Académique Documents

Professionnel Documents

Culture Documents

Accounting and Finace

Transféré par

Lan AnhTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Accounting and Finace

Transféré par

Lan AnhDroits d'auteur :

Formats disponibles

Chapter 7

Cost-Volume-Profit Analysis

Teaching Notes for Cases

7-1. CVP Analysis; Strategy

This problem can perhaps be visualized most easily by first constructing a table which will show

the effects on net income of the various alternatives.

Prior Year eep !l" #se Ne$ Purchase

% &u"gete" Carrier Carrier Truc's

Sales $1,500,000 $1,500,000 $1,!0,000 $1,!0,000

Shipping "osts 1!5,000 #a$ 1%,150 #b$ 1&&,'0' #c$ 10',!'5

(ther )ariable "osts 1,0'5,000 1,0'5,000 1,0!,'00 1,0!,'00

"ontribution *argin $&%0,000 $&5%,+50 $&,!,1'1 $&%,,%05

-i.ed "osts 150,000 150,000 150,000 /

0et 1ncome $1&0,000 $10%,+50 $11!,1'1 /

#a$ .0' #$1,500,000$#1.1$#.'$ 2.0' #$1,500,000$#.1$

#b$ .0' #$1,!0,000$#.'5$#.'$ 2 .0'#$1,!0,000$#.1$

#c$ .0'#1,!0,000$#.+5$

1. 3sing the brea4even e5uation,

Sales 6 )ariable costs 2 -i.ed cost 2 7e5uired 1ncome

$1,!0,000 6 8$10',!'5 2 $1,0!,'009 2 8: 2 $&,000 2 $150,0009 2 $1&0,000

: 6 $,%05

where : is annual fi.ed cost of the truc4 in the form of depreciation. Total cost is 10 . $,%05 6

$%,050.

&. ;gain we use the brea4even e5uation, substituting for re5uired income the e.pected income using the

new carrier #computed previously$.

$1,!0,000 6 8$10',!'5 2 $1,0!,'009 2 8: 2 $&,000 2 $150,0009 2 $11!,1'1

: 6 $11,51

allowable cost 6 10 . $11,51 6 $115,10

6 #$1&0,000 < $11!,1'1$#10$ 2 $%,050

=locher, Stout, "o4ins, "hen> Cost Management 4e %-1 ?The *c@raw<Aill "ompanies, 1nc., &00+

!. =ased on *r. "arterBs decision, it is evident that the truc4s could not be purchased for $115,000, much

less for $%,000. 3sing a new carrier was the economically advisable decision. 3nfortunately it appears

that another variable, carrier reliability, was not ta4en into account. Cossibly the best decision was to 4eep

using the old carrier. The so<called Dsafety marginD can be computed as follows>

S;EFS 6 )" 2 -" 2 10"

: 6 .%!: 2 8:#.0'$#.'$#.'5$ 2 : #.0'$#.1$9 2 $150,000 2 $10%,+50

: 6 $1,00,'%+

where : is the dollar sales necessary to generate the $10%,+50 of income that would have been

provided if the original carrier had been used. Thus sales could have fallen by 8$1,!0,000 <

$1,00,'%+9 or appro.imately $&',000 before the decision could have been regarded as incorrect.

. Simmons is best characterized as a differentiator because of its emphasis on service and on<time

delivery. Aowever, the fact that the increase in shipping rates would mean that "arter would not meet his

profit goals suggests that the mar4et is also somewhat price sensitive. 1t is li4ely that on balance, "arter

must rely on differentiation to succeed, and we must consider the decision about a carrier in these terms.

The main issue is which carrier will provide the best 5uality service. (r, will "arter be able to provide

better service by buying his own truc4s and insourcing the shipping function.

5. )alue chain analysis is useful for identifying the critical value<adding activities in the firm, and for

analyzing the effect of these activities upstream and downstream in the firm. -or e.ample, the value chain

can be used by "arter to help determine whether insourcing the shipping function might have the effect of

increasing or reducing costs in other activities. ;n in<house shipping department might permit the firm to

reduce costs upstream by increasing the fle.ibility of scheduling shipments. The increased fle.ibility in

shipping could allow order filling to be scheduled more efficiently, thus reducing costs there.

=locher, Stout, "o4ins, "hen> Cost Management 4e %-& ?The *c@raw<Aill "ompanies, 1nc., &00+

7-(. CVP Analysis; )e*ie$ of Cost +stimation

1. 0ote that the data for competitor ' must be discarded as it represents a partial year and is therefore not

comparable with the remaining data. -or the first 5uestion, a regression on net income #dependent

variable$ against total revenue #independent variable$ is shown in F.hibit 1>

The regression e5uation is>

0et income 6 0.&+' . 7evenue < $+,'55,,'%

The e5uation has an 7

&

of 0.5, the standard error of the estimate is $1',0&&,0!0 , and the t< value

is &.0. That is a good fit considering that we would e.pect the fit to be affected by a variety of factors

affecting revenue. (n average it appears a casino must generate revenues of $1,',!',,+%5

#6 $+,'55,,'%G.&+'$ to brea4even.

&. 7egress casino revenues #dependent variable$ against s5uare footage of casino space #independent

variable$. The resulting e5uation is shown in F.hibit &.

7evenue 6 $,&,5%1 2 $!,1&& per s5uare foot

The 7

&

is 0.!1, the standard error of the estimate is $&,'+&,%&1 and the t<value is 1.%. This is not

a particularly good fit. Cart of the problem may arise from using 1'H revenues and 1'H5 space. =ut an

even more important issue is> if the two variables are related, which causes which/ 1t is more plausible

that higher revenues lead to the construction of more space, rather than more space generating higher

revenues. Thus any relationship found to hold must be used cautiously in ma4ing revenue predictions.

!. The results are shown below. The fit of both models is e.tremely poor, with 7<s5uared values of less

than &5I and non<significant t<values. This indicates there is not a reliable relationship among these

variables.

=locher, Stout, "o4ins, "hen> Cost Management 4e %-! ?The *c@raw<Aill "ompanies, 1nc., &00+

=locher, Stout, "o4ins, "hen> Cost Management 4e %- ?The *c@raw<Aill "ompanies, 1nc., &00+

=locher, Stout, "o4ins, "hen> Cost Management 4e %-5 ?The *c@raw<Aill "ompanies, 1nc., &00+

=locher, Stout, "o4ins, "hen> Cost Management 4e %-, ?The *c@raw<Aill "ompanies, 1nc., &00+

Regression Using Number of Rooms to Predict Room Revenue

Regression Statistics

Multiple R 0.34198458

R !u"re 0.11#9534#

$d%usted R !u"re &0.00919#1

t"nd"rd 'rror (800.4)9#1

*bserv"tions 9

$N*+$

df SS MS F Significance F

Regression 1 )()09#9.#91 )()09)0 0.9()10( 0.3#)#9135(

Residu"l ) 5489880(.31 )84(#8#

,ot"l 8 #(1#9))(

Coefficients Standard Error t Stat P-value Lower 95%

-ntercept 898).34)) 553#.934()1 1.#(31#3 0.148584 &4105.411988

Rooms 9.1585)(94 9.5118(9491 0.9#(8#1 0.3#)#91 &13.333313##

Regression Using Number of Rest"ur"nts to Predict .ood "nd /ever"ge Revenue

Regression Statistics

Multiple R 0.4)438

R !u"re 0.((503)

$d%usted R !u"re 0.1143()

t"nd"rd 'rror #318.3(5

*bserv"tions 9

$N*+$

df SS MS F Significance F

Regression 1 8114)(4#.#8 8114)(4) (.03(#84 0.19#980598

Residu"l ) ()9448#3).3 399(1(34

,ot"l 8 3#0595884

CoefficientsStandard Error t Stat P-value Lower 95%

-ntercept 4(090.#8 )404.#99)59 5.#84319 0.000)4) (4581.35#(5

No Rest &1(30.93 8#3.3)548#4 &1.4(5)( 0.19#981 &3()(.490)#3

7-,. CVP Analysis; Ser*ice -.ospital/; Strategy

1. The strategic role of ")C ;nalysis for *elford Aospital is to provide a basis for understanding

the relationships between costs, revenues, profits and the level of output for the hospitalJs

services. 1n this case, the hospital needs to be able to analyze the alternative uses of its space for

rental. Kill the space be more profitably used by activities within the hospital/ Khat is the proper

rental charge/ Aow should the rental charge change if the level of e.pected usage increases

significantly/ These are 5uestions that the hospital can best answer using ")C analysis. Similarly,

entities such as a psychiatric unit or a pediatric unit which want to rent space from the hospital

can use ")C analysis to asses the potential profitability of doing so, given different assumptions

of e.pected activity.

&. The brea4even point is determined as follows>

Total -i.ed costs

*elford Aospital charges $&,'00,000

Supervising nurses #$&5,000 . $ 100,000

0urses #$&0,000 . 10$ &00,000

;ides #$',000 . &0$ 1+0,000

Total fi.ed costs $!,!+0,000

"ontribution margin per patient day>

7evenue per patient day $!00

Eess> )ariable costs per patient day

#$,,000,000G$!00 6 &0,000 patient days$

$&,000,000G&0,000 patient days 100

"ontribution margin per patient day $&00

"alculation of =rea4even> $!,!+0,000G$&00 6 1,,'00 patient days

!. "alculation of Eoss from 7ental of ;dditional &0 =eds

1ncrease in revenue #&0 addtJl beds . '0 days . $!00 Gday$ $50,000

1ncrease in e.penses

)ariable e.pense by *elford Aospital

#&0 additional beds . '0 days . $100Gday$ 1+0,000

-i.ed charges by *elford Aospital

#$&,'00,000G,0 beds 6 $+,!!! per bed . &0 beds$ ',,,,,%

Salaries e.pense>

#&0,000 patient days before additional beds, 2 &0

additional beds . '0 days 6 &1,+00, which does not

e.ceed &1,'00 patient days, therefore no additional

personnel re5uired$ <0 <

Total F.penses $1,1,,,,%

0et decrease in earnings from rental of additional beds $ ,0,,,,%

=locher, Stout, "o4ins, "hen> Cost Management 4e %-% ?The *c@raw<Aill "ompanies, 1nc., &00+

7-0 A11T+1 Pa*ilion

1. The best description of the strategy of an entertainment business such as the ;EETFE Cavilion is

differentiation. The mission statement includes> La concertM its better live.N ; live concert is certainly

not the least e.pensive entertainment. Khat brings a customer to the ;EETFE Cavilion is top name acts

and the e.perience of enOoying previous shows. The Cavilion 4nows that and strives to ma4e every

customerJs e.perience a pleasant one.

Some students may argue that the Cavilion employs both differentiation and low price strategies P

the differentiation strategy for nationally well<4nown performers and low price for local or regional

talents. Fven though the tic4et prices for less popular artists are relatively low, attending a concert is not

an activity purchased after comparing prices of different types of entertainment. Catrons attend a concert

because it is fun, and not because it is ine.pensive.

The most important critical success factor for the continuous success of the Cavilion is to ensure

that patrons have a good e.perience, realizing that the patrons each concert have different e.pectations.

-or e.ample, the audience of a Qimmy =uffet concert is li4ely to be different from that other shows. -or

each show, the Cavilion considers fundamentally who the customers are, how the show will entertain

these customers, and how to mar4et the show.

&. The determination of the brea4even point is not straight<forward. 1t re5uires the student to understand

how both types of customers contribute to the CavilionJs profits P the paying tic4et holders and the comp

tic4et holders. To determine the brea4even point>

Since there are many different types of tic4ets, the best approach is to use total revenues and total variable

costs, rather than to use per capita figures. This means using the contribution margin ratio or the variable

cost ratio. -irst determine total variable costs and total fi.ed costs as follows.

=egin by separating par4ing, concession and merchandise costs into their variable #10I of revenue$ and

fi.ed components>

Varia2le 3i4e"

Total -from

3lash )eport/

Car4ing .1 . 1',%,% 6 $1,'%% $,+<$1,'%%6$&,%1 $,+

"oncession .1 . %',&%! 6 $%,'&% $!,!5,<%,'&%6$!5,&' !,!5,

*erchandise .1 . !,,&+ 6 $!,,! $1%,+&,<!,,!6$1,1+! 1%,+&,

Total $1!,5% $5&,0+! $,5,,!0

Then add other variable and fi.ed costs

(ther variable

costs

$1,!&!

@uarantee $1,0,,!5

Croduction 15,50,

(perations 1,''1

;dvertising &0,0!0

Total 5(76778 5(9,6(0:

3sing the variable cost ratio, and since total sales is $!5+,11 #from the -lash 7eport$>

R 6 vGp . R 2 fi.ed costs

R 6 #$&%,+%0G$!5+,11$ . R 2 $&,!,&5

=locher, Stout, "o4ins, "hen> Cost Management 4e %-+ ?The *c@raw<Aill "ompanies, 1nc., &00+

R 6 $&+5,5!

This is appro.imately $&+5,5!G#$&,.''21.'12%.,,2!.5&6$0.0+$ 6 %,1&& tic4et holders, at the

$&,.'' average per capita revenue from tic4eting and assuming the per capita revenues for par4ing,

concessions, and merchandise

;lternatively,

: 6 $&,!,&5G#$0.0+ < $!.0'6$!%.0!$ 6 %,10' paying tic4et holders #small rounding difference$

where> $!.0' is total unit variable cost made up of $1.% of variable e.pense

#$.1%2.!521.1&2.0+2.0&$ and the 10I #of revenue$ contracting fee for par4ing, food, and

merchandising #$.1'12.%,,2.!5&$

The above approach ignores the contribution of LcompN tic4ets and uses only paying tic4et holders.

Aowever, comp patrons should not be ignored because the also pay for par4ing and buy food and

merchandise. Thus, a preferred approach would be to include directly in the analysis the fact that

LcompN tic4et holderJs will pay for par4ing, food, and merchandise, as follows>

a$ The contribution per paying customer is $!%.0! 6 $&.0+<$!.0'

b$ The contribution for each comp customer is $10.0 6 $1!.0' P $!.0',

where $1!.0' 6 $1.'12%.,,2!.5&

The e5uation to solve for the number of paying customers #:$, would then be based on the

assumption that an additional &5I of comp customers would also attend>

$!%.0! . : 2 $10.0 . .&5 . : 6 $&,!,&5 at brea4even

: 6 ,,,5+ paying customers who will be in attendance with an additional appro.imate.&5

. ,,,5+ 6 1,,,5 comp customers.

Assumptions an" ;iscussion Points

The above analyses assumes a constant purchase mi. of tic4et types, as set out in F.hibit ;.

;lso, there are a number of other 4ey assumptions.

1. (ur solution assumes that the $1.% of other variable e.pense applied to both paying tic4et

holders and comp tic4et holders. That is, the "(@S for the concessions and insurance are applicable to

each customer, whether paying or not. Some students will note that the -lash 7eport provided to me by

;lltel Cavilion staff is inconsistent with this because it shows proOect variables e.pense of $1.% . +,&51 6

$1,!&!. The ;lltel staffsJ calculation seems to imply that only paying customers cause these costs. 1

decided to leave this discrepancy in the case to add some realism P 1 can add it to the class discussion and

use it to reinforce the importance of accuracy and consistencyS depending on my goals for the class 1

might correct this number in the case and replace the $1,!&! with the correct calculation of $1.% .

10,!' 6 $1+,00%..

&. 1n my e.perience with the case, a number of students will assume the costs provided in the

-lash 7eport for the ancillaries #par4ing, food, and merchandise$ are fi.ed costs only. 1 remind them of

the case information that states that the concession contractors are paid on a basis of both a fi.ed fee and

a percentage of revenue #and therefore a variable cost$. ;fter a 5uestion or two the class seems to then

understand this point.

!. 7elatively few students attempt to account for the ancillary revenues from the comp tic4et

holders in their initial analysis. 1 allow plenty of time to e.plain this point.

=locher, Stout, "o4ins, "hen> Cost Management 4e %-' ?The *c@raw<Aill "ompanies, 1nc., &00+

. Some students fail to see that the revenue per tic4et includes both tic4et price #avg of $&&.1&$

and other payments to ;lltel Cavilion based on tic4ets sold #facility charge and SG" rebates$, so that the

relevant figure to use is $&,.'' per paying tic4et holder.

1 show this in class as follows>

Tic4et price $&&.1&

-acility charge &.'1

7ebates 1.',

Total revenue per paying tic4et holder $&,.''

0ote that the $1%.,! per tic4et holder calculated in the flash report Oust above the facilities charges is in

errorS it is apparently calculated from the total admissions of $1+&,%' #a correct number$ by the drop

count of 10,!'. This is wrong because the drop count includes comp tic4ets. The correct calculation is

$1+&,%'G+,&51 6 $&&.1& which is shown near the top of the flash report. The $1%.,! calculation was

included in the original case provided to me by ;lltel Cavilion staff. 1 decided to leave this discrepancy in

the case to add some realismS depending on my goals for the class 1 might correct this number in the case

and replace the $1%.,! with $&&.1&.

;lso, note that the fact there are e.tensive 4ey assumptions and a significant amount of uncertainty

involved in the case, the calculation of a brea4even point must be accompanied by a caution regarding

these uncertainties. 1t also argues for an e.plicit sensitivity analysis, as described in the answer to

5uestion below.

!. This 5uestion e.plores the relevance of operating leverage for the ;lltel Cavilion. The

brea4even analysis is li4ely to be more important for a fi.ed fee type of performer because the

fi.ed costs #performer fee included$ will be larger, and the ris4 of loss from poor attendance is

greater. -or this reason, including the greater difficulty in attracting fans to the relatively wea4er fi.ed<

pay performers, the per<capita artists are li4ely to be preferred.

Ke can also loo4 at this 5uestion from both the CavilionJs and the CerformerJs point of view>

-rom the CavilionJs Coint of )iew>

-or the more popular performers for whom we e.pect to fill all the seats, the Cavilion would

prefer to have a fi.ed pay contract, to ta4e advantage of operating leverage P the profits to the Cavilion

would be relatively high if variable costs are low #i.e., with a fi.ed rather than a per capita contract$ and

volume is high. 1n contrast, for the relatively un4nown performer for who the attendance is substantially

in doubt, a per capital contract would be preferable. The performer in this case shares the ris4, and the

CavilionJs relatively low operating leverage protects it from relatively higher losses.

-rom the CerformerJs Coint of )iew>

The popular performer is li4ely to be able to insist on the type of contract that is preferable the

them, presumably either a per capita type of contract or a fi.ed pay contract that has a very high fi.ed pay

amount #the performer might calculate what the Cavilion might earn from the contract based on their

4nowledge of the cost structures of Cavilions generally, and use this to negotiate with the ;lltel Cavilion$.

The Cavilion is li4ely to prefer a per capita contract with this type of performer because of the relatively

higher ris4 for a high fi.ed pay contract.

The un4nown performer, in contrast, is li4ely to prefer a fi.ed pay contract to guarantee a small

or modest pay, irrespective of attendance. The ;lltel Cavilion would then need to ta4e care to ma4e sure

that the

=locher, Stout, "o4ins, "hen> Cost Management 4e %-10 ?The *c@raw<Aill "ompanies, 1nc., &00+

The ;lltel F.perience

Triven in part by the performerJs preferences, the ;lltel CavilionJs contracts tend to be per capita

for the most popular performers and fi.ed pay for the less popular performers.

. Sensitivity analysis could be used to evaluate the ris4 of a potential loss on the U-=S ;llstars event.

Some of the methods that might be used include spreadsheet modeling, including graphical analysis to

depict the change profits as attendance levels change and the use of spreadsheet analysis tools such as

"rystal =all in which the user can ma4e certain aspects of the uncerta+inty of the situation e.plicit and

then see how these ris4 assessments affect overall profitability.

;n e.ample of a spreadsheet model for ;lltel Cavilion is shown in F.hibit T0<1. 1f there is sufficient

class time, 1 demonstrate this spreadsheet for the class at the end of the class discussion, to illustrate the

simplicity and ease of analysis. 1 will usually ta4e a selection of three or four different values for

proOected attendance and show the changes effect proOected profit. 0ote that the proOected profit in the

spreadsheet differs from that in the flash report for an attendance of +,&51 because of the difference in the

handing of other variable e.penses as e.plained above and due to a certain amount of rounding error.

A Simulation <o"el of Alltel Pa*ilion=s Profit> Crystal &all

;s a further e.tension of the sensitivity analysis shown in the spreadsheet #F.hibit T0<1$, and

again, if 1 have sufficient class time, 1 will demonstrate the use of the F.cel ;dd<in "rystal =all to

analyze the uncertainty in the case. "rystal =all #a product of Tecisioneering, 1nc$ is a free and easy to

use tool for developing a probabilistic simulation of a planning conte.t such as for the ;lltel Cavilion

case. ; free seven day evaluation version can be downloaded from TecisioneeringJs web site,

http>GGwww.decisioneering.comGdownloadform.html, and free student versions #no time limit$ are also

available. See the advanced lecture notes above for more information about "rystal =all.

=locher, Stout, "o4ins, "hen> Cost Management 4e %-11 ?The *c@raw<Aill "ompanies, 1nc., &00+

TN-1> +4ample of Sprea"sheet Solution for Alltel Case

Alltel Pavilion

'0P'1,'2 P$3-N4 $,,'N2$N1' 85(51 4-+'N

,*,$6 R'+'NU' .R*M ,-17',-N4

P'R 1$P-,$ 8 (#.99 4-+'N

,*,$6 R'+'NU' .R*M

$N1-66$R-' P'R 1$P-,$ 8 13.09 4-+'N

6' 109 *. R'+'NU' 1.31 13.09 : .1

6' +$R-$/6' '0P'N' 1.)4 .1);.35;1.1.(;.08;.0(

1*N,R-/U,-*N .R*M $N1-66$R-'

P'R 1$P-,$ 8 10.04 13.09&<13.09 : .10=&1.)4

1*N,R-/U,-*N M$R4-N .*R

P$3-N4 1U,*M'R 3055535 <(#.99;10.04= : $,,'N2$N1'

1*N,R-/U,-*N M$R4-N .*R

N*NP$3-N4 1U,*M'R (05)10 10.04 : <.(5 : $,,'N2$N1'=

,*,$6 1*N,R-/U,-*N 8 3(#5(45

6ess> .-0'2 1*, (#35(4) 1550#;14991;(030;5(083;1#0#35

PR*.-, $ 62,997.54

=locher, Stout, "o4ins, "hen> Cost Management 4e %-1& ?The *c@raw<Aill "ompanies, 1nc., &00+

7-:. Sensiti*ity Analysis> )egression Analysis

1. The regression analysis to identify the stores that seem to be operating at below their potential, based

on relationships for all the stores can be determined from a cross<sectional regression. The results are

shown below. 0ote that the regression has e.cellent measures for both reliability and precision. The t

values of each of the independent variables is significant #p V .05$, the 7<s5uared value is high and the

standard error of the estimate is relatively low #$1,''!G$50,!'+ 6 I of the average value of the

dependent variable$. =ased on the residuals analysis, it appears that stores 1, and 5 have actual sales

somewhat below what is predicted based upon relationships to advertising, s5uare feet and gas sales, for

all stores ta4en together in the cross<sectional model. This would suggest that these three stores be given

some further study to determine whether #a$ there is some variable omitted from the model which would

e.plain why these stores have relatively low sales, or #b$ whether in fact the managers at these locations

have simply not been as effective as other managers in producing sales at their locations.

0ote also that whether or not a store sell gasoline has a significant effect on total sales. -or this

data it appears that gasoline contributes appro.imately $,,0, to total sales for locations selling gasoline.

=locher, Stout, "o4ins, "hen> Cost Management 4e %-1! ?The *c@raw<Aill "ompanies, 1nc., &00+

Regression Statistics

*ultiple 7 0.''%5+5+

7 S5uare 0.''51%%51

;dOusted 7 S5uare 0.''&%,&1&%

Standard Frror 1''!.1,+%,

(bservations 10

;0();

df SS MS F

7egression ! '1,0+11,% 1.,F20' 1&.+,1

7esidual , &!+!,!!0.& !'%&%&&

Total ' '!''1%'%

Coefficients Standard Error t Stat P-value

1ntercept <!5&&+.'&%+& &%%&.151!+ <1&.%0,'5 1.,F<05

;dvertising !.101%&1!& 0.!!+,0+1 '.15'&!% '.5F<05

S5uare -eet !.&%&+%' 1.++!5111+ 1+.5&+5, 1.5'F<0,

@as Sales 96809.:7,8: 15',.,&00!5 !.%+%10+ '.10F<0!

Aaving gas sales adds an estimated $,,0, in additional sales.

7FS1T3;E (3TC3T

Observation Predicted Sales Residuals

1 5%,&'' #1,&,5$

& &&,1+1 +,

! ++,0%! 1,&,

,+,005 #1,'!&$

5 &1,'%0 #&,'%%$

, ,,1,0 %,,

% &%,%'& '+1

+ ,%1! 1,5+1

' %,10 #+,$

10 !5,!+, 1,5+&

&. The analysis of the sensitivity of total sales to store size #s5uare feet$ and advertising can be

determined by ta4ing the log transform for each of the data points and recalculating the regression. 0ote

again that the statistical measures for the regression are all e.cellent. 3sing the coefficients of the

independent variables, we can now find that>

$ one percent incre"se in "dvertising5 "ll else e!u"l5 ?ill cre"te " .5(89 incre"se in s"les

$ one percent incre"se in s!u"re feet5 "ll else e!u"l5 ?ill cre"te " 1.19 incre"se in s"les

This is useful information for -ast Shop in planning desired levels of advertising and for considering the

appropriate size for new locations andGor e.tensions to current locations.

=locher, Stout, "o4ins, "hen> Cost Management 4e %-1 ?The *c@raw<Aill "ompanies, 1nc., &00+

)egression $ith 1og Transforms on All Varia2les6 e4cept the ?as Sales -861/ Varia2le

Regression Statistics

Multiple R 0.9948958

R !u"re 0.98981))

$d%usted R !u"re 0.98#9084

t"nd"rd 'rror 0.0(#04)#

*bserv"tions 10

$N*+$

df SS MS F Significance F

Regression ( 0.4#1#818) 0.(308 340.(33 1.0#5(8'&0)

Residu"l ) 0.004)493# 0.000)

,ot"l 9 0.4##431((

Coefficients Standard Error t Stat P-value Lower 95%

-ntercept &0.915(445 0.(5#0))#5 &3.5)41 0.00905 &1.5(0))151

$dvertising 0.5280906 0.05)5(#43 9.18 3.)'&05 0.39(0#((83

!u"re .eet 1.1005755 0.11(#4(85 9.))05 (.5'&05 0.834(1)#4(

=locher, Stout, "o4ins, "hen> Cost Management 4e %-15 ?The *c@raw<Aill "ompanies, 1nc., &00+

Teaching Strategy for Article

@Tools for ;ealing $ith #ncertaintyA

This article e.plains how to use simulation methods within a spreadsheet program such as F.cel

to perform sensitivity analysis for a given decision conte.t. The available spreadsheet simulation

software systems include the programs "rystal =all and W7is4, among others. These software systems

allow the user to analyze the effect of uncertainty on the potential outcomes of a decision. These tools

can be applied directly to ")C analysis. The tools allow the user to see the potential effect on the

brea4even level or total profit of potential variations in the 4ey uncertain factors in the analysis. The

uncertain factors affecting brea4even might be the un4nown level of unit variable cost, price or fi.ed cost.

;lso, in determining total profit, the un4nown level of demand might be a 4ey uncertain factor.

F.ercise> 3se a spreadsheet simulation tool such as "rystal =all or W7is4 to analyze the uncertain

factors in given case situation. "ases %<1,& and ! could be used or a problem from the te.t, for e.ample,

Te.t problem %<5!, the "omputer @raphics "ase. This is illustrated in the L;dvanced Eecture 0otesN

section of the 1nstructorJs 7esource @uide.

=locher, Stout, "o4ins, "hen> Cost Management 4e %-1, ?The *c@raw<Aill "ompanies, 1nc., &00+

Vous aimerez peut-être aussi

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Income Withholding DeclarationDocument2 pagesIncome Withholding DeclarationMoi EscalantePas encore d'évaluation

- Primavera PERT Master Risk Analysis ToolDocument22 pagesPrimavera PERT Master Risk Analysis ToolPallav Paban BaruahPas encore d'évaluation

- Caf 7 Far2 STDocument690 pagesCaf 7 Far2 STMuhammad YousafPas encore d'évaluation

- Days Operated/Rooms Occupied: Particulars Amount (RS.) Amount Per RoomDocument5 pagesDays Operated/Rooms Occupied: Particulars Amount (RS.) Amount Per RoomDr Linda Mary SimonPas encore d'évaluation

- BSNL TM SalaryDocument1 pageBSNL TM SalaryDharmveer SinghPas encore d'évaluation

- Presentation of Business PlanDocument24 pagesPresentation of Business PlanEduardo Canela100% (8)

- Successful Segmentation for Creating Profitable CustomersDocument25 pagesSuccessful Segmentation for Creating Profitable CustomersLan Anh100% (1)

- Topic 2 - BondDocument53 pagesTopic 2 - BondHamdan HassinPas encore d'évaluation

- Quiz in PartnershipDocument5 pagesQuiz in PartnershipPrincessAngelaDeLeon0% (1)

- Model Bankable Projects - GoatDocument39 pagesModel Bankable Projects - GoatSuresh Murugesan100% (2)

- Accounting For Managers - CH 3 - Recording Financial Transactions...Document14 pagesAccounting For Managers - CH 3 - Recording Financial Transactions...Fransisca Angelica Atika SisiliaPas encore d'évaluation

- Glossary 30 Day Trading BootcampDocument9 pagesGlossary 30 Day Trading Bootcampschizo mailPas encore d'évaluation

- Chapter 18 Solutions ManualDocument46 pagesChapter 18 Solutions ManualLan Anh0% (1)

- Chapter 5Document60 pagesChapter 5Lan AnhPas encore d'évaluation

- 100 Sales Tips For 2016Document42 pages100 Sales Tips For 2016Tomas BenadikPas encore d'évaluation

- 1 - Introduction To Financial ManagementDocument6 pages1 - Introduction To Financial ManagementLan AnhPas encore d'évaluation

- Chapter 18 Solutions ManualDocument46 pagesChapter 18 Solutions ManualLan Anh0% (1)

- BusinessDocument20 pagesBusinessLan AnhPas encore d'évaluation

- Modified Pag-Ibig Ii Enrollment FormDocument2 pagesModified Pag-Ibig Ii Enrollment FormRainePas encore d'évaluation

- PESTEL ANALYSIS AND FIVE FORCES MODEL OF LIJJAT PAPADDocument14 pagesPESTEL ANALYSIS AND FIVE FORCES MODEL OF LIJJAT PAPADKeyur Popat100% (1)

- Financial Data Questionnaire Student Visa Application American Consulate GeneralDocument5 pagesFinancial Data Questionnaire Student Visa Application American Consulate Generalmuhyminul100% (3)

- 06 Completing The Accounting CycleDocument26 pages06 Completing The Accounting CycleKristel Joy Eledia NietesPas encore d'évaluation

- Benchmarking Cost Savings and Cost Avoidance PDFDocument41 pagesBenchmarking Cost Savings and Cost Avoidance PDFlsaishankarPas encore d'évaluation

- Project Report for a 500 Bird Per Week Broiler Poultry FarmDocument3 pagesProject Report for a 500 Bird Per Week Broiler Poultry FarmRajesh Jangir100% (1)

- NLG - Annual Report 2016Document48 pagesNLG - Annual Report 2016Kiva DangPas encore d'évaluation

- Pub B in B 2011 06 enDocument174 pagesPub B in B 2011 06 enfilipandPas encore d'évaluation

- Introduction Project 1Document4 pagesIntroduction Project 1Vishal dubeyPas encore d'évaluation

- Marketing Plan of Bkash - Group 2Document11 pagesMarketing Plan of Bkash - Group 2Sharmin A. Salma100% (1)

- Restaurant Cum Fast FoodDocument23 pagesRestaurant Cum Fast FoodAbdul Saboor AbbasiPas encore d'évaluation

- Acr 4.2Document21 pagesAcr 4.2ASIKIN AJA0% (1)

- Understanding 1 View ReportingDocument370 pagesUnderstanding 1 View ReportingSindhu RamPas encore d'évaluation

- Value Investing in ThailandDocument14 pagesValue Investing in ThailandOhm BussarakulPas encore d'évaluation

- Tanduay Trend AnalysisDocument17 pagesTanduay Trend AnalysisDiane Isogon LorenzoPas encore d'évaluation

- Bond Prices and Yields: Bodie, Kane, and Marcus 9 EditionDocument20 pagesBond Prices and Yields: Bodie, Kane, and Marcus 9 EditionBerry FransPas encore d'évaluation

- CURRICULUM VITAE-FP SPV Tax Widasa Group Update 2Document11 pagesCURRICULUM VITAE-FP SPV Tax Widasa Group Update 2febrikafitriantiPas encore d'évaluation

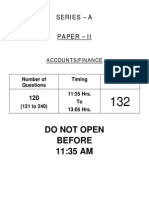

- Fci 132 Accounts - Finance PaperDocument15 pagesFci 132 Accounts - Finance PapersukanyaPas encore d'évaluation

- Letter To Vermillion ShareholdersDocument2 pagesLetter To Vermillion ShareholdersGeorgeBessenyeiPas encore d'évaluation