Académique Documents

Professionnel Documents

Culture Documents

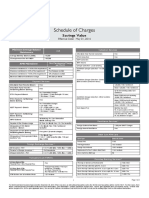

September 2014: Current, Call and Savings Accounts

Transféré par

AseForkliftRepairingTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

September 2014: Current, Call and Savings Accounts

Transféré par

AseForkliftRepairingDroits d'auteur :

Formats disponibles

Tenor 6 - 48 months 0.

99%

C

r

e

d

i

t

C

a

r

d

s

B

a

n

k

i

n

g

T

r

a

n

s

a

c

t

i

o

n

s

Charged Benets

Loan on Phone

Wealth Management Products

Class A Mutual Funds

Structured Notes

Fixed Income Securities

Equities upfront charge of up to 1% on traded amount.

Exit Charges on any products (if applicable) may be applied by the fund house/product provider/issuer. Please refer to the Terms and Conditions or prospectus.

September 2014

S

e

p

t

e

m

b

e

r

2

0

1

4

(

E

)

3

20.58

6

23.28

9

24.20

12

24.57

18

24.72

24

24.59

36

24.09

48

23.51

Tenor 3 - 48 months 1.15%

6 9 12 18 24 36 48

20.09 20.90 21.25 21.44 21.37 21.01 20.57

Balance Consolidation Facility

6 12 18 24 30 36 42 48

27.0 27.0 26.0 26.0 25.5 25.5 25.0 25.0

Loan

Premium Charges 0.44%

0.90% 0.90%

1.43%

1.43% 2.01% 2.01%

12 18 24 30 36 42 48 Tenor in Months

2% of the delayed amount with min. AED 50 and up to a max. of AED 200

L

o

a

n

s

Tenor in Months 3 6 9 12 18 24 36 48

Reducing Balance Rate (%) p.a. 20.58 23.28 24.20 23.53 23.70 23.59 23.13 23.51

Tenor in Months

Reducing Balance Rate (%) p.a.

Flat rate per month

Flat rate per month

Late Payment Fee AED 179

Over Limit Fee AED 179

Card Replacement Fee AED 50

Card Conversion Fee AED 50

Sales Draft Copy AED 100

AED 0

AED 0

AED 50

AED 50

AED 100

Paper Statement Fee/ Copy AED 10/AED 25 per statement

Fees, Rates and Charges Citi Simplicity

Online Funds Transfer Charges (Citibank Online Internet instruction Fee per transfer)

Funds Transfer (in USD or equivalent in other currencies)

Letter Charges for all products

1% of Loan amount with min. AED 500 and up to a max. of AED 2,500

Early Settlement from Same Bank Loans

Early Settlement from Other Bank Loans

Final Settlement from Other Sources / End of Service Benet

Partial Payment from All Sources Including End of Service Benet

1% of remaining balance

1% of remaining balance or

AED 10,000, whichever is less

1% of remaining balance

1% of the partial payment amount

Citibank Global Transfer

(Outgoing)

Easy Installment Plan

Processing Fee AED 100

Personal Loans Processing Fees

Personal Loans Interest Rates (based on reducing balance per annum): Without Salary Transfer to Citibank (Personal Installment Loan) With Salary Transfer to Citibank (Salary Transfer Loan)

12.99% - 14.99% 17.99%-26%

Credit Life Insurance on Personal Loans

Delayed Payment Penal Interest Charges / Late Payment Charges

Stop Check / Advance Payment (per instrument / Check)

Loan Re-scheduling Fee AED 250

Loan Cancellation Fee

Legal and Liability Letters AED 100 Free

Balance Conrmation / Loan Release Letters / Cards Reference Letters / Cards Clearance Letters AED 50 Free

Bank Reference Letter Charges AED 50 Free

AED 100

AED 50

12 - 36 months 1.10% 48 months 1.15% Tenor 3 - 9 months 1.15%

Local Currency (Outgoing

and Incoming inside UAE)

Personal Loans

Max. upfront charge on subscription of 5%

Max. upfront charge on subscription / redemption of 2%

Max. upfront charge on subscription / redemption of 3%

Transfer Amount Currency (Inside/Outside UAE)

USD 1 to 2,499

USD 2,500 to 9,999

USD 10,000 to 49,999

USD 50,000+

Citibank and Citigold

USD 10

USD 15

USD 25

USD 50

1 free transfer for CPC per month

CPC

Free Transfer

The minimum transfer amount

to make a Citibank Global

Transfer is AED 100 or equivalent

AED 25

Penalty for Payment Before Maturity

Ultima / Elite Annual Membership Fee (AMF)

Retail Interest Rate per month

Ultimate/Innite/Platinum (MasterCard)/Signature (AMF)

Retail Interest Rate per month

Platinum (VISA)/Titanium/Gold

Retail Interest Rate per month

Silver (AMF)

Retail Interest Rate per month

Supplementary Cards (AMF)

e-cards (AMF)

Cash Interest Rate per month

Emirates-Citibank Credit Cards

AED 3,000

2.99%

AED 800

2.99%

AED 400

2.99%

AED 250

2.99%

Free

Free

2.99%

PremierMiles

AED 1,500

2.79%

AED 750

2.99%

AED 400

2.99%

_

Free

Free

2.99%

Citi Life Credit Cards

_

AED 600

2.79%

AED 300

2.99%

AED 50 - AED 150

2.99%

Free

Free for Innite/Platinum, others: AED 50

2.99%

Citi Travel Pass

_

_

_

AED 400

2.99%

Free

Free

2.99%

A nance charge is applied to your account if the full balance (including previous Interest) is not paid by each Payment Due Date.

Credit Card Fees

Courier Charges* As per applicable courier service charges. Charges may vary depending on courier service provider

Monthly Fee per Account

Free

AED 25

AED 3,000 or more

Less than AED 3,000

First Check Book (30 leaves)

Subsequent Check Books

Stop Payments (per instrument/ Check)

Check Book Services

Additional Statement Requests (per statement cycle) AED 25 AED 25

Statement

Set-up Charges

Penalty for Insufcient Funds

Standing Instructions

AED 100

AED 50 + Correspondent Bank Charges + AED 60 if couriered (for FCY checks)

Citibank Account Holder

Citibank Account Holder Citigold Account Holder

AED 25

Minimum Monthly Average Balance Requirement per Account

Check Collection Charges

Returned Check - Incoming Clearing / Collection Checks

Citibank ATM / Debit Card Fees

Copy of Sales Slip

Free

AED 25

AED 10

AED 20

Citigold Account Holder

AED 20

Free

Free

Free Copies of Checks (less than 1 year)

AED 50 per request

AED 30 Issuance Fees for Managers Checks

Issuance Fees for Demand Drafts

Funds Transfer Charges to all destinations within and outside UAE (Branch Fee per transfer in USD or equivalent in other currencies)

Current, Call and Savings Accounts

Foreign Exchange Related Fees on Purchase / Sale of Currency Notes

An additional charge of AED 100 would apply if accounts are closed before 1 year.

Managers Checks / Demand Drafts

Outgoing Check Collection (FCY)

Fees on Purchase / Sale of Currency Notes

0.10% (minimum USD 10 & maximum USD 50 or equivalent in other currencies)

Citibank Account Holder

AED 25

Citigold Account Holder

Free Issuance Fee / Annual Membership Fee Free Free

AED 25 Supplementary Card Issuance Fee Free Free

AED 25 Replacement Fee AED 25 Free

AED 25 PIN Maintenance Fee AED 25 Free

Free Citibank ATM Transactions in UAE or Abroad Free Free

AED 2 per transaction Non-Citibank ATM Transactions in UAE

2 Free transactions per month, AED 2 per

additional transaction

5 Free transactions per month,

AED 2 per additional transaction

USD 5 per transaction

Non-Citibank ATM Transactions Abroad

(Prevailing bank foreign exchange rates

will apply on all currency conversions)

1 Free transaction per month,

USD 5 per additional transaction

2 Free transactions per month,

USD 5 per additional transaction

AED 25

Citigold Private Client (CPC)

AED 50

AED 25

Citibank and Citigold

Free

AED 25

CPC

Transfer Amount

USD 1 to 2,499

USD 2,500 to 9,999

USD 10,000 to 49,999

USD 50,000 to 100,000

1% of total amount

Citibank and Citigold

1% of total amount

Citibank Account Holder

USD 20

USD 25

USD 40

USD 75

USD 175 USD 100,000+

0.5% of the total amount

0.5% of the total amount

CPC

Citigold & CPC Account Holder

USD 15

USD 20

USD 35

USD 50

USD 150

1 free transfer for CPC per month

Copies of Checks (over 1 year)

Foreign Currency Cash Deposit / Withdrawals (ATM/Tellers)

Minimum Payment Due

Balances Transfer Facility Processing Fee

Early Settlement Fee - Loan On Phone, Easy Installment Plan,

Cash Advance Fee (Not applicable for Citi Simplicity)

Processing Fee for International and/or Foreign Currency Transactions

Check Clearance

Returned Check Fee

Manager's Check Issued for Credit Balances

Outgoing Check Collection Fee (LCY / FCY)

2% of the balance transferred or AED 200, whichever is less

AED 50 + Correspondent Bank Charges + AED 60 if couriered (FCY Checks)

AED 25

AED 100

Proceeds will be credited to the card account on clearance of the Check

2.99%

3% of cash advance amount or AED 99 whichever is higher with a max. charge of AED 250

PLUS applicable Charges & Amounts, OR AED 100, whichever is higher

As stated on the Statement of Account (SA), i.e. 2.74% of Current Balance on SA,

1% of remaning balance

Schedule of Fees & Charges

Customer Relationship Balance is the monthly average total balance in all deposit accounts (Current/Savings/Call/Time Deposits) and Investment Accounts. Any other product refers to Credit Cards, Loans and Insurance. Fees would be deducted at the end of each month. Citigold Members with a minimum Relationship Balance of USD

100,000 or equivalent in any other currency. Replacement of Priority Pass Cards will be charged at AED 50 Cash Advance Interest accrues from the date of the Cash Advance until repayment of the Cash Advance and interest thereon. Upon closure of the Credit Card, subject to no bank account(s) or other credit card(s) maintained with

Citibank U.A.E., there will be no refund in case of any excess payment made into the Credit Card Account of an amount less than or equal to AED 50 AED equivalent fees and charges will be determined by the Bank by using its exchange rate. Pricing may vary depending on facility/business relationship and subject to credit approvals. All prices,

fees and charges of products and services detailed in this schedule are subject to change fromtime to time at sole discretion of Citibank, N.A. by giving prior notice to the Customer. Such changes apply fromthe effective date specied by the Bank. For more information, please contact our 24-hour CitiPhone Banking Service on +971 4 311 4000.

Investments: Investment products are not bank deposits or obligations or guaranteed by Citibank, N.A., Citigroup Inc. or any of its afliates or subsidiaries unless specically stated. Investment products are not insured by government or governmental agencies. Investment and treasury products are subject to Investment risk, including possible

loss of principal amount invested. Past performance is not indicative of future results: prices can go up or down. Investors investing in investments and/or treasury products denominated in foreign (non-local) currency should be aware of the risk of exchange rate uctuations that may cause loss of principal when foreign currency is converted

to the investors home currency. Investment and treasury products are not available to U.S. persons. All applications for investments and treasury products are subject to Terms and Conditions of the individual investment and treasury products. Customer understands that it is his/her responsibility to seek legal and/or tax advice regarding the

legal and tax consequences of his/her investment transactions. If Customer changes residence, citizenship, nationality, or place of work, it is his/her responsibility to understand how his/her investment transactions are affected by such change and comply with all applicable laws and regulations as and when such becomes applicable. Customer

understands that Citibank does not provide legal and/or tax advice and are not responsible for advising him/her on the laws pertaining to his/her transaction. Citibank UAE does not provide continuous monitoring of existing customer holdings. Deposits: Deposit/interest rates are subject to change from time to time and without prior notice.

Terms and Conditions governing Bank accounts with Citibank, N.A. apply and are available upon request and subject to change without prior notice. Citibank holds the right to refuse a deposit booking order from anyone at its sole discretion. Loans: All loans are at sole discretion of Citibank, N.A based on a) the parties' agreement to the terms

and conditions b) completion of the internal procedures and approvals of Citibank, N.A. c) completion of documents acceptable to Citibank, N.A. The offer is available on a best- effort basis. Loan Insurance premium outstanding will be settled against the pre-payment penalty in cases of premature loan closures. Credit Card: All Credit Card

applications are processed on a best-effort basis and at sole discretion of Citibank. Terms and Conditions apply and are available upon request. All Terms and Conditions are subject to change without prior notice. *Charges are inclusive of taxes.All obligations under the products offered are payable solely at and by Citibank, N.A., subject to the

laws of UAE (including any governmental actions, orders, decrees and regulations). For all products, special Terms and Conditions apply, are subject to change without prior notice and are available upon request. For the current Terms and Conditions, please visit our website www.citibank.ae

Safekeeping charges on Equities, and Exchange Traded Funds (ETF) will be 0.2% p.a. of the value of assets under custody calculated on the average balance of assets under custody and charged quarterly.

Effective January 1st 2014, Safekeeping charges on Fixed Income Securities will be 0.2% p.a. of the value of assets under custody calculated on the average balance of assets under custody and charged quarterly.

Utility Bill Payments

Payment through internet/

ATM /Citiphone Banking

FREE

Overdraft Interest Rates

Max. Interest rate for Secured Overdrafts 3-month LIBOR + 6% p.a.

Max. Interest rate for Unsecured Overdrafts 17.50% p.a.

Inbound Direct Debit

Direct Debit Set up/Cancellation/

Amendment Request

Direct Debit Payment Request -

Stop Payment (per instance)

Direct Debit payment Request

Return- Insufcient Funds

Banking

Account

Free

Free

AED 100

Inbound Direct Debit

Direct Debit Setup/Cancellation/Amendment Request Free

Direct Debit Stop Payment Request (per instance) AED 50

Direct Debit Return Payment Request due to Insufcient Funds AED 100

Balance Consolidation Facility and Loan Insta

Effective March 12, 2014

All Credit Cards

Citi Simplicity

2.99%

2.99%

2.99%

_

Free

_

_

Vous aimerez peut-être aussi

- July 2013: Current, Call and Savings AccountsDocument1 pageJuly 2013: Current, Call and Savings AccountsBala MPas encore d'évaluation

- Emirates NBD RatesDocument1 pageEmirates NBD Ratesmanish450inPas encore d'évaluation

- Personal Banking Personal Banking Personal BankingDocument1 pagePersonal Banking Personal Banking Personal BankingSaravanan ParamasivamPas encore d'évaluation

- EmiratesNBD Credit Card Fees ChargesDocument2 pagesEmiratesNBD Credit Card Fees ChargesHanif MohammmedPas encore d'évaluation

- PersonalBanking SOC 26Dec13EnDocument1 pagePersonalBanking SOC 26Dec13EnHasnain MuhammadPas encore d'évaluation

- EmiratesNBD Schedule of ChargesDocument3 pagesEmiratesNBD Schedule of ChargesbunklyPas encore d'évaluation

- Service and Price Guide: Annual FeeDocument1 pageService and Price Guide: Annual FeetalktokingPas encore d'évaluation

- Yes Bank Smart SalaryDocument2 pagesYes Bank Smart SalaryVicky SinghPas encore d'évaluation

- Product Disclosure Sheet: What Is This Product About?Document6 pagesProduct Disclosure Sheet: What Is This Product About?faisal_ahsan7919Pas encore d'évaluation

- Kfs Credit CardsDocument4 pagesKfs Credit CardsVijayakumar C SPas encore d'évaluation

- Most Important Terms & ConditionsDocument75 pagesMost Important Terms & Conditionsjamin2020Pas encore d'évaluation

- Schedule of Charges: Smart Salary ExclusiveDocument2 pagesSchedule of Charges: Smart Salary ExclusivevedavakPas encore d'évaluation

- Key-Facts-Statement-Signature-Priority-Account UBLDocument4 pagesKey-Facts-Statement-Signature-Priority-Account UBLMuhammadDanialPas encore d'évaluation

- Sosc Ver 210313Document3 pagesSosc Ver 210313Shashank AgarwalPas encore d'évaluation

- PDS Eng June2013Document2 pagesPDS Eng June2013NickHansenPas encore d'évaluation

- Select ChargesDocument1 pageSelect ChargesMd Imran ImuPas encore d'évaluation

- Saadiq SOCDocument28 pagesSaadiq SOCAamir ShehzadPas encore d'évaluation

- PrivateBanking Banking Transactions SOCDocument2 pagesPrivateBanking Banking Transactions SOCMohamedYoussefPas encore d'évaluation

- Yes Bank - Schedule of Charges - Savings Select AccountDocument2 pagesYes Bank - Schedule of Charges - Savings Select AccountBOOMTIMEPas encore d'évaluation

- Key Fact StatementDocument2 pagesKey Fact StatementJohn AdariPas encore d'évaluation

- Key Facts StatementDocument4 pagesKey Facts StatementQuality SecretPas encore d'évaluation

- Schedule of ChargesDocument14 pagesSchedule of ChargeskrishmasethiPas encore d'évaluation

- STD Credit CardDocument5 pagesSTD Credit CardDennis HoPas encore d'évaluation

- Most Important Terms & ConditionsDocument93 pagesMost Important Terms & Conditionslancy_dsuzaPas encore d'évaluation

- SuperCard MITC PDFDocument47 pagesSuperCard MITC PDFPrudhvi RajPas encore d'évaluation

- Credit Card I PdsDocument11 pagesCredit Card I PdsIskandar ZulqarnainPas encore d'évaluation

- Most Important Terms and Conditions - 2Document10 pagesMost Important Terms and Conditions - 2Mohit AroraPas encore d'évaluation

- Schedule of Charges: Savings ValueDocument2 pagesSchedule of Charges: Savings ValueNavjot SinghPas encore d'évaluation

- HCBC CC InfoDocument5 pagesHCBC CC Infooninx26Pas encore d'évaluation

- Summary of Rates and FeesDocument2 pagesSummary of Rates and Fees7fr8cr5wt2Pas encore d'évaluation

- PDS Revision Eng & BM Online (Final)Document6 pagesPDS Revision Eng & BM Online (Final)Faiziya BanuPas encore d'évaluation

- Schedule of Fees and Charges August 17 2012Document8 pagesSchedule of Fees and Charges August 17 2012nayanghimirePas encore d'évaluation

- (A) J00356 S&P Changes - HighFlyer Platinum CC-01-01-2020 Web ENDocument2 pages(A) J00356 S&P Changes - HighFlyer Platinum CC-01-01-2020 Web ENJohn MontyPas encore d'évaluation

- Mitc RupifiDocument13 pagesMitc RupifiKARTHIKEYAN K.DPas encore d'évaluation

- Key Fact StatementDocument2 pagesKey Fact StatementBNREDDY PSPas encore d'évaluation

- SWATI SBI - OrganizedDocument5 pagesSWATI SBI - OrganizedVinod MPas encore d'évaluation

- Key-Fact-Statement NewDocument2 pagesKey-Fact-Statement NewSaravanaSaravananPas encore d'évaluation

- Credit Card PdsDocument12 pagesCredit Card Pds9z95x4pt4jPas encore d'évaluation

- Annual Fees: (Per Month)Document2 pagesAnnual Fees: (Per Month)placido diasPas encore d'évaluation

- 3.2 Credit and Debt ManagementDocument35 pages3.2 Credit and Debt Managementsuhada asriPas encore d'évaluation

- Bajaj Tiger CC MITC NewDocument12 pagesBajaj Tiger CC MITC NewMinatiPas encore d'évaluation

- SUPERCARD Most Important Terms and Conditions (MITC)Document14 pagesSUPERCARD Most Important Terms and Conditions (MITC)Diwana Hai dilPas encore d'évaluation

- Important TNCDocument20 pagesImportant TNCsanthoshsk3072002Pas encore d'évaluation

- Salem Five Direct Consumer Banking Fee ScheduleDocument2 pagesSalem Five Direct Consumer Banking Fee ScheduleshoppingonlyPas encore d'évaluation

- Schedule Charges City BankDocument11 pagesSchedule Charges City BankSumon Emam HossainPas encore d'évaluation

- Credit Card Fees and Charge Leaflet 17032014 enDocument4 pagesCredit Card Fees and Charge Leaflet 17032014 enengg.aliPas encore d'évaluation

- Fees & Charges EnglishDocument2 pagesFees & Charges Englishhunghl9726Pas encore d'évaluation

- CIMB CashRebate CalculationDocument5 pagesCIMB CashRebate CalculationLindaPas encore d'évaluation

- Saadiq SOCDocument31 pagesSaadiq SOCjoshmalikPas encore d'évaluation

- Idfc First MitcDocument12 pagesIdfc First Mitcsrikanth reddyPas encore d'évaluation

- Khalid RR1814B29 PFP 2NDDocument8 pagesKhalid RR1814B29 PFP 2NDRR1814B29Pas encore d'évaluation

- 2018 FRM CandidateGuideDocument14 pages2018 FRM CandidateGuideSagar SuriPas encore d'évaluation

- Credit Card OptionDocument8 pagesCredit Card OptionAlfred LacandulaPas encore d'évaluation

- SUPERCARD Most Important Terms and Conditions (MITC)Document17 pagesSUPERCARD Most Important Terms and Conditions (MITC)jinesh vgPas encore d'évaluation

- CBQ - Tariff of ChargesDocument9 pagesCBQ - Tariff of Chargesanwarali1975Pas encore d'évaluation

- Important Terms and Conditions: To Get The Complete Version, Please Visit WWW - Hsbc.co - inDocument10 pagesImportant Terms and Conditions: To Get The Complete Version, Please Visit WWW - Hsbc.co - inDeepak GuptaPas encore d'évaluation

- You’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountD'EverandYou’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountÉvaluation : 2 sur 5 étoiles2/5 (1)

- Review of Some Online Banks and Visa/Master Cards IssuersD'EverandReview of Some Online Banks and Visa/Master Cards IssuersPas encore d'évaluation

- 1204X (11e)Document58 pages1204X (11e)Carlos MeloPas encore d'évaluation

- Giz2011 en Split Air Conditioning PDFDocument50 pagesGiz2011 en Split Air Conditioning PDFAseForkliftRepairingPas encore d'évaluation

- Curtis 1221b SchematicDocument1 pageCurtis 1221b SchematicMauricio Trujillo Paz100% (1)

- UnClassed Base Panel User ManualDocument36 pagesUnClassed Base Panel User ManualAseForkliftRepairingPas encore d'évaluation

- Powergauge: Led & LCD DisplayDocument2 pagesPowergauge: Led & LCD DisplayAseForkliftRepairingPas encore d'évaluation

- Powergauge: Led & LCD DisplayDocument2 pagesPowergauge: Led & LCD DisplayAseForkliftRepairingPas encore d'évaluation

- Customer Perception Towards Mutual FundsDocument63 pagesCustomer Perception Towards Mutual FundsMT RA100% (1)

- DLMI Annual Report - 2019 - (Part 1)Document27 pagesDLMI Annual Report - 2019 - (Part 1)MeteorFreezePas encore d'évaluation

- OnlineWL 8378 03 Apr 19 070849Document15 pagesOnlineWL 8378 03 Apr 19 070849velmurug_balaPas encore d'évaluation

- CMA Prospectus Syl 2016Document68 pagesCMA Prospectus Syl 2016Niraj AgarwalPas encore d'évaluation

- What Is The Impact of Bank Competition On Financial Stability in EU Area - RevisedDocument12 pagesWhat Is The Impact of Bank Competition On Financial Stability in EU Area - RevisedSamira ATANANPas encore d'évaluation

- Group-Assignment ACC101Document5 pagesGroup-Assignment ACC101Nguyen Duc Minh K17 HLPas encore d'évaluation

- Acct Statement - XX6419 - 08112022Document26 pagesAcct Statement - XX6419 - 08112022AartiPas encore d'évaluation

- Chapter 6 Answers Key Millan Financial Accounting and Reporting (3rd Edition)Document16 pagesChapter 6 Answers Key Millan Financial Accounting and Reporting (3rd Edition)Terese PingolPas encore d'évaluation

- Apr AminiaDocument8 pagesApr AminiaClyde ThomasPas encore d'évaluation

- Dar Al Arkan, 6.875% 26feb2027, USDDocument14 pagesDar Al Arkan, 6.875% 26feb2027, USDshahzadahmadranaPas encore d'évaluation

- Pakistan Stock Exchange Named Best Performing in AsiaDocument2 pagesPakistan Stock Exchange Named Best Performing in AsiaAqib SheikhPas encore d'évaluation

- Portfolio ConstructionDocument15 pagesPortfolio ConstructionParul GuptaPas encore d'évaluation

- Application For Health Coverage and Help Paying CostsDocument29 pagesApplication For Health Coverage and Help Paying CostsChris JarvisPas encore d'évaluation

- Thailand: Financial System Stability AssessmentDocument136 pagesThailand: Financial System Stability Assessmentสริยา แก้วสุพรรณPas encore d'évaluation

- Gold Quarterly ReportDocument43 pagesGold Quarterly ReportLavanya SubramaniamPas encore d'évaluation

- BOI ProductsDocument17 pagesBOI ProductsSuresh BajadPas encore d'évaluation

- Practical Investment Management: Robert A. StrongDocument14 pagesPractical Investment Management: Robert A. Strongkashifali249_8739463Pas encore d'évaluation

- The Big Short IIDocument35 pagesThe Big Short IIflagella1337Pas encore d'évaluation

- 2023 - FRM - PI - PE2 - 020223 - CleanDocument171 pages2023 - FRM - PI - PE2 - 020223 - CleanRaymond Kwong100% (1)

- Toa.m-1401. Conceptual Framework and Accounting ConceptsDocument12 pagesToa.m-1401. Conceptual Framework and Accounting ConceptsRod100% (2)

- Principles of AccountingDocument16 pagesPrinciples of Accountingmd samserPas encore d'évaluation

- Proportional Treaty SlipDocument3 pagesProportional Treaty SlipAman Divya100% (1)

- City Laundry: Chart of Account Assets LiabilitiesDocument6 pagesCity Laundry: Chart of Account Assets LiabilitiesGina Calling DanaoPas encore d'évaluation

- Macroeconomics 2 ExamDocument3 pagesMacroeconomics 2 ExamMWEBI OMBUI ERICK D193/15656/2018Pas encore d'évaluation

- Assignment: Introduction-State Bank of IndiaDocument2 pagesAssignment: Introduction-State Bank of IndiaSarayu BhardwajPas encore d'évaluation

- 23Document2 pages23Heaven HeartPas encore d'évaluation

- Econ 601 f14 Midterm Answer Key PDFDocument5 pagesEcon 601 f14 Midterm Answer Key PDFюрий локтионовPas encore d'évaluation

- OOP Assignment#1 (181209) Program CodeDocument3 pagesOOP Assignment#1 (181209) Program CodeAli AhmadPas encore d'évaluation

- International Accounting Case StudyDocument3 pagesInternational Accounting Case StudyKarma YPas encore d'évaluation

- Barclays US REITs Real Estate The Year Ahead Conference - Key TakeawaysDocument17 pagesBarclays US REITs Real Estate The Year Ahead Conference - Key TakeawaysJames ChaiPas encore d'évaluation