Académique Documents

Professionnel Documents

Culture Documents

Letter

Transféré par

ravi4paperCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Letter

Transféré par

ravi4paperDroits d'auteur :

Formats disponibles

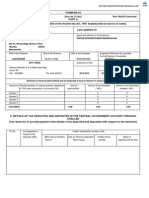

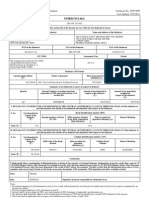

FORM NO.

16

[See rule 31(1)(a)]

Certificate under Section 203 of the Income-tax Act, 1961 for tax deducted at source on salary

Name and address of the Employer

TATA CONSULTANCY SERVICES LIMITED

8th Flr, Nirmal Bldg, Nar, Nariman point, 11th F,

Nariman point, Mumbai - 400021

Maharashtra

+(91)22-0067713127

bhikhoo.katrak@tcs.com

Name and address of the Employee

NEEL KUMAR PRARYA

3-15 PLOT NO 269, PRASHANTI HILLS PHASE II, MEERPET

SAROOR NAGAR MDL, R R DIST, HYDERABAD - 500079 Andhra

Pradesh

PAN of the Deductor

AAACR4849R

TAN of the Deductor

MUMT11446B

PAN of the Employee

AJWPP3305Q

Assessment Year

2014-15

CIT (TDS)

The Commissioner of Income Tax (TDS)

Room No. 900A, 9th Floor, K.G. Mittal Ayurvedic Hospital

Building, Charni Road , Mumbai - 400002

Period with the Employer

To

31-Mar-2014

From

01-Apr-2013

Summary of amount paid/credited and tax deducted at source thereon in respect of the employee

Quarter(s)

Receipt Numbers of original

quarterly statements of TDS

under sub-section (3) of

Section 200

Amount of tax deducted

(Rs.)

Amount of tax deposited / remitted

(Rs.) Amount paid/credited

Q1 HMFXXYTB 22022.00 22022.00 258321.00

Q2 HMFXCGDC 23336.00 23336.00 256521.00

Q3 QASFGCBG 22359.00 22359.00 248181.00

Q4 QQOZRFTA 28541.00 28541.00 281845.00

Total (Rs.) 96258.00 96258.00 1044868.00

Sl. No.

Tax Deposited in respect of the

deductee

(Rs.)

Book Identification Number (BIN)

Receipt Numbers of Form

No. 24G

DDO serial number in Form no.

24G

Date of transfer voucher

(dd/mm/yyyy)

Status of matching

with Form no. 24G

Total (Rs.)

Sl. No.

Tax Deposited in respect of the

deductee

(Rs.)

Challan Identification Number (CIN)

BSR Code of the Bank

Branch

Date on which Tax deposited

(dd/mm/yyyy)

Challan Serial Number Status of matching with

OLTAS*

1 4700.00 0510308 07-05-2013 45116 F

2 11579.00 0510308 07-06-2013 45007 F

3 5743.00 0510308 05-07-2013 45371 F

4 5826.00 0510308 07-08-2013 45254 F

PART A

Certificate No. RKGOXHH Last updated on 28-May-2014

Employee Reference No.

provided by the Employer

(If available)

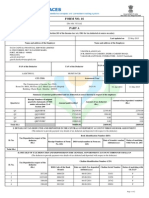

I. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH BOOK ADJUSTMENT

(The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee)

II. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH CHALLAN

(The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee)

Page 1 of 2

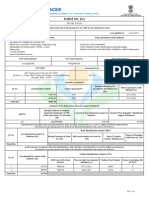

Certificate Number: RKGOXHH TAN of Employer: MUMT11446B PAN of Employee: AJWPP3305Q Assessment Year: 2014-15

I, BHIKHOO JEHANGIRJI KATRAK, son / daughter of JEHANGIRJI DINSHAJI KATRAK working in the capacity of SENIOR GENERAL MANAGER (designation) do

hereby certify that a sum of Rs.96258.00 [Rs. Ninety Six Thousand Two Hundred and Fifty Eight Only (in words)] has been deducted and a sum of Rs.96258.00 [Rs.

Ninety Six Thousand Two Hundred and Fifty Eight Only] has been deposited to the credit of the Central Government. I further certify that the information given

above is true, complete and correct and is based on the books of account, documents, TDS statements, TDS deposited and other available records.

Verification

Place

Date (Signature of person responsible for deduction of Tax)

MUMBAI

31-May-2014

SENIOR GENERAL MANAGER Designation: Full Name:BHIKHOO JEHANGIRJI KATRAK

Notes:

1. Part B (Annexure) of the certificate in Form No.16 shall be issued by the employer.

2. If an assessee is employed under one employer during the year, Part 'A' of the certificate in Form No.16 issued for the quarter ending on 31st March of the financial year shall contain the details

of tax deducted and deposited for all the quarters of the financial year.

3. If an assessee is employed under more than one employer during the year, each of the employers shall issue Part A of the certificate in Form No.16 pertaining to the period for which such

assessee was employed with each of the employers. Part B (Annexure) of the certificate in Form No. 16 may be issued by each of the employers or the last employer at the option of the assessee.

4. To update PAN details in Income Tax Department database, apply for 'PAN change request' through NSDL or UTITSL.

Sl. No.

Tax Deposited in respect of the

deductee

(Rs.)

Challan Identification Number (CIN)

BSR Code of the Bank

Branch

Date on which Tax deposited

(dd/mm/yyyy)

Challan Serial Number Status of matching with

OLTAS*

5 11684.00 0510308 07-09-2013 45001 F

6 5826.00 0510308 07-10-2013 45380 F

7 5826.00 0510308 07-11-2013 40402 F

8 10708.00 0510308 06-12-2013 40188 F

9 5825.00 0510308 07-01-2014 40246 F

10 5825.00 0510308 07-02-2014 40107 F

11 13909.00 0510308 07-03-2014 40474 F

12 8807.00 0510308 30-04-2014 40420 F

Total (Rs.) 96258.00

Legend used in Form 16

* Status of matching with OLTAS

Legend Description Definition

U Unmatched

Deductors have not deposited taxes or have furnished incorrect particulars of tax payment. Final credit will be reflected only when payment

details in bank match with details of deposit in TDS / TCS statement

P Provisional

Provisional tax credit is effected only for TDS / TCS Statements filed by Government deductors."P" status will be changed to Final (F) on

verification of payment details submitted by Pay and Accounts Officer (PAO)

O Overbooked

Payment details of TDS / TCS deposited in bank by deductor have matched with details mentioned in the TDS / TCS statement but the

amount is over claimed in the statement. Final (F) credit will be reflected only when deductor reduces claimed amount in the statement or

makes new payment for excess amount claimed in the statement

F Final

In case of non-government deductors, payment details of TDS / TCS deposited in bank by deductor have matched with the payment details

mentioned in the TDS / TCS statement filed by the deductors. In case of government deductors, details of TDS / TCS booked in Government

account have been verified by Pay & Accounts Officer (PAO)

Page 2 of 2

Digitally signed by

BHIKHOO J KATRAK

Date: 2014.05.31 06:09:33

BRT

Signature Not Verified

Vous aimerez peut-être aussi

- Form No. 16: Part ADocument5 pagesForm No. 16: Part APunitBeriPas encore d'évaluation

- Form 16 by Tcs PDFDocument5 pagesForm 16 by Tcs PDFAnonymous utPqL6jA3i25% (4)

- Form 16Document2 pagesForm 16SIVA100% (1)

- Samsung India Electronics Pvt. LTD.: Signature Not VerifiedDocument7 pagesSamsung India Electronics Pvt. LTD.: Signature Not VerifiedGajendra Singh RaghavPas encore d'évaluation

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Kamlesh PatelPas encore d'évaluation

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionD'EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionPas encore d'évaluation

- 14374752Document2 pages14374752Anshul MehtaPas encore d'évaluation

- A 40029127 Part-ADocument2 pagesA 40029127 Part-Adeepak_cool4556Pas encore d'évaluation

- ADRPD2454Document2 pagesADRPD2454ravibhartia1978Pas encore d'évaluation

- QUA05242 Form16Document5 pagesQUA05242 Form16saurabhPas encore d'évaluation

- ADEPJ433Document2 pagesADEPJ433ravibhartia1978Pas encore d'évaluation

- Shashank Kantheti Hyd 12 13Document5 pagesShashank Kantheti Hyd 12 13kshashankPas encore d'évaluation

- Ahrpv0731f 2013-14Document2 pagesAhrpv0731f 2013-14Shiva KumarPas encore d'évaluation

- Ahspy8053e 2014-15Document2 pagesAhspy8053e 2014-15kzx08110Pas encore d'évaluation

- Form 16Document6 pagesForm 16anon_825378560Pas encore d'évaluation

- Form 16Document22 pagesForm 16Ajay Chowdary Ajay ChowdaryPas encore d'évaluation

- Cfupm8774e 2016-17Document2 pagesCfupm8774e 2016-17Sukanta ParidaPas encore d'évaluation

- PrintTax14 PDFDocument2 pagesPrintTax14 PDFarnieanuPas encore d'évaluation

- Sungf9tIqDhAO64RjsPj Form16 PartADocument2 pagesSungf9tIqDhAO64RjsPj Form16 PartARAJIV RANJAN PRIYADARSHIPas encore d'évaluation

- Form 16 PDFDocument5 pagesForm 16 PDFJoshua Hicks100% (1)

- 255 PartA PDFDocument2 pages255 PartA PDFRamyaMeenakshiPas encore d'évaluation

- PDFDocument5 pagesPDFdhanu1434Pas encore d'évaluation

- Form 16Document2 pagesForm 16Mithun KumarPas encore d'évaluation

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToMohammed MohiePas encore d'évaluation

- FKMPS9021Q Q3 2016-17Document2 pagesFKMPS9021Q Q3 2016-17Hannan SatopayPas encore d'évaluation

- Aaaco1111l Form16a 2011-12 Q3Document1 pageAaaco1111l Form16a 2011-12 Q3Pradnesh KulkarniPas encore d'évaluation

- Gopal G. Trivedi - (108-108) - (2011 - 2012) - Form24Document2 pagesGopal G. Trivedi - (108-108) - (2011 - 2012) - Form24Gopal TrivediPas encore d'évaluation

- Form 16: Wipro LimitedDocument5 pagesForm 16: Wipro Limiteddeepak9976Pas encore d'évaluation

- Form16Document5 pagesForm16er_ved06Pas encore d'évaluation

- Form 16A: Summary of Tax Deducted at Source in Respect of DeducteeDocument1 pageForm 16A: Summary of Tax Deducted at Source in Respect of DeducteeVinayak BadagiPas encore d'évaluation

- TDS at A Glance 2013-14 BookDocument34 pagesTDS at A Glance 2013-14 Bookajad babuPas encore d'évaluation

- Kaushik Sarkar Form 16 DynProDocument5 pagesKaushik Sarkar Form 16 DynProKaushik SarkarPas encore d'évaluation

- TAMIL NADU GOVERNMENT - CONTRIBUTORY PENSION SCHEME - FAQsDocument4 pagesTAMIL NADU GOVERNMENT - CONTRIBUTORY PENSION SCHEME - FAQsDr.Sagindar100% (1)

- P.P.T On Duties - Responsibilities of DDO For GSTDocument30 pagesP.P.T On Duties - Responsibilities of DDO For GSTBilal A BarbhuiyaPas encore d'évaluation

- 141121120000amiop CRS IndivisualDocument5 pages141121120000amiop CRS Indivisualdesignify101Pas encore d'évaluation

- Bir 2316Document2 pagesBir 2316SirDatz TheGreatPas encore d'évaluation

- DSCN - Shree AutomotiveDocument24 pagesDSCN - Shree AutomotiveNikhilesh BhattacharyyaPas encore d'évaluation

- Pay and AllowancesDocument23 pagesPay and AllowancesRavi KumarPas encore d'évaluation

- MTC - 40Document14 pagesMTC - 40Anonymous eCUVunlzKaPas encore d'évaluation

- Compassionate Appointment Approved Merit Point System and FormsDocument10 pagesCompassionate Appointment Approved Merit Point System and FormssoorayshPas encore d'évaluation

- Form No.16: Part ADocument3 pagesForm No.16: Part AYogesh DhekalePas encore d'évaluation

- REPLYDocument94 pagesREPLYabhiGT40100% (1)

- RMC No 23-2012 - Withholding of TaxesDocument7 pagesRMC No 23-2012 - Withholding of TaxesJOHAYNIEPas encore d'évaluation

- Form 16Document3 pagesForm 16Alla VijayPas encore d'évaluation

- Itr 2316Document1 pageItr 2316joshua158150% (2)

- Professional Training ReportDocument10 pagesProfessional Training Reportjaya sreePas encore d'évaluation

- Gadiano 2316Document2 pagesGadiano 2316Jypy Torrejos100% (1)

- 2014-15 Form 16Document4 pages2014-15 Form 16om shanker soniPas encore d'évaluation

- 2316 (1) 2Document2 pages2316 (1) 2jonbelzaPas encore d'évaluation

- Bir 2013Document1 pageBir 2013karlycorePas encore d'évaluation

- CBDT Press Release No 04062010Document1 pageCBDT Press Release No 04062010kcitymanPas encore d'évaluation

- Introduction To TdsDocument28 pagesIntroduction To TdsGavendra BhartiPas encore d'évaluation

- Session - 1Document14 pagesSession - 1AARCHI JAINPas encore d'évaluation

- 2316Document1 page2316EmmanuelClementCastilloTalimoroPas encore d'évaluation

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument1 pageKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldRoger BernasorPas encore d'évaluation

- 1040 Exam Prep: Module II - Basic Tax ConceptsD'Everand1040 Exam Prep: Module II - Basic Tax ConceptsÉvaluation : 1.5 sur 5 étoiles1.5/5 (2)

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesD'EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesPas encore d'évaluation

- A Comparative Analysis on Tax Administration in Asia and the PacificD'EverandA Comparative Analysis on Tax Administration in Asia and the PacificPas encore d'évaluation

- 1040 Exam Prep: Module I: The Form 1040 FormulaD'Everand1040 Exam Prep: Module I: The Form 1040 FormulaÉvaluation : 1 sur 5 étoiles1/5 (3)