingthrphys1940Pas encore d'évaluation

- Hypothesis Testing IIDocument28 pagesHypothesis Testing IIthrphys1940Pas encore d'évaluation

- Linear EquationsDocument25 pagesLinear Equationsthrphys1940Pas encore d'évaluation

- Linear Equations - SupplementDocument12 pagesLinear Equations - Supplementthrphys1940Pas encore d'évaluation

- Further Inference TopicsDocument31 pagesFurther Inference Topicsthrphys1940Pas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Estimation and Testing of Population ParametersDocument27 pagesEstimation and Testing of Population Parametersthrphys1940Pas encore d'évaluation

- Continuous Probability DistributionDocument26 pagesContinuous Probability Distributionthrphys1940Pas encore d'évaluation

- Basic Statistical InferenceDocument29 pagesBasic Statistical Inferencethrphys1940Pas encore d'évaluation

- Discrete Probability DistributionDocument23 pagesDiscrete Probability Distributionthrphys1940Pas encore d'évaluation

- Introduction To StatisticsDocument18 pagesIntroduction To Statisticsthrphys1940Pas encore d'évaluation

- Introduction To ProbabilityDocument25 pagesIntroduction To Probabilitythrphys1940Pas encore d'évaluation

- Further Regression Topics IIDocument32 pagesFurther Regression Topics IIthrphys1940Pas encore d'évaluation

- Radio Frequency Transmitter Type 1: System OperationDocument2 pagesRadio Frequency Transmitter Type 1: System OperationAnonymous qjoKrp0oPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Ir35 For Freelancers by YunojunoDocument17 pagesIr35 For Freelancers by YunojunoOlaf RazzoliPas encore d'évaluation

- Steam Turbine Theory and Practice by Kearton PDF 35Document4 pagesSteam Turbine Theory and Practice by Kearton PDF 35KKDhPas encore d'évaluation

- Photographing Shadow and Light by Joey L. - ExcerptDocument9 pagesPhotographing Shadow and Light by Joey L. - ExcerptCrown Publishing Group75% (4)

- Riddles For KidsDocument15 pagesRiddles For KidsAmin Reza100% (8)

- GIS Multi-Criteria Analysis by Ordered Weighted Averaging (OWA) : Toward An Integrated Citrus Management StrategyDocument17 pagesGIS Multi-Criteria Analysis by Ordered Weighted Averaging (OWA) : Toward An Integrated Citrus Management StrategyJames DeanPas encore d'évaluation

- FS2004 - The Aircraft - CFG FileDocument5 pagesFS2004 - The Aircraft - CFG FiletumbPas encore d'évaluation

- Decision Maths 1 AlgorithmsDocument7 pagesDecision Maths 1 AlgorithmsNurul HafiqahPas encore d'évaluation

- AATCC 100-2004 Assesment of Antibacterial Dinishes On Textile MaterialsDocument3 pagesAATCC 100-2004 Assesment of Antibacterial Dinishes On Textile MaterialsAdrian CPas encore d'évaluation

- Change Management in British AirwaysDocument18 pagesChange Management in British AirwaysFauzan Azhary WachidPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Pom Final On Rice MillDocument21 pagesPom Final On Rice MillKashif AliPas encore d'évaluation

- Lankeda 3d Printer Filament Catalogue 2019.02 WGDocument7 pagesLankeda 3d Printer Filament Catalogue 2019.02 WGSamuelPas encore d'évaluation

- Ancient Greek Divination by Birthmarks and MolesDocument8 pagesAncient Greek Divination by Birthmarks and MolessheaniPas encore d'évaluation

- Petty Cash Vouchers:: Accountability Accounted ForDocument3 pagesPetty Cash Vouchers:: Accountability Accounted ForCrizhae OconPas encore d'évaluation

- 20 Ua412s en 2.0 V1.16 EagDocument122 pages20 Ua412s en 2.0 V1.16 Eagxie samPas encore d'évaluation

- Moor, The - Nature - Importance - and - Difficulty - of - Machine - EthicsDocument4 pagesMoor, The - Nature - Importance - and - Difficulty - of - Machine - EthicsIrene IturraldePas encore d'évaluation

- Simply Put - ENT EAR LECTURE NOTESDocument48 pagesSimply Put - ENT EAR LECTURE NOTESCedric KyekyePas encore d'évaluation

- Mercedes BenzDocument56 pagesMercedes BenzRoland Joldis100% (1)

- Prof Ram Charan Awards Brochure2020 PDFDocument5 pagesProf Ram Charan Awards Brochure2020 PDFSubindu HalderPas encore d'évaluation

- Algorithms For Image Processing and Computer Vision: J.R. ParkerDocument8 pagesAlgorithms For Image Processing and Computer Vision: J.R. ParkerJiaqian NingPas encore d'évaluation

- Surgery Lecture - 01 Asepsis, Antisepsis & OperationDocument60 pagesSurgery Lecture - 01 Asepsis, Antisepsis & OperationChris QueiklinPas encore d'évaluation

- Briana SmithDocument3 pagesBriana SmithAbdul Rafay Ali KhanPas encore d'évaluation

- Brick TiesDocument15 pagesBrick TiesengrfarhanAAAPas encore d'évaluation

- Mission Ac Saad Test - 01 QP FinalDocument12 pagesMission Ac Saad Test - 01 QP FinalarunPas encore d'évaluation

- Report Emerging TechnologiesDocument97 pagesReport Emerging Technologiesa10b11Pas encore d'évaluation

- Evolution of Bluetooth PDFDocument2 pagesEvolution of Bluetooth PDFJuzerPas encore d'évaluation

- EIN CP 575 - 2Document2 pagesEIN CP 575 - 2minhdang03062017Pas encore d'évaluation

- Wi FiDocument22 pagesWi FiDaljeet Singh MottonPas encore d'évaluation

- 4 Wheel ThunderDocument9 pages4 Wheel ThunderOlga Lucia Zapata SavaressePas encore d'évaluation

- CMC Ready ReckonerxlsxDocument3 pagesCMC Ready ReckonerxlsxShalaniPas encore d'évaluation