Académique Documents

Professionnel Documents

Culture Documents

Project Risk Management

Transféré par

ianvlynchCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Project Risk Management

Transféré par

ianvlynchDroits d'auteur :

Formats disponibles

Presented by

Stephen Smith

Project Risk Management

Introduction

Risk Management

Insurance

Business

Financial

Project Risk Management

Project

A temporary endeavour undertaken

to create a unique product or service

A series of activities designed to

achieve a specific outcome within a

set budget and timescale

Project Management

The application of knowledge, skills

tools and techniques to project

activities in order to meet or exceed

stakeholder needs and expectations

from a project

Project Management

The balancing of competing

demands of:

Cost

Quality

Time

Risk Definitions

Risk an uncertain event or

condition that, if it occurs, has a

positive or negative affect on a

project objective

A risk has a cause and, if it occurs,

an effect. PMBOK (Project

Management Body of Knowledge)

Lets digress

Sun Tzu Art of War

Translated into French 1782

Legend Napoleons key to

success

13 Chapters on waging war

Chapter 4 Tactical

Dispositions

Tactics

He wins his battles by making no

mistakes.

He plans no superfluous marches, he

devises no futile attacks. One who seeks to

conquer by sheer strength, clever though he

may be at winning pitched battles, is also

liable on occasion to be vanquished;

whereas he who can look into the future

and discern conditions that are not yet

manifest, will never make a blunder and

therefore invariably win.

Winning

In PM environment

Quality

Cost

Time

AVOIDING mistakes

Project Disasters

Original:

Estimate - AUS$7m

Schedule - 4 years

Actual:

Cost - AUS$102m

Duration - 14 years

Research

Google search string

Construction project cost and time

overruns

Risk Management

Better way to achieve project

Aims and Objectives

Definitions

Project Aims

The clearly defined deliverables,

which have to be met to fulfil a

specific requirement

Definitions

Project Objectives

cost,

time,

quality

Additional objectives: e.g.

Environmental, health and

safety, no disruption to existing

facilities etc.

Risk Management Methodology

Step 1 - RM Planning

Step 1 - RM Planning

Risk Management Plan

identification,

prioritisation, assessment,

analysis,

response planning and

tracking and control

Does not address individual risks

Step 1 - RM Planning

Project Definition

statement of need

business case

Organisational Risk Requirements

current organisational Risk Management Methodology

Defined Roles and Responsibilities

roles and responsibilities

documented and indicate the decision making process

Stakeholder Risk Tolerances

different tolerances for risk

identifying the risk tolerances of the different stakeholders

will enable the project team to prioritise and respond

appropriately to project risk

Template for Risk Management Plan

pre-defined risk management plan templates

Risk Management Planning Inputs

Step 1 - RM Planning

Planning Meetings hold planning

meetings in order to develop the risk

management plan and obtain stakeholder

buy-in

Risk Management Planning Procedure

Step 1 - RM Planning

Risk Management Plan Including the following:

Risk Management Process - Approaches, tools,

and data sources. Early stage, the aims, objectives

and scope of the project identified

Risk Management Hierarchy - Describe how the

various functional areas will manage their own risk

process

Roles and Responsibilities

Identify individuals / teams to fill roles

Risk Co-ordinator to oversee the risk management

process and ensure mitigation procedures are

implemented

Risk Manager responsible for delivery of the

complete risk management service

Risk Facilitator from outside the project to help

perform an independent unbiased risk analysis

Risk Management Planning Deliverables

Step 1 - RM Planning

Budgeting

Budget for hiring external risk management

consultants

Timing

Frequency throughout project lifecycle

Scoring and Interpretation

Methods of scoring Impact/Probability

Acceptable Tolerance

Acceptable tolerances and targets

Proceed through the gates on meeting criteria

Risk Management Planning Deliverables

Step 1 - RM Planning

Reporting Standards

Define how results of risk management

process will be documented, analysed and

communicated to the project team, internal

and external stakeholders, and project

sponsors

Project Risk Database

Recording and centralising risk related

information

Risk registers and risk templates etc. should

be standardised to facilitate ease of data

transfer between different projects

Quality Assurance

Compliance with company QA procedures

Risk Management Planning Deliverables

Step 2 Risk Identification

Involves determining which risks might

affect the project and documenting their

characteristics

Participants in risk identification generally

include the following:

Project team

Risk management team

Subject matter experts

Customers

End users

Stakeholders

Risk identification occurs throughout the

life of the project

Step 2 Risk Identification

Risk Management Plan

Project Work Breakdown Structure and Project

Programme

Project Planning Outputs - Projects aims,

objectives, and scope

Risk Categories - The risk categories should

reflect common sources of risk:

Health & Safety Risks

Budget Risks

Schedule Risks

Quality/Technical Risks

Communication Risks

Historical Information - Use information from prior

projects

Step 2 Risk Identification

Risk Identification Inputs

Step 2 Risk Identification

Documentation Reviews - Perform a structured review

of the business case, statement of need and project

identification documents

Info Gathering Techniques

Brainstorming

Interviewing

Checklists - Checklists can be developed based on

historical information and knowledge accumulated

Advantage: it facilitates identification based on lessons

learned

Disadvantage: it may limit risk identification to only the

items on the checklist

Checklists should always be supplemented by other

risk identification techniques

Assumption Analysis - Every project is conceived and

developed based on a set of assumptions. Project team

identifies risks from assumptions made in development

of the business case

Risk Identification Procedure

Step 2 Risk Identification

Risk List Unprioritised list of Project

Risks

Risk Identification Deliverables

Step 3 Risk Prioritisation

Step 3 Risk Assessment and

Prioritisation

Risk assessment and

prioritisation - Scoring

Assessing impact of a risk should

it materialise, and probability that

an identified risk will materialise.

Revisited at different stages

during the project process

Step 3 Risk Assessment and

Prioritisation

Risk Management Plan

Risk Identification

Scales of Probability and Impact

Risk Assessment and Prioritisation Inputs

Step 3 Risk Assessment and

Prioritisation

Risk Probability and Impact

Risk probability is the likelihood that a risk will occur

Risk impact is the effect on a project if the risk occurs

Analysis of risks using probability and impact

help identify those risks that should be

managed aggressively

Probability/Impact Risk Rating Matrix - A matrix

may be constructed that assigns risk ratings to

risks based on combining probability and impact

scales. One: SWIFT analysis

Calculated Risk Exposure - To complete risk

prioritisation, the specific risks exposure must be

determined. Exposure is a combination of

probability and impact (using SWIFT analysis

above)

Risk Assessment and Prioritisation Procedure

Step 3 Risk Assessment and

Prioritisation

Project Risk Register - The project Risk

Register is derived from assessing the

probability impact of the risk list and

utilising score ratings to rank the risks

Risk Matrix - Risk matrix displays current

prioritisation of risks. It is the high level tool

used to communicate risks and priorities

List of Risks for Additional

Management - Risks classified as high or

moderate would be prime candidates for

more analysis, including quantitative risk

analysis, and for risk management action

Risk Assessment and Prioritisation Deliverables

SWIFT Analysis Page 1 of 4

1.Probability

Cost/time impact is certain.

Most serious total lost type.

On priority one review list.

Certain 100% Likely to occur frequently, many

times during the period of the

project.

Frequent 6

Cost/time impact is certain.

Serious losses.

On priority one review list.

Almost

Certain

95% to

99%

Several times in the period of the

project.

Probable 5

Cost/time impact is fairly

possible. Range of largest

previous losses.

On priority one review list.

Likely 55% to

95%

Some time in the period of the

project.

Occasional 4

Cost/time has little less than an

equal chance of occurring.

Manageable losses.

Risk may be shared.

As Likely

as Not

45% to

55%

Unlikely but possible in the period

of concern (eg once in ten times in

the life of the project).

Remote 3

Cost/time impact is remotely

possible.

Medium losses within the margin

of insurance deducible (or

excess).

Risk may be transferred to

contractor.

Unlikely 5% to 45% So unlikely that it can be assumed

that it will not occur or it cannot

occur.

Improbable 2

Cost/time impact is not possible.

Nuisance, current expense

impact only.

Financial/time impact not to be

considered.

Nil

Chance

0% to 5% The event is unlikely to occur, but

may be theoretically possible. It

can be assumed that it will occur

very exceptionally, but not less

than once every 100 years.

Incredible 1

Commercial Probability Safety Definition Descrip.

Level

SWIFT Analysis Page 2 of 4

Impact

Sever financial

implications/ major

system loss/ loss

of major

possession.

HIGH Total

Collapse

of

Structure

/ System

>1 Multi Fatality and/or

major injuries.

Catastrophic 4

Possibility of

exceeding

contingency.

MEDI

UM

Major

Damage/

Repair to

Structure

/ System

1 Occupational

threatening injury or

illness, substantial

damages.

Critical 3

Can be

accommodated as

part of

contingency, may

require an

insurance claim.

LOW Minor

Damage/

Repair to

Structure

/ System

0.01 Serious minor injury

(requiring more that

3 days off work) or

several minor

injuries resulting in

up to 3 days off

work.

Marginal 2

So minor as to be

regarded as

without

consequence.

NIL Superfici

al

Damage

0.001 So minor as to be

regarded as without

consequence.

Minor 1

Commercial Impact

Severity

on

System

Equivalent

Fatalities

Severity Descrip.

Lev.

SWIFT Analysis Page 3 of 4

1.Risk Ranking

1: Negligible Negligible Negligible Negligible 1 Incredible

Negligible Negligible Tolerable Tolerable 2 Improbable

Negligible Tolerable Tolerable Intolerable 3 Remote

Negligible Tolerable Intolerable Intolerable 4 Occasional

Tolerable Tolerable Intolerable Intolerable 5 Probable

Tolerable Intolerable Intolerable 24: Intolerable 6 Frequent

Probability

1 Low 2 Medium 3 High 4 Very High

Consequence

The aim is to ideally reduce the

RISK to as low a level (number)

as possible. The Control measure

may affect both the Consequence

and Probability.

SWIFT Analysis Page 4 of 4

The risk ranking number obtained represents the following:

Events with risks that are considered as negligible in nature. Whilst

these risks may be considered as low, they should be continuously

monitored and re-evaluated.

4 and

below

LOW

Events with a level of risk that are considered to be of a tolerable

nature and can be managed by introducing risk mitigation measures.

12 to 6

MEDIUM

Events with risks that would have an intolerable effect on the ability to

achieve the project objectives. It is certain that risk mitigation

measures will be required.

24 to 12

HIGH

If risks are at intolerable levels, then action has to be taken to reduce them to

tolerable levels.

Risk Matrix

RED High level risk scoring over 12 on SWIFT Analysis and potential show stopper

AMBER Medium level risk scoring 5-10 on SWIFT Analysis and at higher scores potential serious risk

GREEN Low level risk scoring 0-4 on SWIFT Analysis and must be closely monitoring on a monthly

basis

Step 4 Quantitative Risk Analysis

Thumb rule

Level of contingency by rule of

thumb

Risk based estimating to

develop contingencies for cost

and time

Step 4 Quantitative Risk Analysis

Aims to quantify cost and

time/performance impacts of risks

Techniques such as three point

estimates and Monte Carlo simulation

to:

Quantify the risk exposure for the project,

and determine the size of cost and schedule

contingency reserves that may be needed

Identify risks requiring the most attention by

quantifying their relative contribution to

project risk

Identify realistic and achievable cost,

schedule or scope targets

Step 4 Quantitative Risk Analysis

Risk Management Plan

Risk Identification

Risk Assessment and Prioritisation

Quantitative Risk Analysis Inputs

Step 4 Quantitative Risk Analysis

Three Point Estimating - Used to determine the

minimum, most likely and maximum cost scenarios

should a certain risk materialise; used to determine

realistic outturn cost of that risk based on its

impact/probability rating and the minimum, most

likely, maximum estimate

Monte Carlo Simulation - A project simulation

uses a model that translates the uncertainties

specified at a detailed level into their potential

impact on project objectives. Project cost

simulations are typically performed using the Monte

Carlo technique

Quantitative Risk Analysis Procedure

Step 4 Quantitative Risk Analysis

Cost of Risk and Contingency Levels

Contingency Schedule based on the

current knowledge of the risks facing the

project

Base cost plus Cost of Risk = P50

Quantitative Risk Analysis Deliverables

Traditional vs Risk Estimating

RISK MANAGEMENT

APPROACH

44.30m

43.23m

40.61m

Cost Plan

Traditional Risk Based

Base Cost

Cost of risk

Base Cost

Cost plan

Contingency

+/- 10%

Contingency

P50

P90

Step 5 Risk Response Planning

Step 5 Risk Response Planning

Developing options and determining

actions to reduce threats to the projects

objectives

The identification and assignment of

individuals or parties to take responsibility

for agreed risk response

Step 5 Risk Response Planning

Risk Management Planning

Risk Identification

Risk Assessment and Prioritisation

List of Potential Responses

In the risk identification process, actions may be

identified that respond to individual risks or

categories of risk

Common Risk Causes

This situation may reveal opportunities to

mitigate two or more project risks by

consolidating the risks under one heading and

responding with one generic mitigation plan

Risk Response Planning Inputs

Step 5 Risk Response Planning

Risk Champions - Risk Champions or Risk

Owners must be appointed who will take

responsibility for managing the high priority risks

Risk Mitigation Planning

Mitigation plans should be completed for the high

level priority risks by Risk Champion/Owners

Mitigation seeks to reduce the probability and/or

consequence of an adverse risk event to an

acceptable threshold

Risk mitigation may take the form of implementing a

new course of action that will reduce the problem, or

changing conditions so that the probability of the risk

occurring is reduced

Where it is not possible to reduce probability, a

mitigation response might address the risk impact by

targeting linkages that determine the severity

Risk Response Planning Procedure

Step 5 Risk Response Planning

Risk Mitigation Plan - The risk mitigation

plan should be written to the level of detail

at which the actions will be taken. It should

include some or all of the following:

Identified risks, their descriptions and impacts

Risk Champions/Owners

Specific actions to be taken to prevent the risk

arising or to respond to a risk that does arise

Risk strategy (method selected to deal with the

risk) Hold, Evade, Lower, Pass, Share

(HELPS)

Results from risk prioritisation

Cost of risk should it materialise

Risk Response Planning Deliverables

Risk Matrix

Step 6 Risk Tracking and Control

Step 6 Risk Tracking and Control

Risk tracking and control Continuous

Risk management

Purpose of risk tracking:

Risk plans have been implemented as planned

Risk actions are as effective as expected, or if

new responses should be developed

Project assumptions are still valid

Risk exposure has changed from its prior state,

with analysis of trends

Proper policies and procedures are followed

Risks have occurred or arisen that were not

previously identified

Step 6 Risk Tracking and Control

Risk Management Plan

Risk Identification

Project Communication - Reports, risk

matrixes, tracking tools, problem indicators

etc used in the monitoring of risks should

be included

Scope Changes - Scope changes often

require new risk analysis and response

plans

Risk Tracking and Control Inputs

Step 6 Risk Tracking and Control

Periodic Project Risk Reviews

Project Risk Reviews should be

regularly scheduled throughout the life

of the project

Risk rankings and prioritisation may

change for identified risks during the life

of the project

New risks may arise that had not been

anticipated at previous stages in the

project

Changes may require additional

qualitative or quantitative analysis

Risk Tracking and Control Procedure

Step 6 Risk Tracking and Control

Risk Review Report

Continuous updating of

Risk Register

Risk Mitigation Plan

Risk Database

Developing project risk profiles

Lessons Learnt

Risk Tracking and Control Deliverables

Conclusion

Vous aimerez peut-être aussi

- ISO and IAF Docs 9001 and 14001 2015Document1 pageISO and IAF Docs 9001 and 14001 2015ianvlynchPas encore d'évaluation

- ISO and IAF Docs 9001 and 14001 2015Document1 pageISO and IAF Docs 9001 and 14001 2015ianvlynchPas encore d'évaluation

- HSA Annual Report 2014Document100 pagesHSA Annual Report 2014ianvlynchPas encore d'évaluation

- HSA Statistics Report 2013-2014Document44 pagesHSA Statistics Report 2013-2014ianvlynchPas encore d'évaluation

- Risk Management Register SampleDocument3 pagesRisk Management Register SampleFabiano DamascenoPas encore d'évaluation

- Construction Sample Quality PlanDocument85 pagesConstruction Sample Quality PlanianvlynchPas encore d'évaluation

- 1 2 Quality ObjectivesDocument1 page1 2 Quality ObjectivesianvlynchPas encore d'évaluation

- 3.2.1 Training Sign OffDocument1 page3.2.1 Training Sign OffianvlynchPas encore d'évaluation

- AF2 RaheenDocument2 pagesAF2 RaheenianvlynchPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5783)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- 2 PBDocument17 pages2 PBNasrullah hidayahPas encore d'évaluation

- Availability Dependencies EN XXDocument213 pagesAvailability Dependencies EN XXraobporaveenPas encore d'évaluation

- Bus. Org. OutlineDocument73 pagesBus. Org. OutlineJAY DEEPas encore d'évaluation

- Project Report: Comprative Study of Buying Prefrences of Wills & Gold FlakeDocument67 pagesProject Report: Comprative Study of Buying Prefrences of Wills & Gold FlakeAroraphotosta and commPas encore d'évaluation

- Lawrkhawm: Kum 2014 Branch Kumtir Com-Mittee Neih A NiDocument4 pagesLawrkhawm: Kum 2014 Branch Kumtir Com-Mittee Neih A NibawihpuiapaPas encore d'évaluation

- Lembar Jawaban Siswa - Corona-2020Document23 pagesLembar Jawaban Siswa - Corona-2020Kurnia RusandiPas encore d'évaluation

- The Girl of Fire and Thorns Discussion GuideDocument1 pageThe Girl of Fire and Thorns Discussion GuidePitchDark100% (1)

- CASES IN LOCAL and REAL PROPERTY TAXATIONDocument3 pagesCASES IN LOCAL and REAL PROPERTY TAXATIONTreblif AdarojemPas encore d'évaluation

- Q1. What Do You Understand by Construction Management? Discuss The Historical Evolution of Construction Management?Document5 pagesQ1. What Do You Understand by Construction Management? Discuss The Historical Evolution of Construction Management?Vranda AgarwalPas encore d'évaluation

- Amadioha the Igbo Traditional God of ThunderDocument4 pagesAmadioha the Igbo Traditional God of ThunderJoshua Tobi100% (2)

- The Boy in PajamasDocument6 pagesThe Boy in PajamasKennedy NgPas encore d'évaluation

- EXIDEIND Stock AnalysisDocument9 pagesEXIDEIND Stock AnalysisAadith RamanPas encore d'évaluation

- Biswajit Ghosh Offer Letter63791Document3 pagesBiswajit Ghosh Offer Letter63791Dipa PaulPas encore d'évaluation

- Listof Licenced Security Agencies Tamil NaduDocument98 pagesListof Licenced Security Agencies Tamil NadudineshmarinePas encore d'évaluation

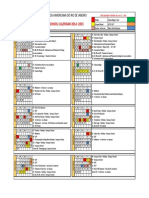

- CalendarDocument1 pageCalendarapi-277854872Pas encore d'évaluation

- Financial Reporting Standards SummaryDocument5 pagesFinancial Reporting Standards SummaryKsenia DroPas encore d'évaluation

- Lecture 4 The Seven Years' War, 1756-1763Document3 pagesLecture 4 The Seven Years' War, 1756-1763Aek FeghoulPas encore d'évaluation

- IBMRD Alumni Feedback FormDocument2 pagesIBMRD Alumni Feedback FormGanesh AntrePas encore d'évaluation

- Assignment World Group6 SectionBDocument3 pagesAssignment World Group6 SectionBWanderer InneverlandPas encore d'évaluation

- The Canterbury Tales Is A Collection of Stories Written in Middle English byDocument25 pagesThe Canterbury Tales Is A Collection of Stories Written in Middle English byyoonglespianoPas encore d'évaluation

- Benno Przybylski Righteousness in Matthew and His World of Thought Society For New Testament Studies Monograph Series 1981Document198 pagesBenno Przybylski Righteousness in Matthew and His World of Thought Society For New Testament Studies Monograph Series 1981alenin1Pas encore d'évaluation

- 5 6271466930146640792Document1 225 pages5 6271466930146640792Supratik SarkarPas encore d'évaluation

- University of ST Andrews 2009 ArticleDocument156 pagesUniversity of ST Andrews 2009 ArticleAlexandra SelejanPas encore d'évaluation

- Peta in Business MathDocument2 pagesPeta in Business MathAshLeo FloridaPas encore d'évaluation

- DPTC CMF C P16995 Client 31052023 MonDocument8 pagesDPTC CMF C P16995 Client 31052023 Monsiddhant jainPas encore d'évaluation

- Spider Man: No Way Home First Official Poster Is Out NowDocument3 pagesSpider Man: No Way Home First Official Poster Is Out NowzlatanblogPas encore d'évaluation

- From Bela Bartok's Folk Music Research in TurkeyDocument3 pagesFrom Bela Bartok's Folk Music Research in TurkeyssiiuullLLPas encore d'évaluation

- Location - : Manhattan, NyDocument15 pagesLocation - : Manhattan, NyMageshwarPas encore d'évaluation

- 2014 10 A Few Good Men Playbill PDFDocument8 pages2014 10 A Few Good Men Playbill PDFhasrat natrajPas encore d'évaluation

- Resume With Leadership New 2Document2 pagesResume With Leadership New 2api-356808363Pas encore d'évaluation