Académique Documents

Professionnel Documents

Culture Documents

Cost - Direct Costing, CVP Analysis

Transféré par

AriMurdiyantoCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Cost - Direct Costing, CVP Analysis

Transféré par

AriMurdiyantoDroits d'auteur :

Formats disponibles

Disclaimer: Im not an expert in accounting neither fluent in english.

I was asked to make this resume and was lazy

translating Carters book. More importantly feel awkward using accounting terms in Indonesian. Any

corrections are welcomed.

Chapter 20 Direct Costing, CVP Analysis, and the theory of constraints

Direct Costing

Introduction

Direct Costing also reffered as variable costing or marginal costing charges only variable manufacturing cost (DL,

DM, and var. FOH) into production cost. All fixed expenses (Depreciation, rent, insurance) are excluded from the cost

production and treated as period expenses. When fixed cost calculated per unit will vary for different volumes of

production, variable unit cost will constant at all level of activity. As result, many managers find direct costing more

understandable and more useful for:

- Profit Planning tool

- Guide to product pricing

- Evaluating profitability of multiple products

- Managerial decision making

Contribution margin or marginal income is the difference between sales revenue and all variable cost. It is used as

account in income statement using direct costing method.

Example

On question of direct costing, we will usually asked to compare between calculation of direct costing and

absorption costing (fixed and variable cost charged into production cost), make their income statements, compute and

reconcile the differences in operating income under two methods.

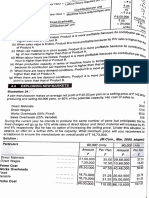

E20-3 Cost Accounting Carter & Ursy

The following data at april Meramput Co. :

Beg. Inv 3.000

Unit sold 9.000

Unit Produced 8.000

Sales Price/unit $ 30

Direct Manufacturing cost/unit $ 10

Fixed FOH total $ 40.000

Comercial expense $ 50.000

Required:

1. Preapare Income Statement using absorption costing

2. Preapare Income Statement using direct costing

3. Provide computation and reconcilitation to explain the difference between those methods.

Answer:

1. Income Statement using absorption costing:

cost/unit unit total

Sales 30,00 $ 9.000 270.000 $

COGS:

Direct manufacturing cost 10,00 $ 9.000 90.000 $

Fixed FOH 5,00 $ 9.000 45.000 $ 135.000 $ fixed cost/unit= $40.000/8.000=$5

Gross Profit 135.000 $

Comercial expenses 44.000 $

Net Income absorption costing 91.000 $

2. Income Statement using direct costing:

cost/unit unit total

Sales 30,00 $ 9.000 270.000 $

COGS:

Direct manufacturing cost 10,00 $ 9.000 90.000 $

Contribution Margin 180.000 $

Less fixed expenses:

Fixed FOH 40.000 $

Fixed Comercial expenses 44.000 $ 84.000 $

Net Income direct costing 96.000 $

3. Computation explaining the difference in operating income

Disclaimer: Im not an expert in accounting neither fluent in english. I was asked to make this resume and was lazy

translating Carters book. More importantly feel awkward using accounting terms in Indonesian. Any

corrections are welcomed.

Net income absorption costing 91.000 $

Net income direct costing 96.000 $

Difference (5.000) $

Unit produced during period 8.000

Unit sold during period 9.000

unit increas/decrease in FG inventory (1.000)

Fixed FOH/unit under absorption costing x 5 $

Difference (5.000)

Conclusion

- The different between absorption and direct costing income statements lies on fixed FOH. Absorption costing

charge fixed FOH based on unit sold when direct costing fully charge fixed FOH at the current period.

- In other word, direct and absorpton income statement would be no different when unit produced equal to unit

sold in the same period and fixed cost/unit has no difference at current and previous period.

- For more advanced case variance, its strongly recommended to study the following cases from Carters book:

P20-2 added cost variance & increase in FG inventory

P20-3 added cost variance & decrease in FG inventory

P20-4 2 quaters income statement assigned to inventory based with FIFO inventory costing method

CVP Analysis

Introduction

Cost, volume, profit (CVP) analysis is a tool that provides management with information about relationship among

costs, profits, product mix, and sales volume. CVP is based on the following asumption:

- That all cost can be segregated into fixed and variable portions.

- That total fixed costs are constant over the range of the analysis

- That total variable costs change in proportion of volume.

Break even analysis is used to determined the level of sales and mix of products required to just recover all cost

incurred during the period.

Break even point (BEP) is the point which cost and revenue are equal.

Relationship between CVP and BEP: When analysing with CVP, break even point is of concern for management to

compute margin of safety, which indicates how much sales can decrease from the targeted level befoe the company

will incur losses.

Equations

Legends:

R(BE) : Total sales revenue required at

BEP

R : Total sales revenue

Q(BE) : Quantity of product required to at

BEP

Q : Quantity of product

F : Total fixed cost

V : Variable cost per $ sales revenue

C : Total variable cost per unit

P : Price per unit

: Total Profit

Disclaimer: Im not an expert in accounting neither fluent in english. I was asked to make this resume and was lazy

translating Carters book. More importantly feel awkward using accounting terms in Indonesian. Any

corrections are welcomed.

Example

CVPs questions usually asked us to compute BEP and sales required to meet certain profit. It could be in dollars

(R equations) or in product quantity that must be sold (Q equations).

4. Soal Latihan Cost Accounting by Mr. Agung

PT. EFG telah melakukan analisis terkait dengan biaya produksi dan penjuaan 5.000 unit produk A, dengan

rincian sbb:

DM $ 75.000

DL $ 50.000

Var. FOH $ 25.000

Fix. FOH $ 35.000

Var. marketing exp. $ 10.000

Fix. marketing exp. $ 20.000

Pertanyaan:

- Hitung berapa jumlah unit yang dibutuhkan untuk mencari titik impas dengan harga jual per unit adalah

$40.

- Hitung berapa unit yang dibutuhkan untuk mendapatkan keuntungan $ 20.000 (ignore tax)

- Tentukan berapa harga jual yang harus diubah oleh perusahaan untuk dapat menghasilkan keuntungan

(profit) 20% dari penjualan (dengan asumsi penjualan 5.000 unit).

Answer:

Variable cost:

DM 75.000 1.

DL 50.000

Var. FOH 25.000 Q(BE) = 55.000

Var. Marketi ng exp 10.000 40-32

Total var. Cost 160.000 Q(BE) = 6.875 uni ts

uni t produced 5.000

var. Cost/uni t 32 2.

Fixed cost: Q = 55.000 + 20.000

Fi xed FOH 35.000 40-32

Fi xed Marketi ng exp. 20.000 Q = 9.375 uni ts

Total fi xed cost 55.000

uni t produced 5.000 3. cost/uni t = var. Cost/uni t + fi x. cost/uni t

Fi x. Cost/uni t 11 = 32 +11

= 43

Pri ce wi th 20% profi t from sal es

= 43 x 100/80

= 53,75 $

Conclusion

- Its simple, isnt it? ow...really? so, lets try more challenging question bellow without peeking its solution :

P20-8 2 products CVP analisys with tax element.

- for more fundamental understanding especially in equations, u may read carters book.

Disclaimer: Im not an expert in accounting neither fluent in english. I was asked to make this resume and was lazy

translating Carters book. More importantly feel awkward using accounting terms in Indonesian. Any

corrections are welcomed.

Chapter 20 Differential Cost Analysis

Introduction

Differential cost analysis is a decision model that can be used for evaluating differential revenue and cost that

related to various alternative actions. Differential cost studies are short term. they are not useful for strategic planning

because they ignore long-term effects of decisions. The benefits using differential cost analysis are for measure

revenue, cost, and profit margin that will occur in the future when a decision is taken. Examples:

1. Accepting or refusing additional orders

2. Accepting or refusing special orders

3. Evaluating make-or-buy alternatives

4. Reducing price in a competitive market

5. Expanding, shutting down, or eliminating a facilitiy

6. Increasing, curtailing, or stopping production of certain products

7. Determining wheter to sell or to process further

8. Choosing among alternative routings in product manufacture

9. Determining the maximum price to pay for raw material

Company may (read conclusion below) accept the proposed project if it will provide additional profit margin.

Accepting or refusing additional orders

Additional orders usually proposed with price lower than normal price. And the company will be interested if

total normal production and addtional order have not met maximum company capacity.

Example

From Mr. Agungs slide: Kapasitas terpasang PT. Aduhai 18.000unit/tahun. Akhir Januari 2006 perusahaan

telah berproduksi dan menjual sebanyak 10.000 unit @ IDR 14.000.

Ilustrasi biaya operasional 10.000 unit:

keterangan Nilai ( Ribuan Rp )

Bahan Baku 20.000

Upah Langsung 35.000

BOP Variabel 15.000

BOP Tetap 24.000

B.Pemasaran Variabel 10.000

B.Pemasaran Tetap 4.000

Administrasi Tetap 9.000

T o t a l 117.000

Salah satu konsumen datang dengan pesanan sebanyak 6.000 unit dengan harga @ IDR 10.000. Diterima atau

ditolak pesanan tersebut?

Disclaimer: Im not an expert in accounting neither fluent in english. I was asked to make this resume and was lazy

translating Carters book. More importantly feel awkward using accounting terms in Indonesian. Any

corrections are welcomed.

Answer

Keterangan Penjualan awal 10.000 unit

(Ribuan Rp)

Penjualan Tambahan 6000 unit

(Ribuan Rp)

Penjualan 140.000 60.000

B.Bahan Baku 20.000 12.000

B.Upah Langsung 35.000 21.000

BOP Variabel 15.000 9.000

BOP Tetap 24.000 -

B.Pemasaran Var 10.000 6.000

B.Pemasaran Tetap 4.000 -

B.Adm Tetap 9.000 -

Laba Usaha 23.000 12.000

Conclusion

- From the example above, company may accept the offer since it gives additional profit. But management

should also consider of the long-run effect of the sale on the other (regular) customers and the reaction of

competitors. If the regular customers become aware that the product has been sold at a reduced price, they

may demand simillar cost concessions. If the concessions are not granted, the loss of bussiness could result,

and if granted, a reduced profit margin could result. On the other hand product that sold at reduced price

might affect competitors to retaliate by cutting their prices. Such actions can result in a price war and lost

profits for all concerned. So, the decision wheter to approve or not is literally subjective.

- Fixed costs are not added for analysing additional order. It happens because all fixed costs have been allocated

to normal production.

- for more exercise, you can try E21-2 from carters book.

Accepting or refusing special orders

special order not only proposed at lower price and the company has not met maximum capacity. But also

makes company spend additional cost. It can be from additional materials or rent expense from special equipment.

Example

From quiz - PT. ABC menjual sepatu OR, telah mengunakan 70% kapasitas produksi. Karena berkualitas,

didekati ADIDAS Co. untuk memproduksi sepatu. ADIDAS menawar pembelian 150.000 unit dengan spesifikasi

khusus. Untuk memnuhi permintaan, diperlukan peralatan khusus dan material tambahan. produksi standar

perusahaan memerlukan biaya sbb:

DM $ 5

DL $ 6

Applied FOH $ 9

Selling commission 5%

Shipping cost $ 1

Fixed Marketing

expense

$ 5.000

Var. marketing

expense

$

1,5/unit

untuk menentukan harga jual, perusahaan menggunakan ark up 40% dari product cost. Sedangkan untuk

memenuhi pesanan khusus, perusahaan harus menambah biaya sewa peralatan $ 15.000 dan tambahan DM $

2/unit. harga yang ditawarkan ADIDAS adalah $ 30. Pertanyaan:

Disclaimer: Im not an expert in accounting neither fluent in english. I was asked to make this resume and was lazy

translating Carters book. More importantly feel awkward using accounting terms in Indonesian. Any

corrections are welcomed.

- Tentukan harga penawaran minimum yang akan dterima PT. ABC

- Dari penawaran tersebut, apakah perusahaan akan menerima atau menolak

- Identifikasikan faktor yang harus dipertimbagkan dalam menerima atau menolak tawaran tersebut.

Answer

Sales 30 $ 150.000 4.500.000 $

DM 5 $ 150.000 750.000 $

DL 6 $ 150.000 900.000 $

Applied FOH 9 $ 150.000 1.350.000 $

Selling commission 30 $ 150.000 5% 225.000 $

Shipping cost 1 $ 150.000 150.000 $

Var. Marketing exp 1,5 $ 150.000 225.000 $

rent expense 15.000 $

additional DM 2 $ 150.000 300.000 $

Total cost 3.915.000 $

Profit 585.000 $

Total Cost 3.915.000 $

Total unit 150.000

minimum offer (BEP) 26,10 $

accept the offer?

factors Production capacity, revenue, cost, profit margin, long-run

effects such sales on regular costumers and price war

Yes, it will still incur profit and assumed that the offer

within 30% company production capacity and ignoring long-

term effects

Conclusion

- not only for profit, but management should also consider long-run effect such reducing profit on regular sales

and war pricing against competitor in the future because they have sold special order at lower price. But, as far

as i remember, Mr. Agung stated that decision to approve order is taken if special/additional order can provide

additional profit. So, do whats MR. Agung said at final exam.

- Fixed costs from normal production are not added. But you shoul compute additional fixed cost and materials

on special order.

- For more exercises,try P21-1 and P21-2 Carters book.

Evaluating make-or-buy alternatives

Sometimes company faces alternatives to make or purchases their component parts for finished products from another

company. Cheaper cost by buying than making is the main factor.

Example

From Mr. Agungs slide Kapasitas produks PT. KAMI 100.000 unit/tahun dengan harga jual @ IDR 15.000. Pada

akhir tahun 2006 dapat kontrak dari pemeritah untuk tahun 2007 ebanyak 100.000 unit dengan harga @ IDR 15.000.

PT. ANDA perusahaan sejenis menawarkan produknya ke PT.KAMI dengan harga @ IDR 9.500. Produksi atau beli?

Disclaimer: Im not an expert in accounting neither fluent in english. I was asked to make this resume and was lazy

translating Carters book. More importantly feel awkward using accounting terms in Indonesian. Any

corrections are welcomed.

taksiran biaya operasional 100.000 unit

keterangan Nilai (Ribuan Rp)

Bahan baku 200.000

Upah langsung 350.000

BOP Variabel 150.000

BOP Tetap 240.000

Pemasaran Var 100.000

Pemasaran Tetap 40.000

Adm tetap 90.000

T o t a l 1.170.000

Answer

Keterangan Produksi ( Ribuan Rp) Membeli (Ribuan Rp)

Penjualan 1.500.000 1.500.000

B.Bahan Baku 200.000 -

B.Upah Lsg 350.000 -

BOP Variabel 150.000 -

BOP Tetap 240.000 240.000

B.Pemas.Variabel 100.000 -

B.Pemas.Tetap 40.000 40.000

B.Adm Tetap 90.000 90.000

Pembelian Produk - 950.000

Laba Usaha 330.000 180.000

Conclusion

- By making on its own, company will receive more profit. so the choice would obviously self production.

- But there is 2 type of cases.

1

st

. Company has already manufacturing the parts or whole product until now. Then decide wheter to stop

production and buy or continue production.

2

nd

. Company has never manufactured the parts or whole product ever before. Then decide wheter to start

making or buy.

- In the 1

st

case, u should consider about the fixed costs (full arbsorption costing) when analysing, but in 2

nd

case, you should use differential cost in 1

st

year. That means you should not compute fixed costs in it. But in

2

nd

year (company decided to produce it regularly) and further u have to use full absorption costing.

- for more understanding, try E21-4, E21-5, P21-4 from Carters book.

Vous aimerez peut-être aussi

- Solutions On Capital Budgeting AssignmentsDocument3 pagesSolutions On Capital Budgeting AssignmentsjakezzionPas encore d'évaluation

- Managerial Economics 8th Edition Samuelson Solutions Manual DownloadDocument18 pagesManagerial Economics 8th Edition Samuelson Solutions Manual DownloadJulie Tauscher100% (23)

- Jawaban 6 - Customer ProfitabilityDocument6 pagesJawaban 6 - Customer ProfitabilityfauziyahPas encore d'évaluation

- CVPDocument10 pagesCVPLorena Pernato0% (1)

- Chapter 12Document42 pagesChapter 12Yong RenPas encore d'évaluation

- Cost Management A Strategic Emphasis 6th Edition Blocher Solutions ManualDocument25 pagesCost Management A Strategic Emphasis 6th Edition Blocher Solutions Manuala108725720Pas encore d'évaluation

- Chapter 3: Product Costing and Cost Accumulation in A Batch Production EnvironmentDocument31 pagesChapter 3: Product Costing and Cost Accumulation in A Batch Production EnvironmentSusan TalaberaPas encore d'évaluation

- ABC Hansen & Mowen ch4 P ('t':'3', 'I':'669594619') D '' Var B Location Settimeout (Function ( If (Typeof Window - Iframe 'Undefined') ( B.href B.href ) ), 15000)Document22 pagesABC Hansen & Mowen ch4 P ('t':'3', 'I':'669594619') D '' Var B Location Settimeout (Function ( If (Typeof Window - Iframe 'Undefined') ( B.href B.href ) ), 15000)Aziza AmranPas encore d'évaluation

- Differential Analysis: The Key To Decision MakingDocument25 pagesDifferential Analysis: The Key To Decision MakingJhinglee Sacupayo Gocela100% (1)

- Horngren Cost 7ce ISM Ch14Document36 pagesHorngren Cost 7ce ISM Ch14Alan WenPas encore d'évaluation

- Review Problems Managerial AccountingDocument3 pagesReview Problems Managerial Accountingukandi rukmanaPas encore d'évaluation

- Assigment 5.34Document7 pagesAssigment 5.34Indahna SulfaPas encore d'évaluation

- Target Costing Presentation FinalDocument57 pagesTarget Costing Presentation FinalMr Dampha100% (1)

- Cost Test Bank by CarterDocument426 pagesCost Test Bank by Carterguess who50% (2)

- 6e ch08Document42 pages6e ch08Ever PuebloPas encore d'évaluation

- Anton Video Tech Sells The Play Station Portable (PSP) 1 2Document6 pagesAnton Video Tech Sells The Play Station Portable (PSP) 1 2Siti Marian V. OlmillaPas encore d'évaluation

- PrelimA2 - CVP AnalysisDocument8 pagesPrelimA2 - CVP AnalysishppddlPas encore d'évaluation

- Cost TB C02 CarterDocument23 pagesCost TB C02 CarterArya Stark100% (1)

- 20 Direct Costing - Cost-Volume-Profit AnalysisDocument28 pages20 Direct Costing - Cost-Volume-Profit AnalysisAccounting MaterialsPas encore d'évaluation

- 2311 Acct6131039 Lhfa TK1-W3-S4-R2 Team8Document8 pages2311 Acct6131039 Lhfa TK1-W3-S4-R2 Team8Nadilla NurPas encore d'évaluation

- Ethic 1Document11 pagesEthic 1Ah BiiPas encore d'évaluation

- Lecture-8.1 Job Order Costing (Theory) PDFDocument15 pagesLecture-8.1 Job Order Costing (Theory) PDFNazmul-Hassan SumonPas encore d'évaluation

- Test Bank Managerial Accounting Decision Making and Motivating Performance 1st Edition Datar and Rajan PDFDocument9 pagesTest Bank Managerial Accounting Decision Making and Motivating Performance 1st Edition Datar and Rajan PDFAlly CapacioPas encore d'évaluation

- HM-Ch03 Activity Cost Behaviour-TerjDocument49 pagesHM-Ch03 Activity Cost Behaviour-TerjMc KeteqmanPas encore d'évaluation

- ICMA Questions Aug 2011Document57 pagesICMA Questions Aug 2011Asadul Hoque100% (1)

- Exercise 7 - Standard CostingDocument3 pagesExercise 7 - Standard CostingSports savagePas encore d'évaluation

- Akuntansi Manajemen Absoprtion CostingDocument7 pagesAkuntansi Manajemen Absoprtion CostingMuhammad SyahPas encore d'évaluation

- Chapter08 BudgetingDocument19 pagesChapter08 Budgetinglyn0490Pas encore d'évaluation

- 1 ++Marginal+CostingDocument71 pages1 ++Marginal+CostingB GANAPATHYPas encore d'évaluation

- Week 5 A Framework For ChangeDocument38 pagesWeek 5 A Framework For ChangeseescriPas encore d'évaluation

- Acct 203 - CH 6 DqsDocument2 pagesAcct 203 - CH 6 Dqsapi-340301334100% (1)

- Programmazione e Controllo Esercizi Capitolo 11Document31 pagesProgrammazione e Controllo Esercizi Capitolo 11Jamie Shaula ColladoPas encore d'évaluation

- Chapter 19 Accounting For State and Local Governmental Units - Governmental FundsDocument45 pagesChapter 19 Accounting For State and Local Governmental Units - Governmental FundsFauzi AchmadPas encore d'évaluation

- Cost Behavior Exercises Hand-OutsDocument2 pagesCost Behavior Exercises Hand-OutsDianne MadridPas encore d'évaluation

- Cost Volume Profit Analysis Review NotesDocument17 pagesCost Volume Profit Analysis Review NotesAlexis Kaye DayagPas encore d'évaluation

- Joint Cost AllocationDocument20 pagesJoint Cost AllocationMuhammad Haris Fajar RahmatullahPas encore d'évaluation

- SDocument59 pagesSmoniquettnPas encore d'évaluation

- UAE Accounting System vs. IFRS Rules.Document6 pagesUAE Accounting System vs. IFRS Rules.Shibam JhaPas encore d'évaluation

- Horngren ch05Document44 pagesHorngren ch05Moataz MaherPas encore d'évaluation

- Tutorial Chapter 13 - 14 Cost Management System - ABC - Pricing DecisionsDocument42 pagesTutorial Chapter 13 - 14 Cost Management System - ABC - Pricing DecisionsNaKib NahriPas encore d'évaluation

- Programmazione e Controllo Esercizi Capitolo 11 PDFDocument31 pagesProgrammazione e Controllo Esercizi Capitolo 11 PDFAby HuzaiPas encore d'évaluation

- 2010-03-22 081114 PribumDocument10 pages2010-03-22 081114 PribumAndrea RobinsonPas encore d'évaluation

- Pak Taufikur CH 11 Financial Management BrighamDocument69 pagesPak Taufikur CH 11 Financial Management BrighamRidhoVerianPas encore d'évaluation

- CH 02Document13 pagesCH 02John Glenn Lambayon50% (2)

- Pricing Decisions and Cost ManagementDocument25 pagesPricing Decisions and Cost ManagementErcan Efeoğlu100% (1)

- Activity Based CostingDocument51 pagesActivity Based CostingAbdulyunus AmirPas encore d'évaluation

- U.S. Department of Agriculture Promotes The Food Exports: Chapter 4 Government and Global BusinessDocument7 pagesU.S. Department of Agriculture Promotes The Food Exports: Chapter 4 Government and Global BusinessRhea Royce CabuhatPas encore d'évaluation

- Study Guide SampleDocument154 pagesStudy Guide SampleBryan Seow0% (1)

- Fundamentals of Cost Management: True / False QuestionsDocument238 pagesFundamentals of Cost Management: True / False QuestionsElaine GimarinoPas encore d'évaluation

- Analysis of Risk and Return: Multiple ChoiceDocument28 pagesAnalysis of Risk and Return: Multiple ChoiceHaris KhanPas encore d'évaluation

- ACC51112 Transfer PricingDocument7 pagesACC51112 Transfer PricingjasPas encore d'évaluation

- Variable Vs Absorption CostingDocument15 pagesVariable Vs Absorption CostingAmaliaPutriKamilPas encore d'évaluation

- Flexible Budgets and Overhead Analysis: True/FalseDocument69 pagesFlexible Budgets and Overhead Analysis: True/FalseRv CabarlePas encore d'évaluation

- Chapter 21 - Weygandt Financial and Managerial Accounting, 3e Challenge ExercisesDocument2 pagesChapter 21 - Weygandt Financial and Managerial Accounting, 3e Challenge ExercisesTien Thanh DangPas encore d'évaluation

- Chapter02 Solutions Hansen6eDocument16 pagesChapter02 Solutions Hansen6eJessica NoviaPas encore d'évaluation

- Chapter 15Document12 pagesChapter 15Zack ChongPas encore d'évaluation

- CH 14Document4 pagesCH 14Hoàng HuyPas encore d'évaluation

- CH 11Document27 pagesCH 11Nikki GarciaPas encore d'évaluation

- Fin3 Midterm ExamDocument8 pagesFin3 Midterm ExamBryan Lluisma100% (1)

- Cost and Cost ClassificationDocument10 pagesCost and Cost ClassificationAmod YadavPas encore d'évaluation

- CH 4Document21 pagesCH 4JAPPas encore d'évaluation

- Chapter On CVP 2015 - Acc 2Document16 pagesChapter On CVP 2015 - Acc 2nur aqilah ridzuanPas encore d'évaluation

- Day 3Document33 pagesDay 3Leo ApilanPas encore d'évaluation

- The Alpine House, Inc., Is A Large Retailer of Snow Skis.Document13 pagesThe Alpine House, Inc., Is A Large Retailer of Snow Skis.Cinema RecappedPas encore d'évaluation

- ECO162 Chapter 6Document15 pagesECO162 Chapter 6farahPas encore d'évaluation

- QmfgexDocument21 pagesQmfgexCeleste CondoriPas encore d'évaluation

- Conviser Company: Joint Cost Product C Product L Product T TotalDocument6 pagesConviser Company: Joint Cost Product C Product L Product T TotalKiyo KoPas encore d'évaluation

- Video Case CH 15Document3 pagesVideo Case CH 15Panji Yudha SanjayaPas encore d'évaluation

- Lec 6 - Factor ProductDocument18 pagesLec 6 - Factor ProductPriyadharshan BobbyPas encore d'évaluation

- StratDocument20 pagesStratDhea MaligayaPas encore d'évaluation

- Production Possibility FrontierDocument2 pagesProduction Possibility FrontierAlex Moore-MinottPas encore d'évaluation

- 11th Cost and RevenueDocument2 pages11th Cost and Revenueshaurya patelPas encore d'évaluation

- NOS-ManufacturingDocument5 pagesNOS-Manufacturingws. cloverPas encore d'évaluation

- Answer P5-2Document2 pagesAnswer P5-2Prilly ManembuPas encore d'évaluation

- Case 5-33 (Pittman) - 1Document12 pagesCase 5-33 (Pittman) - 1MOHAK ANANDPas encore d'évaluation

- Assignment 1B - HP Case Study Assignment 1B - HP Case StudyDocument5 pagesAssignment 1B - HP Case Study Assignment 1B - HP Case StudyTun Thu LinPas encore d'évaluation

- C.A-I Chapter-5Document4 pagesC.A-I Chapter-5Tariku KolchaPas encore d'évaluation

- The Costs of Production: DR Ayesha Afzal Assistant ProfessorDocument19 pagesThe Costs of Production: DR Ayesha Afzal Assistant ProfessorFady RahoonPas encore d'évaluation

- Micro Economics UNIT 2 BBADocument6 pagesMicro Economics UNIT 2 BBAkunjapPas encore d'évaluation

- Acoounting For Inventory and Cost of Goods SoldDocument39 pagesAcoounting For Inventory and Cost of Goods Soldsaba gul rehmatPas encore d'évaluation

- Managerial Economics - Short Answer CHDocument4 pagesManagerial Economics - Short Answer CHAnkita T. MoorePas encore d'évaluation

- SaaS Metrics Cheat SheetDocument8 pagesSaaS Metrics Cheat SheetJoe WiraPas encore d'évaluation

- The Cost of ProductionDocument49 pagesThe Cost of ProductionShreyans KothariPas encore d'évaluation

- Periode: 01-03-2023 Branch: 1PZ1: NIK Nama JabatanDocument10 pagesPeriode: 01-03-2023 Branch: 1PZ1: NIK Nama JabatanClarisa EmeliaPas encore d'évaluation

- Pcu Topic Number 4 ActivityDocument1 pagePcu Topic Number 4 ActivityAilyn S. BulataoPas encore d'évaluation

- Economics Unit Ii 3Document90 pagesEconomics Unit Ii 3Aishvariya SPas encore d'évaluation

- 4 Production Functions - PPT IsoquantsDocument46 pages4 Production Functions - PPT IsoquantsVishal GalaPas encore d'évaluation

- The Traditional Theory of CostsDocument13 pagesThe Traditional Theory of Costsamrendra kumarPas encore d'évaluation

- Exploring New Market QuestionDocument5 pagesExploring New Market QuestionA-01 SNEHAL AHERPas encore d'évaluation

- Agri CHAPTER 3 and 4Document22 pagesAgri CHAPTER 3 and 4Girma UniqePas encore d'évaluation