Académique Documents

Professionnel Documents

Culture Documents

Parrish Answer Brief (Fla. 4th DCA)

Transféré par

DanielWeingerCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Parrish Answer Brief (Fla. 4th DCA)

Transféré par

DanielWeingerDroits d'auteur :

Formats disponibles

IN THE DISTRICT COURT OF APPEAL OF THE STATE OF FLORIDA

FOURTH DISTRICT

CASE NO. 4D14-101

LOWER CASE NO. 13-023090

BOARD OF COUNTY COMMISSIONERS

BROWARD COUNTY, etc.,

Appellant

vs.

LORI PARRISH, etc.,

Appellee

_______________________________/

ANSWER BRIEF OF LORI PARRISH

WILLIAM R. SCHERER BRUCE S. ROGOW

DANIEL S. WEINGER, ESQ. TARA A. CAMPION

CONRAD & SCHERER, LLP BRUCE S. ROGOW, P.A.

Counsel for Appellee Counsel for Appellee

633 South Federal Highway 500 E. Broward Blvd. #1930

Fort Lauderdale, FL 33301 Fort Lauderdale, FL 33394

Telephone: (954) 462-5500 Telephone: (954) 767-8909

Facsimile: (954) 463-9244 Facsimile: (954) 764-1530

wscherer@conradscherer.com brogow@rogowlaw.com

dswpleadings@conradscherer.com tcampion@rogowlaw.com

eservice@conradscherer.com

E-Copy Received Apr 14, 2014 3:37 PM

ii

Table of Contents

Table of Contents ............................................................................................ ii

Table of Authorities ....................................................................................... iii

Preface ............................................................................................................. 1

Statement of Case and Facts ........................................................................... 2

Summary of Argument ................................................................................... 8

Argument ...................................................................................................... 10

I. Standard of Review ............................................................................. 10

II. The Trial Court Correctly Found the Property Appraiser is Entitled

to a Writ of Mandamus Requiring the County Commission to Perform the

Ministerial Act of Issuing Payments to the Property Appraiser for the

Property Appraisers DOR FY-2014 Final Budget .................................. 10

III. The Writ of Mandamus Issued by the Trial Court Does Not Violate

the Separation of Powers Doctrine ........................................................... 18

Conclusion .................................................................................................... 21

Certificate of Service .................................................................................... 23

Certificate of Type Size and Style ................................................................ 23

iii

Table of Authorities

Cases

Anthony v. Gary J. Rotella & Assocs., P.A.,

906 So.2d 1205 (Fla. 4th DCA 2005) ....................................................... 10

Bailey v. State,

100 So. 3d 213 (Fla. 3d DCA 2012) ......................................................... 11

Brown v. State,

358 So. 2d 16 (Fla. 1978) ......................................................................... 20

Chiles v. Children A, B, C, D, E, & F,

589 So. 2d 260 (Fla. 1991) ................................................................. 19, 20

Coal. for Adequacy & Fairness in Sch. Funding, Inc. v. Chiles,

680 So. 2d 400 (Fla. 1996) ....................................................................... 19

Florida Dept. of Children & Families v. Y.C.,

82 So. 3d 1139 (Fla. 3d DCA 2012) ......................................................... 19

Harvard ex rel. J.H. v. Vill. of Palm Springs,

98 So. 3d 645 (Fla. 4th DCA 2012) .......................................................... 10

Huffman v. State,

813 So.2d 10 (Fla. 2000) .......................................................................... 10

Migliore v. City of Lauderhill,

415 So. 2d 62 (Fla. 4th DCA 1982) .......................................................... 11

Rosado v. State,

1 So.3d 1147 (Fla. 4th DCA 2009) ........................................................... 10

Shea v. Cochran,

680 So.2d 628 (Fla. 4th DCA 1996) ......................................................... 12

Turner v. Singletary

623 So.2d 537 (Fla. 1st DCA 1993) ......................................................... 10

Statutes

Fla. Stat. 129.01 ............................................................................................ 2

Fla. Stat. 192.091 ................................................................................. passim

Fla. Stat. 380.07 .......................................................................................... 16

Fla. Stat., 195.087 ................................................................................ passim

iv

Rules

Fla. R. App. P. 9.030(b)(1)(A) ........................................................................ 1

Other Authorities

Fla. Atty Gen. Op. 97-02 (1997) ................................................................... 14

1

Preface

This Answer Brief is submitted on behalf of LORI PARRISH, Petitioner

below.

Board of County Commissioners, Broward County, has appealed, pursuant

to Fla. R. App. P. 9.030(b)(1)(A), the final order of the trial court granting the

Petition for Writ of Mandamus of Petitioner, LORI PARRISH.

Board of County Commissioners, Broward County, is referred to as

Appellant, the County Commission, or the County.

LORI PARRISH is referred to as Appellee or the Property Appraiser.

The following symbols will be used:

R. ___ references are to the Record on Appeal.

I.B. ___ references are to the Initial Brief of Appellant.

Unless otherwise indicated, all emphasis is supplied by the writer.

2

Statement of Case and Facts

Appellee brought this action in her official capacity as Broward County

Property Appraiser, a constitutional officer, per Article VIII, (1)(d), Florida

Constitution. Appellant, the County Commission, is statutorily required to fund

the Property Appraisers budget as approved by the Florida Department of

Revenue (DOR). See Fla. Stat., 195.087, 192.091 and 129.01. Florida

Statutes, 195.087(1)(a) sets forth the procedure for approval of the Property

Appraisers budget, providing:

On or before J une 1 of each year, every property appraiser, regardless

of the form of county government, shall submit to the Department of

Revenue a budget for the operation of the property appraisers office

for the ensuing fiscal year beginning October 1. The property

appraiser shall submit his or her budget in the manner and form

required by the department. A copy of such budget shall be furnished

at the same time to the board of county commissioners. The

department shall, upon proper notice to the county commission and

property appraiser, review the budget request and may amend or

change the budget request as it deems necessary, in order that the

budget be neither inadequate nor excessive. On or before J uly 15, the

department shall notify the property appraiser and the board of county

commissioners of its tentative budget amendments and changes. Prior

to August 15, the property appraiser and the board of county

commissioners may submit additional information or testimony to the

department respecting the budget. On or before August 15, the

department shall make its final budget amendments or changes to

the budget and shall provide notice thereof to the property appraiser

and board of county commissioners. Consistent with the process laid

out above: (Emphasis added).

3

Pursuant to this statutory scheme, on May 31, 2013, the Property Appraiser

timely submitted its proposed FY-2014 budget

1

to the DOR for its review. (R. 16-

17.) The County Commission was also furnished a copy. (R. 17.) DOR reviewed

the Property Appraisers FY-2014 budget request to determine whether it needed

to amend or change the budget in order to ensure the Property Appraisers budget

was neither inadequate nor excessive. (R. 19.)

On J uly 11, 2013, the DOR issued notice to the Property Appraiser and the

County Commission of the tentative FY-2014 budget which included the DORs

amendments and changes to the Property Appraisers submission. (R. 18-27.) The

notice advised the County Commission and the Property Appraiser they could

submit any additional information or testimony prior to the DOR issuing the final

FY-2014 budget. (R. 19.)

In response to the DORs request, on August 12, 2013, Bertha Henry,

Broward County Administrator, on behalf of the County Commission, submitted

additional information to be considered by the DOR before it issued the final

approved FY-2014 budget. (R. 27-31.) Specifically, Ms. Henry advised the DOR

of the County Commissions recommended budget for the Property Appraiser,

which was less than the amount contained in the DORs tentative FY-2014 budget.

(R. 28.)

1

Fiscal Year 2014 (FY-2014) began on October 1, 2013, and runs through September 30,

2014.

4

On August 15, 2013, after considering the County Commissions

recommendations as provided by Ms. Henry, the DOR provided formal notice to

the Property Appraiser and the County Commission of the Property Appraisers

final budget in the amount of $18,712,207.00 (DOR FY-2014 Final Budget). (R.

32-40.)

On September 24, 2013, the County Commission held its final public

hearing on the Countys own budget, which was to include the DOR FY-2014

Final Budget as mandated by the Florida Statutes. (R. 41-86). Contrary to statute,

the County Commission voted to approve a County budget which did not include

the DOR FY-2014 Final Budget, but rather the Countys desired budget for the

Property Appraiser in the amount of $14,947,000.00, which had already been

rejected by the DOR. Id.

At the subsequent October 1, 2013 County Commission meeting, the County

Commission voted to appeal the DOR FY-2014 Final Budget to the Administration

Commission. (R. 87-158.) While there was significant discussion and even a

motion to amend the County Commissions budget to, as required by law, comply

with the DOR FY-2014 Final Budget while any appeal was pending, the County

Commission instead and again, without any legal authority, confirmed its

September 24th decision to impose its own budget on the Property Appraiser. (R.

87-158.)

5

Separate and apart from the County Commissions unilateral decision to

deviate from the legally mandated process, the Property Appraiser, in accordance

with Florida Statutes, 192.091 and as a consequence of the DOR FY-2014 Final

Budget, submitted to the County Commission its request for the statutorily

mandated quarterly draw based on the DOR approved budget. (R. 164.) The

quarterly draw, per the DOR FY-2014 Final Budget, totaled $4,140,881.75. Id.

On October 3, 2013, the County Commission advised the Property Appraiser it

would be providing only $3,963,750.00, thus withholding $177,131.75 in

operational funding for the quarter. (R. 161.) In so doing, the County Commission

unilaterally and without legal authority adjusted the amount to reflect the County

Commissions desired budget rather than the DOR FY-2014 Final Budget. Id.

Significantly, despite the County Commissions final action deviating from the

statutorily mandated payment, the County Commission conceded at both the

September 24th and the October 1st commission meetings that the DOR sets the

Property Appraisers budget and the County Commission must fulfill the DORs

directive even if the County Commission disagrees and even if the County

Commission chooses to appeal the DORs final budget. (R. 71-129.) For example,

the following statements were made, among others, by County Commissioners

and/or the County Attorney at the meetings:

MAYOR J ACOBS: The difference between these two

constitutional officers is one could go and basically thumb their

6

nose at what the Countys budget was and send a different

budget tothe Department of Revenueand it puts the

Property Appraiser in a significantly different position, because

[her] budgets gets submitted and approved [by the DOR] . . .

the Property Appraisers in a very unique position over the

other constitutional officers, and Im concerned about this.

(R. 71-74.)

COMMISSIONER KIAR: You mentioned it yourself Mayor

and others. The Property Appraiser is treated differently than

the other constitutional officers. . . . The difference is we owe

the Property Appraiser the money that the Department of

Revenue approved. We technically owe that money to her.

Thats money that were supposed to appropriate to [her].

If were upset with that, we can appeal to the cabinet. But we

have to appropriate that money. That is technically her money.

Its been approved by the Department of Revenue. Its been set

up that [way]. We owe her that money.

(R. 74.)

COMMISSIONER WEXLER: And for us, we need to we

need to, because I believe we have no choice here today . . . if

the Department of Revenue has set the Property Appraisers

budget, I believe we have to fulfill that directive; however we

have an appeal process that we can go down.

(R. 101.)

COMMSSIONER KIAR: I actually disrespectfully disagree

with [the issue of] whether or not we have to provide Ms.

Parrish this money.

She's different than the other constitutional officers. When the

Department of Revenue approves a budget that means we have

to give it to her. Shes entitled to it. I think that we need to

give it to her. And I know that its your legal opinion that we

give either the money that was appropriated in our budget or the

7

Department of Revenues but I dont believe theres any legal

authority to back that up. . . .

(R. 128-29.)

On October 9, 2013, the County Commission filed an appeal of the DOR

FY-2014 Final Budget to the Administration Commission, once again

acknowledging Section 195.087(1), Florida Statutes, gives [the DOR]

unrestrained and unrestricted authority to establish county budgets. Shortly

thereafter, the Property Appraiser filed a Petition for Writ of Mandamus on the

grounds that the County Commissions unlawful withholding of $177,131.75 in the

quarterly draw of the DOR FY-2014 Final Budget is an essential departure from

the requirements of law and due process, and will cause the Property Appraiser

irreparable material harm by preventing the Property Appraiser from performing

her statutory duty. (R. 1-164.) The trial court agreed and entered a Writ of

Mandamus on December 31, 2013. (R. 328-30.) This appeal follows.

8

Summary of Argument

Because the County Commissions duty to adhere to the DORs final budget

is wholly ministerial, the trial court correctly found its refusal to fully fund the

Property Appraiser warranted mandamus relief, as it is the precise type of agency

inaction mandamus is designed to redress.

The Property Appraiser has a clear legal right pursuant to Florida Statutes

192.091 to receive payment in full from the County Commission for the Property

Appraisers DOR FY-2014 Final Budget. There is nothing discretionary about the

mandates in 192.091 that the budget approved by the DOR shall be the basis

upon which the tax authorities shall be billed and payments shall be made

quarterly. Accordingly, unless and until the Governor and Cabinet, sitting as the

Administration Commission, amend the Property Appraisers DOR FY-2014 Final

Budget, the budget stands as approved and must be proportionately funded by the

County Commission.

The only governmental body with the authority to amend the DOR final

budget is the Governor and the Cabinet sitting as the Administration Commission

and only then if it finds that any aspect of the budget is unreasonable in light of

the workload of the office of the property appraiser. Fla. Stat., 195.087(1)(b).

There is, however, nothing in 195.087 to suggest the county commission is

relieved of its statutorily mandated duties to adhere to the DORs final budget and

9

make the full quarterly payment by merely filing an appeal with the Administration

Commission. If the legislature intended the County to receive an automatic stay

pending an appeal to the Administration Commission, it would have provided for

one.

The Writ of Mandamus issued by the trial court does not violate the

separation of powers doctrine. The claim that the trial courts writ violates the

separation of powers doctrine is no more persuasive than the Countys claim that it

had the discretion to refuse to fully fund the budget in the first place. Similarly,

the Countys assertion that the writ interferes with the discretion of the

Administration Commission completely misses the mark. The writ entered by the

trial court does nothing to interfere with the Administration Commissions

discretion to amend the final budget. Instead, in issuing the writ the court simply

found that under the clear language of Chapters 192 and 195, the County has no

discretion to deviate from the DORs final budget unless and until the

Administration Commission chooses to exercise its discretion.

10

Argument

I. STANDARD OF REVIEW

The standard of review from a trial courts decision on a petition for writ of

mandamus is abuse of discretion except to the extent the appellate court must

interpret a statute, in which case the review is de novo. See Harvard ex rel. J.H. v.

Vill. of Palm Springs, 98 So. 3d 645, 646 (Fla. 4th DCA 2012) (citing Rosado v.

State, 1 So.3d 1147, 1148 (Fla. 4th DCA 2009), and Anthony v. Gary J. Rotella &

Assocs., P.A., 906 So.2d 1205 (Fla. 4th DCA 2005)).

II. THE TRIAL COURT CORRECTLY FOUND THE

PROPERTY APPRAISER IS ENTITLED TO A WRIT OF

MANDAMUS REQUIRING THE COUNTY COMMISSION TO

PERFORM THE MINISTERIAL ACT OF ISSUING

PAYMENTS TO THE PROPERTY APPRAISER FOR THE

PROPERTY APPRAISERS DOR FY-2014 FINAL BUDGET

A petitioner seeking a writ of mandamus must show a clear legal right to the

requested relief, the respondent has an indisputable legal duty to perform the

requested action, and there is no other adequate remedy available. See Huffman v.

State, 813 So.2d 10, 11 (Fla. 2000). Although a writ of mandamus cannot be used

to compel a public agency clothed with discretion to exercise its discretion in a

particular manner, see Turner v. Singletary, 623 So.2d 537, 538 (Fla. 1st DCA

1993), it is axiomatic that mandamus will lie when a public agency fails to perform

a ministerial duty which requires no discretion. See Bailey v. State, 100 So. 3d

11

213, 219 (Fla. 3d DCA 2012) (To be entitled to a writ of mandamus, the

petitioner must show the existence of a clear legal right on his or her part, a

ministerial duty on the part of the respondent, and the absence of any other

adequate legal remedy); Migliore v. City of Lauderhill, 415 So. 2d 62, 63 (Fla. 4th

DCA 1982) approved, 431 So. 2d 986 (Fla. 1983) (It has long been established

that mandamus lies to compel the performance of a specific imperative ministerial

duty). Because the County Commissions duty to adhere to the DORs final

budget is wholly ministerial, the trial court correctly found that its refusal to fully

fund the Property Appraiser warranted mandamus relief. The Countys refusal to

follow the law is the precise type of agency inaction mandamus is designed to

redress.

The Property Appraiser has a clear legal right pursuant to Florida Statutes

192.091 to receive payment quarterly, and in full, from the County Commission

based on the Property Appraisers DOR FY-2014 Final Budget. The statute

provides:

(1)(a) The budget of the property appraiser's office, as approved by

the Department of Revenue, shall be the basis upon which the several

tax authorities of each county, except municipalities and the district

school board, shall be billed by the property appraiser for services

rendered. Each such taxing authority shall be billed an amount that

bears the same proportion to the total amount of the budget as its

share of ad valorem taxes bore to the total levied for the preceding

year. All municipal and school district taxes shall be considered as

taxes levied by the county for purposes of this computation.

12

(b) Payments shall be made quarterly by each such taxing

authority

See Fla. Stat. 192.091(1)(a)-(b). (Emphasis added).

The fatal flaw in the Countys argument is its failure to recognize the

difference between shall and may. There is nothing discretionary about the

mandate of 192.091 that the budget approved by the DOR shall be the basis

upon which the tax authorities shall be billed and payments shall be made

quarterly. Therefore, unless and until the Governor and Cabinet, sitting as the

Administration Commission, amend the Property Appraisers DOR FY-2014 Final

Budget, the budget stands as approved and must be proportionately funded by the

County Commission.

The action requested from the County Commission is a textbook example of

a ministerial act. A duty or act is defined as ministerial when there is no room for

the exercise of discretion, and the performance being required is directed by law.

Shea v. Cochran, 680 So.2d 628, 629 (Fla. 4th DCA 1996) (citations omitted).

Once the DOR approved and made final the Property Appraisers FY-2014 budget,

on August 15, 2013, the County Commission had an indisputable and non-

discretionary duty per Florida Statutes, 192.091 and 195.087, to fund the

Property Appraisers annual operational budget.

Although 195.087(1)(a) provides that a copy of the Property Appraisers

proposed budget be furnished to the Board of County Commissioners, it does not

13

provide for, or otherwise require, approval by the County Commission. In fact, the

County Commission is not even invited to participate in the process until after the

DOR reviews and makes the amendments it deems necessary to the Property

Appraisers proposed budget and issues same. Even then, the County

Commissions participation is limited to providing the DOR additional information

or testimony prior to DOR issuing a final budget.

The County Commission relies on Florida Statutes section 195.087(1)(b) to

argue the DOR budget does not become final until it is amended by the

Administration Commission, but its submission omits critical language which

belies the Countys submission:

The Governor and Cabinet, sitting as the Administration Commission,

may hear appeals from the final action of the department upon a

written request being filed by the property appraiser or the presiding

officer of the county commission no later than 15 days after the

conclusion of the hearing held pursuant to s. 200.065(2)(d). The

Administration Commission may amend the budget if it finds that any

aspect of the budget is unreasonable in light of the workload of the

office of the property appraiser in the county under review. The

budget request as approved by the department and as amended by the

commission shall become the operating budget of the property

appraiser for the ensuing fiscal year beginning October 1, except

that the budget so approved may subsequently be amended under

the same procedure. (Emphasis added) (Emphasized portion omitted

by County).

14

Viewing the final sentence in its entirety, it is clear the Property Appraisers

final budget is subject to amendment throughout the entire year.

2

The Countys

misbegotten view of the language leads to the illogical conclusion that the budget

could never become final because it is always subject to amendment. When

reading sections sections 192.091 and 195.087 in pari materia, it is obvious the

final action of the Department of Revenue is the final budget unless and until the

final budget is amended (either through an appeal to the Administration

Commission or through a subsequent budget amendment request), at which point

the amended budget becomes the final budget in its stead. There is nothing in

these statutes to suggest, however, that the County Commission is authorized to

usurp the discretionary function of the Department of Revenue and ignore its own

mandatory duty to fund the approved budget.

In Fla. Atty Gen. Op. 97-02 (1997), the Attorney General was asked, under

the same statutory scheme, whether the budget of the county tax collector was

subject to approval from the DOR, the board of county commissioners, or both.

The AG found the DOR was solely responsible for the tax collectors budget under

195.087.

2

This is consistent with the formal notice of the final budget provided on August 15 by the

DOR, in which the Departments Budget Supervisor advised this final budget, as approved by

the Department of Revenue, may only be amended through a budget amendment requested by

the Property Appraiser or an appeal to the Governor and Cabinet sitting as the Administration

Commission. (R. 33).

15

The board of county commissioners may address objections or

concerns regarding the budget of the tax collector to the Department

of Revenue. However, it is the department that is charged under the

statute with determining whether the budget is adequate. Once such a

determination has been made by the department, the statute prohibits a

reduction or increase without the departments approval.

Nevertheless, the County Commission violated the prohibition by reducing the

Property Appraisers budget without so much as seeking, much less receiving, the

DORs approval.

The only governmental body with the authority to amend the DOR final

budget is the Governor and the Cabinet sitting as the Administration Commission

if it finds that any aspect of the budget is unreasonable in light of the workload of

the office of the property appraiser. Fla. Stat., 195.087(1)(b). There is nothing

in 195.087 to suggest that filing an appeal to the Administration Commission

relieves the Commission of its statutorily mandated duties to adhere to the DORs

final budget and to make full quarterly payments to the Property Appraiser.

Critically, under the express language of section 195.087(2), the review by the

Administration Commission is not even mandatory, but wholly discretionary: The

Governor and Cabinet, sitting as the Administration Commission, may hear

appeals. (Emphasis added). Thus, if there were no court ordered relief, as was

obtained here, the Property Appraiser could only sit by while the County

Commission files an appeal which may never be heard. There is no timetable for

the appeal to the Administration Commission even if granted. In fact, as of the

16

time of filing this brief, the Administration Commission has still not given any

indication as to when or if it will consider the Countys appeal. Clearly the remedy

is mandatory relief to preserve the Property Appraisers right to the funds.

If the Legislature intended the County to receive an automatic stay pending

an appeal to the Administration Commission, it would have provided it. Florida

Statutes 380.07, which concerns appeals to the Florida Land and Water

Adjudicatory Commission from certain development orders by property owners,

developers, or state land planning agencies, provides an example of the legislature

doing that. The Florida Land and Water Adjudicatory Commission has the same

makeup as the Administration Commission (i.e., it is composed of the Governor

and the Cabinet). However, unlike appeals to the Administration Commission

under 195.087(2), appeals to the Florida Land and Water Adjudicatory

Commission pursuant to 380.07 trigger an automatic stay. See Fla. Stat.

380.07(4) (The filing of the petition stays the effectiveness of the order until

after the completion of the appeal process).

By not including a similar stay provision in 195.087, the legislature

intended what is evident from the statute itself: county commissions are required to

perform their ministerial duties of funding the Department of Revenues final

budgets until such time as the Administration Commission chooses to exercise its

discretion whether to amend. The difference in the procedure between the two

17

statutes makes sense in light of the nature of the interests at stake. The Florida

Land and Water Adjudicatory Commission hears appeals from development

orders, therefore it is logical to maintain the status quo until the appeal is heard.

Conversely, the County Commissions failure to fund the budget interferes with

the operations of a constitutionally mandated office, requiring compliance pending

any budget review.

There can be no doubt if the County Commission completely withheld all

funds from the Property Appraiser, the fact it filed an appeal under section 195.087

could not prevent the Property Appraiser from seeking the performance of its

ministerial task through a mandamus petition. Withholding less than the amount

budgeted by the DOR is a distinction of degree having no bearing on the

dereliction of the mandatory duty to pay quarterly the full portion of the DOR FY

approved budget.

While the County Commission has the legal right to ask the Administration

Commission to retroactively amend the DOR FY-2014 Final Budget, nothing in

Florida law gives the County Commission the legal right to withhold any of the

approved funds from the Property Appraiser in the interim. A writ of mandamus is

the Property Appraisers only legal remedy to seek recovery of the withheld DOR

FY-2014 Final Budget funds and compel the County Commission to comply with

its statutory duty.

18

III. THE WRIT OF MANDAMUS ISSUED BY THE TRIAL

COURT DOES NOT VIOLATE THE SEPARATION OF

POWERS DOCTRINE

Although raised as the first argument in its Initial Brief, the County

Commissions claim that the writ entered by the trial court violates the separation

of powers doctrine was only, at best, tangentially raised in the trial court. In any

event, the argument is without merit.

The County claims [t]he trial court encroached on the power of the states

executive branch by ordering, on an indefinite interim basis, relief that only the

Administration Commission is empowered to grant. (I.B. at p. 9.) Although the

Administration Commission is the only body from which the County can seek

relief, it is not an encroachment to have a court compel, in the interim, the

Countys mandatory duty to perform its ministerial function.

The Countys assertion that the writ interferes with the discretion of the

Administration Commission completely misses the mark. The writ entered by the

trial court does nothing to interfere with the Countys appeal to the Administrative

Commission and the Administration Commissions discretion to amend the final

budget. In issuing the writ the court simply found that, under the clear language of

Chapters 192 and 195, the County has no discretion to deviate from the DORs

final budget unless and until the Administration Commission chooses to exercise

its discretion.

19

While the cases offered by the County speak of legal principles related to

separation of powers, they have no bearing here, where the County had no

discretion to act and the writ does not interfere with the Administration

Commissions ultimate discretion. For example, in Florida Dept. of Children &

Families v. Y.C., 82 So. 3d 1139, 1142 n.8 (Fla. 3d DCA 2012), the court

recognized the separation of powers doctrine is violated where a court on its own

motion agrees to require executive action which is otherwise within the executive

agencys own discretion. As discussed supra, there is nothing discretionary about

the Countys obligations to fully fund the Property Appraisers DOR final budget.

See Fla. Stat. 192.091(1)(a)-(b) (The budget of the property appraiser's office, as

approved by the Department of Revenue, shall be the basis [e]ach such taxing

authority shall be billed [p]ayments shall be made quarterly) (emphasis

supplied).

The Countys reliance upon cases concerning appropriations of funds is

similarly unavailing. In Coal. for Adequacy & Fairness in Sch. Funding, Inc. v.

Chiles, 680 So. 2d 400 (Fla. 1996), the plaintiffs sought declaratory relief that the

state failed to allocate adequate resources for a uniform system of free public

schools. Id. at 402. The court found, under the Florida Constitution, it was up to

the legislature to determine how much money to appropriate to education. In

Chiles v. Children A, B, C, D, E, & F, 589 So. 2d 260 (Fla. 1991), the court

20

recognized that the legislature may not delegate its powers, and under the

separation of powers doctrine, [a]ny attempt by the legislature to abdicate its

particular constitutional duty is void. Id. at 264. This case has nothing to do with

the legislative or executive branches abdicating their powers. Nor does it involve

an appropriation of funds by the court. In fact, the writ issued by the trial court

here merely insures compliance with the Property Appraisers Department of

Revenue FY 2014 Final Budget. The writ also serves to undo the County

Commissions misappropriation of the Property Appraisers funds. The

Administration Commissions power to amend the budget is wholly unaffected by

the writ. As the trial court recognized, the writ is not intended to usurp the

budgetary authority of . . . the Administration Commission . . . but merely directs

[the County Commission] to comply and discharge their ministerial act of funding

the budget for [the Property Appraiser], as approved or subsequently amended by

the DOR. (R. 328-30.) (Emphasis in original).

Finally, the County, quoting Brown v. State, 358 So. 2d 16 (Fla. 1978),

suggests that by entering the writ of mandamus, the trial court impermissibly filled

in a statutory vacuum with relief which is only consistent with how the court

thought the law should read. Not so. Here, the plain and unambiguous language of

section 192.091, speaks for itself. The budget of the property appraiser's office,

as approved by the Department of Revenue, shall be the basis [e]ach such taxing

21

authority shall be billed [p]ayments shall be made quarterly. See

192.091(1)(a)-(b). Ironically, it is the County reading language into the statute;

language which is simply not there. It seeks the discretion where no such

discretion is provided for and it claims an automatic stay during its appeal to the

Administration Commission, although no such procedural relief is provided for.

And by insisting the statute provides a method for the Property Appraiser, who

does not seek to challenge the DOR FY 2014 Final Budget, to petition the

Administration to undo the Countys illegal withholding of funds in the interim,

the County turns the statutory scheme inside out. The Property Appraisers budget

has been approved; the Property Appraiser can rely on it and seek to compel

compliance with it.

Conclusion

The County Commissions actions denied the Property Appraiser due

process rights by withholding without any legal authority a portion of the

Property Appraisers approved budget funds. While the County Commission has

the right to appeal the Property Appraisers DOR FY-2014 Final Budget to the

Administration Commission, until the Administration Commission exercises its

discretion to hear the appeal and decides to amend the Property Appraisers

budget, the Property Appraisers DOR FY-2014 Final Budget is final and the

County Commission is legally obligated to fund it.

22

This Court should affirm the writ of mandamus issued by the trial court

compelling the County Commission to fully fund the Property Appraisers DOR

FY-2014 Final Budget.

Respectfully submitted,

By: /s/ Daniel S. Weinger

DANIEL S. WEINGER, ESQ.

23

Certificate of Service

I HEREBY CERTIFY that a true and correct copy of the foregoing was

furnished via electronic service to all counsel on the attached Mailing List on this

14th day of April, 2014.

Certificate of Type Size and Style

The undersigned counsel certifies that the type and style used in this brief is

14 point Times New Roman.

CONRAD & SCHERER, LLP

Attorneys for Appellee

P. O. Box 14723

Fort Lauderdale, FL 33302

Phone: (954) 462-5500

By:/s/ Daniel S. Weinger

WILLIAM R. SCHERER

Florida Bar No. 169454

wrs@conradscherer.com

DANIEL S. WEINGER

Florida Bar No. 172900

dweinger@conradscherer.com

Email Service:

wrspleadings@conradscherer.com

eservice@conradscherer.com

dswpleadings@conradscherer.com

-and-

BRUCE S. ROGOW

Florida Bar No. 067999

TARA A. CAMPION

Florida Bar No. 90944

24

500 E. Broward Blvd.

Suite 1930

Fort Lauderdale, FL 33394

Telephone: (954) 767-8909

Facsimile: (954) 764-1530

brogow@rogowlaw.com

tcampion@rogowlaw.com

25

SERVICE LIST

J oni Armstrong Coffey

MARK J OURNEY

ADAM KATZMAN

ANDREW J . MEYERS

Broward County Attorney

Governmental Center, Suite 423

115 South Andrews Avenue

Fort Lauderdale, Florida 33301

Telephone: 954-357-7600

Facsimile: 954-357-7641

jacoffey@broward.org

mjourney@broward.org

akatzman@broward.org

ameyers@broward.org

mmcghie@broward.org

Vous aimerez peut-être aussi

- Swartzentruber Amish Petition To U.S. Supreme CourtDocument34 pagesSwartzentruber Amish Petition To U.S. Supreme CourtinforumdocsPas encore d'évaluation

- DeWeese v. HaywardDocument13 pagesDeWeese v. HaywardAnonymous ZRsuuxNcCPas encore d'évaluation

- Rex Sinquefield BriefDocument32 pagesRex Sinquefield BriefSt. Louis Public RadioPas encore d'évaluation

- Shreveport City Council Meeting Agenda For Dec. 12, 2023Document5 pagesShreveport City Council Meeting Agenda For Dec. 12, 2023Curtis HeyenPas encore d'évaluation

- CrawfordQC 1 21 2020Document90 pagesCrawfordQC 1 21 2020dchester smithPas encore d'évaluation

- AG Herring Second Response To Petition For Writ of MandamusDocument24 pagesAG Herring Second Response To Petition For Writ of MandamusActivate VirginiaPas encore d'évaluation

- March 2014 Legislation EditionDocument9 pagesMarch 2014 Legislation EditionKimberly PruimPas encore d'évaluation

- DAVID N. KANAMPIUDocument4 pagesDAVID N. KANAMPIUmwenda mworiaPas encore d'évaluation

- Supreme Court upholds conviction of officials for falsifying documentsDocument4 pagesSupreme Court upholds conviction of officials for falsifying documentsRegan SabatePas encore d'évaluation

- The Gujarat Government Gazette: ExtraordinaryDocument4 pagesThe Gujarat Government Gazette: ExtraordinaryDeep HiraniPas encore d'évaluation

- BondDocument7 pagesBondChris BuckPas encore d'évaluation

- MEMO - Public Defender ContractDocument12 pagesMEMO - Public Defender ContractCoughman MattPas encore d'évaluation

- Oliver Kamm v. Broward Sherrif's Office, 4th DCA, FloridaDocument30 pagesOliver Kamm v. Broward Sherrif's Office, 4th DCA, FloridaTater FTLPas encore d'évaluation

- Kenneth G. Rush and The Fifth Third Bank v. United States, 694 F.2d 1072, 3rd Cir. (1982)Document5 pagesKenneth G. Rush and The Fifth Third Bank v. United States, 694 F.2d 1072, 3rd Cir. (1982)Scribd Government DocsPas encore d'évaluation

- City Council 16 Sep 13 AgendaDocument773 pagesCity Council 16 Sep 13 AgendaDavid NelsonPas encore d'évaluation

- Frank Miskovsky v. United States, 414 F.2d 954, 3rd Cir. (1969)Document5 pagesFrank Miskovsky v. United States, 414 F.2d 954, 3rd Cir. (1969)Scribd Government DocsPas encore d'évaluation

- In The Circuit Court of St. Louis County State of MissouriDocument14 pagesIn The Circuit Court of St. Louis County State of MissouriepraetorianPas encore d'évaluation

- Boe Agenda 2013 08 13Document28 pagesBoe Agenda 2013 08 13transparentnevadaPas encore d'évaluation

- The Andhra Pradesh Agricultural LandDocument10 pagesThe Andhra Pradesh Agricultural LandKishore KrishnaPas encore d'évaluation

- 02 25 2021 Emerson V HillsboroughDocument25 pages02 25 2021 Emerson V Hillsborough10News WTSPPas encore d'évaluation

- February 25 2014 Complete AgendaDocument21 pagesFebruary 25 2014 Complete AgendaTown of Ocean CityPas encore d'évaluation

- Investigative Audit of City of Shreveport Issued Oct. 6, 2022Document28 pagesInvestigative Audit of City of Shreveport Issued Oct. 6, 2022CurtisPas encore d'évaluation

- September 17, 2013 - AgendaDocument6 pagesSeptember 17, 2013 - AgendaRiverhead News-ReviewPas encore d'évaluation

- Ivil I ' ' : IN J Udicial INDocument3 pagesIvil I ' ' : IN J Udicial INMy-Acts Of-SeditionPas encore d'évaluation

- CFD 2004-3 OPT Full Version of Mello Roos Offering City of IndioDocument990 pagesCFD 2004-3 OPT Full Version of Mello Roos Offering City of IndioBrian DaviesPas encore d'évaluation

- Hunt v. East Cleveland DecisionDocument10 pagesHunt v. East Cleveland DecisionWKYC.comPas encore d'évaluation

- United States Court of Appeals, Second Circuit.: No. 861, Docket 93-6069Document14 pagesUnited States Court of Appeals, Second Circuit.: No. 861, Docket 93-6069Scribd Government DocsPas encore d'évaluation

- 1023 AppDocument2 pages1023 Appapi-254148709Pas encore d'évaluation

- SMN 2013 03 20 B 006Document1 pageSMN 2013 03 20 B 006Swift County Monitor NewsPas encore d'évaluation

- Us V Henthorn, Appellant's Brief, 10th CirDocument36 pagesUs V Henthorn, Appellant's Brief, 10th CirBen MillerPas encore d'évaluation

- Mangubat v. SandiganbayanDocument9 pagesMangubat v. SandiganbayangleePas encore d'évaluation

- A150816 (Alameda County Superior Court Case No. HG12615549Document15 pagesA150816 (Alameda County Superior Court Case No. HG12615549E MartinPas encore d'évaluation

- Rizona Ourt of Ppeals: Plaintiff/Appellant, VDocument12 pagesRizona Ourt of Ppeals: Plaintiff/Appellant, VScribd Government DocsPas encore d'évaluation

- Hospitality SettlementDocument9 pagesHospitality SettlementKevin AccettullaPas encore d'évaluation

- Letter From LLDocument3 pagesLetter From LLMy-Acts Of-SeditionPas encore d'évaluation

- U.S. Atttorney Seeks Over $1.6 Million in Fines From WestchesterDocument38 pagesU.S. Atttorney Seeks Over $1.6 Million in Fines From WestchestertauchterlonieDVPas encore d'évaluation

- Measure JDocument7 pagesMeasure JKJ HiramotoPas encore d'évaluation

- Lien Process, Notices and Relevant InformationDocument19 pagesLien Process, Notices and Relevant InformationClaire TPas encore d'évaluation

- Cebu Highway Scam Decision Upholds ConvictionsDocument92 pagesCebu Highway Scam Decision Upholds ConvictionsAudrey Leroi SarmientoPas encore d'évaluation

- El Al.Document41 pagesEl Al.Chapter 11 DocketsPas encore d'évaluation

- Irving's Response To Former Mayor Herbert Gears' Lawsuit To End Senior Citizens TaxesDocument58 pagesIrving's Response To Former Mayor Herbert Gears' Lawsuit To End Senior Citizens TaxesaselkPas encore d'évaluation

- CMS Report 2Document4 pagesCMS Report 2RecordTrac - City of OaklandPas encore d'évaluation

- Motion To Dismiss 702 CertificationDocument2 pagesMotion To Dismiss 702 Certificationalbenfreir100% (2)

- Motion For Partial Summary Judgment and Request For Expedited Consideration - 2015.11.12Document259 pagesMotion For Partial Summary Judgment and Request For Expedited Consideration - 2015.11.12Carla Amundaray0% (1)

- Petition For Cert To CO Supreme Court - 12.17.20Document90 pagesPetition For Cert To CO Supreme Court - 12.17.20The ForumPas encore d'évaluation

- Republic Vs National Land Commission & 2 Others Ex Parte Ravindra Ratilal TaylorDocument14 pagesRepublic Vs National Land Commission & 2 Others Ex Parte Ravindra Ratilal TaylorgkaniuPas encore d'évaluation

- Lewis County Board of Legislators Agenda Feb. 6, 2024Document20 pagesLewis County Board of Legislators Agenda Feb. 6, 2024NewzjunkyPas encore d'évaluation

- January 7, 2014 - PacketDocument75 pagesJanuary 7, 2014 - PacketTimesreviewPas encore d'évaluation

- Brief of Amicus Curiae Owners' Counsel of American and Pacific Legal Foundation in Support of Appellants, Johnson v. City of Suffolk, No. 191563 (Va. June 29, 2020)Document31 pagesBrief of Amicus Curiae Owners' Counsel of American and Pacific Legal Foundation in Support of Appellants, Johnson v. City of Suffolk, No. 191563 (Va. June 29, 2020)RHTPas encore d'évaluation

- Prosecutors File Appeal in Robert Kraft Prostitution CaseDocument63 pagesProsecutors File Appeal in Robert Kraft Prostitution CaseGary DetmanPas encore d'évaluation

- Certified For Publication: Filed 7/7/10Document20 pagesCertified For Publication: Filed 7/7/10L. A. PatersonPas encore d'évaluation

- CHANGE IN OWNERSHIP Handbook PDFDocument179 pagesCHANGE IN OWNERSHIP Handbook PDFJoe Long100% (2)

- Application For A Writ of Certiorari, Kellberg v. Yuen, No. SCWC-12-0000266 (Sep. 17, 2013)Document18 pagesApplication For A Writ of Certiorari, Kellberg v. Yuen, No. SCWC-12-0000266 (Sep. 17, 2013)RHTPas encore d'évaluation

- Final Draft For BriefDocument42 pagesFinal Draft For Briefanie4everPas encore d'évaluation

- Detroit V Adams Realty ServicesDocument15 pagesDetroit V Adams Realty ServicesMichigan Court WatchPas encore d'évaluation

- Defendants' Reply Brief For Cert To Supreme Court - 1.28.21Document22 pagesDefendants' Reply Brief For Cert To Supreme Court - 1.28.21The ForumPas encore d'évaluation

- Agenda For Shreveport City Council Meeting Jan.23, 2014Document4 pagesAgenda For Shreveport City Council Meeting Jan.23, 2014Curtis HeyenPas encore d'évaluation

- Arizona Secretary of State Katie Hobbs' ReplyDocument18 pagesArizona Secretary of State Katie Hobbs' ReplycronkitenewsPas encore d'évaluation

- The Self-Help Guide to the Law: Contracts and Sales Agreements for Non-Lawyers: Guide for Non-Lawyers, #5D'EverandThe Self-Help Guide to the Law: Contracts and Sales Agreements for Non-Lawyers: Guide for Non-Lawyers, #5Pas encore d'évaluation

- Desouza Answer Brief (Fla. 4th DCA)Document18 pagesDesouza Answer Brief (Fla. 4th DCA)DanielWeingerPas encore d'évaluation

- Telli Jurisdictional Brief (Florida Supreme Court)Document15 pagesTelli Jurisdictional Brief (Florida Supreme Court)DanielWeingerPas encore d'évaluation

- Telli Initial Brief On The Merits (Florida Supreme Court)Document33 pagesTelli Initial Brief On The Merits (Florida Supreme Court)DanielWeingerPas encore d'évaluation

- Sutherland Reply Brief (11th Cir.)Document15 pagesSutherland Reply Brief (11th Cir.)DanielWeingerPas encore d'évaluation

- Sutherland Initial Brief (11th Cir.)Document47 pagesSutherland Initial Brief (11th Cir.)DanielWeingerPas encore d'évaluation

- Extra Inning Dynasty Trust Answer Brief (Fla. 4th DCA)Document45 pagesExtra Inning Dynasty Trust Answer Brief (Fla. 4th DCA)DanielWeingerPas encore d'évaluation

- Ultrasmith Racing Reply Brief (Fla. 4th DCA)Document21 pagesUltrasmith Racing Reply Brief (Fla. 4th DCA)DanielWeingerPas encore d'évaluation

- Aguiar Answer Brief (Fla. 4th DCA)Document28 pagesAguiar Answer Brief (Fla. 4th DCA)DanielWeingerPas encore d'évaluation

- Ultrasmith RacingInitial Brief (Fla. 4th DCA)Document9 pagesUltrasmith RacingInitial Brief (Fla. 4th DCA)DanielWeingerPas encore d'évaluation

- Leibel Answer Brief (Fla. 4th DCA)Document39 pagesLeibel Answer Brief (Fla. 4th DCA)DanielWeingerPas encore d'évaluation

- Brinkman Initial Brief (Fla. S. CT.)Document30 pagesBrinkman Initial Brief (Fla. S. CT.)DanielWeingerPas encore d'évaluation

- Miriam Makeba (A Hero)Document18 pagesMiriam Makeba (A Hero)TimothyPas encore d'évaluation

- Warmbier V DPRK ComplaintDocument22 pagesWarmbier V DPRK ComplaintLaw&Crime100% (1)

- Grounds For DisbarmentDocument1 pageGrounds For Disbarmentjojazz74Pas encore d'évaluation

- Canley Community Church Welcome LeafletDocument2 pagesCanley Community Church Welcome LeafletjonrogersukPas encore d'évaluation

- Purpose: To Ascertain and Give Effect To The Intent of The LawDocument11 pagesPurpose: To Ascertain and Give Effect To The Intent of The LawApril Rose Flores FloresPas encore d'évaluation

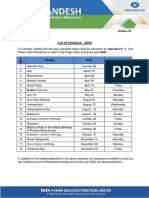

- Holiday List - 2020Document3 pagesHoliday List - 2020nitin369Pas encore d'évaluation

- Let's - Go - 4 - Final 2.0Document4 pagesLet's - Go - 4 - Final 2.0mophasmas00Pas encore d'évaluation

- The Peace OfferingDocument8 pagesThe Peace Offeringribka pittaPas encore d'évaluation

- Cresencio Libi Et Al Vs Hon Intermediate AppellateDocument17 pagesCresencio Libi Et Al Vs Hon Intermediate AppellateMaria GraciaPas encore d'évaluation

- Addressing Social Issues in the PhilippinesDocument3 pagesAddressing Social Issues in the PhilippinesAaron Santiago OchonPas encore d'évaluation

- Password Reset B2+ CST 4BDocument1 pagePassword Reset B2+ CST 4BSebastian GrabskiPas encore d'évaluation

- Harsha Tipirneni Vs Pooja TipirneniDocument9 pagesHarsha Tipirneni Vs Pooja TipirneniCSPas encore d'évaluation

- Supreme Court Ruling on Illegal Possession of Firearms CaseDocument15 pagesSupreme Court Ruling on Illegal Possession of Firearms CaseNoel Gillamac0% (1)

- Basic Commerce Clause FrameworkDocument1 pageBasic Commerce Clause FrameworkBrat WurstPas encore d'évaluation

- J. Penn de Ngong - The Black Christ of AfricaDocument348 pagesJ. Penn de Ngong - The Black Christ of Africarkamundimu100% (1)

- Mock Bar Test 1Document9 pagesMock Bar Test 1Clark Vincent PonlaPas encore d'évaluation

- Recommendations for Medical Student Letters of ReferenceDocument5 pagesRecommendations for Medical Student Letters of ReferenceCaroline HeiplePas encore d'évaluation

- Edited Second Committee Report Kite Flying April 10 2021Document2 pagesEdited Second Committee Report Kite Flying April 10 2021Ei BinPas encore d'évaluation

- At First SightDocument1 pageAt First SightJezail Buyuccan MarianoPas encore d'évaluation

- FILM CRITIQUEDocument14 pagesFILM CRITIQUERohan GeraPas encore d'évaluation

- Yamane vs. BA LepantoDocument32 pagesYamane vs. BA LepantoAlthea Angela GarciaPas encore d'évaluation

- Strictly Private & Confidential: Date: - 07-01-18Document4 pagesStrictly Private & Confidential: Date: - 07-01-18shalabh chopraPas encore d'évaluation

- Company Law: Study TextDocument11 pagesCompany Law: Study TextTimo PaulPas encore d'évaluation

- Mitchell Press ReleaseDocument4 pagesMitchell Press ReleaseWSLSPas encore d'évaluation

- Intermediate GW 12aDocument2 pagesIntermediate GW 12aKarol Nicole Huanca SanchoPas encore d'évaluation

- Angels MedleyDocument7 pagesAngels MedleywgperformersPas encore d'évaluation

- English - Sketches. Books.1.and.2Document169 pagesEnglish - Sketches. Books.1.and.2Loreto Aliaga83% (18)

- Erotic Artworks Jonh o Dirty Anal Games PDFDocument2 pagesErotic Artworks Jonh o Dirty Anal Games PDFLydiaPas encore d'évaluation

- PTA Vs Philippine GolfDocument2 pagesPTA Vs Philippine Golfrm2803Pas encore d'évaluation

- Caste in Contemporary India Divya VaidDocument23 pagesCaste in Contemporary India Divya Vaidshyjuhcu3982Pas encore d'évaluation