Académique Documents

Professionnel Documents

Culture Documents

City of SD Response To PRA, Received 12-18-09

Transféré par

api-25966063Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

City of SD Response To PRA, Received 12-18-09

Transféré par

api-25966063Droits d'auteur :

Formats disponibles

PRA Request, San Diego County Taxpayers Association

We received your request for information dated November 25, 2009, and have coordinated

responses to your questions below. The questions are listed in the order that they were asked in

the email sent from Lani Lutar, President & CEO of the San Diego County Taxpayers

Association.

1. Please provide a copy of the PowerPoint budget presentation given to the San Diego

County Taxpayers Association on November 24, 2009.

Please refer to Attachment 1.

2. Please provide a legal opinion on the Mission Bay Revenue Transfer described on

page 10 of the Fiscal Year 2010 Budget Amendment Report and Fiscal Year 2011

Proposed General Fund Budget.

A public opinion on the Mission Bay Revenue Transfer was not requested during the

Fiscal Year 2010 Budget Amendment Report and Fiscal Year 2011 Proposed General

Fund Budget deliberations, and therefore one is not available. Any communication

regarding this matter between staff and the City Attorney’s office are exempt from

disclosure as they are attorney-client communications.

3. The Fiscal Year 2010 Budget Amendment Report and Fiscal Year 2011 Proposed

General Fund Budget notes that a portion ($3.6 million) of the total annual debt

service payments in Fiscal Year 2011 for deferred maintenance bonds will be paid

for from the Capital Outlay Fund rather than the General Fund. Please explain how

this $3.6 million portion was determined, and what projects within the bond are

included in that portion’s calculation.

Capital Outlay can only be used to pay the principal portion of the total annual debt

services payments, which amounts to an estimated $3.6 million of the total $9.5 million

in deferred maintenance bonds. The City is currently in the process of restructuring the

debt service note; the actual principal portion will be determined when that process is

finalized and adjustments to the amount of the debt service payment will be made at that

time if necessary.

4. Please provide a legal opinion on the matter of deferred maintenance bonds being

paid from the Capital Outlay Fund, specifically from the proceeds of sale of real

estate assets.

Please refer to Attachment 2.

5. Please provide either: a copy of the McGuigan Settlement financing proposal or

correspondence with the financial institution that has expressed a willingness to

purchase the remaining balance of the settlement with favorable financing terms for

the City.

The McGuigan Settlement financing proposal has not been approved by Council at this

time, and so is not available for release as part of a Public Records Act response. The

McGuigan Settlement financing proposal described on page 9 of the Fiscal Year 2010

Budget Amendment Report and Fiscal Year 2011 Proposed General Fund Budget, was

updated on page 2 of the Addendum to Fiscal Year 2010 Budget Amendment Report and

Fiscal Year 2011 Proposed General Fund Budget as follows:

• The sentence “As a result, the amount to be financed would be reduced by

these amounts to approximately $37.0 million” should be revised to reflect the

amount of $33.6 million.

• The sentence “The General Fund budget deficit for Fiscal Year 2011 will be

reduced by the difference between the General Fund portion of the settlement

of $32.0 million (included in the $179.1 million projected deficit) and the debt

service amount of $7.6 million due in Fiscal Year 2011 under the financing

plan” should be revised to state “…and the General Fund debt service amount

of $6.7 million…”.

6. Please provide a detailed budget (including fund balances) for the Library System

Improvement Program Fund over the past three years. Please include a list of

current projects within the program detailing the cost of each project and their

current balance of funds.

Please refer to Attachment 3 for fund balances over the past three years and a list of

current Capital Improvement Projects (CIP). The $10.2 million in fund balance at the end

of Fiscal Year 2009 will be used to fund the current year CIP budgeted expenditures of

$3.6 million, the Fiscal Year 2010 transfer of $4.3 million approved by the City Council

as part of the Fiscal Year 2010 Annual Budget, and the Fiscal Year 2011 transfer of $2.0

million approved by the City Council as part of the actions taken to mitigate the projected

Fiscal Year 2011 $179.1 million deficit.

7. Please provide a detailed budget (including fund balances) for the De Anza

Operating Fund over the past three years.

De Anza Operating Fund

Fund Balance Revenue Expense

Fiscal Year 2007 $1,419,357.82 $3,936,078.68 $2,674,748.15

Fiscal Year 2008 $4,123,936.82 $5,590,065.73 $2,885,486.73

Fiscal Year 2009 $6,694,447.82 $5,262,584.36 $2,692,073.36

8. Please provide a list of deferred maintenance projects which have been funded since

Fiscal Year 2007, with the source of funding for each project identified.

The list of deferred maintenance projects by source of funding is still being compiled,

and will be made available shortly.

9. Will the City need to identify an additional $51-73 million in cuts or new revenue by

June 2010 in order for the Fiscal Year 2011 Budget to be balanced, based upon the

most current projections in the Fiscal Year 2010 First Quarter Budget Monitoring

Report?

The projected deficit for Fiscal Year 2011 reported in the City’s 2011-2015 Five-Year

Financial Outlook took into consideration a large drop in major revenues in Fiscal Year

2010, a drop that was also identified in the Fiscal Year 2010 First Quarter Budget

Monitoring Report. The Financial Management Department will be monitoring revenues

throughout Fiscal Year 2010 and any changes to projected major revenues for Fiscal

Years 2010 and 2011 will be considered, along with the new Annual Required

Contribution (ARC) when it is determined, for the Mayor’s June Revision to the Fiscal

Year 2011 Proposed Budget. At that time, adjustments will be recommended to the

Proposed Budget if necessary.

Attachments: 1. PowerPoint Presentation: Fiscal Years 2010/2011 Budget Overview $179M

Deficit

2. Memorandum: Use of Capital Outlay Fund for Payment of Debt Service

3. Library System Improvement Fund, Fiscal Years 2008-2010

Attachment 1

Attachment 2

Attachment 3

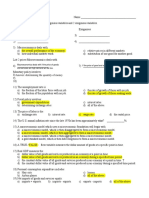

Library System Improvement Fund

Fund Balance

Fiscal Year 2007 $14,171,777.00

Fiscal Year 2008 $14,590,831.00

Fiscal Year 2009 $10,236,644.26

FY 2010 Capital Improvement Projects

Year-to-Date

Remaining Expenditures and Year-to-Date

Available Encumbrances, as of Balance, as of

Description Project Budget 12-17-2009 12-17-2009

Skyline Hills Library $182,803 $50,000 $130,303

University Heights Library $23,571 $0 $23,571

College Heights Branch $72,508 $0 $72,508

San Diego Main Library $203,391 $174,950 $28,440

Logan Heights Branch Library $2,534,012 $1,450,619 $1,083,394

Balboa Branch Library $71,572 $56,255 $15,316

North Park Library $451,519 $0 $451,519

Paradise Hills Library $39 229

$39,229 $0 $39 229

$39,229

Scripps Miramar Ranch Library $24,708 $0 $24,708

Rancho Bernardo Library $8,207 $0 $8,207

Fund Balance $3,611,519 $1,731,824 $1,877,195

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- 2.2 MultiplierDocument51 pages2.2 Multipliersamira2702Pas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Bank of England StructureDocument1 pageBank of England StructureMUHAMMADLM100% (3)

- SK Approves 2023 Annual Investment PlanDocument2 pagesSK Approves 2023 Annual Investment PlanCazy Mel EugenioPas encore d'évaluation

- Excel Template Chapter 7 Payroll Project Short Version 1Document71 pagesExcel Template Chapter 7 Payroll Project Short Version 1Vipul Bhalara33% (24)

- Homework 1 PDFDocument6 pagesHomework 1 PDFjnm,Pas encore d'évaluation

- LTE, State of City Address Response, 1-15-10, LLDocument1 pageLTE, State of City Address Response, 1-15-10, LLapi-25966063Pas encore d'évaluation

- List of Deferred Maintenance Projects, Funded by $103 M Bond, 3-19-09Document2 pagesList of Deferred Maintenance Projects, Funded by $103 M Bond, 3-19-09api-25966063Pas encore d'évaluation

- CalPERS Presentation - A Look Into The FutureDocument63 pagesCalPERS Presentation - A Look Into The Futureapi-25966063Pas encore d'évaluation

- Letter To City of San Diego Re Main Library Opposition, 10-23-09, LLDocument2 pagesLetter To City of San Diego Re Main Library Opposition, 10-23-09, LLapi-25966063Pas encore d'évaluation

- Letter To UT Editor, 12-13-09 Stetz Column, Public Pensions, 12-15-09, LLDocument1 pageLetter To UT Editor, 12-13-09 Stetz Column, Public Pensions, 12-15-09, LLapi-25966063Pas encore d'évaluation

- 10 22 09 Partnership LuncheonDocument1 page10 22 09 Partnership Luncheonapi-25966063Pas encore d'évaluation

- IPR Coalition, 10-20-09Document1 pageIPR Coalition, 10-20-09api-25966063Pas encore d'évaluation

- New Blue Fact SheetDocument1 pageNew Blue Fact Sheetapi-25966063Pas encore d'évaluation

- City Response PHR ParkDocument2 pagesCity Response PHR Parkapi-25966063Pas encore d'évaluation

- UT, NCTimes, and OCRegister Pension Editorials, 10-13-09, AHDocument6 pagesUT, NCTimes, and OCRegister Pension Editorials, 10-13-09, AHapi-25966063Pas encore d'évaluation

- FRBM ActDocument2 pagesFRBM ActSpideycodPas encore d'évaluation

- A Note On The Determinants and Consequences of OutsourcingDocument28 pagesA Note On The Determinants and Consequences of OutsourcingHobz KaderPas encore d'évaluation

- Calamba Doctors' College student council election platformsDocument2 pagesCalamba Doctors' College student council election platformsJohn Carlo LalapPas encore d'évaluation

- Macroeconomic Analysis and Policies PDFDocument3 pagesMacroeconomic Analysis and Policies PDFRKPas encore d'évaluation

- IMF Regional Economic Outlook Sub-Saharan Africa April 2016Document137 pagesIMF Regional Economic Outlook Sub-Saharan Africa April 2016The Independent MagazinePas encore d'évaluation

- Major Changes To Enhanced STAR and Senior Exemption RenewalsDocument1 pageMajor Changes To Enhanced STAR and Senior Exemption RenewalsNewzjunkyPas encore d'évaluation

- Taxation Chapter 8 Multiple Choice QuestionsDocument8 pagesTaxation Chapter 8 Multiple Choice QuestionsSimbePas encore d'évaluation

- ACCA F7 December 2013 Q1 Workings Consolidated Financial StatementsDocument3 pagesACCA F7 December 2013 Q1 Workings Consolidated Financial StatementsKian TuckPas encore d'évaluation

- Practice Quiz-3 With AnswersDocument5 pagesPractice Quiz-3 With Answersvik05345Pas encore d'évaluation

- Assignment - Credit PolicyDocument10 pagesAssignment - Credit PolicyNilesh VadherPas encore d'évaluation

- 3.1 Indirect TaxesDocument4 pages3.1 Indirect TaxesmuskaanPas encore d'évaluation

- Rhetorical Analysis Paper - Revised English 1010Document7 pagesRhetorical Analysis Paper - Revised English 1010api-302840500100% (2)

- Panteion University, Greece: T.panagiotidis@lboro - Ac.ukDocument18 pagesPanteion University, Greece: T.panagiotidis@lboro - Ac.ukHerlan Setiawan SihombingPas encore d'évaluation

- 2.4 Fiscal PolicyDocument28 pages2.4 Fiscal PolicyBunty MahanandaPas encore d'évaluation

- AD-AS MODELDocument29 pagesAD-AS MODELsenthilbala100% (1)

- Ed Ex ExtraDocument99 pagesEd Ex ExtraKaran JhaveriPas encore d'évaluation

- Effect of Monetary Policy On Real Sector of NepalDocument6 pagesEffect of Monetary Policy On Real Sector of Nepalmr_vishalxpPas encore d'évaluation

- Business Math Notes PDFDocument12 pagesBusiness Math Notes PDFCzareena Sulica DiamaPas encore d'évaluation

- Monetory Policy AssignmentDocument6 pagesMonetory Policy AssignmentAwais AhmadPas encore d'évaluation

- IDOC to Application Mapping DocumentDocument44 pagesIDOC to Application Mapping DocumentLâmNhậtYếnThanhPas encore d'évaluation

- House Hearing, 107TH Congress - President's Tax Relief Proposals: Individual Income Tax RatesDocument144 pagesHouse Hearing, 107TH Congress - President's Tax Relief Proposals: Individual Income Tax RatesScribd Government DocsPas encore d'évaluation

- Belgrade Insight Issue No118Document9 pagesBelgrade Insight Issue No118Raca ZivkovicPas encore d'évaluation

- Global POVEQ NGADocument2 pagesGlobal POVEQ NGABonifacePas encore d'évaluation

- Loan Payment CalculatorDocument2 pagesLoan Payment CalculatorSandeep KumarPas encore d'évaluation

- ADS 404 Chapter 8 2018Document28 pagesADS 404 Chapter 8 2018NURATIKAH BINTI ZAINOLPas encore d'évaluation