Académique Documents

Professionnel Documents

Culture Documents

Corporation Notes

Transféré par

Melani AlbisCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Corporation Notes

Transféré par

Melani AlbisDroits d'auteur :

Formats disponibles

Corporation

an artificial being created by operation of law having the right of succession and the powers, attributes and properties

expressly authorized by law or incident to its existence.

Advantages Disadvantages

1. Limited Liability 1. Complicated in formation

2. Transferability of shares 2. Greater degree of government control and supervision

3. Continued life existence 3. Centralized management

4. Greater source funds 4. Heavier income tax

Kinds of Corporation

1. Stock Corporations issued shares of stock to the shareholders

2. Non-Stock Corporations do not issue shares of stock bec. they are created for civic, charitable or religious purposes

Component of Corporation

1. Incorporators also called the founders of a corporation. The law requires that incorporators must consist of at least 5 but not

more than 15

2. Corporators represents the several classifications of owners of corporation after its formation. Specifically corporators are

incorporators and shareholders and or members of the corporation.

3. Shareholders or members owners of a corporation.

4. Subscribers are those who have made an agreement with the corporation to buy share of stock at future payments.

Articles of Incorporation

basic instrument by which a corporation is formed under the corporation statutes, executed by several persons as

incorporators.

By- Laws

the regulations, ordinances, rules or laws adopted by any association or corporation for its government.

Stock certificate or share certificate

Evidence of the shareholders ownership interest in a corporation.

Accounting for Share Capital

Corporations Partnerships Sole Proprietorship

1. Owners Several (at least 5) 2 or more one

2. Ownership Account Shareholders Equity Partners Capital Owners Capital

3. Equity section of Balance Sheet Partners Equity Owners Equity

4. Income summary close to Accumulated

Profits/Losses (Retained

Earnings

Partners Capital Owners Capital

Share Capital (Capital Stock)

- the share capital subsection of shareholders equity consists of the following elements:

1. Share Capital refers to the paid in capital representing the amount of the total par or stated value of the shares issued. It

represents the portion of authorized share capital that has been fully paid. The share may be par value share or no par but

with stated value

2. Subscribed share capital the portion of share capital that investor agreed to purchase.

3. Subscriptions receivable unpaid portion of the subscribed shares.

4. Treasury shares this represents issued shares reacquired by the issuing corporation.

Major Classifications of share capital

1. Ordinary share (common stock) represents basic interest of ownership in a corporation.

2. Preference share (preferred stock) preference with respect to dividends and/or assets over ordinary shares.

Classifications of preference share capital

a. Cumulative preference shares the right to receive dividend in arrears (undeclared dividend in previous years)

b. Non-cumulative preference shares the right to receive dividend in arrears is lost.

c. Participating preference shares the right to receive additional dividend after the dividend for both ordinary shares and

preferred shares are paid.

d. Non-participating not entitled to receive additional dividend only the dividends declared during the current year.

e. Convertible preference shares holders are given the option to convert the preference share into ordinary shares.

f. Redeemable or callable preference shares issued preference shares can be bought back by the issuing corporation.

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Accounting for Shareholders' EquityDocument59 pagesAccounting for Shareholders' EquityDee100% (2)

- 2 End of Part I (Project Moonlight Money)Document152 pages2 End of Part I (Project Moonlight Money)sidsatrianiPas encore d'évaluation

- Pondicherry University MBA Paper on Investment and Portfolio ManagementDocument285 pagesPondicherry University MBA Paper on Investment and Portfolio ManagementYonas Tsegaye HailePas encore d'évaluation

- Basics of Share and DebentureDocument14 pagesBasics of Share and DebentureChaman SinghPas encore d'évaluation

- Unit 4: Indian Accounting Standard 23: Borrowing Costs: After Studying This Unit, You Will Be Able ToDocument31 pagesUnit 4: Indian Accounting Standard 23: Borrowing Costs: After Studying This Unit, You Will Be Able ToSri KanthPas encore d'évaluation

- Bases Conversion and Development Authority v. Commissioner of InternalDocument7 pagesBases Conversion and Development Authority v. Commissioner of InternalEd EchPas encore d'évaluation

- Chap. 9 - Discussion AssignmentsDocument3 pagesChap. 9 - Discussion AssignmentsEdi HermawanPas encore d'évaluation

- CFA I QBank, Cost of CapitalDocument15 pagesCFA I QBank, Cost of CapitalGasimovskyPas encore d'évaluation

- AUDITING PROBLEMSDocument8 pagesAUDITING PROBLEMSKath LeynesPas encore d'évaluation

- Special Qualifying Examination For FreshmenDocument21 pagesSpecial Qualifying Examination For FreshmenPerbielyn BasinilloPas encore d'évaluation

- Consolidated Zarah NotesDocument174 pagesConsolidated Zarah NotesRoseanne MateoPas encore d'évaluation

- Beyond Meat valuation reportDocument73 pagesBeyond Meat valuation reportKathir K100% (1)

- Review 105 - Day 7 Theory of AccountsDocument11 pagesReview 105 - Day 7 Theory of AccountsKathleen PardoPas encore d'évaluation

- Corporate Accounting Unit 1: Introduction: Mission Vision Core ValuesDocument52 pagesCorporate Accounting Unit 1: Introduction: Mission Vision Core ValuesMudra JainPas encore d'évaluation

- Financial Accounting 2 Chapter 3 SolmanDocument28 pagesFinancial Accounting 2 Chapter 3 SolmanElijah Lou ViloriaPas encore d'évaluation

- CapitalBudgeting WACCDocument3 pagesCapitalBudgeting WACCRahul SharmaPas encore d'évaluation

- A Conceptual View On Companies Act 2013: With Special Reference To Share CapitalDocument12 pagesA Conceptual View On Companies Act 2013: With Special Reference To Share CapitalSameer DhumalePas encore d'évaluation

- Ch15 UpdatedDocument94 pagesCh15 Updatedkokmunwai717Pas encore d'évaluation

- Summer Training Report On Mas FinanceDocument73 pagesSummer Training Report On Mas FinanceHimanshu Singh TanwarPas encore d'évaluation

- Accounting AnswersDocument5 pagesAccounting AnswersallhomeworktutorsPas encore d'évaluation

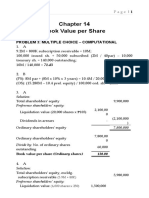

- Sol. Man. Chapter 14 Bvps 2021Document6 pagesSol. Man. Chapter 14 Bvps 2021Nikky Bless LeonarPas encore d'évaluation

- How To Prepare Cash Flow StatementDocument24 pagesHow To Prepare Cash Flow StatementKNOWLEDGE CREATORS100% (3)

- 2021 July ADocument10 pages2021 July AAmar Farhan b. Abdul JalilPas encore d'évaluation

- Accounting Final Review NotesDocument8 pagesAccounting Final Review NotesARHistoryHubPas encore d'évaluation

- Solution AP Test Bank 1Document8 pagesSolution AP Test Bank 1ima100% (1)

- CBSE Class 12 Accountancy Question Paper 2018Document39 pagesCBSE Class 12 Accountancy Question Paper 2018vaishnavi coolPas encore d'évaluation

- Republic Act 10606 - PhilHealthDocument21 pagesRepublic Act 10606 - PhilHealthriaheartsPas encore d'évaluation

- Accounting Principles: Corporations: Organization and Capital Stock TransactionsDocument58 pagesAccounting Principles: Corporations: Organization and Capital Stock TransactionsThế Vinh100% (1)

- Accounting for shareholders' equity and share capitalDocument9 pagesAccounting for shareholders' equity and share capitalNimfa SantiagoPas encore d'évaluation

- Afar First Take 2Document16 pagesAfar First Take 2Pau CaisipPas encore d'évaluation