Académique Documents

Professionnel Documents

Culture Documents

Val Project 6

Transféré par

Oladipupo Mayowa PaulCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Val Project 6

Transféré par

Oladipupo Mayowa PaulDroits d'auteur :

Formats disponibles

IMMINENT INVESTORS

DIANNE DE LUISE

TAKASHI HANZAWA

SMIT SHARMA

PETER GENIS

J ULIA KIM

Company Price DCF Valuation Relative Valuation Option Recommendation

Model Used Value Multiple Used Value Valuation

Trump Entertainment Resorts 14.77 $ FCFF3 21.43 $ EV/EBITDA 23.25 $ Buy

Morgan Stanley 52.62 $ DDM 64.00 $ PBV 56.60 $ Buy

Wynn Resorts LTD. 52.94 $ FCFFSt 50.30 $ Forward PE 29.48 $ 57.69 $ Sell

NEC Electronics Corp. 4,740.00 $ FCFF2 7,761.00 $ PE 5,109.00 $ Buy

General Motors Corp. 26.68 $ FCFFSt 17.88 $ PBV 17.19 $ Sell

2

Trump Entertainment Resorts BUY

(DELISTED: Formally Trump Hotel and Casino Resorts Pre-Bankruptcy)

Potential High Growth

Company Overview

Trump Hotel Casino Resorts filed Chapter 11 in November of 2004. According to public bankruptcy and

restructuri ng plan documentation, upon restructuring the company will reemerge as Trump Entertainment Resorts.

The company owns and manages four casino hotel properties: Trump Taj Mahal (Atlantic City), Trump Marina

(Atlantic City), Trump Plaza (Atlantic City) and Trump Indiana (Gary, Indiana).

- Taj Mahal: Destination resort located on the northern end of ACs boardwalk. Features 1,250 hotel rooms,

including 242 suites, 19 dining and 12 beverage locations, parking for approximately 6,950 cars, 140,000

square feet of meeting space, and 159,086 square feet of gaming space housing approximately 4,419 slot

machines, 129 tables, and 78 poker tables

- Plaza: Located at the center of ACs boardwalk, the Plaza features 904 hotel rooms, including 140 suites,

36,000 square feet of conference space and 91,366 square feet of casino space housing 2,842 slot machines

and 91 table games

- Marina: Located in the Marina district, the Marina features 728 guest rooms, including 153 suites, 97 of which

are luxury suites, 79,700 square feet of gaming space housing 2,545 slot machines, 76 table games, a

simulcast racetrack facility and approximately 58,000 square feet of convention, ballroom and meeting space

- Indiana: Located 25 miles from Chicago, Trump Indiana is located on a 280 foot gaming vessel with

approximately 43,000 square feet of gaming space housing 1,632 slot machines, 30 table games, 30 poker

tables and capacity to accommodate approximately 2,700 passengers. Shares a docking facility and 40,000

square foot land-based pavilion, which it shares with its joint venture partner, Majestic Star Casino.

Valuation

DCFF Rationale: We used the three-stage FCFF discount model given the firms high degree of leverage (6.5x

Debt/EBITDA upon emergence from bankruptcy). FCFF, unlike FCFE, more appropriately adjusts for the volatility

brought on by significant debt repayment and the sensitivity of the value of equity (small % of overall firm

capitalization) to assumptions about growth and risk.

3 Stage Rationale: We selected a three-stage model because the firm, despite modest growth in the first few

years, has the potential for significant growth as a result of the construction of a new hotel tower at its Taj Majal

casino in Atlantic City. We expect the company to return to more normalized growth levels upon achieving the full

benefit from these room additions (expected within 24 months of opening).

Recommendation: BUY

Fair Value: $21.43 (45% upside from expected emergence value of $14.7)

The assumptions used to build the DCF model are as follows:

Phase Stable High Stable Terminal Notes:

Period 2005-2007 2007-2009 2009-2014 Perpetuity

Risk Free Rate 4.20% 4.20% 4.20% 4.20% Based on 10 year treasury

Bottom-up Beta Calculator:

Unlevered beta for sector = 0.95 0.95 0.95 0.95 Based on industry average (see comps)

Firm's Current mkt D/E ratio = 70.90% 76.03% 57.10% 46.27% Based on model

Firm's Current tax rate = 42.00% 42.00% 42.00% 42.00% As disclosed in company filings

Bottom-up beta for firm = 1.34 1.37 1.26 1.20 Calculation

Expected Return on the Market 10.00% 10.00% 10.00% 10.00% Expected return - Chase Gaming Index

Cost of Equity (CAPM) 11.98% 12.14% 11.54% 11.19% CAPM Calculation

Debt 1418.2 1686.4 1471.4 1082.1 Model

Equity 582 582 582 582 Model

Debt/(Debt+Equity) 70.90% 74.34% 71.66% 65.03% Based on model

Pre Tax Cost of Debt 8.23% 7.65% 7.15% 6.65% Model

Tax Rate 42.00% 42.00% 42.00% 42.00% As disclosed in plan

After Tax Cost of Debt 4.78% 4.44% 4.15% 3.86% Calculation

WACC 6.87% 6.41% 6.24% 6.42% Calculation

3

Based on these inputs our valuation is as follows:

Valuation Composition Pre-Reorg

Reorg Plan

Value

Post Reorg

Fair Value

(based on

DCFF)

Present Value of FCFF in Stage 1 - stable

growth phase ($193.91)

Present Value of FCFF in Stage 2 - High growth

phase $160.91

Present Value of FCFF in Stage 3 - stable

growth phase $390.50

Present Value of Terminal Value of Firm = $1,862.26

Value of the firm = $1,900.00 $2,047.00 $2,219.76

+ Cash and Marketable Securities = $30.00 $90.00 $90.00

Market Value of Debt = $1,850.00 $1,465.00 $1,465.50

Implied Value of Equity = $80.00 $582.00 $844.26

Shares Outstanding 29.90 39.40 39.40

Value of Equity per Share = $2.68 $14.77 $21.43

% Variance Versus Plan 45.1%

Relative Valuation

We used 15 companies to perform the relative valuation analysis. This data was collected from companies that

operate in both local and destination gaming markets in the US. Our selections were based on those companies

that were most alike (based on size, asset quality, diversification and leverage) to Trump Entertainment Resorts

upon emergence from bankruptcy (see Appendix Exhibit A for more detail).

The EV/EBITDA multiple here is 9.6x resulting in a stock price of $23.25.

Trump Entertainment

See Public Comps Worksheet EV/2005E EBITDA EV/Revenue P/E

Implied Multiple 9.6x 2.5x 21.6x

Current Price (Post Reorganization) $14.77 $14.77 $14.77

Implied Enterprise Value $2,291.43 $2,924.43 $1,731.46

Total Debt $1,465.50 $1,465.50 $1,465.50

Cash $90.00 $90.00 $90.00

Net Debt $1,375.50 $1,375.50 $1,375.50

Implied Equity Value $915.93 $1,548.93 $355.96

Shares Outstanding 39.40 39.40 39.40

Implied Price Based on Industry $23.25 $39.31 $9.03

% (Over)/Under Valued 57.4% 166.1% -38.8%

Peer Group Averages

4

Regressions were completed with the EV/EBITDA, the EV/Revenue and the PE multiples. The EV/EBITDA

produced the highest R-squared.(See Exhibit Below)

Return on Capital Vs. EBITDA Multiple

y = 0.0083x + 0.0375

R

2

= 0.6332

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

30.0%

35.0%

0.00 5.00 10.00 15.00 20.00 25.00

EV/EBITDA

R

O

C

Regression Analysis

For our regression analysis, we selected a broader sample of 29 companies from the Gaming and Lodging sector

to more accurately compare against the industry.

The Regression equation is: EV/EBITDA Multiple (EV/EBITDA versus ROC) = .938 (Intercept) + 75.89 (ROC)

The Regression Summary is:

Regression Statistics

Multiple R 0.795723932

R Square 0.633176576

Adjusted R Square 0.619590523

Standard Error 2.912647626

Observations 29

Coefficients Standard Error t Stat

Intercept 0.938764372 1.476984032 0.635595478

ROC 75.89134478 11.11671513 6.826777864

EV/EBITDA= 7.97x

Based on our analysis, TERs predicted EV/EBITDA multiple is 7.97x forward EBITDA, resulting in an

implied equity value per share of $15.40.

EV/EBITDA= 7.97x

EBITDA $248.77

Valuation Multiple 7.97x

Enterprise Value $1,982.27

Net Debt $1,375.50

Equity Value $606.77

S/O 39.40

Implied Price Per Share $15.40

Current Price $14.77

% Over/(Under) Valued 4.26%

ROC Line Fit Plot

0.00

5.00

10.00

15.00

20.00

25.00

30.00

0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0%

ROC

E

V

/

E

B

I

T

D

A

Market Valuation

The Market regression equation is:

Enterprise Value /EBITDA= 8.554 + 1.016 g(rev) - .150 (Tax rate) -.0664 (Debt/Capital) -0.0188 Reinvestment Rate

(R

2

=38.0 %)

Based on this equation TERs EV/EBITDA multiple is 8.5x, resulting in a stock price of $15.30.

5

Final Analysis

The Current Post Reorganization stock price is set for $14.77. By this measure, the Market, Industry and Select

comps all indicate TER is undervalued.

Trump Entertainment

See Public Comps Worksheet EV/2005E EBITDA EV/Revenue P/E DCFF Price TEV Regression Averages

Implied Multiple 9.6x 2.5x 21.6x 9.28x 7.97x 9.32x

Current Price (Post Reorg) $14.77 $14.77 $14.77 $14.77 $14.77 $14.77

Implied Enterprise Value $2,291.43 $2,924.43 $1,731.46 $2,219.76 $1,982.27 2229.9x

Total Debt $1,465.50 $1,465.50 $1,465.50 $1,465.50 $1,465.50 1465.5x

Cash $90.00 $90.00 $90.00 $90.00 $90.00 90.0x

Net Debt $1,375.50 $1,375.50 $1,375.50 $1,375.50 $1,375.50 1375.5x

Implied Equity Value $915.93 $1,548.93 $355.96 $844.26 $606.77 854.4x

Shares Outstanding 39.40 39.40 39.40 39.40 39.40 39.4x

Implied Share Price $23.25 $39.31 $9.03 $21.43 $15.40 $21.68

% (Over)/Under Valued 57.4% 166.1% -38.8% 45.1% 4.3% 46.8%

Peer Group Averages Valuation Output

I recommend to BUY Trump Entertainment Resorts

6

NEC Electronics Corporation (TSE: 6723)

Foreign Company

NEC Electronics Corporation (TSE: 6723) specializes in semiconductor products encompassing advanced

technology solutions for the high-end computing and broadband networking markets, system solutions for the

mobile handsets, PC peripherals, automotive and digital consumer markets, and platform solutions for a wide range

of customer applications. NEC Electronics Corporation is a subsidiary of NEC Corporation (NEC holds 70.04% of

NEC Electronics Corporations voting stocks). However, as an enterprise primarily engaged in system LSIs and

other semiconductor businesses, the company is responsible for its own management and conducts its business

operations independently.

DCF Valuation

Model used: FCFF 2 stage

Strategic Background

NEC Electronics Corporation is one of the largest semiconductor firms in Japan. Most semiconductor businesses in

Japan have grown only as one division of general electronic companies, such as NEC, Hitachi, Toshiba, Fujitsu

and Mitsubishi. Such semiconductor divisions were expected to provide key components for the parents main

businesses, such as PC, Server, and Digital Consumer Products. NEC determined to carve-out its semiconductor

business so that the new company could capture lucrative businesses in broadband networking markets as well as

above mentioned markets not only from its parent, but also from their competitors.

Why 2 stage?

While semiconductor business is not new, its markets are still expanding. For instance, PC, Server, Digital

Consumer (DVD set top box, Digital TV, and HDD recorder), Mobile phone, Game consoles, broadband networking

devices are all promising markets. NEC Electronics Corporation focuses on System LSI which serves for those

applications. Whereas DRAM is already a commodity product, System LSI, including CPU, is customized and

highly sophisticated products. Developing and manufacturing such semiconductors need extremely heavy

investment, cutting edge technologies and experienced engineers. NEC Electronics Corporation is in a leading

position in this world. We expect that the growth trend will continue over the next 5 years.

Why FCFF?

Since NEC Electronics Corporation is a younger firm, the capital structure is fluctuating and debt ratio is not stable.

FCFF valuation is better for the firm.

Assumptions used to build DCF model are

Input High Growth Stable Growth

Length of growth period 5 Forever

Growth rate 15.37% 1.49%

Debt ratio 24.59% 24.59%

Beta 3.14 2.00

Riskfree rate 1.24% 1.24%

Risk Premium 1.21% 1.21%

Cost of Debt 2.24% 2.24%

Tax Rate 40.57% 40.57%

Return on Capital 4.00% 3.08%

Reinvestment Rate 384.14% 48.32%

Cost of Equity 5.03% 3.66%

Cost of Capital 4.12% 3.08%

Based on these inputs the valuation was as follows: (Unit: 100M Japanese Yen)

Firm Value 11,512

Market Value of Debt 1,913

Market Value of Equity 9,599

Value of Equity Option 14

Value of Equity in Common Stock 9,585

Market Value of Equity/share 7,761 Yen

Present market value = 4,740 Yen (as of 04/28/2005)

7

Relative Valuation

21 companies were used as comparables. Mainly US based semiconductor firms with Market Capitalization

greater than $1.5 bn were used.

Regression was completed with PE ratio. The regression with PE produced high R-squared and is reproduced

below.

The regression equation is

Current PE = 144 - 36.5 Payout Ratio - 58.9 Value Line Beta

Predictor Coef SE Coef T P

Constant 143.97 18.01 7.99 0.000

Payout Ratio -36.53 26.07 -1.40 0.178

Value Line Beta -58.90 10.99 -5.36 0.000

S = 20.1434 R-Sq = 62.7% R-Sq(adj) = 58.5%

As the Value Line Beta for NEC is not available, I used average Value Line Beta of semiconductor firms with similar

revenues, which is 1.70. I also applied bottom-up beta used in my DCF valuation, which is 3.14. Payout ratio as of

April 28, 2005 is 0.125. EPS is JY 130. Based on this regression, NECs predicted PE is as follows:

(Value Line Beta 1.70) : PE=39.3, resulting in a Price/share of JY 5109.

(Bottom-up Beta 3.14) : PE=-45.5, making no sense.

(Actual PE): 36.5 (EPS=JY 130, Per share price= JY 4740)

Market Valuation:

The market regression equation is

PE = -8.110+0.528 Payout+14.605 Beta + 0.799 g (R^2 = 32.5)

Based on this equation the predicted PE=50.09 (w/ Bottom-up Beta), 29.07 (w/ Value Line Beta)

This does not match very well with the comparable firm regression. The market regression will produce higher PE

with Bottom-up Beta, and lower PE with Value Line Beta. This result is the opposite of the relative valuation above.

Value of Control:

One common reason why a firms stock price might be mismatched with its value is poor management. Poor

management can lead to severe value loss. It is possible to estimate the value of control in a firm by calculating the

firm value under current management and comparing it to the firm value if it were optimally managed. NEC is the

case of a firm that could benefit from a value-enhancing strategy. The firm value would increase substantially if it

increases its operative efficiency. But taking more debt would not change its value. The following table summarizes

the DCF valuation of NEC in its current state.

Year FCFF Terminal Value PV

1 -873 -839

2 -1007 -929

3 -866 -769

4 -353 -303

5 224 186

14272 11873

Total 9220

Cash and securities 2291

Firm Value 11512

If NEC were to raise its debt ratio from 25% to 30%, its beta would increase and its cost of capital would also

increase rather than decrease. We find that the current debt ratio is almost optimal number and there is no merit of

changing debt ratio. The impact of increasing the debt ratio on various valuation variables is highlighted below.

8

Variable Old New

Beta 3.14 3.41

Cost of Equity 5.03 5.36

Cost of Debt 2.24 2.24

WACC 4.12 4.15

If we could increase ROC from 4% to 5%, we would get the following value of control. Actually, the current ROC is

lower than the cost of capital. It is highly possible to improve ROC.

Year FCFF Terminal Value(PV) PV

1 -902 -867

2 -1076 -992

3 -950 -843

4 -393 -337

5 249 207

15879 13210

Total 10379

Cash and securities 2291

Firm Value w/control change 12670

Firm Value Status Quo 11512

Value of Control 1158

(unit: 100M Japanese Yen)

Thus, either incumbent or new management would be able to increase the value of NEC by 1158 by improving

ROC.

Final Analysis:

Current price (04/28/05) JY 4,740

DCF 2stage FCFF JY 7,761

RV - PE JY 5,109 (w/ averaged Value Line Beta)

actual PE 36.5

Comparable regression - predicted PE 39.3 (w/ averaged Value Line Beta)

Market regression - predicted PE 50.09 (w/ Bottom-up Beta), 29.07 (w/ Value Line Beta)

I would place more weight on the DCF valuation than the relative valuation and market regression since relative

valuation and market regression produced contradicting numbers. Thus, I think the DCF valuation is most

representative of NECs current value.

I recommend to BUY NEC.

9

Morgan Stanley (MWD)

Service Company

Morgan Stanley is a global financial services firm that, through its subsidiaries and affiliates, provides its products

and services to a large and diversified group of clients and customers, including corporations, governments,

financial institutions and individuals. It operates its business trough four segments: Institutional Securities business

segment includes Investment Banking, Sales, Trading, Financing and market-making activities and other activities;

Individual investor group business segment includes comprehensive brokerage, investment and financial services

designed to accommodate individual investment goals and risk profiles; Investment management business

segment includes global asset management products and services for individual and Institutional Investors, and

Credit services business segment includes discover financial services (DFS), discover network, PULSE EFT

Association, Inc. (PULSE) and Consumer Banking Group International. (finance.yahoo.com)

DCF Valuation

Model used: DDM 2 stage

Strategic Background

Morgan Stanley is one of the foremost investment bank and has been earning a a high ROE (~20%) for the past

few years since its merger with Dean Witter brokerage. It is likley to continue earning excess returns in near future

as it exhausts the full gain of the merger synergy. But at the same time it faces tough competition from existing

institutions, both from niche players in each of its businesses and also from the traditional full service firms like

Goldman Sachs, Merrill Lynch, JP Morgan-Chase, Lehman Brothers, Citigroup and others.

Why 2 stage?

The structure of securities industry is changing, with "consolidation" being the keyword. Big behemoths like

Citigroup and JP Morgan-Chase,that combine the muscle of banking deposits to get investment banking business

are cutting into the lucrative aspects of Morgan Stanley's (MWD) business and this is likely to slow down MWD's

growth after 5 years to a stable growth model.

Why DDM?

MWD, has consistently given out dividends in the past and is likely to continue with regular increasing dividends in

the future. Further, the corporate governance is generally quite good at MWD and in addition the regulators (SEC

etc.) keep a close eye on the capital requierements and other ratios.

Beta Calculation

For financial firms we do not unlever and relever the beta since D/E does not have the same meaning as non-

financial firms. Moreover, financial firms are much more homogeneous with respect to capital structure.

Assumptions used to build DCF model are

Input High Growth Stable Growth

Length of growth period 5 Forever

Growth rate 12.06% 4%

Beta 0.943 1

Riskfree rate 4.5 4.5

Risk Premium 4.84 4.84

Tax Rate 35% 35%

Return on Equity 18.04% 10%

Cost of equity 9.06% 9.34%

Payout Ratio 24.35% 60%

Based on these inputs the valuation was as follows

Value/share = $64

Present market value = $52.62 (as of 04/29/2005)

Relative Valuation

16 companies were used as comparables. Mainly US based financial firms with Market Capitalization greater than

$1 bn were used.

10

Regression was completed with both PE and PBV ratios. The regression with PBV produced the highest R-

squared and is reproduced below. Moreover, PBV relative valuation made sense for MWD, since for financial firms

the emphasis is on ROE and the BV of equity is a scarce resource since capital requirements are based on it due

to banking regulations. This requires BV to be marked to market as closely as possible and hence BV of equity has

more meaning for financial firms. Also, since I only had a limited set of comparables it made sense to include only

1 independent variable.

Regression equation is

PBV = 0.8 + 0.08 * ROE

Coefficients

Standard

Error t Stat P-value

Intercept 0.807 0.399 2.023 0.064

ROE 0.080 0.025 3.126 0.008

R Square 0.429

Adjusted R Square 0.385

Return on Common Equity Line Fit Plot

0.00

0.50

1.00

1.50

2.00

2.50

3.00

3.50

4.00

0 5 10 15 20 25

Return on Common Equity

P

r

i

c

e

t

o

B

o

o

k

R

a

t

i

o

Price to Book Ratio Predicted Price to Book Ratio

Based on this regression, MWDs predicted PBV = 2.16, while the actual observed PBV = 1.95; indicating that

MWD, appears undervalued wrt comparable firms by 10% relative to the way market is pricing the financial sector.

BV per share was $25.83, resulting in a Price/share of $56.62.

A simple matrix plot of the ROE and PBV of the comparable firms shows that MWD is marginally positioned in the

undervalued box due to its high ROE.

11

PBV - ROE Matrix

0

0.5

1

1.5

2

2.5

3

3.5

4

0 5 10 15 20 25

ROE

P

B

V

Undervalued

High ROE

Low MV/BV

Overvalued

Low ROE

High MV/BV

High ROE

High MV/BV

MWD

Market Valuation:

The market regression equation is

PBV = 0.202 ROE - 0.297 Beta + 0.0984 g - 0.0135 Payout (R^2 = 51.55)

Based on this equation the predicted PBV = 3.9.

This does not match very well with the comparable firm regression; nonetheless it confirms that MWD is

undervalued with respect to the broader market.

Final Analysis:

All the 3 valuations, DCF, Relative to comparable firms and Market regression show that MWD is undervalued.

Current price (04/29/05) $52.62

DCF 2stage DDM $64

RV - PBV $56.6

actual PBV 1.9

Comparable regression - predicted PBV 2.2

Market regression - predicted PBV 3.9

I recommend to BUY MWD.

12

General Motors (GM)

Auto & Truck Manufacturers / Consumer Cyclical

General Motors Corporation (GM) has two core businesses: Automotive and Other Operations (Auto and Other),

and Financing and Insurance Operations (FIO). GM's Auto and Other segment consists of GM's four automotive

regions: GM North America, GM Europe, GM Latin America/Africa/Mid-East, and GM Asia Pacific, which constitute

GM Automotive, and Other, which primarily includes the design, manufacturing and marketing of locomotives. GM

offers vehicles under the following nameplates: Chevrolet, Pontiac, GMC, Oldsmobile, Buick, Cadillac, Saturn,

HUMMER, Opel, Vauxhall, Holden and Saab. GM's FIO operating segment primarily relat es to General Motors

Acceptance Corporation (GMAC). GMAC provides a range of financial services, including consumer vehicle

financing, automotive dealership and other commercial financing, residential and commercial mortgage services,

automobile service contracts, personal automobile insurance coverage and selected commercial insurance

coverage.

DCF Valuation

Model used: FCFF Stable Growth Model

General Motors is a largest car manufacturer operating in market with a lot of over capacity. High growth is not

possible in this environment. We assume that GM will grow at rate that is a little lower then average of economy

(3%). Because stable growth model FCFF is used, using current reinvestment from 10K is not valid (it is very high

high). Instead, implied long term reinvestment is used (g/ROC*EBIT(1-t)). For GM, market value of debt is

significantly larger then market value of equity. As a result, levered beta of GM is very high (2.79).

Assumptions used to build DCF model are

Input High Growth Stable Growth

Length of growth period 0 Forever

Growth rate - 3.00%

Beta - 2.79

Riskfree rate - 4.59%

Risk Premium - 4.00%

Tax Rate - 35%

Cost of debt - 6.02%

Cost of capital - 5.35%

Reinvestment Rate - 75.73%

Debt Ratio - 87.84%

Based on these inputs the valuation was as follows

Value/share = $17.88

Present market value = $26.68 (as of 04/29/2005)

Relative Valuation

There are very few companies in Auto & Truck industry. I used Auto & Truck and Auto Parts industry together to

run the regression. Both of these industries are part of Consumer Cyclical sector, so regression was also ran

against broader list of consumer cyclical companies. While, PE ratio, seems to be most appropriate ratio to used, a

lot changed in GM financials since they released 10K report in March, 2005. Since then NI stopped being positive

and predicted not to be positive for a while. As a result stock lost about 40% of value and using 10K earnings gives

very low value of PE. I decided to use PBV ratio instead due to relatively stable book value of equity. Using Auto &

Trucks and Auto Parts, I had sample of 30 companies.

Following is a regression equation:

PBV=9.63*ROE+0.05*beta+13.35*g-2.68*payout_ratio

In this equation, beta is a regression beta, g is a growth in equity earnings and percentages are in the normal

percentage form (10% is 0.1 in equation)

R square of this regression is 78.6%

t-statistics is as following:

ROE -> 3.85, beta -> 0.14, g -> 5.54, payout ratio -> -4.18

Based on the regression and current values, PBV=0.35, while actual observer PBV=0.54. Based on this value,

value per share is $17.19

13

Market Valuation:

The market regression equation is

PBV = 0.202 ROE - 0.297 Beta + 0.0984 g - 0.0135 Payout (R^2 = 51.55)

Based on this equation the predicted PBV = 1.465.

This is much higher then observed PBV and would imply price of stock of $71.95. Interesting observation is, if I get

rid of pensions and other postretirement liabilities, price of the stock would be in that range (about $64). GM is

relatively unique in the market considering how high the pension and other postretirement obligations are. Most of

the companies either do not have any obligations at all (using defined contributions vs. defined benefits), or have

very little obligations. GM is a old company and has a legacy of obligations. In fact, GM is a biggest private medical

and pension provider in the United States. Why did regression on auto companies worked more closer with

expectations? All auto manufacturers have relatively high pensions and other post retirement obligations (both

American and Japanese). So, I will not consider $71.95 as a possible value, and will actually make an assumption,

that regression on market as a whole will show companies like GM as undervalued (due to not taking in

consideration pensions and other postretirement benefits)

Final Analysis:

Both DCF and relative (by industry) valuations show that GM is currently overvalued. I recommend to sell it. GM

has a lot of problems in the future. Not only Auto market is in over capacity, GM has disadvantage to other

companies in the sector due to higher legacy cost to former employees.

I recommend to SELL General Motors.

14

Wynn Resorts, Limited (WYNN)

Negative Earnings

Company Overview

Wynn Resorts, Limited recently opened Wynn Las Vegas, a concept of Stephen A. Wynn, which is considered the

preeminent luxury hotel casino in Las Vegas. The $2.7 billion Wynn Las Vegas opened on April 28

th

, 2005. Most

recently, Mr. Wynn was Chairman of the Board, President and CEO of Mirage Resorts, Incorporated and its

predecessor from 1973 to 2000. In that role, he was responsible for the development of Bellagio, The Mirage,

Treasure Island at The Mirage and the Golden Nugget in Las Vegas, Nevada as well as the Atlantic City Golden

Nugget in New Jersey and Beau Rivage in Biloxi, Mississippi. Wynn Resorts Ltd. plans to expand by opening

another resort, Encore, next to Wynn Las Vegas, which is slated to open in 2008.

DCF Valuation

The n-stage FCFF discount model was used since the firm is small in size, growing at a high rate, and the industry

has significant barriers to entry. Because their first resort did not open until recently, their earnings were negative,

and due to the lack of historical data, we used comparables as benchmark. Target growth rates were estimated for

a 10-year high growth phase using average analyst estimates. The key drivers for this company are the length of

the growth period, high and stable growth rate and reinvestment rate.

The assumptions used to build the DCF model are:

Input High Growth Stable Growth

Length of growth period 10 Forever

Growth Rate Declining from 68% to 7% 4%

Beta 0.67 0.72

Riskfree Rate 4.2 4.2

Risk Premium 4.0 4.0

Tax Rate 0% 35%

Return on Capital -4.99% 17.53%

Cost of Equity 6.87% 7.08%

Cost of Capital 6.81% 6.67%

Reinvestment Rate 100% 50%

Debt Ratio 24% 24%

After Tax Cost of Debt 6.63% 5.33%

Based on these inputs, the valuation was as follows:

Debt Value $1,627.97

Equity Value $5,004.18

Firm Value $6,632.15

Value/Share $50.30

Current Market Price $52.94

Relative Valuation

20 companies were used as comparables. Since Wynn Resorts, Limited will derive the majority of its revenue from

the US, the comparables used were primarily US firms in the hotel/gaming sector. We note that because this

companys fi rst hotel/casino just opened recently, and due to its negative earnings, the only relevant and applicable

multiple was the Forward PE ratio.

15

Regression Analysis: Forward PE versus Expected Growth in EPS: next 5

The regression equation is

Forward PE = 7.13 + 107 Expected Growth in EPS: next 5

Predictor Coef SE Coef T P

Constant 7.135 2.514 2.84 0.011

Expected Growth in EPS: next 5 107.49 15.87 6.77 0.000

S = 3.10478 R-Sq = 73.0% R-Sq(adj) = 71.4%

Based on this regression, WYNNs predicted forward PE is 25.86 resulting in a predicted stock price of $29.48.

Expected Growth in EPS: next 5

F

o

r

w

a

r

d

P

E

0.25 0.20 0.15 0.10 0.05

35

30

25

20

15

Scatterplot of Forward PE vs Expected Growth in EPS: next 5

Market Valuation

The market regression equation is

Forward PE = 20.7 + 20.8 Expected Growth in EPS: next 5 - 0.209 Payout Ratio

- 15.6 Market Debt to Capital

Predictor Coef SE Coef T P

Constant 20.6965 0.6112 33.86 0.000

Expected Growth in EPS: next 5 20.765 2.586 8.03 0.000

Payout Ratio -0.2087 0.5641 -0.37 0.711

Market Debt to Capital -15.560 1.638 -9.50 0.000

S = 11.0096 R-Sq = 10.6% R-Sq(adj) = 10.5%

Based on this equation, the predicted forward PE was 20.62, resulting in a predicted stock price of $23.51. We

would place more weight on the DCF valuation than the market regression since there is some ambiguity

associated with choosing comparables across different sectors and because the R-sq is very low.

16

Option Pricing Model

Wynn Resorts Ltd. was a negative earnings firm because it did not have any operating resorts until recently.

Utilizing the option pricing model, with industry average standard deviation for stock and bond prices and an

average debt life of 15 years, results in an option value of $57.69

Final Analysis:

I recommend to SELL Wynn.

17

APPENDIX:

Trump Entertainment Resorts

Exhibit A: Public Comp Worksheet

Trading Statistics

Price Ratios Enterprise Value Ratios Other

Price Price / LTM Equity Enterprise EPS Book Revenue EBITDA Est. EPS CY05E Div.

Company Ticker Current High Low Value Value

(1)

LTM CY05E Value LTM CY05E LTM CY05E Growth P/E/G Yield

Trump Entertainment Resorts TER 14.60 NM NM 582 1,980 NM NM 1.0x 1.7x 1.7x 8.6x 8.3x 16.5% NA 0.0%

Ameristar Casinos, Inc. ASCA 51.44 (11.7%) 115.5% 1,504 2,184 23.0x 21.0x 4.7x 2.6x 2.3x 9.4x 8.4x 16.0% 1.3x 1.2%

Aztar Corporation AZR 27.10 (23.4%) 16.6% 1,002 1,686 22.2x 18.3x 1.8x 2.1x 1.9x 10.0x 8.1x 10.0% 1.8x 0.0%

Boyd Gaming Corporation BYD 51.41 (13.2%) 141.7% 4,714 6,865 35.7x 25.5x 5.0x 3.2x 3.1x 14.5x 11.0x 17.0% 1.5x 1.0%

Isle of Capri ISLE 25.07 (20.1%) 60.4% 790 1,792 31.0x 21.8x 3.1x 1.3x 1.6x 7.8x 7.3x 20.0% 1.1x 0.0%

Kerzner International KZL 57.72 (14.1%) 44.5% 2,156 2,734 22.6x 21.4x 1.9x 4.4x 4.1x 17.0x 14.7x 17.5% 1.2x 0.0%

Penn / Argosy Pro Forma PENN 32.36 (9.4%) 143.3% 2,844 5,953 30.5x 21.6x 7.1x 2.7x 2.7x 10.9x 10.4x 20.0% 1.1x 0.0%

Pinnacle Entertainment PNK 14.71 (28.6%) 39.3% 619 1,057 367.8x 54.5x 1.5x 1.9x 1.5x 10.2x 7.9x 15.0% 3.6x 0.0%

Monarch Casino MCRI 18.60 (25.6%) 187.3% 361 382 21.3x 17.8x 5.5x 3.0x 2.8x 10.6x 9.7x 25.0% 0.7x 0.0%

Riviera Holdings RIV 14.65 (9.8%) 429.5% 187 384 NM NM -6.4x 1.9x 1.9x 9.6x 9.5x NM NM 0.0%

Station Casinos STN 65.55 (8.0%) 61.6% 4,639 5,911 31.7x 27.0x 9.5x 6.0x 5.5x 15.5x 13.4x 15.0% 1.8x 1.3%

MGM Mirage / Mandalay PF MGG 69.40 (12.8%) 75.2% 10,579 22,545 NM 23.4x 3.8x 3.4x 3.3x 11.4x 10.1x 15.0% 1.6x 0.0%

Harrah's Caesars Pro Forma HET 66.05 (9.0%) 50.3% 12,153 21,710 NM 17.9x 2.1x 2.5x 2.3x 9.3x 9.2x 15.0% 1.2x 0.0%

WYNN Resorts WYNN 54.86 (28.2%) 60.5% 5,512 6,783 NM NM 3.4x NM 9.3x NA 37.0x 17.5% NM 0.0%

Las Vegas Sands LVS 37.26 (31.0%) 2.4% 13,245 13,752 58.2x 34.5x 10.1x 11.5x 8.7x 45.5x 21.7x 17.5% 2.0x 0.0%

Mean Excluding Trump 64.4x 25.4x 3.8x 3.6x 3.6x 14.0x 12.7x 17.0% 1.6x 0.2%

Median Excluding Trump 30.5x 21.6x 3.5x 2.6x 2.5x 10.4x 9.6x 0.2x 1.3x 0.0x

Low Excluding Trump 21.3x 17.8x -6.4x 1.3x 1.5x 7.8x 7.3x 10.0% 0.7x 0.0%

High Excluding Trump 367.8x 54.5x 10.1x 11.5x 9.3x 45.5x 37.0x 25.0% 3.6x 1.3%

1. Enterprise value defined as market equity value plus total debt, minority interest and preferred stock at book value less cash & cash equivalents. Assumes debt instruments trade at par

Vous aimerez peut-être aussi

- Casino Operations Management. 2ND EditionDocument419 pagesCasino Operations Management. 2ND EditionFrancis B Jandog100% (24)

- Value Investing: From Graham to Buffett and BeyondD'EverandValue Investing: From Graham to Buffett and BeyondÉvaluation : 4 sur 5 étoiles4/5 (24)

- A Guide to Creating A Successful Algorithmic Trading StrategyD'EverandA Guide to Creating A Successful Algorithmic Trading StrategyÉvaluation : 4.5 sur 5 étoiles4.5/5 (3)

- Wynn ResortsDocument54 pagesWynn ResortsSimone Trice100% (6)

- FM 475 Final ExamDocument7 pagesFM 475 Final Examabccd11Pas encore d'évaluation

- Bankruptcy and Restructuring at Marvel Entertainment GroupDocument12 pagesBankruptcy and Restructuring at Marvel Entertainment Groupvikaskumar_mech89200% (2)

- FM11 CH 11 Mini CaseDocument13 pagesFM11 CH 11 Mini CasesushmanthqrewrerPas encore d'évaluation

- Wynn CaseDocument3 pagesWynn CaseGalina Pancenko0% (1)

- Group Assignment - Mergers, Acquisitions and Corporate Restructuring ValuationDocument7 pagesGroup Assignment - Mergers, Acquisitions and Corporate Restructuring ValuationRohitPas encore d'évaluation

- 1 - TVM Student TemplatesDocument16 pages1 - TVM Student Templatesaazad3201Pas encore d'évaluation

- FIN322 Week4 TutorialDocument4 pagesFIN322 Week4 Tutorialchi_nguyen_100Pas encore d'évaluation

- Kohler DCF Control Prem and DiscDocument6 pagesKohler DCF Control Prem and Discapi-239586293Pas encore d'évaluation

- Corporate Finance Practice ExamDocument22 pagesCorporate Finance Practice ExamNitin ArasappanPas encore d'évaluation

- Fin439 Final Luv Aal UpdatedDocument91 pagesFin439 Final Luv Aal Updatedapi-323273427Pas encore d'évaluation

- Advanced Portfolio Management: A Quant's Guide for Fundamental InvestorsD'EverandAdvanced Portfolio Management: A Quant's Guide for Fundamental InvestorsPas encore d'évaluation

- Venetian Palazzo MapDocument2 pagesVenetian Palazzo MapjonesjoePas encore d'évaluation

- Venue Map Wynn HotelDocument1 pageVenue Map Wynn Hotelmario sanchezPas encore d'évaluation

- Same Accident Different PerceptionsDocument1 pageSame Accident Different Perceptionsayujain1875% (4)

- Valuation Models: Aswath DamodaranDocument47 pagesValuation Models: Aswath DamodaranSumit Kumar BundelaPas encore d'évaluation

- Brigham Chapter 21 Solution ManualDocument12 pagesBrigham Chapter 21 Solution Manualprimadonna03100% (3)

- BNFN 4309 - Topic 2 (Activity # 3) - AKDocument18 pagesBNFN 4309 - Topic 2 (Activity # 3) - AKabeerPas encore d'évaluation

- RSE Acquisition of Flinder ValvesDocument4 pagesRSE Acquisition of Flinder Valvesraulzaragoza0422100% (1)

- Group 1 Section A PDFDocument14 pagesGroup 1 Section A PDFNayeem Md Sakib100% (1)

- VebitdaDocument24 pagesVebitdaAndr EiPas encore d'évaluation

- Welcome To The Presentation On Valuation Section A Group 1Document37 pagesWelcome To The Presentation On Valuation Section A Group 1Nayeem Md SakibPas encore d'évaluation

- UpsDocument3 pagesUpsanandi.g9Pas encore d'évaluation

- Simple Discounted Cash Flow Model & Relative ValuationDocument14 pagesSimple Discounted Cash Flow Model & Relative ValuationlearnPas encore d'évaluation

- Valuation & Fin Moduling PDFDocument14 pagesValuation & Fin Moduling PDFTohidul Anwar ChyPas encore d'évaluation

- Valuation ModelsDocument47 pagesValuation ModelsAshwin Kumar100% (1)

- Equity Analysis and Evaluation - II Assignment December 23Document14 pagesEquity Analysis and Evaluation - II Assignment December 23sachin.saroa.1Pas encore d'évaluation

- Glob CrossDocument18 pagesGlob Crossminhthuc203Pas encore d'évaluation

- Damodaran On Valuation Lect5Document7 pagesDamodaran On Valuation Lect5Keshav KhannaPas encore d'évaluation

- 1.1 What Is Their Profit Margin? Profit MarginDocument16 pages1.1 What Is Their Profit Margin? Profit MarginVenay SahadeoPas encore d'évaluation

- Technical Finance Prep AnswersDocument28 pagesTechnical Finance Prep Answersajaw267Pas encore d'évaluation

- Extra Questions and Problems on Bond Pricing and YieldsDocument8 pagesExtra Questions and Problems on Bond Pricing and YieldsDeepak SandhuPas encore d'évaluation

- Digital CompaqDocument8 pagesDigital CompaqgauravrewariPas encore d'évaluation

- Amazon ValuationDocument22 pagesAmazon ValuationDr Sakshi SharmaPas encore d'évaluation

- Business Analysis and Valuation - IntroductionDocument109 pagesBusiness Analysis and Valuation - IntroductioncapassoaPas encore d'évaluation

- Valuation AnalysisDocument27 pagesValuation Analysisnimitjain10Pas encore d'évaluation

- Genmath Q2 Week4Document36 pagesGenmath Q2 Week4ShenniePas encore d'évaluation

- Market TypesDocument32 pagesMarket TypesJintu Moni BarmanPas encore d'évaluation

- FM 6 Financial Statements Analysis MBADocument50 pagesFM 6 Financial Statements Analysis MBAMisganaw GishenPas encore d'évaluation

- Chapter 9. Tool Kit For The Cost of CapitalDocument14 pagesChapter 9. Tool Kit For The Cost of CapitalasimqaiserPas encore d'évaluation

- Berkshire Threaded Fasteners Co.: Question 1: Drop 300 As of 1/1/74?Document24 pagesBerkshire Threaded Fasteners Co.: Question 1: Drop 300 As of 1/1/74?Yousif100% (1)

- Solutions To Brief ExercisesDocument2 pagesSolutions To Brief Exercises7seas498 7seas498Pas encore d'évaluation

- Starwood Hotels Resorts Worldwide Inc FinancialsDocument48 pagesStarwood Hotels Resorts Worldwide Inc FinancialsAgarwal SaranshPas encore d'évaluation

- Nike Inc - Cost of Capital - Syndicate 10Document16 pagesNike Inc - Cost of Capital - Syndicate 10Anthony KwoPas encore d'évaluation

- BFC5935 - Tutorial 9 SolutionsDocument6 pagesBFC5935 - Tutorial 9 SolutionsXue XuPas encore d'évaluation

- 2018 SIMR Bootcamp Valuation & ModelingDocument24 pages2018 SIMR Bootcamp Valuation & ModelingRahul GuptaPas encore d'évaluation

- Mergers and Acquisitions: The Market For Corporate ControlDocument34 pagesMergers and Acquisitions: The Market For Corporate Controlangel23lovePas encore d'évaluation

- Corporate Finance Practice ExamDocument22 pagesCorporate Finance Practice ExamgPas encore d'évaluation

- FINS1613 Business Finance Tutorial Week 7 Solutions (RTBWJ Chapter 9)Document5 pagesFINS1613 Business Finance Tutorial Week 7 Solutions (RTBWJ Chapter 9)Edward YangPas encore d'évaluation

- Equity Instruments 1Document272 pagesEquity Instruments 1motty123456Pas encore d'évaluation

- FM Assaignment Second SemisterDocument9 pagesFM Assaignment Second SemisterMotuma Abebe100% (1)

- Evaluating Financial Performance: Finance Jaime F. ZenderDocument33 pagesEvaluating Financial Performance: Finance Jaime F. ZenderRenjul ParavurPas encore d'évaluation

- Cost of Capital Excel Temple-Free CH 10Document10 pagesCost of Capital Excel Temple-Free CH 10Mohiuddin AshrafiPas encore d'évaluation

- 72 BIWS O&G ValuationDocument9 pages72 BIWS O&G Valuationdk773Pas encore d'évaluation

- Chapter 10 SolutionDocument13 pagesChapter 10 SolutionPhước NgọcPas encore d'évaluation

- ValuationDocument11 pagesValuationDidar RikhonPas encore d'évaluation

- Tutorial 3 Terminal Value AfterDocument10 pagesTutorial 3 Terminal Value AfteroussemPas encore d'évaluation

- Excel FunctionsDocument13 pagesExcel Functionsخالد مطيرPas encore d'évaluation

- Financial Leverage Du Pont Analysis &growth RateDocument34 pagesFinancial Leverage Du Pont Analysis &growth Rateahmad jamalPas encore d'évaluation

- Marketing Analytics ExerciseDocument7 pagesMarketing Analytics ExerciseIrisQianWangPas encore d'évaluation

- Cruz Janna Kassandra Midterm Practice ProblemsDocument6 pagesCruz Janna Kassandra Midterm Practice ProblemsMiguel PultaPas encore d'évaluation

- Solutions To Week 3 Practice Text ExercisesDocument6 pagesSolutions To Week 3 Practice Text Exercisespinkgold48Pas encore d'évaluation

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsD'EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsPas encore d'évaluation

- 9854 Goldlink Insurance Audited 2013 Financial Statements May 2015Document3 pages9854 Goldlink Insurance Audited 2013 Financial Statements May 2015Oladipupo Mayowa PaulPas encore d'évaluation

- FirstCity Group profit up 88% in 3 monthsDocument1 pageFirstCity Group profit up 88% in 3 monthsOladipupo Mayowa PaulPas encore d'évaluation

- Filling Station GuidelinesDocument8 pagesFilling Station GuidelinesOladipupo Mayowa PaulPas encore d'évaluation

- Amcon Bonds FaqDocument4 pagesAmcon Bonds FaqOladipupo Mayowa PaulPas encore d'évaluation

- 2006 Q1resultsDocument1 page2006 Q1resultsOladipupo Mayowa PaulPas encore d'évaluation

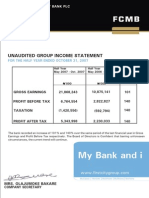

- FCMB Group PLC 3Q13 (IFRS) Group Results Investors & Analysts PresentationDocument32 pagesFCMB Group PLC 3Q13 (IFRS) Group Results Investors & Analysts PresentationOladipupo Mayowa PaulPas encore d'évaluation

- IBT199 IBTC Q1 2014 Holdings Press Release PRINTDocument1 pageIBT199 IBTC Q1 2014 Holdings Press Release PRINTOladipupo Mayowa PaulPas encore d'évaluation

- Best Practice Guidelines Governing Analyst-Corporate Issuer Relations - CFADocument16 pagesBest Practice Guidelines Governing Analyst-Corporate Issuer Relations - CFAOladipupo Mayowa PaulPas encore d'évaluation

- Abridged Financial Statement September 2012Document2 pagesAbridged Financial Statement September 2012Oladipupo Mayowa PaulPas encore d'évaluation

- FCMB Group PLC Announces HY13 (Unaudited) IFRS-Compliant Group Results - AmendedDocument4 pagesFCMB Group PLC Announces HY13 (Unaudited) IFRS-Compliant Group Results - AmendedOladipupo Mayowa PaulPas encore d'évaluation

- 9M 2013 Unaudited ResultsDocument2 pages9M 2013 Unaudited ResultsOladipupo Mayowa PaulPas encore d'évaluation

- Diamond Bank Half Year Results 2011 SummaryDocument5 pagesDiamond Bank Half Year Results 2011 SummaryOladipupo Mayowa PaulPas encore d'évaluation

- IBT199 IBTC Q1 2014 Holdings Press Release PRINTDocument1 pageIBT199 IBTC Q1 2014 Holdings Press Release PRINTOladipupo Mayowa PaulPas encore d'évaluation

- First City Monument Bank PLC.: Investor/Analyst Presentation Review of H1 2008/9 ResultsDocument31 pagesFirst City Monument Bank PLC.: Investor/Analyst Presentation Review of H1 2008/9 ResultsOladipupo Mayowa PaulPas encore d'évaluation

- q1 2008 09 ResultsDocument1 pageq1 2008 09 ResultsOladipupo Mayowa PaulPas encore d'évaluation

- q1 2008 09 ResultsDocument1 pageq1 2008 09 ResultsOladipupo Mayowa PaulPas encore d'évaluation

- 5 Year Financial Report 2010Document3 pages5 Year Financial Report 2010Oladipupo Mayowa PaulPas encore d'évaluation

- 2007 Q2resultsDocument1 page2007 Q2resultsOladipupo Mayowa PaulPas encore d'évaluation

- Dec09 Inv Presentation GAAPDocument23 pagesDec09 Inv Presentation GAAPOladipupo Mayowa PaulPas encore d'évaluation

- June 2009 Half Year Financial Statement GaapDocument78 pagesJune 2009 Half Year Financial Statement GaapOladipupo Mayowa PaulPas encore d'évaluation

- 5 Year Financial Report 2010Document3 pages5 Year Financial Report 2010Oladipupo Mayowa PaulPas encore d'évaluation

- 9-Months 2012 IFRS Unaudited Financial Statements FINAL - With Unaudited December 2011Document5 pages9-Months 2012 IFRS Unaudited Financial Statements FINAL - With Unaudited December 2011Oladipupo Mayowa PaulPas encore d'évaluation

- GTBank H1 2011 Results PresentationDocument17 pagesGTBank H1 2011 Results PresentationOladipupo Mayowa PaulPas encore d'évaluation

- 2011 Year End Results Press Release - FinalDocument2 pages2011 Year End Results Press Release - FinalOladipupo Mayowa PaulPas encore d'évaluation

- GTBank FY 2011 Results PresentationDocument16 pagesGTBank FY 2011 Results PresentationOladipupo Mayowa PaulPas encore d'évaluation

- 2011 Half Year Result StatementDocument3 pages2011 Half Year Result StatementOladipupo Mayowa PaulPas encore d'évaluation

- Fs 2011 GtbankDocument17 pagesFs 2011 GtbankOladipupo Mayowa PaulPas encore d'évaluation

- GTBank H1 2012 Results AnalysisDocument17 pagesGTBank H1 2012 Results AnalysisOladipupo Mayowa PaulPas encore d'évaluation

- Final Fs 2012 Gtbank BV 2012Document16 pagesFinal Fs 2012 Gtbank BV 2012Oladipupo Mayowa PaulPas encore d'évaluation

- School of Human SciencesDocument4 pagesSchool of Human Sciencesnm.nandita5938Pas encore d'évaluation

- Vegas Loop Land Use MapDocument4 pagesVegas Loop Land Use MapKSNV News3LVPas encore d'évaluation

- Robbins Ultimate Business Mastery Nerd ReportDocument174 pagesRobbins Ultimate Business Mastery Nerd ReportAngel Briones96% (23)

- Travel Leisure India Amp South Asia April 2019Document150 pagesTravel Leisure India Amp South Asia April 2019Tourify CorporatePas encore d'évaluation

- Executive Summary WynnDocument5 pagesExecutive Summary Wynnapi-505730347Pas encore d'évaluation

- Case Study of Wynn ResortsDocument12 pagesCase Study of Wynn ResortsVikasPathakPas encore d'évaluation

- Val Project 6Document17 pagesVal Project 6Oladipupo Mayowa PaulPas encore d'évaluation

- Wynn Resorts XS Declaratory Judgment ActionDocument23 pagesWynn Resorts XS Declaratory Judgment ActionRyan Gile, Esq.Pas encore d'évaluation

- Wynn Resort Case StudyDocument3 pagesWynn Resort Case StudyjakuPas encore d'évaluation

- Wynn Rewards BrochureDocument2 pagesWynn Rewards BrochureJordanPas encore d'évaluation

- Trevor Stuart-Hill - Juston Parker - An Introduction To Revenue Management For The Hospitality Industry - Principles and Practices For The Real World-Pearson (2014)Document276 pagesTrevor Stuart-Hill - Juston Parker - An Introduction To Revenue Management For The Hospitality Industry - Principles and Practices For The Real World-Pearson (2014)Ankit MhrPas encore d'évaluation

- Business Plan For A Korean Fine-Dining Restaurant in Las VegasDocument50 pagesBusiness Plan For A Korean Fine-Dining Restaurant in Las VegasBlazeDream Technologies Pvt LtdPas encore d'évaluation

- Wynn Resorts Case W o ReferencesDocument28 pagesWynn Resorts Case W o Referencesapi-505509027Pas encore d'évaluation

- Steve Wynn v. The Associated PressDocument31 pagesSteve Wynn v. The Associated PressdocumentPas encore d'évaluation

- Case 2: Wynn Resort SWOT of Company: Strenghts WeaknessesDocument3 pagesCase 2: Wynn Resort SWOT of Company: Strenghts WeaknessesLinda AmerikaPas encore d'évaluation

- GB-AGM-2020 FINAL CFO SlidesDocument67 pagesGB-AGM-2020 FINAL CFO SlidesMICHAELG3000Pas encore d'évaluation

- 02 - Wynn Resorts - LTD Case Study EngDocument15 pages02 - Wynn Resorts - LTD Case Study EngjohanmateoPas encore d'évaluation

- Spa Magazine Decembrie 2012Document91 pagesSpa Magazine Decembrie 2012Popa EmilPas encore d'évaluation

- Attorneys For Plaintiff Steve Wynn: United States District Court District of NevadaDocument25 pagesAttorneys For Plaintiff Steve Wynn: United States District Court District of NevadaAnonymous i6lkegiPas encore d'évaluation

- 2015 US Collections 9 CatalogDocument368 pages2015 US Collections 9 CatalogTabletopJournalPas encore d'évaluation

- Wynn Resorts vs. Resorts World Las Vegas LawsuitDocument17 pagesWynn Resorts vs. Resorts World Las Vegas LawsuitLas Vegas Review-JournalPas encore d'évaluation

- Buffet's Checklist On Macau GamingDocument84 pagesBuffet's Checklist On Macau Gamingjm1346Pas encore d'évaluation