Académique Documents

Professionnel Documents

Culture Documents

FIN 3331 Critical Thinking Assignment

Transféré par

Helen Joan BuiCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

FIN 3331 Critical Thinking Assignment

Transféré par

Helen Joan BuiDroits d'auteur :

Formats disponibles

Emily Smith just received a promotion at work that increased her annual salary to $42,000.

She

is eligible to participate in her employers 401(k) retirement plan to which the employer matches,

dollar for dollar, workers contributions up to 5% of salary. However, Emily wants to buy a new

$25,000 car in 3 years, and she wants to have enough money to make a $10,000 down payment

on the car and finance the balance. Fortunately, she expects a sizable bonus this year that she

hopes will cover that down payment in 3 years.

A wedding is also in her plans. Emily and her boyfriend, Paul, have set a wedding date two years

in the future, after he finishes medical school. In addition, Emily and Paul want to buy a home of

their own in 5 years. This might be possible because two years later, Emily will be eligible to

access a trust fund left to her as an inheritance by her late grandfather. Her trust fund has $80,000

invested at an interest rate of 5%.

1. Justify Emilys participation in her employers 401(k) plan using the time value of money

concepts by calculating the actual annual return on her own contributions. She will

contribute $1,000 per year to her 401(k) for 25 years and the employer will match dollar

for dollar. Assume that her 401(k) earns 6% per year for 25 years and all contributions

are made at the end of each year.

2. Calculate the amount of money that Emily needs to set aside from her bonus this year to

cover the down payment on a new car, assuming she can earn 4% on her savings. What if

she could earn 10% on her savings?

3. What will be the value of Emilys trust fund in 36 years, assuming she takes possession

of $20,000 in 2 years for her wedding, and leaves the remaining amount of money

untouched where it is currently invested?

4. Suggest at least two conditions that Emily and Paul could take to accumulate more for

their retirement.

5. Suppose that Emily and Paul purchase a $200,000 home in 5 years and make $40,000

down payment immediately. Find the monthly mortgage payment assuming that the

remaining balance is financed at a 3% fixed rate for 15 years. What if its mortgage term

is 30 years?

6. What can you conclude about the relationship between the mortgage term and the amount

of the monthly payment? From Question 5, is the monthly payment with the 30-year term

half as large as the monthly payment with the 15-year term? Explain.

Use the following information to answer the following questions.

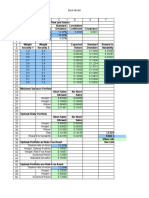

ABC, Inc. Income Statement (in thousands)

December 31, 2014

Sales $200,000

Cost of goods sold 140,000

Gross profit on sales 60,000

Operating expenses 56,000

Operating income (EBIT) 4,000

Interest expense 1,000

Earnings before tax 3,000

Income tax 1,050

Net income available to common stockholders $1,950

Number of shares outstanding 1, 500

Market price per share $22

ABC, Inc. Balance Sheet (in thousands)

December 31, 2014

Assets

Cash $2,000

Accounts receivable 17,800

Inventories 8,700

Total current assets 28,500

Gross fixed assets 70,000

Accumulated depreciation 26,500

Net fixed assets 43,500

Total assets $72,000

Liabilities and Equity

Accounts payable $18,000

Accruals 13,350

Total current liabilities 31,350

Long-term debt 8,250

Total liabilities 39,600

Common stock (par value and paid in capital) 2,000

Retained earnings 30,400

Total stockholders' equity 32,400

Total liabilities and equity $72,000

Industry Key Ratios

Industry Average Ratios

Current ratio 1.1

Quick ratio 0.60

Days Sales Outstanding (DSO) 25 days

Fixed assets turnover 5.8

Total asset turnover 2.95

Liabilities-to-assets ratio 65%

Times-interest-earned 3.2

Net profit margin 1.3%

Return on equity 7.32%

Price/earnings ratio 20.38

Market/book ratio 3.19

1. Calculate current ratio and acid test ratio for the firm.

2. Calculate DSO, fixed assets turnover, and total asset turnover for the firm.

3. Calculate liabilities-to-assets ratio and times-interest-earned ratio for the firm.

4. Calculate net profit margin and return on equity for the firm.

5. Evaluate the performance of the firm relative to the average performance of the industry

in the following areas:

Liquidity management

Asset management

Debt management

Profitability management

6. What is the firms price/earnings ratio and market/book ratio? What do these ratios tell us

about the firm?

Vous aimerez peut-être aussi

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)D'EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Évaluation : 5 sur 5 étoiles5/5 (1)

- J.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnD'EverandJ.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnPas encore d'évaluation

- Practice Test MidtermDocument6 pagesPractice Test Midtermrjhuff41Pas encore d'évaluation

- BU340 Managerial FinanceDocument50 pagesBU340 Managerial FinanceG JhaPas encore d'évaluation

- BU340 Managerial FinanceDocument58 pagesBU340 Managerial FinanceG JhaPas encore d'évaluation

- TCCB Revision - ProblemsDocument4 pagesTCCB Revision - ProblemsDiễm Quỳnh 1292 Vũ ĐặngPas encore d'évaluation

- Tutorial QuestionsDocument15 pagesTutorial QuestionsWowKid50% (2)

- Acct. 101 - Practice ExamA - Chapters 10, 11 - Spring 2013Document8 pagesAcct. 101 - Practice ExamA - Chapters 10, 11 - Spring 2013leoeoaPas encore d'évaluation

- Tutorial 40 Sem 2 20212022Document6 pagesTutorial 40 Sem 2 20212022Nishanthini 2998Pas encore d'évaluation

- Exam #2 NotesDocument3 pagesExam #2 NotesMoreskyPas encore d'évaluation

- Fin 517 - Take Home ExamDocument3 pagesFin 517 - Take Home ExamJennifer PearsallPas encore d'évaluation

- Exercise For Mid TestDocument11 pagesExercise For Mid TestNadia NathaniaPas encore d'évaluation

- Practice Test MidtermDocument6 pagesPractice Test Midtermzm05280Pas encore d'évaluation

- BONDS and STOCK 33Document3 pagesBONDS and STOCK 33Bloody HunterPas encore d'évaluation

- Equity PricingDocument4 pagesEquity PricingMichelle ManuelPas encore d'évaluation

- Final Exam Review W21 Questions OnlyDocument14 pagesFinal Exam Review W21 Questions Only費長威Pas encore d'évaluation

- FINC 655 Summer 2012 Exam #1 - You Must Show All of Your Work To Receive Any Credit Problems (5pts Each)Document7 pagesFINC 655 Summer 2012 Exam #1 - You Must Show All of Your Work To Receive Any Credit Problems (5pts Each)Sheikh HasanPas encore d'évaluation

- Chapter 2,3,4 - Exercises in SlidesDocument6 pagesChapter 2,3,4 - Exercises in SlidestroancutePas encore d'évaluation

- Bonds N Stock All Ques TogetherDocument5 pagesBonds N Stock All Ques TogetherSufyan AshrafPas encore d'évaluation

- Corporate Finance Academic Year 2011-2012 TutorialsDocument21 pagesCorporate Finance Academic Year 2011-2012 TutorialsSander Levert100% (1)

- Assignment No 1 SFA&DDocument6 pagesAssignment No 1 SFA&DSyed Shabbir RizviPas encore d'évaluation

- # Solution: 900,000/100,000 9:. 9 16 144Document5 pages# Solution: 900,000/100,000 9:. 9 16 144Joel Christian MascariñaPas encore d'évaluation

- Homework Set IDocument4 pagesHomework Set IjondoedoePas encore d'évaluation

- Assignment-I CF (GCUF)Document5 pagesAssignment-I CF (GCUF)Kashif KhurshidPas encore d'évaluation

- Class Handout 1Document3 pagesClass Handout 1Atul AryaPas encore d'évaluation

- Financial AnalysisDocument3 pagesFinancial AnalysisAtul AryaPas encore d'évaluation

- Final RevisionDocument9 pagesFinal RevisionVo Phuc An (K17 HCM)Pas encore d'évaluation

- FI 580 Final Exam XCLDocument28 pagesFI 580 Final Exam XCLjoannapsmith33Pas encore d'évaluation

- Financial Management Source 4Document13 pagesFinancial Management Source 4John Llucastre CortezPas encore d'évaluation

- Bonds and Stock CWDocument4 pagesBonds and Stock CWMunazza Jabeen40% (5)

- De Kiem Tra 29-7-21 - VNUISDocument2 pagesDe Kiem Tra 29-7-21 - VNUISPhương Anh NguyễnPas encore d'évaluation

- PART 1 - Post As Word or Excel Attachment - Total 5 PointsDocument7 pagesPART 1 - Post As Word or Excel Attachment - Total 5 PointsmulPas encore d'évaluation

- Aynur Efendiyeva - Maliye 1Document7 pagesAynur Efendiyeva - Maliye 1Sheen Carlo AgustinPas encore d'évaluation

- Q and Answers SDocument8 pagesQ and Answers SPriyesha UnagarPas encore d'évaluation

- Ebersoll Manufacturing CoDocument5 pagesEbersoll Manufacturing CoShemu PlcPas encore d'évaluation

- Bs204 Frequently Asked QuestionsDocument13 pagesBs204 Frequently Asked QuestionsTakudzwa GwemePas encore d'évaluation

- BONDS and STOCKDocument3 pagesBONDS and STOCKSufyan AshrafPas encore d'évaluation

- Topic 3+ 4 Valuation of SecuritiesDocument4 pagesTopic 3+ 4 Valuation of SecuritiesHaha1234Pas encore d'évaluation

- Tutorial Questions Spring 2014Document13 pagesTutorial Questions Spring 2014lalaran123Pas encore d'évaluation

- Assign 1 Jones MDocument5 pagesAssign 1 Jones MAndrew NeuberPas encore d'évaluation

- FIN 370 Final Exam (29/30 Correct Answers)Document13 pagesFIN 370 Final Exam (29/30 Correct Answers)KyleWalkeer0% (1)

- Problems-Finance Fall, 2014Document22 pagesProblems-Finance Fall, 2014jyoon2140% (1)

- Tutorial I, II, III, IV QuestionsDocument15 pagesTutorial I, II, III, IV QuestionsAninda DuttaPas encore d'évaluation

- Assign 2Document3 pagesAssign 2Abdul Moqeet100% (1)

- Midterm 1 Practice With SolutionsDocument28 pagesMidterm 1 Practice With Solutionszaid nazalPas encore d'évaluation

- CF Mid Term - Revision Set 3Document10 pagesCF Mid Term - Revision Set 3linhngo.31221020350Pas encore d'évaluation

- Chap 6 RevisionDocument3 pagesChap 6 RevisionTên Hay Thế0% (1)

- Work SheetDocument3 pagesWork Sheetkassa hilemnehPas encore d'évaluation

- Financial CasesDocument64 pagesFinancial CasesMarwan MikdadyPas encore d'évaluation

- POST Final Exam 2 April 2006-1Document12 pagesPOST Final Exam 2 April 2006-1Bi ChenPas encore d'évaluation

- AssignmentDocument2 pagesAssignmentLamia ZahanPas encore d'évaluation

- Exercises For Before The Exam: November 11th November 18thDocument32 pagesExercises For Before The Exam: November 11th November 18thMušija AjlaPas encore d'évaluation

- Bai Tap 1Document4 pagesBai Tap 1hoang.phamnguyetminhPas encore d'évaluation

- Cost of Capital HandoutDocument5 pagesCost of Capital HandoutAli SajidPas encore d'évaluation

- Assignment No 1 CFDocument6 pagesAssignment No 1 CFAltaf HussainPas encore d'évaluation

- BF 320114152Document5 pagesBF 320114152Kelvin Lim Wei LiangPas encore d'évaluation

- 118 Homework QuestionsDocument3 pages118 Homework QuestionscarlacauntayPas encore d'évaluation

- Accounting Textbook Solutions - 50Document19 pagesAccounting Textbook Solutions - 50acc-expertPas encore d'évaluation

- Chapter 4 Sample BankDocument18 pagesChapter 4 Sample BankWillyNoBrainsPas encore d'évaluation

- Sample MC QuestionsDocument11 pagesSample MC QuestionskarynPas encore d'évaluation

- Chap 10&11Document8 pagesChap 10&11Helen Joan BuiPas encore d'évaluation

- Chap 10Document12 pagesChap 10Helen Joan BuiPas encore d'évaluation

- Case Study FinalDocument6 pagesCase Study FinalHelen Joan BuiPas encore d'évaluation

- Case 4472Document5 pagesCase 4472Helen Joan Bui100% (2)

- PixarDocument2 pagesPixarHelen Joan BuiPas encore d'évaluation

- Huyen Bui Asm1Document10 pagesHuyen Bui Asm1Helen Joan BuiPas encore d'évaluation

- FIN 3331 Risk and Return AssignmentDocument2 pagesFIN 3331 Risk and Return AssignmentHelen Joan BuiPas encore d'évaluation

- Reverse Osmosis Desalination: Our Global Expertise To Address Water ScarcityDocument16 pagesReverse Osmosis Desalination: Our Global Expertise To Address Water Scarcitynice guyPas encore d'évaluation

- B - Cracked Tooth SyndromeDocument8 pagesB - Cracked Tooth SyndromeDavid TaylorPas encore d'évaluation

- Course Guide Pe1 PDFDocument4 pagesCourse Guide Pe1 PDFrahskkPas encore d'évaluation

- Challenger 350 Recommended Operating Procedures and TechniquesDocument104 pagesChallenger 350 Recommended Operating Procedures and Techniquessebatsea100% (1)

- AERO241 Example 10Document4 pagesAERO241 Example 10Eunice CameroPas encore d'évaluation

- MPERSDocument1 pageMPERSKen ChiaPas encore d'évaluation

- Chi - Square Test: PG Students: DR Amit Gujarathi DR Naresh GillDocument32 pagesChi - Square Test: PG Students: DR Amit Gujarathi DR Naresh GillNaresh GillPas encore d'évaluation

- BKM 10e Ch07 Two Security ModelDocument2 pagesBKM 10e Ch07 Two Security ModelJoe IammarinoPas encore d'évaluation

- 2021 Life Skills ATP Grade 5Document10 pages2021 Life Skills ATP Grade 5Koketso SekwenyanePas encore d'évaluation

- NURTURE Module-V 11 1 en PDFDocument4 pagesNURTURE Module-V 11 1 en PDFJorge SingPas encore d'évaluation

- Pressure Classes: Ductile Iron PipeDocument4 pagesPressure Classes: Ductile Iron PipesmithPas encore d'évaluation

- What To Do Following A Workplace AccidentDocument5 pagesWhat To Do Following A Workplace AccidentMona DeldarPas encore d'évaluation

- Public Conveyances: Environments in Public and Enclosed Places"Document1 pagePublic Conveyances: Environments in Public and Enclosed Places"Jesse Joe LagonPas encore d'évaluation

- Formulation and Evaluation of Mefenamic Acid Ointment Using Penetration EnhancersDocument5 pagesFormulation and Evaluation of Mefenamic Acid Ointment Using Penetration EnhancersIndradewiPas encore d'évaluation

- c3175492 Pavan Kumarvasudha Signed OfferletterDocument6 pagesc3175492 Pavan Kumarvasudha Signed OfferletterPavan Kumar Vasudha100% (1)

- Missoula County Fairgrounds Phase 2Document10 pagesMissoula County Fairgrounds Phase 2Olivia IversonPas encore d'évaluation

- Building and Environment: Nabeel Ahmed Khan, Bishwajit BhattacharjeeDocument19 pagesBuilding and Environment: Nabeel Ahmed Khan, Bishwajit Bhattacharjeemercyella prasetyaPas encore d'évaluation

- STR Mpa-MpmDocument8 pagesSTR Mpa-MpmBANGGAPas encore d'évaluation

- Endothermic Gas Production Overview: Tmosphere Ngineering OmpanyDocument6 pagesEndothermic Gas Production Overview: Tmosphere Ngineering OmpanyJhon ChitPas encore d'évaluation

- Butt Weld Cap Dimension - Penn MachineDocument1 pageButt Weld Cap Dimension - Penn MachineEHT pipePas encore d'évaluation

- 10.1.polendo (Additional Patent)Document11 pages10.1.polendo (Additional Patent)Rima AmaliaPas encore d'évaluation

- Library PDFDocument74 pagesLibrary PDFfumiPas encore d'évaluation

- B1 Pendent SprinklerDocument2 pagesB1 Pendent SprinklerDave BrownPas encore d'évaluation

- INTP Parents - 16personalitiesDocument4 pagesINTP Parents - 16personalitiescelinelbPas encore d'évaluation

- Form 28 Attendence RegisterDocument1 pageForm 28 Attendence RegisterSanjeet SinghPas encore d'évaluation

- Standerdised Tools of EducationDocument25 pagesStanderdised Tools of Educationeskays30100% (11)

- (Engine International Air Pollution Prevention) : EIAPP CertificateDocument2 pages(Engine International Air Pollution Prevention) : EIAPP CertificateTan DatPas encore d'évaluation

- Mdp36 The EndDocument42 pagesMdp36 The Endnanog36Pas encore d'évaluation

- 21 05 20 Montgomery AssocDocument1 page21 05 20 Montgomery AssocmbamgmPas encore d'évaluation

- Bioplan Nieto Nahum)Document6 pagesBioplan Nieto Nahum)Claudia Morales UlloaPas encore d'évaluation