Académique Documents

Professionnel Documents

Culture Documents

2015 Budget Proposal Highlights PDF

Transféré par

Randora LkDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

2015 Budget Proposal Highlights PDF

Transféré par

Randora LkDroits d'auteur :

Formats disponibles

NDB Securities (Pvt) Ltd,

5th Floor,

# 40, NDB Building,

Nawam Mawatha,

Colombo 02.

Tel: +94 11 2131050

Fax: +94 11 2314180

Research Team Sidath Kalyanaratne, Vaishalie Shakespeare, Raguram Raamakrishnan, Upul Atapattu

2

0

1

5

B

u

d

g

e

t

P

r

o

p

o

s

a

l

s

Socio Economic Budget

The government of Sri Lanka presented the budget focusing on a medium term

budgetary framework from 2015 2017, targeting a gradual reduction in budget

deficit to 4.6%, 3.8% and 3.0% by 2015, 2016 and 2017 respectively. The budget

deficit expected for 2014 is 5.0% of GDP (Gross Domestic Product), in

comparison to the recorded deficit of 4.9% by September 2014. The reforms

presented in the budget 2015 encourages certain local industries through import

substitution whilst increased focus was towards elevating the healthcare and

education sectors and its work force. Furthermore, proposals targeted the low

income segment of the country while several concessions were granted to small

scale businesses. The infrastructure developmetn drive is expected to continue

through the proposed investments for 2015, focussing on the provincial and rural

roads and the rail network.

Tax concession for new investments A company with a committed

investment in excess of LKR 500 Mn made before the 31

st

of December 2015, in

the manufacturing sector (excluding liquor and tobacco), is proposed a reduction

of 50.0% of the applicable tax rate for a period of 7 years from the

commencement of commercial operations.

Electricity tariff reduction extended beyond the residential consumer

segment It is proposed to have a separate tariff band for SMEs, restaurants

and small shops consuming electricity below 300 units per month to enjoy a

25.0% tarrif reduction on the monthly electricity expenses. The budget also

proposes a tariff reduction of 15.0% for all other industries from November 2014.

Key highlights on import substitution An increase in CESS on rubber

imports by LKR 10/Kg and impose a CESS of LKR 150/Kg on imported milk

powder was proposed whilst the high CESS on the importation of butter, yogurt

and diary products to be maintained.

Special provision tax on motor vehicle imports It was proposed to impose an

Excise Special Provision tax on motor vehicle imports in lieu of all multiple

taxes at the point of import. The simplified taxation is expected to generate

additional revenue of LKR 5 Bn.

Minimum wages proposed The budget proposed a minimum salary of LKR

15,000 per month for the state employees whilst increasing the cost of living

allowance by LKR 2,200 to LKR 10,000 by January 2015. The total number of

state employees stood at 1.3 million as at 2014Q1. The government expenditure

on public servants remained at LKR 305.6 Bn for the first nine months of 2014,

an increase of 6.8% compared to the same period of the previous year.

Furthermore, it was proposed to increase the private sector minimum

remuneration to LKR 10,000 per month whilst suggesting a minimum increase of

24.10.2014

NDB Securities (Pvt) Ltd 2015 Budget Proposal Highlights 24

th

October 2014 2

-1,000

-500

0

500

1,000

1,500

2,000

2,500

2012 2013 2014 (budget) 2014 (revised) 2015 (budget)

LKR Bn

Government Revenue & Grants Government Expenditure Budget Deficit

LKR 500 per month for those who are already drawing a salary above the

proposed minimum.

Reduction in VAT (Value Added Tax) The government proposed to reduce

the VAT to 11.0% from 12.0% in 2015. Revenue from VAT increased to LKR

200.4 Bn for the first nine months of 2014, an increase of 11.2% compared to the

corresponding period in 2013.

PAYE (Pay As You Earn) Taxes Reduced The budget proposed a

reduction in PAYE tax rate to a maximum of 16.0% for all employment

categories by 2015. Revenue from PAYE tax increased by 15.0% to LKR 16.7

Bn during the first nine months of 2014 from LKR 14.5 Bn in 2013.

Government continue to back the Airlines Sri Lankan Airlines Ltd and

Mihin Lanka Ltd were allocated USD 150 Mn. The funds will be utilized for the

final phase of the proposed capitalization. The combined expected loss is LKR

30.6 Bn for the two airlines, compared to the incurred loss of LKR 16.4 Bn for

the first six months of 2014. The actual loss made by the two entities for 2013

stood at LKR 30.6 Bn.

A Snapshot of the 2015 Budget

The government is expecting to achieve a budget deficit of LKR 500.0 Bn for

2014, a reduction of the deficit by 3.1% from the 2014 budget. However, deficit

for the first nine months of 2014 reached LKR 489.8 Bn.

The Government has been able to reduce the deficit as a percentage of GDP to

4.9% for the first nine months of 2014. Furthermore, the government expect to

achieve a budget deficit of 5.2% of GDP in 2014 and 4.6% in 2015, which may

be a challenge under the suggested reforms.

Source - Budget Speech 2015

Total revenue and grants are expected to increase by 19%, while total

expenditure is expected to increase by 15% in 2015. Tax revenue is expected to

contribute up to 83.8% of the total revenue and grants, where as recurrent

Government Revenue, Expenditure and Budget Deficit

NDB Securities (Pvt) Ltd 2015 Budget Proposal Highlights 24

th

October 2014 3

expenditure is expected to decrease to 69% from 72% of the total expenditure for

2015.

Source Budget Speech 2015

Government Revenue

The revenue expected for 2014 has been revised downwards by LKR 47.5 Bn (to

LKR 1,422 Bn). The total revenue is LKR 836.9 Bn up to September 2014. The

monthly revenue needs to increase by about 10% in the last three months of 2014

to achieve this target.

Source Budget Speech 2015

Inflows from income tax is expected to rise 24.8% to LKR 322 Bn in 2015, while

taxes on goods and services are set to rise 15.2% to LKR 774 Bn. Taxes on

external trade is projected to increase 23.5% to LKR 321 Bn.

3

4

5

6

7

8

2012 2013 2014 (budget) 2014 (revised) 2015 (budget)

%

-

100.00

200.00

300.00

400.00

500.00

600.00

700.00

800.00

900.00

Income Tax Taxes on Goods

and Services

Taxes on External

Trade

Non Tax Revenue

LKR Bn

2014 (budget) 2014 (revised) 2015 (budget)

Tax and Non-Tax Revenue

Budget Deficit as a Percentage of GDP

NDB Securities (Pvt) Ltd 2015 Budget Proposal Highlights 24

th

October 2014 4

Government Expenditure

The total expenditure for 2014 is expected to be LKR 1,922 Bn, which is a

downward revision of LKR 63.6 Bn. The actual expenditure incurred up to

September was LKR 1,326.7 Bn, which is well within the revised target. Public

investments/GDP has come down to 5.6% from the budgeted 6.7%.

Source - Budget Speech, 2015

For 2015, public investments as a percentage of GDP is expected to rise to 6.2%,

which seems to be optimistic, while recurrent expenditure is set to rise by

10.03% to LKR 1,525 Bn.

Source - Budget Speech, 2015

0

200

400

600

800

1,000

1,200

1,400

1,600

1,800

2013 2014 (budget) 2014 (revised) 2015 (budget)

LKR Bn

Recurrent Public Investments

-

100.00

200.00

300.00

400.00

500.00

600.00

Salaries and Wages Other Goods and

Services

Interest Subsidies and

Transfers

LKR Bn

2014 (budget) 2014 (revised) 2015 (budget)

Total Expenditure

Recurrent Expenditure

NDB Securities (Pvt) Ltd 2015 Budget Proposal Highlights 24

th

October 2014 5

Deficit Financing

Total foreign financing is expected to be LKR 260.0 Bn in 2014, which is 12.0%

above the budgeted figure of LKR 235.5 Bn. Total domestic financing is

expected to come down 14% to LKR 240.0 Bn in 2014. Irrespective of the

interest rates being in check, the government has reduced its domestic bank

borrowings to LKR 81.0 Bn from the budgeted LKR 100.00 Bn. Meanwhile,

foreign commercial borrowings have seen a substantial increase of two folds in

2014 to LKR 197.0 Bn from budgeted LKR 97.5 Bn.

Source - Budget Speech, 2015

Funding mix for the 2015 deficit is expected to be financed by total foreign and

domestic borrowings at the ratio of 48.2:51.8. Government has slightly increased

its domestic financing mix to 51.8% from 48.0% witnessed in 2014. Foreign

commercial borrowing is expected to increase to 37.4% in 2015 in comparison

with 18.9% in 2014, which is an increase of LKR 97.5 Bn in absolute value.

Impact on the Stock Market

The budget proposes an electricity tariff reduction of 15.0% for all industries,

apart from the tariff reduction of 25.0% proposed for small scale business

units consuming less than 300 units per month. Further clarifications would

be required to understand if the 15% tariff reduction would have an impact

on certain companies in the listed space.

Proposal to reduce the present rate of VAT from 12.0% to 11.0%.

The tax-free threshold applicable for VAT on supermarket scale retail trade

to be fixed at LKR 100 Mn per quarter (as opposed to LKR 250 Mn

previously).

Pre budget increase in exercise tax on cigarettes and liquor (arrack proof litre

by LKR 90, foreign liquor proof litre by LKR 120, Beer with alcohol volume

over 5.0% by LKR 15, Beer with alcohol volume less than 5.0% by LKR 10)

to remain unchanged. This may have an impact on some of the companies on

the beverage, food and tobacco sector.

210.00

220.00

230.00

240.00

250.00

260.00

270.00

280.00

290.00

Total Foreign Financing Total Domestic Financing

LKR Bn

2014 (budget) 2014 (revised) 2015 (budget)

Deficit Financing

NDB Securities (Pvt) Ltd 2015 Budget Proposal Highlights 24

th

October 2014 6

Proposal to increase the CESS on rubber imports by LKR 10/Kg and

implement a guaranteed price of LKR 300/Kg to encourage small rubber

growers to be implemented from November 2014. The proposed outcome

may have an impact on some of the companies listed under the plantation

sector.

The budget proposes a CESS on imported milk power of LKR 100/Kg.

The government proposes the Ceylon Petroleum Corporation to form a joint

venture to protect its interest in the Trincomalee oil tank farm that has been

leased on a 99 year tenor to the Indian Oil Company, to develop storage

facilities. This may have an impact on certain power and energy sector

companies on the listed space.

In order to assist small poultry farms, the government proposes a supply

mechanism to provide maize at LKR 40/Kg and provide incentives for

chicken and eggs exporters. This may have an impact on certain listed

companies on the beverage, food and tobacco sector.

Similar to the previous budget, it was proposed to implement a credit scheme

with an 8-year maturity at 6 percent interest to all well performing companies

that will commit, on an agreed area for planting and replanting, for social

development of plantation workers and to increase the volume of value added

tea exports.

NDB Securities (Pvt) Ltd 2015 Budget Proposal Highlights 24

th

October 2014 7

Summary of the Budget 2012 2013 2014 2014 2015

2012

(actual)

2013

(actual)

2014

(budget)

2014

(revised)

2015

(budget)

Total Revenue and Grants 1,118 1,204 1,470 1,422 1,689

Total Revenue 1,102 1,188 1,437 1,394 1,654

Tax Revenue 909 1,006 1,275 1,189 1,416

Income Tax 173 206 283 258 321

Taxes on Goods and Services 520 572 689 672 774

Taxes on External Trade 217 228 303 260 321

Non Tax Revenue 143 132 163 149 174

Provincial Councils Tax Sharing and Devolved Revenue 50 51 - 56 64

Grants 16 16 32 28 35

Total Expenditure 1,607 1,720 1,986 1,922 2,210

Recurrent 1,181 1,256 1,328 1,386 1,525

Salaries and Wages 386 432 411 478 558

Other Goods and Services 135 108 192 152 163

Interest 408 446 441 443 425

Subsidies and Transfers 251 270 285 313 379

Public Investment 444 481 669 553 696

Education and Health 46 56 74 78 120

Infrastructure 398 425 594 475 576

Other (18) (17) (11) (17) (11)

Revenue Surplus(+)/Deficit (-) (80) (68) 109 8 129

Budget Deficit (489) (516) (516) (500) (521)

Total Financing 489 516 516 500 521

Total Foreign Financing 181 80 236 260 251

Foreign Borrowings 235 179 234 173 258

Foreign Borrowings-Gross 365 179 332 370 453

Debt Repayments (184) (99) (96) (110) (202)

Foreign Commercial 130 - 98 197 195

Total Domestic Financing 308 436 281 240 270

Non-bank Borrowings 71.00 83.00 129.30 120.00 160.00

Foreign Investments in T Bills / Bonds 106.00 56.00 51.30 39.00 40.00

Bank Borrowings 132.00 297.00 100.00 81.00 70.00

Revenue and Grants/GDP (%) 14.70 13.90 14.80 14.40 14.90

Revenue/GDP (%) 14.50 13.70 14.50 14.10 14.60

Tax/GDP (%) 12.00 11.60 12.80 12.00 12.50

Expenditure/GDP (%) 21.20 19.80 20.00 19.40 19.50

Current Expenditure/GDP (%) 15.60 14.50 13.40 14.00 13.50

Public Investment/GDP (%) 5.90 5.50 6.70 5.60 6.20

Revenue Surplus (+)/ Deficit (-)/ GDP (%) (1.00) (0.80) 1.10 0.10 1.10

Budget Deficit/ GDP (%) (Excluding Grants) (6.40) (5.90) (5.20) (5.00) (4.60)

Source:- Budget Speech 2015

NDB Securities (Pvt) Ltd 2015 Budget Proposal Highlights 24

th

October 2014 8

Mrs. Prasansani Mendis Chief Executive Officer prasansini@ndbs.lk 011 2131005

Sales Branches

Head Office CSE

Mr. Gihan R. Cooray gihan@ndbs.lk 011 2131010 Mr. Sujeewa Athukorala sujeewa@ndbs.lk 011 3135495

Mr. Jayantha Samarasinghe jayantha@ndbs.lk 011 2131011 Mrs. Shiromi De Silva shiromi@ndbs.lk 011 2335054

Mr. Aroos Faleel aroosfaleel@ndbs.lk 011 2131012 Kiribathgoda

Mr. Uditha Silva uditha@ndbs.lk 011 2131016 Mr. Gayan Pathirana gayan@ndbs.lk 011 2907515

Mr. Taamara De Silva taamara@ndbs.lk 011 2131018 Galle

Mr. Imran Reyal imran@ndbs.lk 012 2131021 Mr. Upul Hettiarachchi upul@ndbs.lk 091 2225447

Mr. Ramesh Anthony ramesh@ndbs.lk 011 2131023 Gampaha

Mr. Nimal Kumara kumara@ndbs.lk 011 2131022 Mr. Chamesh Hettiarachchi chamesh@ndbs.lk 033 2231117

Mr. Sanjaya Prabath sanjaya@ndbs.lk 011 2131024 Kaluthara

Mr. Akram Thadani akram@ndbs.lk 011 2131025 Mr. Ranganath Wijethunge ranganath@ndbs.lk 034 2221589

Mr. Ishanka Fernando ishanka@ndbs.lk 011 2131054 Mr. A A Jeewantha jeewantha@ndbs.lk 034 2221589

Mr. Harsha Sritharan harsha@ndbs.lk 011 2131017 Jaffna

Mr. Sajed Sallay sajed@ndbs.lk 011 2131019 Mr. C Padmanathan chandru@ndbs.lk 021 2224978

Mr. Stefan De Alwis stefan@ndbs.lk 011 2131015 Ms. Sanjika Ranjithkumar sanjika@ndbs.lk 021 5671155

Mr. S. Vibushan

vibusha.@ndbs.lk 021 5671155

Rathnapura

Operations Mr. Uddeepa Peiris uddeepa@ndbs.lk 045 2230800

Ampara

Contacts Us mail@ndbs.lk 011 2131000 Mr. Ravi De Mel ravi@ndbs.lk 063 2224245

NDB Securities (Pvt) Ltd

5th Floor, NDB Building,

40, Nawam Mawatha, Colombo 02

NDB Securities (Pvt) Ltd

NDB Securities (Pvt) Ltd 2015 Budget Proposal Highlights 24

th

October 2014 9

Disclaimer

This document is based on information obtained from sources believed to be reliable, but NDB Securities (Pvt)

Ltd., (NDBS) accepts no responsibility or makes no warranties or representations, express or implied, as to

whether the information provided in this document is accurate, complete or up-to-date. Furthermore, no

representation or warranty is made by NDBS as to the sufficiency, relevance, importance, appropriateness,

completeness or comprehensiveness of the information contained herein for any specific purpose. Prices,

opinions and estimates reflect our judgment on the date of original publication and are subject to change at any

time without notice. NDBS reserves the right to change their opinion at any point in time as they deem

necessary. There is no guarantee that the target price for the stock will be met or that predicted business results

for the company will be met. NDBS accepts no liability whatsoever for any direct or consequential loss or

damage arising from any use of these reports or their contents. References to tax are based on our

understanding of current law and Inland Revenue practices, which may change from time to time.

Any recommendation contained in this document does not have regard to the specific investment objectives,

financial situation and the particular needs of any specific addressee. This document is for the information of

addressee only and is not to be taken as substitution for the exercise of judgment by addressee. The information

contained in any research report does not constitute an offer to sell securities or the solicitation of an offer to

buy, or recommendation for investment in, any securities within Sri Lanka or any other jurisdiction. The

information in any research report is not intended as financial advice. Moreover, none of the research reports is

intended as a prospectus within the meaning of the applicable laws of any jurisdiction and none of the research

reports is directed to any person in any country in which the distribution of such research report is unlawful.

Past results do not guarantee future performance. NDBS cautions that any forward-looking statements in any

research report implied by such words as anticipate, believe, estimate, expect, and similar expressions

as they relate to a company or its management are not guarantees of future performance. The investments in

undertakings, securities or other financial instruments involve risks. Any discussion of the risks contained

herein should not be considered to be a disclosure of all risks or complete discussion of the risks which are

mentioned.

NDBS and its associates, their directors, and/or employees may have positions in, and may effect transactions in

securities mentioned herein and may also perform or seek to perform broking, investment banking and other

financial services for these companies.

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (120)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Corporate Finance MCQsDocument0 pageCorporate Finance MCQsonlyjaded4655100% (1)

- Joe Schroeder: The New Normal of Network MarketingDocument4 pagesJoe Schroeder: The New Normal of Network MarketingRebecca JohnsonPas encore d'évaluation

- Business PlanDocument20 pagesBusiness PlanAnonymous M7xjslU50% (2)

- Long-Term Construction QuizDocument4 pagesLong-Term Construction QuizCattleyaPas encore d'évaluation

- Girl Scouts Cookies Marketing Online Case StudyDocument2 pagesGirl Scouts Cookies Marketing Online Case Studyg_rayPas encore d'évaluation

- Project SelectionDocument17 pagesProject SelectionCecilia Camarena QuispePas encore d'évaluation

- Edible Oil Industry PakistanDocument3 pagesEdible Oil Industry PakistanZain AGaffarPas encore d'évaluation

- A Study of Customer Satisfaction Toward Service Quality in Retail With Referance To Reliance SmartDocument75 pagesA Study of Customer Satisfaction Toward Service Quality in Retail With Referance To Reliance SmartAkanksha DeepPas encore d'évaluation

- 03 September 2015 PDFDocument9 pages03 September 2015 PDFRandora LkPas encore d'évaluation

- Wei 20150904 PDFDocument18 pagesWei 20150904 PDFRandora LkPas encore d'évaluation

- Weekly Foreign Holding & Block Trade Update: Net Buying Net SellingDocument4 pagesWeekly Foreign Holding & Block Trade Update: Net Buying Net SellingRandora LkPas encore d'évaluation

- Global Market Update - 04 09 2015 PDFDocument6 pagesGlobal Market Update - 04 09 2015 PDFRandora LkPas encore d'évaluation

- Global Market Update - 04 09 2015 PDFDocument6 pagesGlobal Market Update - 04 09 2015 PDFRandora LkPas encore d'évaluation

- Weekly Update 04.09.2015 PDFDocument2 pagesWeekly Update 04.09.2015 PDFRandora LkPas encore d'évaluation

- Results Update Sector Summary - Jun 2015 PDFDocument2 pagesResults Update Sector Summary - Jun 2015 PDFRandora LkPas encore d'évaluation

- Sri0Lanka000Re0ounting0and0auditing PDFDocument44 pagesSri0Lanka000Re0ounting0and0auditing PDFRandora LkPas encore d'évaluation

- Daily 01 09 2015 PDFDocument4 pagesDaily 01 09 2015 PDFRandora LkPas encore d'évaluation

- Press 20150831ebDocument2 pagesPress 20150831ebRandora LkPas encore d'évaluation

- CCPI - Press Release - August2015 PDFDocument5 pagesCCPI - Press Release - August2015 PDFRandora LkPas encore d'évaluation

- Microfinance Regulatory Model PDFDocument5 pagesMicrofinance Regulatory Model PDFRandora LkPas encore d'évaluation

- ICRA Lanka Assigns (SL) BBB-rating With Positive Outlook To Sanasa Development Bank PLCDocument3 pagesICRA Lanka Assigns (SL) BBB-rating With Positive Outlook To Sanasa Development Bank PLCRandora LkPas encore d'évaluation

- Press 20150831ea PDFDocument1 pagePress 20150831ea PDFRandora LkPas encore d'évaluation

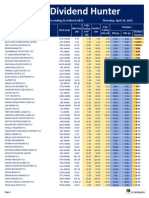

- Dividend Hunter - Mar 2015 PDFDocument7 pagesDividend Hunter - Mar 2015 PDFRandora LkPas encore d'évaluation

- Earnings & Market Returns Forecast - Jun 2015 PDFDocument4 pagesEarnings & Market Returns Forecast - Jun 2015 PDFRandora LkPas encore d'évaluation

- Results Update For All Companies - Jun 2015 PDFDocument9 pagesResults Update For All Companies - Jun 2015 PDFRandora LkPas encore d'évaluation

- Daily - 23 04 2015 PDFDocument4 pagesDaily - 23 04 2015 PDFRandora LkPas encore d'évaluation

- Dividend Hunter - Mar 2015 PDFDocument7 pagesDividend Hunter - Mar 2015 PDFRandora LkPas encore d'évaluation

- Dividend Hunter - Apr 2015 PDFDocument7 pagesDividend Hunter - Apr 2015 PDFRandora LkPas encore d'évaluation

- Janashakthi Insurance Company PLC - (JINS) - Q4 FY 14 - SELL PDFDocument9 pagesJanashakthi Insurance Company PLC - (JINS) - Q4 FY 14 - SELL PDFRandora LkPas encore d'évaluation

- Chevron Lubricants Lanka PLC (LLUB) - Q4 FY 14 - SELL PDFDocument9 pagesChevron Lubricants Lanka PLC (LLUB) - Q4 FY 14 - SELL PDFRandora LkPas encore d'évaluation

- N D B Securities (PVT) LTD, 5 Floor, # 40, NDB Building, Nawam Mawatha, Colombo 02. Tel: +94 11 2131000 Fax: +9411 2314180Document5 pagesN D B Securities (PVT) LTD, 5 Floor, # 40, NDB Building, Nawam Mawatha, Colombo 02. Tel: +94 11 2131000 Fax: +9411 2314180Randora LkPas encore d'évaluation

- Earnings Update March Quarter 2015 05 06 2015 PDFDocument24 pagesEarnings Update March Quarter 2015 05 06 2015 PDFRandora LkPas encore d'évaluation

- CRL Corporate Update - 22 04 2015 - Upgrade To A Strong BUY PDFDocument12 pagesCRL Corporate Update - 22 04 2015 - Upgrade To A Strong BUY PDFRandora LkPas encore d'évaluation

- GIH Capital Monthly - Mar 2015 PDFDocument11 pagesGIH Capital Monthly - Mar 2015 PDFRandora LkPas encore d'évaluation

- BRS Monthly (March 2015 Edition) PDFDocument8 pagesBRS Monthly (March 2015 Edition) PDFRandora LkPas encore d'évaluation

- Weekly Foreign Holding & Block Trade Update - 02 04 2015 PDFDocument4 pagesWeekly Foreign Holding & Block Trade Update - 02 04 2015 PDFRandora LkPas encore d'évaluation

- The Morality of Capitalism Sri LankiaDocument32 pagesThe Morality of Capitalism Sri LankiaRandora LkPas encore d'évaluation

- Daily Stock Watch 08.04.2015 PDFDocument9 pagesDaily Stock Watch 08.04.2015 PDFRandora LkPas encore d'évaluation

- The Works of John Stuart Mill - Tomo 16Document561 pagesThe Works of John Stuart Mill - Tomo 16CaboclobrasPas encore d'évaluation

- Questionnare MainDocument12 pagesQuestionnare Mainmohd junedPas encore d'évaluation

- SSRN Id3309920Document10 pagesSSRN Id3309920Faqiatul Maria WahariniPas encore d'évaluation

- Ch06 Solutions Manual 2015-07-16Document34 pagesCh06 Solutions Manual 2015-07-16Prema Khatwani KesariyaPas encore d'évaluation

- Trabajo Mercado de Capitales 9 de AbrilDocument28 pagesTrabajo Mercado de Capitales 9 de AbrilMauricio Alonso Jaramillo AlvarezPas encore d'évaluation

- Finance L5Document40 pagesFinance L5Rida RehmanPas encore d'évaluation

- Example 3BA21 033130050 TMA1Document10 pagesExample 3BA21 033130050 TMA1Hamshavathini YohoratnamPas encore d'évaluation

- Semester-1 Bi-102 - EconomicsDocument3 pagesSemester-1 Bi-102 - EconomicsYaniPas encore d'évaluation

- Nagarjuna LTDDocument6 pagesNagarjuna LTDkiranPas encore d'évaluation

- A Case Study On IKEADocument28 pagesA Case Study On IKEAArno PrimadityaPas encore d'évaluation

- Financial Management Chapter FourDocument76 pagesFinancial Management Chapter Fourbiko ademPas encore d'évaluation

- Finished ProjectDocument74 pagesFinished ProjectMohammed AfnanPas encore d'évaluation

- Branch Less BankingDocument20 pagesBranch Less BankingBinay KumarPas encore d'évaluation

- Computable General EquilibriumDocument4 pagesComputable General Equilibriumjohn.geek2014Pas encore d'évaluation

- Sales Tax Past Papers - Practical Questions - 2011 To 2022Document25 pagesSales Tax Past Papers - Practical Questions - 2011 To 2022Arif AliPas encore d'évaluation

- Offer or ProposalDocument8 pagesOffer or ProposalZeeshan Ali100% (1)

- Exercises Revenue and Labor Budgeting-University SettingDocument14 pagesExercises Revenue and Labor Budgeting-University SettingJenelyn UbananPas encore d'évaluation

- Equitymaster's Secrets: The Biggest Lessons From Our Entire 20 Year Investing Journey. .Document20 pagesEquitymaster's Secrets: The Biggest Lessons From Our Entire 20 Year Investing Journey. .Mithilesh WaghmarePas encore d'évaluation

- No Demand: ServicesDocument2 pagesNo Demand: ServicesJamilaPas encore d'évaluation

- Marketing ColgateDocument21 pagesMarketing ColgateTanuwePas encore d'évaluation

- NestleDocument7 pagesNestleAakash1994sPas encore d'évaluation

- PC1 JozaraDocument40 pagesPC1 JozaraFarhat Durrani0% (1)