Académique Documents

Professionnel Documents

Culture Documents

Mining Cost Indexes

Transféré par

Hamit AydınDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Mining Cost Indexes

Transféré par

Hamit AydınDroits d'auteur :

Formats disponibles

Mining Cost Indexes: Surface & Underground Mining &

Milling Operations

The MCS Canadian indexes are composite indexes representing the cost of developing and

operating a typical mining and milling operation in Canada. Separate indexes are listed for

surface mine capital costs, surface mine operating costs, underground mine capital costs,

underground mine operating costs, mill capital costs, and mill operating costs. Composite

proportions are determined from base model estimates with cost distributions published in

Mining Cost Service. The surface mine base model is a typical truck/hydraulic excavator

operation mining 10,000 short tons ore and 20,000 short tons waste per day. The underground

mine base model is a 10,000 short tons per day room and pillar operation using conventional

drilling and blasting, with shaft access and LHD and truck haulage. The mill base model is a

10,000 short ton per day single product flotation mill.

Cost indexes provide a means of adjusting outdated cost information for the effects of

inflation. They are based on statistical averages of costs for specific items and time periods.

Following are the Mining Cost Service composite indexes for surface and underground

mining and milling operations. Indexes for specific cost centers, e.g. labor, equipment,

transportation, are available by subscription to Mining Cost Service.

Note: Beginning with January 2001 data, Statistics Canada began publishing labor data based

on the North American Industry Classification (NAICS) rather than the Standard Industrial

Classification 1980 (SIC80). This resulted in some minor changes to all the MCS indexes for

Canada. The current and historical MCS indexes have been adjusted to reflect the new

classification system.

Notice about change in basis: As of January 2009, all CCG indexes for capital and operating

costs were re-stated to reflect a change in estimating methods by Statistics Canada for Survey

of Earnings, Payrolls, and Hours (SEPH) for construction and mining employees. CCG

indexes from January 2001 to present are affected and the new indexes are provided here.

Indexes prior to January 2001 remain unchanged.

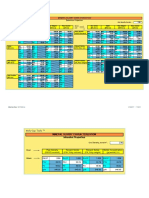

Mining Cost Service (MCS) Indexes for Canada

Surface Mine Underground Mine Milling/Processing

Year

Capital

Cost Index

Operating

Cost Index

Capital

Cost Index

Operating

Cost Index

Capital

Cost Index

Operating

Cost Index

2000 107.8 110.8 107 109.5 107.9 107.6

2001 108.9 114.5 108 114.1 108.1 111.2

2002 109.9 113 109.7 114.3 110.1 113.2

2003 110.7 116.2 110 116.6 111.3 116.6

2004 114.3 124.7 112.6 124 116 123.7

2005 118.9 132.5 115.7 128 120.6 131.5

2006 121.2 135.1 117.3 128.3 122.3 131.9

2007 126.2 143.7 121.5 136.2 126.4 136.4

2008 135.1 157.9 128.4 145.7 135.8 147.4

2009 133.1 146.4 129.9 142.5 134.3 139.9

2010 134.3 149.3 130.4 144.3 135 144.4

Data revised on June 22, 2011.

Model Smelter Schedule - Lead Concentrates

Payments

Lead: Pay for 95% of the lead content at market value, with minimum deductions of 1.5 to

3.0 units per dry tonne.

Gold: Deduct 0.03 to 0.07 troy ounce per dry tonne and pay for 95% of the remaining gold at

market value.

Silver: Deduct 0.5 to 2.0 troy ounce per dry tonne and pay for 95% of the remaining silver at

market value.

Copper: Some smelters will pay for as much as 40% of contained copper while at some other

smelters is considered deleterious.

Deductions

Treatment Charge: Terms for clean, very low-silver material for 2012 settled at $200 to $210

per tonne (flat), of $200 per tonne at a basis $2,100 per tonne with variety of up and down

escalators and a silver RC of $0.40 to $0.60 per ounce. Terms for clean, very low-silver

material for 2013 are estimated at about $200 at a basis $2,000 per tonne with variety of up

and down escalators and a silver RC of $1.50 per ounce. In 2012, TCs for high silver content

(100 ounces per tonne) concentrates settled at about $300 per tonne, basis $2,100 with an

up escalator of 4% and a down escalator of 1%, and a silver refining charge of $1.50 per

ounce. Generally, high silver long-term contracts range from $210 to $300 per tonne, with

silver refining charges at $0.60 to $1.50 per ounce.

Complex Concentrates: Smelters are charging an additional $50 to $100 per tonne for low-

grade, high-silver, complex or bulk concentrates.

Refining Charges

(1)

$6.00 - $10.00 per ounce of payable gold

$0.60 - $1.50 per ounce of payable silver

(2)

Penalties

Deleterious Element Penalties: Lead concentrates containing excessive amounts of the

following elements may be penalized of rejected: arsenic, antimony, bismuth, nickel, copper,

alumina, tellurium, and mercury. Iron in excess of 10% is also considered deleterious. See

individual smelter descriptions for details.

Moisture: High moisture content may also be penalized due to material handling difficulties.

Notes

Lead refining charges: These are rarely assessed directly in today's market. They are usually

built into treatment charges. Additional charges may be assessed in the form of a metal-to-

market levy if the smelter is not located near the lead metal market.

Silver refining charges: These previously ranged from $0.30 to $0.40 per troy ounce of

payable silver. However, with the rise in the silver price, smelters have increased this charge

to $0.60 to $1.50 per troy ounce, depending on the smelter and quality of concentrate.

Recent spot contracts are charging up to $1.50 per troy ounce for high silver concentrates

and some Chinese smelters are demanding $3.00 to $4.00 per troy ounce for these

concentrates.

Vous aimerez peut-être aussi

- Santa Rita del Cobre: A Copper Mining Community in New MexicoD'EverandSanta Rita del Cobre: A Copper Mining Community in New MexicoPas encore d'évaluation

- 2011 Cost Models SectionDocument56 pages2011 Cost Models Sectionoduk odbayarPas encore d'évaluation

- X Reserves Resources 201112Document50 pagesX Reserves Resources 201112Eun Young MPas encore d'évaluation

- Balance Celda X Celda Por MallasDocument8 pagesBalance Celda X Celda Por MallasFlor Margarita Alfaro MiñanoPas encore d'évaluation

- Date: Project No: Purpose: Procedure: FeedDocument5 pagesDate: Project No: Purpose: Procedure: FeedRogger Renato Salinas LopezPas encore d'évaluation

- SamplingDocument8 pagesSamplingSreedhar BellaryPas encore d'évaluation

- Heap Leach Modeling Employing CFD Technology - A - Process - Heap Model PDFDocument8 pagesHeap Leach Modeling Employing CFD Technology - A - Process - Heap Model PDFInfernuzPas encore d'évaluation

- Leaching Section 3Document16 pagesLeaching Section 3EDSON CHENJERAIPas encore d'évaluation

- CyanideDocument52 pagesCyanideWilliamEliezerClPas encore d'évaluation

- SCRCostManualchapter Draftforpubliccomment6!5!2015Document101 pagesSCRCostManualchapter Draftforpubliccomment6!5!2015Mustika Putri PertiwiPas encore d'évaluation

- BookDocument170 pagesBookPriscyla RoquePas encore d'évaluation

- Cyanide Control in The Metallurgical Process of Gold Extraction in AngloGold (S.a.)Document8 pagesCyanide Control in The Metallurgical Process of Gold Extraction in AngloGold (S.a.)Luis La TorrePas encore d'évaluation

- FS - K.HILL BATTERY-GRADE MANGANESE PROJECT - K-Hill-FS-11142022Document482 pagesFS - K.HILL BATTERY-GRADE MANGANESE PROJECT - K-Hill-FS-11142022girl2wise100% (1)

- 015-038 GaylardDocument24 pages015-038 GaylardJob MateusPas encore d'évaluation

- Outlook for PAL Process in Nickel IndustryDocument14 pagesOutlook for PAL Process in Nickel IndustryGeorgi SavovPas encore d'évaluation

- Electrochemical EquilibriumDocument54 pagesElectrochemical EquilibriumChelsea MartinezPas encore d'évaluation

- Report 32 Dec 3231451432 ADocument100 pagesReport 32 Dec 3231451432 AuturoncoPas encore d'évaluation

- Cost Estimation HandbookDocument160 pagesCost Estimation HandbookKay KaiPas encore d'évaluation

- Gold and Diamond Mining Study Guyana PDFDocument89 pagesGold and Diamond Mining Study Guyana PDFJaque BauerPas encore d'évaluation

- Mass Balancer - WeightReDocument12 pagesMass Balancer - WeightReJob MateusPas encore d'évaluation

- Blast Fume Clearance Reentry TimesDocument8 pagesBlast Fume Clearance Reentry TimesYuni_Arifwati_5495Pas encore d'évaluation

- Recent Developments in Preconcentration Using Dense Media SeparationDocument13 pagesRecent Developments in Preconcentration Using Dense Media Separationcarlos0s0nchez0aliagPas encore d'évaluation

- Spent Acid OverviewDocument2 pagesSpent Acid OverviewacckypenrynPas encore d'évaluation

- KE-42 3000 12. HydrocycloneDocument16 pagesKE-42 3000 12. HydrocycloneGeorgi SavovPas encore d'évaluation

- Is the 80th Percentile Always the Best Design PointDocument7 pagesIs the 80th Percentile Always the Best Design PointThiago JatobáPas encore d'évaluation

- SGS MIN 2001 04 Cyanide Management by SART en 11 09Document7 pagesSGS MIN 2001 04 Cyanide Management by SART en 11 09Jon CastilloPas encore d'évaluation

- Nexa Resources S.A. - Vazante - Technical ReportDocument332 pagesNexa Resources S.A. - Vazante - Technical ReportAlex HePas encore d'évaluation

- Technical Report VANADIUM-TITANIUM-IRON Resource Estimation of The IRON-T Property MATAGAMI AREA, QUEBECDocument89 pagesTechnical Report VANADIUM-TITANIUM-IRON Resource Estimation of The IRON-T Property MATAGAMI AREA, QUEBECRichard J MowatPas encore d'évaluation

- Stripping Ratio PDFDocument59 pagesStripping Ratio PDFKeylla Chavez RosasPas encore d'évaluation

- Gold Leach PlantDocument8 pagesGold Leach PlantJosé Guilherme ValadaresPas encore d'évaluation

- Full Paper Freiberg Conference 2013Document8 pagesFull Paper Freiberg Conference 2013jlzmotricoPas encore d'évaluation

- Appendix 20 - Cyanide Facility Decommissioning Plan (ICM Code Principle 5) For Kalgoorlie Consolidated Gold MinesDocument38 pagesAppendix 20 - Cyanide Facility Decommissioning Plan (ICM Code Principle 5) For Kalgoorlie Consolidated Gold MinesPaipinpokoPas encore d'évaluation

- SWP Blast No1 - Loading of Explosive - 2003Document9 pagesSWP Blast No1 - Loading of Explosive - 2003Lucky LukmanPas encore d'évaluation

- Maximising Cash Flow for Existing AssetsDocument9 pagesMaximising Cash Flow for Existing AssetsAbe ArdiPas encore d'évaluation

- Imwaru (Industrial and Mining Water Research Unit) Imwaru (Industrial and Mining Water Research Unit)Document15 pagesImwaru (Industrial and Mining Water Research Unit) Imwaru (Industrial and Mining Water Research Unit)sirbhimselfPas encore d'évaluation

- Código JORCDocument44 pagesCódigo JORCPatricio LeddyPas encore d'évaluation

- L&T Construction: Rehabilitation of Bhagirathi WTP, Delhi List of Lab EquipmentsDocument1 pageL&T Construction: Rehabilitation of Bhagirathi WTP, Delhi List of Lab EquipmentsRamBinodSharmaPas encore d'évaluation

- ASH MINERAL-PROCESSING 4pp Webversion-1Document4 pagesASH MINERAL-PROCESSING 4pp Webversion-1pmarteenePas encore d'évaluation

- Break Even Analysis of Mining ProjectsDocument60 pagesBreak Even Analysis of Mining ProjectsAnil Kumar100% (1)

- Progress On Geoenvironmental Models For Selected Mineral DepositDocument217 pagesProgress On Geoenvironmental Models For Selected Mineral DepositJHOEL_GEOPas encore d'évaluation

- CPT Cavitation SystemDocument9 pagesCPT Cavitation SystemLuis Gutiérrez AlvarezPas encore d'évaluation

- Moly-Cop Tools: Mineral Slurry Characterization Extensive PropertiesDocument2 pagesMoly-Cop Tools: Mineral Slurry Characterization Extensive PropertiesAnonymous TsKN7XZBPas encore d'évaluation

- Alufer - Bauxite Factsheet PDFDocument2 pagesAlufer - Bauxite Factsheet PDFRaraPas encore d'évaluation

- New Afton Presentation1 PDFDocument32 pagesNew Afton Presentation1 PDFOktarianWisnuLusantonoPas encore d'évaluation

- Mineral Processing: History Unit OperationsDocument9 pagesMineral Processing: History Unit Operationsالقيصر صالحPas encore d'évaluation

- A Solution Concentration Model For CIP SimulationDocument87 pagesA Solution Concentration Model For CIP SimulationFJ De LangePas encore d'évaluation

- Cerro Corona Testwork Report May09.2Document4 pagesCerro Corona Testwork Report May09.2Freck Pedro OliveraPas encore d'évaluation

- Mining Cost Service Ex 1Document3 pagesMining Cost Service Ex 1theresia_ksPas encore d'évaluation

- A CIP Simulation Technique Using Excel Built-In FunctionalityDocument4 pagesA CIP Simulation Technique Using Excel Built-In FunctionalityluischusPas encore d'évaluation

- 01 1500 David DreisingerDocument74 pages01 1500 David DreisingerJaime MercadoPas encore d'évaluation

- Paper - ML Proceso Outotec de Lixiviacion A Presion PDFDocument11 pagesPaper - ML Proceso Outotec de Lixiviacion A Presion PDFJesus Ururi100% (1)

- Determination of RevenueDocument3 pagesDetermination of RevenuePanjy Si CikmalePas encore d'évaluation

- Net Smelter ReturnDocument7 pagesNet Smelter Returnsunpit100% (2)

- Net smelter return calculationDocument7 pagesNet smelter return calculationlindaPas encore d'évaluation

- Liberating valuables from tailings with ball mill designDocument5 pagesLiberating valuables from tailings with ball mill designEngineering Office ShahrakPas encore d'évaluation

- Application of Whittle 4D To Risk Manag. in OP OptimisationDocument12 pagesApplication of Whittle 4D To Risk Manag. in OP Optimisationminerito22110% (1)

- Chapter 7 Calculation of The Net Smelter Return (NSR) of A MineDocument7 pagesChapter 7 Calculation of The Net Smelter Return (NSR) of A MineLFPas encore d'évaluation

- Action Notes: Rating/Target/Estimate ChangesDocument23 pagesAction Notes: Rating/Target/Estimate ChangesJeff SharpPas encore d'évaluation

- Copper Mountain August 2014 Corp PresDocument29 pagesCopper Mountain August 2014 Corp PresBLBVORTEXPas encore d'évaluation

- Ore Accounting - Revenue Assumptions MECO 4210 2023Document62 pagesOre Accounting - Revenue Assumptions MECO 4210 2023Martin ChikumbeniPas encore d'évaluation

- Numerical Comparison of Some Explicit Time Integration Schemes Used in DEM, FEM/DEM and Molecular DynamicsDocument24 pagesNumerical Comparison of Some Explicit Time Integration Schemes Used in DEM, FEM/DEM and Molecular DynamicsHamit AydınPas encore d'évaluation

- Engineering Economic Analysis Case StudyDocument3 pagesEngineering Economic Analysis Case StudyHamit AydınPas encore d'évaluation

- ROADHEADERDocument15 pagesROADHEADERHamit AydınPas encore d'évaluation

- World Mineral Supplies Assessment and Perspective PDFDocument468 pagesWorld Mineral Supplies Assessment and Perspective PDFHamit AydınPas encore d'évaluation

- The Engineering Economist: A Journal Devoted To The Problems of Capital InvestmentDocument24 pagesThe Engineering Economist: A Journal Devoted To The Problems of Capital InvestmentHamit AydınPas encore d'évaluation

- Rock CuttingDocument16 pagesRock CuttingHamit Aydın100% (2)

- Application of Hierarchical Clustering For ClassifDocument11 pagesApplication of Hierarchical Clustering For ClassifHamit AydınPas encore d'évaluation

- The Engineering Economist: A Journal Devoted To The Problems of Capital InvestmentDocument19 pagesThe Engineering Economist: A Journal Devoted To The Problems of Capital InvestmentHamit AydınPas encore d'évaluation

- New Approach For Estimating Total Mining Costs in Surface Coal MinesDocument8 pagesNew Approach For Estimating Total Mining Costs in Surface Coal MinesHamit AydınPas encore d'évaluation

- ErgitmeDocument9 pagesErgitmeHamit AydınPas encore d'évaluation

- Economic Evaluation of Mineral ExtractionDocument5 pagesEconomic Evaluation of Mineral ExtractionHamit AydınPas encore d'évaluation

- Mechanical Force TransducersDocument8 pagesMechanical Force TransducersHamit AydınPas encore d'évaluation

- The Oxford 3000 WordDocument17 pagesThe Oxford 3000 Wordunaisali100% (1)

- Valuation of Mineral Exploration Properties Using the Cost ApproachDocument11 pagesValuation of Mineral Exploration Properties Using the Cost ApproachHamit AydınPas encore d'évaluation

- Reliability Analysis - RSM - Comp and GeotechDocument9 pagesReliability Analysis - RSM - Comp and GeotechHamit AydınPas encore d'évaluation

- Oxford Vocabulary TrainerDocument31 pagesOxford Vocabulary TrainerHamit Aydın100% (2)

- Keynote Lecture 4Document20 pagesKeynote Lecture 4Hamit AydınPas encore d'évaluation

- Longman Communication 3000: A Core Vocabulary List for English LearnersDocument16 pagesLongman Communication 3000: A Core Vocabulary List for English LearnersSarvin1999100% (3)

- Proving Ring US PDFDocument22 pagesProving Ring US PDFzilangamba_s4535Pas encore d'évaluation

- Ochoa Project Preliminary Economic Assessment for Polyhalite ResourceDocument258 pagesOchoa Project Preliminary Economic Assessment for Polyhalite ResourceHamit AydınPas encore d'évaluation

- Economic Evaluation Technical Guide V102 August 2013Document74 pagesEconomic Evaluation Technical Guide V102 August 2013Hamit AydınPas encore d'évaluation

- Lead ZincDocument27 pagesLead ZincElder18Pas encore d'évaluation

- Bureau of Mines CES Placer Mining Design of Placer OperationsDocument22 pagesBureau of Mines CES Placer Mining Design of Placer OperationsHamit AydınPas encore d'évaluation

- Know The IronDocument13 pagesKnow The IrondudealokPas encore d'évaluation

- Rango de Penetracion Alan Bauer en InglesDocument7 pagesRango de Penetracion Alan Bauer en InglesLied Jonathan MejiasilvaPas encore d'évaluation

- Risk assessment workbook for minesDocument64 pagesRisk assessment workbook for minesHamit AydınPas encore d'évaluation

- Installation of RDocument4 pagesInstallation of RHamit AydınPas encore d'évaluation

- Valuation of Metals and Mining CompaniesDocument81 pagesValuation of Metals and Mining CompaniesJon GoldmanPas encore d'évaluation

- Probabilistic Identification o F Keyblocks in Rock Excavations PDFDocument250 pagesProbabilistic Identification o F Keyblocks in Rock Excavations PDFHamit AydınPas encore d'évaluation

- Indo American Journal of Pharmaceutical Research (India)Document4 pagesIndo American Journal of Pharmaceutical Research (India)Pharmacy2011journalsPas encore d'évaluation

- MS-MS Analysis Programs - 2012 SlidesDocument14 pagesMS-MS Analysis Programs - 2012 SlidesJovanderson JacksonPas encore d'évaluation

- Prob Stats Module 4 2Document80 pagesProb Stats Module 4 2AMRIT RANJANPas encore d'évaluation

- Chocolate - Useful Physical ConstantsDocument2 pagesChocolate - Useful Physical ConstantsJuan CPas encore d'évaluation

- Operational Transconductance Amplifier ThesisDocument6 pagesOperational Transconductance Amplifier ThesislaurahallportlandPas encore d'évaluation

- Pricelist Mobil Area Jabodetabek Semester 2 2022 TerbaruDocument108 pagesPricelist Mobil Area Jabodetabek Semester 2 2022 TerbarutonymuzioPas encore d'évaluation

- What Is RTN/Microwave TechnologyDocument27 pagesWhat Is RTN/Microwave TechnologyRavan AllahverdiyevPas encore d'évaluation

- Your Song RitaDocument1 pageYour Song Ritacalysta felix wPas encore d'évaluation

- Hufenus 2006 Geotextiles GeomembranesDocument18 pagesHufenus 2006 Geotextiles Geomembranesbkollarou9632Pas encore d'évaluation

- WIP CaseStudyDocument3 pagesWIP CaseStudypaul porrasPas encore d'évaluation

- Elimination - Nursing Test QuestionsDocument68 pagesElimination - Nursing Test QuestionsRNStudent1100% (1)

- Mic ProjectDocument12 pagesMic Projectsarthakjoshi012Pas encore d'évaluation

- Cryptography 01092014Document19 pagesCryptography 01092014Anshu MittalPas encore d'évaluation

- Msds PentaneDocument6 pagesMsds PentaneMuhammad FikriansyahPas encore d'évaluation

- CalderaDocument56 pagesCalderaEsteban TapiaPas encore d'évaluation

- BS 7941-1-2006Document20 pagesBS 7941-1-2006Willy AryansahPas encore d'évaluation

- Real Talk GrammarDocument237 pagesReal Talk GrammarOmar yoshiPas encore d'évaluation

- General Biology 2: Quarter 3, Module 1 Genetic EngineeringDocument20 pagesGeneral Biology 2: Quarter 3, Module 1 Genetic EngineeringRonalyn AndaganPas encore d'évaluation

- Swami Brahmananda - The Spiritual Son of Sri RamakrishnaDocument7 pagesSwami Brahmananda - The Spiritual Son of Sri RamakrishnaEstudante da Vedanta100% (2)

- Marketing Strategy of Air-Conditioning Companies: Project SynopsisDocument13 pagesMarketing Strategy of Air-Conditioning Companies: Project SynopsisSrikanta ChoudhuryPas encore d'évaluation

- 2023-05-11 St. Mary's County TimesDocument40 pages2023-05-11 St. Mary's County TimesSouthern Maryland OnlinePas encore d'évaluation

- GRP104 Course Outline: Introduction to Key Topics in Human GeographyDocument26 pagesGRP104 Course Outline: Introduction to Key Topics in Human GeographyKelvin WatkinsPas encore d'évaluation

- Traffic Sign Detection and Recognition Using Image ProcessingDocument7 pagesTraffic Sign Detection and Recognition Using Image ProcessingIJRASETPublicationsPas encore d'évaluation

- ParikalpDocument43 pagesParikalpManish JaiswalPas encore d'évaluation

- Chinkon Kishin - Origens Shintoístas Do Okiyome e Do Espiritismo Na MahikariDocument2 pagesChinkon Kishin - Origens Shintoístas Do Okiyome e Do Espiritismo Na MahikariGauthier Alex Freitas de Abreu0% (1)

- 692pu 6 6Document1 page692pu 6 6Diego GodoyPas encore d'évaluation

- Boutique Olive Oil Machines Catalogue ENG5Document33 pagesBoutique Olive Oil Machines Catalogue ENG5Younesse EL BraiPas encore d'évaluation

- English Task Resumido 2Document12 pagesEnglish Task Resumido 2Luis ArmandoPas encore d'évaluation

- 2021 Vallourec Universal Registration DocumentDocument368 pages2021 Vallourec Universal Registration DocumentRolando Jara YoungPas encore d'évaluation

- Sepuran® N Module 4": in NM /H at 7 Barg 25°CDocument2 pagesSepuran® N Module 4": in NM /H at 7 Barg 25°CsanjaigPas encore d'évaluation