Académique Documents

Professionnel Documents

Culture Documents

Impact of E-Banking Services Provided by United Bank of Inda To Its Customers

Transféré par

sohinee_deyTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Impact of E-Banking Services Provided by United Bank of Inda To Its Customers

Transféré par

sohinee_deyDroits d'auteur :

Formats disponibles

A

PROJECT REPORT

ON

IMPACT OF E-BANKING SERVICES PROVIDED BY UNITED BANK

OF INDIA ON ITS CUSTOMERS

SUBMITTED TO

SAVITRIBAI PHULE PUNE UNIVERSITY

IN PARTIAL FULFILLMENT OF 2 YEARS FULL TIME COURSE MASTERS OF

BUSINESS ADMINISTRATION (MBA)

SUBMITTED BY

SOHINEE DEY

(BATCH 2013-2015)

UNDER THE GUIDANCE OF

PROF. VIDYUT DESHPANDE

SINHGAD BUSINESS SCHOOL, PUNE - 411 004

ACKNOWLEDGEMENT

There is always a sense of gratitude which one express for others for their help and

supervision in achieving the goals. I too express my deep gratitude to each and every one

who has been helpful to me in completing the project report successfully.

I would like to express my sincere gratitude to the Director of Sinhgad Business

School Dr. Chetan Chaudhari, who granted me with the opportunity to carry out my Summer

Internship Project.

I would also like to express my thanks and gratitude to my internal guide

Prof. Vidyut Deshpande for her valuable suggestions, helping in every inch to undertake this

project.

My special thanks to my Project Mentor Mr. Srijan Kumar Kundu (Senior Manager,

IT Dept.) for his invaluable guidance, directions and Intent supervision at every step of this

project.

Last but not the least, my endeavor in compiling this project would be uncrowned if I

do not express my heartiest thanks to Mr. Ashwini Kumar Jha (Asst. General Manager,

HRD), Mr. Rathin De (General Manager, IT Dept.), Mr. Gauri Prasad Sharma (Deputy

General Manager, IT Dept.) and Mr. Manish Agarwal (Asst. General Manager, IT Dept.) for

taking me as a trainee in IT department and the complete staff of IT department for their

support and guidance throughout the project.

I am indebted to my parents and friends and to those who may have contributed

directly or indirectly during the course of the project.

Sohinee Dey

Table of Contents

Sr. No. TOPIC Page No.

1 ABSTRACT 1

2 INTRODUCTION 3

2.1 What is E-Banking? 3

2.2 Evolution of E-Banking 3

2.3 Channels of E-Banking 4

2.4 Advantages of E-Banking 4

2.5 Disadvantages of E-Banking 5

3 OBJECTIVES AND SCOPE 6

3.1 Objectives 6

3.2 Scope 7

4 INDUSTRY PROFILE 8

4.1 What is Banking? 8

4.2 History 8

4.3 Structure of banking sector in India 10

4.4 Functions of a Bank 10

5 ORGANIZATION PROFILE 11

5.1 Vision Statement 12

5.2 Logo of the company with slogan 12

5.3 Board of Directors 12

5.4 Areas of operation 13

5.5 E-Banking products and services profile Competitors information 13

5.6 Competitors Information 17

5.7 Number of branches and offices of UBI 17

5.8 History 17

5.9 Awards and recognitions 17

5.10 STP 18

5.11 SWOT Analysis 18

6 THEORETICAL BACKGROUND 19

6.1 Project Information 19

6.2 Application of IT in the study 20

7 OUTLINE OF THE PROBLEM OR TASK UNDERTAKEN 21

8 RESEARCH METHODOLOGY 23

8.1 What is a research methodology? 23

8.2 Objectives of research 24

8.3 Type of research 24

8.4 Research design 24

8.5 Methods of data collection 25

8.6 Sources of data 25

8.7 Study population 26

8.8 Sampling Size 26

8.9 Sampling method 27

8.10 Data Processing Analysis and presentation 27

9 DATA ANALYSIS 28

10 LEARNING EXPERIENCE 48

11 LIMITATIONS OF THE STUDY 50

12 CONCLUSION 51

13 CONTRIBUTION TO THE ORGANIZATION 52

13.1 Technology and security standards 52

13.2 Legal standards 53

13.3 Regulatory and supervisory issues 54

14 BIBLIOGRAPHY 55

15 ABBREVIATIONS 56

16 ANNEXURE 57

LIST OF TABLES

Table No. Table Heading Page No.

1 Number of banks failed to establish between 1913-1918 8

2 Board of Directors 12

3 Services available for Mobile Banking 16

4 Services available for Card System 16

5 STP 18

6 SWOT Analysis 18

7 Respondents having UBI E-Banking account 28

8 Gender of the respondents 29

9 Age group of the respondents using UBI E-Banking 30

10 Profession of the respondents using UBI E-Banking services 31

11 Awareness of people regarding e-banking services provided by UBI

while opening an account

32

12 Sources of awareness about E-Banking 33

13 Respondents feel using the Internet for shopping and banking would

make life easier

34

14 Reasons for choosing UBI E-Banking Services 35

15 E-Banking channels customers think are more user-friendly 36

16 Frequency of respondents using UBI E-Banking services 37

17 UBI E-Banking products and services regularly used by respondents 38

18 Customers who make purchases through E-Banking 39

19 Respondents who used UBI E-Banking services in the last 12 months 40

20 Benefits accrued from E-Banking services to its users 41

21 Problems identified by the users of UBI E-Banking service 42

22 Importance of Privacy Maintenance while using E-Banking services 43

23 Importance for maintaining Security of Transactions 44

24 Respondents still visiting the bank after having started using UBI E-

Banking

45

25 Reasons to visit your Bank branch 46

26 Respondents overall satisfied with UBI E-Banking 47

1

1. ABSTRACT

With the rapid globalization of the Indian economy, enterprises are facing with ever changing

competitive environment. Enterprises are adopting strategies aimed at developing competitive

advantage based on enhanced customer value in terms of product differentiation, quality,

speed, service and costs. Over the last decade India has been one of the fastest adopters of

information technology, particularly because of its capability to provide software solution to

organizations around the world. This capability has provided a tremendous impetuous to the

domestic banking industry in India to deploy the latest in technology, particularly in the

Internet banking and e-commerce arenas. Electronic banking or E-Banking is the use of

electronic means to transfer funds directly from one account to another, rather than by check

or cash. Through reducing bank costs, electronic banking can increase bank incomes.

Technology is playing a major role in increasing the efficiency, courtesy and speed of

customer service. It is said to be the age of E-banking.

Despite rapid advances in all facets of technology, organizations still struggle with the

formidable task of developing software applications that meet quality standards. When

judging the quality of the provided E-banking services, customers consider a lot of factors

which influence their judgment. For some customers the response and efficiency of the

service providers would be of greatest importance, for others the security and privacy issues

might be more important, and still for others what matters most may be the website design

and ease of use. In reality, customers have different expectations and requirements. They

deem different aspects of the service delivery process for essential in order for them to be

satisfied with the service. This empirical research study mainly focuses on the major factors

that influences online customers satisfaction with the overall service quality of the bank.

Interviewing and surveying, along with review of the current system ensures a better

understanding of the situation before introducing any improvements. With the survey and

interview results in this research project, I, being a part of the systems analysis team, figured

out exactly what requirements are essential to the end-users. By performing in-depth

requirements gathering, I was able to provide the design team with a solid requirements

document. This will in turn save time for the design and implementation phases of the

systems development life cycle (SDLC) of Management Information Systems (MIS).

2

Purpose- The purpose of this study is to explore the E-Banking functionality provided by

United Bank of India and investigate the impact of E-Banking on customer satisfaction.

Design/Methodology/Approach- The research design is a combination of both quantitative

and qualitative research. Samples of hundred respondents (100) were collected comprising of

thirty (30) bank staffs and seventy (70) clients of the bank through questionnaire and

interviews which was edited, coded tabulated and analyzed through the application of

statistical techniques, such as bar graphs and pie charts for completeness and accuracy to

determine the effect of electronic banking on customer satisfaction.

Findings- This research study showed that the factors related to adoption of E-Banking

services like accessibility, convenience, usability, content, cost and performance had a

positive effect on United Bank of Indias customers satisfaction and loyalty but they are a

little more concerned about the privacy and security issues related to these services.

The study contributes adding knowledge regarding what constitutes E-Banking services.

3

2. INTRODUCTION

2.1. What is E-Banking?

E-Banking is a combination of two, Electronic technology and Banking. Electronic Banking

is a process by which a customer performs banking Transactions electronically without

visiting a brick-and-mortar institutions. E-Banking denotes the provision of banking and

related service through extensive use of information technology without direct recourse to the

bank by the customer.

2.2. Evolution of E-Banking

The story of technology in banking started with the use of punched card machines like

Accounting Machines or Ledger Posting Machines. The use of technology, at that time, was

limited to keeping books of the bank. It further developed with the birth of online real time

system and vast improvement in telecommunications during late 1970s and 1980s. It

resulted in a revolution in the field of banking with convenience banking as a buzzword.

Through Convenience banking, the bank is carried to the doorstep of the customer.

Intense competition has forced banks to rethink the way they operated their business. They

had to reinvent and improve their products and services to make them more beneficial and

cost effective. Technology in the form of E-banking has made it possible to find alternate

banking practices at lower costs.

Traditional Banking

Gunpowder

Personalized services,

time consuming, limited

access

Virtual or E-Banking

Nuclear Charged

Real time transactions,

integrated platform, all

time access

4

2.3. Channels of E-Banking:

2.3.1. Mobile Banking

Mobile banking comes in as a part of the banks initiative to offer multiple channel banking

providing convenience for its customer. A versatile multifunctional, free service that is

accessible and viewable on the monitor of mobile phone.

2.3.2. Internet Banking

The advent of the Internet and the popularity of personal computers presented both an

opportunity and a challenge for the banking industry. Now the banks customers are

connected to the Internet via personal computers and can avail their services at all times of

the day.

2.3.3. Automated Teller Machines (ATM):

An automated teller machine or automatic teller machine (ATM) is a computerized

telecommunications device that provides a financial institution's customers a method of

financial transactions in a public space without the need for a human clerk or bank teller by

inserting a plastic ATM card.

2.3.4. Card System

Credit/Debit cards: Debit and Credit cards operate like cash or a personal cheque. Debit cards

are different from credit cards. While a credit card is a way to "pay later," a debit card is a

way to "pay now." When you use a debit card, your money is quickly deducted from your

checking or savings account.

2.4. Advantages of E-Banking

Convenience- Unlike your corner bank, online banking sites never close; theyre

available 24 hours a day, seven days a week, and theyre only a mouse click away.

Ubiquity- If youre out of state or even out of the country when a money problem arises,

you can log on instantly to your online bank and take care of business, 24\7.

Transaction speed- Online bank sites generally execute and confirm transactions at or

5

quicker than ATM processing speeds.

Efficiency-You can access and manage all of your bank accounts, including IRAs, even

securities, from one secure site.

Effectiveness- Many online banking sites now offer sophisticated tools, including

account aggregation, stock quotes, rate alert and portfolio managing program to help you

manage all of your assets more effectively

2.5. Disadvantages of E-Banking

Learning curves- Banking sites can be difficult to navigate at first. Plan to invest some

time and\or read the tutorials in order to become comfortable in your virtual lobby.

Security issues- The phenomenon financial identity theft exists for decades, possibly

since the introduction of identities itself, by means of phishing, pharming, social

engineering and malware. It causes a serious concern as many customers have faces

such issues in their pasts. Types of customer targeted online banking fraud are:

Phishing: Phishing is referred to as the attempt to acquire personal information in

order to abuse this information for identity theft. Criminals are trying to obtain the

customers personal data such as usernames, passwords, pin codes, debit cards and

other private information. A well-known form of phishing is the distribution of

fake e-mails.

Pharming: Pharming is yet another way hackers attempt to manipulate users on

the Internet. While phishing attempts to capture personal information by getting

users to visit a fake website, pharming redirects users to false websites.

Social engineering: Social engineering is a method in which the criminal uses

human interaction in order to obtain personal information. A well-known way of

social engineering is a criminal who pretends to be an employee of a Financial

Service Provider.

Malware: Malware refers to a software program designed to damage or do

unwanted actions on a computer system. Examples of malware include viruses,

Trojan horses, and spyware. Malware can gather data from a user's system without

the users knowledge. This can include anything from the Web pages a user visits

to personal information, such as passwords.

6

3. OBJECTIVES AND SCOPE

Title of the project:

Impact of E-Banking services provided by United Bank of India on its customers

3.1. OBJECTIVES

3.1.1. Primary Objectives:

To explore the functionalities of the various E-banking services provided by United

Bank of India (UBI).

To investigate and analyze the impact of UBI E-Banking services on its customers.

To provide the UBI E-Banking software design team with a solid customers

requirements document for introducing improvements in the system.

Strengthening the bond between the banks and their customers by providing

suggestions for improving the E-Banking system of UBI, thereby helping them to

retain and/or expand their overall customer base.

3.1.2. Secondary Objectives:

To gain proper knowledge about the UBI E-Banking services to make personal use.

To educate the E-Banking customers on how to use the UBI E- Banking services and

various protection measures that is to be taken to avoid online fraud.

To find out the relationship between electronic banking and customer satisfaction at

UBI Headoffice.

7

3.2. SCOPE:

3.2.1. Geographical scope

The study was limited to the Head office of UBI in Kolkata. This was due to limited time and

resources which could not allow me to carry out the research in the other branches of UBI for

the full information regarding the research study. Conducting the research in the Head office

of UBI with quite a good number of clients enabled me to get better outcomes of the research.

3.2.2. Time scope

The study covered a period of two months, that is, from the beginning of June 2014 to the end

of July 2014.

3.2.3. Scope of the study

The study includes the various services provided by UBI.

It investigates about all applications of online banking in UBI.

It helps the UBI E-Banking systems design team to have a solid requirement

documentation which will in turn save time for the design and implementation phases

of the systems development life cycle (SDLC).

Hence the study will lead to new ways to tackle the problems and the SWOT of UBI

in respect of E- Banking.

8

4. INDUSTRY PROFILE

4.1. Definition:

As per Banking Regulation Act 1949 Section 5(b)

"Banking means, accepting for the purpose of lending or investment, of deposits of money

from the public, repayable on demand or otherwise, and withdrawal by cheque, draft, or

otherwise."

4.2. History:

Banking in India, in the modern sense, originated in the last decades of the 18th

century. The first banks were The General Bank of India, which started in 1786, and Bank of

Hindustan, which started in 1770; both are now defunct. The oldest bank still in existence in

India is the State Bank of India, which originated in the Bank of Calcutta in June 1806, which

almost immediately became the Bank of Bengal.

The years of the First World War were turbulent, and it took its toll with banks simply

collapsing despite the Indian economy gaining indirect boost due to war-related economic

activities. At least 94 banks in India failed between 1913 and 1918 as indicated in the

following table:

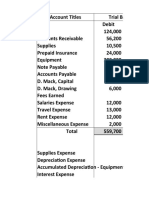

Table: 1

Years

Number of banks

that failed

Authorised capital

(Rs. Lakhs)

Paid-up Capital

(Rs. Lakhs)

1913 12 274 35

1914 42 710 109

1915 11 56 5

1916 13 231 4

1917 9 76 25

1918 7 209 1

9

Post-Independence:

The Reserve Bank of India, India's central banking authority, was nationalized on January 1,

1949. In 1949, the Banking Regulation Act was enacted which empowered the Reserve Bank

of India (RBI) "to regulate, control, and inspect the banks in India".

Nationalization in the 1960s:

Banks Nationalization in India: Newspaper Clipping, Times of India, July 20, 1969

Liberalization in the 1990s:

In the early 1990s, the then Narasimha Rao government embarked on a policy

of liberalization, licensing a small number of private banks. These came to be known as New

Generation tech-savvy banks, and included Global Trust Bank (the first of such new

generation banks to be set up), which later amalgamated with Oriental Bank of

Commerce, UTI Bank (since renamed Axis Bank),ICICI Bank and HDFC Bank. This move,

along with the rapid growth in the economy of India, revitalized the banking sector in India,

which has seen rapid growth with strong contribution from all the three sectors of banks,

namely, government banks, private banks and foreign banks.

10

4.3. Structure of banking sector in India:

4.4. Functions of a bank:

Drafts

Lockers

Underwriting

Project Reports

Social Welfare Programmes

Other Utility Functions

Saving Deposits

Fixed Deposits

Current Deposits

Recurring Deposits

Overdraft

Cash Credit

Loans

Discounting of

Bills

Transfer of Funds

Periodic Payments

Collection of Cheques

Portfolio Management

Periodic Collections

Other Agency Functions

Functions

of Bank

Primary

Functions

Secondary

Functions

Accepting

Deposits

Granting

Advances

Agency

Functions

Utility

Functions

Ministry of Finance

RBI

Scheduled Banks

Cooperative Banks

Commercial Banks

State

Cooperative

Urban

Cooperative

Regional

Rural

Banks

Foreign

Banks

Private

sector

Banks

Public

sector

Banks

11

5. ORGANIZATION PROFILE

Name: United Bank of India

Type: Public

Industry: Banking and Financial Services

Founded: 1950

Headquarters: United Tower

11, Hemanta Basu Sarani

Kolkata- 700001

West Bengal, India

Products:

Deposit Scheme

Credit Scheme

NRI Services

United Mobile Services

Foreign Exchange

Insurance Policies

RTGS

E-Payment

Nomination Facility

Lockers

Credit Cards

ATM Cum Debit Cards

Tax- Collection

Remittance Service in with

Western Union Money Transfer

Third Party Banking Products:

Mutual Funds

Life Insurance in tie up with

Tata AIG Life Insurance

Company

Credit Card in tie-up with SBI

Cards

Foreign Remittance Services in

tie-up with Western Union

Demat Depository Services in

association with Cent

Website: www.unitedbankofindia.com

E-Banking website: https://ebank.unitedbankofindia.com

12

5.1. Vision Statement

Their Vision is to emerge as a dynamic, techno savvy, customer-centric, progressive and

financially sound premier bank of our country with pan-India presence, Sharply focused on

business growth and profitability with due emphasis on risk management in an environment

of professionalism, Trust and transparency, observing highest standards of corporate

governance and corporate social responsibilities meeting the expectations of all its stake

holders as well as the aspirations of its employees.

5.2. Logo of the company:

5.3. Board of Directors (Table: 2)

Mr. Deepak Narang Executive Director

Mr. Sanjay Arya Executive Director

Mr. Mihir Kumar Government Nominee Director

Mrs. Parvathy V. SundaramRBI Nominee Director

Mr. Pratyush Sinha Shareholder Director

Mr. Sanjib Pati Workmen Employee Director

Mr. Sunil Goyal Part-time Non-official Director under CA

Catagory

Mr. Kiranbhai B. Vadodaria Part-time Non-official Director

Mr. Pijush Kanti Ghosh Officer Employee Director

Mrs. Renuka Muttoo Non official Director

13

5.4. Areas of operation

5.4.1. Retail Banking Services:

The objective of the Retail Bank is to provide its target market customers a full range of

financial products and banking services, giving the customer a one stop window for all

his/her banking requirements. The products are backed by world-class service and delivered

to the customers through the growing branch network, as well as through alternative delivery

channels like ATMs, Net Banking and Mobile Banking.

5.4.2. Corporate Banking Services:

The Bank's target market is primarily large, blue chip manufacturing companies in the Indian

corporate sector and to a lesser extent, emerging midsized corporates. For these corporate, the

Bank provides a wide range of commercial and transactional banking services. The Bank

provides commercial banking products and services to corporate customers, including mid-

sized and small businesses and government entities.

5.4.3. Treasury Operations:

With the liberalization of the financial markets in India, corporate need more sophisticated

risk management information, advice and product structures, These and fine pricing on

various treasury products are provided through the bank's Treasury team. The Treasury

business is responsible for managing the returns and market risk on this investment portfolio.

5.5. E-Banking products and services profile:

5.5.1. Internet Banking

Login Access to single user/ multiple users

My Account Account view / Statement

Fund Transfers Transferring of funds

Tax Payments Direct and indirect tax payments

Bill Payments Utility Bill Payment

Profile and Password Update user profile and change passwords

Alerts Alert service for all the transactions

Emails For assistance/query related issues

14

Login: Enables one to access the account 24 hours a day, 7 days a week. It allows access to

both single users and multiple users by using their respective user Ids and passwords.

My Accounts: The option gives the summary of the operative type, term deposit type and

also Loan type of accounts of a user. It also gives individual details of such accounts with

balances.

Fund Transfers: Under this option the user gets the facility to transfer funds between

different accounts. The options available to him are as under

Transfer of Funds between self accounts.

Transfer of funds from self account to any third party account within any branch of

bank

Inter Bank fund transfer (NEFT / RTGS)

Tax Payments: Online UBI provides the facility to pay direct taxes online. As a tax payer,

you need to have a bank account enabled for net banking facility with transaction rights in

anyone of UBI branches. Any United Online user may pay the following taxes online

Direct Tax (CBDT)

Indirect Tax

W.B Commercial Tax

User may generate duplicate receipts of the taxes paid using this service.

Bill Payments: Many categories of Billers are available for payment using United Online.

For e.g. Credit Card, Insurance etc.

United QuickPay - A simple and convenient service for receiving and paying your bills

online

Features :

View and Pay bills anytime, anywhere

Fast convenient and hassle free

Access to all major utility billers

Profile and Passwords: This option enables the user to customise the internet banking

options as under:

15

Changing of passwords - Login ,transaction or SMS passwords

Changing of own profile by nicknaming accounts

Changing of date format viz. dd/mm/yy to mm/dd/yyyy and like.

Changing of amount format from lacs to millions.

Changing address, phone no, primary accounts etc.

Alerts: User may subscribe to the following SMS alerts online for his accounts

Account Debit/Credit Alerts : Operative Accounts

End of the day balance Operative Accounts

Login Password Expiry No of Days

Salary Credited Operative Accounts

Stop Cheque Operative Accounts

Transaction Password Expiry No of Days

Emails: Every user of United Online service is linked to a Relationship Manager who looks

into the mails and requests made by the user. For this purpose the user is provided with a mail

option, which he can use for communicating with the Relationship Manager.

5.5.2. Mobile Banking

5.5.2.1. Mobile Banking Service over Application/ Wireless Application Protocol (WAP)

The service is available on java enabled /Android mobile phones (with or without GPRS)

where the user is required to download the application on to the mobile handset. The service

can also be availed via WAP on all phones (java/non java) with GPRS connection.

5.5.2.2. Mobile Banking Service over SMS:

The service is available on all phones. Ordinary SMS charges are applicable. In this mode

the Customer sends plain text SMS in predefined format to the mobile banking system on the

mobile number 9223173933 over an unencrypted channel to perform the transactions.

16

The services available for Mobile Banking are: (Table: 3)

Services/Mobile banking techniques Over WAP Over SMS

Balance enquiry Yes Yes

Mini statement Yes Yes

Funds transfer (within outside the bank) Yes Yes

Mobile to mobile Yes Yes

Mobile to account Yes Yes

Stop cheque request Yes Yes

Check cheque status Yes Yes

ATM locator (by pin code/location) Yes Yes

Branch locator (by pin code/location) Yes Yes

Mobile recharge and recharge status enquiry Yes Yes

Other services (update profile, chande password,

enable/disable transactions, change mPIN, etc)

Yes No

Refer a friend No Yes

5.5.3 Services available for Card System: (Table: 4)

Services/Cards EMV Visa Debit

Card

Visa Debit Card RuPay Debit

Card

RuPay Kissan

Credit Card

Cash withdrawal Daily Limit- Rs

50000/-

Daily Limit- Rs

25000/-

Daily Limit- Rs

25000/-

Daily Limit- Rs

25000/-

Swiping at Point

of Sale or POS

Daily Limit- Rs

50000/-

Daily Limit- Rs

25000/-

Daily Limit- Rs

25000/-

Daily Limit- Rs

25000/-

Mini Statement Yes Yes Yes Yes

Balance Enquiry Yes Yes Yes Yes

Pin Change Yes Yes Yes Yes

5.5.4. ATM Services:

State Bank offers you the convenience of over 2500 ATMs in India and continuing to expand

faster. This means that you can transact free of cost at the ATMs of United Bank Group.

Customers can also transact offsite through other banks using the Visa ATM cum Debit Card.

17

5.6. Competitors information:

Some of the major competitors for UBI in the banking are :

IDBI bank

Indian Overseas Bank

Bank of Maharashtra

Central Bank of India

5.7. Number of branches and offices: UBI has 2000 branches and offices and is having

a Total business of more than Rs 2 lac crore. Presently the Bank is having a Three-tier

organisational set-up consisting of the Head Office, 35 Regional Offices and the Branches.

5.8. History:

United Bank of India is one of the 14 banks which were nationalised on July 19, 1969. On

October 12, 1950, the name of Bengal Central Bank Limited (established in 1918 as Bengal

Central Loan Company Limited) was changed to United Bank of India Limited for the

purpose of amalgamation and on December 18, 1950, Comilla Banking Corporation Limited

(established in 1914), the Camilla Union Bank Limited (established in 1922), the Hooghly

Bank (established 1932) stood amalgamated with the Bank. Subsequently, other banks

namely, Cuttack Bank Limited, Tezpur Industrial Bank Limited, Hindusthan Mercantile

Limited and Narang Bank of India Limited were merged with the Bank.

5.9. Awards and recognitions:

National Award for the second best performance in financing small scale units by

Ministry of Small Scale Industries, Government of India in the year 2006.

Golden jubilee Award for the best bank in north east zone for excellence in the field

of khadi and village industries from the Ministry of MSME, Government of India in

the year 2007.

National Award for the best bank for excellence in the field of khadi and village

industries for east and north east zones from the Ministry of MSME, Government of

India in the year 2008.

National Award under Prime Minister Employment Guarantee Programme in north

east zone from the Ministry of MSME, Government of India in the year 2009.

18

5.10. STP: (Table: 4)

Segment Individual and Industry banking

Target group Semi-Urban Sector

Positioning Complete Banking solutions

5.11. SWOT Analysis: (Table: 5)

Strength 1. Financial products for rural segment

2. Deep reach across country with schemes like financial

inclusion

3. Strong operations with 1600 networked branches

4. 31 Regional offices spread all over India

5. Acquisition of Hindusthan Mercantile Bank(1973), UBI

acquired Narang Bank of India (1973)

Weakness 1. Lack of proper technology driven services when compared to

private banks

2. Employees show reluctance to solve issues quickly due to

higher job security and customers waiting period is long when

compared to private banks

3. Very Low International presence

4. Advertising is less thus weak brand recognition as compared

to major players

5. The public sometimes confuses the two banks Union Bank of

India and United Bank of India (both UBI)

Opportunity 1. Small enterprise banking

2. Improved Urban retail banking

3. Young and talented pool of graduates and B schools are in

rise to open new horizon to so called old government bank

Threat 1. Small enterprise banking

2. Improved Urban retail banking

19

6. THEORETICAL BACKGROUND

6.1. Project Information

Electronic banking or E-Banking is the use of electronic means to transfer funds directly from

one account to another, rather than by check or cash. Through reducing bank costs, electronic

banking can increase bank incomes. Banks are growing in size by mergers and acquisitions,

which have been driven by communication and technology. Technology is playing a major

role in increasing the efficiency, courtesy and speed of customer service. It is said to be the

age of E-banking.

Electronic Delivery Channels

Internet Banking

Mobile Banking

Automated Teller Machine (ATM)

Debit/Credit Cards

Despite rapid advances in all facets of technology, organizations still struggle with the

formidable task of developing software applications that meet quality standards. When

judging the quality of the provided E-banking services, customers consider a lot of factors

which influence their judgment. For some customers the response and efficiency of the

service providers would be of greatest importance, for others the security and privacy issues

might be more important, and still for others what matters most may be the website design

and ease of use. In reality, customers have different expectations and requirements. They

deem different aspects of the service delivery process for essential in order for them to be

satisfied with the service. In addition to the above, it is identified that there is limited

information available either on actual adoption or usage rates for UBIs Internet banking

services and this might be due to limited number of studies carried out in this field. There was

almost no study conducted to understand what users and non-users perceive about Internet

banking services provided by UBI. This study proposes to identify factors that influence

adoption and use of e-banking / Internet banking services in UBI. It is being attempted by

collecting data in forms questionnaires and interviews from 100 respondents who are

currently using UBI E-Banking services.

20

6.2. Application of IT in the study

Figure: Systems Development Life Cycle (SDLC)

This study is based on the preliminary investigation and systems analysis which constitutes of

the first and second phase of SDLC in which system requirements are studied and structured.

Requirements must drive design and development decisions throughout the product

development life cycle. A proper understanding of the UBI E-Banking services and data

gatherings on customer requirements through surveys and interviews has defined the current

E-Banking system, including the location of problems/opportunities and an explanation of

how to fix/enhance/replace the system.

Interviewing and surveying, along with review of the current system ensures a better

understanding of the situation before introducing any improvements. With the survey and

interview results I was able find out exactly what requirements were essential to the end-

users. A misunderstanding early on can create a huge difference between what the client

wants and what gets created. By performing in-depth requirements gathering, I, being a part

of the systems analysis team, was able to provide the design team with a solid requirements

document. This in turn saved time for the design and implementation phases of SDLC.

PRELIMINARY

INVESTIGATION

SYSTEMS ANALYSIS

SYSTEMS DESIGN

SYSTEMS

DEVELOPMENT

SYSTEMS

IMPLEMENTATION

SYSTEMS

MAINTAINENCE

21

7. OUTLINE OF THE PROBLEM OR TASK UNDERTAKEN

Advantages previously held by large financial institutions have shrunk considerably. The

Internet has leveled the playing field and afforded open access to customers in the global

marketplace. Internet banking is a cost-effective delivery channel for financial institutions.

Consumers are embracing the many benefits of Internet banking. Access to one's accounts at

any time and from any location via the World Wide Web is a convenience unknown a short

time ago. This empirical research study mainly focuses on the major factors that influences

online customers satisfaction with the overall service quality of their bank.

United Bank of India is going for the retail banking in a big way. However, much is still to be

achieved. This study that has been conducted in this project show these facts:

About 75% of the respondents feel that E-Banking services are necessary for its

convenience, 24 hours accessibility and quick services.

8% respondents are still visiting Bank after having started using UBI E-Banking.

More number of customers visits Banks after having e-Banking because of they cant

do all the transactions those are physical and some of the information can be

discussed with Bank employees directly.

60% of the respondents face problems using UBI E-Banking services due to lack of

knowledge and insecurity.

More than 65% of the respondents have either not used UBI E-Banking services or

have used the services only once in a year.

65% of the respondents are not willing to use their cards online due to security

reasons.

81% respondents agree that new laws should be made to protect privacy on the

Internet.

22

59% of the users are satisfied with the E-Banking services provided by the Bank.

When judging the quality of the provided E-banking services, customers consider a lot of

factors which influence their judgment. For some customers the response and efficiency of

the service providers would be of greatest importance, for others the security and privacy

issues might be more important, and still for others what matters most may be the website

design and ease of use. In reality, customers have different expectations and requirements.

They deem different aspects of the service delivery process for essential in order for them to

be satisfied with the service.

This study is based on the preliminary investigation and systems analysis of UBI E-Banking

services which constitutes of the first and second phase of SDLC of MIS, in which system

requirements are studied and structured. A proper understanding of the UBI E-Banking

services and data gatherings on customer requirements through surveys and interviews has

defined the current E-Banking system, including the location of problems/opportunities and

an explanation of how to fix/enhance/replace the system.

23

8. RESEARCH METHODOLOGY

8.1. What is a research methodology?

Research is defined as human activity based on intellectual application in the investigation of

matter. The primary purpose for applied research is discovering, interpreting, and the

development of methods and systems for the advancement of human knowledge on a wide

variety of scientific matters of our world and the universe.

In every research area or subject, our knowledge is incomplete and problems are waiting to

be solved. We address the void in our knowledge and those unresolved problems by asking

relevant questions and seeking answers to them. The role of research is to provide a method

for obtaining those answers by inquiringly studying the evidence within the parameters of the

scientific method.

Methodology is the method followed while conducting the study on a particular project.

Through this methodology a systematic study is conducted on the basis of which the basis of

a report is produced.

It is a written game plan for conducting Research. Research methodology has many

dimensions. It includes not only the research methods but also considers the logic behind the

methods used in the context of the study and explains why only a particular method or

technique has been used. It also helps to understand the assumptions underlying various

techniques and by which they can decide that certain techniques will be applicable to certain

problems and other will not. Therefore in order to solve a research problem, it is necessary to

design a research methodology for the problem as the some may differ from problem to

problem.

24

8.2. Objectives of research:

To identity the level of security among customers in using these services.

To educate the customers about important measures the customer has to take to avoid

online fraud.

To understand the problems encountered by the users while using E-Banking channels

(ATM, Internet banking, etc.)

To examine the most and the least important factor that influences the consumers

demand towards internet banking system.

To study the awareness level of customers regarding E-Banking.

To find out the frequency and the factors that influences the adoption of E-Banking

services.

To measure the satisfaction level of people.

8.3. Type of research:

This study is both of QUANTITATIVE and QUALITATIVE in nature. It helps in breaking

vague problem into smaller and precise problem and emphasizes on focussing into these

areas and reach necessary conclusions.

8.4. Research design

Research design constitutes the blue print for the collection, measurement and analysis of

data. The present study seeks to identify the various E-Banking services provided by UBI

Head Office to its customers and to what extent they have proven to be helpful. The research

design is a combination of both quantitative and qualitative research. The research has been

conducted on service class people within Kolkata. For the selection of the sample, convenient

sampling method was adopted and an attempt has been made to include all the age groups

and gender within the service class.

25

8.5. Methods of data collection:

8.5.1. Questionnaire

Questionnaires had both open and close-ended questions which required specific answers.

The respondents selected the correct options, ticked and wrote the correct answers where

appropriate, for those who could read and write. For those who were unable to read and write,

interviews were conducted using the questionnaires.

8.5.2. Interviews

Interviews were determined beforehand while others arose during the course of the

conversation. The interviews were also done on individual-oriented basis to allow expression

of personal viewpoints. The researcher used face to face interviews because of the following

reasons; Provision of first-hand information, Rich data collection, Cost effective, speedy and

Ability to clarify the questions, clear doubts and adds new questions where necessary.

8.6. Sources of data:

What is Primary data?

Data used in research originally obtained through the direct efforts of the researcher through

surveys, interviews and direct observation. Primary data is data that has not been previously

published, i.e. the data is derived from a new or original research study and collected at the

source. It is more current and more relevant to the research project.

8.6.1. Sources of Primary data:

Questionnaire was used to collect primary data from respondents. The questionnaire was

structured type and contained questions relating to different dimensions of e-banking

preferences among service class such as level of usage, factors influencing the usage of e-

banking services, benefits accruing to the users of e-banking services, problems encountered.

The questions included in the questionnaire were open-ended, dichotomous and offering

multiple choices. Interviews were were also done on individual-oriented basis to allow

26

expression of personal viewpoints.

What is Secondary data?

Secondary data is information that has already been collected for a purpose other than the

current research project but has some relevance and utility for your research.

Secondary data can be classified into internal sources and external sources. Internal sources

include data that exists and is stored inside your organization. External data is data that is

collected by other people or organizations from your organization's external environment.

8.6.2. Sources of Secondary data:

Most of the data has been collected from Sr. Manager (IT) Mr. Srijan Kumar Kundu.

Through the official website of UBI- www.unitedbankofindia.com and various other

websites.

Collection of information from different kinds of books the data of company what

they maintained.

8.7. Study population

The study population comprised of all the employees and some clients of UBI Head Office-

8.8. Sampling Size

It indicates the numbers of people to be surveyed. The survey was carried out at UBI Head

Office. Though large samples give more reliable results than small samples but due to

constraint of time and money, the sample size was restricted to hundred respondents (100);

comprising of thirty (30) bank staff and seventy (70) clients of the bank who were

interviewed to determine the effect of electronic banking on customer satisfaction. The

respondents belong to different income group and profession.

27

8.9. Sampling method

The study involved the use of purposive sampling, whereby samples were selected from the

study population. Here the respondents were selected from the bank officials who serve

specific roles within electronic banking systems like database managers and bank managers.

This helped to ensure interviewing of relevant informants with first-hand information.

8.10. Data Processing Analysis and presentation

The data collected using the questionnaires and interview guides was edited, coded

tabulated and analysed through the application of statistical techniques, such as bar graphs

and pie charts for completeness and accuracy. Descriptive statistics such as tables were

used in the presentation of the data and the qualitative data collected required a descriptive

and content analysis.

28

9. DATA INTERPRETATION

Statistics

Respondents having UBI E-Banking account.

Response valid

Response missing

100

0

Respondents having UBI E-Banking account. (Table: 7)

Frequency Percentage Cumulative Percentage

YES 100 100.0 100.0

Respondents having UBI E-Banking account:

The percentage of E-Banking users is 100%.

Here I took customer information from Bank containing only of users of Internet

Banking and e-banking users.

100%

0%

Do you have an UBI E-Banking account?

YES

NO

29

Statistics

Gender of the respondents

Response valid

Response missing

100

0

Gender of the respondents (Table: 8)

Frequency Percentage Cumulative Percentage

Male

Female

67

33

100

67.0

33.0

100.0

67.0

100.0

Gender of the respondents:

67% of the respondents are male.

The rest 33% of the respondents are female.

0

10

20

30

40

50

60

70

Male Female

Gender of the respodents

30

Statistics

Age group of the respondents using UBI E-Banking

Age group of the respondents using UBI E-Banking (Table: 9)

Frequency Percentage Cumulative Percentage

15-30 years

31 to 40 years

41 to 50 years

Above 50 years

31

43

21

5

100

31.0

43.0

21.0

5.0

100.0

31.0

74.0

95.0

100.0

Age group of the respondents using UBI E-Banking:

31% of the E-Banking users age between 15 to 30 years.

43% of the E-Banking users are between 31 to 40 years of age.

21% of the users a between 41 to 50 years of age.

5% of the users using UBI E-Banking services are above 50 years of age.

0

5

10

15

20

25

30

35

40

45

15 to 30 years 31 to 40 years 41 to 50 years Above 50 years

Age group of the respondents using UBI E-Banking

Response valid

Response missing

100

0

31

Statistics

Profession of the respondents using UBI E-Banking services

Profession of the respondents using UBI E-Banking services (Table: 10)

Profession of the respondents using UBI E-Banking services:

63 per cent of the respondents are service men.

21 per cent are from business background.

3 per cent respondents are non-working.

13 per cent are students.

0

10

20

30

40

50

60

70

Service man Business Man Not working Student

Profession of the respondents using UBI E-Banking services

Response valid

Response missing

100

0

Frequency Percentage Cumulative Percentage

Service man

Business man

Not working

Student

63

21

3

13

100

63.0

21.0

3.0

13.0.

100.0

63.0

84.0

87.0

100.0

32

Statistics

Awareness of people regarding e-banking services provided by UBI while opening an

account.

Awareness of people regarding e-banking services provided by UBI while opening an

account (Table: 11)

Frequency Percentage Cumulative Percentage

Fully aware

Had an idea

No idea

37

46

17

100

37.0

46.0

17.0

100.0

37.0

83.0

100.0

.

Awareness of people regarding e-banking services provided by UBI while opening an

account:

37% of the respondents were fully aware about the various E-Banking services

provided by UBI.

46% of the respondents had some idea about the E-Banking services.

17% of the respondents did not have any idea about how these services work.

37%

46%

17%

Awareness of people regarding e-banking services provided by

UBI while opening an account

Fully aware

Had an idea

No idea

Valid

Missing

100

0

33

Statistics

Sources of awareness about E-Banking

Response valid

Response missing

100

0

Sources of awareness about E-Banking (Table: 12)

Frequency Percentage Cumulative Percentage

Friends

Family

Relatives

Bank officials

Advertisements

Total

39

7

16

20

18

100

39.0

7.0

16.0

20.0

18.0

100.0

39.0

46.0

62.0

82.0

100.0

Sources of awareness about E-Banking are:

39% respondents responded as friends

20% respondents responded as Bank officials

18% respondents chosen by advertisements.

0

5

10

15

20

25

30

35

40

Sources of awareness about E-Banking

34

As shown in figure more respondents came to know about E-Banking by friends.

From Family were very few because its an electronic Banking and only educated and

youngsters can able to do.

Statistics

Feel using the Internet for shopping and banking would make life easier.

Response valid

Response missing

100

0

Feel using the Internet for shopping and banking would make life easier. (Table: 13)

Frequency Percentage Cumulative Percentage

YES

NO

Total

73

27

100

73.0

27.0

100.0

73

100.0

Customers felt using E-Banking services for shopping and banking would make your

life easier:

73% respondents responsed e-banking servises would make their lives easier.

Remaining 27% respondents responsed that the services are not necessary.

The figure shows that most of the customers felt e-Banking a necessity in their life.

73%

27%

Do you feel using E-Banking services for shopping and banking

would make life easier?

YES

NO

35

Statistics

Reasons for choosing UBI E-Banking Services

Response valid

Response missing

130

0

Reasons for choosing UBI E-Banking Services (Table: 14)

Frequency Percentage Cumulative Percentage

Convenience

24 Hour Access to accounts

To Save Time

Others

Total

63

34

17

16

130

48.5

26.2

13.1

12.3

100.0

48.5

74.6

87.7

100.0

Reasons for choosing UBI e-Banking Services

63 Respondents (48%) chosen UBI e-Banking because of its convenience, 34(26%)

chose because of 24 hrs access to accounts, 17(13%) chose to save time and others

chose for other reasons 16(12%).

Here the frequency is 138 i.e. respondents are only 100 but they chose multiple

choices

From the figure it can be said that nearly 50% of the customers chose e-Banking

because of its convenience and 24 Hours access to their accounts.

0

10

20

30

40

50

60

70

Convenience 24 Hour Access

to accounts

To Save Time Others

What are the reasons for choosing UBI E-Banking Services? Please

select all that apply.

36

Statistics

E- Banking services respondents think are more user-friendly

Response valid

Response missing

100

0

E-Banking services Customers think are more user-friendly. (Table: 15)

Frequency Percentage Cumulative Percentage

Internet Banking

ATM services

Mobile Banking

Debit/Credit Cards

Total

8

38

11

43

100

8.0

38.0

11.0

43.0

100.0

8.0

46.0

57.0

100.0

Customers who think services are more user-friendly

43% respondents think Debit/Credit cards as more user-friendly compared to other

services.

38% respondents think ATM services as more user friendly.

11% and 8% respondents think Internet Banking and Mobile Banking as more user-

friendly respectively.

So as shown in figure internet banking users felt Debit/Credit cards as a more user

friendly E-Banking channel.

8%

38%

11%

43%

E-Banking channels Customers think are more user-friendly

Internet Banking

Atm Services

Mobile Banking

Debit/Credit Cards

37

Statistics

Frequency of respondents using UBI E-Banking services

Response valid

Response missing

100

0

Frequency of respondents using UBI E-Banking services (Table: 16)

Frequency Percentage Cumulative Percentage

Daily

Monthly

Weekly

Never

Total

17

43

24

16

100

17.0

43.0

24.0

16.0

100.0

17.0

60.0

84.0

100.0

Usage rate of UBI online services

43% respondents responded that they use UBI E-Banking services once in a month

24% responded that they use the services once in a week.

17% users use online services daily and 16% respondents have never used the

services.

0

5

10

15

20

25

30

35

40

45

Daily Monthly Weekly Never

17

43

24

16

38

Statistics

UBI E-Banking products and services regularly used by respondents

Response valid

Response missing

100

0

UBI E-Banking products and services regularly used by respondents (Table: 17)

Frequency Percentage Cumulative Percentage

Account statement

Tax Payment

Third party transfer

Bill Payment

Transaction Enquiry

49

41

8

19

21

138

35.5

29.7

5.8

13.8

15.2

100.0

35.5

65.2

71.0

84.8

100.0

Products& Services customers use regularly

49 respondents (35.5%) used e-Banking to check their account statement. 41 used for

Tax payment (29.7%), 8 used for cheque book request (5.8%), 19 used for Bill

payment (13.8%) and 21 transaction enquiry (15.2%).

From above it is clear that most of the customers use e-Banking to check their account

statements and for Tax payment.

This is multiple option question so 138 respondents responded with multiple choices.

35%

30%

6%

14%

15%

UBI E-Banking products and services regularly used by

respondents

Account Statement

Tax payment

Third Party Transfer

Bill Payment

Transaction Enquiry

39

Statistics

Make purchases through E-Banking

Response valid

Response missing

100

0

Number of respondents making purchases through E-Banking (Table: 18)

Frequency Percentage Cumulative Percentage

YES

NO

Total

48

52

100

48.0

52.0

100.0

48.0

100.0

Respondents purchasing through e-Banking

52% respondents responded that they did not make purchases through e-Banking.

Only 48 respondents made purchasing through UBI E-Banking.

From the above graph less number of users made purchases through UBI E-Banking.

48%

52%

Respondents making purchases through E-Banking

YES

NO

40

Statistics

Frequency of respondents who used UBI E-Banking services in the last 12 months

Valid

Missing

100

0

Frequency of respondents who used UBI E-Banking services in the last 12 months. (Table:

19)

Valid Frequency Percentage Cumulative Percentage

None

One time

Two to four times

Five to seven times

Eight to ten times

Over ten times

Total

34

32

14

10

6

4

100

34.0

32.0

14.0

10.0

6.0

4.0

100.0

34.0

66.0

80.0

90.0

96.0

100.0

Made purchasing through e-Banking in the last 12months

34% respondents response is none. 32% respondents used the services once a year.

Only few of respondents used UBI E-banking services many because they prefer manual

banking over e-Banking.

From the above graph 60% respondents hardly used UBI e-Banking services in a year.

0

5

10

15

20

25

30

35

None One time Two to four

times

Five to

seven times

Eight to ten

times

Over ten

times

Used UBI E-Banking services in the last 12 months

41

Statistics

Benefits accrued from E-Banking services to its users

Response valid

Response missing

100

0

Benefits accrued from E-Banking services to its users. (Table: 20)

Frequency Percentage Cumulative Percentage

Time Saving

Inexpensive

Easy Processing

Easy Fund Transfer

Others

42

13

24

16

5

100

42.0

13.0

24.0

16.0

5.0

100.0

42.0

55.0

79.0

95.0

100.0

Benefits accrued from E-Banking services to its users

42% respondents think that UBI e-Banking services save a lot of time and 24% thinks

it is an easy process.

13% think that the services are inexpensive.

42%

13%

24%

16%

5%

Benefits accrued from E-Banking services to its users

Time Saving

Inexpensive

Easy Processing

Easy Fund Yransfer

Others

42

Statistics

Problems identified by the users of UBI E-Banking service

Problems identified by the users of UBI E-Banking service. (Table: 21)

Frequency Percentage Cumulative Percentage

Lack of Knowledge

Insecurity

ATM out of order

Password Forgotten

Card Misplaced

Card Misuse

36

24

13

14

11

2

100

36.0

24.0

13.0

14.0

11.0

2.0

100.0

36.0

60.0

73.0

87.0

98.0

100.0

Problems identified by the users of UBI E-Banking service

36% respondents face problems using E-banking services due to lack of knowledge

and 24% due to insecurity of losing their personal information.

14% faces problems as they cannot remember their account passwords.

11% had their cards misplaces and 2% had their cards misused.

36%

24%

13%

14%

11%

2%

Problems identified by the users of UBI E-Banking service

Lack of Knowledge

Insecurity

ATM out of order

Password Forgotten

Card Misplaced

Card Misuse

Response valid

Response missing

100

0

43

Statistics

Importance of Privacy Maintenance while using E-Banking services.

Importance of Privacy Maintenance while using E-Banking services. (Table: 22)

Frequency Percentage Cumulative Percentage

Very important

Less important

Not important

Total

63

22

15

100

63.0

22.0

15.0

100.0

63.0

85.0

100.0

Importance of Privacy maintenance while using E-Banking services

63% respondents responded privacy is very important.

22% respondents feels it is less important.

15% respondents thinks it does not hold any importance.

63%

22%

15%

Importance of Privary Maintainence while usinf E-Banking

services

Very Important

Less Important

Not Important

Response valid

Response missing

100

0

44

Statistics

Importance of Security of Transactions while using E-Banking services.

Importance of Security of Transactions while using E-Banking services.(Table: 23)

Frequency Percentage Cumulative Percentage

Very important

Less important

Not important

Total

81

13

6

100

81.0

13.0

6.0

100.0

81.0

94.0

100.0

Importance of Security of Transactions while using E-Banking services:

81 respondents responded security transactions was very important to them.

13% thinks it is less important and 6% thinks it is not important.

From the graph we can understand how much important it is for the customers to have

security for transactions.

81%

13%

6%

Security of transactions

Very Important

Less Important

Not Important

Response valid

Response missing

100

0

45

Statistics

Respondents still visiting the bank after

having started using UBI E-Banking

Response valid

Response missing

100

0

Respondents still visiting the bank after having started using UBI E-Banking. (Table: 24)

Frequency Percentage Cumulative Percentage

YES

NO

Total

86

14

100

86.0

14.0

100.0

86

100.0

Still visits the Bank since after having started using UBI e-Banking

86 respondents that they still visiting Bank after having started using UBI E-Banking.

More number of customers visits Banks after having e-Banking because of they cant

do all the transactions those are physical and some of the information can be

discussed with Bank employees directly.

0

10

20

30

40

50

60

70

80

90

YES NO

Do you still visit the bank after having started using UBI E-

Banking?

46

Statistics

Reasons to visit your Bank branch (single most important reason)

Response valid

Response missing

100

0

Statistics

Reasons to visit your Bank branch (single most important reason). (Table: 25)

Frequency Percentage Cumulative Percentage

To make deposit

To get advice for investment

options

To enquire about balance

To withdraw cash

Other

Total

37

10

7

39

7

100

37.0

10.0

7.0

39.0

7.0

100.0

37.0

47.0

54.0

93.0

100.0

-

Reasons to visit your Bank branch:

39 % has responded that they visit the branch to withdraw cash & 37% to make

deposits.

10% of the respondents visit the branch to get advice for investment.

14% visit the bank to enquire about their account balance and other purposes.

40%

11%

7%

42%

What are the reasons to visit your bank branch? (Please select

the singlemost important reason.

To make diposit

To get advice for investment

options

To enquire about balance

To withdraw cash

Other

47

Statistics

Respondents overall satisfied with UBI E-Banking

Response valid

Response missing

100

0

Respondents overall satisfied with UBI E-Banking. (Table: 26)

Frequency Percentage Cumulative Percentage

Very satisfied

Satisfied

Neutral

Unsatisfied

Total

18

59

14

9

100

18.0

59.0

14.0

9.0

100.0

18.0

77.0

91.0

100.0

Respondents overall satisfied with UBI e-Banking

59 respondents were satisfied with SBI E-Banking services and 18 were very satisfied.

8 respondents chose unsatisfied because of some technical issues till not resolved.

15 are neutral.

18%

59%

14%

9%

Respondents overall satisfied with UBI E-Banking

Very Satisfied

Satisfied

Neutral

Unsatisfied

48

10. LEARNING THROUGH THE PROJECT

Out of the overall percentage of the UBI E-Banking users 67% are male users and

33% are female users.

31% of UBI E-Banking users age between 15 to 30 years, 43% age between 31 to 40

years, 21% between 41 to 50 years and 5% users age 50 years and above.

The UBI E-Banking users constitutes of 63% users who are service men by

profession, 21% are business men, 13% students and 3% users who are not working

presently.

The overall percentage of respondents having complete knowledge about e-banking

services provided by the bank while opening an account in it is 37%, those having

some idea about it is 46% and the percentage of people have no awareness of e-

banking services provided by the bank is 17%. It can reasonably, be concluded that

nearly 85% of the population is having awareness about e-banking services.

39% of the respondents came to know about UBI E-Banking services through friends,

7% through family members, 16% through their relatives, 20% from the bank officials

themselves while opening bank accounts and 18% through advertisements.

The Users of UBI E-Banking services who feel that using the internet for shopping

and banking has made their lives easier constitutes of 73% population. From this we

can conclude that E-Banking is making a positive impact on the lives of the users.

A study of the factors, influencing the usage was made by listing out various factors

such as convenience, 24 hours access, time saving etc., and amongst the various

factors convenience is ranked as the major motivating factor, followed by 24 hours

access and time saving factor.

The E-Banking channel that respondents feel is most user-friendly is the card system

which includes UBI Debit/Credit cards with 43% response, followed by ATM

services with 38% response, followed by Mobile Banking with 11% . Interestingly

Internet banking has got the lowest response of 8%.

Out of the 100 users of UBI E-Banking 43% users use the services only once a month,

24% users uses the services once a week 17% uses them on a daily basis. 16% of the

respondents have never used UBI E-Banking services in their lives. Here we can see

that about one-sixth of the population in ignorant of the services.

49

63% of the respondents feel that maintenance of privacy while using UBI E-Banking

services is very important. 22% respondents have neutral feelings and 15% feels it is

of less importance.

81% of the respondents feel that there should be security of transactions while making

online transactions through UBI E-Banking. This shows that security of transactions

is a factor that should be given utmost importance.

Most of the services that the users use while using UBI E-Banking is to check account

statement which topped with 35.5% response, followed by Tax payment with 29.7%

response, followed by transaction enquiry with 15.2% response and bill payment and

third party transfer with 13.8% and 5.8% response respectively.

When asked to list various benefits accruing from the usage of e-banking, time saving

received highest percentage score at 42.42% among different benefits such as time

saving (42.42%), inexpensive (12.72%), easy processing (24.24%), easy fund

transfer(15.75%).Quite interestingly, easy processing feature scored more than the

inexpensiveness of the e-banking services. The other benefits accruing to the people

include ready availability of funds, removal of middlemen and no rude customer

relation executives.

Among the users, various problems that are encountered while using e-banking

services. Card misuse and its misplace are major reasons that create hurdles in its

usage, while time consumption, accounting mistakes such as amount debited but not

withdrawn and change of mobile number seem to be the least bothering problems.

86% respondents still visits their bank after having started using UBI E-Banking

services for reasons like making deposits, get advice for investments, to enquire about

balance, to withdraw cast etc.

Overall, 67% of the users are satisfied with UBI E-Banking services. 15 % users have

neutral feelings about the services and 8% users are not satisfied.

50

11. LIMITATIONS OF THE STUDY

This work had been conducted within a short period of two months and this restriction

in time employed made it impossible for the researcher to include all areas affected.

The sample size of only 100 was taken from the large population for the purpose of

study, so there can be difference between results of sample from total population.

The respondents were reluctant to respond and felt uneasy and suspicious of the

information being gathered and thought that the data was to be used for other motives

against them.

Due to continuous change in environment, what is relevant today may be irrelevant

tomorrow.

51

12. CONCLUSION

The internet banking has been growing rapidly in India. It is an innovative tool that is fast

becoming a necessity. It is a successful strategic weapon for banks to remain profitable in a

volatile and competitive marketplace of today. The service is quick, easy to use, easy to

transfer money from one account to another electronically at any time of the day. The growth

in the recent years in E-banking services has resulted into benefit to the customer. However it

was noticed that skilled employees are less with reference to electronic banking than manual

banking. The customer representatives for on-line services fairly respond to clients queries

on a timely fashion, were the major factors negatively affecting electronic banking methods

employed at UBI Head Office. Findings reveal that Electronic Banking has satisfied most of

people banking needs, most bank clients enjoy using e-Banking, however they are not aware

and knowledgeable of the current threats and required security measures that need to be

taken while using E-Banking.

The usage of E-banking is all set to increase among the customers. The customers at the

moment are not using the services thoroughly due to various hurdling factors like insecurity

and privacy reasons etc. However, in future, the availability of technology to ensure safety

and privacy of e-transactions and the RBI guidelines on various aspects of internet banking

will definitely help in rapid growth of internet banking in India.

52

13. CONTRIBUTION TO THE ORGANIZATION

Internet banking would drive us into an age of creative destruction due to non-physical

exchange, complete transparency giving rise to perfectly electronic market place and

customer supremacy. This study focuses on the various factors that need to be followed in

order to have a satisfied customer base and long-term success. Below are the various

recommendations:

13.1. Technology and Security Standards:

Organizations should make explicit security plan and document it. There should be a

separate Security Officer / Group dealing exclusively with information systems

security. The Information Technology Division will actually implement the computer

systems while the Computer Security Officer will deal with its security. The

Information Systems Auditor will audit the information systems.

Organizations should make explicit security plan and document it. There should be a

separate Security Officer / Group dealing exclusively with information systems

security. The Information Technology Division will actually implement the computer

systems while the Computer Security Officer will deal with its security. The

Information Systems Auditor will audit the information systems.

Access Control: Logical access controls should be implemented on data, systems,

application software, utilities, telecommunication lines, libraries, system software, etc.

Logical access control techniques may include user-ids, passwords, smart cards or

other biometric technologies.

Firewalls: At the minimum, banks should use the proxy server type of firewall so that

there is no direct connection between the Internet and the banks system. It facilitates

a high level of control and in-depth monitoring using logging and auditing tools. For

sensitive systems, a stateful inspection firewall is recommended which thoroughly

53

inspects all packets of information, and past and present transactions are compared.

These generally include a real-time security alert.

Penetration Testing: The information security officer and the information system

auditor should undertake periodic penetration tests of the system, which should

include:

Attempting to guess passwords using password-cracking tools.

Search for back door traps in the programs.

Attempt to overload the system using DdoS (Distributed Denial of Service) &

DoS (Denial of Service) attacks.

Check if commonly known holes in the software, especially the browser and

the e-mail software exist.

The penetration testing may also be carried out by engaging outside experts

(often called Ethical Hackers).

Monitoring against threats: The banks should acquire tools for monitoring systems

and the networks against intrusions and attacks. These tools should be used regularly

to avoid security breaches.

13.2. Legal Issues

Banks may be allowed to apply for a license to issue digital signature certificate under

Section 21 of the Information Technology Act, 2000 and function as certifying

authority for facilitating Internet banking. Reserve Bank of India may recommend to

Central Government for notifying the business of certifying authority as an approved

activity under clause (o) of Section 6(1) of the Banking Regulations Act, 1949.