Académique Documents

Professionnel Documents

Culture Documents

Different Modes of Investment of IBBL-BUBT

Transféré par

Al-Amin Bhuiyan ShourovDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Different Modes of Investment of IBBL-BUBT

Transféré par

Al-Amin Bhuiyan ShourovDroits d'auteur :

Formats disponibles

Internship Report

On

DIFFERENT MODES OF INVESTMENT

Of

ISLAMI BANK BANGLADESH LIMITED (IBBL)

Internship Report

on

Different Modes of Investment of Islami Bank Bangladesh Limited

Supervised By

Nadira Sultana

Assistant Professor

Department of Finance

Bangladesh University of Business & Technology (BUBT)

Submitted By

Al-Amin Hossain

ID NO: 10112101476

Intake: 24

th

Program: BBA

Major in Finance

Bangladesh University of Business & Technology(BUBT)

Date of Submission: 18-10-2014

LETTER OF TRANSMITTAL

October 18, 2014

Nadira Sultana

Assistant Professor,

Department of Finance

Bangladesh University of Business & Technology (BUBT)

Subject: Submission of Internship Report on Different Modes of I nvestment of Islami Bank

Bangladesh Limited

Dear Madam,

With due respect and humble submission, I would like to inform you that I have completed my

internship program at Islami Bank Training & Research Academy (IBTRA). The title of my

internship report on Different Modes of I nvestment of Islami Bank Bangladesh Limited and here

is the report submitted to you for your kind evaluation.

Working in a Bank was a great experience for me. I believe, this will help me to build my career in

Banking Sector. The internship program gave me the opportunity to enrich my theoretical knowledge

through practical exposure of financial activities of some businesses. I was appointed in the General

banking, Investment and Foreign exchange department there, which helped me to get firsthand

knowledge about banking.

I therefore, hope that this report will provide necessary information about Different Modes of

Investment of Islami Bank Bangladesh Limited(IBBL).

I will be available at any time convenient for further clarification on the report.

Yours faithfully,

..

Al-Amin Hossain

ID NO: 10112101476

BBA Program, 24

th

Intake

Department of Finance

Bangladesh University of Business and Technology (BUBT)

STUDENT DECLARATION

I am, Al-Amin Hossain, hereby declare that the report of internship Program titled Different Modes

of Investment of Islami Bank Bangladesh Limited is uniquely prepared by me after the completion

of two months work at Pallabi Branch of Islami Bank Bangladesh Limited.

I confirm that, the report is only prepared for my academic requirement not for other purpose. It might

be with the interest of opposite party of the corporation. I also assure that this report is not submitted

anywhere of Bangladesh before me.

Al-Amin Hossain

ID NO: 10112101476

BBA Program, 24

th

Intake

Department of Finance

Bangladesh University of Business and Technology (BUBT)

CERTIFICATE OF SUPERVISOR

This is to certify that Al-Amin Hossain, a student of BBA Program, ID No. 10112101476 has

successfully completed his Internship Program entitled Different Modes of Investment of Islami

Bank Bangladesh Limited under my supervision as the partial fulfillment for the award of BBA

degree.

He has done his job according to my supervision and guidance. He has tried his best to do this

successfully. I think this program will help him in the future to build up his career. I wish his success

and prosperity.

....

Nadira Sultana

Assistant Professor

Department of Finance

Bangladesh University of Business & Technology (BUBT)

ACKNOWLEDGMENT

At first I want to express my gratitude to Almighty Allah for giving me the strength and the

composure to finish the task within the scheduled time. Then I am very grateful to the Islami Bank

Bangladesh Limited for providing me the opportunity to complete my internship program.

I received cordial co-operation from the officers and members of staffs of Islami Bank Bangladesh

Limited, Pallabi Branch. I want to express my cordial gratitude to them for their co-operation without

which it would not be possible to complete the report.

I would like to express my deep sense of gratitude & sincere appreciation to my internship supervisor

Nadira Sultana, Assistant Professor, Department of Finance, Bangladesh University of Business &

Technology (BUBT), for his continuous support & guidance during the practical orientation period.

His suggestions and comments were really a great source of spirit to make the report a good one.

It is a great pleasure to me to have a practical experience in banking industry. Special thanks go to

Islami Bank Training and Research Academy (IBTRA) for giving me the opportunity to work with

ISLAMI BANK BANGLADESH LIMITED. Thanks to Md.Nazmul Huda, Senior Principle Officer &

In-Charge of Investment Department for his supervision during my internship program. His guidance

and suggestion regarding banking activities of IBBL helped me much to develop my knowledge in

Finance.

I am really thankful to MD.Qamrul Bari Imami (Vice-President & Manager) of the Islami Bank

Bangladesh Limited, Pallabi Branch for giving me the excellent opportunity to do my practical

orientation in his branch.

Last but not least, my sincere thanks go to my beloved mother for her prayers for me. My special

thanks are due to my beloved family, who were always with me.

Finally I would also like to thank all of the officials of Islami Bank Bangladesh Limited, Pallabi

Branch due to their kind and helpful cooperation with me.

TABLE OF CONTENT

Particulars Page no.

Abbreviation I

Executive Summary II

Chapter-01: Introduction

01-04

1.1 Introduction 02

1.2 Origin of the Report 02

1. Significance of the Report 02

1.4 Scope of the Report 02

1.5 Objective of the report 03

1.6 Methodology of the Report 03-04

1.7 Limitations of the Report 04

Chapter -02: An overview of the IBBL

05-25

2.1 What is Islamic Banking 06

2.2 Objectives of Islamic Banking 06-07

2.3 Essential Features of Islamic Banking 07

2.4 A summary of History and Present Status of Islamic banking around the World 08

2.5 Conventional and Islamic Banking 09-10

2.6 History of IBBL 11-12

2.7 Mission 11

2.8 Vision 11-12

2.9 Shariah Council of IBBL 12

2.10 Objectives of Shariah Council 12-13

2.11 Membership of different organization 13

2.12 Special features of the IBBL 13

2.13 Strategic Objectives 14

2.14 Core Values 14-15

2.15 Commitments 15

2.16 Aims and objectives 15

2.17 Present programs of the organization 16

2.18 Product & Services 16-18

2.19 Functions of IBBL 19-20

2.20 Organizational Structure of IBBL 21

2.21 Hierarchy Management of IBBL 22

2.22 Corporate Information (2013) 23-24

2.23 Recognition of Performance 25

Chapter -03: Theoretical Aspect

26-32

3.1 Investment 27

3.2 Islami Banking 27

3.3 Convensional Banking 27

3.4 Riba(Interest) & Profit 27

3.5 Difference between a) Profit vs Riba and b) Rent vs Riba 28

3.6 Modes of investment: 29-30

3.7 Status of Investment 31

3.8 Investment Scheme of IBBL 32

Chapter- 04: Investment Activities of IBBL

33-47

4.1 Investment 34

4.2 Investment Management of Islami Bank Bangladesh Limited 34

4.3 Investment Policy of Islami Bangladesh Bank Limited 34

4.4 Investment Principles of Islami Bangladesh Bank Limited 34-35

4.5 Investment Process of IBBL 36-39

4.6 Investment Modes of IBBL 40-47

4.6.1 Bai Mechanism 40-45

4.6.2 Share Mechanism 45-46

4.6.3 Ijara Mechanism 47

Chapter- 05: Analysis 48-77

5.1 Year Wise Deposits & growth rate of Islami Bank Bangladesh Limited 49

5.2 Year Wise Investment Deposit Ratio Analysis 50

5.3 Year Wise Investment & Growth Rate 51

5.4. Mode Wise Investment in 2013 52

5.5. Trend of Mode Wise Investment from 2009 to 2013 53-60

5.5.1.1 Investment in Bai Murabaha 53

5.5.1.2 Investment in HPSM 54

5.5.1.3 Investment in Bai Mujjal 55

5.5.1.4 Investment in Bill Purchase & Nego 56

5.5.1.5 Investment in Quard E Hasana 57

5.5.1.6 Investment in Bai Salam 58

5.5.1.7 Investment in Mudaraba 59

5.5.1.8 Investment in Musharaka 60

5.6 Sector Wise Investment in 2013 61-67

5.6.1. Trend of some sector wise investment of IBBL & Industry Investment 62

5.6.1.2 Commerce Investment 63

5.6.1.3 Real Estate Investment 64

5.6.1.4. Agriculture Investment 65

5.6.1.5. Transport Investment 66

5.6.1.6. SME Investment 67

5.7 Income from Investment 68

5.8 Mode Wise Income of IBBL-2013 69-72

5.8.1.1 Invest Income from Murabaha 69

5.8.1.2 Invest Income from Musharaka 70

5.8. 1.3Investment Income from Bai-Muajjal 71

5.8.1.4 Investment Income from HPSM total 72

5.9 Classified Investment as a Percentage of total Investment 73

5.10 Bad or loss as a Percentage of total Investment 74

5.11 Return on Investment (ROI) of IBBL 75

5.12 SWOT Analysis 76-77

Chapter-06: Comparative Analysis

78-82

6.1: Deposit of IBBL as % of total National Deposit 79

6.2: Investment of IBBL as % of total Investment 80

6.3: Comparison of Investment to Deposit Ratio of IBBL & National Investment to

Deposit Ratio

81

6.4: Non- performing Investment of IBBL as % of total Investment 82

Chapter-07: Findings, Recommendation & Conclusion 83-86

7.1 Major Findings 84

7.2 Recommendation 85

7.3 Conclusion 86

Bibliography 88

LIST OF ABBREVIATION

Abbreviation Elaboration

BBA Bachelor of Business Administration

IBBL Islami Bank Bangladesh Limited

BB Bangladesh Bank

BDT Bangladeshi Taka

GOV Government of Bangladesh

CC Cash Credit

CIB Credit Information Bureau

IRM Investment Risk Management

DF Doubtful Loan

FO Financial Obligation

FI Financial Institution

NPI Non Performing Investment

OD Overdraft

RM Relationship Manager

SME Small and Medium Enterprise

RMU Risk Management Unit

CSR Corporate Social Responsibility

RIP Rural Investment Program

AVP Assistant Vice President

ACU Asian Clearing Union

B/C Bill of Collection

BBS Bangladesh Bureau of Statistics

L/C Letter of Credit

TT Telegraphic Transfer

TIN Tax Payers Identification Number

PAD Payment Against Documents

MT Mail Transfer

LCAF Letter of Credit Application Form

IBTRA Islami Bank Training & Research Academy

EXECUTIVE SUMMARY

The main focus of this report is on the Investment modes of Islami Bank Bangladesh Limited.The

study focuses on different modes of investment, the investment procedure and nonperforming

investment of Islami Bank Bangladesh Limited, sector wise investment, geographical location wise

investment of Islami Bank Bangladesh Limited. The study has been conducted mainly based on

secondary data. Some information has also been collected from the discussion with the officers. Trend

analyses are mainly conducted to analyze the trend of investment, sector wise investment of Islami

Bank Bangladesh Limited. Non performing investment and investment performance of IBBL within

the banking industry are also analyzed in the report. Results of the study show that there is an

increasing trend in deposit, investment, and investment income from IBBL. Islami Bank Bangladesh

Limited provides more investment in internal trade finance, house building sector. Islami Bank

Bangladesh Limited does not provide enough investments in agricultural sector. Classified investment

as percentage of total investment of IBBL has fluctuated over the years and classified investment as

percentage of total investment of IBBL was higher than industry average over each year of analysis.

Therefore, Bank should give more effort to maintain and improve its trend of deposit rate by

increasing their branches, providing more customer services like-prompt service, developing new

savings scheme.

1.1 Introduction:

One of the tried and proven methods of combating the short comings is experience in the internship

program. It is the combined arrangement between the educational institution and corporate house

operating in the practical field BBA program to produce skillful Business Executive having an

absolution professional outlook. For any business school student only curriculum activity is not

enough for handling the real business situation, therefore it is an opportunity for the students to know

about the field of business through the internship program. As internship program is a perfect blend of

the theoretical and practical knowledge. This report is originated to fulfill the requirement of the

assign project internship report on Investment Activities of Islami Bank Bangladesh Limited. In

this regard an organization attachment at Pallabi Branch of Islami Bank Bangladesh Limited has been

given to me a period of two months commencing from 1

st

July, 2012 to 28

th

August, 2014. During this

period I learned how the host organization works with the help of the internal supervisor. The internal

supervisor assigned me one of the projects and shuffled me around to educate me about the operation

of a bank.

1.2 Origin of the Report:

This Internship Report has been preparing under the Internship program, an indispensable part of the

Bachelor of Business Administration (BBA) program. For the internship purpose, I chose Islami Bank

Bangladesh Ltd (IBBL).I prepare this report on the investment related activities of the organization.

1.3 Significance of the Report:

Islami Bank Bangladesh Ltd. is the biggest Bank in Bangladesh in private sector.There are a few

number Of private Banks that can compete with IBBL. The Banking system aiming to gain the goal of

Islamic economy through setting a well designed Islamic Monitory system. Regarding use of money

Islam has Its clear-cut instruction through some distinctive guidelines. Avoiding interest (Riba),

restricting exploitation & speculation etc. are major guidelines in this process. So Islamic Banking

system is doing Banking business under Islamic guide lines.

1.4 Scope of the Report:

Scope of the report is mainly limited to the analysis of investment activities of Islami Bank

Bangladesh Limited. In order to conduct study on this main aspect the following aspects also come

within the scope of the study:

An overview of the Islami Bank Bangladesh Limited.

An analysis of different modes of investment of IBBL.

An analysis of sector wise investment of IBBL.

Status of classified investment.

1.5 Objective of the Report:

The primary objective of this report is to observe the investment related activities for the Investment

Department of Islami Bank Bangladesh Ltd. Objectives are include:

To analyze different modes of investment.

To seek out all the strengths, weaknesses, opportunities & threats.

To compare with other conventional banks.

To familiarize with the various investment schemes.

To get the practical exposure of the banking activities.

To adapt with the corporate environment.

To understand the investment policy of IBBL with other banks.

1.6 Methodology of the Report:

Methodology is the process or system through which a study is being carried out for the purpose of

collection of information that is required is collection with the study for reaching a conclusion on that

Study.

This section of the report contains three Questionnaires, as follows:

a) Questionnaires for common Clients.

b) Questionnaires for Investors.

c) Questionnaire for Banking.

1.6.1. Research design:

This report is analytical in nature which briefly reveals analyze the investment activities of Islami

Bank Bangladesh Limited. It has been conducted by collecting secondary data. Annual reports of IBBL

the major secondary data sources in this purpose. This study has been conducted by collecting data

for the period of 5 years from 2009 to 2013.

1.6.2 Data collection method:

The data required for this study were collected from both primary and secondary sources; however,

majority of the information was collected from secondary sources.

a) Primary source

Primary data was collected form

Branch Manager & Second Officer.

Face to face conversation with employees and staffs.

Practical work experience.

Face to face conversation with clients.

b) Secondary source

The secondary data has been collected from

Annual Report of Islami Bank Bangladesh Limited.

Various prescribed forms of investment were analyzed.

IBTRA Library.

Manuals of Investment of IBBL.

Different text books & materials.

Website of the Islami Bank Bangladesh Limited.

The major portion of the data source used for this report is a secondary one.

1.7 Limitation of the Report:

I have faced some problems during preparing my report:

Lack of experiences has acted as constraints in the way of meticulous exploration on the

topic.

Lack of current information.

Shortage of time for preparing the report in order.

The study was conducted mostly on secondary data.

2.1 What is Islamic Banking?

Islami banking has been defined in different ways. The definition of Islamic bank, as approved by the

Secretariat of the OIC, is stated in the following manner.

An Islami bank is a financial institution whose statutes, rules and procedures expressly state its

commitment to the principle of Islamic Shariah And to the banning of the receipt and payment of

interest on any of its operations.

Shawki Islami Shehta viewing the concept from the prospective of an Islamic Economy and the

prospective role to be played by an Islamic bank there in opines:

It is, therefore, natural, and indeed, imperative for an Islamic bank to incorporate in its functions and

practices commercial investment and social activities, as an institution designed to promote the

civilized mission of an Islamic Economy(Ibid).

It appears from the definition that Islamic banking is systems of financial intermediation that avoids

receipt and payment of interest in its transaction and conducts its operation in a way that it helps

achieve the objectives of an Islamic economy. Alternatively, this is a banking system whose operation

is based on Islamic principles of transaction of which profit and loss sharing (PLS) is a major feature,

ensuring justice and equity in the economy. That is why Islamic banks are often known as PLS bank.

2.2 Objectives of Islamic Banking

The primary objective of establishing Islamic banks all over the world is to promote, foster and

develop the application of Islamic principles in the business sector. More specifically, the objectives

of Islamic banking when viewed in the context of its role in the economy are listed as following:

To offer contemporary financial services in conformity with Islamic Shariah;

To contribute towards economic development and prosperity within the principles of Islamic

justice;

Optimum allocation of scarce financial resources; and

To help ensure equitable distribution of income.

The objectives of Islamic banking are discussed below:

Offer Financial Services: Interest-based banking, which is considered a practice of Riba in

financial transactions, is unanimously identified as anti-Islamic. That means all transactions made

under conventional banking are unlawful according to Islamic Shariah. Thus, the emergence of

Islamic banking is clearly intended to provide for Shariah approved financial transactions.

Islamic Banking for Development: Islamic banking is claimed to be more development- oriented

than its conventional counterpart. The concept of profit sharing is a built-in development promoter

since it establishes a direct relationship between the banks return on investment and the successful

operation of the business by the entrepreneurs.

Optimum Allocation of Resources: Another important objective of Islamic banking is the optimum

allocation of scarce resources. The foundation of the Islamic banking system is that it promotes the

investment of financial resources into those projects that are considered to be the most profitable and

beneficial to the economy.

Islamic Banking for Equitable Distribution of Resources: Perhaps the most important objective of

Islamic banking is to ensure equitable distribution of income and resources among the participating

parties: the bank, the depositors and the entrepreneurs.

2.3 Essential Features of Islamic Bank :

Prohibition of interest

The traditional capitalist banking system depends on interest. It receives interest for providing loans

and pays interest for taking loans. The spread between these two interests is the source of its profit.

But according to Islamic Shariah all types of interest is banned. So, Islamic bank does not carry on

business of interest and it completely avoids the transaction of interest.

Investment based on profit

After departing from interest, the alternate ways of income for Islamic bank is investment and profit.

Thus IBBL gives up any transaction of interest and makes investments based on profit. Bank

distributes its profit to its depositors and shareholders.

Investment in Halal business

Islamic Shariah has banned the business of haram goods. For example, Islam not only forbids the

drinking of alcohol but also banned any business of alcohol. Therefore, Islamic bank does not get any

haram business and only do halal business.

Halal paths and procedures

Islamic Shariah also rejects any haram path or process in case of a halal business. Therefore, Islamic

bank system only allows the halal path procedures of halal business.

2.4 A summary of History and Present Status of Islamic banking around the World

1. In 1962- Pilgrims Saving Corporation was established in Malaysia under Islamic Principle.

2. In 1963- Dr. Ahmed A El-Naggar established an Islamic Bank named Savings Bank in

Mitgamar, 100 km a way from Cairo, Egypt.

3. In 1969-An Islamic Specialized Bank named Tabugn Haji was established in Malaysia.

4. In 1970- Foreign Ministers of OIC countries in their meeting decided to form Islamic

Banking in Muslim countries.

5. In 1971- Nasir Social Bank was established in Cairo, Egypt.

6. In 1973- Finance Ministers of OIC countries in their meeting decided to form an Internal

Islamic Bank on 18-12-73.

7. In 1974- Finance Ministers of OIC countries signed a charter to form an International Islamic

bank, during August.

8. In 1975- Islamic Development Bank (IDB) was formed in Jeddah, KSA on 20-10-75.

9. In 1975- Dubai Islamic Bank was established in Dubai UAE

10. In 1977 i) Faisal Islamic Bank was established Sudan.

ii) Kuwait Finance House was established in Kuwait.

11. In 1977- International Association of Islamic banks (LaIb) was formed in Jeddah, K.S.A

Total member of LAIB was 180.

12. In 1978- Jordan Islamic Bank for Finance and Investment was established in Jordan.

13. In 1978- Pakistan declared all Banks as Islamic

14. In 1983- Islamic bank Bangladesh Ltd. (IBBL) was established in Dhaka, Bangladesh.

15. In 1983- Islamic bank was established in Turkey.

16. In 1984- Iran declared all Banking system Islamic

17. In 1990-The accounting and Auditing Organization for Islamic Financial.

18. Institutions (AAOIFI), formerly known as Financial Accounting Organization for Islamic

Banks and Financial Institution was established on 26-02-90 in accordance with the

Agreement of Association signed in Algiers, Algeria Corporation body in 1991 on 27-03-91

in the state of Bahrain.

2.5 Conventional and Islamic Banking:

Conventional banking is essentially based on the debtor-creditor relationship between the depositors

and the bank on the one hand, and between the borrowers and the bank on the other. Interest is

considered to be the price of credit, reflecting the opportunity cost of money.

Islam, on the other hand, considers a loan to be given or taken, free of charge, to meet any

contingency. Thus in Islamic Banking, the creditor should not take advantage of the borrower. When

money is lent out on the basis of interest, more often it happens that it leads to some kind of injustice.

The first Islamic principle underlying such kinds of transactions is that deal not unjustly, and ye

shall not be dealt with unjustly. Hence, commercial banking in an Islamic framework is not based

on the debtor-creditor relationship.

The second principle regarding financial transactions in Islam is that there should not be any reward

without taking a risk. This principle is applicable to both labor and capital. As no payment is allowed

for labor, unless it is applied to work, there is no reward for capital unless it is exposed to business

risk. Thus, financial intermediation in an Islamic framework has been developed on the basis of the

above two principles. Consequently financial relationships in Islam have been participatory in nature.

Several theorists suggest that commercial banking in an interest-free system should be organized on

the principle of profit and loss sharing. The institution of interest is thus replaced by a principle of

participation in profit and loss.

That means a fixed rate of interest is replaced by a variable rate of

return based on real economic activities. The distinct characteristics which provide Islamic banking

with its main points of departure from the traditional interest-based commercial banking system are:

(a) the Islamic banking system is essentially a profit and loss sharing system and not merely an

interest (Riba) banking system; and (b) investment (loans and advances in the Conventional sense)

under this system of banking must serve simultaneously both the benefit to the investor and the

benefit of the local community as well.

The financial relationship as pointed out above is referred to

in Islamic jurisprudence as Mudaraba.

For the interest of the readers, the distinguishing features of the conventional banking and Islamic

banking are shown in terms of a box diagram as shown below:

Conventional Banks Islamic Banks

1. The functions and operating modes of

conventional banks are based on manmade

principles.

1. The functions and operating modes of Islamic

banks are based on the principles of Islamic

Shariah.

2. The investor is assured of a predetermined rate

of interest.

2. In contrast, it promotes risk sharing between

provider of capital (investor) and the user of funds

(entrepreneur).

3. It aims at maximizing profit without any

restriction.

3. It also aims at maximizing profit but subject to

Shariah restrictions.

4. It does not deal with Zakat. 4. In the modern Islamic banking system, it has

become one of the service-oriented functions of

the Islamic banks to collect and distribute Zakat.

5. Leading money and getting it back with interest

is the fundamental function of the conventional

banks.

5. Participation in partnership business is the

fundamental function of the Islamic banks.

6. Its scope of activities is narrower when

compared with an Islamic bank.

6. Its scope of activities is wider when compared

with a conventional bank. It is, in effect, a multi-

purpose institution.

7. It can charge additional money (compound rate

of interest) in case of defaulters.

7. The Islamic banks have no provision to charge

any extra money from the defaulters.

8. In it very often, banks own interest becomes

prominent. It makes no effort to ensure growth

with equity.

8. It gives due importance to the public interest.

Its ultimate aim is to ensure growth with equity.

9. For interest-based commercial banks, borrowing

from the money market is relatively easier.

9. For the Islamic banks, it is comparatively

difficult to borrow money from the money market.

10. Since income from the advances is fixed, it

gives little importance to developing expertise in

project appraisal and evaluations.

10. Since it shares profit and loss, the Islamic

banks pay greater attention to developing project

appraisal and evaluations.

11. The conventional banks give greater emphasis

on credit-worthiness of the clients.

11. The Islamic banks, on the other hand, give

greater emphasis on the viability of the projects.

12. The status of a conventional bank, in relation to

its clients, is that of creditor and debtors.

12. The status of Islamic bank in relation to its

clients is that of partners, investors and trader.

2.6 History of IBBL

Bangladesh is one of the largest Muslim countries in the world. The people of this country are deeply

committed to Islamic way of life as enshrined in the Holy Quran and the Sunnah. Naturally, it remains

a deep cry in their hearts to fashion and design their economic lives in accordance with the precepts of

Islam. The establishment of Islami Bank Bangladesh Limited on March 13, 1983 as a public company

with limited liability under the companies Act 1913. It is the true reflection of this inner urge of its

people, which started functioning with effect from March 30, 1983. This bank is the first of its kind in

Southeast Asia. It is committed to conduct all banking and investment activities on the basis of

interest-free profit-loss sharing system. In doing so, it has unveiled a new horizon and ushered in a

new silver lining of hope towards materializing a long cherished dream of the people of Bangladesh

for doing their banking transactions in line with what is prescribed by Islam. With the active co-

operation and participation of Islamic Development Bank (IDB) and some other Islamic banks,

financial institutions, government bodies and eminent personalities of the Middle East and the gulf

countries, Islami Bank Bangladesh Limited has by now earned the unique position of a leading private

commercial bank in Bangladesh.

The bank was formally inaugurated on the August 12, 1983. The banks corporate headquarter is

housed in its own 18-storied modern building at 40, Dilkusha Commercial Area, Dhaka.

2.7 Mission

To establish Islamic Banking through the introduction of welfare oriented banking system and also

ensure equity and justice in the field of all economic activities, achieve balanced growth and

equitable development through diversified investment operations particularly in the priority sectors

and less developed areas of the country and to encourage socio-economic uplift and financial

services to the low-income community particularly in the rural areas.

2.8 Vision

Our vision is to always strive to achieve superior financial performance, be considered a leading

Islamic Bank by reputation and performance.

Their goal is to establish and maintain the modern banking techniques, to ensure the

soundness and development of the financial system based on Islamic principles and to

become the strong and efficient organization with highly motivated professionals, working

for the benefit of people, based upon accountability, transparency and integrity in order to

ensure stability of financial systems.

They will try to encourage savings in the form of direct investment.

They will also try to encourage investment particularly in projects which are more likely to

lead to higher employment.

2.9 Shariah Council of IBBL:

Profile of Council Members:

The Shariah Council of Islamic Bank generally consists of experts from the following four areas:

1. Fuqaha: Persons representing this group must be well versed in the Quran, Sunnah and fully

conversant with the opinion of all schools of islami thought and Islami law and jurisprudence. They

must view Islam as a total way of life and a living religion.

2. Banker: There must be a member who is fully conversant with banking law and practices and has

practical experiences in Banking business including foreign trade.

3. Economist: A member from this group need not necessarily be an Islami economist to start with.

But if he is an Islami Economist it is an added advantage. What is important is that he must be really

proficient in modern economies with an in depth study of the community, which a bank is going to

solve. He must have up to date knowledge in the development of the contemporary world.

4. Lawyer: A member representing this group should be a successful practitioner lawyer. He must be

proficient in commercial law including company law. In consultation with the Fuqaha and Economist

members of the council, he should be able to draft such innovating contracts, which will have the

sanction of Islami principles and a banking law of the land.

2.10 Objectives of Shariah Council:

The functions of the council are to offer views and opinions on matters related to the bank from time

to time. The council may require any paper document from the bank and examine the same to see

whether it is according to see whether it is according to Islamic principles.

The shariah council assists the Board of Directors by advising them on matters related to shariah.

The opinion of the majority of members is taken as the opinion of the council provided that the said

opinion is supported by at least three Muftis of the council.

The council maintains its secretariat and a well-equipped library as the Head Office of the bank where

it keeps proper records of all of its proceedings and decisions.

The council elects a chairman and a secretary from amongst them. The chairman will normally

preside over the meetings. In his absence the members present elect one of them to preside over the

meetings.

The council may whenever it thinks necessary, constitutes a subcommittee to help the council.

The council issues Shariah Certificate in the Annual Report of the bank.

2.11 Membership of different organization:

Bangladesh Institution of Bank Management (BIBM).

The Institution of Bankers Bangladesh (IBB).

Bangladesh Association of Banks (BAB).

Bangladesh Foreign Exchange Dealers' Association (BAFEDA).

Central Shariah Board for Islamic Banks of Bangladesh.

International Chamber of Commerce- Bangladesh.

2.12 Special features of the IBBL:

Islami Bank Bangladesh Limited

(IBBL) was incorporated on13.03.1983 as

a public company with limited liability

under the companies act, 1913. The bank

started functioning with effect from

30.03.1983 as the first Shariah based

interest-free bank in South-East Asia.

The bank is committed to run all its

activities as per Islamic Shariah. IBBL

through its steady progress and continuous

success has, by now, earned the reputation

of being one of the leading private sector

banks of the country. The distinguishing

features of IBBL are as under:

All its activities are conducted on

interest-free system according to Islamic

Shariah.

Investment is made through different

modes permitted under Islamic Shariah.

Investment income of the bank is

shared with the Mudaraba depositors

according to a ratio to ensure a reasonably

fair rate of return on their deposits.

Its aims are to introduce a welfare-

oriented banking system and also to

establish equity and justice in the field of

all economic activities.

It extends Socio-economic and

financial services to the poor, helpless and

low-income group of the people for their

economic upliftment particularly in the

rural areas.

It plays a vital role in human resource

development and employment generation

particularly for the unemployed youths.

Its aim is to achieve balance growth &

equitable development of the country

through diversified investment operations

particularly in the priority sectors and in

the less developed areas.

2.13 Strategic Objectives:

To ensure customers' satisfaction.

To ensure welfare oriented banking.

To establish a set of managerial succession and adopting technological changes to ensure

successful development of an Islamic Bank as a stable financial institution.

To prioritize the clients welfare.

To emerge as a healthier & stronger bank at the top of the banking sector and continue stable

positions in ratings, based on the volume of quality assets.

To ensure diversification by Sector, Size, Economic purpose & geographical location wise

Investment and expansion need based Retail and SME/Women entrepreneur financing.

To invest in the thrust and priority sectors of the economy.

To strive hard to become a employer of choice and nurturing & developing talent in a

performance-driven culture.

To pay more importance in human resources as well as financial capital.

To ensure lucrative career path, attractive facilities and excellent working environment.

To ensure zero tolerance on negligence in compliance issues both shariah and regulatory

issues.

To train & develop human resources continuously & provide adequate logistics to satisfy

customers need.

To be excellent in serving the cause of least developed community and area.

To motivate team members to take the ownership of every job.

To ensure development of devoted and satisfied human resources.

To encourage sound and pro-active future generation.

To achieve global standard.

To strengthen corporate culture.

To ensure Corporate Social Responsibilities (CSR) through all activities.

To promote using solar energy and green banking culture and ecological balancing.

2.14 Core Values :

Trust in Almighty Allah

Strict observance of Islamic Shariah

Highest standard of Honesty, Integrity & Morale

Welfare Banking

Equity and Justice

Environmental Consciousness

Personalized Service

Adoption of Changed Technology

Proper Delegation, Transparency & Accountability

2.15 Commitments:

To Shariah

To the Regulators

To the Shareholders

To the Community

To the Customers

To the Employees

To other stakeholders

To Environment

2.16 Aims and objectives:

To conduct interest-free banking.

To establish participatory banking instead of banking on debtor-creditor

relationship.

To invest on profit and risk sharing basis.

To accept deposits on Mudaraba & Al-Wadeah basis.

To establish a welfare-oriented banking system.

To extend co-operation to the poor, the helpless and the low-income group for

their economic enlistment.

To play a vital role in human development and employment generation.

To contribute towards balanced growth and development of the country

through investment operations particularly in the less developed areas.

To contribute in achieving the ultimate goal of Islamic economic systems

To establish a well-balanced economic

system.

2.17 Present programs of the organization:

2.18 Product & Services:

Main product & services of IBBL are as follows:

a) Deposit Schemes

b) Investment Modes

c) Special Scheme

e) ATM Services

f) Special Services

g) Foreign Exchange Business

2.18.1 Deposit Schemes:

Islami Bank Bangladesh limited offers to open the following account to the depositors:

I) Al-Wadiah Current Account

ii) Mudaraba Savings Account

iii) Mudaraba Term Deposit (3 months/6

months/12 months/24 months/36 months)

Islami Bank Bangladesh Ltd.

Foreign Exchange General Banking Investment Deposit Collection

iv) Mudaraba Special Notice Account

v) Mudaraba Special Savings (Pension)

Account (5 years to 10 years)

vi) Mudaraba Haji Savings Account (1 year to

25 years)

vii) Mudaraba Savings Bond Scheme (5 years

to 8 years)

viii) Mudaraba Foreign Currency Deposit Scheme

ix) Mudaraba Waqf Cash Deposit Account

x) Mudaraba Monthly Profit Deposit Scheme (3 years to 5 years)

xi) Mudaraba Muhor Savings Deposit Scheme

2.18.2 Investment Modes:

IBBL invests its money in various sectors of

the economy through different modes

permitted by Shariah and approved by

Bangladesh Bank. The modes of investment

are as follows:

i) Bai- Mechanism

a) Bai-Murabaha

b) Bai-Muajjal

c) Bai-Salam

ii) Ijara Mechanism

a) Hire Purchase

b) Hire Purchase under Shirkatul Melk

iii) Share Mechanism

a) Mudaraba

b) Musharaka

2.18.3 Special Scheme:

Islami Bank Bangladesh Ltd. being welfare oriented institution has now designed and implemented

investment schemes keeping in view the needs of different sectors and various sections of people for

their socio-economic uplift and to improve their quality of life. The special scheme is as follows:

i) Household Durable Scheme

ii) Housing Investment Scheme

iii) Real Estate Investment Program

iv) Transport Investment Program

v) Car Investment Program

vi) Investment Scheme for Doctors

vii) Small Business Investment Scheme

viii) Agriculture Implements Investment Scheme

ix) Micro Industries Investment Scheme

x) Mirpur Silk Weavers Investment Scheme

xi) Rural Development Scheme

2.18.4 ATM Services:

Automated Teller Machine (ATM) has unveiled the horizon of electronic banking of 21st Century.

Through ATM, customers can avail non-stop online teller service without going to the specific branch

of the member bank. The service is now offered by ETN and eleven member banks including Islami

Bank Bangladesh Limited.

i) Facilities

ii) Getting IBBL ATM Card

iii) Cash withdrawal Procedure

iv) Issuing Branches

v) Location of ATM Booths

vi) BTTB Bill payment Procedure

vii) IBBL Schemes-Installment payment Procedure

2.19 Functions of IBBL:

The operation of Islamic Bank Bangladesh limited can be divided into three (3) major categories:

2.19.1 General Banking:

It includes: -

a) Mobilization of deposits

b) Receipts and payment of cash.

c) Handling transfer transaction.

d) Operations of clearing house

e) Maintenance of accounts with

Bangladesh bank and other bank.

f) Collection of cheques and bill.

g) Issue and payment of Demand Draft,

telegraphic transfer and payment Order.

h) Executing customers standing

instructions.

i) Maintenance of safe deposit lockers.

j) Maintenance of internal accounts of the

bank.

While doing all the above noted work IBBL

issue cheques-book, Deposit account operating

form, SS card, Ledgers, Cash book, Deposit

account ledgers, preparation statement of

accounts, Pass book, Balance of different

accounts and calculates profits.

Islami Bank Bangladesh limited offers to open

the following account to the depositors:

1.Al-Wadiah Current Account.

2.Mudaraba Savings Account.

3.Mudaraba term deposit Account. (3 month

/ 6 month / 12 month / 36 months term)

4.Mudaraba Special notice Account

5.Mudaraba Hajj Savings Account (1 year to

25 year term)

6.Mudaraba Special savings (pension)

Account (5 year to 10 year term)

7.Mudaraba Savings bond Scheme (5 year &

8 year term)

8.Mudaraba Foreign Currency Deposit

Account.

9.Mudaraba Monthly Deposit Account.

10. Mudaraba Moharana Account.

2.19.2 Investment:

IBBL invests its money in various sectors of

the economy through different modes

permitted by shariah and approved by

Bangladesh Bank. The modes of investment

are as follows:

i) Bai- Mechanism

a) Bai-Murabaha

b) Bai-Muajjal

c) Bai-Salam

ii) Ijara Mechanism

a) Hire Purchase

b) Hire Purchase under Shirkatul Melk

iii) Share Mechanism

a) Mudaraba

b) Musharaka

2.19.3 Foreign Exchange Business:

Foreign Exchange Business plays a vital role

in providing substantial revenue in the bank

income pool. Like all modern Banks IBBL

operates in the area of the foreign Exchange

business. IBBL performs the following tasks:

a) Opening letter of credit (LC)

against commission for importing

industrial, agricultural

and other permissible items under

Islamic Shariah and Import policy.

b) Opening letter of credit on the

principle of Mudaraba sale, on the

principle of Musharaka sale and under

wage earner scheme.

c) Handling of export/import

document.

d) Negotiation of export / import

document when discrepancy occurs.

e) Financing in import under MPI

(Mudaraba Post Import)

f) Financing to export on profit or loss

sharing.

g) Handling Inward and outward

remittance.

2.20 Organizational Structure of IBBL:

2.21 Hierarchy Management of IBBL:

Executive President

Deputy Executive President

Executive Vice President

Senior Vice President

Vice President

Assistant Vice President

Senior Principle Officer

Principle Officer

Senior Officer

Officer

Probationary Officer

Assistant Officer Grade-i

Assistant Officer Grade-ii

Assistant Officer Grade-iii

2.22 Corporate Information (2013):

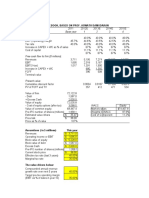

Financial Information: [ As on: 31 December 2013 ]

BDT (Tk.) US Dollar ($)

Authorized Capital 20,000.00 Million 257.23 Million

paid-up Capital 14,636.28 Million 188.25 Million

Equity 45,511.90 Million 385.36 Million

Reserve Fund 29,149.01Million 374.91 million

Deposits 473,140.96 Million 6,085.41 Million

Investment

(including Investment in

Shares)

474,015.95 Million 6,096.67 Million

Foreign Exchange

Business

BDT (Tk.) US Dollar ($)

Import 285,890 Million 3,677.04 Million

Export 205,269 Million 2,640.12 Million

Remittance 286,956 Million 3,690.75 Million

Organizational Information:

Chairman, Board of

Director

Prof. Abu Nasser Muhammad Abduz Zaher

Managing Director &

CEO

Mohammad Abdul Mannan

Company Secretary Abu Reza Md. Yeahia

CFO Mohammad Nesar Uddin, FCA, ACMA

Number of Zones 15

Number of Branches 286

Number of AD Branches 48

Number of ATM Booth 298

Number of Shareholders 33,686

Number of Manpower 11,381

Contact Information:

Address Head Office

Islami Bank Tower

40, Dilkusha Commercial Area

Dhaka-1000, Bangladesh

GPO Box No.23

Phone PABX (88-02-) 9563040, 9560099, 9567161,

9567162

Mobile 88-01711-435638-9

FAX 88-02-9564532, 9568634

SWIFT IBBLBDDH

E-mail info@islamibankbd.com

Web-site www.islamibankbd.com

2.23 Recognition of Performance:

As recognition of good performance IBBL won the following awards:

BBL has been selected as the only Bank from Bangladesh in top 1000 banks in the world by a

UK based century old financial magazine, 'The Banker' published the list in its July 2012

issue.

The institute of Chartered Accountants of Bangladesh (ICAB) awarded IBBL the first prize of

SARRC Anniversary Award for Corporate Governance.

South Asian Federation of Accountants (SAFA) awarded IBBL as joint Winner in the

Corporate Governance Disclosure Award-2010.

South Asian Federation of Accountants (SAFA) also awarded IBBL with Certificate of Merit

in Banking Sector in the Annual Report for the year 2010.

The Institute of Cost and Management Accountants of Bangladesh (ICMAB), awarded IBBL

as the ICMAB National Best Corporate Award-2007 (First Position, Local Bank) and ICMAB

Best Corporate Performance Award 2008 (Second Position, Private Commercial Bank).

The Institute of Chartered Accountants of Bangladesh (ICAB) awarded IBBL with 3rd

position under the catergory-1, Banking in the best published accounts and reports for the

year 2010, the Certificate of Appreciation for the year 2001 & 2010 and Certificate of Merit

for the year 2008.

The Global Finance, a reputed U.S.A. based quarterly Financial Magazine, awarded IBBL as

the best Islamic Financial Institution of the country for the years 2008, 2009, 2010 & 2011.

The Global Finance also awarded IBBL as the best bank of the country for the year 1999,

2000, 2004 and 2005.

ICICI Bank, Hong Kong, awarded IBBL as The Quality Recognition Award-2009 for U.S.

Dollar Clearing (2009).

Bankers Forum awarded IBBL as the Best Bank for Corporate Social Responsibility for 2008

and 2009.

The Bank-Bima Patrika, a Fortnightly Magazine, awarded IBBL as the Best Islami Banking

Award 2007.

Exclusive economic weekly The Industry awarded IBBL as the Best Rated Bank Award-

2010.

The Citi Bank NA awarded IBBL as the Largest Contributor in Foreign Trade Operations

in Europe- Bangladesh corridor in 2009.

The UAE Exchange awarded IBBL for mobilizing around 30% of total foreign remittance of

the country.

3.1 Investment:

Investment is the action of deploying funds with the intention and expectation that they will earn a

return for their owners of a fund can deploy it through real investment or financial investment. When

resources are spent to purchase fixed and current assets for use in a production process for trading

purpose, then it can be termed as real investment. For example, deposit of money with a bank,

purchase of Mudarabah Savings Bond or share of a company. Financial investments ultimately takes

form of real investment as it is meant for so. Since hoarding is condemned by Islam and a 2.5 percent

annual tax (Zakat) is imposed on savings, the owner of a fund, if he is unable to make real investment,

has no option but to invest his savings as a financial investment.

3.2 Islami Banking:

Islamic Banking' A banking system that is based on the principles of Islamic law (also known

Shariah) and guided by Islamic economics. Two basic principles behind Islamic banking are the

sharing of profit and loss and, significantly, the prohibition of the collection and payment of interest.

3.3 Convensional Banking:

Conventional banking is essentially based on the debtor-creditor relationship between the depositors

and the bank on the one hand, and between the borrowers and the bank on the other. Interest is

considered to be the price of credit, reflecting the opportunity cost of money.

3.4 Riba(Interest) & Profit:

Riba(Interest): The literal meaning of interest or Al-RIBA as it is used in the Arabic language

means to excess or increase. In the Islamic terminology interest means effortless profit or that profit

which comes free from compensation or that extra earning obtained that is free of exchange. Hazrat

Shah Waliullah Dehlvi a great scholar and leader has given a very concise and precise definition of

interest. He says,

"Riba` is a loan with the condition that the borrower will return to the lender more than and better

than the quantity borrowed."

Profit: A financial benefit that is realized when the amount of revenue gained from a business

activity exceeds the expenses, costs and taxes needed to sustain the activity. Any profit that is gained

goes to the business's owners, who may or may not decide to spend it on the business.

3.5 Difference between Profit vs Riba :

In Islam Riba (Interest) is strictly prohibited. Islam support business based banking where banks are

allowed to earn through profit from business. That is banks profit will not be fixed prior to business.

But Riba (Interest) is fixed whatever the business situation is. I will try to difference Riba (Interest)

against Profit and Rent.

Riba (interest) Profit

11. Excess over the principal in a loan

transaction.

1. Positive end result of business operation.

2. Unearned income 2. Has to earn by investing labour and capital.

33. Return of principal with additional amount

(interest) is ensured.

3. No such surety.

4. Pre-determined 4. Uncertain

55. Interest may repetitively be earned on a single

transaction.

5. Profit may be earned once from a single deal.

66. Prefixed cost of goods and services and

creates inflation.

6. Profit is found after deduction of all expenses from

total income. So it has no relation with inflation.

77. Interest increases money supply in the

market.

7. There is no opportunity of increasing money supply.

88. These is the opportunity of compounding

8. Close end transaction.

9. ere is no risk of erosion of capital.

9. Risk of erosion of capital is there.

110. No chance of negative end result i.e., loss. 1 10. This is every possibility of negative end result.

111. Declared Haram (prohibited) unequivocal

terms in the holy Quran.

1 11. Halal (permitted) as declared by the holy Quran.

12. Transfers assets from poor to rich. 12. Ensure equitable distribution.

3.6 Modes of investment:

Bai-Murabaha:

This mode is binding upon the Client to purchase from the Bank. The Bank sells the goods at a

higher price (Cost + Profit) to earn profit. The cost of goods sold and profit mark-up therewith

are separately and clearly be mentioned in the Bai-Murabaha agreement. After purchasing of

goods the Bank must bear the risk of goods until those are actually sold and delivered to the

Client/buyer.

Bai-muajjal:

This mode is binding upon the Client to purchase from the Bank but bank is not bound to declare the cost

of goods and profit mark-up separately to the client. Stock and availability of goods is a pre-condition for

Bai-Muajjal agreement. The responsibility of the bank is to purchase the desired goods at the

disposal of the client to acquire ownership of the same before signing the Bai- Muajjal agreement with

the client. Bank must bear the risk of goods until those are actually sold and delivered to the client/buyer.

Bai-Salam:

The terms Bai and Salam have been derived from Arabic words. The words Bai means sale and

purchase and the word Salam means Advance. Bai-Salam means advance sale and purchase.

It is a sale in which an advance payment is made by the buyer, but the delivery is delayed to an agreed

date. In the Bai-Salam, a financial transaction happens in advance in cash as a price of commodity whose

delivery will be in a future date. It means deferred is the commodity sold (debt in kind) and price of the

commodity described is to be aid immediately in advance.

Istisna'a:

Instisna'a sale is a contracting which the price is paid in advance at the time of contract and the object of

sales manufactured and delivered later A manufacturer, artist or craftsman may take orders, with or

without advance payment, to make articles himself or hire labor to do so.

The majority of the jurists consider Istisna's as one of the divisions of Salam, Therefore, It is subsumed

under the definition of Salam, But the Hanafie school of jurisprudence makes Istisna's as an independent

and distinct contract, The jurists of the Hanafie school have given various definitions to Istisna'a some of

which are "That it is a contract with a manufacturer to make the something" and It is a contract on a

commodity on liability with the provision of work" The purchasers called Mustasnia contractor and the

seller is called "sania" maker manufacturer and the thing is called 'masnooa' manufactured, built, made.

Mudaraba:

Most of investment of IBBL is formed under Mubaraba Mode. It is a form of partnership where one party

provides the funds while the other provides the expertise and management. Any profits generated are

shared between two parties on a pre-agreed basis, while capital loss is exclusively borne by the partner

providing the capital. But IBBL is an expert organization in business sector so they face less failure and if

there is any loss they can overcome it by other sector.

Musharakah:

The partners (entrepreneurs, bankers) share both capital and management of a project so that profits will

be distributed among them as per ratio, where loss is shared according to ratio of their equity

participation. Investment division is the most important for all banks. In investment division maintain all

types of investment procedures of Mirpur-10 branch and support the branch to take different types of

initiatives. So I am prepared to report mode of investment as result majority time I work in the Investment

department.

Ijarah :

The term Ijarah has been derived from the Arabic words Air and Ujrat which means consideration,

return, wages or rent. This is really the exchange value or consideration, return, wages, rent of service of

an asset. Ijarah has been defined as a contract between two parties, the Hire and Hirer where the Hirer

(lessee) enjoys or reaps a specific service or benefit against a specified consideration or rent from the

asset owned by the Hire (lessor). It is a hire agreement under which a certain asset is hired out by the Hire

to a Hirer against fixed rent or rentals for a specified period

3.7 Status of investment:

Unclassified:

These are the investment with which the bank satisfied about repayment. No doubt exists up till now

about their recovery.

Classified:

These are the loans which the bank finds overdue after the due date. The bank applies its predefined

policy and procedures, after a loan becomes classified.

Special Mention Account (SMA):

When loan installment is first missed by the borrower, the loan account is classified as a special

Mention Account (SMA). The tenure of SMA varies with the category of loans.

Sub-Standard:

If a loan is not repaid or reschedule within the SMA period, it becomes Sub- Standard loan. From this

stage the loan is treated as defaulted. Interest is treated the same way as in SMA.

Doubtful:

If a loan is not repaid r reschedule within the sub-standard period, it becomes a doubtful loan Interest

will be treated as before in this stage.

Bad and Loss:

If a loan is not repaid or reschedule within the doubtful stage, it is termed as bad and loss. Serious

doubts exist as to the recovery of such loans.

3.8 Investment Scheme of IBBL:

Under consumer financing, the Bank finances to the individuals for meeting their personal. family and

household needs. The Bank has taken up various welfare oriented investment Schemes

1. Household Durables Scheme (HDS

2. Investment Scheme for Doctors (ISD)

3. Transport Investment Scheme (TIS

4. Car Investment Scheme (CIS)

5. Small Business Investment Scheme (SBIS)

6. Micro Industries Investment Scheme (MIIS)

7. Agricultural Implement Investment Scheme (AIIS)

8. Real Estate Investment Program (REIP)

9. Real Estate Investment (Commercial & Working Capital)

10. Agricultural Investment of IBBL

11. Urban Poor Developmet Scheme

12. Woman Entrepeneur Investment Scheme

4.1 Investment:

Investment is an asset or item that is purchased with the hope that it will generate income or

appreciate in the future. In an economic sense, an investment is the purchase of goods that are not

consumed today but are used in the future to create wealth. In finance, an investment is a monetary

asset purchased with the idea that the asset will provide income in the future or appreciate and be sold

at a higher price.

4.2 Investment Management of Islami Bank Bangladesh Limited:

Investment management is a dynamic field where a certain standard of long range planning is needed

to allocation the fund in diverse field and to minimize the risk and maximizing the return on the

invested fund. Continuous supervision, monitoring and follow-up are highly required for ensuring the

timely repayment and minimizing the default. Actually the investment portfolio is not only constituted

the banks asset structure but also a vital factor of the banks success. The overall success in

investment management depends on the banks investment policy, portfolio of investment, monitoring,

supervision and follow-up of the loan and advance. Therefore, while analyzing the investment

management of Islami Bank Bangladesh Limited, it is required to analyze its investment policy,

investment procedure and quality of investment portfolio.

4.3 Investment Policy of Islami Bangladesh Bank Limited:

One of the most important ways, a bank can make sure that its investment meet organizational and

regulatory standards and they are profitable. It is important to establish an investment policy. Such a

policy gives investment management a specific guideline in making individual investment decisions

and in shaping the banks overall investment portfolio. In Islami Bank Bangladesh Limited there is

perhaps an investment policy but there is no investment written policy.

4.4 Investment Principles of Islami Bangladesh Bank Limited:

In the future, investment principles include the general guidelines of providing investment by branch

manager or investment officer. In Islami Bank Bangladesh Limited they follow the following

guideline while giving loan and advance to the client.

Investment advancement shall focus on the development and enhancement of customer

relationship. All investment extension must comply with the requirements of Banks

Memorandum and Article of Association, Banking Companys Act, Bangladesh Banks

instructions, other rules and regulation as amended from time to time.

Loans and advances shall normally be financed from customers deposit and not out of

temporary funds or borrowing from other banks.

The bank shall provide suitable investment services for the markets in which it operates.

It should be provided to those customers who can make best use of them.

The conduct and administration of the investment portfolio should contribute within defined

risk limitation for achievement of profitable growth and superior return on the bank capital.

Interest rates of various lending categories will depend on the level of risk and types of

security offered.

4.5 Investment Process of IBBL:

SELECTION OF THE

CLIENT

APPLICATION STAGE

APPRAISAL STAGE

SANCTIONING STAGE

DOCUMENTATION

STAGE

DISBURSEMENT STAGE

MONITORING &

RECOVERY STAGE

a) Selection of the client:

Here, investment taker (client) approaches to any of the branch of Islami Bank Bangladesh Limited

(IBBL). Then, he talks with the manager or respective officer (Investment). Secondly, bank considers

five Cs of the client. After successful completion of the discussion between the client and the bank,

bank selects the client for its proposed investment. It is to be noted that the client/customer must

agree with the banks rules & regulations before availing investment. Generally, bank analyses the

following five Cs of the client:

Character

Capacity

Capital

Collateral

Condition.

b) Application stage:

At this stage, the bank will collect necessary information about the prospective client. For this reason,

bank informs the prospective client to provide and/or fill duly respective information which is crucial

for the initiation of investment proposal. Generally, here, all the required documents for taking

investment have to prepare by the client himself. Documents that are necessary for getting investment

of IBBL are prescribed below:

Trade License photocopy (for proprietorship);

Abridged pro forma income statement;

Attested copy of partnership deed (for partnership business);

Prior three (03) years audited balance sheet (for joint stock company);

Prior three (03) years business transactions statement for the musharaka/mudaraba

investment;

Abridged pro forma income statement for the musharaka/mudaraba investment;

Attested copy of the Memorandum of Association (MOA) & Articles of Association (AOA)

for the joint stock company;

Attested copy of the Tax Identification Number (TIN)- including final assessment;

Tenders of the proposed assets (in case of HPSM);

Detailed summary of the sundry debtors and creditors (including both time & schedule);

Summary of the personal movable & immovable assets; and others.

c) Appraisal stage:

At this stage, the bank evaluates the client and his/her business. It is the most important stage.

Because, on the basis of this stage, bank usually goes for sanctioning the proposed investment

limit/proposal. If anything goes wrong here, the bank suddenly stops to make payment of investment.

In order to appraise the client, Islami Bank Bangladesh Limited (IBBL), provides a standard

F-167B Form (Appraisal Report) to the client for gathering all the information. However, the

following contents are presented from that appraisal report:

Companys/Clients Information.

Owners Information.

List of Partners/Directors.

Purpose of Investment/Facilities.

Previous Bankers Information.

Business/Industry Analysis.

Asset-Liability position of the client as per Audited Balance Sheet.

Working Capital Assessment.

Risk Grade.

Insurance Coverage.

Audit Observation.

Security Analysis.

d) Sanctioning stage:

At this stage, the bank officially approves the investment proposal of the respective client. In this case

client receives banks sanction letter. Islami Bank Bangladesh Limited (IBBL),s sanction letter

contains the following elements:

Investment Limit in million.

Mode & amount of investment.

Purpose of investment.

Period of investment.

Rate of return.

Securities

e) Documentation stage:

At this stage, usually the bank analyses whether required documents are in order. In the

documentation stage, Islami Bank Bangladesh Limited (IBBL) checks the following documents of the

client:

Tax Payment Certificate.

Stock Report.

Trade License (renewal).

VAT certificate

Liability statement from different parties.

Receivable from different clients.

Other assets statement.

Aungykar Nama.

Three (03) years net income & business transactions.

Performance report with the bank.

Account Statement Form of the bank.

Particulars of the Proposal.

Particulars of the Properties.

Outstanding liability position of the bank.

CIB (Credit Information Bureau) Report.

f) Disbursement stage:

At this stage, bank decides to pay out money. Here, the client gets his/her desired fund or goods. It is

to be noted that before disbursement a site plan showing the exact location of each mortgage

property needs to be physically verified.

g) Monitoring & Recovery stage:

At this final stage of investment processing of the Islami Bank Bangladesh Limited (IBBL), bank will

contact with the client continually, for example- bank can obtain monthly stock report from the client

in case of micro investment. Here, the bank will keep his eye on over the investment taker. If needed,

bank will physically verify the clients operations. Also if bank feels that anything is going wrong

then it tries to recover its investment fund from the client.

4.6 Modes of Investment of IBBL:

When money is deposited in the IBBL, the bank, in turn, makes investments in different forms

approved by the Islamic Shariah with the intention to earn a profit. Not only a bank, but also an

individual or organization can use Islamic modes of investment to earn profits for wealth

maximization. Some popular modes of IBBLs Investment are discussed below.

Islami Bank Bangladesh Ltd. operates its investment activities mainly through 3 (three) mechanisms:

Bai Mechanism,

Share Mechanism

Hire Purchase Under shirkatul Melk

4.6.1 Bai Mechanism

Bai Murabaha

Meaning:

The terms 'Bai- Murabaha' have derived from Arabic words Bai and Ribhun. The word Bai means

purchase and sale and the words Ribhun means an agreed upon profit. Bai-Murabaha means sale on

agreed upon profit.

Definition:

Bai-Murabaha may be defined as a contract between a Buyer and a seller under which the seller sells

certain specific goods permissible under Islamic Shariah and the Law of the land to the Buyer at a

cost plus agreed profit payable on cash or on any fixed future date in lump- sum or by installments.

The profit marked-up may be fixed on lump sum or in percentage of the cost price of the goods. There

are different types of Murabaha as given bellow:

Types of Murabaha:

In respect of dealing parties Bai-Murabaha may be of two types.

1. Murabaha Adiah: Without request from buyer if the seller sells by adding purchase value with

certain profit after getting the authority is known as Murabaha Adiah.

2. Murabaha lil Amiri Bissira: With request from buyer if the seller sells by adding purchase value

with certain profit after getting the authority is known as Murabaha lil Amiri Bissira.

Important Features of Bai Murabaha:

It is permissible for the client to offer an order to purchase particular goods by the Bank dealing its

specification and committing himself to buy the same from their bank on Murabaha. i.e. Cost-plus

agreed upon profit.

It is permissible to make the promise binding upon the client to purchase from the Bank that is he is to

either satisfy the promise or to indemnify the damages caused by breaking the promise without

excuse.

It is permissible to take cash/collateral security to guarantee the implementation of the promise or to

indemnify the damages.

It is also permissible to document the debt resulting from Bai-Murabaha by a Guarantor or a mortgage

or both like any other debt is permission. Mortgage/ Cash Security may be obtained prior to the

signing of the Agreement or at the time of signing the Agreement.

Stock and availability of goods is a basic condition for signing a Bai-Murabaha agreement. Therefore,

the Bank must purchase the goods as per specification of the client to acquire ownership of the same

before signing the Bai-Murabaha agreement with the client.

After purchase of goods the Bank must bear the risk of goods until those are actually sold and

delivered to the Client, i.e., after purchase of the goods by the Bank and before selling of those on

Bai-Murabaha to the client buyer, the bank shall bear the consequences of any damages or defects,

unless there is an agreement with the client releasing the Bank of the defects that means, if the goods

are damaged, bank is liable, of the goods are defective (defect that id nor included in the release) the

bank bears the responsibility.

The bank must deliver the specified goods to the Client on specified date and at specified place of

delivery as per Contract.

The Bank shall sell the goods at a higher price (Cost +Profit) to earn profit. The cost of goods sold

and profit mark-up therewith shall separately and clearly be mentioned on the Bai- Murabaha

agreement. The profit mark-up may be mentioned in lump sum or in percentage of the purchase/cost

price of the goods. But under no circumstances, the percentage of the purchase/cost price of goods.

But under no circumstances, the percentage of the profit shall have any relation with time or

expressed in relation with time, such as per month, per annum, etc.

The price once fixed as per agreement and deferred cannot be further increased.

It is permissible for the bank to authorize any third party to buy and receive the goods on Bank's

behalf the authorization must be in a separate contract.

These features make Bai-Murabaha identical from all other modes of Islamic Investment. There are

certain steps to accomplish a deal of Bai- Murabaha as shown below.

Bai Muajjal (Deferred sale)

Meaning:

The terms "Bai" and "Muajja" have been derived from Arabic words 'Bai' and 'Ajal'. The word Bai

means purchase and sale and the word 'Ajal' means a fixed time or a fixed period. "Bai-Muajjal"

means sale for which payment is made at a future fixed date or within a fixed period. In short, it is a

sale on Credit.

Definition:

The Bai-Muajjal may be defined as a contract between a Buyer and a Seller under which the seller

sells certain specific goods (permissible under Shariah and law of the country), to the Buyer at an

agreed fixed price payable at a certain fixed future date in lump sum or within a fixed period by fixed

installments. The seller may also sell the goods purchased by him as per order and specification of the

buyer.

Bai-Muajjal is treated as a contract between the bank and the client under which the bank sells to the

client certain specific goods, purchased as per order and specification of the client at an agreed price

payable with in a fixed future date in lump sum or by fixed installments.

Thus it is a credit sale of goods by which ownership of the goods is transferred by the bank to the

client but the payment of sale price by the client is deferred for a fixed period.

It may be noted here that in case of Bai- Muajjal and Bai-Murabaha, the Islamic bank is a financier to

the client not in the sense that the bank finances the purchase of goods by the client, rather it is a

financier by deferring the receipt of the sale price of goods, it sells to the client. If the bank does not

purchase the goods or does not make any purchase agreement with seller but only makes payment of

any goods directly purchased and received by the client from the seller under Bai-Muajjal / Bai-

Murabaha agreement, that will be a remittance/ payment of the amount on behalf of the client, which

shall be nothing but a loan to the client and any profit on this amount shall be nothing but interest.

Therefore, purchase of goods by the bank should be for and on behalf of the bank and the payment of

price of goods by the bank must be made for and on behalf of the bank. If in any way the payment of

price of goods is turned in to a payment for and on behalf of the client, or it is paid to the client any

profit on it will be Riba.

There are some important features of Bai- Muajjal as given bellow:

Important Features:

It is permissible for the Client to offer an order to purchase by the bank particular goods deciding its

specification and committing him to by the same from the bank on Bai-Muajjal I.e. deferred payment

sale at fixed price.

It is permissible to make the promise binding upon the Client to purchase from the bank, i.e. he is to

either satisfy the promise or to indemnify the damages caused by breaking the promise without

excuses.

It is permissible to take cash/ collateral security to guarantee the implementation of the promise or to

indemnify the damages.

It is also permissible to document the debt resulting from Bai-Muajjal by a Guarantor, or a mortgage

or both like any other debt. Mortgage/ Guarantee/ Cash security may be obtained prior to the signing

of the Agreement or at the time of signing the Agreement.

Stock and availability of goods is a basic condition for signing a Bai- Muajjal Agreement. Therefore,