Académique Documents

Professionnel Documents

Culture Documents

3 Asian Paints Q2FY15 Result Update 22-Oct-14

Transféré par

girishrajsCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

3 Asian Paints Q2FY15 Result Update 22-Oct-14

Transféré par

girishrajsDroits d'auteur :

Formats disponibles

I

n

d

i

a

R

e

s

e

a

r

c

h

DOLAT CAPITAL

October 22, 2014

C

o

n

s

u

m

e

r

/

R

e

s

u

l

t

U

p

d

a

t

e

Asian Paints

CMP: ` `` `` 650 TP: ` `` `` 680 Accumulate

High Points

Volume growth of 13.5% in

decorative business.

Industrial business

witnesses improvement in

growth rate.

Raw Material cost benign but

no price reduction planned.

Introducing FY17 estimates.

Recommend Accumulate

with a TP of `680.

Financials

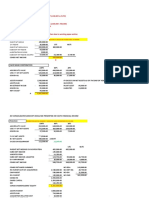

Year Net Sales % growth EBITDA OPM% PAT % growth EPS(` `` ``) % growth PER(x) ROANW(%) ROAIC(%)

FY14 127,148 15.9 19,979 15.7 12,288 10.3 12.8 10.3 50.7 33.1 47.8

FY15E 146,336 15.1 24,270 16.6 15,334 24.8 16.0 24.8 40.7 34.4 52.4

FY16E 170,833 16.7 28,818 16.9 18,787 22.5 19.6 22.5 33.2 34.7 53.4

FY17E 202,546 18.6 35,248 17.4 23,554 25.4 24.6 25.4 26.5 35.3 54.8

Figures in ` mn

Q2FY15 Result (` mn)

Parti cul ars Q2FY15 Q1FY14 Y-O-Y (%) Q1FY15 Q-O-Q (%) H1FY15 H1FY14 Y-O-Y(%)

Net Sales 36,330 31,147 16.6 33,622 8.1 69,952 59,558 17.5

Expenditure 30,967 26,039 18.9 28,057 10.4 59,025 49,803 18.5

Raw Materials 20,469 17,665 15.9 19,309 6.0 39,778 33,802 17.7

Staff Cost 2,335 1,859 25.7 2,253 3.7 4,588 3,868 18.6

Other Expenditure 8,163 6,516 25.3 6,495 25.7 14,658 12,134 20.8

Operating Profit 5,362 5,108 5.0 5,565 -3.6 10,927 9,755 12.0

Other Income 480 454 5.8 473 1.4 953 731 30.4

Interest 70 120 -41.4 78 -9.9 148 205 -27.9

Depreciation 669 603 11.0 646 3.6 1,314 1,202 9.4

Excep Items - Gain / (Loss) 0 0 252 0

PBT 5,103 4,839 5.4 5,315 -4.0 10,166 9,079 12.0

Tax 1,541 1,449 6.3 1,590 -3.1 3,130 2,839 10.3

Net Profit 3,563 3,390 5.1 3,725 -4.4 7,036 6,240 12.8

Minority Interest 90 122 87 176 219

Reported PAT 3,473 3,268 3,639 6,860 6,020

Adj Profit 3,473 3,268 6.3 3,639 -4.6 7,112 6,020 18.1

Gross Margin (%) 43.7 43.3 37.2 42.6 108.8 43.1 43.2 -11.0

Staff cost (%) 6.4 6.0 46.1 6.7 -27.2 6.6 6.5 6.5

Other exp (%) 22.5 20.9 155.1 19.3 315.2 21.0 20.4 58.2

OPM (%) 14.8 16.4 -164.0 16.6 -179.2 15.6 16.4 -75.7

Tax rate (%) 30.2 29.9 24.2 29.9 28.0 30.8 31.3 -48.2

NPM (%) 9.8 10.9 -107.9 11.1 -127.4 10.1 10.5 -41.8

Scrip Details

Equity ` 959mn

Face Value ` 1/-

Market Cap ` 623bn

USD 10.1bn

52 week High / Low ` 680 / 461

Avg. Volume (no) 1,396,649

BSE Sensex 26,768

NSE Nifty 7,980

Bloomberg Code APNT IN

Reuters Code ASPN.BO

Sr. Analyst: Amit Purohit

Tel : +9122 4096 9724

E-mail: amitp@dolatcapital.com

Asian Paint reported a consolidated revenue growth of 16.6% to ` 36.3bn.

EBITDA at ` 5.36bn was up 5.9% YoY as margins declined by 164bps to

14.8%. Gross margin expanded by 37bps YoY to 43.7%. Higher employee

cost up 46bps and other expenditure up 155bps YoY lead to a reduction in

margins. Employee cost increased due to addition and fluctuation in gratuity

valuation while other expenditure were higher due to higher advertising spend.

PBT, was up 5.4% YoY and Adj PAT stood at ` 3.47bn up 6.3% YoY.

Standalone business (decorative paints) reported revenue of ` 29.9bn up 18.3%.

We estimate a volume growth of 13.5% and sustenance of strong volume growth

despite higher base of last year (15% volume in Q2FY14) is encouraging.

EBITDA grew by 5.4% as margin declined by 197bps to 16.1%. Gross margins

expanded by 40bps YoY to 44.8%.

Subsidiary business (Industrial and International) reported a 9.4% revenue growth

to ` 9.4bn and EBTDA grew by 1.4% to ` 551mn. The company witnessed

good growth in two wheeler. Gross margin remained flat and higher employee

cost impacted the operating performance.

Valuation and View

Management indicated that festive season would improve the outlook for volume

growth in Paints in the coming quarters. We introduce FY17 and estimate a

16.8% CAGR in revenue and 24% CAGR in earnings during FY14-17E. We

expect strong PAT growth in the coming quarters, mainly due to lower base of

last year and benign raw material cost. We believe, the P/E multiples remain

high due to strong volume growth and improvement in margins. The stock trades

at trading at very rich valuations at 33x FY16E of `19.6 and 26x FY17E EPS of

`24.6. We recommend a Accumulate with a target price of `680.

2

DOLAT CAPITAL

India Research

Asian Paints October 22, 2014

Key takeaways of Conference call:

Volume growth for the quarter is estimated at 13.5% (15% vol growth in Q2FY14).

Management indicated volume growth remained strong both in rural and urban

markets. The trend is likely to continue in the festive season.

Raw material prices remain benign. Currently 17-18% of the sales are from

solvent paints which would benefit from lower crude price.

With respect the price reduction, the management indicated that it will review

only when there is a substantial fall in the prices. There are no immediate plans

to reduce the prices.

International business growth was driven by Bangladesh, Nepal and Oman. In

the Industrial business specially the Refinish and tow wheeler segment has

witnessed growth. Higher margin segment, passenger car did well especially

for J apanese players which has benefited Kansai Nerolac

The company has total capex plan to `5bn in the domestic business which

would include a maintenance capex of `1.5-2bn. Capacity addition would be

done in its Rohtak plant (2lac tons) and Ankleshwar (30,000 tons). The company

looking at expansion in the South market which would largely focus on the

decorative segment.

Quarterly trend in volume growth:

Quarterly trend in operating performance:

y p g p

Source: Company, Dolat Research

Source: Company, Dolat Research

3

DOLAT CAPITAL

India Research

Asian Paints October 22, 2014

IMPORTANT RATIOS

Parti cul ars Mar 14 Mar15E Mar16E Mar17E

(A) Measures of Performance (%)

Gross Margin 42.3 43.4 43.7 44.3

EBIDTA Margin (excl. O.I.) 15.7 16.6 16.9 17.4

EBIDTA Margin (incl. O.I.) 16.6 17.7 18.0 18.7

Interest / Sales 0.3 0.2 0.1 0.1

Gross Profit Margin 16.3 17.5 17.8 18.5

Tax/PBT 31.2 31.8 31.2 31.2

Net Profit Margin 9.6 10.3 10.9 11.5

(B) As Percentage of Net Sales

Raw Material 57.7 56.6 56.3 55.7

Employee Expenses 6.0 6.2 6.2 6.2

Other Expenses 20.6 20.6 20.6 20.7

(C) Measures of Financial Status

Interest Coverage (x) 50.5 87.3 124.5 153.6

Average Cost Of Debt (%) 19.3 15.2 12.0 12.0

Debtors Period (days) 32 33 33 33

Closing stock (days) 59 60 60 60

Inventory Turnover Ratio (x) 6.2 6.1 6.1 6.1

Fixed Assets Turnover (x) 3.5 3.9 4.3 4.9

Working Capital Turnover (x) 13.2 10.7 10.3 9.0

Non Cash Working Capital (` Mn) 5,556 6,109 7,863 11,171

(D) Measures of Investment

EPS (`) (Reported) 13.2 16.5 20.2 25.3

EPS (`) 12.8 16.0 19.6 24.6

CEPS (`) 15.4 18.8 22.4 27.5

DPS (`) 5.6 7.3 8.4 9.6

Dividend Payout (%) 43.8 45.4 43.0 39.1

Profit Ploughback (%) 56.2 54.6 57.0 60.9

Book Value (`) 42.1 50.9 62.0 77.0

RoANW (%) 33.1 34.4 34.7 35.3

RoACE (%) 30.4 31.6 31.9 32.7

RoAIC (%) (Excl Cash & Invest.) 47.8 52.4 53.4 54.8

(E) Valuation Ratios

CMP (`) 650 650 650 650

P/E (x) 50.7 40.7 33.2 26.5

Market Cap. (` Mn.) 623,480 623,480 623,480 623,480

MCap/ Sales (x) 4.9 4.3 3.6 3.1

EV (` Mn.) 609,531 602,910 589,117 576,386

EV/Sales (x) 4.8 4.1 3.4 2.8

EV/EBDITA (x) 30.5 24.8 20.4 16.4

P/BV (x) 15.4 12.8 10.5 8.4

Dividend Yield (%) 0.9 1.1 1.3 1.5

E-estimates

CASH FLOW

Parti cul ars Mar 14 Mar15E Mar16E Mar17E

Profi t before tax 18,442 23,244 28,164 35,340

Depreciation & w.o. 2,457 2,661 2,713 2,805

Net Interest Exp 422 300 250 250

Direct taxes paid -5,715 -7,391 -8,787 -11,026

Chg. in Working Capital -1,380 -553 -1,754 -3,309

Extra Ordinary

(A) CF from Opt. Activities 14,226 18,260 20,586 24,060

Capex {Inc./ (Dec.) in FA n WIP} -2,090 -4,800 1,200 -2,300

Free Cash Fl ow 12,136 13,460 21,786 21,760

Inc./ (Dec.) in Investments -3,926 -3,337 -12,739 -10,163

(B) CF from Inv. Activities -6,016 -8,137 -11,539 -12,463

Issue of Equity/ Preference -212 419 337 423

Inc./(Dec.) in Debt -633 200 0 0

Interest exp net -422 -300 -250 -250

Dividend Paid (Incl. Tax) -5,387 -6,958 -8,080 -9,203

(C) Cash Flow from Financing-6,654 -6,639 -7,993 -9,030

Net Change in Cash 1,557 3,485 1,054 2,568

Openi ng Cash bal ances 2,538 4,111 7,595 8,650

Cl osi ng Cash bal ances 4,111 7,595 8,650 11,218

E-estimates

INCOME STATEMENT ` `` `` mn

Parti cul ars Mar 14 Mar15E Mar16E Mar17E

Net Sales 127,148 146,336 170,833 202,546

Other income 1,342 1,934 2,309 3,147

Total Income 128,490 148,270 173,141 205,693

Total Expenditure 107,169 122,065 142,014 167,298

Operational / Direct expenses 73,407 82,759 96,167 112,892

Employee Expenses 7,597 9,094 10,596 12,517

Other Expenses 26,165 30,212 35,251 41,889

EBIDTA (Excl. OI) 19,979 24,270 28,818 35,248

EBIDTA (Incl. OI) 21,321 26,204 31,127 38,395

Interest 422 300 250 250

Gross Profi t 20,899 25,904 30,877 38,145

Depreciation 2,457 2,661 2,713 2,805

Profit Before Tax & EO Items 18,442 23,244 28,164 35,340

Extra Ordinary Exps/(Income) -100 0 0 0

Profit Before Tax 18,343 23,244 28,164 35,340

Tax 5,715 7,391 8,787 11,026

Net Profit 12,628 15,852 19,377 24,314

Minority Interest 440 518 590 760

Net Profit 12,288 15,334 18,787 23,554

BALANCE SHEET

Parti cul ars Mar 14 Mar15E Mar16E Mar17E

Sources of Funds

Equity Capital 959 959 959 959

Other Reserves 39,443 47,820 58,526 72,876

Net Worth 40,402 48,779 59,485 73,835

Minority Interest 2,064 2,582 3,172 3,932

Secured Loans 377 377 377 377

Unsecured Loans 1,500 1,700 1,700 1,700

Loan Funds 1,877 2,077 2,077 2,077

Deferred Tax Liability 1,674 2,092 2,430 2,854

Total Capital Employed 46,016 55,530 67,164 82,698

Applications of Funds

Gross Block 35,851 37,851 39,651 41,651

Less: Accumulated Depreciation 12,358 15,019 17,732 20,537

Net Block 23,493 22,832 21,920 21,115

Capital Work in Progress 700 3,500 500 800

Invest ment s 11,714 15,051 27,790 37,953

Current Assets, Loans & Advances

Inventories 20,635 24,055 28,082 33,295

Sundry Debtors 11,177 13,030 15,211 18,035

Cash and Bank Balance 4,111 7,595 8,650 11,218

Loans and Advances 4,772 5,109 6,359 8,410

sub total 40,695 49,789 58,302 70,958

Less : Current Li abi l i ti es & Provi si ons

Current Liabilities 26,241 30,093 34,840 40,594

Provisions 4,787 5,992 6,950 7,975

sub total 31,028 36,085 41,789 48,569

Net Current Assets 9,667 13,704 16,512 22,389

Misc Expenses 442 442 442 442

Tot al Assets 46,016 55,530 67,164 82,699

E-estimates

Shareholding Pattern as on Sep'14 (%)

DOLAT CAPITAL

This report contains a compilation of publicly available information, internally developed data and other sources believed to be reliable. While

all reasonable care has been taken to ensure that the facts stated are accurate and the opinion given are fair and reasonable, we do not take

any responsibility for inaccuracy or omission of any information and will not be liable for any loss or damage of any kind suffered by use of

or reliance placed upon this information. For Pvt. Circulation & Research Purpose only.

Dol at Dol at Dol at Dol at Dol at Capital Market Pvt. Ltd.

20, Rajabahadur Mansion, 1st Floor, Ambalal Doshi Marg, Fort, Mumbai - 400 001

Our Research reports are also available on Reuters, Thomson Publishers, DowJ ones and Bloomberg (DCML <GO>)

BUY Upside above 20%

ACCUMULATE Upside above 5% and up to 20%

REDUCE Upside of upto 5% or downside of upto 15%

SELL Downside of more than 15%

Analyst Sector/Industry/Coverage E-mail Tel.+91-22-4096 9700

Amit Khurana, CFA Co-Head Equities and Head of Research amit@dolatcapital.com +91-22-40969745

Amit Purohit Consumer amitp@dolatcapital.com +91-22-40969724

Deepali Gautam Utilities deepalig@dolatcapital.com +91-22-40969795

Kunal Dalal Auto & Auto Ancillaries kunald@dolatcapital.com +91-22-40969749

Milind Bhangale Pharma milindb@dolatcapital.com +91-22-40969731

Pawan Parakh Capital Good pawanp@dolatcapital.com +91-22-40969712

Priyank Chandra Oil & Gas priyank@dolatcapital.com +91-22-40969737

Rahul J ain IT Services rahul@dolatcapital.com +91-22-40969754

Rajiv Pathak Financials rajiv@dolatcapital.com +91-22-40969750

Prachi Save Derivatives prachi@dolatcapital.com +91-22-40969733

Associates Sector/Industry/Coverage E-mail Tel.+91-22-4096 9700

Afshan Sayyad Agrochemicals afshans@dolatcapital.com +91-22-40969726

Abhishek Lodhiya Real Estate abhishekl@dolatcapital.com +91-22-40969753

Avinash Kumar Capital Goods avinashk@dolatcapital.com +91-22-40969764

Devanshi Dhruva Economy devanshid@dolatcapital.com +91-22-40969756

Manish Raj Cement manishr@dolatcapital.com +91-22-40969725

Pranav J oshi Financials pranavj@dolatcapital.com +91-22-40969706

Equity Sales/Trading Designation E-mail Tel.+91-22-4096 9797

Purvag Shah Principal purvag@dolatcapital.com +91-22-40969747

Vikram Babulkar Co-Head Equities and Head of Sales vikram@dolatcapital.com +91-22-40969746

Kapil Yadav AVP - Institutional Sales kapil@dolatcapital.com +91-22-40969735

Parthiv Dalal AVP - Institutional Sales parthiv@dolatcapital.com +91-22-40969705

P. Sridhar Head Sales Trading sridhar@dolatcapital.com +91-22-40969728

Chandrakant Ware Senior Sales Trader chandrakant@dolatcapital.com+91-22-40969707

J atin Padharia Head of Sales Trading - Derivatives jatin@dolatcapital.com +91-22-40969703

Shirish Thakkar Sales Trader - Derivatives shirisht@dolatcapital.com +91-22-40969702

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Adjustment Depreciation MCQ SDocument5 pagesAdjustment Depreciation MCQ SAtiq43% (7)

- KPIT Technologies LTD: Rating: Target Price: EpsDocument3 pagesKPIT Technologies LTD: Rating: Target Price: EpsgirishrajsPas encore d'évaluation

- KPIT Technologies (KPISYS) : Optimistic RecoveryDocument11 pagesKPIT Technologies (KPISYS) : Optimistic RecoverygirishrajsPas encore d'évaluation

- KPIT 2QFY16 Outlook ReviewDocument5 pagesKPIT 2QFY16 Outlook ReviewgirishrajsPas encore d'évaluation

- KPIT Technologies: IT Services Sector Outlook - NeutralDocument9 pagesKPIT Technologies: IT Services Sector Outlook - NeutralgirishrajsPas encore d'évaluation

- KPIT 2QFY16 Result Update - 151026Document4 pagesKPIT 2QFY16 Result Update - 151026girishrajsPas encore d'évaluation

- Strong Beat, Improving Visibility - Re-Rating To Follow: Q2FY16 Result HighlightsDocument9 pagesStrong Beat, Improving Visibility - Re-Rating To Follow: Q2FY16 Result HighlightsgirishrajsPas encore d'évaluation

- Cholamandalam Initiation ReportDocument44 pagesCholamandalam Initiation ReportgirishrajsPas encore d'évaluation

- Kridhan Infra - EmkayDocument17 pagesKridhan Infra - EmkaygirishrajsPas encore d'évaluation

- 3 - 2014 India Investor Pulse Presentation - 140115Document42 pages3 - 2014 India Investor Pulse Presentation - 140115girishrajsPas encore d'évaluation

- 5 - ICRA's Assesment On Coal Mine AuctionDocument11 pages5 - ICRA's Assesment On Coal Mine AuctiongirishrajsPas encore d'évaluation

- Shriram City Union Finance: Growth Improves, Higher Spread BuyDocument8 pagesShriram City Union Finance: Growth Improves, Higher Spread BuygirishrajsPas encore d'évaluation

- 2 Economic InsightsDocument5 pages2 Economic InsightsgirishrajsPas encore d'évaluation

- 2 Economic InsightsDocument5 pages2 Economic InsightsgirishrajsPas encore d'évaluation

- 2014 MozambiqueLNGReport ENGDocument176 pages2014 MozambiqueLNGReport ENGgirishrajs100% (1)

- 3 - 2014 India Investor Pulse Presentation - 140115Document42 pages3 - 2014 India Investor Pulse Presentation - 140115girishrajsPas encore d'évaluation

- Outlook For American Natural Gas - Sieminski - 11112014Document27 pagesOutlook For American Natural Gas - Sieminski - 11112014girishrajsPas encore d'évaluation

- Knowledge BaseDocument5 pagesKnowledge BasegirishrajsPas encore d'évaluation

- Shriram City Union Finance: Growth Improves, Higher Spread BuyDocument8 pagesShriram City Union Finance: Growth Improves, Higher Spread BuygirishrajsPas encore d'évaluation

- Shriram City Union Finance: Growth Improves, Higher Spread BuyDocument8 pagesShriram City Union Finance: Growth Improves, Higher Spread BuygirishrajsPas encore d'évaluation

- Investors Presentation Q3-FY-14 01042014Document33 pagesInvestors Presentation Q3-FY-14 01042014girishrajsPas encore d'évaluation

- Oil Downstream Outlook To 2035Document98 pagesOil Downstream Outlook To 2035girishrajsPas encore d'évaluation

- OIL Sustainability Report 2013 14Document124 pagesOIL Sustainability Report 2013 14girishrajsPas encore d'évaluation

- World LNG Estimated August 2014 Landed Prices: Cove Point Cove PointDocument1 pageWorld LNG Estimated August 2014 Landed Prices: Cove Point Cove PointgirishrajsPas encore d'évaluation

- Shree Cement: Strong Cement Volume Growth Amid Cost Efficiency Lower NSR Qoq Moderates Profit GrowthDocument7 pagesShree Cement: Strong Cement Volume Growth Amid Cost Efficiency Lower NSR Qoq Moderates Profit GrowthgirishrajsPas encore d'évaluation

- 11 September Newsletter 2014 FinalDocument8 pages11 September Newsletter 2014 FinalgirishrajsPas encore d'évaluation

- Shree Cement (SHRCEM) : Strong Growth VisibilityDocument13 pagesShree Cement (SHRCEM) : Strong Growth VisibilitygirishrajsPas encore d'évaluation

- Shree Cement: Tepid Quarter But Still Outdoes Peers - BUYDocument5 pagesShree Cement: Tepid Quarter But Still Outdoes Peers - BUYgirishrajsPas encore d'évaluation

- Wipro: Cross Currency & Client Issues Eroded Otherwise in Line QuarterDocument10 pagesWipro: Cross Currency & Client Issues Eroded Otherwise in Line QuartergirishrajsPas encore d'évaluation

- Punjab National Bank: CMP: TP: AccumulateDocument4 pagesPunjab National Bank: CMP: TP: AccumulategirishrajsPas encore d'évaluation

- FAR.2649 - Cash To Accrual and Single EntryDocument24 pagesFAR.2649 - Cash To Accrual and Single Entrylijeh312Pas encore d'évaluation

- 9.1 Learning Objective 9-1: Chapter 9 LiabilitiesDocument67 pages9.1 Learning Objective 9-1: Chapter 9 LiabilitiesSeanPas encore d'évaluation

- Class 12 Businessstudy Notes Chapter 9 Studyguide360Document22 pagesClass 12 Businessstudy Notes Chapter 9 Studyguide360Aaditi VPas encore d'évaluation

- Appendix BDocument5 pagesAppendix Bowenish9903Pas encore d'évaluation

- 4.6 Week 4 Peer AssessmentDocument6 pages4.6 Week 4 Peer AssessmentRiskiBiz60% (5)

- T1 Budget For Planning S2-1718Document11 pagesT1 Budget For Planning S2-1718Faizah MKPas encore d'évaluation

- Valuation of Companies Valuation Based On Discounted CashflowDocument5 pagesValuation of Companies Valuation Based On Discounted CashflowAliceJohnPas encore d'évaluation

- Acc Practice in ExcelDocument34 pagesAcc Practice in Excelku daarayPas encore d'évaluation

- 2018 FAR Module2-RecordingBusinessTransactionsDocument4 pages2018 FAR Module2-RecordingBusinessTransactionsIrah LouisePas encore d'évaluation

- Receivables by Lopez, Joebin C.Document9 pagesReceivables by Lopez, Joebin C.Joebin Corporal LopezPas encore d'évaluation

- Capital Structure TheoriesDocument33 pagesCapital Structure TheoriesNaman LadhaPas encore d'évaluation

- CA Inter FM Super 50 Q by Sanjay Saraf SirDocument129 pagesCA Inter FM Super 50 Q by Sanjay Saraf SirSaroj AdhikariPas encore d'évaluation

- PIPFA 2012solutions OptDocument56 pagesPIPFA 2012solutions OptshahzebkhansPas encore d'évaluation

- Unit 7 PresentationDocument23 pagesUnit 7 PresentationcristianaPas encore d'évaluation

- Cleaning Service Business PlanDocument33 pagesCleaning Service Business Planimranzet75% (4)

- Red. of DebenturesDocument20 pagesRed. of DebenturesPadala LakshmiPas encore d'évaluation

- Financial Stament Review PDFDocument8 pagesFinancial Stament Review PDFglenn dandyne montanoPas encore d'évaluation

- ch13 - Substantive Audit Testing - Financing and Investing CycleDocument19 pagesch13 - Substantive Audit Testing - Financing and Investing CycleJoshua WacanganPas encore d'évaluation

- IFRS - 2017 - Solved QPDocument15 pagesIFRS - 2017 - Solved QPSharan ReddyPas encore d'évaluation

- Completion of The Accounting PDFDocument10 pagesCompletion of The Accounting PDFZairah HamanaPas encore d'évaluation

- Equity MethodDocument2 pagesEquity MethodJeane Mae BooPas encore d'évaluation

- Introduction To Financial Modelling PDFDocument18 pagesIntroduction To Financial Modelling PDFJeffrey Millinger50% (2)

- Case Solution 1Document18 pagesCase Solution 1maham nazirPas encore d'évaluation

- CA51024 - Quiz 2 (Solutions)Document6 pagesCA51024 - Quiz 2 (Solutions)The Brain Dump PHPas encore d'évaluation

- Chapter 4 Question Answer KeyDocument63 pagesChapter 4 Question Answer KeyBrian Schweinsteiger Fok100% (2)

- Quiz AKLDocument3 pagesQuiz AKLKevin AntoniusPas encore d'évaluation

- Asset AccountingDocument60 pagesAsset AccountingNirav PandyaPas encore d'évaluation

- Mommy's Light Annual Report 2010Document15 pagesMommy's Light Annual Report 2010John HayesPas encore d'évaluation

- What Are The Main Types of Depreciation Methods?Document8 pagesWhat Are The Main Types of Depreciation Methods?Arkei Fortaleza100% (1)