Académique Documents

Professionnel Documents

Culture Documents

When Should You Start Cashing in On Social Security?

Transféré par

healthyzero9332Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

When Should You Start Cashing in On Social Security?

Transféré par

healthyzero9332Droits d'auteur :

Formats disponibles

When should you start cashing in on Social Security?

FORTUNE -- Year-end festivities are usually approaching, together with Hanukkah lights nearing

their peak, Christmas lights likely up, and the New Year's celebration virtually upon us. Thus

selection time as compared to the season of mild can there be to chat regarding ... mortality?

No, I'm certainly not raising this gloomy subject just to be contrarian in a period of widespread

celebrations. I'm raising it throughout Fortune's Investor's guide simply because among probably

the actual most interesting investment decisions which you might have got to produce (or may

possess already made) involves estimating just how long you're likely to live.

This selection doesn't involve stocks or even bonds. That involves Social Safety retirement benefits.

Here's the actual deal, throughout grossly simplified form, which is the simply real approach to deal

with Social security questions without having bogging down. In the actual event that you've got your

requisite ten years of employment (or are already married of sufficient length to become able to

somebody with the requisite 10 years), you can start drawing Social security retirement advantages

whenever anyone want coming from ages 62 to 70. Your earlier a person begin taking money, the

actual much less money an individual obtain a year. The Actual later on an individual begin, the

greater you get.

MORE: Electronic payments are generally settling pertaining to Mexico

For example, from 62, you receive 75% of your typical retirement benefit. at 66, you receive 100%.

at 70 it's 132%. Every year waiting from 62 on increases your own advantages through concerning

8%.

Social security doesn't care whenever you begin getting the money, because those obtaining lower

payments with regard to longer intervals cost your system exactly your same as people acquiring a

greater payment regarding shorter periods. Nevertheless when you're taking your cash could

produce a huge difference in order to you collectively with your own survivors, as you'll see.

There are usually drawbacks to getting benefits with 62 if an individual are employed. I talk about

these and in addition the assumptions upon which usually this column is based at the bottom of the

page. In 66, however, there are not any penalties. That's if the decision gets purely economic.

The conventional wisdom is actually to must wait until you're 70 to attract advantages in the event

you can easily afford to, because every year you wait raises your payments by regarding 8% -- think

about waiting as longevity insurance. In the particular event that an individual allow it to always be

able to be for your mid-eighties or even longer, you'd do better for you to wait. Your rough math: In

case instead of having 100% in 66 you begin collecting 132% at 70, it will take 12 years

regarding in which 32% distinction in order to equal the 4 years of advantages you'd get collected

starting at 66.

MORE: Giant pool of money that ate your U.S. not as awful as initially thought

So in the wedding you stay for your mid-eighties or even longer, shipped for you to you big. However

of course there's a new risk: If you do not collect anything and also die at, say, 69 and also 11

months, a person (and your survivors) obtain nothing. It's what's known in the insurance biz as

mortality risk.

Once you're 66, it's tough to quit 8% any year, especially these days. Yet there's in which pesky

mortality risk: both my parents died inside their early seventies. Consequently i want to demonstrate

the actual middle path in which my wife as well as I made a determination to follow. We began to

always be able to collect Social Safety two years ago, when I turned 67. (She's somewhat younger as

compared to I am.) Consequently have we walked away from your prospect better income? Not

Necessarily totally.

We've been using our monthly Social Safety rewards and investing them, primarily throughout

individual dividend-paying stocks. In case we are generally in any position to earn 4% or perhaps 5%

a year through these investments, celebrate up for a great part of the 8% Social Safety increase that

we're forgoing. As Well As whom knows, maybe we'll make even more. Meanwhile, it hedges our

mortality danger along with leaves us far better off if 1 as well as each people don't make it for you

to our eighties.

With luck, I'll be in a position to create a follow-up column many years coming from now and also

permit you understand how our hybrid Social Safety strategy features turned out. but throughout

deference to the season, I'll quit becoming depressing. Enjoy your year-end lights.

-----------------------

How it works

If anyone opt to take retirement advantages with ages 62 by means of 65 as well as 11 months, a

part of your current benefit can be deferred in the event you make more than a new specific amount

-- at present $15,120 annually -- through working. Social Safety defers one dollar out of your

advantage for every a couple of money anyone earn over the threshold. The Particular deferred

amount goes to boost the benefits which you find beginning at get older 66 (or, under a few

circumstances, later).

There's any 2nd earnings test, far more complex as compared to the first one, which relates to your

wages inside the yr that you flip 66. That involves simply how much you're making within the a

number of months prior to the 66th birthday. I can't commence to explain it.

However, as long when you hold again until anyone turn 66 (or later) to start out using benefits,

neither test will pose a problem.

A further note: I can't assist a person to deal with just about any problems you could possess along

with Social security as well as assist a person to understand what rules cover you. Please consult

your Social security Administration or even an outside expert regarding help. This specific stuff can

be quite complicated, in order to repeat the least.

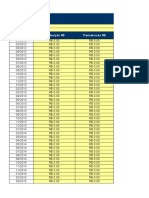

Here would end up being the Social Safety rewards that people born by means of Dec. 31, 1954

would get, as a share regarding their "primary insurance amount," by beginning to consider

retirement payments from ages ranging from 62 (the earliest allowable date) in order to 70 (the

latest date).

Age Percentage

62 75%

63 80%

64 86.6667%

65 93.3333%

66 100%

67 108%

68 116%

69 124%

70 132%

In my column, I tried to keep issues easy by simply saying that each year right after 62 that you wait

around in order to collect rewards raises the advantage amounts by simply regarding 8%. Please

note the particular "about." Since you are able to always be able to see from your figures above, it is

actually not the straight series improve associated with 8% a new year.

These figures apply only to folks born via the end of 1954. Presently there are very different

quantities for people born in 1955 or perhaps later. Your regular retirement age rises for you to 66

and a new pair of weeks for folks born throughout 1955 and also increases simply by two months

annually until it reaches 67 for folks born within 1960 and also later.

Note: Most the particular numbers here assume in which Social Security's benefit formula remains

unchanged. However, I expect the actual system in order to change at a few point regarding long

term recipients, along with potentially with regard to existing recipients like my wife and also me,

who're drawing maximum benefits with regard to our group simply because my employers and I

compensated maximum Social Safety tax regarding more than 35 years.

Source: Fortune, depending on details from the Social Safety Administration

A shorter edition of this story appeared within the December 23, 2013 issue regarding Fortune.

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (120)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The New Industrial Policy-1991: - Liberalization - Privatization - GolbalizationDocument15 pagesThe New Industrial Policy-1991: - Liberalization - Privatization - GolbalizationBhavyePas encore d'évaluation

- Careerguru - PK: Inspector Inland Revenue Important McqsDocument5 pagesCareerguru - PK: Inspector Inland Revenue Important McqsWaqas Vicky100% (2)

- Harmonized System 2017Document55 pagesHarmonized System 2017Abdul Ghaffar100% (1)

- How To Invest For Financial Freedom in PakistanDocument5 pagesHow To Invest For Financial Freedom in PakistanAnonymous DlNhQiPas encore d'évaluation

- Asia Competitiveness ForumDocument2 pagesAsia Competitiveness ForumRahul MittalPas encore d'évaluation

- What Is Shock Therapy?Document4 pagesWhat Is Shock Therapy?MAITREE VYASPas encore d'évaluation

- Jarl Moe - Think About Inheritance TaxDocument3 pagesJarl Moe - Think About Inheritance TaxJarl MoePas encore d'évaluation

- Financial Repression - Economic Growth Ne PDFDocument13 pagesFinancial Repression - Economic Growth Ne PDFRazaPas encore d'évaluation

- Circular DebtDocument14 pagesCircular DebtNaina MukhtarPas encore d'évaluation

- Krugman and Wells CH 17Document6 pagesKrugman and Wells CH 17Nayar Rafique100% (1)

- Amended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesDocument2 pagesAmended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any Changesgolcha_edu532Pas encore d'évaluation

- Macroeconomic Theory SyllabusDocument3 pagesMacroeconomic Theory SyllabusromirrcPas encore d'évaluation

- Global Imbalances: Olivier Blanchard Mexico City, May 2007Document20 pagesGlobal Imbalances: Olivier Blanchard Mexico City, May 2007shahPas encore d'évaluation

- Inflation and Unemployment: What Is The Connection?Document24 pagesInflation and Unemployment: What Is The Connection?sajid93Pas encore d'évaluation

- About The IMF2Document10 pagesAbout The IMF2Subhobrata MukherjeePas encore d'évaluation

- 3.6 - PLANILHA Celesc INPC Distribuicao Transmissao Encargos 01Document8 pages3.6 - PLANILHA Celesc INPC Distribuicao Transmissao Encargos 01AugustoAdvPas encore d'évaluation

- The Effects of Government Expenditure On Economic GrowthDocument16 pagesThe Effects of Government Expenditure On Economic GrowthMilan Deskar-ŠkrbićPas encore d'évaluation

- Lesson 19 International TradeDocument31 pagesLesson 19 International TradeJohn Christopher Verdejo RamirezPas encore d'évaluation

- Voluntary Retirement SchemeDocument6 pagesVoluntary Retirement Schemenidskhurana100% (3)

- Accruals and PrepaymentsDocument2 pagesAccruals and PrepaymentsMasud AhmedPas encore d'évaluation

- 6 IpeDocument46 pages6 IpeFarhan NawazPas encore d'évaluation

- Cir VS PLDTDocument1 pageCir VS PLDTKling KingPas encore d'évaluation

- 1proceedings EKCC DEC 2018 PDFDocument696 pages1proceedings EKCC DEC 2018 PDFVeronica BulatPas encore d'évaluation

- Federal Block GrantsDocument9 pagesFederal Block GrantsJoe AdamsPas encore d'évaluation

- Martinez Aed Lesson Plan 11-18-14Document5 pagesMartinez Aed Lesson Plan 11-18-14api-273088531Pas encore d'évaluation

- Economy,: Why Study Public Finance? Facts On Government in The United States and Around The WorldDocument1 pageEconomy,: Why Study Public Finance? Facts On Government in The United States and Around The WorldpenelopegerhardPas encore d'évaluation

- The BCC Compounding Machine!: Amout Left After ReinvestDocument144 pagesThe BCC Compounding Machine!: Amout Left After ReinvestSathish AmiresiPas encore d'évaluation

- Currency BoardDocument4 pagesCurrency BoardAMEP09Pas encore d'évaluation

- M. Setterfield Ed. - Complexity, Endogenous Money and Macroeconomic TheoryDocument436 pagesM. Setterfield Ed. - Complexity, Endogenous Money and Macroeconomic Theoryglamis100% (1)

- Supplement: Comparative Economic DevelopmentDocument42 pagesSupplement: Comparative Economic Developmentkhup gwtePas encore d'évaluation