Académique Documents

Professionnel Documents

Culture Documents

Uribe Notes

Transféré par

Ralph Jarvis Hermosilla AlindoganTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Uribe Notes

Transféré par

Ralph Jarvis Hermosilla AlindoganDroits d'auteur :

Formats disponibles

Uribe Civil Law Review (Succession and Property)

Azys Notes 1

Day 7: Succession

Quiz

A legatee is a person called to the succession either by the provision of a

will or by operation of law. False. A legatee inherits by will and not by

operation of law.

The validity of a will depends upon the observance of the law in force at

the time of death of the testator. False. Not absolutely true. Intrinsic

validity is governed by the law at the time of death of the testator but

formal requirements are governed by the laws at the time of execution of

the will.

Capacity to succeed is governed by the law of the nation of the decedent.

True. Capacity to succeed is governed by decedents national law. This is

by provision of Art. 1039 (not Art. 16

1

).

In order to make a will it is essential that the testator be of sound mind at

the time of its probate. False. In most cases, the probate of a will is done

post mortem. How could the testator be of sound mind if he is already

dead? What is essential is that the testator be of sound mind at the time of

execution of the will. Sound mind in testamentary succession

means that the testator knew (1) the nature of his estate to be

disposed of; (2) the proper subjects of his bounty; and (3) the

character of the testamentary act.

Succession is a mode of acquisition by virtue of which the property, rights

and obligations to the extent of the value of the inheritance, of a person

are transmitted to another or others either by his will or by operation of

law. False. This is an incomplete definition. Death is required for the

transmission to happen.

Legatees and devisees are persons to whom gifts of real and personal

property are respectively given by virtue of a will. False. It is the other

way around.

2

Legitime is that part of the testators property which he cannot dispose of

because the law has reserved it for certain heirs who are, therefore,

called legal heirs. False. Legitime is reserved for compulsory heirs.

Every will must be acknowledged before a notary public by the testator

and the witnesses, in the presence of each other. False. Acknowledgment

does not have to be done at the same time.

1

Art. 16 states that (1) the order of succession; (2) amount of hereditary rights; and (3) intrinsic validity of

testamentary succession are governed by the national law of the decedent.

2

LP , DR

If the testator be deaf, or a deaf-mute, the will shall be read to him twice;

otherwise, he shall designate two persons to read it and communicate to

him, in some practicable manner, the contents thereof. False. For obvious

reasons. It would be pointless to have someone read the will to him twice,

thrice or even a hundred times. Deaf and deaf-mutes must personally read

the will. If this is not possible, he shall designate two persons (who need

not be one of the subscribing witnesses or the notary public) to read it and

communicate to him, in some practicable manner, the contents thereof.

The rule that the will must be read to him twice (once by a subscribing

witness and again by the notary public) is applicable to blind testators.

Full blood relationship is that existing between persons who have

legitimate relations. False. It is possible to have only a half blood

relationship with a legitimate brother. Full blood relationship is that

existing between persons who have the same father and the same mother.

Half blood relationship is that existing between persons who have the

same father, but not the same mother, or the same mother, but not the

same father.

A was one of the three witnesses in the execution of the will of X. In the

will, X gave a car to A. Which of the following is correct? (a) legacy is

void (b) will is void (c) cannot be considered as a competent witness. A.

Interested witnesses are not prohibited from being witnesses to

a will but the devise or legacy, so far only as concerns him, his

spouse, parent or child, or anyone claiming under any of them

shall be void unless there are three other competent witnesses

to the will.

The rights to the succession are transmitted from the moment of the

death of the decedent. What are its implications?

o A will is an act mortis causa.

o In Bonilla, The moment of death is the determining factor when

the heirs acquire a definite right to the inheritance whether such

right be pure or contingent. The right of the heirs to the property of

the deceased vests in them even before judicial declaration of their

being heirs in the testate or intestate proceedings.

o In Uson, the NCC was not given retroactive effect so that the

illegitimate children of the deceased may inherit from him. The

Court held that, There shall be retroactive effect only when the new

rights do not prejudice any vested or acquired right of the same

origin. The right of ownership of Maria Uson over the lands in

question became vested in 1945 upon the death of her late husband

and this is so because of the imperative provision of the law which

Uribe Civil Law Review (Succession and Property)

Azys Notes 2

commands that the rights to succession are transmitted from the

moment of death. The new right recognized by the new Civil Code

in favor of the illegitimate children of the deceased cannot,

therefore, be asserted to the impairment of the vested right of Maria

Uson over the lands in dispute.

The intrinsic validity of testamentary dispositions shall be governed by the

national law of the decedent. Art. 16 par. 2

X, a citizen of France but a permanent resident of Canada, suffered a

heart attack and died in Japan while attending a conference. He was

survived by his wife, an American citizen, his parents, a sister and two

children who are both Filipino citizens. He left properties in the

Philippines and in France. He left a will which he executed in London.

The capacity of his children to succeed shall be governed by what law?

French law. Under Art. 1039, the national law of the testator governs

capacity to succeed.

Recit

Reserva minima is more consistent with the philosophy of socialization of

ownership.

3

Succession is a mode of acquisition but not necessarily acquisition of

ownership. E.g. what is transmitted only is the right of a usufructuary over

a thing.

Philippine laws on succession has a basis in property law (e.g. devises and

legacees) as well as in the law on family relations (e.g. legitime).

X, a resident of California, died with children A (legitimate) and B

(illegitimate). Can B inherit from X? Depends. The problem does not

mention the nationality of X. In succession, Art. 1039 provides that the

national law of the decedent determines the capacity of heirs to succeed.

Will was executed by a French national in the Philippines. Which law

should the will have conformed to in order to be probated in the

Philippines? Either French or Philippine law. Generally, probation only

looks at the compliance of the execution of the will with respect to the

formal requirements of the law. Under Philippine law, formal

requirements of a will may follow the laws of any of the following: (1) laws

3

Recall that in reserva troncal, the subject property must have been received by the reservista by operation of

law. In reserva maxima, all of the properties which the descendant had previously acquired by gratuitious title

from an ascendant, brother or sister must be considered as passing to the ascendant-reservista insofar as his

legitime can contain. In reserva minima, subject property must be considered as passing to the ascendant-

reservista partly by operation of law and partly by force of the descendants will.

of the place of nationality of the testator; (2) laws of the place of residence

of the testator; (3) laws of the place of domicile of the testator; (4) laws of

the place of execution of the will; or (5) laws of the Philippines.

A Filipino executed will in Kuwait but not in accordance with the law

Kuwait. May the will be probated in the Philippines? Depends. Said

Filipino may execute his will according to the laws of his nationality

(Philippines), laws of place of residence, or the NCC. (Art. 816 by analogy)

A certain property was given by Y to Z. What law should govern in

deciding the validity of this disposition? Capacity to succeed is governed

by the law of the nation of the decedent. (Art. 1039)

A will was executed abroad. Is there a need to probate said will in this

country? Yes if there are properties in the Philippines that were disposed

of through the will.

If the will above has not yet been probated abroad, can it be probated in

the Philippines? Yes. There is no law requiring probate abroad before it

may be probated in the Philippines. However, there there is jurisprudence

ruling on the matter. In Palaganas, the Court held that our laws do not

prohibit the probate of wills executed by foreigners abroad

although the same have not as yet been probated and allowed in

the countries of their execution.

What is the Doctrine of Processual Presumption? Foreign law, whenever

applicable, should be proved as facts. Otherwise, it is to be presumed that

it is the same as the law of the forum.

Bellis case: Art. 17 is no longer an exception to Art. 16. Thus, even if the

national law of the testator does not provide for legitimes, said national

law must still prevail.

No Notes for Days 8 and 9

Day 10: Succession

Recit

Every will must be in writing and in a language or dialect known to the

testator.

Holographic will must be written, signed and dated entirely by the hand

of the testator.

Uribe Civil Law Review (Succession and Property)

Azys Notes 3

Notarial wills must be/contain

4

: (1) Subscribed by the testators and at

least three instrumental witnesses; (2) Attested by at least three

instrumental witnesses; (3) Marginal signatures on every page except the

last by the testator and at least three instrumental witnesses

5

; (4)

Paginated with numbers correlatively in letters on the upper part

6

; (5)

Attestation clause containing facts certifying that the will has been

executed before the witnesses in accordance with the formalities

prescribed by law

7

; and (6) Acknowledged before a notary public by the

testator and witnesses

8

.

Objects of Formalities: (1) Close the door against bad faith and fraud; (2)

Avoid substitution of wills; and (3) Guarantee the truth and authenticity of

wills. The doctrine of substantial compliance may be applied if it does not

run counter to these objectives.

In re Enrique Lopez: When the attestation clause fails to indicate number

of pages of will or the facts required to be indicated regarding signing the

will, substantial compliance may be invoked if these facts can be

ascertained without the need of presentation of evidence alliunde.

Icasiano v Icasiano: One of the pages of the will was not signed. However,

the Court said that this was mere inadvertence on the part of the witness

and the testatrix should not be penalized for this.

Garcia v Vasquez: Rules on blind testators apply to persons who are

essentially blind (e.g. advanced stage of glaucoma)

Notary public signed the will not in the presence of the testator and the

witnesses. Does this invalidate the will? What if the Notary public failed

to sign? Neither will affect the validity of the will. What is required is

that the notary acknowledge the will, not sign it.

4

SAM-PAA

5

That the marginal signatures be on the left margin is merely directory; Inadvertence of one of the witnesses

in failing to sign every page should not prejudice the testator

6

What is mandatory is that the will be paginated

7

Facts that must be indicated:

(1) Number of pages used in making the will

(2) That the testator signed the will and every page thereof in the presence of the witnesses or if the

testator did not sign it himself, that he caused some other person to write his name under his

express direction and in the presence of the witnesses

(3) That the witnesses signed the will and every page thereof in the presence of the testator and of each

other

8

The notarial will remains valid even if the notary public failed to sign the will. What is required is that the will

be acknowledged before the notary public. Note also that the acknowledgment need not be done on the same

day as the execution of the will.

Gonzales v CA: Credible as used in NCC 805 should not be given the

same meaning it has under the Naturalization Law. The witnesses required

under the latter law are character witnesses, while the witnesses under the

former merely attest to the due execution of a will and affirm the

formalities attendant thereto. To be a witness, what is necessary

only is that he is qualified under Art. 820 of the NCC

9

and not

disqualified under Art. 821 of the NCC.

10

Note that the following may be credible witnesses but not competent to be

a witness to a will: (1) below the age of 18; (2) blind, deaf or dumb; (3) not

able to read and write; (4) not domiciled in the Phil.

The following persons are neither credible nor competent: those who have

been convicted of falsification of a document, perjury or false testimony.

The law presumes credibility.

Kalaw v Relova: Mere authentication of an insertion to a will will

not suffice. The law expressly requires authentication by the full

signature of testatrix.

Roxas v De Jesus: When the law requires the will to be dated, the law

means that the testator must indicate the day, month and year of

execution. However, an exception is made under the doctrine of

substantial compliance when there is no showing of bad faith, undue

influence and pressure, and the authenticity of the will is established.

9

Qualifications of Witnesses to Wills:

(1) sound mind

(2) at least 18 years old

(3) Not blind, deaf or dumb

(4) Able to read and write

10

Disqualifications of Witnesses to Wills:

(1) Not domiciled in the Philippines

(2) Convicted of falsification of a document, perjury or false testimony

Uribe Civil Law Review (Succession and Property)

Azys Notes 4

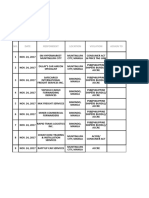

Incorporation v Codicil v New Will

Incorporation Codicil New Will

A document

incorporated in a will to

clarify the provisions

Adds to, explains or

alters a provision in a

previous will

Makes an independent

disposition

Document is

incorporated at the

time of execution.

Made after the

execution of the

previous will.

Made after the

execution of the

previous will.

Testamentary

dispositions not

allowed.

A codicil may add or

annul testamentary

dispositions, and

republish or revoke

previous wills.

A new will may add or

annull testamentary

dispositions, and

republish or revoke

previous wills.

Must be referred to in

the will indicating the

number of pages of the

document incorporated.

It must also be signed

by the testator and the

witnesses on each and

every page, except if

voluminous.

May be attested or

holographic. It does not

have to follow the form

of the previous will.

May be attested or

holographic. It does not

have to follow the form

of the previous will.

Ex. Sketches,

Inventories, Books of

accounts

Ex. In previous will,

testator bequeather a

car to A. The legacy is

made more particular

by specifying which car

through a codicil.

Ex. The document

makes a testamentary

disposition in favor of

someone who was not

included in the previous

will.

In the incorporation of document by reference, do the witnesses referred

to in Art. 827(1) have to be the same set of witnesses as in the will? Yes,

precisely because they are incorporated in the same will to be attested,

they are also executed at the same time.

How are will republished? Depends on what the reason for nullity is. If it is

void as to its form, it is necessary to republish by reproducing the

testamentary dispositions in the previous will. If the nullity however is for

other reasons, the will may be republished through a codicil which will

refer to the previous will.

There are three modes of revocation

11

. Bear this in mind. Even if the

will was not destroyed, the will or certain provisions of the will may be

11

Three Modes of Revocation

(1) by operation of law

(2) by a codicil or a new will

(3) by physically destroying the will with intention to destroy the same

revoked by implication of law (e.g. heir committed an act of unworthiness

or became incapacitated to inherit).

There need not be any reason for making revocations. However, if a cause

is provided and the said cause happened to false or illegal, the revocation

is null and void.

Difference of the effects of an express and implied revocation: If after

making a will, the testator makes a second will expressly revoking the first,

the revocation of the second does not revive the first. If the second will

only impliedly revoked the first will, the first will is automatically revived

with the revocation of the second will.

A revocation made in a subsequent will shall take effect, even if the new

will should become inoperative because the heirs, legatees or devisees

renounce or become incapacitated will not revive the first will. However,

in Molo v Molo, the Court held that under the Doctrine of Dependent

Relative Revocation, where the act of destruction is connected with the

making of another will so as fairly to raise the inference that the testator

meant the revocation of the old to depend upon the efficacy of a new

disposition intended to be substituted, the revocation will be conditional

and dependent upon the efficacy of the new disposition; and if, for any

reason, the new will intended to be made as a substitute is inoperative, the

revocation fails and the original will remains in full force.

The finality of the allowance of a will has the following effects: (1)

conclusive as to the formal validity of the will; (2) not subject to collateral

attack; and (3) conclusive to the whole world. Thus, the issue as to the

voluntariness of its execution may not be raised anymore. In fact, a

criminal action against the forger of a will which had been duly admitted

to probate by a court of competent jurisdiction is barred after the finality

of the allowance of the will.

In Rodelas, the Court held that unlike notarial wills, holographic wills

may not be proved by testimonial evidence when lost or destroyed.

The general rule is that the original of the holographic will must be

presented during its probate. However, a photostatic copy may also be

admitted since a comparison with the handwriting of the testator may still

be made.

In Codoy, the Court ruled that Art. 811 is mandatory. At least one witness

who shall testify that the testamentary dispositions and the signature are

in the handwriting of the testator. If, however, the will is contested, at least

**Examples of (1): Incapacity; Legal Separation; Preterition; Judicial suit against the debtor in a legacy of credit

or remission

Uribe Civil Law Review (Succession and Property)

Azys Notes 5

three such witnesses must be presented. In both cases, expert witnesses

may be resorted to.

Day 11: Succession

12

Recit

Who may inherit from the adopted child? RJs position is that, because

the legal ties between the adopted child and his biological parents are

already severed and that, for purposes of the law, the adopted child shall

be considered a legitimate child of his/her adopter/s, only the adopter/s

should inherit from the adopted child. However, Professor Uribe believes

otherwise and argues that it should be 50-50

Preterition is the omission in the will of one, some or all of his compulsory

heirs in the direct line. Its effect is to annul the institution of heirs.

However, devises and legacies remain valid insofar as they are not

inofficious.

Omission of the spouse in the will is not preterition because she

is not a compulsory heir in the direct line. There is also no

preterition if the compulsory heir received inheritance by way

of (1) devise or legacy; (2) donation inter vivos; or (3) intestate

succession. In all these cases, the heirs instituted are not annulled. The

remedy of the affected heir/s is for the completion of their legitime.

There is also no preterition when the compulsory heir omitted in the will is

a disinherited compulsory heir. A disinherited heir may be deprived of his

legitime.

Can brothers and sisters be validly disinherited? Note that the law only

provides grounds for disinheritance of ascendants, descendants and

spouse. Yes, brothers and sisters may be disinherited. The law does

not provide the grounds with respect to siblings which implies that

disinheritance may be for any ground. Unlike the compulsory heirs, the

law did not deem it necessary to limit the grouds for their disinheritance.

May a disinherited heir inherit more than his legitime such as if the free

portion was given to disinherited heir by intestate succession? No.

According to sir, to do so would be contrary to the intention of the testator

to disinherit or deprive the heir of his legitime.

What if the will containing a disinheritance of an heir on a ground which is

one of those provided by law is declared void? Will the disinheritance be

valid? Not necessarily. Consider the ground for disinheritance. Some of

them may be an act of unworthiness which does not require that the same

be written on the will.

12

Notes for 2

nd

half of Day 11 only

Uribe Civil Law Review (Succession and Property)

Azys Notes 6

Incapacity is legal disinheritance or disinheritance by operation of law.

13

Disinheritance, on the other hand, must be in writing and conform to the

requirements of Art. 918.

Incapacity under Art. 1027 (1) to (5) and under Art. 1028 refers

only to testamentary dispositions. They may still inherit through

intestacy. Incapacity based on unworthiness disqualifies a compulsory heir

from succeeding even to his legitime.

13

Who are incapacitated to succeed?

Art. 1027

(1) The priest who heard the confession of the testator during his last illness, or the minister of the

gospel who extended spiritual aid to him during the same period

(2) The relatives of such priest or minister of the gospel within the fourth degree, the church, order,

chapter, community, organization, or institution to which such priest or minister may belong;

(3) A guardian with respect to testamentary dispositions given by a ward in his favor before the

final accounts of the guardianship have been approved, even if the testator should die after the

approval thereof; nevertheless, any provision made by the ward in favor of the guardian when

the latter is his ascendants, descendant, brother, sister, or spouse, shall be valid;

(4) Any attesting witness to the execution of a will, the spouse, parents, or children, or any one

claiming under such witness, spouse, parents, or children;

(5) Any physician, surgeon, nurse, health officer or druggist who took care of the testator during his

last illness;

(6) Individuals, associations and corporations not permitted by law to inherit.

Art 1028 in relation to 739

(1) Those made between persons who were guilty of adultery or concubinage at the time of the

donation;

(2) Those made between persons found guilty of the same criminal offense, in consideration

thereof;

(3) Those made to a public officer or his wife, descendants and ascendants, by reason of his office.

Art. 1032: Causes of unworthiness

(1) Parents who have abandoned their children or induced their daughters to lead a corrupt or

immoral life, or attempted against their virtues;

(2) Any person who has been convicted of an attempt against the life of the testator, his or her

spouse, descendants or ascendants;

(3) Any person who has accused the testator of a crime for which the law prescribes imprisonment

for six years or more, if the accusation has been found to be groundless;

(4) Any heir of full age who, having knowledge of the violent death of the testator, should fail to

report it to an officer of the law within a month, unless the authorities have already taken

action; this prohibition shall not apply to cases wherein, according to law, there is no obligation

to make an accusation;

(5) Any person convicted of adultery or concubinage with the spouse of the testator;

(6) Any person who by fraud, violence, intimidation, or undue influence should cause the testator

to make a will or to change one already made;

(7) Any person who by the same means prevents another from making a will, or from revoking one

already made, or who supplants, conceals, or alters the latter's will;

(8) Any person who falsifies or forges a supposed will of the decedent.

Only reconciliation is necessary to reverse disinheritance

whereas it is necessary that there be something in writing to

overcome incapacity through acts of unworthiness.

If there is no will, reconciliation will bar the offended person from later on

disinheriting the offending person. If disinheritance has been made, such

disinheritance is set aside.

If testator knew of the cause of the unworthiness at the time of making the

will, the cause of unworthiness shall be without effect. If he should find

out after the execution of the will, the testator may condone them in

writing.

If the ground for disinheritance also happens to be a ground for

unworthiness

14

, reconciliation will have the effect of

condonation if the decedent actually disinherited the unworthy

heir. If no disinheritance was effected, a written pardon is still

necessary.

Why is there a need to still disinherit when the ground is already a

ground for unworthiness? Filipinos easily forget. If it is written on the

will, the executor will be reminded of the act of unworthiness.

Will all cases involving loss of parental authority be a ground for the the

disinheritance of said parent? No. The loss of parental authority may be

due to emancipation or adoption.

The wife had an illicit relationship with her ex-boyfriend. The husband

filed for legal separation. However, husband died before the issuance of

the decree of legal separation. Will the wife inherit from the husband?

Not if the husband validly disinherited the wife. The ground for

disinheritance only requires that the spouse has given cause for legal

separation. It is not necessary that there be a final judgment granting the

petition for legal separation. If, on the other hand, the petition for legal

separation has already been granted by the court, a will disinheriting the

guility spouse is no longer necessary. The guilty spouse becomes

incapacitated to inherit by intestate succession by operation of law.

14

What grounds are common in disinheritance and unworthiness? Art. 1032 except (4), (7) and (8). With

respect to the cause attempt on the life of the testator, his or her spouse or any of his descendants or

ascendants, if a descendant is the one being disinherited, a finding of guilit by final judgment is necessary. For

all other persons, a conviction of an attempt on the life is enough to disinherit as well as make a person

unworthy to inherit.

Uribe Civil Law Review (Succession and Property)

Azys Notes 7

Legitimes and Intestate Succession

15

Amount of

Legitime

Intestate

Succession

Legitimate Child

Surviving Spouse

Legitimate Children

Surviving Spouse

same as 1 LC

Equal shares for

all heirs

Legitimate Child

Illegitimate Children

Surviving Spouse

of 1 LC

a

same as SS

of 1 LC

same as 1 LC

b

Legitimate Children

Illegitimate Children

Surviving Spouse

of 1 LC

a

same as 1 LC

same as SS

of LC

same as LC

Legitimate Children

Illegitimate Children

of 1 LC

a

Twice an IC

of 1 LC

b

Illegitimate Children

Surviving Spouse

Legitimate Parents Entire Estate

Legitimate Parents

Illegitimate Children

Legitimate Parents

Surviving Spouse

Legitimate Parents

Illegitimate Children

15

Legitimes and Intestate Succession

a. The legitime of an illegitimate child is not necessarily of a legitimate child if the estate is not enough.

The illegitimate children will share amongst themselves whatever is left of the estate after deducting the

legitimes of the legitimate children and of the surviving spouse.

b. Similar to the preceding rule, ensure that the legitimes of the legitimate children and of the surviving

spouse are not impaired. To illustrate, the value of the estate is P200K. There are 2 legitimate children

and 5 illegitimate children. Following Art. 983 literally will give us P50K for each legitimate child and P25K

for each illegitimate child. However, this would be more than the value of the estate. Thus, the share of

the illegitimate children are adjusted to P20K each.

c. Illegitimate parents are excluded by children of any class

d. 1/3 share for the surviving spouse if (1) the marriage was celebrated in articulo mortis; (2) the other

spouse dies within three months; (3) the spouse who dies is the person who was contemplating death at

the time of the marriage; and (4) they have not lived together for five years.

e. Share of a full-blood is twice the share of a half-blood

f. Collateral Relatives

No distinction between half-blood and full-blood

Nearer excludes the remote

No representation

Up to the 5

th

degree only

g. State

Personal property city/municipality of residence; if non-resident, where it may be found

Real property city/municipality where it may be found

Surviving Spouse

Illegitimate Children Entire Estate

Illegitimate Parents

c

Entire Estate

Illegitimate Parents

Surviving Spouse

Surviving Spouse

Brothers and Sisters,

Nephews and Nieces

e

or

d

None

Brothers and Sisters,

Nephews and Nieces

e

None Entire Estate

Other collateral relatives

f

None Entire Estate

State

g

None Entire Estate

Limitations to Legitimes of Compulsory Heirs

o Reserva Troncal Its purpose is to prevent people outside the

family to receive property, by chance or accident, property which

otherwise would have remained with the said family.

o Disinheritance Art. 918

16

provides the requisites of a valid

disinheritance. Art. 919-921 provides for the grounds for the

disinheritance of compulsory heirs. The compulsory heir may be

deprived of his legitime as a consequence of the disinheritance. He,

however, may still inherit through intestate succession.

o Reserva Adoptiva In Teotico v del Val, the Court held that

under our law, the relationship established by adoption is limited

solely to the adopter and the adopted and does not extend to the

relatives of the adopting parents or of the adopted child except only

as expressly provided for by law. Hence, no relationship is created

between the adopted and the collaterals of the adopting parents. As

a consequence, the adopted is an heir of the adopter but not of the

relatives of the adopter.

Reserva Troncal

o Transfer of the Properties

16

Requisites of a valid disinheritance:

a. It must be done in a valid will;

b. It must be express;

c. There must be a true cause;

d. The cause must be existing;

e. It must be total and complete;

f. The cause must be stated in the will;

g. The heir disinherited must be identified;

h. The will must not have been revoked.

Uribe Civil Law Review (Succession and Property)

Azys Notes 8

(1) Ascendant, brother or sister who transfers subject

property by gratuitous title to the Descendant of the

Reservista (a.k.a. Mediate source)

(2) Descendant of the Reservista (a.k.a. Prepositus)

(3) Reservista who inherits from the Descendant by

intestate succession

(4) Relatives who are within the third degree and who

belong to the line from which said property came (a.k.a.

Reservatorios)

o The three degrees is counted from the prepositus

o It is not required that a reservatorio be alive at the time of death

of the prepositus. What is important is that he is alive to inherit

at the time of death of the reservista.

o If there are no reservatorios at the time of death of the

reservista, the property subject of reserva troncal forms part of

the estate of the reservista

o Apply the rules on intestate succession:

Nearer excludes the more remote

Representation in favor of the children of predeceased

siblings (nephews and nieces) of the prepositus

A full-blood is entitled to a share double that of a half-

blood

COLLATION PROBLEM: X died intestate in 1985 leaving 3 legitimate

children (A, B and C) and 2 illegitimate children (D and E). He donated

P30K to F, a friend, in 1970; to A, P40K in 1975, and to D P50K in 1980.

He left an estate amounting to P100K with debts in the amount of P40K.

o Who will inherit from the estate? What are their respective shares?

(1) Deduct the debts of the estate from the Gross Estate to find the

value of the Net Hereditary Estate

P100K P40K = P60K

(2) Add the value of the properties donated

17

unless such donation

is not subject to collation

18

to find the value of the Distrubutable

17

Use values at the time of donation

18

What donations are not subject to collation?

Donations made by a person who does not have compulsory heirs. Collation is done so as not to

impair the legitime. Here, there is no such legitime that may be impaired.

When in a donation to a compulsory heir, the testator provided that said donation shall not be

subject to collation.**

When a donee who is also a compulsory heir repudiates the inheritance, those donations that he

received will not be subject to collation.**

Estate; The Distributable Estate is the basis for the calculation

of legitimes

P60K + P120K = P180K

(3) Determination of the Legitimes

Legitimate children = P30K each

Illegitimate child = P15K each

(4) Determination of the Free Portion

P180K (P30K x 3) (P15K x 2) = P60K

(5) Charging

If the donee is a compulsory heir, the donation is to be

charged to his legitime unless the donor provided

otherwise

A P30K to the legitime

D P15K to the legitime

If the donation to the compulsory heir is greater than his

or her legitime, charge the excess to the free portion

A P10K

D P35K

If the donee is not a compulsory heir, the donation is to

be charged to the freely disposable portion

F P30K

o In the problem above, it appears that there is P15K worth of

inofficious donation. Who will suffer the reduction?

Reduction of devises and legacies pro-rata.

Reduce the donations. Follow the later-in-time rule (Last

in, First out) but be careful not to impair the legitime. In

this case, the donation to D must be reduced by P15K.

What if the FP is not enough to provide for the legacies and devices? Art.

911 provides a rule. However, Art. 950 also provides for a pecking order.

Donations given by ascendants to the children of the compulsory heir in the descending line (e.g.

Grandfather of A donated property to A. As grandfather died with As father as one of the surviving

compulsory heirs. As father is not obliged to bring into collation the donated property)

Property donated to the spouse of a child (but if the property was donated to the spouses jointly,

the childs share will be subject to collation)

Expenses for support, education, medical attendance, apprenticeship, ordinary equipment or

customary gifts.

Expenses incurred by the parents in giving their children a career unless they impair the legitime If

the legitime is impaired, the sum which the child would have spent if he had lived in the house of his

parents are not included in the collation.

Wedding gifts to ascendants that do not exceed 1/10 of the free portion

**The general rule is that a donation to a compulsory heir is collated (imputed or charged) to his legitime.

Uribe Civil Law Review (Succession and Property)

Azys Notes 9

Apply Art. 950 if the scenario is purely among legatees and devisees.

Otherwise, apply Art. 911.

If a donation is void, it will not be a subject of collection. Instead it will be

part of the gross estate.

Principles Affecting the Freely Disposable Portion: (1) Institution of Heirs;

(2) Substitution; and (3) Legacies and Devises

May there be a valid institution of heir pertaining to the entire estate?

Yes, if there are no compulsory heirs or the instituted heirs are also the

compulsory heirs.

May a will be valid even though there are no heirs instituted? Yes, there

may be legacies and devises.

The following are presumptions in the institution of heirs: (1) presumption

of equality; (2) presumption of individuality; and (3) presumption of

simultaneity.

o If the instituted heirs are brothers but one is of the half-blood while

the other is of the full-blood, the presumption is that their shares

are equal.

19

(Presumption of equality)

o I hereby institute A, B and the 10 children of C as my heirs.

Interpret this that their share in the estate is to be divided into 12

shares. (Presumption of individuality)

o In testatmentary succession, if a parent and his children are

instituted, the parent and his children will inherit simultaneously.

Rule on proximity does not apply. (Presumption of simultaneity)

Kinds of Institution:

(1) Simple (I hereby give my car to A

(2) Conditional (I hereby give my car to A upon As passing the bar exam)

(3) Modal (I hereby give you a piece of land but with the obligation to

deliver 10 cavans of rice to my spouse)

If the condition happens, its effect will retroact to the date of the

death of the testator. However, the heir must have capacity to

succeed at the time of the happening of the suspensive

condition.

Generally, conditions not to marry are prohibited in testamentary

dispositions. However, the prohibition does not apply when the condition

is imposed on the surviving spouse by the deceased spouse or by the

latters ascendants or descendants.

19

Contrast this with intestate succession where the 2:1 proportion applies

If condition is impossible, condition is considered not written. This is the

same rule in donations inter vivos. Contrast these two to impossible

conditions in onerous obligations. Under Art. 1183, the obligation which

depends upon the condition are annulled. In the first and second, it is the

condition that is nullified.

An heir subject to a suspensive term has vested rights over the inheritance.

However, the inheritance is not demandable until the happening of the

term.

A mode does not suspend but obligates unlike a condition which

does not obligate but suspends. For this reason, the law requires a

caucion muciana or a security to be put up to protect the right of the heirs

(who would succeed to the property) in case the condition, term or mode is

violated.

To be construed as a mode, it must be a clear obligation and not just a

wish on the part of the testator.

The definition of substitution under 859 does not contemplate

fideicommissary substitution. This is so because in a fideicommissary

substitution both the original heir and the substitute inherit from the

testator (hence the requirement that both must be living at the time of the

death of the testator). But if you read 859, it presupposes that substitution

only happens if the original heir should die, repudiate, or be incapacitated

to accept the inheritance. This is not the case in a fideicommissary

substitution.

A simple substitution, without a statement of the cases to which it refers,

shall comprise the three possible causes for substitution: (1) predecease;

(2) repudiation; and (3) incapacity.

20

In fideicommissary substitution, the 2

nd

heir must be one degree away

from the 1

st

heir. They must both be living and qualified at the time of

death of the testator. The 1

st

heir has the obligation to preserve the

property inherited and transmit the same to the heir either at a given time

or upon his death. In the event that the 2

nd

heir dies before the

transmission, his successors may succeed by representation. This is

because from the moment of death of the testator, the rights of the 1

st

and

2

nd

heirs are vested.

21

Capacity to succeed of the substitute would be in relation to the

testator and not the heir to be substituted.

20

RIP

21

Dont confuse this with reserva troncal where the death of the reservatorios will result in the property going

to the estate of the reservista

Uribe Civil Law Review (Succession and Property)

Azys Notes 10

X has two children A and B. His net estate is P1M. In his will, he instituted

A and B as his sole heirs. However, there was a provision in the will

obliging B to give to Y P25K per month for 1 year. How much will Y get?

P25K x 12 months = P300K but this will impair Bs legitime. Therefore, Y

may only receive a maximum of P250K so that Bs legitime of P250K will

not be impaired.

What are the rules with respect to legacies and devisees when they are

bequeathed by the testator even though he did not own the same?

o If testator did not know that he did not know it, legacy or

devise is void. (Art. 930, vitiated by mistake)

o If testator knew, Art. 931 applies whether or not there was an

order to buy the devise or legacy in the will. It is to be presumed

that the estate is ordered to do so to fulfill the obligation

imposed by the testamentary disposition.

What if the legacy or devise is already owned by the legatee or devisee at

the time of execution of the will? This is an ineffective legacy or

devise.

What if the legacy or devise was acquired by the legatee or devisee after

the execution of the will? Depends if the acquisition was gratuitous or

onerous. If onerous, the legatee or devisee will be reimbursed.

Who will reimburse the legatee or devisee in the problem above? If it is a

sub-legacy or a mode (e.g. I will give to you of my estate if you give B a

car), it is the heir who must make the reimbursement. Otherwise, it is the

estate.

Is there any situation where the reimbursement need not be made

eventhough the legatee or devisee acquired after the execution the legacy

or devise by gratuitous title? Yes, if the legatee or devisee acquired the

same from the testator.

What if the legacy or devise has been pledged or mortgaged? It is

immaterial whether the pledge or mortgage of the thing was done before

or after the execution of the will. The debt must be paid to release the

thing from the debt or mortgage.

What is a legacy of credit? It is a legacy wherein the testator bequeths to

another a credit against a third person. E.g. I give to B all the debts A

owes me.

What is a legacy of remission? It is a testamentary disposition of a debt in

favor of the debtor. E.g. I give to A everything as legacy his debt to me.

Note however that the legacy of credit or remission will only cover

those debts incurred prior to the execution of the will. Thus, even

if the will states that testator will pay his credit of P1M to the legatee, if at

the time of death only P50K remains of the P1M loan, only the P50K will

be paid out as legacy.

Moreover, a judicial suit against the debtor in a legacy of credit or

remission essentially revokes the legacy of credit or remission.

What are the rules with respect to generic devises and indeterminate

devises? A generic legacy is valid eventhough there is nothing of

the same kind which exists in the estate. The estate will have to buy

it. The rule is different with respect to indeterminate devises. There must

exist immovables of the same kind for the devise to be valid.

A legacy for education lasts until the legatee is of age in order that the

legatee may finish his professional, vocational or general course.

A legacy for support lasts for the lifetime of the legatee. The amount, if not

indicated by the testator, will be presumed to be the same as the amount

given by the testator to the legatee when the testator was still living.

Circumstances such as the social standing and the needs of the legatee as

well as the value of the estate will also be taken into consideration in the

determination of the amount of the legacy of support.

The 2:1 Proportion Rule with respect to half-bloods and full-

bloods does not apply (1) in testamentary succession; (2) in

reserva troncal; and (3) when collateral relatives inherit by

intestate succession.

Uribe Civil Law Review (Succession and Property)

Azys Notes 11

Day 12: Succession and Property Relations

22

Lecture on Succession

What is the proximity rule? The relative nearest in degree excludes the

more distant ones. Each generation forms a degree.

What are the exceptions to the proximity rule?

1. Right of representation

2. Direct line preferred over collateral line

3. Nephews and nieces exclude uncles and aunts even though they may be

of the same degree

4. Full blood preferred over half-blood

5. Legitimate children is preferred over illegitimate children

6. Iron curtain bar

Whether in testamentary or intestate succession, there is never

a right of representation in the ascending line; only in the

descending line.

There is no right of representation in the collateral line except

in intestate succession with respect to the children of brothers

and sisters.

In the right of representation, the person representing inherits directly

from the deceased and not from the person being represented. This is

most relevant in cases of incapacity (e.g. grandson committed an act of

unworthiness against his father, grandson can still inherit from his

grandfather through right of representation.)

Exceptions to the equal distribution principle

1. Right of representation

2. In the ascending line only equal between maternal and paternal lines

Accretion takes place only if there is no substitution (testate) or no

representation (testate and intestate).

Accretion is the presumed will but a substitution is an express will.

Between a presumed will and an express will, the one expressed prevails.

In testamentary succession, accretion takes place if there are two or more

persons called to the same inheritance, the share of the heir who dies,

renounces or becomes incapacitated accrue to the other heirs. (e.g. Car is

bequethed to A and B. A dies. The car goes to B alone.)

In testamentary succession, follow this order:

22

Notes for 2

nd

half of Day 12 only

o If the institution of heirs fails (predecease, incapacitated or

renounce), substitution occurs.

o If there is no substitution, the right of representation

applies in the direct descending line to the legitime if

the vacancy is caused by predecease, incapacity or

disinheritance.

o The right of accretion applies to the free portion if two or

more persons are called to the same inheritance and one or

some (but not all) of the said heirs predecease, renounce or be

incapacitated.

In intestacy, accretion always takes place when inheritance is

renounced because there is no representation in repudiation.

There is no representation in repudiation. This is regardless of whether the

inheritance repudiated was by will or by law.

There is also no right of representation in favor of an

illegitimate child with respect to his legitimate parents. On the

other hand, an illegitimate child of an illegitimate parent may represent

such illegetimate parent in their grandparents estate.

A disinherited heir may be representated when he is a

compulsory heir but only up to the value of his legitime. A

disinherited heir may not be represented under any other circumstance.

A disinherited heir may also inherit through intestate succession but only

to the value of his legitime.

Should the part repudiated be the legitime, the other co-heirs shall

succeed to in their own right, and not by the right of accretion. Although

the effect is tially the same.

Bars to accretion: (1) express provision; (2) substitution; (3)

representation; (4) when the shares have been designated and such

sharing are not equal

23

Partition may be done (1) thru a will; (2) by asking a third

person to take charge of the partition; or (3) by agreement

among all the heirs through an extrajudicial settlement when

there is no will and no creditors.

Before the partition of the land, one of the heirs sold his share. May the

other heirs redeem the property? Yes, within 30 days from written notice

or from actual notice.

23

If the sharing, by will, is not equal, the portion of the person who predecease or who is incapacitated will

not go to the other testate heir, but will be distributed to the legal heirs instead.

Uribe Civil Law Review (Succession and Property)

Azys Notes 12

Quiz

An action filed by a co-owner against another will not prosper. False A

co-owner may file an action against another co-owner. E.g. Action for

partition; Action for ejectment when the co-owner takes exclusive

possession and asserts exclusive ownership over the co-owned property

(De Guia)

Possession constitutes the foundation of a prescriptive right. False. The

possession should be adverse possession. In Bogo-Medellin Milling, the

Court held that for possession to constitute the foundation of a

prescriptive right, it must be under claim of title or adverse. It

must be coupled with the element of hostility towards the true owner.

An easement is non-apparent if it is used at intervals and depends on the

act of man, like the easement of right of way. False. An easement is

discontinuous if it is used at intervals and deoends on the act of man (e.g.

road v. drainage). It is the presence of physical signs indicating their

existence that makes an easement apparent (asphalt road v. unpaved

road). The determination of whether an easement is continuous or

discontinuous or whether it is apparent or non-apparent is relevant in

determining whether the easement may be acquired by prescription. Only

continuous and apparent easements may be acquired by

prescription of 10 years. All other easements are acquired by virtue of

a title.

An easement or servitude is a personal right, constituted on the corporeal

movable property of another, by virtue of which the owner has to refrain

from doing, or must allow someoene to do something on his property, for

the benefit of another thing or person. False. An easement must be

constituted on an immovable property.

Donations of an immovable property must be in writing to be valid.

False. The law further requires that donation be on a public

instrument specifying therein the property donated and the

value of the charges, if any.

24

The non-registration of a deed of donation does not affect its validity.

True. The registration of a donation does not affect its validity. However,

it must be registered in order to affect third persons.

24

If movable property is donated

Oral donation with simultaneous delivery of the thing to be donated or the document representing

the right donated

Both donation and acceptance must be in writing if the value of the movable exceeds P5K

The lease of a property for more than one year is considered not merely

an act of administration but an act of strict dominion or ownerhsip.

False. This should be lease of real property.

In case of double sale of real property which is registered under the

Torrens system, mere registration is not enough to give such registrar a

better right over the property. True. The registration should have been

done in good faith.

A builder in good faith cannot be compelled to pay rentals during the

period of retention nor be disturbed in his possession by ordering him to

vacate. True. In Nuguid, the Court held that the right of retention is

considered as one of the measures devised by the law for the protection of

builders in good faith. Its object is to guarantee full and prompt

reimbursement of necessary and useful expenses

The owner of the land has the right to offset or compensate the necessary

and useful expenses incurred by the builder-possesor in good faith with

the fruits received by the latter. False. See Nuguid case cited above.

Builder possessor in good faith has to be reimbursed.

Legal easements are those established by the will of the owners. False.

Legal easements are established by law. Voluntary easements are those

established by the will of the owners.

A person, as a buyer or mortgagee, is not required to go beyond what

appears on the face of the covering title itself. False. When the OCT/TCT

is in the name of the seller when the land is sold, the buyer has a right to

rely on what appears on the face of the document. If there is nothing that

indicates any irregularity, he is not expected to make further

investigations or inquiries. However, the rule above does not apply to

banks since a higher degree of diligence is expected of them.

Where the party has knowledge of a prior existing interest which is

unregistered at the time he acquired a right to the same land, his

knowledge of that prior unregistered interest has the efect of registration

as to him. True.

Ordinary acquisitive prescription requires possession of things in good

faith and with just title for a period of thirty years. FALSE. Only ten years

is required for acquisitive prescription if the possession is in good faith

and with just title. It is in extraordinary acquisitive prescription that thirty

years of open, continuous, exclusive and notorious possession is required.

The statutory period of prescription starts when a person who has

neither title nor good faith, secures tax declaration in his name and may,

therefore, be said to have adversely claimed the ownership of the lot.

Uribe Civil Law Review (Succession and Property)

Azys Notes 13

False. The statement is only accurate if the person who acquired the tax

declaration is in actual possession of the land.

Ownership is one of the attributes of possession. False. Its the other way

around.

Those who occupy the land of another at the latters tolerance without

any contract between them, are necessarily bound by an implied promise

that the occupants will vacate the property upon demand. True.

A co-owner of an undivided parcel of land is an owner of the whole, and

over the whole he exercises the right of dominion. True.

There is still co-ownership even if the different portions owned by

different people have already been concretely determined and separately

identified if they have not yet been technically described. False. There is

no co-ownership if the property has been partitioned.

An action to demand partition is imprescriptible and not subject to

laches. True. A co-owner may demand partition anytime except (1) if there

is an agreeement to keep the thing undivided

25

; (1) if the donor or testator

prohibited partition

26

; or (3) if it is prohibited by law.

Sample Bar Exam Questions

Manila Petroleum Co. owned and operated a petroleum operation facility

off the coast of Manila. The facility was located on a floating platform

made of wood and metal, upon which was permanently attached the

heavy equipment of the petroleum operations and living quarters of the

crew. The floating platform likewise contained a garden area, where

trees, plants and flowers were planted. The platform was tethered to a

ship, the MV 101, which was anchored to seabed.

(1) Is the platform movable or immovable property?

Immovable under par. 9 of Art. 415 if it can be shown that it was

intended to remain fixed on the sea.

(2) Are the equipment and living quarters movable or immovable

property?

25

said agreement cannot indicate more than 10 years but this period may be extended by a new agreement

26

the prohibition cannot be for more than 30 years

Immovable under par. 5 of Art. 415 if it can be shown that they are

being used for the industry, and that they were permanently attached

to the immovable property by the owner of said immovable property.

(3) Are the trees, plants and flowers immovable or immovable property?

Yes. Under par. 2 of Art. 415, trees, plants and growing fruits are

immovable while they are attached to another immovable property.

Flowers, although not expressly included in the enumeration, can fall

under growing fruits.

Salvador, a timber concessionare, built on his lot a warehouse where he

processes and stores his timber for shipment. Adjoing the warehouse is a

furniture factory owned by NARRAMIX of which Salvador is a majority

stockholder. NARRAMIX leased space in the warehouse where it placed

its furniture-making machinery.

(1) How would you classify the furniture-making machinery as property

under the Civil Code?

Movable. It was not attached to the land by the owner of the land but

only by the lessee. Except in cases where the Court applies the doctrine

of piercing the veil of corporate fiction, Salvador, although a majority

stockholder of Narramix, is a separate entity from the corporation.

(2) Suppose the lease contract between Salvador and NARRAMIX

stipulates that at the end of the lease the machinery shall become the

property of the lessor, will your answer be the same?

My answer would be different. In Davao Saw Mill, the Court ruled that

the lessee was acting as an agent of the lessor of the premises.

Therefore, the machinery attached by lessee Narramix was, by fiction

of law, attached by owner Salvador.

The following things are property of public dominion, except:

(1) Ports and bridges constructed by the State Art. 420

(2) Vehicles and weapons of the AFP for public service

(3) Rivers Art. 420

(4) Lands reclaimed by the state from the sea ANSWER; This is

patrimonial property of the State that may be alienated.

Uribe Civil Law Review (Succession and Property)

Azys Notes 14

Which of the following statements is worng?

(1) Patrimonial property of the state, when no longer intended for public

use or for public service, shall become property of public dominion

(2) All property of the State, which is not of public dominion, is

patrimonial property

(3) The property of provinces, cities and municipalities is divided into

property for public use and patrimonial property

(4) Property is either of public dominion or of private ownerhship

Answer: (1) because it is the other way around ANSWER; It is the

other way around. Property of public dominion, when no longer

intended for public use or for public service, shall become patrimonial

property of the state.

(2) is true. Property owned by the State which is not intended for

public use or public service is patrimonial.

(3) is true. Property of provinces, cities and municipalities is divided

into property for public use and patrimonial property. Property for

public use in these LGUs consist of the provincial roads, city streets,

municipal streets, the squares, fountains, public waters, promenades,

and public works for publc service paid for by the concerned LGUs. All

others are patrimonial property.

(4) Property is either of public dominion or of private ownership.

The relevance of distinguishing public properties from private ones is

that the former are exempt from execution because of their necessity

for governmental functions. For the same reason, properties of the

public domain are not within the commerce of men.

Distinguish occupation from possession

(1) Both are modes of acquiring ownership

(2) Occupation is a way of acquiring things that are appropriable by

nature which are without an owner such as animals, hidden

treasure and abandoned movables. It is, however, not a mode for

acquiring a piece of land.

(3) On the other hand, possession is a mode for acquiring both

movables and immovables. In the case of immovables, such

possession must be adverse in character.

Anthony bought a piece of untitled agricultural land from Bert. Bert, in

turn, acquired the property by forging Carlos signature in a deed of sale

over the property. Carlo had been in possession of the property for 8

years, declared it for tax purposes, and religiously paid all taxes due on

the property. Anthony is not aware of the defect in Berts title, but has

been in actual physical possession of the property from the time he

bought it from Bert, who had never been in possession. Anthony has since

then been in possession of the property for one year.

(1) Can Anthony acquire the property through acquisitive prescription?

Yes. He can acquire the property through acquisitive prescription

because the subject land is unregistered property.

(2) How many years does Anthony need?

1 year because Anthony is a possessor in good faith. Thus, the 8 years

of possession by Carlo can be continued by Anthony to acquire the real

property through ordinary acquisitive prescription.

(3) If Carlo is able to legally recover his property, can he require Anthony

to account for all the fruits he has harvested from the property while

in possession?

No. The general rule is that the fruits pertain to the owner. There are

exceptions to this rule such as: (1) when possessor of the land receives

the fruits in good faith; (2) in antichresis where the creditor gets the

fruits; (3) in usufructuary where the possesor has the right to enjoy the

fruits; and (4) in a lease agreement where the lessee gets the natural

and industrial fruits.

27

(4) If there are standing crops on the property when Carlo recovers

possession, can Carlo appropriate them?

27

PAUL

Uribe Civil Law Review (Succession and Property)

Azys Notes 15

Yes. Art. 448 applies since both parties acted in good faith. Carlo, as

owner of the land, has the following options:

a. Appropriate the fruits

b. Compel Bert, who is a sower in good faith, to rent the land

Marcelino, a treasure hunter as just a hobby, has found a map which

appears to indicate the location of hidden treasure. He has an idea of the

land where the treasure might possibly be found. Upon inquiry,

Marcelino learns that the owner of the land, Leopoldo, is a permanent

resident of Canada. Nobody, however, could give him Leopoldo's exact

address. Ultimately, anyway, he enters the land and conducts a search.

He succeeds. Leopoldo, learning of Marcelino find", seeks to recover the

treasure from Marcelino but the latter is not willing to part with it.

Falling to reach an agreement, Leopoldo sues Marcelino for the recovery

of the property, Marcelino contests the action. How would you decide the

case?

(1) Is this still by chance since he found a map and used it to find the

hidden treasure?

No. It is by chance if it is by good luck. In this case, Marcelino used a

map to find it.

(2) Is Leopoldo entitled to a share?

Yes. The owner of the land is the owner of its surface and everything

under it. Assuming arguendo that Marcelino found the subject

property by chance and that the find is therefore hidden treasure,

Leopoldo is still entitled to ownership of the subject property. Under

Art. 438, hidden treasure belongs to the owner of the land, building or

other property on which it is found. Marcelino would have been

entitled to a 50% share except that he was a trespasser.

Adam, a building contractor, was engaged by Blas to construct a house

on a lot which he (Blas) owns. While digging on the lot in order to lay

down the foudation of the house, Adam hit a very hard object. It turned

out to be the vault of the old Banco de las Islas Filipinas. Using a

detonation device, Adam was able to open the vault containing old notes

and coins which were in circulation during the Spanish era. While the

notes and coins are no longer legal tender, they were valued at P100

million because of their historical value and the coins silver nickel

content. The following filed legal claims over the notes and coins:

(1) Adam, as finder;

(2) Blas, as owner of the property where they were found;

(3) Bank of the Philippine Islands, as successor-in-interest of the owner of

the vault; and

(4) The Philippine Government because of their historical value.

Who owns the notes and coins?

From RJ: It depends on how you argue:

a. It can belong to BPI if you argue that the vault containing the notes and

coins are not hidden treasure (because the ownership of which is

apparent), but simply a lost movable; hence the finder has the duty to

return (but the finder will get 1/10 as finder's share) (see 439, 720)

b. It can belong to Adam, as finder, and Blas, as owner if you argue that it

is a res nullius (owned by no one) because of the length of time and

therefore, a hidden treasure.

Assuming that either or both Adam and Blas are adjudged as owners,

will the notes and coins be deemed part of their absolute community or

conjugal partnership of gains with their respective spouses?

From RJ: As for the question whether or not it will form part of the

community property or conjugal property, the answer is yes. It forms part

of community property because it is property that is acquired during the

marriage. It forms part of conjugal property by express provision of law

117 (4).

Demetrio knew that a piece of land bordering the beach belonged to

Ernesto. However, since the latter was studying in Europe and no one

was taking care of the land Demetrio occupied the same and constructed

thereon nipa sheds with tables and benches which he rented out to people

who want to have a picnic by the beach. When Ernesto returned, he

demanded the return of the land. Demetrio agreed to do so after he has

removed the nipa sheds. Ernesto refused to let Demetrio remove the nipa

Uribe Civil Law Review (Succession and Property)

Azys Notes 16

sheds on the ground that these already belonged to him by right of

accession. Who is correct?

Ernesto is correct. Demetrio built the nipa huts with the knowledge that

Ernesto owned the lot and without the consent of Ernesto. He was therefor

a builder in bad faith. In cases where the landowner acted in good faith

while the builder acted in bad faith, Art. 449 applies. Thus, the builder,

planter or sower loses what is built, planted or sown, and the landowner

becomes the owner of the same.

As an alternative, Ernesto may demand the demolition of the nipa hut at

the expense of Demetrio in order to restore the land to its former

condition.

Another option available to Ernesto is to compel Demetrio to buy the land

regardless if the value of the land is considerably more than the nipa hut.

In all three cases, the landowner is entitled to damages and the builder,

planter or sower has a right to be reimbursed for necessary expenses for

the preservation of the land.

In good faith, Pedro constructed a five-door commercial building on the

land of Pablo who was also in good faith. When Pablo discovered the

construction, he opted to appropriate the building by paying Pedro the

cost thereof. However, Pedro insists that he should be paid the current

market value of the building, which was much higher because of

inflation.

(1) Who is correct, Pedro or Pablo?

Pablo is correct. Under Article 448 of the New Civil Code in relation to

Article 546, the builder in good faith is entitled to a refund of the necessary

and useful expenses incurred by him, or the increase in value which the

land may have acquired by reason of the improvement, at the option of the

landowner. The option between the two is determined by the landowner

Pablo.

The case of Pecson v. CA is not applicable to the problem. In the Pecson

case, the builder was the owner of the land who later lost the property at a

public sale due to non-payment of taxes. The Court ruled that Article 448

does not apply to the case where the owner of the land is the builder but

who later lost the land; not being applicable, the indemnity that should be

paid to the buyer must be fair market value of the building and not just the

cost of construction thereof. The Court opined in that case that to do

otherwise would unjustly enrich the new owner of the land.

(2) In the meantime that Pedro is not yet paid, who is entitled to the

rentals of the building, Pedro or Pablo?

Pablo is entitled to the rentals of the building. As the owner of the land,

Pablo is also the owner of the building being an accession thereto.

However, Pedro who is entitled to retain the building is also entitled to

retain the rentals. He, however, shall apply the rentals to the indemnity

payable to him after deducting reasonable cost of repair and maintenance.

For many years, the Rio Grande river deposited soil along its bank,

beside the titled land of Jose. In time, such deposit reached an area of one

thousand square meters. With the permission of Jose, Vicente cultivated

the said area. Ten years later, a big flood occurred in the river and

transferred the 1,000 square meters to the opposite bank, beside the land

of Agustin. The land transferred is now contested by Jose and Agustin as

riparian owners and by Vicente who claims ownership by prescription.

Who should prevail,? Why?

Jose should prevail. The disputed area, which is an alluvion, belongs by

right of accretion to Jose, the riparian owner (Art. 457). When, as given in

the problem, the very same area was "transferred" by flood waters to the

opposite bank, it became an avulsion and ownership thereof is retained

by Jose who has two years to remove it (Art. 459, CC).

Vicente's claim based on prescription is baseless since his possession was

by mere tolerance of Jose and, therefore, did not adversely affect Jose's

possession and ownership (Art. 537, CC). Inasmuch as his possession is

merely that of a holder, he cannot acquire the disputed area by

prescription.

The properties of Jessica and Jenny, who are neighbors, lie along the

banks of the Marikina River. At certain times of the year, the river would

swell and as the water recedes, soil, rocks and other materials are

deposited on Jessica's and Jenny's properties. This pattern of the river

Uribe Civil Law Review (Succession and Property)

Azys Notes 17

swelling, receding and depositing soil and other materials being

deposited on the neighbors' properties have gone on for many years.

Knowing this pattern, Jessica constructed a concrete barrier about 2

meters from her property line and extending towards the river, so that

when the water recedes, soil and other materials are trapped within this

barrier. After several years, the area between Jessica's property line to

the concrete barrier was completely filled with soil, effectively increasing

Jessica's property by 2 meters. Jenny's property, where no barrier was

constructed, also increased by one meter along the side of the river.

(1) Can Jessica and Jenny legally claim ownership over the additional

2 meters and one meter, respectively, of land deposited along their

properties?

Only Jenny may legally claim ownership over the additional one meter

in her property. Under Art. 457, to the owners of lands adjoining the

banks of rivers belong the accretion which they gradually receive

from the effects of the current of the waters. Deposit should be

gradual and natural without intervention of man. By constructing a

barrier to trap the soil and other materials brought by the water, the

accretion can no longer be said to have been from the effects of the

current of the Marikina River.

(2) If Jessica's and Jenny's properties are registered, will the benefit

of such registration extend to the increased area of their

properties?

No, there is a need to register the accretion. To the owners of land

adjoining banks of rivers belong the accretions it receives from the

gradual effects of the current of the waters. When the accretion was

created, its ownership was passed automatically to Jenny. However,

there is still a need to register the same in order for that portion of the

land to be imprescriptible.

(3) Assume the two properties are on a cliff adjoining the shore of

Laguna Lake. Jessica and Jenny had a hotel built on the

properties. They had the earth and rocks excavated from the

properties dumped on the adjoining shore, giving rise to a new

patch of dry land. Can they validly lay claim to the patch of land?

No. This is reclamation without the authority of the State. As held in

Chavez v PEA, reclaimed land belongs to the State. Since the bed of the

lake is public dominion then everything above it is also part of public

dominion.