Académique Documents

Professionnel Documents

Culture Documents

Weekly Trends: Earnings To The Rescue

Transféré par

dpbasicTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Weekly Trends: Earnings To The Rescue

Transféré par

dpbasicDroits d'auteur :

Formats disponibles

Weekly Trends

Ryan Lewenza, CFA, CMT, Private Client Strategist October 24, 2014

Please read domestic and foreign disclosure/risk information beginning on page 5

Raymond James Ltd. 5300-40 King St W. | Toronto ON Canada M5H 3Y2.

2200-925 West Georgia Street | Vancouver BC Canada V6C 3L2.

Earnings to the Rescue

The Q3/14 earnings season is now in full gear with roughly 300 companies in

the S&P 500 Index (S&P 500) reporting earnings over the next two weeks. So

far, results have been solid, which we expect to continue over the reporting

season.

Of the 178 companies to report so far, 142 companies have reported earnings

above analysts estimates, resulting in a beat rate of 80%. This is well above

recent quarters and the long-term average of 62%.

S&P 500 Q3/14 earnings are forecasted to be US$29.03/share, which would

equate to growth of 6.4% Y/Y. We believe the final growth rate may actually

come in stronger, possibly in the 8-9% range, as weve witnessed a consistent

trend of upside earnings surprises over the last year.

More importantly, S&P 500 quarterly earnings are set to hit a new all-time

high. While the bears like to claim that the Feds quantitative easing (QE)

policies are the only thing supporting the equity markets, they must not be

looking at corporate earnings, which have been very strong and are hitting new

all-time highs.

We expect corporate earnings to remain healthy in the coming quarters, which

should be supportive to equities.

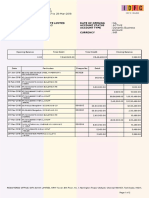

Equity Market YTD Returns (%)

Canadian Sector Curr. Wt Recommendation

Consumer Di screti onary 5.9 Market wei ght

Consumer Stapl es 3.1 Market wei ght

Energy 24.3 Overwei ght

Fi nanci al s 35.4 Overwei ght

Heal th Care 3.1 Underwei ght

Industri al s 8.7 Overwei ght

Informati on Technol ogy 1.9 Overwei ght

Materi al s 10.9 Market wei ght

Tel ecom 4.6 Underwei ght

Uti l i ti es 2.0 Underwei ght

Technical Considerations Level Reading

S&P/TSX Composi te 14,486.8

50-DMA 15,093.1 Downtrend

200-DMA 14,674.0 Downtrend

RSI (14-day) 45.0 Neutral

Source: Bl oomberg, Raymond James Ltd.

-2.1

-7.3

-0.1

-0.1

-4.1

5.5

-0.6

6.4

-13 -8 -3 3 8

MSCI EM

MSCI EAFE

MSCI Europe

MSCI World

Russell 2000

S&P 500

S&P/TSX Small Cap

S&P/TSX Comp

11,000

11,500

12,000

12,500

13,000

13,500

14,000

14,500

15,000

15,500

16,000

Jul-12 Jan-13 Jul-13 Jan-14 Jul-14

S&P/TSX

50-DMA

200-DMA

Chart of the Week

Q3/14 Consensus Estimates Are Pointing to 6.4% Y/Y Growth For The S&P 500.

We Believe Earnings Could Come In Closer To 8-9% Y/Y.

Source: Bloomberg, Raymond James Ltd.

2.2%

5.2%

5.0%

5.4%

8.6%

9.2%

2.6%

9.2%

6.4%

11.7%

0%

2%

4%

6%

8%

10%

12%

14%

Q3/12 Q4/12 Q1/13 Q2/13 Q3/13 Q4/13 Q1/14 Q2/14 Q3/14F Q4/14F

S&P 500 EPS Growth Rate Y/Y

Weekly Trends October 24, 2014 | Page 2 of 4

Q3/14 Earnings Update

The Q3/14 earnings season is now in full gear with roughly 300 companies in the S&P

500 reporting earnings over the next two weeks. So far, results have been solid,

which we expect to continue over the reporting season. As weve conveyed in

reports over the last few months, corporate earnings are likely to take on a more

important role with valuations having expanded and the US Federal Reserve (Fed)

likely to end its asset purchases at month-end. We believe the equity markets are

slowly transitioning from one supported by the Feds QE policies to one based on

and driven by fundamentals. If, as we expect, corporate earnings continue to grow,

then this should be supportive to equities. Highlights of the US Q3/14 earnings

season include:

While only a third of the way through the season, results have been above

expectations. Of the 178 companies to report so far, 142 companies have

reported earnings above analysts estimates, resulting in a beat rate of

80%. This is well above recent quarters and the long-term average of 62%.

S&P 500 Q3/14 earnings are currently forecasted to be US$29.03/share,

which would equate to growth of 6.4% Y/Y. This follows the 9.2% growth

rate for Q2/14 and continues the trend of positive earnings growth since

the mid-2012 earnings slowdown. We believe the final growth rate may

actually come in stronger, possibly in the 8-9% range, as weve witnessed a

consistent trend of upside earnings surprises over the last year.

More importantly, S&P 500 quarterly earnings are set to hit a new all-time

high. While the bears like to claim that the Feds QE policies are the only

thing supporting the equity markets, they must not be looking at corporate

earnings, which have been very strong and are hitting new all-time highs.

From a sector perspective, nine of the 10 sectors are expected to post

positive earnings growth, with the materials and health care sectors posting

the highest growth rates.

Potential headwinds to earnings that we are monitoring include the impact

of a stronger US dollar and the deceleration of economic momentum in

Europe and Asia. These factors could weigh on the large US multinationals.

In sum, Q3/14 corporate earnings are on track to post a high-single digit growth rate,

which is supportive for equities and, in our opinion, not yet receiving the full

attention it deserves by the financial media.

Consensus is Pointing to 6.4% Y/Y Growth 80% of S&P 500 Companies Have Beaten Estimates

Source: Bloomberg, Raymond James Ltd.

2.2%

5.2%

5.0%

5.4%

8.6%

9.2%

2.6%

9.2%

6.4%

11.7%

0%

2%

4%

6%

8%

10%

12%

14%

Q3/12 Q4/12 Q1/13 Q2/13 Q3/13 Q4/13 Q1/14 Q2/14 Q3/14F Q4/14F

S&P 500 EPS Growth Rate Y/Y

70%

72%

71%

73% 73%

71%

74% 74% 74%

75%

80%

60%

65%

70%

75%

80%

Q1/12 Q2/12 Q3/12 Q4/12 Q1/13 Q2/13 Q3/13 Q4/13 Q1/14 Q2/14 Q3/14

S&P 500 EPS Beat Rate

Long-term Average = 62%

S&P 500 Earnings Are Projected

To Hit a New All-Time High in Q3/14

$0.00

$5.00

$10.00

$15.00

$20.00

$25.00

$30.00

$35.00

Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 Mar-14

S&P 500 Quarterly Earnings Per Share

Q3 $29.03

Weekly Trends October 24, 2014 | Page 3 of 4

Valuation Update

We also wanted to provide an update on where North American (NA) valuations

currently stand. Overall, we would characterize the NA markets as fairly valued, with

the S&P 500 and S&P/TSX Composite Index (S&P/TSX) trading in line with their long-

term averages.

One technical approach that we employ is Elliot Wave, which posits that markets

trade in repeatable patterns of five primary waves. Based on our Elliot Wave count,

we believe that wave three commenced on September 2011. From that low, the S&P

500 gained 78%, with its trailing P/E increasing from 11.9x to 17.5x today. That is a

sizable increase in the multiple, with some citing the current valuation as being

worrisome for the equity markets. While we agree that valuations have expanded

markedly, which is one factor in our call for more modest rates of return over the

next few years, we do not agree with the assertion that markets are steeply

overvalued and likely to peak soon. Consider this:

While valuations have increased they are now just slightly above their long-

term averages. For the S&P 500, the long-term average is 16.4x, with the

current multiple just 1 point above the average. For the S&P/TSX, it

currently trades 18.4x, which is just below its long-term average of 18.9x.

Given valuations are trading in-line with their long-term averages, we would

characterize the markets as fairly valued at present.

On forward earnings estimates, the S&P 500 and S&P/TSX trade at more

reasonable P/Es of 16.3x and 15.5x, respectively.

We believe stocks are attractively valued when compared to bonds.

Currently the earnings yield (inverse of the P/E) for the S&P 500 is 5.9%

versus the 10-year Treasury yield of 2.3%, resulting in a historically high

spread between the two.

Finally, we note that equity markets rarely peak at their average, often

overshooting to the upside. In fact, we have found that the S&P 500 has

historically peaked in the 19x to 21x range. We believe further upside in

equities will likely be driven by earnings growth, but we cannot rule out the

potential for further multiple expansion based on historical trends.

Valuations have increased with this strong bull-run. However, they are currently just

in line with their long-term averages and are below typical peak levels.

S&P 500 P/E Has Increased Markedly to 17.5x However, That is Just 1 Point Above the Long-term Avg

Source: Bloomberg, Raymond James Ltd.

11

12

13

14

15

16

17

18

19

Jan-11 Jul-11 Jan-12 Jul-12 Jan-13 Jul-13 Jan-14 Jul-14

S&P 500 Trailing P/E

0

5

10

15

20

25

30

35

'54 '59 '64 '69 '74 '79 '84 '89 '94 '99 '04 '09 '14

S&P 500 Trailing P/E

Long-term Average

= 16.4x

Market Peak S&P 500 P/E (LTM)

Date At Market Peak

12-Dec-61 22.4

9-Feb-66 18.0

29-Nov-68 18.0

11-Jan-73 19.5

28-Nov-80 9.1

25-Aug-87 22.5

17-Jul-98 27.3

24-Mar-00 30.6

12-Oct-07 17.5

Average 20.5

Avg Ex Mar 00 19.3

Median 19.5

Historically the S&P 500 Has Peaked

at an Average/Median of 20.5x/19.5x

Weekly Trends October 24, 2014 | Page 4 of 4

Important Investor Disclosures

Complete disclosures for companies covered by Raymond James can be viewed at: www.raymondjames.ca/researchdisclosures.

This newsletter is prepared by the Private Client Services team (PCS) of Raymond James Ltd. (RJL) for distribution to RJLs retail clients. It is not a

product of the Research Department of RJL.

All opinions and recommendations reflect the judgement of the author at this date and are subject to change. The authors recommendations may

be based on technical analysis and may or may not take into account information contained in fundamental research reports published by RJL or its

affiliates. Information is from sources believed to be reliable but accuracy cannot be guaranteed. It is for informational purposes only. It is not

meant to provide legal or tax advice; as each situation is different, individuals should seek advice based on their circumstances. Nor is it an offer to

sell or the solicitation of an offer to buy any securities. It is intended for distribution only in those jurisdictions where RJL is registered. RJL, its

officers, directors, agents, employees and families may from time to time hold long or short positions in the securities mentioned herein and may

engage in transactions contrary to the conclusions in this newsletter. RJL may perform investment banking or other services for, or solicit

investment banking business from, any company mentioned in this newsletter. Securities offered through Raymond James Ltd., Member-Canadian

Investor Protection Fund. Financial planning and insurance offered through Raymond James Financial Planning Ltd., not a Member-Canadian

Investor Protection Fund.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual funds. Please read the prospectus before

investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The results presented

should not and cannot be viewed as an indicator of future performance. Individual results will vary and transaction costs relating to investing in

these stocks will affect overall performance.

Information regarding High, Medium, and Low risk securities is available from your Financial Advisor.

RJL is a member of Canadian Investor Protection Fund. 2014 Raymond James Ltd.

Vous aimerez peut-être aussi

- Weekly Trends Aug 15Document5 pagesWeekly Trends Aug 15dpbasicPas encore d'évaluation

- Weekly Trends April 10, 2015Document4 pagesWeekly Trends April 10, 2015dpbasicPas encore d'évaluation

- Weekly Market Commentary 6-26-2012Document4 pagesWeekly Market Commentary 6-26-2012monarchadvisorygroupPas encore d'évaluation

- Weekly Market Commentary 3-512-2012Document4 pagesWeekly Market Commentary 3-512-2012monarchadvisorygroupPas encore d'évaluation

- Weekly Commentary 4.14.14Document3 pagesWeekly Commentary 4.14.14Income Solutions Wealth ManagementPas encore d'évaluation

- Weekly Market Commentary 4/15/2013Document4 pagesWeekly Market Commentary 4/15/2013monarchadvisorygroupPas encore d'évaluation

- Weekly Trends December 11, 2015Document4 pagesWeekly Trends December 11, 2015dpbasicPas encore d'évaluation

- Weekly Market Commentary 10-10-11Document3 pagesWeekly Market Commentary 10-10-11monarchadvisorygroupPas encore d'évaluation

- Market Analysis August 2021Document19 pagesMarket Analysis August 2021Thanh Trịnh BáPas encore d'évaluation

- Weekly Trends October 2, 2015Document4 pagesWeekly Trends October 2, 2015dpbasicPas encore d'évaluation

- Annual Report: March 31, 2011Document23 pagesAnnual Report: March 31, 2011VALUEWALK LLCPas encore d'évaluation

- Weekly Market Commentary 4-11-12Document3 pagesWeekly Market Commentary 4-11-12monarchadvisorygroupPas encore d'évaluation

- 2014 q4 Crescent FinalDocument10 pages2014 q4 Crescent FinalCanadianValue100% (1)

- First Trust WESBURY July 2014Document2 pagesFirst Trust WESBURY July 2014viejudaPas encore d'évaluation

- LPL 2014 Mid-Year OutlookDocument15 pagesLPL 2014 Mid-Year Outlookkbusch32Pas encore d'évaluation

- Weekly Market Commentary 02-14-12Document3 pagesWeekly Market Commentary 02-14-12monarchadvisorygroupPas encore d'évaluation

- Stock Market Commentary February 2015Document9 pagesStock Market Commentary February 2015Edward C LanePas encore d'évaluation

- U.S. Equity Strategy (What's Driving The Equity Market) - September 14, 2012Document4 pagesU.S. Equity Strategy (What's Driving The Equity Market) - September 14, 2012dpbasicPas encore d'évaluation

- Weekly Market Commentary 03302015Document5 pagesWeekly Market Commentary 03302015dpbasicPas encore d'évaluation

- Q4 14 UpdateDocument6 pagesQ4 14 UpdatedpbasicPas encore d'évaluation

- Growth Equity Portfolio Fourth Quarter Review December 31st, 2016Document4 pagesGrowth Equity Portfolio Fourth Quarter Review December 31st, 2016Anonymous Ht0MIJPas encore d'évaluation

- Accord Capital Equities Corporation: Outlook For Week XXIV - June 13 To 17 - TD 114-118Document2 pagesAccord Capital Equities Corporation: Outlook For Week XXIV - June 13 To 17 - TD 114-118JC CalaycayPas encore d'évaluation

- Delarue ErDocument98 pagesDelarue ErShawn PantophletPas encore d'évaluation

- Market Analysis Nov 2022Document12 pagesMarket Analysis Nov 2022Muhammad SatrioPas encore d'évaluation

- Weekly Market Commentary 06-27-2011Document2 pagesWeekly Market Commentary 06-27-2011Jeremy A. MillerPas encore d'évaluation

- Mid-Year Outlook 2014 Abridged: Investor's Almanac Field NotesDocument4 pagesMid-Year Outlook 2014 Abridged: Investor's Almanac Field NotesJanet BarrPas encore d'évaluation

- Investment Commentary: Market and Performance SummaryDocument20 pagesInvestment Commentary: Market and Performance SummaryCanadianValuePas encore d'évaluation

- Weekly Trends Nov 21Document5 pagesWeekly Trends Nov 21dpbasicPas encore d'évaluation

- Weekly Market Commentary 3-17-2014Document4 pagesWeekly Market Commentary 3-17-2014monarchadvisorygroupPas encore d'évaluation

- Spring 2014 HCA Letter FinalDocument4 pagesSpring 2014 HCA Letter FinalDivGrowthPas encore d'évaluation

- Weekly Market Commentary 03092015Document5 pagesWeekly Market Commentary 03092015dpbasicPas encore d'évaluation

- Weekly Trends March 10, 2016Document5 pagesWeekly Trends March 10, 2016dpbasicPas encore d'évaluation

- GS Market Know How 1Q2015Document20 pagesGS Market Know How 1Q2015asdfgh132Pas encore d'évaluation

- TomT Stock Market Model October 30 2011Document20 pagesTomT Stock Market Model October 30 2011Tom TiedemanPas encore d'évaluation

- Sgreits 020911Document18 pagesSgreits 020911Royston Tan Keng SanPas encore d'évaluation

- Goldman - July 25Document27 pagesGoldman - July 25Xavier Strauss100% (2)

- Weekly Market Commentary 04132015Document4 pagesWeekly Market Commentary 04132015dpbasicPas encore d'évaluation

- Lane Asset Management Stock Market and Economic Commentary February 2016Document11 pagesLane Asset Management Stock Market and Economic Commentary February 2016Edward C LanePas encore d'évaluation

- How Long Will Profit Margins Continue To Defy The Skeptics?: MarketDocument4 pagesHow Long Will Profit Margins Continue To Defy The Skeptics?: MarketdpbasicPas encore d'évaluation

- x20140206 SM WMT Downgrade UnderperformDocument25 pagesx20140206 SM WMT Downgrade UnderperformErisiePas encore d'évaluation

- July 15 Market CommentaryDocument4 pagesJuly 15 Market CommentaryIncome Solutions Wealth ManagementPas encore d'évaluation

- Stock Market Commentary June 2016Document10 pagesStock Market Commentary June 2016Edward C LanePas encore d'évaluation

- Spin OffsDocument5 pagesSpin Offseurodental5923100% (1)

- Weekly Market Commentary 06222015Document6 pagesWeekly Market Commentary 06222015dpbasicPas encore d'évaluation

- Lane Asset Management 2014 Review and 2015 Fearless ForecastDocument16 pagesLane Asset Management 2014 Review and 2015 Fearless ForecastEdward C LanePas encore d'évaluation

- Market Balance - Daily For August 11, 2011Document3 pagesMarket Balance - Daily For August 11, 2011JC CalaycayPas encore d'évaluation

- The Outlook: Tech KnowledgeDocument8 pagesThe Outlook: Tech KnowledgeNorbertCampeauPas encore d'évaluation

- Weekly Market Commentary: Lies, Damn Lies, and ChartsDocument4 pagesWeekly Market Commentary: Lies, Damn Lies, and ChartsmonarchadvisorygroupPas encore d'évaluation

- Why drilling is key to jiujitsu progression and injury preventionDocument11 pagesWhy drilling is key to jiujitsu progression and injury preventionKeshav PitaniPas encore d'évaluation

- Weekly Market CommentaryDocument3 pagesWeekly Market Commentarycaitmary10Pas encore d'évaluation

- Valuations Suggest Extremely Overvalued MarketDocument9 pagesValuations Suggest Extremely Overvalued Marketstreettalk700Pas encore d'évaluation

- Market Analysis Feb 2022 (Updated)Document16 pagesMarket Analysis Feb 2022 (Updated)Penguin DadPas encore d'évaluation

- Market Analysis Aug 2023Document17 pagesMarket Analysis Aug 2023nktradzPas encore d'évaluation

- Santa Claus RallyDocument7 pagesSanta Claus Rallytanner3052Pas encore d'évaluation

- Third Point (Dan Loeb) Q3 2018 Investor Letter: The Good PlaceDocument8 pagesThird Point (Dan Loeb) Q3 2018 Investor Letter: The Good PlaceYui ChuPas encore d'évaluation

- TomT Stock Market Model 2012-05-20Document20 pagesTomT Stock Market Model 2012-05-20Tom TiedemanPas encore d'évaluation

- Weekly Market Commentary 3/18/2013Document4 pagesWeekly Market Commentary 3/18/2013monarchadvisorygroupPas encore d'évaluation

- 1Q 2019 PresentationDocument8 pages1Q 2019 Presentationaugtour4977Pas encore d'évaluation

- Standard Correction or Bull Trap?: ST THDocument7 pagesStandard Correction or Bull Trap?: ST THClay Ulman, CFP®100% (1)

- BMO ETF Portfolio Strategy Report: Playing Smart DefenseDocument7 pagesBMO ETF Portfolio Strategy Report: Playing Smart DefensedpbasicPas encore d'évaluation

- SSRN Id3132563Document13 pagesSSRN Id3132563dpbasicPas encore d'évaluation

- The Race of Our Lives RevisitedDocument35 pagesThe Race of Our Lives RevisiteddpbasicPas encore d'évaluation

- Otlk-Bklt-Ret-A4 1711Document48 pagesOtlk-Bklt-Ret-A4 1711dpbasicPas encore d'évaluation

- Credit Suisse Investment Outlook 2018Document64 pagesCredit Suisse Investment Outlook 2018dpbasic100% (1)

- Thackray Newsletter 2018 08 AugustDocument9 pagesThackray Newsletter 2018 08 AugustdpbasicPas encore d'évaluation

- GMOMelt UpDocument13 pagesGMOMelt UpHeisenberg100% (2)

- Etf PSR q4 2017 eDocument7 pagesEtf PSR q4 2017 edpbasicPas encore d'évaluation

- Fidelity Multi-Sector Bond Fund - ENDocument3 pagesFidelity Multi-Sector Bond Fund - ENdpbasicPas encore d'évaluation

- Thackray Newsletter 2017 09 SeptemberDocument9 pagesThackray Newsletter 2017 09 SeptemberdpbasicPas encore d'évaluation

- 2018 OutlookDocument18 pages2018 OutlookdpbasicPas encore d'évaluation

- Retirement 20/20: The Right Advice Can Bring Your Future Into FocusDocument12 pagesRetirement 20/20: The Right Advice Can Bring Your Future Into FocusdpbasicPas encore d'évaluation

- Thackray Newsletter 2017 09 SeptemberDocument4 pagesThackray Newsletter 2017 09 SeptemberdpbasicPas encore d'évaluation

- TL Secular Outlook For Global GrowthDocument12 pagesTL Secular Outlook For Global GrowthdpbasicPas encore d'évaluation

- Thackray Newsletter 2017 07 JulyDocument8 pagesThackray Newsletter 2017 07 JulydpbasicPas encore d'évaluation

- Thackray Newsletter 2017 01 JanuaryDocument11 pagesThackray Newsletter 2017 01 JanuarydpbasicPas encore d'évaluation

- Retirement 20/20: The Right Advice Can Bring Your Future Into FocusDocument12 pagesRetirement 20/20: The Right Advice Can Bring Your Future Into FocusdpbasicPas encore d'évaluation

- Thackray Seasonal Report Storm Warning 2017-May-05Document12 pagesThackray Seasonal Report Storm Warning 2017-May-05dpbasic100% (1)

- GeopoliticalBriefing 22nov2016Document6 pagesGeopoliticalBriefing 22nov2016dpbasicPas encore d'évaluation

- TL What It Would Take For U.S. Economy To GrowDocument8 pagesTL What It Would Take For U.S. Economy To GrowdpbasicPas encore d'évaluation

- Hot Charts 9feb2017Document2 pagesHot Charts 9feb2017dpbasicPas encore d'évaluation

- Hot Charts 17nov2016Document2 pagesHot Charts 17nov2016dpbasicPas encore d'évaluation

- Boc Policy MonitorDocument3 pagesBoc Policy MonitordpbasicPas encore d'évaluation

- Special Report 30jan2017Document5 pagesSpecial Report 30jan2017dpbasicPas encore d'évaluation

- From Low Volatility To High GrowthDocument4 pagesFrom Low Volatility To High GrowthdpbasicPas encore d'évaluation

- Thackray Newsletter: - Know Your Buy & Sells A Month in AdvanceDocument11 pagesThackray Newsletter: - Know Your Buy & Sells A Month in AdvancedpbasicPas encore d'évaluation

- INM 21993e DWolf Q4 2016 NewEra Retail SecuredDocument4 pagesINM 21993e DWolf Q4 2016 NewEra Retail SecureddpbasicPas encore d'évaluation

- Peloton Webinar September 26-2016Document26 pagesPeloton Webinar September 26-2016dpbasicPas encore d'évaluation

- CMX Roadshow Final November 2016Document25 pagesCMX Roadshow Final November 2016dpbasicPas encore d'évaluation

- The Trumpquake - Special Report 10nov2016Document5 pagesThe Trumpquake - Special Report 10nov2016dpbasicPas encore d'évaluation

- Notes On by Aman SrivastavaDocument5 pagesNotes On by Aman SrivastavaAshish LatherPas encore d'évaluation

- 2008 EuropeanDocument32 pages2008 EuropeanvaiscapitalPas encore d'évaluation

- Kaneshiro V Michael Kim, Bank of America Home LoansDocument9 pagesKaneshiro V Michael Kim, Bank of America Home LoansForeclosure FraudPas encore d'évaluation

- Bank Code List with English Names from 003 to 395Document4 pagesBank Code List with English Names from 003 to 395zackPas encore d'évaluation

- Lehman BrothersDocument3 pagesLehman Brothers1921 Pallav PaliPas encore d'évaluation

- Financial Accounting Part 6Document26 pagesFinancial Accounting Part 6dannydoly100% (1)

- Unit I - Overview of Finance and Financial Management: Notes 1 For Afm 101Document5 pagesUnit I - Overview of Finance and Financial Management: Notes 1 For Afm 101MHIL RAFAEL DAUGDAUGPas encore d'évaluation

- Bitcoin in India: Akshaya Tamradaman, Sangeeta NagpureDocument3 pagesBitcoin in India: Akshaya Tamradaman, Sangeeta NagpureMaruko ChanPas encore d'évaluation

- Questionaire-Internal Control-1Document7 pagesQuestionaire-Internal Control-1Mirai KuriyamaPas encore d'évaluation

- Rothbard's Wall Street Banks and American Foreign PolicyDocument5 pagesRothbard's Wall Street Banks and American Foreign PolicyGold Silver WorldsPas encore d'évaluation

- BC NEIA Booklet English 01-08-2019Document14 pagesBC NEIA Booklet English 01-08-2019abhiroopbosePas encore d'évaluation

- BranchDocument2 pagesBranchkaviyapriyaPas encore d'évaluation

- Example Pooling and Servicing Agreement PDFDocument2 pagesExample Pooling and Servicing Agreement PDFTrentonPas encore d'évaluation

- MortgageDocument7 pagesMortgageGaurav GoyalPas encore d'évaluation

- ECS Mandate Form for Credit Card PaymentsDocument1 pageECS Mandate Form for Credit Card Payments0sandeepPas encore d'évaluation

- Documents Required For Student Visa in FranceDocument1 pageDocuments Required For Student Visa in Francerony chidiacPas encore d'évaluation

- Impact of New Financial Products On Financial PerfDocument9 pagesImpact of New Financial Products On Financial PerfResearch SolutionsPas encore d'évaluation

- Factors Affecting Growth of Plastic Money in PakistanDocument5 pagesFactors Affecting Growth of Plastic Money in PakistanArafat IslamPas encore d'évaluation

- G.R. No. 153134Document2 pagesG.R. No. 153134Dan LocsinPas encore d'évaluation

- 55 Money Hacks 1 Minute Budget Money Quiz Win 250!Document2 pages55 Money Hacks 1 Minute Budget Money Quiz Win 250!kartik sethPas encore d'évaluation

- HDFC HAPPAY Prepaid Application Form-10072023Document5 pagesHDFC HAPPAY Prepaid Application Form-10072023jaikant.hccPas encore d'évaluation

- Hans Memling Life and WorkDocument38 pagesHans Memling Life and WorkHaneen HannouchPas encore d'évaluation

- Chapter - IDocument36 pagesChapter - Iharman singhPas encore d'évaluation

- IDFC Bank StatementDocument2 pagesIDFC Bank StatementSURANA197367% (3)

- Credit Rating Agency in IndiaDocument81 pagesCredit Rating Agency in IndiaMaaz Kazi100% (1)

- 2 Fin. Intermediaries & InnovationDocument29 pages2 Fin. Intermediaries & InnovationIbna Mursalin ShakilPas encore d'évaluation

- Soal Bahasa Inggris 75Document7 pagesSoal Bahasa Inggris 75dedyPas encore d'évaluation

- Thank You For Your Order: Order Details Order SummaryDocument1 pageThank You For Your Order: Order Details Order SummaryBen YoganathanPas encore d'évaluation

- IMF and World BankDocument22 pagesIMF and World BankrlakshmanaPas encore d'évaluation

- How To Crack The SystemDocument21 pagesHow To Crack The Systemnubirakwe9100% (5)