Académique Documents

Professionnel Documents

Culture Documents

Macroeconomic Developments in Serbia: September 2014

Transféré par

faca_zakonTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Macroeconomic Developments in Serbia: September 2014

Transféré par

faca_zakonDroits d'auteur :

Formats disponibles

September 2014

Macroeconomic Developments

in Serbia

Inflation Pressures are Low

Inflation is below the target tolerance band but is expected to return within the band by

the year-end

Inflation is below the target tolerance band mainly due to a

fall in food prices, resulting from lower agriculture prices.

However, disinflationary impact of food prices is waning

(contribution -0.2pp y-o-y in August).

Low core inflation is reflecting relative exchange rate

stability in the previous period and low aggregate demand.

Inflation expectations of the financial sector are anchoring

within the target tolerance band.

Disinflation pressures of food prices are about to dissipate

and contribute to rise in inflation in Q4 2014, along with

expected electricity price hike.

Low aggregate demand additionally suppressed by

additional measures of fiscal consolidation will remain the

strongest disinflationary factor.

Main risks to the projected inflation path are associated

primarily with global and fiscal developments.

Chart 1 CPI Developments

(y-o-y rates, in %)

Chart 2 Inflation Projection (from August 2014 IR)

(y-o-y rates, in %)

1.5

2.0

0

2

4

6

8

10

12

14

16

1

2009

3 5 7 9111

2010

3 5 7 9111

2011

3 5 7 9111

2012

3 5 7 9111

2013

3 5 7 9111

2014

3 5 7

CPI Inflation

CPI excl. Food, Energy, Alcohol and Tobacco

0

2

4

6

8

10

12

14

3

2012

6 9 12 3

2013

6 9 12 3

2014

6 9 12 3

2015

6 9 12 3

2016

6

2

Net Exports and Investments - Main Drivers of

Economic Activity

Construction activity to push GDP growth in

Q3

In the coming period GDP growth will be

driven by net exports and investments

Economic growth in 2013 was one of the highest in the

region (2.5%), largely driven by agriculture, automobile and

oil industry. Positive trends were recorded in several other

industrial branches - energy, chemical, electronic industry,

etc.

GDP declined by 1.1% s-a in Q2 due to negative effects of

flooding on energy sector and agriculture.

GDP is expected to grow by 0.5% s-a in Q3 supported by

reconstruction in the areas hit by floods.

In 2014 GDP is expected to decline by 0.5% with positive

contribution to GDP movement coming from net exports

and investments (contributions: C -1.6, I +0.2, G

C

-0.2

G

I

+0.5, NX +0.5pp).

Determined by the expected set of additional austerity

measures and consequently the decline in final

consumption, it is likely to expect short-term stagnation of

GDP in 2015.

Future growth will depend on the speed of the euro area

recovery and the pace of fiscal consolidation.

Chart 3 GDP Developments

(seasonally adjusted, Q1 2006=100)

Chart 4 GDP Growth Projection (from August 2014 IR)

(y-o-y rates, in %)

100

105

110

115

Q3

2008

Q1 Q3

2009

Q1 Q3

2010

Q1 Q3

2011

Q1 Q3

2012

Q1 Q3

2013

Q1 Q3*

2014

*

NBS estimate

-3

-2

-1

0

1

2

3

4

5

Q2

2012

Q4 Q2

2013

Q4 Q2

2014

Q4 Q2

2015

Q4 Q2

2016

3

External Imbalances Expected to Narrow Further

due to Suppressed Domestic Demand

Mays flooding and slowdown in external

demand due to increased geopolitical

uncertainties led to drop in exports

CAB is expected to improve further with low

domestic demand and recovery of external

demand

In Jan-July 2014 current account balance improved by

12.7% y-o-y, reflecting supply-driven growth of exports.

In the same period, exports grew by 7.7% y-o-y, while

imports grew by 2.5% y-o-y due to weak domestic demand.

In July exports stood 44.3% above their pre-crisis level,

while imports were 6.0% below that mark. Exports-to-

imports ratio stood at 73.9% (12-month moving average).

The highest contribution to improvement of CAD/GDP

ratio in 2013 came from chemical (1.1pp), automobile

(0.9pp), oil industry (0.8pp) and services (0.5pp).

Despite adverse effects of the floods on CAD/GDP ratio

(1.0pp), we expect this years current account deficit to be

lower than in 2013.

As domestic demand remains suppressed by the fiscal

consolidation measures, investments in tradables sector

and euro area recovery will lead to further improvement in

trade balance.

Chart 5 Exports and Imports

(seasonally adjusted, 2008=100)

Chart 6 Current Account Deficit and Remittances

(% share in GDP)

40%

50%

60%

70%

80%

90%

60

80

100

120

140

160

180

1

2008

3 5 7 9111

2009

3 5 7 9111

2010

3 5 7 9111

2011

3 5 7 9111

2012

3 5 7 9111

2013

3 5 7 9111

2014

3 5 7

Exports, lhs

Imports, lhs

X/M coverage (12M MA), rhs

10.1

17.7

21.6

6.6

6.7

9.1

10.7

5.0

7.4

10.5

12.3

6.5

5.9

3.8

10,6

9,0

6,8

10,8 10,5

8,4

8,7

8,8

9,1 8,9

0

5

10

15

20

25

2006 2007 2008 2009 2010 2011 2012 2013 2014* 2015*

CAD (BPM-5) old methodology

CAD (BPM-6)** new methodology

Remittances

*

NBS forecast

** higher CAD according to new methodology arised from the statistical

discrepancy related to coverage of exports and imports of goods and inclusion

of reinvested earnings in income account

4

he fall of the Serbias risk premium since the

year beginning was the highest in the region

Serbias risk premium on historical lows in the

last four months

Serbias external debt decreased due to

private sector deleveraging

Despite the recent increase by app. 40 bp, EMBI spread for

Serbia has seen the largest fall among the observed

countries in the region since the year beginning (by more

than 100 bp).

At the beginning of September it stood at app. 260 bp.

In April S&P confirmed Serbias BB- rating reflecting

government willingness to conduct fiscal consolidation and

expected speed-up in structural reforms. In July, Fitch

confirmed B+ rating for Serbia, with stable outlook.

Total external debt to GDP ratio dropped to 80.0% at the

end of Q2.

The deleveraging process is driven by banks, as

enterprises are increasing their exposure in 2014.

Gradual bank deleveraging is expected to continue in

2014, as declining lending activity is increasingly financed

from domestic savings.

Compared to other CEE countries, bank deleveraging is

modest (8.5% GDP reduction from maximum exposure).

Chart 7 EMBI Risk Premium

(basis points, daily values)

Chart 8 External Debt

(EUR m)

0

200

400

600

800

1000

12

2009

2 4 6 8 1012

2010

2 4 6 8 1012

2011

2 4 6 8 1012

2012

2 4 6 8 1012

2013

2 4 6 8

EMBI Global Romania

Hungary Poland

Turkey Serbia

Croatia Bulgaria

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

-950

-700

-450

-200

50

300

550

800

1050

1300

1550

1800

Q2

2008

Q4 Q2

2009

Q4 Q2

2010

Q4 Q2

2011

Q4 Q2

2012

Q4 Q2

2013

Q4 Q2

2014

Enterprises, lhs

Banks, lhs

Private external debt in GDP, rhs

External debt in GDP, rhs

*Excluding EUR 672.1 mln growth in corporate external debt which is the result of purchase

transactions between two associated companies and thus cannot be regarded as real

cross border borrowing by firms.

5

Monetary Policy on Cautious Loosening Cycle

Recent depreciation of regional currencies due

to increased global uncertainties

Since June NBS kept key policy rate on hold

reflecting fiscal and external risks

The Dinar weakened by 2.7% in the first eight months of

2014.

Recent weakening of the dinar was driven by global

uncertanties, as well as by domestic factors - fiscal

uncertainty, higher CAD and increased demand for FX by

the energy sector.

In 2014, the NBS intervened in the IFEM by selling EUR

1015m and buying EUR 200m.

Risks of further escalation of geopolitical tensions could

negatively affect international capital flows and the

countrys risk premium.

Implementation of fiscal consolidation measures will

contribute to the alleviation of external risks and help to

stabilize inflation at a low level, which will enable further

monetary policy easing.

Bank lending rates have been following the key policy

rate. Recent drop in lending rates resulted from

subsidized loans programme initiated by the government.

Chart 9 Exchange Rate Developments

(Q2 2010=100)

Chart 10 Interest Rates

(y-o-y rates, in %)

50

55

60

65

70

75

80

85

90

95

100

105

110

115

120

12

2009

2 4 6 8 1012

2010

2 4 6 8 1012

2011

2 4 6 8 1012

2012

2 4 6 8 1012

2013

2 4 6 8

Serbia Romania

Poland Hungary

Turkey

13.6

8.5

5

10

15

20

25

30

1

2009

3 5 7 9111

2010

3 5 7 9111

2011

3 5 7 9111

2012

3 5 7 9111

2013

3 5 7 9111

2014

3 5 7 9

Private Sector* (3 months moving average)

Policy Rate

*weighted interest rate on non-indexed RSD loans (up to September 2010

the data was exclusively used for research purposes of NBS)

6

Recovery of FDI Inflows is Expected

EU accession process, government stability

and structural reforms will stimulate FDIs

FDI inflows are well-diversified, with

increasing share directed at tradables sector

FDI recovered in 2013 as a result of projects in the

manufacturing sector, followed by finance and construction.

In the first seven months of 2014 FDI inflow of EUR 0.7bn

was recorded. Majority of the inflows targets energy sector

(45% of total), manufacturing (24%) and retail trade (7%).

Despite geopolitical tensions, significant inflow in the

medium term is expected from the South Stream gas

pipeline. Bilateral agreements will result in increased inflows

from UAE and China.

Before the crisis, dominant share of FDI inflows was

directed at financial services and real estate.

Share of investments directed at tradables sector is

increasing, and is expected to contribute to future exports

growth.

Chart 11 Net FDI

(EUR bn)

Chart 12 FDI Composition by sector

(% of gross inflow)

1.250

3.323

1.821

1.824

1.373

1.040

2.197

0.669

1.229

1.250

1.400

0

2

4

6

8

10

12

14

16

18

2005 2006 2007 2008 2009 2010 2011 2012 2013 Total 2014* 2015*

FDI (BPM-6)**

FDI (BPM-5)

14.3%

6.4%

5.6%

4.7%

3.7%

7.0%

* NBS forecast **as of 2010, includes intercompany loans and reinvested earnings

2.3%

14.726

3.8%

4.3%

3.9%

6.2% of GDP

0

20

40

60

80

100

2007 2008 2009 2010 2011 2012 2013

Other Construction & real estate

Finance Trade & repairs

Manufacturing Tradable sector share*

*includes manufacturing, agricultre, transport, accomodation, food services

7

Fiscal Consolidation

Main Challenge for the Government

Set of additional austerity measures is to be

implemented by the government

which will stabilize public debt-to-GDP in

the medium-term

In H1 general govt. deficit amounted to 7.6% of GDP (incl.

below-the-line items) mainly due to high interest payments

(3.7% of GDP). Fiscal deficit is expected to reach 8% GDP

in 2014 partly due to flooding.

The austerity measures adopted earlier this year include the

preferential VAT rate increase, introduction of the solidarity

tax on wages in public sector and employment freeze.

Consolidation measures to be implemented in Q4 mainly

include cuts in public wage and pension bills, speed-up public

sector reforms and should result in stand-by arrangement

with IMF.

Public debt amounted to 20.9bn (67.0% of GDP) at the

end of July 2014.

In order to stabilize public debt in medium-term (by 2017),

a fiscal adjustment of app. 5pp of GDP is required over

2014-2017 period.

Reduction in below-the-line items (projected at 1.7% of

GDP in 2014) including loan guarantees to public sector

and bank recapitalizations is essential to stabilize public

debt.

Reform of public enterprises will contribute to this process.

Chart 13 Fiscal Revenues, Expenditures and Result

(% share in GDP)

Chart 14 Public Debt

(EUR bn)

-10

-8

-6

-4

-2

0

2

4

6

8

10

30

35

40

45

50

55

60

2006 2007 2008 2009 2010 2011 2012 2013 Q1

2014

Q2

Fiscal balance, rhs Primary balance, rhs

Revenues, lhs Expenditures, lhs

0

10

20

30

40

50

60

70

-1

1

3

5

7

9

11

13

Q2

2010

Q4 Q2

2011

Q4 Q2

2012

Q4 Q2

2013

Q4 Q2

2014

External, lhs

Internal, lhs

% of GDP, rhs

8

The Pace of Contraction in Bank Lending is

Slowing Down

High banking sector capitalisation due to

restrictive monetary policy and strong

prudential measures (in pre-crisis period)

Improvement in lending activity resulted from

government`s subsidized loan programme to

the coorporate sector

In 2014 banks kept high level of CAR from 2013, ending

une 2014 with 20.4%, mainly due to recapitalizations and

lower credit risk-weighted assets.

Stress tests show that Serbian banking sector is resilient to

potential negative shocks.

After a more than a year, the pace of contraction in bank

lending has softened.

Subsidized loans contributed to a mild recovery in bank

lending to enterprises (liquidity loans and loans for

financing of durable working capital). From mid May to

mid August RSD 78.2bn worth of subsidized loans was

extended.

The y-o-y growth in credit to households picked up slightly

to 4.4% in July.

Chart 15 Capitalization of the Serbian banking sector

(CAR, in %)

Chart 16 Bank Lending to Enterprises and Households

(y-o-y rates, excluding exchange rate effects, in %)

20.4

0

5

10

15

20

25

30

Q1Q2

2009

Q3Q4Q1Q2

2010

Q3Q4Q1Q2

2011

Q3Q4Q1Q2

2012

Q3Q4Q1 Q2

2013

Q3Q4Q1Q2

2014

Basel Standard (8%)

Regulatory Minimum (12%)

Introduction of Basel II

-7.6

4.4

-3.1

-0.9

-15

-10

-5

0

5

10

15

20

25

1

2010

3 5 7 9 11 1

2011

3 5 7 9 11 1

2012

3 5 7 9 11 1

2013

3 5 7 9 11 1

2014

3 5 7

Enterprises Households

Total Total*

*With the exclusion of four delicensed banks' receivables

9

Banking Sector Credibility Sustained

Household FX savings grew by more than

3.5bn since 2008

Reserve requirement policy is set to stimulate

dinar and longer-term bank funding

After a drop in Q4 2008, FX savings has been increasing. At

the end of July 2014 it stood at 8.5bn.

Good memory from 2008 (unhampered withdrawals of

savings after Lehmans collapse) contributed to rise in

savings afterwards.

Savings were unaffected by delicensing of the four banks

over last two years.

Although still low, RSD savings have doubled compared to

2012-end.

As of June 2012, RR ratios are as follows:

FX: 29% for < 2y, 22% for > 2y;

FX indexed deposits: 50% regardless of funds maturity;

RSD: 5% for < 2y, 0% for > 2y.

During January 2011 August 2014, RR allocated in FX

decreased by 967.6m, while RR allocated in dinars

increased by RSD 84.7bn.

Chart 17 Household FX Savings

(EUR bn, e.o.p.)

Chart 18 Reserve Requirement Ratios

(in %)

0

5

10

15

20

25

30

35

40

45

0

1

2

3

4

5

6

7

8

9

1

2008

4 7 10 1

2009

4 7 10 1

2010

4 7 10 1

2011

4 7 10 1

2012

4 7 10 1

2013

4 7 10 1

2014

4 7

FX savings, bn EUR, l.h.s.

LC savings, bn RSD, r.h.s.

29.0

30.0

50.0

5.0

25.0

22.0

0.0

0

10

20

30

40

50

1

2011

3 5 7 9 11 1

2012

3 5 7 9 11 1

2013

3 5 7 9 11 1

2014

3 5 7

FX <2y

Fx indexed, all maturities

RSD <2y

FX >2y

RSD >2y

10

Although Non-Performing Loans Are High,

Banking Sector is Stable

Non-performing loans are high ...but potential losses are fully covered

Main drivers of total NPL are companies in manufacturing,

trade and construction sectors and entities in bankruptcy

procedure (included in other sectors).

NPL in the households sector are significantly below the

average (10.4% in July 2014).

NBS has adopted certain regulatory measures aimed at

resolving NPL, but economic recovery dynamics and

effectiveness of legal framework will be equally important.

Gross NPLs are fully covered by balance sheet loan loss

reserves, i.e. regulatory provisions (112.0% in July 2014).

IFRS provisions cover more than half of NPL (54.3% in

July 2014).

NPL net of IFRS provisions to capital reached 34.4% in

July 2014.

Chart 19 Gross NPL ratio by sectors

(in %)

Chart 20 Gross NPL coverage ratio

(in %)

10.4

22.8

27.1

0

5

10

15

20

25

30

35

40

1

2009

3 5 7 9111

2010

3 5 7 9111

2011

3 5 7 9111

2012

3 5 7 9111

2013

3 5 7 9111

2014

3 5 7

Households

Total NPL

Corporates

Other sectors

34.9

112.0

54.3

40

60

80

100

120

140

160

Q1 Q2Q3

2009

Q4Q1 Q2Q3

2010

Q4Q1 Q2Q3

2011

Q4 Q1Q2Q3

2012

Q4Q1 Q2Q3

2013

Q4Q1Q2 7

2014

Regulatory provisions

(balance only) to gross NPL

IFRS provisions of total loans

to gross NPL

11

Banking Sector Profitability Recovered in 2014

Serbian banking sector is highly liquid Profitability is still negatively affected by high

write-offs

Liquidity ratio is far above the regulatory limit (in July 2014 it

stood at 2.6).

High share of liquid assets to total assets (37.5% in July

2014).

The loan-to-deposit ratio for the banking sector is on

conservative level (1.1 in July 2014).

In 2013 negative profitability of banking sector was driven

by 2 banks (which contributed to 50% of all banking

sector losses), one of which withdrew from the market

through the firesale of assets.

Pre-tax profit is 159 m for the first seven months of

2014 (ROE is 5.3 and ROA is 1.1).

Net interest income and net fees are key components and

drivers of operating income. Net interest margin to

average assets is stable (cca 4%).

Chart 21 Liquidity Chart 22 Profitability

(in %)

20%

25%

30%

35%

40%

45%

50%

55%

60%

0.0

0.5

1.0

1.5

2.0

2.5

3.0

Q1Q2Q3

2009

Q4Q1Q2Q3

2010

Q4Q1Q2Q3

2011

Q4Q1Q2Q3

2012

Q4Q1Q2Q3

2013

Q4Q1Q2July

2014

Loans / Deposits (lhs)

Liuidity ratio (lhs)

Liquid assets to total assets (rhs)

1.1

2.6

37.5%

50

55

60

65

70

75

80

-2

0

2

4

6

8

10

2009 2010 2011 2012 2013 July

2014

ROE (lhs)

ROA (lhs)

Cost to income (rhs)

* Data for ROA and ROE without Agrobanka (2011) and Razvojna banka

Vojvodine (2012)

12

Large Share of Newly Extended Loans is in

Domestic Currency

Coorporate sector is relying more on domestic

bank loans

The new program of government subsidies

gave a boost to corporate loan dinarisation

from June

The outstanding amount of cross border loans is lower than

in 2010, albeit a small increase is registered in H1 2014.

A slight growth of domestic bank loans to enterprises and

stable household borrowing resulted in a small rise of the

share of coorporate and household debt in GDP.

In July 78.3% and 48.6% of new loans to households and

enterprises, respectively, were denominated in local

currency.

Still high interest rate differential contributed to the

increase in the deposit dinarization.

The Government favors local currency savings through its

tax policy and promotes the development of dinar

securities market by issuing longer-term dinar bonds.

NBS supports dinarization through its required reserves

policy.

Chart 23 Private Sector Debt in GDP*

(share in GDP)

Chart 24 Loan and Deposit Dinarisation

(share in total)

4.1

7.2

11.0

10.4

9.6

9.0 8.8

8.6 8.8

4.6

6.2

7.2

7.9

9.1

9.7

9.8

8.8

8.9

2.6

3.9

4.9

4.9

5.4

5.8

5.8

5.9

5.9

0%

20%

40%

60%

80%

100%

2006 2007 2008 2009 2010 2011 2012 2013 Q2

2014

Loans to households

Domestic loans to enterprises

Cross-borders**

* Values in white are in EUR bn

** Starting from 2012. EUR 672.1 mln and EUR 680.6mln as of March 2014 is excluded

from corporate external debt as a result of purchase transactions between two associated

29%

24%

24%

15%

20%

25%

30%

35%

1

2010

3 5 7 9 11 1

2011

3 5 7 9 11 1

2012

3 5 7 9 11 1

2013

3 5 7 9 11 1

2014

3 5 7

Loans to enterprises and households

Deposits of enterprises and households

25%

13

14

Structural slides

Compared to Pre-Crisis Period GDP Growth is

More Sustainable

Consumption-led GDP growth averaged 4.6%

in the period 2005-2008, but the trend reversed

during the crisis

GDP composition has shifted towards less

consumption and more net exports and

investments

Prior to the crisis, high capital inflows led to consumption-

based growth which resulted in increased vulnerabilities and

external imbalances.

With the first wave of the crisis, this trend reversed and

growth became slower, but more sustainable and driven by

net exports and investments.

Large scale investments in automobile and oil industry

(2011 2012) will contribute to rebalancing in the upcoming

years.

As a consequence of the crisis, the share of private

consumption in GDP is declining, bringing painful

adjustments.

Continuation of EU accession process and euro area

recovery will lead to an increase in tradable sectors FDIs,

contributing to more favorable GDP composition.

Fiscal consolidation measures and structural reforms, will

unlock growth potential by removing bottlenecks and

constraints to future growth.

Chart 25 Contributions to Real GDP Growth

(y-o-y rates, pp)

Chart 26 GDP Composition

(share in GDP)

5.4

3.6

5.4

3.8

-3.5

1.0

1.6

-1.5

2.5

-0.5

0.0

-16

-12

-8

-4

0

4

8

12

16

20

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014* 2015*

NX G

I C

CII GDP

* NBS forecast

81.2% 81.7%

80.2%78.0%

77.8%

74.8% 73.6%

70.1%

-28.9%

-20.4%

-17.1%

-19.3%

-20.0%

-14.5%

-14.1%

-11.3%

-40%

-20%

0%

20%

40%

60%

80%

100%

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014* 2015*

C I G CII NX

* NBS forecast

15

Serbias Main Trading Partner is the EU

Serbias major export partners are the EU and

CEFTA

More than half of Serbias imports come from

the EU

Share of exports to EU-28 amounted to 66.6% of total.

Within the EU main export partners in H1 were Italy and

Germany (share of 18.9% and 12.5% of total exports,

respectively).

Serbia is a net exporter to CEFTA countries. Over two thirds

of Serbias CEFTA-bound exports go to Bosnia and

Herzegovina and Montenegro (8.2% and 4.9% of total,

respectively).

Russia is also an important export destination (6.5% of

total).

In H1, major import partners from the EU-28 were

Germany and Italy (12.1% and 12.0% of imports,

respectively).

Share of imports from EU-28 amounted to 64.0% of total.

Outside of the EU, Serbia was importing most from

Russia (10.9%) and China (7.5%).

Chart 27 Exports by Country in H1 2014

(EUR m)

Chart 28 Imports by Country in H1 2014

(EUR m)

0

200

400

600

800

1000

1200

ITA GER BH RUS ROM MNE MKD SLO

0

100

200

300

400

500

600

700

800

900

1000

GER ITA RUS CHN POL HUN AUT

16

17

Appendix

18

Chart 29 Contributions of CPI Components to y-o-y Inflation

(y-o-y rates, pp)

In the last year y-o-y inflation fell by 5.8pp of which -2.2pp (around 37%) is attributable to food prices.

Core inflation, which is the persistent part of the inflation, shows low inflationary pressures since the beginning

of the year.

Waning Disinflationary Impact of Food Prices

0.2

0.8

0.7

0.0

-0.2

1.5

-4

0

4

8

12

16

1

2010

2 3 4 5 6 7 8 9 101112 1

2011

2 3 4 5 6 7 8 9 101112 1

2012

2 3 4 5 6 7 8 9 10 1112 1

2013

2 3 4 5 6 7 8 9 101112 1

2014

2 3 4 5 6 7 8

Energy Services Industrial products excl. food and energy

Processed food Unprosessed food CPI Inflation

Tolerance Band Inflation Target

19

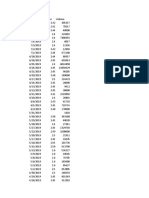

Serbias Economic Outlook

2008 2009 2010 2011 2012 2013 2014 2015

Real GDP, y-o-y % 3.8 -3.5 1.0 1.6 -1.5 2.5 -0.5 0.0

Consumption, y-o-y % 6.7 -2.8 -0.9 -1.1 -1.8 -1.5 -2.1 -4.7

Investment,

1

y-o-y % 16.1 -23.3 -6.8 12.6 15.8 -2.2 1.5 8.0

Government, y-o-y % -0.2 -4.6 0.3 -0.4 2.6 -6.9 1.7 -3.2

Exports, y-o-y % 9.8 -8.0 15.3 3.4 1.8 16.6 5.8 7.5

Imports, y-o-y % 9.6 -19.1 3.1 7.0 1.9 2.0 3.5 1.1

Unemployment Rate, %

4

13.6 16.1 19.2 23.0 23.9 22.1 21.0 21.5

Real Wages, y-o-y % 5.6 0.8 1.0 0.2 1.1 -0.6 -1.0 -2.9

Money Supply (M3), y-o-y % 9.8 21.5 12.9 10.3 9.4 4.6 - -

CPI,

2

y-o-y % 8.6 6.6 10.3 7.0 12.2 2.2

National Bank of Serbia Repo Rate,

3

% 17.8 9.5 11.5 9.75 11.25 9.5 n/a n/a

Current Account Deficit BPM-5 (% of GDP) 21.6 6.6 6.7 9.1 10.7 5.0 - -

Current Account Deficit BPM-6 (% of GDP) - - 7.4 10.5 12.3 6.5 5.9 3.8

General Government Deficit (% of GDP) 2.6 4.5 4.7 4.9 6.5 5.0 5.5

5

4.2

5

Augmented Fiscal Deficit

6

(% of GDP) - - - - 7.5 5.9 7.1

5

5.2

5

4

Labor Force Survey

5

MoF Fiscal Strategy (2013)

6

Includes below-the-line items, MoF data

Excluding the ef f ect of change in inventories

Inf lation f igures in the table represent Dec on Dec inf lation: (Pt/Pt-12)*100-100

End of period data

Chart 2

Serbia

NBS Forecast

20

Banking Sector Overview

2008 2009 2010 2011

Number of banks 34 34 33 33 32 * 30* 29*

Employees 32,342 31,182 29,887 29,228 28,394 26,380 25,502

Branches 2,734 2,635 2,487 2,383 2,243 1,989 1,850

HHI Assets 627 636 629 664 678 741 776

Share of foreign banks, % 75.3 74.3 73.5 74.1 75.2 74.3 74.9

Assets (net), EUR m 20,056 22,530 24,015 25,211 25,322 24,827 24,704

Capital, EUR m 4,740 4,667 4,720 5,104 5,198 5,186 5,249

Loans (gross), EUR m 13,071 13,404 15,324 17,204 17,273 16,140 16,144

Of which gross NPL, EUR m 1,474 2,103 2,592 3,275 3,217 3,448 3,681

Gross NPL ratio, % 11.3 15.7 16.9 19.0 18.6 21.4 22.8

Deposits, EUR m 11,565 13,570 14,263 14,584 14,936 15,067 15,125

Pretax Income, EUR m 392 209 241 296** 230*** -18 159

CAR, % 21.9 21.4 19.9 19.1 19.9 20.9 20.4****

Liquidity Ratio 1.8 1.9 2.0 2.2 2.1 2.4 2.6

FX ratio, % 7.4 3.6 3.9 6.2 5.5 4.4 2.6

ROA, % 2.08 1.02 1.08 1.23** 0.97*** -0.07 1.12

ROE, % 9.27 4.62 5.37 6.04** 4.65*** -0.36 5.29

NIM

1

, % 5.4 5.1 4.6 4.6 4.3 4.2 4.2

1

NIM to average total asset

***** last available data June 2014

** with Agrobanka: Pretax Income 12.0m , ROA 0.05, ROE 0.24

*** with Razvojna banka Vojvodina: Pretax Income 102.5m, ROA 0.43, ROE 2.05

Serbia

2012 2013

July

2014

* the National Bank of Serbia revoked Nova Agrobanka's operating licence on 27 October 2012, on 6 April 2013 the National Bank of Serbia revoked operating licence to Razvojna

banka Vojvodine , to Privredna banka Beograd on 26 October 2013 and Univerzal banka Beograd in January 2014

Vous aimerez peut-être aussi

- EC Greece Forecast Autumn 13 PDFDocument2 pagesEC Greece Forecast Autumn 13 PDFThePressProjectIntlPas encore d'évaluation

- Global Financial CrisisDocument31 pagesGlobal Financial CrisisF-10Pas encore d'évaluation

- Country Strategy 2011-2014 MoldovaDocument21 pagesCountry Strategy 2011-2014 MoldovaBeeHoofPas encore d'évaluation

- Mid-Quarter Monetary Policy Review by RBI On 19 March 2013Document3 pagesMid-Quarter Monetary Policy Review by RBI On 19 March 2013torqtechPas encore d'évaluation

- Country Strategy 2011-2014 AzerbaijanDocument15 pagesCountry Strategy 2011-2014 AzerbaijanBeeHoofPas encore d'évaluation

- International Monetary Fund: Hina Conomic UtlookDocument10 pagesInternational Monetary Fund: Hina Conomic UtlooktoobaziPas encore d'évaluation

- June 28, 2011 July 13, 2011 June 28, 2011 June 28, 2011 January 29, 2001Document70 pagesJune 28, 2011 July 13, 2011 June 28, 2011 June 28, 2011 January 29, 2001Ilya MozyrskiyPas encore d'évaluation

- Republic of Moldova 2011Document78 pagesRepublic of Moldova 2011Alexandra MelentiiPas encore d'évaluation

- Economic Slowdown and Macro Economic PoliciesDocument38 pagesEconomic Slowdown and Macro Economic PoliciesRachitaRattanPas encore d'évaluation

- Economic and Fiscal Outlook 2014-USDocument40 pagesEconomic and Fiscal Outlook 2014-USMaggie HartonoPas encore d'évaluation

- Country Strategy 2011-2014 GreeceDocument19 pagesCountry Strategy 2011-2014 GreeceBeeHoofPas encore d'évaluation

- Taklimat Laporan Tahunan 2009 Dan Laporan Kestabilan Kewangan & Sistem Pembayaran 2009Document45 pagesTaklimat Laporan Tahunan 2009 Dan Laporan Kestabilan Kewangan & Sistem Pembayaran 2009nizar4Pas encore d'évaluation

- Euro Area - Economic Outlook by Ifo, Insee and IstatDocument2 pagesEuro Area - Economic Outlook by Ifo, Insee and IstatEduardo PetazzePas encore d'évaluation

- 1Q12 GDP - Hurdles Along The Way: Economic UpdateDocument9 pages1Q12 GDP - Hurdles Along The Way: Economic UpdateenleePas encore d'évaluation

- Macroeconomic Factors Affecting USD INRDocument16 pagesMacroeconomic Factors Affecting USD INRtamanna210% (1)

- Highlight of Economy 2009-10-2Document18 pagesHighlight of Economy 2009-10-2Mateen SajidPas encore d'évaluation

- Economicoutlook 201314 HighlightsDocument5 pagesEconomicoutlook 201314 Highlightsrohit_pathak_8Pas encore d'évaluation

- Monetary and Liquidity Measures: by Poornima. SDocument10 pagesMonetary and Liquidity Measures: by Poornima. SEmilabiPas encore d'évaluation

- Lecture Slides Sate of The Economy Sri Lanka 2105Document65 pagesLecture Slides Sate of The Economy Sri Lanka 2105lkwriterPas encore d'évaluation

- Quarterly Economic Update: June 2005Document26 pagesQuarterly Economic Update: June 2005সামিউল ইসলাম রাজুPas encore d'évaluation

- KOF Bulletin: Economy and ResearchDocument15 pagesKOF Bulletin: Economy and Researchpathanfor786Pas encore d'évaluation

- EPZ Annual Report Performance Report For 2014 (Public) - May 2015 Rev 1Document52 pagesEPZ Annual Report Performance Report For 2014 (Public) - May 2015 Rev 1chris_ohaboPas encore d'évaluation

- Country Strategy 2011-2014 BulgariaDocument20 pagesCountry Strategy 2011-2014 BulgariaBeeHoofPas encore d'évaluation

- Impact of The Financial Crisis On The GambiaDocument11 pagesImpact of The Financial Crisis On The GambiaProfessor Tarun Das100% (2)

- State of The Economy: Executive SummaryDocument8 pagesState of The Economy: Executive SummaryFarrukh SohailPas encore d'évaluation

- State of The Economy 2011Document8 pagesState of The Economy 2011agarwaldipeshPas encore d'évaluation

- 「アジア経済見通し」セミナー(2015年4月9日)配布資料(インド)Document16 pages「アジア経済見通し」セミナー(2015年4月9日)配布資料(インド)ADBJROPas encore d'évaluation

- Country Strategy 2011-2014 UkraineDocument17 pagesCountry Strategy 2011-2014 UkraineBeeHoofPas encore d'évaluation

- Strong U.K. Economic Recovery Remains Intact: Economics GroupDocument5 pagesStrong U.K. Economic Recovery Remains Intact: Economics Grouppathanfor786Pas encore d'évaluation

- GME Botswana ReportDocument15 pagesGME Botswana ReportSunil SurendranathPas encore d'évaluation

- Investment and Growth: 1.1 Contribution AnalysisDocument5 pagesInvestment and Growth: 1.1 Contribution AnalysisaoulakhPas encore d'évaluation

- Highlights: Economic Advisory Council To The PM Economic Outlook 2012/13Document6 pagesHighlights: Economic Advisory Council To The PM Economic Outlook 2012/13mustaneer2211Pas encore d'évaluation

- INFLATION - Macroeconomic-Situation-Report-4th-Quarter-UpdateDocument15 pagesINFLATION - Macroeconomic-Situation-Report-4th-Quarter-UpdateTenzin SangpoPas encore d'évaluation

- It 2013-11-15 SWD enDocument10 pagesIt 2013-11-15 SWD enSpiros StathakisPas encore d'évaluation

- Cps Nep 2013 2017 Ea SummaryDocument7 pagesCps Nep 2013 2017 Ea Summaryakyadav123Pas encore d'évaluation

- Group 4 - Sec B - Turkey GDP AnalysisDocument13 pagesGroup 4 - Sec B - Turkey GDP Analysisdipesh3412Pas encore d'évaluation

- India Econimic Survey 2010-11Document296 pagesIndia Econimic Survey 2010-11vishwanathPas encore d'évaluation

- State of The Economy and Prospects: Website: Http://indiabudget - Nic.inDocument22 pagesState of The Economy and Prospects: Website: Http://indiabudget - Nic.inNDTVPas encore d'évaluation

- Total E Oct08Document76 pagesTotal E Oct08Tien DangPas encore d'évaluation

- Budget 2012 EconomyDocument19 pagesBudget 2012 EconomynnsriniPas encore d'évaluation

- Greece Country Strategy 2007-2010: Black Sea Trade and Development BankDocument18 pagesGreece Country Strategy 2007-2010: Black Sea Trade and Development BanklebenikosPas encore d'évaluation

- Greece Southeastern 200706Document16 pagesGreece Southeastern 200706Andronikos KapsalisPas encore d'évaluation

- India Union Budget 2013 PWC Analysis BookletDocument40 pagesIndia Union Budget 2013 PWC Analysis BookletsuchjazzPas encore d'évaluation

- Economic StatusDocument29 pagesEconomic StatusAnthony EtimPas encore d'évaluation

- G P P C: Group of TwentyDocument13 pagesG P P C: Group of Twentya10family10Pas encore d'évaluation

- Country Strategy 2011-2014 RussiaDocument18 pagesCountry Strategy 2011-2014 RussiaBeeHoofPas encore d'évaluation

- First City Monument Bank PLC.: Investor/Analyst Presentation Review of H1 2008/9 ResultsDocument31 pagesFirst City Monument Bank PLC.: Investor/Analyst Presentation Review of H1 2008/9 ResultsOladipupo Mayowa PaulPas encore d'évaluation

- GDP Fy14 Adv Est - 7 Feb 2014Document4 pagesGDP Fy14 Adv Est - 7 Feb 2014mkmanish1Pas encore d'évaluation

- Pakistan Economic Survey 2010 2011Document272 pagesPakistan Economic Survey 2010 2011talhaqm123Pas encore d'évaluation

- Budget 2015-16Document100 pagesBudget 2015-16bazitPas encore d'évaluation

- Comparison of UAE and French EconomyDocument16 pagesComparison of UAE and French EconomyuowdubaiPas encore d'évaluation

- Highlights: Economy and Strategy GroupDocument33 pagesHighlights: Economy and Strategy GroupvladvPas encore d'évaluation

- Aeo 2017 55 enDocument15 pagesAeo 2017 55 enWallaceAceyClarkPas encore d'évaluation

- Impact of Inflation, Fiscal Policy & Trading On Economic Growth of PakistanDocument31 pagesImpact of Inflation, Fiscal Policy & Trading On Economic Growth of PakistanNabeel Ahmed KhanPas encore d'évaluation

- Press Release Bank Negara Malaysia Annual Report 2008Document13 pagesPress Release Bank Negara Malaysia Annual Report 2008FarahSillayPas encore d'évaluation

- Summary of Nigeria Economic ReportDocument5 pagesSummary of Nigeria Economic ReportAnthony EtimPas encore d'évaluation

- The Economic Outlook For Germany May 8, 2010Document16 pagesThe Economic Outlook For Germany May 8, 2010Ankit_modi2000Pas encore d'évaluation

- Fighting CorruptionDocument43 pagesFighting Corruptionfaca_zakonPas encore d'évaluation

- Roma and Non Roma in The Labour MarketDocument60 pagesRoma and Non Roma in The Labour Marketfaca_zakonPas encore d'évaluation

- Swedish Pension SystemDocument20 pagesSwedish Pension Systemfaca_zakonPas encore d'évaluation

- The Swedish Pension System: Albert Memeti Economics of Aging and PensionsDocument18 pagesThe Swedish Pension System: Albert Memeti Economics of Aging and Pensionsfaca_zakonPas encore d'évaluation

- ACC221 Quiz1Document10 pagesACC221 Quiz1milkyode9Pas encore d'évaluation

- UNACEMDocument246 pagesUNACEMAlexandra Guzman BurgaPas encore d'évaluation

- Facebook Blueprint Study Guide (2019 Update) PDFDocument65 pagesFacebook Blueprint Study Guide (2019 Update) PDFKhizar Nadeem Syed50% (2)

- The Lazy Dispensing Gps GenieDocument111 pagesThe Lazy Dispensing Gps Geniemaxdev0% (1)

- Republic Act No 1400Document8 pagesRepublic Act No 1400annePas encore d'évaluation

- The Investment Portfolio: Maria Aleni B. VeralloDocument11 pagesThe Investment Portfolio: Maria Aleni B. VeralloMaria Aleni100% (1)

- Iso Iatf 16949 FaqsDocument3 pagesIso Iatf 16949 Faqsasdqwerty123Pas encore d'évaluation

- Test of Significance - : 3-Standard Error of DifferenceDocument4 pagesTest of Significance - : 3-Standard Error of Differenceavinash13071211Pas encore d'évaluation

- 7 P'sDocument14 pages7 P'sReena RialubinPas encore d'évaluation

- Digital Banking, Customer PDFDocument27 pagesDigital Banking, Customer PDFHafsa HamidPas encore d'évaluation

- DBSV - Asian Consumer DigestDocument119 pagesDBSV - Asian Consumer DigesteasyunittrustPas encore d'évaluation

- High Line CorruptionDocument3 pagesHigh Line CorruptionRobert LedermanPas encore d'évaluation

- Dear SirDocument2 pagesDear SircaressaPas encore d'évaluation

- Strengths in The SWOT Analysis of Hero Moto CropDocument4 pagesStrengths in The SWOT Analysis of Hero Moto CropMd aadab razaPas encore d'évaluation

- IC Accounts Payable Ledger 9467Document2 pagesIC Accounts Payable Ledger 9467Rahul BadaikPas encore d'évaluation

- RMM 0180 Reservations Cum Transport CoordinatorDocument1 pageRMM 0180 Reservations Cum Transport CoordinatorSundar PanditPas encore d'évaluation

- Cowgirl ChocolatesDocument5 pagesCowgirl ChocolatesAlex Ibarra100% (1)

- Goldin Financial / Bon Pasteur Acquisition / HKex Public FilingDocument9 pagesGoldin Financial / Bon Pasteur Acquisition / HKex Public Filingskadden1Pas encore d'évaluation

- Property Surveyor CVDocument2 pagesProperty Surveyor CVMike KelleyPas encore d'évaluation

- United States Court of Appeals For The Second CircuitDocument19 pagesUnited States Court of Appeals For The Second CircuitScribd Government DocsPas encore d'évaluation

- Walmart Analyst ReportDocument29 pagesWalmart Analyst ReportAlexander Mauricio BarretoPas encore d'évaluation

- Sample Company Presentation PDFDocument25 pagesSample Company Presentation PDFSachin DaharwalPas encore d'évaluation

- RAMPT Program PlanDocument39 pagesRAMPT Program PlanganeshdhagePas encore d'évaluation

- Reference Form 2011Document473 pagesReference Form 2011LightRIPas encore d'évaluation

- Industrial Organization Markets and Strategies 2Nd Edition Belleflamme Solutions Manual Full Chapter PDFDocument55 pagesIndustrial Organization Markets and Strategies 2Nd Edition Belleflamme Solutions Manual Full Chapter PDFnhatmaiqfanmk100% (9)

- Donnina C Halley V Printwell (GR 157549)Document22 pagesDonnina C Halley V Printwell (GR 157549)Caressa PerezPas encore d'évaluation

- Is The Really Ford's Way Forward?Document23 pagesIs The Really Ford's Way Forward?Gisela Vania AlinePas encore d'évaluation

- Assignment 2 Ent530 - Social Media PortfolioDocument25 pagesAssignment 2 Ent530 - Social Media PortfolioNUR AININ SOFIA MOHD OMARPas encore d'évaluation

- Accra Investments Corp Vs CADocument4 pagesAccra Investments Corp Vs CAnazhPas encore d'évaluation

- Ingles Cuestionario Quimestre 2-1Document3 pagesIngles Cuestionario Quimestre 2-1Ana AlvaradoPas encore d'évaluation