Académique Documents

Professionnel Documents

Culture Documents

Economy

Transféré par

Sandip KumarCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Economy

Transféré par

Sandip KumarDroits d'auteur :

Formats disponibles

In 1907, the Aluminum Company of America was founded.

It is the largest aluminum manufacturer in the world, Aluminum Company of

America (Alcoa) produces aluminum and alumina for the packaging, automotive,

aerospace, construction, and other markets. Alcoa's primary operations included

bauxite mining, alumina refining, and aluminum smelting. Its principal products

included alumina and its chemicals, automotive components, and beverage cans.

During the late 1990s, the company was organized into 21 business units, with 178

operating locations in 28 countries.

History

The Aluminum Company of America" became the firm's new name in 1907.

In 1938, the Justice Department charged Alcoa with illegal monopolization, and

demanded that the company be dissolved.

Alcoa purchased an 8% stake of Aluminium Corporation of China in 2001.It tried to

form a strategic alliance with China's largest aluminum producer, ; however, it was

unsuccessful. Alcoa sold their stake in Chalco on September 12, 2007 for around $2

billion.

In 2004, Alcoa's specialty chemicals business was sold to two private equity firms led

by Rhne Group for an enterprise value of $342, which included the assumption of

debt and other unfunded obligations

In 2005 Alcoa acquired two major production facilities in Russia, at Samara and

Belaya Kalitva

2006, Alcoa relocated its top executives from Pittsburgh to New York City

On July 16, 2012, Alcoa announced that it will take over full ownership and operation

of Evermore Recycling and make it part of Alcoa's Global Packaging group.

In June 2013, Alcoa announced it would permanently close its Fusina primary

aluminium smelter, in Venice where production had been curtailed since June 2010.

On January 9, 2014 it was reported that Alcoa had reached a settlement with the U.S.

Securities and Exchange Commission and the Department of Justice over charges of

bribing Bahraini officials.

Case summary

cost advantages and government actions gave Aluminum Company of America

(Alcoa) a U.S. monopoly in aluminum.

monopoly lasted for 50 decades.

Alcoa invention and patented lead alcoa to produce aluminum at much lower cost

than competitors

this firm controlled most domestic and many international sources of bauxite ore

Alcoa was only American producer of aluminum

Alcoa faced some competition from foreign producers, but U.S. established high

tariffs on aluminum imports

during WWI, when foreign competitors were unable to effectively produce and sell in

other countries, Alcoa became an exporter

Alcoa continued to export after war

between WWI and WWII, Alcoa remained only aluminum smelter (producer) in U.S.

due to its technological advantages and economies of scale

demand for aluminum increased substantially with start of WWII

aluminum was used to produce planes and other manufactured products for the war

effort.

during WWII, government financed new plants that were built and run by Alcoa and

encouraged development of other aluminum producers

break up

at end of WWII in 1945, U.S. Supreme Court ruled Alcoa monopoly should be broken

up

government-financed Alcoa plants sold at low prices to Reynolds Metals Company &

Permanente Metals Corporation (owned by Henry Kaiser) creating oligopoly by 1950

o Alcoa: 50.9% of all sales

o Reynolds: 30.9%

o Kaiser Aluminum & Chemical Corporation (renamed Permanente Metals):

18.2%

Pratical application

Public utilities

apparently believing theyre natural monopolies, governments grant monopoly rights

for essential good or service public utilities

water

gas

electric power

mail delivery

Electric power utilitie

Monopolist

o A single supplier of a good or service for which there is no close substitute

o The monopolist therefore constitutes the entire industry

Barriers to entry

Barriers to entry include:

o Ownership of resources without close substitutes

o Economies of scale

o Legal or governmental restrictions

Ownership of resources without close substitutes

o The Aluminum Company of America (ALCOA) at one time owned most of of the

worlds bauxite

Economies of scale

o Low unit costs and prices drive out rivals

o The largest firm can produce at the lowest average total cost

Natural Monopoly

o A monopoly that arises from the peculiar production characteristics in an industry

o It usually arises when there are large economies of scale

o One firm can produce at a lower average cost than can be achieved by multiple firm

The Cost Curves That Might Lead to a Natural Monopoly

Legal or governmental restrictions

o Licenses, franchises, and certificates of convenience

o Examples include

Electrical utilities

Radio and television broadcasting

Legal or governmental restrictions

o Patents

Intellectual property

o Tariffs

Taxes on imported goods

o Regulation

Government enforcement of safety and quality

How Society Loses from Monopoly (contd)

As a result of monopoly, consumers are worse off in two ways:

o The monopoly profits that result constitute a transfer of a portion of consumer

surplus away from consumers to the monopolist

o The failure of the monopoly to produce as many units as would have been produced

under perfect competition eliminates consumer surplus that otherwise would have

been a benefit to consumers

Crafting a monopoly by alcoa

Alcoa scaled up primary operations rapidly during period of aluminum process patent

control

Vertical integration forward and backward

Secured exclusive contracts with suppliers of scarce inputs: hydro, bauxite, etc.

R&D internalized; expertise established

Tariffs kept foreign aluminum out

Canadian operations did business in Europe

Costs (and prices) came dramatically down

By WWI--no new entrants in primary production

Problem faced by alcoa long with solution

By the time the US entered the war, 90% of Alcoas production was used in military

applications.

By 1918, the New Kensington works was producing mess kits, canteens and helmets,

instead of cooking utensils. Aluminum became regulated like other strategic materials

and prices remained low.

As the war ended, Alcoa found itself with excess capacity, a huge decline in demand,

and a return of imports. Price controls were lifted and the expansion of aluminum

spilled over into civilian uses.

Patent problem-

Patent disputes arose between the Cowles brothers and Hall. Cowles had started using

Halls process without licensing, and had acquired rights to the Bradley patents for the

electric arc process they employed. After suits and countersuits, Cowles and Hall

settled by Pittsburgh Reduction Company licensing the Bradley patents through 1909,

and Cowles agreeing to purchase 146,000 pounds of aluminum annually at ten cents

off the list price.

World war 2

the government believed that the shortage was due to Alcoa having a monopoly in US

primary aluminum production.

Alcoa received negative publicity for failing to anticipate war production needs.

Alcoas monopoly was cited as the principal reason.

After the war was over, the US canceled Alcoas plant leases and most plants were

sold to Kaiser and Reynolds, at or below the cost to build them and Alcoa was

required to license the technology necessary to run them. The only plant Alcoa was

permitted to keep was the Cressona extrusion plant.

The country was left with an oligopoly of four major companies Alcoa, Aluminium

Limited, which was to become Alcan, Reynolds and Kaiser. In 1947, Alcoa petitioned

for a ruling that it no longer monopolizes the market, but the ruling was rejected and

the Justice Department retained jurisdiction over Alcoa until 1957.

solution

With astounding speed, Alcoa met the war time challenge. In three years, Alcoa built

over 20 plants: 8 smelters, 11 fabricating plants, 4 refineries, and operated them for

the government.

Total investments in the industry during World War II rose to $672 million, of which

$474 million were Alcoa investments. Employment rose from 26,179 in 1939 to

95,044 by 1944.

Prior to the war, Alcoa concentrated on production. The war brought the realization

that product improvements would be necessary.

After World War I, as power resources in the US became increasingly expensive,

Alcoa expanded. Alcoa entered the bidding for developments in Canada by James B.

Duke.

By 1928, Alcoa had over half of the world capacity in primary aluminum: 90,000

metric tons in the US, 45,000 in Canada and 15,000 in Europe, but managing overseas

operations presented problems.

On June 4, 1928, Alcoa divested its ownership/interest in 34 companies worldwide

and transferred them to Aluminium Limited of Canada.

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- RRDocument1 pageRRSandip KumarPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Allegation and MixtureDocument1 pageAllegation and MixtureSandip KumarPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- Navitas English Course Dates 2019Document2 pagesNavitas English Course Dates 2019Sandip KumarPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Pea504 - Analytical Skills-IDocument20 pagesPea504 - Analytical Skills-ISandip KumarPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- mgn514 - International Environment and ManagementDocument14 pagesmgn514 - International Environment and ManagementSandip KumarPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Consolidated ProfitDocument4 pagesConsolidated ProfitSandip KumarPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Pest Analysis of Banking IndustryDocument8 pagesPest Analysis of Banking IndustrySandip KumarPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Statement of Purpose For Joining A MPA ProgramDocument6 pagesStatement of Purpose For Joining A MPA Programbakedcentipede75% (16)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Public Health Status and Challenges in NepalDocument19 pagesPublic Health Status and Challenges in NepalSandip KumarPas encore d'évaluation

- ACC501 Accounting RubricDocument1 pageACC501 Accounting RubricSandip KumarPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Accounts AssignmentDocument7 pagesAccounts AssignmentSandip KumarPas encore d'évaluation

- Profit Per Unit Hour Units A 80 40 10 B 50 20 15 Total Profit 1550Document1 pageProfit Per Unit Hour Units A 80 40 10 B 50 20 15 Total Profit 1550Sandip KumarPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Porter's Five Forces Analysis of Industry CompetitionDocument20 pagesPorter's Five Forces Analysis of Industry CompetitionAnurvi YadavPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Cover PageDocument2 pagesCover PageSandip KumarPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- Accounts AssignmentDocument7 pagesAccounts AssignmentSandip KumarPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- ASSIGNMENTdetailsDocument1 pageASSIGNMENTdetailsSandip KumarPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Financial ManagementDocument11 pagesFinancial ManagementSandip KumarPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- Solutions-Profit and LossDocument1 pageSolutions-Profit and LossSandip KumarPas encore d'évaluation

- SandeepDocument3 pagesSandeepSandip KumarPas encore d'évaluation

- Book 1Document2 pagesBook 1Sandip KumarPas encore d'évaluation

- QuestionnaireDocument1 pageQuestionnaireSandip KumarPas encore d'évaluation

- Linear RegressionDocument2 pagesLinear RegressionSandip KumarPas encore d'évaluation

- Mkt501 TestDocument4 pagesMkt501 TestSandip KumarPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Questions: Strongly Disagree Disagree Neutral Agree Strongly AgreeDocument1 pageQuestions: Strongly Disagree Disagree Neutral Agree Strongly AgreeSandip KumarPas encore d'évaluation

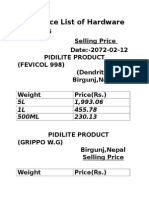

- Price List of Hardware ProductsDocument2 pagesPrice List of Hardware ProductsSandip KumarPas encore d'évaluation

- HW2 MKT501Document6 pagesHW2 MKT501Sandip KumarPas encore d'évaluation

- Price List of Flush Door ProductsDocument1 pagePrice List of Flush Door ProductsSandip KumarPas encore d'évaluation

- Table of Contents for Financial Ratio Analysis of BanksDocument1 pageTable of Contents for Financial Ratio Analysis of BanksSandip KumarPas encore d'évaluation

- Price List of Hardware ProductsDocument2 pagesPrice List of Hardware ProductsSandip KumarPas encore d'évaluation

- Baba Glass House 1Document1 pageBaba Glass House 1Sandip KumarPas encore d'évaluation

- Chevron Attestation PDFDocument2 pagesChevron Attestation PDFedgarmerchanPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Meta Platforms Inc.Document3 pagesMeta Platforms Inc.KRISTINA DENISSE SAN JOSEPas encore d'évaluation

- Management 8th Edition Kinicki Test Bank DownloadDocument25 pagesManagement 8th Edition Kinicki Test Bank DownloadGloria Jones100% (24)

- Proposal On Human Resource MagmtDocument15 pagesProposal On Human Resource MagmtKalayu KirosPas encore d'évaluation

- Sharekhan Summer Internship Report on Sales ProcessDocument26 pagesSharekhan Summer Internship Report on Sales ProcessSandeep SharmaPas encore d'évaluation

- Banking Sector Overview: Definitions, Regulation, FunctionsDocument39 pagesBanking Sector Overview: Definitions, Regulation, FunctionsDieu NguyenPas encore d'évaluation

- Bisleri's Brand Management StrategiesDocument18 pagesBisleri's Brand Management StrategiesRushikesh PednekarPas encore d'évaluation

- An Innovative Step in Loyalty programs-LOYESYSDocument18 pagesAn Innovative Step in Loyalty programs-LOYESYSJason MullerPas encore d'évaluation

- Chapter 1: The Problem and Its BackgroundDocument3 pagesChapter 1: The Problem and Its BackgroundPatricia Anne May PerezPas encore d'évaluation

- 2003Document126 pages2003Jumardi SingarePas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- DFS AgMechanization Aug2017Document69 pagesDFS AgMechanization Aug2017KaziNasirUddinOlyPas encore d'évaluation

- Enterprise Data Management Data Governance PlanDocument36 pagesEnterprise Data Management Data Governance PlanSujin Prabhakar89% (9)

- Database MarketingDocument5 pagesDatabase MarketingYasser AbdesselamPas encore d'évaluation

- MBAChallenge CaseStudy2015-2 PDFDocument29 pagesMBAChallenge CaseStudy2015-2 PDFLuis BembelePas encore d'évaluation

- Enhancing NRI Business Report for IDBI BankDocument47 pagesEnhancing NRI Business Report for IDBI BankKaran BhatiaPas encore d'évaluation

- Idea Generation and Business DevelopmentDocument13 pagesIdea Generation and Business DevelopmentbitetPas encore d'évaluation

- Quiz 3 STMGMTDocument3 pagesQuiz 3 STMGMTJoetta BlevinsPas encore d'évaluation

- Qualifying Examination ReviewerDocument6 pagesQualifying Examination ReviewerAira Kaye MartosPas encore d'évaluation

- Substantive Procedures (1-Page Summary)Document2 pagesSubstantive Procedures (1-Page Summary)Alizeh IfthikharPas encore d'évaluation

- Exam 2Document2 pagesExam 2samuel debebePas encore d'évaluation

- BBM & BCOM SyllabusDocument79 pagesBBM & BCOM Syllabusyathsih24885Pas encore d'évaluation

- Good Sales Candidate ResumesDocument2 pagesGood Sales Candidate ResumesKapoor InfraPas encore d'évaluation

- Mohammad Nurul Huda & Muhammad Ridwan Lubis 121-131Document11 pagesMohammad Nurul Huda & Muhammad Ridwan Lubis 121-131argo victoriaPas encore d'évaluation

- Financial Markets and Services NotesDocument94 pagesFinancial Markets and Services NotesShravan Richie100% (7)

- Grade 9-POA RevisionDocument2 pagesGrade 9-POA RevisionGierome Ian BisanaPas encore d'évaluation

- International Price List Marine b005 Ipl 2018 01Document20 pagesInternational Price List Marine b005 Ipl 2018 01RezaPas encore d'évaluation

- Creating The Service ProductDocument35 pagesCreating The Service ProductReasat AzimPas encore d'évaluation

- Anwesha Roy - 30701017043Document17 pagesAnwesha Roy - 30701017043Anwesha RoyPas encore d'évaluation

- Top reasons to invest in Oracle EPM Cloud for operational efficiencyDocument3 pagesTop reasons to invest in Oracle EPM Cloud for operational efficiencyemedinillaPas encore d'évaluation

- Training AND DevelopmentDocument62 pagesTraining AND DevelopmentUmbraSeriiPas encore d'évaluation