Académique Documents

Professionnel Documents

Culture Documents

T2125 and GST-HST Worksheet

Transféré par

Tax Templates Inc.Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

T2125 and GST-HST Worksheet

Transféré par

Tax Templates Inc.Droits d'auteur :

Formats disponibles

TTI develops Excel worksheets to help Canadian professionals solve tax challenges.

Please see our website, or contact us for more information. Were happ! to arrange a presentation or provide cloud access.

www.taxtemplates.ca " sales#taxtemplates.ca " $%&''%('$%&$()

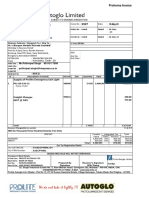

T2125 & GST-HST Worksheet

This worksheet supports the integrated completion of the T*$*( + ,tatement of -usiness or Professional

.ctivities, and /,T%0,T return using the ,implified or 1uick methods.

2our clients situation3

Tax !ear ended 4ec 5$, *'$5

/,T%0,T method ,implified method

0,T rate $56

Income and general expenses

o Professional income $$5,'''

o .dvertising 7,(*'

o 89E $,&'&

o :ees and dues $,''' ;no 0,T included<

o Interest &' = $5' = **' >,4 = 5?'

.utomobile expenses

o :uel and oil *,&*(

o Insurance $,*''

o Parking )'7

o -usiness use, and maintenance receipts @about ?'6A ;total km unknown<

8ar $*, *'$5 $*,''' km

Bov $&, *'$5 **,''' km

0ome office expenses

o Electricit! 5,5)'

o Insurance &''

o -usiness use C'' D 7,'''

Ether information

o Computer purchase *,7&C

o CC. per T*$*( 7,*'' ;including assets carried forward<

Calculate the amounts to be reported on !our clients T*$*( and /,T%0,T return.

Mr. A

T2125 and GST / HST Worksheet

Tax year ended December 31, 213

! 1."

13."

Tax year ended

#$s%ness or &ro'ess%ona( %ncome 113,. ) ! 1,. HST or GST ! 13,.

*nc($s%on 'rom +$%ck method !

,ther %ncome ) ! ! HST or GST ! !

,ther ded$ct%ons ) ! ! HST or GST ! !

Ad-$sted .ross %ncome 1,.

Ad/ert%s%n. 0,52. ) ! 0,. HST or GST ! 52.

Mea(s and enterta%nment 1.ross2 1,33. ) ! 1,4. HST or GST ! 10.

#ad debts ! HST or GST ! !

*ns$rance ) ! ! 5o 6xc%se Taxes ! !

*nterest ) 34.53 34.53 5o 6xc%se Taxes ! !

#$s%ness 'ees, (%censes, etc. 1,. ) ! 1,. 5o 6xc%se Taxes o ! !

,''%ce ex&enses ) ! ! HST or GST ! !

S$&&(%es ) ! ! HST or GST ! !

7ro'ess%ona( 'ees ! HST or GST ! !

Mana.ement and adm%n%strat%on ! HST or GST ! !

8ent ) ! ! HST or GST ! !

Ma%ntenance and re&a%rs ) ! ! HST or GST ! !

Sa(ar%es, 9a.es, and bene'%ts ) ! ! 5o 6xc%se Taxes ! !

7ro&erty taxes ! 5o 6xc%se Taxes ! !

Tra/e( ) ! ! HST or GST ! !

Te(e&hone and $t%(%t%es ) ! ! HST or GST ! !

:$e( costs 1not 'or motor /eh%c(es2 ! HST or GST ! !

De(%/ery, 're%.ht, and ex&ress ) ! ! HST or GST ! !

Motor /eh%c(e ex&enses 3,3;. )

<<A / 6<7 c(a%med on T2125 0,2.

7r%/ate hea(th &(an &rem%$ms ! 5o 6xc%se Taxes ! !

,ther ex&enses 19%th tab$(at%ons2 ) ! ! 5o 6xc%se Taxes ! !

,ther ex&enses 19%th tab$(at%ons2 ) ! ! 5o 6xc%se Taxes ! !

,ther ex&enses ! 5o 6xc%se Taxes ! !

,ther ex&enses ! 5o 6xc%se Taxes ! !

,ther ex&enses ! 5o 6xc%se Taxes ! !

,ther ex&enses ! 5o 6xc%se Taxes ! !

,ther ex&enses ! 5o 6xc%se Taxes ! !

,ther ex&enses ! 5o 6xc%se Taxes ! !

5et %ncome 1(oss2 35,33.02 420. Sa(es ex&enses *T<s

GST / HST amo$nts 213 *ncome and sa(es ex&enses 1%nc($de any sa(es taxes2

2 Tab$(at%ons Sa(es tax content <ond%t%on 1 <ond%t%on 2

A&&ro/ed

GST / HST ca(c$(at%on

December 31, 213

Andre9 ,ct 1, 210

7re&ared

8e/%e9ed

1 3

<a(c$(at%on method

7er%od or re.%on

7ro&ort%on

HST rate

GST rate

7ST rate

S%m&(%'%ed method

<ond%t%on 1 <ond%t%on 2

Tem&(ate s$&&ort

T2125 tota( 0 5

;34;

;;35 = ;;34

;231

32;; / 351;

Deta%(s be(o9

Tax Tem&(ates *nc.

210!1!2>

12?2

Mr. A

T2125 and GST / HST Worksheet

Tax year ended December 31, 213

! 1."

13."

Tax year ended

A&&ro/ed

GST / HST ca(c$(at%on

December 31, 213

Andre9 ,ct 1, 210

7re&ared

8e/%e9ed <a(c$(at%on method

7er%od or re.%on

7ro&ort%on

HST rate

GST rate

7ST rate

S%m&(%'%ed method

<ond%t%on 1 <ond%t%on 2

Tem&(ate s$&&ort

Descr%&t%on

@eh%c(e 1

:$e( and o%( 2,325. ) ! 2,5. HST or GST ! 325.

*nterest ! 5o 6xc%se Taxes ! !

*ns$rance 1,2. 1,2. 5o 6xc%se Taxes ! !

A%cens%n. and re.%strat%on ! 5o 6xc%se Taxes ! !

Ma%ntenance and re&a%rs ) ! ! HST or GST ! !

Aeas%n. ! HST or GST ! !

,ther ex&enses 19%th tab$(at%ons2 ) ! ! 5o 6xc%se Taxes ! !

,ther ex&enses ! 5o 6xc%se Taxes ! !

#$s%ness $se &ercenta.e 1,13; 10,030 m >." m >."

7ark%n. ;0. ) ! 3. HST or GST ! 10.

,ther ex&enses ! 5o 6xc%se Taxes ! !

3,3;. 331.5

Mar 12, 213 12, 5o/ 13, 213 22, 345 10,030.13 m

!

Descr%&t%on

@eh%c(e 2

:$e( and o%( ! HST or GST ! !

*nterest ! 5o 6xc%se Taxes ! !

*ns$rance ! 5o 6xc%se Taxes ! !

A%cens%n. and re.%strat%on ! 5o 6xc%se Taxes ! !

Ma%ntenance and re&a%rs ! HST or GST ! !

Aeas%n. ! HST or GST ! !

,ther ex&enses ! 5o 6xc%se Taxes ! !

,ther ex&enses ! 5o 6xc%se Taxes ! !

#$s%ness $se &ercenta.e ! !

7ark%n. ! HST or GST ! !

,ther ex&enses ! 5o 6xc%se Taxes ! !

! !

!

!

#$s%ness $se &ercenta.e

BM / day Days ,dometer

T2125 tota( 5

GST / HST amo$nts

Sa(es tax content <ond%t%on 1

213 M%(ea.e reasonab%(%ty ! @eh%c(e 1

5 0 3

@eh%c(e 1 *T<s

Sa(es tax content <ond%t%on 1 <ond%t%on 2

GST / HST amo$nts

@eh%c(e 2 *T<s

#$s%ness $se &ercenta.e

! ! !

!

Tota( BM

Tota(

A%tres

Days

213 M%(ea.e reasonab%(%ty ! @eh%c(e 2

Aatest date Tota( BM

8e.%on A/era.e C / A

,dometer

#y '$e( ex&ense

#y ma%ntenance records

BM / day ,dometer

:$e( and o%( 1C2

Aatest date 6ar(%est date

3;.43

T2125 tota(

#y '$e( ex&ense

213 Motor /eh%c(e ex&enses ! @eh%c(e 1 1%nc($de any sa(es taxes2

1

2 3 4

#$s%ness k%(ometres

Tota(

2

#y ma%ntenance records

8e.%on

1

! ! !

,dometer Tota( BM

213 Motor /eh%c(e ex&enses ! @eh%c(e 2 1%nc($de any sa(es taxes2

A / 1km :$e( ty&e

A%tres A / 1km Tota( BM

Tota( k%(ometres

:$e( and o%( 1C2

:$e( ty&e A/era.e C / A

Tab$(at%ons

#$s%ness k%(ometres Tota( k%(ometres

0

<ond%t%on 2

6ar(%est date

Tax Tem&(ates *nc.

210!1!2>

12?2

Mr. A

T2125 and GST / HST Worksheet

Tax year ended December 31, 213

! 1."

13."

Tax year ended

A&&ro/ed

GST / HST ca(c$(at%on

December 31, 213

Andre9 ,ct 1, 210

7re&ared

8e/%e9ed <a(c$(at%on method

7er%od or re.%on

7ro&ort%on

HST rate

GST rate

7ST rate

S%m&(%'%ed method

<ond%t%on 1 <ond%t%on 2

Tem&(ate s$&&ort

Descr%&t%on

Heat ) ! ! HST or GST ! !

6(ectr%c%ty 3,3;. ) ! 3,. HST or GST ! 3;.

*ns$rance 3. 3. 5o 6xc%se Taxes ! !

Ma%ntenance ) ! ! HST or GST ! !

Mort.a.e %nterest ! 5o 6xc%se Taxes ! !

7ro&erty taxes ! 5o 6xc%se Taxes ! !

,ther ex&enses 19%th tab$(at%ons2 ) ! ! 5o 6xc%se Taxes ! !

#$s%ness $se &ercenta.e 4 0, 15." 15."

5>. 53.5

Asset

:$rn%t$re and '%xt$res 3 1." ! HST or GST ! !

,''%ce e+$%&ment 3 1." ! HST or GST ! !

Sma(( too(s 12 1." ! HST or GST ! !

Mach%nery 03 1." ! HST or GST ! !

5et9ork e+$%&ment 04 1." ! HST or GST ! !

<om&$ter e+$%&ment 5 2,034. 1." 2,2. HST or GST ! 234.

Asset

@eh%c(e 1 >." ) HST or GST 13." !

@eh%c(e 2 ! ) 5o 6xc%se Taxes ! !

GST / HST amo$nts

Sa(es tax content <ond%t%on 1 <ond%t%on 2 T2125 tota( 0 5 1 2 Tab$(at%ons

213 #$s%ness $se o' home ex&enses 1%nc($de any sa(es taxes2

3

<ond%t%on 2

GST / HST amo$nts

Sa(es tax content

A&&(%cab(e

HST or GST rate

*T<s

#$s%ness $se &ercenta.e

#$s%ness &ort%on o' <<A

1'rom T12

Sa(es tax content <ond%t%on 1 <ond%t%on 2

Sa(es tax

&er%od or re.%on

Tota(

Tota( area

<ond%t%on 2

<ond%t%on 2

<ond%t%on 2

<ond%t%on 2

GST / HST amo$nts

#$s%ness $se o' home *T<s

#$s%ness $se

&ercenta.e

Ac+$%s%t%on

1d%s&os%t%on2 /a($e

213 <a&%ta( assets 1%nc($de any sa(es taxes2

#$s%ness $se

&ercenta.e

#$s%ness area

<(ass

213 A((o9ab(e motor /eh%c(e *T<s based on <<A 1%nc($de any sa(es taxes2

T2125 tota(

Descr%&t%on

<(ass Descr%&t%on

<ond%t%on 2

Tax Tem&(ates *nc.

210!1!2>

12?2

Mr. A

T2125 and GST / HST Worksheet ! Tab$(at%ons

Tax year ended December 31, 213

! ) ! ) ! ) ! ) ! ) ! ) 34.53 ) ! ) ! ) ! ) ! ) ! ) ! )

3.

13.

224.53

3>.

#$s%ness or

&ro'ess%ona( %ncome

,ther %ncome ,ther ded$ct%ons Ad/ert%s%n.

Mea(s and

enterta%nment

1.ross2

*ns$rance *nterest

#$s%ness 'ees,

(%censes, etc.

,''%ce ex&enses S$&&(%es

1.4112454

8ent

Ma%ntenance and

re&a%rs

Sa(ar%es, 9a.es,

and bene'%ts

213 *ncome and sa(es ex&enses 1%nc($de any sa(es taxes2

213 ann$a( 'orex rates

D7E

6F8

FSD HBD .132>>35

.;;4410

1.2;;103

1.3431314

AFD

G#7

.15442

Tax Tem&(ates *nc.

210!1!2>

12?2

! ) ! ) ! ) ! ) ! ) ! ) ! ) ! ) ! ) ! ) ! ) ! ) ! )

,ther ex&enses

19%th tab$(at%ons2

,ther ex&enses

19%th tab$(at%ons2

7ark%n. Heat 6(ectr%c%ty Ma%ntenance

De(%/ery, 're%.ht,

and ex&ress

,ther ex&enses

19%th tab$(at%ons2

,ther ex&enses

19%th tab$(at%ons2

:$e( and o%(

Ma%ntenance and

re&a%rs

Te(e&hone and

$t%(%t%es

Tra/e(

213 #$s%ness $se o' home ex&enses 1%nc($de any sa(es taxes2 213 Motor /eh%c(e ex&enses ! @eh%c(e 1 1%nc($de any sa(es taxes2 213 *ncome and sa(es ex&enses 1%nc($de any sa(es taxes2

Tax Tem&(ates *nc.

210!1!2>

12?2

Mr. A

GST / HST 8et$rn

Tax year ended December 31, 213

1,.

!

!

!

1,.

14,44.532

13,3;.2

10,2.2

35,33.02

15>.2

35,233.02

! !

! !

! !

! ! !

! ! !

! ! !

! !

;;04

5otes

Tota(

Sa(es d$r%n. 213 ! <ond%t%on 1

Sa(es d$r%n. 213 ! <ond%t%on 2

<red%t on " rem%ttance rate Amo$nt Sa(es 8ate

Tota(

Sa(es d$r%n. 213 ! <ond%t%on 2

Sa(es d$r%n. 213 ! <ond%t%on 1

Sa(es 8ate Amo$nt

,ct 1, 210

1Sa(es 6x&enses2

1Motor @eh%c(e 6x&enses2 ;231

;;35 ! ;;34

;34;

#$s%ness or 7ro'ess%ona( *ncome

7re&ared

8e/%e9ed

A&&ro/ed

T2125 8econc%(%at%on

!

Andre9

! *nc($s%on 'rom +$%ck method

1,ther ded$ct%ons2

,ther %ncome

Ad-$sted Gross *ncome

!

G$%ck method ca(c$(at%ons

GST / HST on sa(es

Sa(es d$r%n. 213

<red%t on e(%.%b(e s$&&(%es Sa(es 8ate Amo$nt

32;; / 351;

!

5et *ncome 1Aoss2 #e'ore Ad-$stments

1#$s%ness Fse o' Home 6x&enses2

3521 ! ;2>5

;;05

! 1,ther Ad-$stments2

5et *ncome 1Aoss2

1<<A / 6<7 <(a%med on T21252

Tax Tem&(ates *nc.

210!1!2>

12?2

Mr. A

GST / HST 8et$rn

Tax year ended December 31, 213

,ct 1, 210 7re&ared

8e/%e9ed

A&&ro/ed

Andre9

:rom

8T1 213 ! 1 ! 1 213 ! 12 ! 31 S%m&(%'%ed method

1,.

1,.

13,.

13,.

1,3.

!

1,3.

11,>.

!

11,>.

!

11,>.

! 11,>.

13

1;

110

Tota( *T<s and ad-$stments

5et tax

11

111 GST / HST rebates

GST / HST d$e on ac+$%s%t%on o' taxab(e rea( &ro&erty

Tota( other cred%ts

#a(ance

8e'$nd <(a%med

#a(ance

Tota( other deb%ts

,ther cred%ts

112

113 A

115

25

05

7ayment 6nc(osed

,ther deb%ts

113 #

113 <

To

15

13

10

#$s%ness n$mber 5ame

Tota( GST / HST and ad-$stments 'or &er%od

Ad-$stments

,ther GST / HST to be se('!assessed

,ther ad-$stments

*nsta(ment and other ann$a( '%(er &ayments

1>

*n&$t tax cred%ts ! *T<s

Mr. A

11

Sa(es and other re/en$e

5et tax ca(c$(at%on

GST / HST amo$nts co((ected or co((ect%b(e

Ad-$stments

Sa(es and other re/en$e

#$s%ness / &ro'ess%ona( %ncome

Ad-$stments

14

<a(c$(at%on $sed

213 Goods and Ser/%ces Tax / Harmon%Hed Sa(es Tax 1GST / HST2 8et$rn

Tax Tem&(ates *nc.

210!1!2>

12?2

Vous aimerez peut-être aussi

- Corporate Tax Continuity WorksheetDocument5 pagesCorporate Tax Continuity WorksheetTax Templates Inc.100% (1)

- Release Notes Insurance 471 (FS-CM, FS-CD) EDocument133 pagesRelease Notes Insurance 471 (FS-CM, FS-CD) EViviana GuimarãesPas encore d'évaluation

- 6d6 Free - Issue 3Document68 pages6d6 Free - Issue 3gebejiPas encore d'évaluation

- CAT 320C Escavadeira - Motor de GiroDocument6 pagesCAT 320C Escavadeira - Motor de GiroAparecidaMarques100% (1)

- Admin Case DigestDocument7 pagesAdmin Case Digestkaren mariz manaPas encore d'évaluation

- TAX2 Midterm NotesDocument178 pagesTAX2 Midterm Notesjamilove20Pas encore d'évaluation

- Marketing Research Tropical HutDocument23 pagesMarketing Research Tropical Hutlasseislasse67% (9)

- RR 10-98Document2 pagesRR 10-98matinikkiPas encore d'évaluation

- Lepanto Consolidated Mining Company vs. Ambanloc (June 29, 2010)Document5 pagesLepanto Consolidated Mining Company vs. Ambanloc (June 29, 2010)Vince LeidoPas encore d'évaluation

- Cusi Vs Domingo (Land Tits)Document2 pagesCusi Vs Domingo (Land Tits)Mary LeandaPas encore d'évaluation

- Toyota Reverse LogisticsDocument2 pagesToyota Reverse LogisticsShrimali Nirav0% (3)

- CIN - SAP Configs SetupDocument11 pagesCIN - SAP Configs Setupdeepraj1983Pas encore d'évaluation

- 13 (Capital Budgeting) : (Investing Activities) (Growth Management)Document18 pages13 (Capital Budgeting) : (Investing Activities) (Growth Management)Oranoot WangsukPas encore d'évaluation

- Budget IndDocument21 pagesBudget IndSANTHAN KUMARPas encore d'évaluation

- Curso 25714 Aula 08 v1Document99 pagesCurso 25714 Aula 08 v1YanPas encore d'évaluation

- PiattaformaDocument9 pagesPiattaformaJoseph FryePas encore d'évaluation

- Soal Matematika Kelas 3 SDDocument3 pagesSoal Matematika Kelas 3 SDkholisinnnPas encore d'évaluation

- Final MCQ Test 3Document15 pagesFinal MCQ Test 3Wiz MathersPas encore d'évaluation

- David Sm13e CN 08Document18 pagesDavid Sm13e CN 08Koki MostafaPas encore d'évaluation

- Cc3 - His Geo Edu Civil 4aep Modele 4Document3 pagesCc3 - His Geo Edu Civil 4aep Modele 4Salma ArabiPas encore d'évaluation

- Gas Natural Vehicular GNVDocument26 pagesGas Natural Vehicular GNVSergio Mauricio Páez GarcíaPas encore d'évaluation

- Fascicle3juny13 AngDocument4 pagesFascicle3juny13 AngBeatriz Sánchez AsunciónPas encore d'évaluation

- Layouts Oil and Gas Installations: Oil Industry Safety DirectorateDocument27 pagesLayouts Oil and Gas Installations: Oil Industry Safety DirectorateC.E. Ishmeet SinghPas encore d'évaluation

- Apc 2008Document4 pagesApc 2008z4nukrePas encore d'évaluation

- Attachment Process Audit Plan and Review: Page - ofDocument5 pagesAttachment Process Audit Plan and Review: Page - ofmilou88Pas encore d'évaluation

- Grammar Army1Document38 pagesGrammar Army1Takumi IkedaPas encore d'évaluation

- Government of India Ministry of RailwaysDocument10 pagesGovernment of India Ministry of Railwaysrdas1980Pas encore d'évaluation

- APC2008 Rules 0812Document4 pagesAPC2008 Rules 0812markpeakPas encore d'évaluation

- Thesis-M Deri TaufanDocument106 pagesThesis-M Deri TaufansadiaPas encore d'évaluation

- (Chief Administrative Officer), # $ %& ल (ल, %) *, ह ,-./0 12 - 3$ 45 6 .7 8, 89Document2 pages(Chief Administrative Officer), # $ %& ल (ल, %) *, ह ,-./0 12 - 3$ 45 6 .7 8, 89rajivrai159Pas encore d'évaluation

- TaxDocument45 pagesTaxShailesh Kediya100% (2)

- Patrón de Punto Cruz P2P-18301111 IMG - 20201029 - 181749 - 653.jpgDocument15 pagesPatrón de Punto Cruz P2P-18301111 IMG - 20201029 - 181749 - 653.jpgCristina Saldaña ZacariasPas encore d'évaluation

- Social Custom and BehaviourDocument4 pagesSocial Custom and BehaviourWilliam AnthonyPas encore d'évaluation

- Curso 25714 Aula 09 v1Document91 pagesCurso 25714 Aula 09 v1YanPas encore d'évaluation

- TIC 4 Ejer AGE 2009 PDFDocument1 pageTIC 4 Ejer AGE 2009 PDFvxzvxcvadsfzvcPas encore d'évaluation

- A Translation and Analysis of The PátimokkhaDocument310 pagesA Translation and Analysis of The PátimokkhaBuddhistmindBuddhistmindPas encore d'évaluation

- LTF320HF01 SamsungDocument29 pagesLTF320HF01 Samsungmarius tanjalaPas encore d'évaluation

- Curso 3860 Aula 00 2309 CompletoDocument41 pagesCurso 3860 Aula 00 2309 CompletoJoao Pedro Alves Paiva BorgesPas encore d'évaluation

- Patrón de Punto Cruz P2P-18338026 IMG - 20201029 - 181749 - 653.jpgDocument19 pagesPatrón de Punto Cruz P2P-18338026 IMG - 20201029 - 181749 - 653.jpgCristina Saldaña ZacariasPas encore d'évaluation

- Gaurav Dahiya 2K12/EL/034 2. Sanket Shokeen 2K12/CE/103 3. Vijay Kumar 2K12/CE/120Document6 pagesGaurav Dahiya 2K12/EL/034 2. Sanket Shokeen 2K12/CE/103 3. Vijay Kumar 2K12/CE/120Gaurav DahiyaPas encore d'évaluation

- Contrato Access InternetDocument4 pagesContrato Access InternetCarlos Enrique Veintemilla ZambranoPas encore d'évaluation

- 2.2A Transformer Protection Theory - WYUDocument60 pages2.2A Transformer Protection Theory - WYU劉簡Pas encore d'évaluation

- Page 1 of 1: 数字签名者:张文龙 DN:cn=张文龙, o=印度 分公司, ou=供应链, email=zhangwenlong@tc 日期:2020.11.20 17:08:49 +08'00'Document1 pagePage 1 of 1: 数字签名者:张文龙 DN:cn=张文龙, o=印度 分公司, ou=供应链, email=zhangwenlong@tc 日期:2020.11.20 17:08:49 +08'00'Aditya SinghPas encore d'évaluation

- ReliabilityDocument5 pagesReliabilityHafiz HalarPas encore d'évaluation

- 2nd CT Macndroeconomics (MBA)Document2 pages2nd CT Macndroeconomics (MBA)kuashask2Pas encore d'évaluation

- Bai Giang Tuvan GSDocument59 pagesBai Giang Tuvan GSDung NguyenthanhPas encore d'évaluation

- 05 - Labor Record and DystociaDocument50 pages05 - Labor Record and Dystociaรัชพล อัมพวาPas encore d'évaluation

- Similar Existing Solution - VietnameseDocument27 pagesSimilar Existing Solution - VietnamesetranphongPas encore d'évaluation

- Cebus ApellaDocument112 pagesCebus ApellalaboratorioclinicoelvelasPas encore d'évaluation

- New Contractor'S License Application: Required Items Complied Yes No NADocument23 pagesNew Contractor'S License Application: Required Items Complied Yes No NAsharmine_ruizPas encore d'évaluation

- NL9 7 TakahashiDocument20 pagesNL9 7 TakahashiAnand KrishnaPas encore d'évaluation

- Pm-030 Ims Transition and Contingency Plan v2Document20 pagesPm-030 Ims Transition and Contingency Plan v2Ivo HuaynatesPas encore d'évaluation

- Patrón de Punto Cruz P2P-18301102 IMG - 20201029 - 181749 - 653.jpgDocument23 pagesPatrón de Punto Cruz P2P-18301102 IMG - 20201029 - 181749 - 653.jpgCristina Saldaña ZacariasPas encore d'évaluation

- 02 - Portaria Nº 275-2018 - Pós Stricto EaDDocument3 pages02 - Portaria Nº 275-2018 - Pós Stricto EaDAndre OliveiraPas encore d'évaluation

- 17 05 2017 YArt CPEC Urdu PDFDocument7 pages17 05 2017 YArt CPEC Urdu PDFHajra AamirPas encore d'évaluation

- IT-2 TY-2013 Without Formula - 2013Document12 pagesIT-2 TY-2013 Without Formula - 2013Muhammad TausifPas encore d'évaluation

- Plan de Afacere Al Petshop PDFDocument11 pagesPlan de Afacere Al Petshop PDFMarian PopaPas encore d'évaluation

- Accounting Group Study 1Document13 pagesAccounting Group Study 1ahmustPas encore d'évaluation

- Journey Into Burmese Silence PDFDocument244 pagesJourney Into Burmese Silence PDFCPas encore d'évaluation

- The SalamanderDocument77 pagesThe SalamanderparaschivPas encore d'évaluation

- Iii. Both (A) and (B) Are True.: ST NDDocument5 pagesIii. Both (A) and (B) Are True.: ST NDLeslie LimPas encore d'évaluation

- General Chemistry 10th Edition Ebbing Test BankDocument63 pagesGeneral Chemistry 10th Edition Ebbing Test BankJeffreyThomasadwie100% (15)

- Config HRDocument146 pagesConfig HRAmar UbhePas encore d'évaluation

- Divided States: Strategic Divisions in EU-Russia RelationsD'EverandDivided States: Strategic Divisions in EU-Russia RelationsPas encore d'évaluation

- Corporate Loss Carryback WorksheetDocument2 pagesCorporate Loss Carryback WorksheetTax Templates Inc.Pas encore d'évaluation

- Trust Savings WorksheetDocument5 pagesTrust Savings WorksheetTax Templates Inc.Pas encore d'évaluation

- Tax Scenario WorksheetDocument5 pagesTax Scenario WorksheetTax Templates Inc.Pas encore d'évaluation

- Salary Vs Dividend WorksheetDocument6 pagesSalary Vs Dividend WorksheetTax Templates Inc.Pas encore d'évaluation

- Incorporation Savings WorksheetDocument6 pagesIncorporation Savings WorksheetTax Templates Inc.Pas encore d'évaluation

- Corporate Loss Carryback WorksheetDocument2 pagesCorporate Loss Carryback WorksheetTax Templates Inc.Pas encore d'évaluation

- Corporate Loss Carryback WorksheetDocument2 pagesCorporate Loss Carryback WorksheetTax Templates Inc.Pas encore d'évaluation

- Loan Amortization WorksheetDocument5 pagesLoan Amortization WorksheetTax Templates Inc.Pas encore d'évaluation

- Forex WorksheetDocument2 pagesForex WorksheetTax Templates Inc.Pas encore d'évaluation

- Corporate Loss Carryback WorksheetDocument2 pagesCorporate Loss Carryback WorksheetTax Templates Inc.Pas encore d'évaluation

- Corporate Loss Carryback WorksheetDocument2 pagesCorporate Loss Carryback WorksheetTax Templates Inc.Pas encore d'évaluation

- Capital Gains Reserve WorksheetDocument4 pagesCapital Gains Reserve WorksheetTax Templates Inc.Pas encore d'évaluation

- Corporate Loss Carryback WorksheetDocument2 pagesCorporate Loss Carryback WorksheetTax Templates Inc.Pas encore d'évaluation

- Econ 100.2 Ex4 Answer Key PDFDocument6 pagesEcon 100.2 Ex4 Answer Key PDFKevin Ortiz100% (1)

- Barque Hotels Private Limited-2927Document1 pageBarque Hotels Private Limited-2927Shimoyal RehmanPas encore d'évaluation

- T Codes For SAP Sales Register and Excise InvoiceDocument1 pageT Codes For SAP Sales Register and Excise InvoicekssumanthPas encore d'évaluation

- Applied Direct TaxationDocument548 pagesApplied Direct TaxationVarun SinghPas encore d'évaluation

- Excel Skills - Cashbook & Bank Reconciliation TemplateDocument17 pagesExcel Skills - Cashbook & Bank Reconciliation TemplateLawrence MaretlwaPas encore d'évaluation

- 2020 Albany County BudgetDocument378 pages2020 Albany County BudgetDave LucasPas encore d'évaluation

- Nike Inc q414 Press Release - 6-25-2014 6pm - CleanDocument9 pagesNike Inc q414 Press Release - 6-25-2014 6pm - CleanmanduramPas encore d'évaluation

- Apss146e 1217Document2 pagesApss146e 1217Saad AlenziPas encore d'évaluation

- Whistleblower ComplaintDocument7 pagesWhistleblower ComplaintThe FederalistPas encore d'évaluation

- Marcia Brady Tucker and Estate of Carll Tucker, Deceased, Marcia Brady Tucker, Carll Tucker, JR., and Luther Tucker, Executors v. Commissioner of Internal Revenue, 322 F.2d 86, 2d Cir. (1963)Document5 pagesMarcia Brady Tucker and Estate of Carll Tucker, Deceased, Marcia Brady Tucker, Carll Tucker, JR., and Luther Tucker, Executors v. Commissioner of Internal Revenue, 322 F.2d 86, 2d Cir. (1963)Scribd Government DocsPas encore d'évaluation

- The Stony Brook Press - Volume 13, Issue 1Document15 pagesThe Stony Brook Press - Volume 13, Issue 1The Stony Brook PressPas encore d'évaluation

- Kundan Kumar - Offer Letter - Asp - Net Dev PDFDocument3 pagesKundan Kumar - Offer Letter - Asp - Net Dev PDFKundan Kumar100% (1)

- Residential Status and Scope of Total IncomeDocument19 pagesResidential Status and Scope of Total IncomeSamyak JainPas encore d'évaluation

- 4358945Document5 pages4358945mohitgaba19Pas encore d'évaluation

- Sugar Crisis in Pakistan-Compatible1Document26 pagesSugar Crisis in Pakistan-Compatible1Bushra Riaz50% (2)

- Geojit Insights NOVEMBER 2019 FlipBook2Document52 pagesGeojit Insights NOVEMBER 2019 FlipBook2MauryanPas encore d'évaluation

- Judicial Technicality and Efficacyof Clubbing ProvisionDocument5 pagesJudicial Technicality and Efficacyof Clubbing ProvisionKunwarbir Singh lohatPas encore d'évaluation

- CRPT1001902Document4 pagesCRPT1001902NaveenPas encore d'évaluation

- Administration of HarhsaDocument6 pagesAdministration of HarhsaGahininath ShelkePas encore d'évaluation

- Nature of Excise DutyDocument16 pagesNature of Excise DutyVinod PatelPas encore d'évaluation

- Procedures and Documentation For Availing Export Incentives 2016Document4 pagesProcedures and Documentation For Availing Export Incentives 2016Sadaf NazneenPas encore d'évaluation

- Invoice M112308296312009275Document1 pageInvoice M112308296312009275Bruh YooinkPas encore d'évaluation

- VI Sem Rescheduled UG PVT Reg. TT 2021 PDFDocument4 pagesVI Sem Rescheduled UG PVT Reg. TT 2021 PDFAlkesh AntonyPas encore d'évaluation

- S.6 Economics NotesDocument28 pagesS.6 Economics NotesMarvinPas encore d'évaluation