Académique Documents

Professionnel Documents

Culture Documents

WriteUp #1 - Inside Job

Transféré par

LinhCU0 évaluation0% ont trouvé ce document utile (0 vote)

35 vues1 pageMovie write-up for the movie "Inside Job" directed by Charles Ferguson.

Copyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentMovie write-up for the movie "Inside Job" directed by Charles Ferguson.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

35 vues1 pageWriteUp #1 - Inside Job

Transféré par

LinhCUMovie write-up for the movie "Inside Job" directed by Charles Ferguson.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 1

Linh Vuu September 10, 2014

Inside Job Movie Write-Up Group: TA Chad Lazar

I would not agree with the conclusion from the documentary Inside Job that The

financial industry [has] turned its back on society. (Ferguson) Since America was founded, it

had conceived a capitalist free market economy. A market where the nations trade and industry

are controlled by the invisible hand of private owners. The invisible hand is then guided by

the profit motive engendered from an individuals selfishness and greed. The rule of our

economy is that those with more money have more influence over how the economy runs and

can legally manipulate the system for their own benefit. Thus, the financial industry has always

acted in the manner described by the documentary in which each individual fends for oneself in

order to achieve their personal success through any means necessary and morally (or not).

Our economy was founded on the ideal that government should have little to no

intervention in our free market transactions and that the laws of supply and demand should be the

only forces to direct our economy. Thus, our economy has developed to what it is today.

Deregulation and privatization defines the American economy. In the case of Wall Street,

deregulation allowed for the executive management to abuse their authorities and basically do

whatever they wanted to do with the capital they had available to them, especially since it wasnt

their money. Who wouldnt want to invest with money that isnt theirs? Ideally, there would be

no risk involved for them, only profits to be gained and more money to claim. Another point that

this documentary discusses is the creation of extremely risky investments, such as derivatives

and collateralized debt obligations. Nonetheless, based on the common knowledge of risk-return

tradeoff, the higher the risk, then the higher the return. It is out of human selfishness and greed,

that those who are knowledgeable will use their expertise to the best of their ability to extort all

opportunities possible. Selling these risky derivatives to their customers then betting against

them makes sense for these executives because they will be the ones to reap the benefits, even if

it means the rest of the economy and America will suffer from it.

Obviously, the activities described in the documentary are morally and ethically unjust.

No company will benefit by deceiving their customers. They might benefit from the short-term

gains, but people will learn about their wrongdoings and no longer invest in their company in the

long-term. Even if people do not realize that the companies are managing their money unjustly,

people will still lose a lot of money and can no longer contribute to the consumption that fuels

the production of these companies. Both parties will inevitably fail and the economy will come

into a halt by falling into recession. Hence, even today our economy could be described as being

stuck in a bubble. For instance, China is often recognized for its growing housing market

bubble that may burst any moment, resulting in inflation of real estate prices, foreclosures, and

an economic downturn. Now the government is forced to mediate the problem through stimulus

measures that costs a lot of money, which the economy does not have and taxpayers are not

willing to compensate for. With the continuation of our current mindset that our economy will

always prosper from deregulation and privatization, the financial industry will continue to

disintegrate while top executives cash their checks and leave before the actual chaos begins.

Thus, I do not believe our financial industry [has] turned its back on society (Ferguson)

because it was established with its existing mindset of all for one and one only. Its back was

always turned against society because each individual seeks prosperity and profit for themselves

only. However, I believe more regulation is needed in the regard to control the humanistic greed

and eliminate the corruption in our existing economy by enforcing more accountability.

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Slavery - The West IndiesDocument66 pagesSlavery - The West IndiesThe 18th Century Material Culture Resource Center100% (2)

- Stemming The Rise of Islamic Extremism in BangladeshDocument6 pagesStemming The Rise of Islamic Extremism in Bangladeshapi-3709098Pas encore d'évaluation

- Barbri Notes Personal JurisdictionDocument28 pagesBarbri Notes Personal Jurisdictionaconklin20100% (1)

- Bias and PrejudiceDocument16 pagesBias and PrejudiceLilay BarambanganPas encore d'évaluation

- B005EKMAZEThe Politics of Sexuality in Latin America: A Reader On Lesbian, Gay, Bisexual, and Transgender Rights - EBOKDocument948 pagesB005EKMAZEThe Politics of Sexuality in Latin America: A Reader On Lesbian, Gay, Bisexual, and Transgender Rights - EBOKWalter Alesci-CheliniPas encore d'évaluation

- Critical RegionalismDocument8 pagesCritical RegionalismHarsh BhatiPas encore d'évaluation

- TenancyDocument2 pagesTenancyIbrahim Dibal0% (2)

- The Dreyfus AffairDocument3 pagesThe Dreyfus AffairShelly Conner LuikhPas encore d'évaluation

- Oil Lifting and Ship Chandelling in NigeriaDocument1 pageOil Lifting and Ship Chandelling in NigeriaBlackfriars LLPPas encore d'évaluation

- Dr. Ram Manohar Lohiya National Law University, Lucknow.: Topic: Decline of The Mauryan EmpireDocument11 pagesDr. Ram Manohar Lohiya National Law University, Lucknow.: Topic: Decline of The Mauryan EmpiredivyavishalPas encore d'évaluation

- Speciak Casual Leave Sakala Janula SammeDocument5 pagesSpeciak Casual Leave Sakala Janula SammeA2 Section CollectoratePas encore d'évaluation

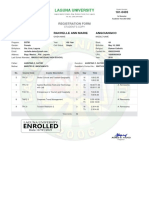

- Laguna University: Registration FormDocument1 pageLaguna University: Registration FormMonica EspinosaPas encore d'évaluation

- AMSCO Guided Reading Chapter 8Document9 pagesAMSCO Guided Reading Chapter 8Raven H.0% (1)

- Unity Law College Exam Questions Cover Women's Rights LawsDocument1 pageUnity Law College Exam Questions Cover Women's Rights Lawsजय कृष्णा पाण्डेयPas encore d'évaluation

- WW 3Document12 pagesWW 3ayesha ziaPas encore d'évaluation

- Final Test Subject: Sociolinguistics Lecturer: Dr. H. Pauzan, M. Hum. M. PDDocument25 pagesFinal Test Subject: Sociolinguistics Lecturer: Dr. H. Pauzan, M. Hum. M. PDAyudia InaraPas encore d'évaluation

- Behaviour Social Relations and Solidarity Between Friends On Adolescent Lifestyle BehaviorsDocument4 pagesBehaviour Social Relations and Solidarity Between Friends On Adolescent Lifestyle BehaviorsmvickeyPas encore d'évaluation

- Swing States' Votes Impact Federal SpendingDocument13 pagesSwing States' Votes Impact Federal SpendingozzravenPas encore d'évaluation

- Sternberg Press - June 2019Document7 pagesSternberg Press - June 2019ArtdataPas encore d'évaluation

- Tehran Times, 16.11.2023Document8 pagesTehran Times, 16.11.2023nika242Pas encore d'évaluation

- Caste Certificate Form for SCDocument1 pageCaste Certificate Form for SCGaneshRedijPas encore d'évaluation

- Gulliver's Travels to BrobdingnagDocument8 pagesGulliver's Travels to BrobdingnagAshish JainPas encore d'évaluation

- CPDprovider PHYSICALTHERAPY-71818Document7 pagesCPDprovider PHYSICALTHERAPY-71818PRC Board100% (1)

- History of QuezonDocument5 pagesHistory of QuezonVIVIAN JEN BERNARDINOPas encore d'évaluation

- Iowa State U.A.W. PAC - 6084 - DR1Document2 pagesIowa State U.A.W. PAC - 6084 - DR1Zach EdwardsPas encore d'évaluation

- BPS95 07Document93 pagesBPS95 07AUNGPSPas encore d'évaluation

- European UnionDocument27 pagesEuropean UnionAndrea HuntPas encore d'évaluation

- Bengali Journalism: First Newspapers and Their ContributionsDocument32 pagesBengali Journalism: First Newspapers and Their ContributionsSamuel LeitaoPas encore d'évaluation

- A Guide To The Characters in The Buddha of SuburbiaDocument5 pagesA Guide To The Characters in The Buddha of SuburbiaM.ZubairPas encore d'évaluation

- Poe On Women Recent PerspectivesDocument7 pagesPoe On Women Recent PerspectivesЈана ПашовскаPas encore d'évaluation