Académique Documents

Professionnel Documents

Culture Documents

PEZA Presentation

Transféré par

Isagani DionelaDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

PEZA Presentation

Transféré par

Isagani DionelaDroits d'auteur :

Formats disponibles

UTHORITY

UTHORITY

Lilia B. de Lima

Undersecretary and Director General

Philippine Economic Zone Authority

AmCham Hall, 2F, Corinthian Plaza Bldg.,

Paseo de Roxas, Makati City

12:00 PM, 31 July 2008

AmCham Hall, 2F, Corinthian Plaza Bldg.,

Paseo de Roxas, Makati City

12:00 PM, 31 July 2008

A presentation for

UPDATE ON PEZA ACTIVITIES AND PROGRAMS

The American Chamber of Commerce

of the Philippines, Inc.

PHILIPPINE ECONOMIC ZONE AUTHORITY

An investment promotion agency attached to the

Department of Trade and Industry.

It took over the functions of the former Export

Processing Zone Authority (EPZA) in 1995.

It supervises economic zones that are proclaimed

under its mandate nationwide.

The Special Economic Zone Act of 1995

Reinforce governments efforts on:

Investment Promotion

Employment Creation

Export Generation

BAGUIO EPZ

BAGUIO EPZ

BATAAN EPZ

BATAAN EPZ

MACTAN EPZ

MACTAN EPZ

CAVITE EPZ

CAVITE EPZ

Total Area : 3,183 hectares

Total Area : 3,183 hectares

LUISITA INDUSTRIAL PARK

CARMELRAY DEVT. CORP.

SUBIC SHIP. ENGG. INC.

VICTORIA WAVE

GATEWAY BUSINESS PARK

LIGHT IND. & SCIENCE PARK

LAGUNA TECHNOPARK

LAGUNA INTL. INDL PARK

TABANGAO SPECIAL EPZ

FIRST CAVITE INDL. ESTATE

LEYTE INDL. DEVT ESTATE

MACTAN ECOZONE II

16 EPZA- REGISTERED

PUBLIC & PRIVATE ECONOMIC ZONES

( 1969 - 1994)

MAJOR POLICY THRUST

PEZA ceased developing

economic zones

Encouraged private sector to

develop economic zones

166 OPERATING ECONOMIC ZONES

( As of J une 2008)

Total Area : 6,661.63 hectares

BAGUIO CITY ECONOMIC ZONE

FORT ILOCANDIA

LUISITA INDUSTRIAL PARK

TECO SPECIAL ECONOMIC ZONE

ANGELES INDUSTRIAL PARK

AGUS INDUSTRIAL ESTATE

VICTORIA WAVE

ROBINSONS PLACE NOVALICHES

DILIMAN IT BUILDING

CONVERGYS IT BUILDING

HTMT CYBER PARK

EDSA CENTRAL IT CENTER

E-SQUARE INFORMATION TECHNOLOGY PARK

MULTINATIONAL BANCORPORATION

PEOPLESUPPORT CENTER IT BUILDING

NORTHGATE CYBERZONE

MACROASIA ECOZONE

EUGENIO LOPEZ JR. COMMUNICATION CENTER

EASTWOOD CITY CYBERPARK

EXPORTBANK PLAZA BUILDING

THE ENTERPRISE CENTER

RCBC PLAZA

SM ICITY

SM CYBERZONE 1

G.T. TOWER INTERNATIONAL

AMKOR TECHNOLOGY

PACIFIC INFORMATION TECHNOLOGY CENTER

ROBINSONS CYBERPARK

ROBINSONS-EQUITABLE TOWER

PBCOM TOWER

SUMMIT ONE OFFICE TOWER

PHILAMLIFE I.T. BUILDING

6750 AYALA AVE. BLDG.

UNIONBANK PLAZA

BPI BUENDIA CENTER

EAST CYBER GATE

GATEWAY OFFICE TOWER

INSULAR LIFE BUILDING

MARVIN PLAZA BUILDING

MSE CENTER

OCTAGON IT BUILDING

ORIENT SQUARE IT BUILDING

RIVERBANK CENTER ICT BLDG. I

UP SCIENCE & TECHNOLOGY PARK (South)

V-TECH TOWER

FOOD TERMINAL INC. SEZ

EMI SPECIAL ECOZONE

BATAAN ECONOMIC ZONE

SUBIC SHIPYARD

PLASTIC PROCESSING CENTER SEZ

HERMOSA ECOZONE

LEYTE INDL. DEVELOPMENT ESTATE

LEYTE INFORMATION COMMUNICATION TECH. PARK

JOSE PANGANIBAN SEZ

RAPU-RAPU ECOZONE

CAVITE ECONOMIC ZONE

LAGUNA INTL. INDUSTRIAL PARK

LIGHT INDUSTRY & SCIENCE PARK I

LIGHT INDUSTRY & SCIENCE PARK II

LIGHT INDUSTRY & SCIENCE PARK III

TABANGAO SPECIAL ECONOMIC ZONE

LAGUNA TECHNOPARK I

FIRST CAVITE INDUSTRIAL ESTATE

GATEWAY BUSINESS PARK

GATEWAY BUSINESS PARK I

GREENFIELD LAGUNA AUTOMOTIVE PARK

YTMI REALTY SPECIAL ECONOMIC ZONE

LIMA TECHNOLOGY CENTER

FIRST PHILIPPINE INDUSTRIAL PARK EXP. I

COCOCHEM AGRO INDUSTRIAL PARK

PEOPLES TECHNOLOGY COMPLEX

FIRST PHILIPPINE INDUSTRIAL PARK

CARMELRAY INDUSTRIAL PARK

CARMELRAY INDUSTRIAL PARK II

CALAMBA PREMIERE INTERNATIONAL PARK

TOYOTA STA. ROSA SEZ

TOYOTA STA. ROSA SEZ II

DAIICHI INDUSTRIAL PARK

LAGUNA TECHNOPARK III

LAGUNA TECHNOPARK II

LAGUNA TECHNOPARK IV

FILINVEST TECHNOLOGY PARK - CALAMBA

EASTBAY ARTS, RECREATIONAL AND TOURISM

ROBINSONS BIG R SUPERCENTER

STA. ROSA COMMERCIAL IT PARK

PHILTOWN TECHNOLOGY PARK

ROBINSONS PLACE LIPA

MACTAN ECONOMIC ZONE

BIGFOOT IT PARK

MACTAN ECONOMIC ZONE II

MANGO SQUARE

ARCENAS ESTATE IT BUILDING

JY SQUARE IT CENTER

CEBU LIGHT INDUSTRIAL PARK

WEST CEBU INDUSTRIAL PARK

NEW CEBU TOWNSHIP

MRI ECONOMIC ZONE

HVG ARCADE IT PARK

INNOVE IT PLAZA

ASIATOWN IT PARK

FEDERATED IT PARK

ROBINSONS METRO BACOLOD

PUEBLO DE ORO IT PARK

JASAAN MIS. ORIENTAL ECOZONE

DBP IT PLAZA

THE BLOCK IT PARK

CIIF AGRO-INDUSTRIAL PARK

RIO TUBA EXPORT PROCESSING ZONE

SARANGANI ECONOMIC DEVELOPMENT ZONE

SRC CALUMPANG ECONOMIC DEVT. ZONE

FIRST ORIENTAL BUSINESS & INDUSTRIAL PARK

61 Manufacturing or Industrial

Estates

99 IT Parks (26) and IT Centers (73)

5 Tourism Ecozones

1 Medical Tourism Park

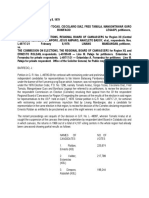

1995 2007 Economic Zone Investments : P 1.173 Trillion

449%

24%

144 %

61 % .6%

EPZA

PEZA

12.7 B

9.6 B

86 -93

1994

52.5 B

65.3 B

159.7 B

96.9 B

155.7 B

156.7 B

80.8 B

38.7 B

31.7 B

50.5 B

67.2 B

83.7 B

133.7 B

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

89

ECONOMIC ZONE INVESTMENTS

160

140

120

100

80

60

40

20

0

57 %

33 %

25 %

90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06

60 %

07

13-YEAR ECONOMIC ZONE INVESTMENTS

PEZA

1995 - 2007

P 1.173 T

EPZA

1982 1994

P 33.068 B

EPZA

1982 1994

P 33.068 B

35

Times

Bigger

LOCATOR INVESTMENTS BY NATIONALITY

( 1995 2007 )

36.82 %

Japanese

18.82 % American

17.49 % Filipino

4.03 % British

6.45 % Dutch

3.58 % Singaporean

2.97 % Korean

2.20 % British Cayman Islands

1.16 % Taiwanese

1.06 % Others

2.03 % Germans

1.00 % British Virgin Islands

LOCATOR INVESTMENTS BY PRODUCT SECTOR

( 1995 - 2007 )

Electrical Machinery

and Apparatus

Transport and Car Parts

Information Technology

Services

Chemical and Chemical

Products

Medical, Precision and

Optical Instruments

Rubber and

Plastic Products

Garments and Textiles

Other Manufactures

50.94 %

Electronics and

Semiconductors

7.55 %

6.52 %

7.18 %

2.75 %

2.30 %

1.74 %

1.10 %

19.92 %

In Billion US Dollars

1995 : US $ 4.284

1996 : US $ 6.500

1997 : US $ 10.626

1998 : US $ 13.270

1999 : US $ 15.807

2000 : US $ 20.025

2001 : US $ 19.498

2002 : US $ 22.775

2003 : US $ 27.313

2004 : US $ 30.924

2005 : US $ 32.030

2006 : US $ 36.077

1994 : US $ 2.739

2007 : US $ 40.889

56.4 %

51.7 %

63.5 %

24.9 %

19.1 %

26.7 %

- 2.5%

16.8%

19.9%

13.2%

3.6%

12.6%

13.3%

PHILIPPINE MANUFACTURED EXPORTS

( Billion U.S. Dollars )

1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004

2.7

9.5

4.3

11.5

6.5

12.0

10.6

11.0

13.3

12.8

15.8

15.9

20.0

14.3

19.5

9.1

22.7

8.8

27.2

4.8

30.7

4.8

Economic Zone Manufactured Exports

Other Philippine Manufactured Exports

40

35

30

25

20

15

10

5

0

22%

78%

27%

73%

35%

65%

49%

51%

51%

49%

50%

50%

58%

42%

68%

32%

72%

28%

85%

15%

86%

14%

12.2

15.8

18.5

21.6

26.1

31.7

34.3

28.6

31.5

32.0

35.5

2005

31.6

5.3

86%

14%

36.9

2006

35.1

6.0

85%

15%

41.1

2007

36.9

5.9

86%

14%

42.8

45

GLORIA

MACAPAGAL

ARROYO

Her Excellency

10 million jobs in

6 years

Trabaho at

kabuhayan sa bawat

Pilipino.

1995

1997

1996

1998

1999

2000

2001

2002

2003

2004

2005

2006

121,823

152,250

183,709

219,791

247,076

91,860

278,407

289,548

328,384

362,851

406,752

451,279

545,025

1994

2007 593,108

TOP ECONOMIC ZONE INVESTORS

TI (Philippines), Inc. Electronics American

Amkor Technology Electronics American

Intel Technology Electronics American

Fujitsu Computer Electronics Japanese

NXP Semiconductors Electronics Dutch

Sunpower Philippines Solar Cells Brit. Cayman

Toshiba Information Electronics Japanese

Epson Precision Electronics Japanese

Integrated Micro Electronics British

Hitachi Global Storage Electronics Dutch

Toyota Autoparts Automotive Japanese

Coral Bay Nickel Corp. Minerals Japanese

TOP ECONOMIC ZONE INVESTORS

TDK Fujitsu Phils. Electronics Japanese

Lufthansa Technik Air Transport German

Samsung Electro-Mech Electronics Korean

Ibiden Philippines Electronics Japanese

Rohm Electronics Electronics Japanese

Terumo (Philippines) Med. Instruments Japanese

Pilipinas Kao, Inc. Coco products Japanese

JP Morgan Chase Bank IT American

Taiyo Yuden Electronics Japanese

Cypress Mfg. Ltd. Electronics American

Continental Temic Electronics German

Panasonic Comm. Electronics Dutch

TOP ECONOMIC ZONE INVESTORS

Ford Motor Company Automotive American

Teletech Customer Care I.T. American

Mitsumi Philippines Electronics Japanese

Hoya Glass Disk Electronics Singaporean

Nidec Philippines Electronics Japanese

Convergys I.T. American

Manticao Nickel Corp. Mineral Filipino

Analog Devices Electronics Dutch

Nidec Precision Electronics Japanese

Honda Parts Mfg. Automotive Japanese

eTelecare Global IT Filipino

Takata (Philippines) Automotive Japanese

AMERICAN ENTERPRISES IN PEZA ECONOMIC ZONES

25 Electronics and Semiconductors

INDUSTRY NUMBER

Information Technology

Transport and Car Parts

Chemical & Chemical Products

Fabricated Metals

Rubber & Plastic Products

Garments

Others

TOTAL

5

6

1

18

100

5

1

161

TOP 30 AMERICAN COMPANIES IN PEZA

1. TI (Philippines), Inc.

2. Amkor Technology

3. Intel Technology Philippines, Inc.

4. JP Morgan Chase Bank, NA Phil. Customer

Care Center

5. Cypress Manufacturing

6. Ford Motor Company

7. TeleTech Customer Care Management Phil., Inc.

8. Convergys Phil. Services Corp.

9. AMI Semiconductor Phil., Inc.

10. ICT Marketing Services, Inc.

TOP 30 AMERICAN COMPANIES IN PEZA

11. PeopleSupport (Phil.), Inc.

12. Visteon Phil., Inc.

13. American Power Conversion Corp.

14. Moog Controls Corp. (Phil. Branch)

15. Dell International Services Phil., Inc.

16. APAC Customer Services, Inc. Phil. Branch

17. INFONXX Philippines, Inc.

18. Ford Phil. Component Manufacturing Co.

19. Accenture, Inc.

20. ACP Test Company, Inc.

TOP 30 AMERICAN COMPANIES IN PEZA

21. West Contact Services, Inc.

22. SC Reservationss (Phil.), Inc.

23. Draka Philippines, Inc.

24. Sitel Philippines Corp.

25. Ford Philippines Machining Company

26. RMH Teleservices Asia Pacific, Inc.

27. EXLSERVICE Philippines, Inc.

28. Epixtar Phil IT-Enabled Services Corp.

29. Genpact Services LLC

30. Sitel Customer Care Philippines, Inc.

TOURISM ECOZONE

TOURISM ECONOMIC ZONE

LOCATION

AREA / FACILITIES

REQUIREMENT

INCENTIVES FOR

DEVELOPERS

PRIORITY

AREAS

IDENTIFIED BY

DOT

5 Hectares

Integrated resort complex offering

accommodation, sports and

recreation centers, convention and

cultural facilities, theme parks, and

other special interest with foreign

tourists as primary clientele.

Must conform with development

guidelines of the Department of

Tourism

5% tax on gross income

(only for new

development)

TOURISM ECONOMIC ZONE

REGISTRABLE ACTIVITIES

Enterprises establishing and

operating the following:

Accommodation

Sports and recreation centers

Convention and cultural facilities

Theme Parks

Other special interest or

attraction activities with foreign

tourists as primary clientele

INCENTIVES

1. 4 years Income Tax Holiday (ITH)

2. Special 5% tax on gross income in lieu of

all national and local taxes after the ITH

3. Tax and duty free importation of capital

equipment required for the technical

viability and operation of the registered

activity

4. Exemption from payment of local

government fees such as Mayors Permit,

Business Permit, Permit on the Exercise of

Profession/Occupation/Calling, Health

Certificate Fee, Sanitary Inspection Fee,

and Garbage Fee;

5. Zero Value Added Tax (VAT) Rate on local

purchases to include telecommunications,

power, and water bills;

6. Special Investors visa

7. Employment of foreign nationals

8. Simplified import procedures

MEDICAL TOURISM

SPECIAL ECONOMIC ZONE

MEDICAL TOURISM PARK

LOCATION

AREA / FACILITIES

REQUIREMENT

INCENTIVES FOR

DEVELOPERS

METRO MANILA

AND CEBU CITY

OTHER PARTS

OF THE

COUNTRY

1 Hectare

1. Adequate telecom facilities

2. Clean, uninterruptible power

supply

3. Security and building monitoring

system

1 Hectare

1. Adequate telecom facilities

2. Clean, uninterruptible power

supply

3. Security and building monitoring

system

None

5% tax on gross income

(only for new

development)

MEDICAL TOURISM CENTER (Hospital or Stand Alone Bldg)

LOCATION

AREA / FACILITIES

REQUIREMENT

INCENTIVES FOR

DEVELOPERS

METRO MANILA

AND CEBU CITY

OTHER PARTS

OF THE

COUNTRY

5,000 square meters

1. Adequate telecom facilities

2. Clean, uninterruptible power

supply

3. Security and building monitoring

system

2,000 square meters

1. Adequate telecom facilities

2. Clean, uninterruptible power

supply

3. Security and building monitoring

system

None

5% tax on gross income

(only for new

development)

RETIREMENT SPECIAL

ECONOMIC ZONE

RETIREMENT ECOZONE PARK

LOCATION

AREA / FACILITIES

REQUIREMENT

INCENTIVES FOR

DEVELOPERS

Anywhere in the

country

4 Hectares

1. Reliable power and water supply

and distribution system

2. Sewerage and drainage system

3. Adequate telecom facilities

5% tax on gross income

(only for new

development)

RETIREMENT ECOZONE CENTER

LOCATION

AREA / FACILITIES

REQUIREMENT

INCENTIVES FOR

DEVELOPERS

METRO MANILA

AND CEBU CITY

OTHER PARTS

OF THE

COUNTRY

5,000 square meters

1. Reliable power and water supply

and distribution system

2. Sewerage and drainage system

3. Adequate telecom facilities

2,000 square meters

1. Reliable power and water supply

and distribution system

2. Sewerage and drainage system

3. Adequate telecom facilities

5% tax on gross income

(only for new

development)

5% tax on gross income

(only for new

development)

AGRO-INDUSTRIAL

ECOZONE

AGRO-INDUSTRIAL ECONOMIC ZONE

LOCATION

AREA / FACILITIES

REQUIREMENT

INCENTIVES FOR

DEVELOPERS

MUST BE

OUTSIDE

METRO MANILA

5 Hectares

Must conform with development

guidelines of :

DA, BFAR, DENR, and

Land Use and Zoning Regulations

5% tax on gross income

(only for new

development)

AGRO-INDUSTRIAL ECONOMIC ZONE

REGISTRABLE ACTIVITIES

1. Import-substituting commercial production and

processing of agricultural crops for bio-fuel

(such as but not limited to jetropha, coconut,

sweet sorghum, sugar, etc.)

2. Processing / manufacturing for export of

agricultural and marine products (livestock and

poultry, fruits and vegetables, aquaculture

products

3. Integrated livestock, poultry, and related

projects involving primary production up to

processing of final product

4. Production of agricultural inputs such as feeds,

veterinary drugs and vaccines, fertilizers, and

agri-chemicals for export

5. Projects involving the processing of

agricultural waste materials into commercially

viable products for export

6. Bio-technology products using agricultural

products as inputs or to be used as inputs for

agricultural production

7. Support services such as cold storages and

warehouses, and similar facilities

INCENTIVES

1. 4 years Income Tax Holiday (ITH)

2. Special 5% tax on gross income in lieu of

all national and local taxes after the ITH

3. Tax and duty free importation of production

equipment and machineries, breeding

stocks, farm implements including spare

parts and supplies of the equipment and

machineries

4. Exemption from export taxes, wharfage

dues, impost and fees

5. Exemption from payment of local

government fees such as Mayors Permit,

Business Permit, Permit on the Exercise of

Profession/Occupation/Calling, Health

Certificate Fee, Sanitary Inspection Fee,

and Garbage Fee;

6. Zero Value Added Tax (VAT) Rate on local

purchases to include telecommunications,

power, and water bills;

7. Special Investors visa

8. Employment of foreign nationals

9. Simplified import and export procedures;

THE PHILIPPINES

SUCCESS FACTORS

Literate, English speaking, easy to train,

hardworking and very friendly

FI LI PI NO WORKERS

FI LI PI NO WORKERS

Among the Best in the World

Among the Best in the World

THE COUNTRYS COMPETI TI VE EDGE

In the IT Service Sector

Filipino Workers are

considered the new breed of

world-class service

professionals and

are referred to as

Global Knowledge Workers

because they are intelligent

and able to compete

at the highest levels

among the best in the world.

STRATEGIC LOCATION STRATEGIC LOCATION

STRATEGIC LOCATION

Russia

EUROPE

United States

of America

South

America

Pacific Ocean

Atlantic Ocean

Australia

Japan

Korea

China

India Africa

Taiwan

Hong Kong

Philippines

Thailand

Malaysia

Singapore

Indonesia

Germany

France

United

Kingdom

Canada

Middle

East

THE

PEZA EDGE

PEZA recognizes

Just-in-time deliveries

Reduction of cost

are musts for exports to

be competitive

FAST TURNAROUND

ESPECIALLY FOR ELECTRONICS

96 HOURS OR 4 DAYS TO COMPLETE THE PRODUCTION

CYCLE:

DAY 1

An Asian company sends raw materials to the Philippines.

Raw materials arrive in the Philippines on the same day.

Cleared by Customs on the same day.

Received by the Economic Zone Company on the same day.

DAY 2 - DAY 3

Products are manufactured.

DAY 4

Finished products brought to the Port.

Cleared by Customs on the same day.

Shipped to the Asian country on the same day.

Arrive in the Asian country on the same day.

AS A CONSEQUENCE:

Most companies EARN PROFI T

even on their first year of

operation.

Most companies have been

EXPANDING their operations.

Batangas Port

The Gateway to Southern Luzon

New and most modern port facility and equipment

Centrally located within the CALABARZON economic

zones; Target volume minimum 10,000TEUs/month

Industrial Parks & Economic Industrial Parks & Economic

Zones (PEZA): Zones (PEZA):

Laguna International Industrial Laguna International Industrial

Park Park

Laguna Technopark Laguna Technopark

Lima Technology Center Lima Technology Center

First Philippine Industrial Park First Philippine Industrial Park

First Batangas Industrial Park First Batangas Industrial Park

Calamba Premiere Industrial Calamba Premiere Industrial

Park Park

Carmelray Carmelray Industrial Park 1 & 2 Industrial Park 1 & 2

Light Industry & Science Park of Light Industry & Science Park of

the Phils. 1 & 2 the Phils. 1 & 2

Yazaki Yazaki- -Torres Manufacturing Inc. Torres Manufacturing Inc.

Cavite Special Economic Zone Cavite Special Economic Zone

Min. 10,000 TEUs/mo.

Target volume

DISTANCES BETWEEN MAJOR POINTS

Manila - Calamba : 50 km

Manila Batangas : 100 km

Cabuyao Calamba : 5 km

Sta.. Rosa Calamba : 10 km

Calamba Batangas : 50 km

Mariveles Manila : 27 nautical

miles

ATI Batangas Phase 2

Marginal Wharf

LOA 450 meters - 2 berths

Draft - 13 meters

Annual throughput capacity

480,000 TEU

Container yard

6.6 hectares

Container freight station

4,100 square meters

Two (2) high capacity ship to

shore gantry cranes that ensure

efficient loading and discharge

of containers

- 8 Tractors

- Dutch Lanka Chassis

- Forklift

Mobile Equipment

- 4 Rubber Tyred Gantries

- 1 Reach Stacker

Benefits

1. ATI Stevedoring charges -14% lower than

Manila

2. 30 Minute Customs Processing

3. 40%-60% Reduction in trucking cost

4. Faster Turn-Around Time

5. Predictability of deliveries

6. Reduced overtime costs

Other Benefits

Availability of large spaces for warehousing and

other needs

State of the Art Equipment

Building and Occupancy Permits are issued by PEZA.

Import and Export Permits are issued by PEZA.

Special non-immigrant visa processed in PEZA.

Harmonized customs processes because of PEZA-BOC MOA.

Environment Clearance made easy because of PEZA-DENR MOA.

Exemption from Local Government Business Permits for

companies inside PEZA.

Registration requirements simplified, registration forms made

simple, approval made easy.

If a company files its application 1 day before a Board Meeting, its

application will be included in the agenda for approval. The PEZA

Board meets 2 times a month.

PEZA IS A ONE-STOP SHOP

At the zones, PEZA provides 24 hours a

day, 7 days a week of continuous

service to locator companies.

The Director General herself and other

PEZA officials are on call 24 hours a day,

7 days a week.

PEZA IS A NON-STOP SHOP

PEZA

A Total Service Plus Shop

More than granting incentives, PEZA

serves as the Advocate and

Champion for Economic Zone

Stakeholders Concerns.

MAKE DOING BUSINESS

LESS COSTLY

EASIER

MORE COMPETITIVE

PEZAs TOTAL COMMITMENT

TO INVESTORS

NO RED TAPE

ONLY RED CARPET TREATMENT

PEZAs TOTAL COMMITMENT TO INVESTORS

TRIMMING and RESTRUCTURING

the BUREAUCRACY

38.47 % Reduction in Officers and Personnel

PEZA

619 Officers and Personnel

( 30 June 2008 )

1,006 Officers and Personnel

( 31 December 1994 )

EPZA

REMITTANCES TO THE NATIONAL GOVERNMENT

( Payments of Loans, Dividends and Income Taxes )

P 11.132 Billion

( 1995 30 June 2008 )

PEZA EPZA

P 145.498 Million

( 1969 - 1994 )

2006 Total Remittances

P 1.170 B

2007 Total Remittances

P 968.299 M

PEZA - 3

rd

BIGGEST AMONG GOCCs & GFIs in

DIVIDENDS/ REMITTANCES TO THE

NATIONAL GOVERNMENT

From January to May 2008

1. Philippine Ports Authority P 589 M

2. Land Bank of the Philippines P 442 M

3. Philippine Economic Zone Authority (PEZA) P 346 M

4. Philippine National Oil Company (PNOC) P 336 M

Report from the Department of Finance

21 June 2008 Issue of the

Philippine Daily Inquirer

WHERE

WHERE

BUSINESSES

BUSINESSES

LOCATE

LOCATE

AND

AND

PROFIT

PROFIT

Vous aimerez peut-être aussi

- Michael S. Lewis-Beck-Data Analysis - An Introduction, Issue 103-SAGE (1995)Document119 pagesMichael S. Lewis-Beck-Data Analysis - An Introduction, Issue 103-SAGE (1995)ArletPR100% (1)

- Planning Administration - Presentation1-NEDA Appraisal and Funding PPP-JOM-7 May 2017Document160 pagesPlanning Administration - Presentation1-NEDA Appraisal and Funding PPP-JOM-7 May 2017Aris TesoroPas encore d'évaluation

- SMIDPDocument34 pagesSMIDPAsmawi Noor SaaraniPas encore d'évaluation

- Student Exploration: Electron Configuration: 8-27-2005 Joshua Perez-LunaDocument14 pagesStudent Exploration: Electron Configuration: 8-27-2005 Joshua Perez-LunaJoshua Perez-Luna67% (3)

- Equipment Lending FormDocument1 pageEquipment Lending FormJoshua HernandezPas encore d'évaluation

- SWOT Analysis Summary City of Hayward: November 18, 2009Document6 pagesSWOT Analysis Summary City of Hayward: November 18, 2009Alessandra MartesPas encore d'évaluation

- GR No 86889Document4 pagesGR No 86889ElephantPas encore d'évaluation

- Gaveres v. Tavera 1 Phil 71 (1901)Document2 pagesGaveres v. Tavera 1 Phil 71 (1901)Fahimah MalambutPas encore d'évaluation

- Piercing of Corporate VeilDocument4 pagesPiercing of Corporate VeilRhic Ryanlhee Vergara FabsPas encore d'évaluation

- Linan vs. PunoDocument14 pagesLinan vs. PunoPatricia SanchezPas encore d'évaluation

- Case Digest in Civpro Rule 58, 59, 60 Nad 62Document14 pagesCase Digest in Civpro Rule 58, 59, 60 Nad 62Raymart L. MaralitPas encore d'évaluation

- 37 (Commissioner of Internal Revenue v. Smart Communication, Inc.Document1 page37 (Commissioner of Internal Revenue v. Smart Communication, Inc.Ariel Mark PilotinPas encore d'évaluation

- It-Bpm and Gic Road Map 2012-2016Document44 pagesIt-Bpm and Gic Road Map 2012-2016Trish BustamantePas encore d'évaluation

- 10 Da-596-06Document3 pages10 Da-596-06Cheska VergaraPas encore d'évaluation

- Woodchild Holdings, Inc. vs. Roxas Electric and Construction Company, Inc.Document22 pagesWoodchild Holdings, Inc. vs. Roxas Electric and Construction Company, Inc.Xtine CampuPotPas encore d'évaluation

- VAT On TollDocument3 pagesVAT On TollChariss GarciaPas encore d'évaluation

- SPBUS SYLLABUSDocument10 pagesSPBUS SYLLABUSMark FaderguyaPas encore d'évaluation

- BSP Circular No. 706Document8 pagesBSP Circular No. 706Unis BautistaPas encore d'évaluation

- Company Law Research PaperDocument4 pagesCompany Law Research PaperpalakPas encore d'évaluation

- 128 Fogelson v. American Woolen Co. (REYES)Document2 pages128 Fogelson v. American Woolen Co. (REYES)AlexandraSoledadPas encore d'évaluation

- Case Digest G R No 160932 January 14 2013Document3 pagesCase Digest G R No 160932 January 14 2013Nathaniel Niño TangPas encore d'évaluation

- Conde vs. Ca FactsDocument8 pagesConde vs. Ca FactsasdfghjkattPas encore d'évaluation

- A Synopsis On AdvertisingDocument14 pagesA Synopsis On AdvertisingBansi Dhar ChoudharyPas encore d'évaluation

- Benguet Corp. v. CBAADocument8 pagesBenguet Corp. v. CBAAEmma Ruby Aguilar-ApradoPas encore d'évaluation

- Soccorro Clemente vs. RPDocument7 pagesSoccorro Clemente vs. RPJazztine ArtizuelaPas encore d'évaluation

- Litonjua, Jr. vs. Eternit Corp.Document13 pagesLitonjua, Jr. vs. Eternit Corp.fred_barillo09Pas encore d'évaluation

- Articles of Incorporation DMCIDocument13 pagesArticles of Incorporation DMCIRon FabiPas encore d'évaluation

- Admin Law CasesDocument246 pagesAdmin Law CasesAlfred Bryan AspirasPas encore d'évaluation

- Investment - PHP Foreign InvestmentDocument4 pagesInvestment - PHP Foreign InvestmentYash ThakkarPas encore d'évaluation

- Mabuhay Textile Vs OngpinDocument10 pagesMabuhay Textile Vs OngpinanajuanitoPas encore d'évaluation

- Pub Corp NotesDocument45 pagesPub Corp NotesSherine Lagmay RivadPas encore d'évaluation

- Bulletcorporation: (The Companies Act, 1956) (Company Limited by Shares) Memorandum of Association OFDocument10 pagesBulletcorporation: (The Companies Act, 1956) (Company Limited by Shares) Memorandum of Association OFBhopesh KadianPas encore d'évaluation

- Republic Act 8424Document7 pagesRepublic Act 8424Mark Pelobello MalhabourPas encore d'évaluation

- Fundamentals of Foreign InvestmentsDocument4 pagesFundamentals of Foreign InvestmentsVIPUL ThakurPas encore d'évaluation

- Samridhi Foundation - Draft MoaDocument7 pagesSamridhi Foundation - Draft MoaPawan KumarPas encore d'évaluation

- Midterm Answers With ExplanationDocument10 pagesMidterm Answers With ExplanationJyPas encore d'évaluation

- Confidentiality / Non-CircumventionDocument8 pagesConfidentiality / Non-CircumventionKevin ZhangPas encore d'évaluation

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument55 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress Assembledjayrkulit16Pas encore d'évaluation

- GR 122480 BpiDocument1 pageGR 122480 BpiNaomi InotPas encore d'évaluation

- Sawadjaan V CADocument1 pageSawadjaan V CARS SuyosaPas encore d'évaluation

- 26 Reyes Vs CADocument22 pages26 Reyes Vs CALanz OlivesPas encore d'évaluation

- EO 51, Series of 2018Document3 pagesEO 51, Series of 2018Li-an Rodrigazo0% (1)

- Wiltshire Fire Co. Vs NLRC and Vicente OngDocument6 pagesWiltshire Fire Co. Vs NLRC and Vicente OngStephanie ValentinePas encore d'évaluation

- Memorandum of AssociationDocument13 pagesMemorandum of AssociationRavi KrishnanPas encore d'évaluation

- How To Create A CorporationDocument2 pagesHow To Create A Corporationicecyst888Pas encore d'évaluation

- Rodriguez v. Dir. Bureau of Labor RelationsDocument11 pagesRodriguez v. Dir. Bureau of Labor RelationsSamuel ValladoresPas encore d'évaluation

- Prisma Construction & Development Corp vs. Menchavez GR No. 160545 March 9, 2010Document6 pagesPrisma Construction & Development Corp vs. Menchavez GR No. 160545 March 9, 2010morningmindsetPas encore d'évaluation

- Case DigestDocument20 pagesCase DigestRain MarkPas encore d'évaluation

- Pantranco vs. NLRCDocument4 pagesPantranco vs. NLRCJaneen ZamudioPas encore d'évaluation

- Roles of Lawyers On JDRDocument1 pageRoles of Lawyers On JDRAnonymous zuizPMPas encore d'évaluation

- Comelec Resolution 9631Document5 pagesComelec Resolution 9631BlogWatchPas encore d'évaluation

- Tax Digests - Recent JurisprudenceDocument25 pagesTax Digests - Recent JurisprudenceMark Xavier Overhaul LibardoPas encore d'évaluation

- SEc Cert - PaynaticsDocument1 pageSEc Cert - PaynaticsMa. Angelica de GuzmanPas encore d'évaluation

- Persons Cases FinalDocument45 pagesPersons Cases FinalAnna Elaine EspeletaPas encore d'évaluation

- The Japan Philippines Economic Partnership Agreement or JPEPA Timeline/StatusDocument3 pagesThe Japan Philippines Economic Partnership Agreement or JPEPA Timeline/StatusBambi Baldo- CustodioPas encore d'évaluation

- Smart Communications, Inc. V. Regina M. Astorga G.R. No. 148132, January 28, 2008, NACHURA, JDocument1 pageSmart Communications, Inc. V. Regina M. Astorga G.R. No. 148132, January 28, 2008, NACHURA, JBianca Nerizza A. Infantado IIPas encore d'évaluation

- 02.02 Express Investments III Private Ltd. vs. Bayan Telecommunications, IncDocument73 pages02.02 Express Investments III Private Ltd. vs. Bayan Telecommunications, IncLloyd Edgar G. ReyesPas encore d'évaluation

- ESSO Standard Eastern Inc Vs CIRDocument6 pagesESSO Standard Eastern Inc Vs CIRToya MochizukiePas encore d'évaluation

- PezaDocument37 pagesPezaMA G.Pas encore d'évaluation

- Philippines Electronics IndustryDocument36 pagesPhilippines Electronics IndustryelynjovergaraPas encore d'évaluation

- List of Economic Zones - 30 June 2013Document78 pagesList of Economic Zones - 30 June 2013JonJon Miv0% (1)

- SQTP Specification For PIC16-17 MCUsDocument6 pagesSQTP Specification For PIC16-17 MCUsJose Rivas Shango DeiPas encore d'évaluation

- Brondial Notes - SPECIAL PROCEEDINGDocument34 pagesBrondial Notes - SPECIAL PROCEEDINGIsagani DionelaPas encore d'évaluation

- Counter Affidavit - Illegal Possession of FirearmsDocument5 pagesCounter Affidavit - Illegal Possession of FirearmsIsagani DionelaPas encore d'évaluation

- Anti Red Tape Act 2018 - RA-11032 PDFDocument16 pagesAnti Red Tape Act 2018 - RA-11032 PDFIsagani DionelaPas encore d'évaluation

- Answer With CounterclaimDocument13 pagesAnswer With CounterclaimIsagani DionelaPas encore d'évaluation

- Contract of LeaseDocument3 pagesContract of LeaseIsagani DionelaPas encore d'évaluation

- Affidavit of LossDocument2 pagesAffidavit of LossIsagani DionelaPas encore d'évaluation

- Omnibus Cases - Remedial LawDocument206 pagesOmnibus Cases - Remedial LawIsagani DionelaPas encore d'évaluation

- TIGLAO Impeachment Complaint PDFDocument54 pagesTIGLAO Impeachment Complaint PDFIsagani DionelaPas encore d'évaluation

- Revised IRR RA9520 UpdatedDocument98 pagesRevised IRR RA9520 UpdatedIsagani DionelaPas encore d'évaluation

- Special Power of Attorney - Alex Bascos JRDocument2 pagesSpecial Power of Attorney - Alex Bascos JRIsagani DionelaPas encore d'évaluation

- Bar Review Lecture - VATDocument71 pagesBar Review Lecture - VATIsagani DionelaPas encore d'évaluation

- Is ISIS A Faith-Based Terrorist Group Columbia Journalism Review-LibreDocument3 pagesIs ISIS A Faith-Based Terrorist Group Columbia Journalism Review-LibreIsagani DionelaPas encore d'évaluation

- Omnibus Cases - Legal EthicsDocument78 pagesOmnibus Cases - Legal EthicsIsagani DionelaPas encore d'évaluation

- Puerto Azul Land vs. Pacific WideDocument8 pagesPuerto Azul Land vs. Pacific WideIsagani DionelaPas encore d'évaluation

- PIDS Do Barangays Really Matter in Local Services Delivery?: Some Issues and Policy OptionsDocument29 pagesPIDS Do Barangays Really Matter in Local Services Delivery?: Some Issues and Policy OptionsIsagani DionelaPas encore d'évaluation

- The Roosh ProgramDocument2 pagesThe Roosh ProgramVal KerryPas encore d'évaluation

- 1.1. CHILLER 1.2. Centrifugal: 5.2.hrizontalDocument2 pages1.1. CHILLER 1.2. Centrifugal: 5.2.hrizontalShah ArafatPas encore d'évaluation

- COCapplication08rev Working SampleDocument34 pagesCOCapplication08rev Working SampleTanya HerreraPas encore d'évaluation

- SRM OverviewDocument37 pagesSRM Overviewbravichandra24Pas encore d'évaluation

- April 7-9 2022-WPS OfficeDocument3 pagesApril 7-9 2022-WPS OfficeAllen AntolinPas encore d'évaluation

- 2022 05 141RBSF351652506386Document6 pages2022 05 141RBSF351652506386tathagat jhaPas encore d'évaluation

- Dossat PrinciplesOfRefrigerationDocument554 pagesDossat PrinciplesOfRefrigerationHernan CobaPas encore d'évaluation

- 107 01 Covers and Side Doors A SideDocument38 pages107 01 Covers and Side Doors A Sideben vervuurtPas encore d'évaluation

- (LS 1 English, From The Division of Zamboanga Del SurDocument17 pages(LS 1 English, From The Division of Zamboanga Del SurKeara MhiePas encore d'évaluation

- Discussion 2: OOA: Case Study Robot in MazeDocument17 pagesDiscussion 2: OOA: Case Study Robot in MazeArmmetPas encore d'évaluation

- Sistema A-101 LVSDocument4 pagesSistema A-101 LVSAdministrador AngloPas encore d'évaluation

- Adsa Ka SyllabusDocument3 pagesAdsa Ka SyllabusHacker RanjanPas encore d'évaluation

- Layers of The EarthDocument26 pagesLayers of The EarthLoo DrBrad100% (1)

- Metascope An/Pas-6 (5855-790-6197) : Technical ManualDocument38 pagesMetascope An/Pas-6 (5855-790-6197) : Technical ManualDens VillaPas encore d'évaluation

- Bibliografi 3Document3 pagesBibliografi 3Praba RauPas encore d'évaluation

- Quotation Request Form: Customer DetailsDocument1 pageQuotation Request Form: Customer DetailsAmanda RezendePas encore d'évaluation

- Oracle Pac 2nd KeyDocument48 pagesOracle Pac 2nd KeyKrishna Kumar GuptaPas encore d'évaluation

- ACFrOgDVly789-6Z8jIbi7pBoLupubEgMyOp7PczEvUguHoW3uj oR2PKzDvuhRzzkIhacYjxXRrU6iA7sHt t6MhtpZFq0t uZL2pF5Ra NNZ kmcl5w7BCQeUegKhjRhNuou88XxLodzWwbsrDocument14 pagesACFrOgDVly789-6Z8jIbi7pBoLupubEgMyOp7PczEvUguHoW3uj oR2PKzDvuhRzzkIhacYjxXRrU6iA7sHt t6MhtpZFq0t uZL2pF5Ra NNZ kmcl5w7BCQeUegKhjRhNuou88XxLodzWwbsrJohn Steven LlorcaPas encore d'évaluation

- ECON 304 Course ContentDocument2 pagesECON 304 Course ContentAanand JhaPas encore d'évaluation

- Additional Material On CommunicationDocument15 pagesAdditional Material On CommunicationSasmita NayakPas encore d'évaluation

- Renaissance QuestionsDocument3 pagesRenaissance QuestionsHezel Escora NavalesPas encore d'évaluation

- Summative Lab Rubric-Intro To ChemistryDocument1 pageSummative Lab Rubric-Intro To ChemistryGary JohnstonPas encore d'évaluation

- Data Structures and Algorithms AssignmentDocument25 pagesData Structures and Algorithms Assignmentعلی احمد100% (1)

- Almugea or Proper FaceDocument5 pagesAlmugea or Proper FaceValentin BadeaPas encore d'évaluation

- Project Scheduling: Marinella A. LosaDocument12 pagesProject Scheduling: Marinella A. LosaMarinella LosaPas encore d'évaluation

- Description: Super Thoroseal Is A Blend of PortlandDocument2 pagesDescription: Super Thoroseal Is A Blend of Portlandqwerty_conan100% (1)

- AutoCAD 2006 Installing Network License Manager0Document12 pagesAutoCAD 2006 Installing Network License Manager0gurugovindanPas encore d'évaluation

- How To Get Jobs in Neom Saudi Arabia 1703510678Document6 pagesHow To Get Jobs in Neom Saudi Arabia 1703510678Ajith PayyanurPas encore d'évaluation