Académique Documents

Professionnel Documents

Culture Documents

Introduction To Development and Financial Reform in Emerging Economies

Transféré par

Pickering and ChattoTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Introduction To Development and Financial Reform in Emerging Economies

Transféré par

Pickering and ChattoDroits d'auteur :

Formats disponibles

INTRODUCTION

Kobil Ruziev and Nicholas Perdikis

Economic crises, be they large like the 1929 Great Depression or the Global

Financial Crisis (GFC) of 2008, or small, are costly in terms of lost economic

opportunities. They are also painful as they lead to unemployment and increase

personal and social tensions, damaging the lives of millions of ordinary people.

Ironically, major crises provide an impetus to challenge orthodox thinking which

can lead to new ideas with radically different policy conclusions. The Great

Depression, for example, inspired John Maynard Keynes to write The General

Theory (1936). In this pioneering work, Keynes rigorously explained, in terms

of fundamental uncertainty, monetary production and investor psychology,

why market-based monetary economies were inherently unstable and proposed

measures to tame excessive fluctuations in aggregate demand.

Success, however, often breeds complacency. This is a common trait in academic disciplines and is no less true of economics. The economic success in

advanced economies during the post-World War II period and the subsequent

triumph of Keynesianism in the 1950s and 1960s led to the detachment of

economic theorizing from reality. Economists started treating restrictive formal

models, and the results of simulations based on them, as if they represented reality. Unfortunately, the economic problems of the late 1970s and the early 1980s,

which could not be explained by the traditional Keynesianism, did very little

to change this trend. With the collapse of Keynesianism, the detachment from

reality actually widened with the rise and subsequent dominance of the neoclassical orthodoxy during the so-called Great Moderation, which preceded the

GFC. Orthodox theories not only failed to predict the scale and the magnitude

of the GFC, but, with their insistence (or preaching) of the inherent stability of

market-based economies, can also be blamed for indirectly contributing to it.

Although the GFC has been interpreted as the second biggest crisis since the

Great Depression in terms of its depth, probably it is the biggest ever in terms of

its breadth as it affected almost all countries in the world in one way or another.

Copyright

766 Development and Financial Reform 2.indd 3

07/11/2014 16:03:25

Development and Financial Reform in Emerging Economies

The hope and expectation is that, similar to the Great Depression, the GFC will

motivate economists to challenge the established orthodoxy in economics and

help bridge the gap between economics and the real world. Although the status

quo is proving a lot more difficult to change than expected, the dissatisfaction

with the neoclassical orthodoxy is gradually gaining momentum.

In this sense, this volume of collective essays aims to contribute to this process; specifically so in the context of development economics in general and the

financial sector reforms in emerging economies in particular. Modern development strategy, led by international financial institutions in charge of policy

advice to emerging economies, is built heavily around uncompromising orthodox economic ideas that are succinctly summarized by the words Washington

Consensus, the term coined by Williamson. By putting its dogmatic faith in

sheer market efficiency, this approach gives only marginal importance to the role

and vitality of institutions in the economic process, and ignores largely the complex and time-consuming nature of institutional capacity building. It does not

fully engage with the ideas of alternative schools of thought on the operation

and functioning of modern economies despite the repeated failures of its policy

recommendations in emerging economies since the 1960s.

By revisiting the contributions of past influential economists, and evaluating

unintended consequences of reforms in some of the transition and developing

economies, this volume aims to reassert the importance of historic experiences in

generating a more realistic and dynamic world view about the way modern economies function and hence the way development strategy should be formalized.

Recognition of the constantly changing nature of the economic relations and

the associated evolution of institutions, including money, banking and finance,

in the economic process is of paramount importance in this regard. Improving

our general understanding of the potential sources of economic growth and

the essential inputs required to develop the productive capacity of economies

should also help us to design and shape better economic policies. One of the

key and critical conclusions to emerge from this volume is that improvements

in our understanding of the interdependence between the changing nature of

economic relations and the development of ideas which form the basis of policy

prescription can lead not only to the adoption of better and more relevant policies, but also to more accurate anticipation and analysis of their likely impact.

The book is aimed at a broad audience, including academics, postgraduate students, policymakers and professional practitioners.

This essay collection would not have come into existence if it were not for the

respect and admiration the contributors had for the work of Dipak Ghosh who

died when the idea of this book was being conceived. He was a passionate fellow

academic who worked tirelessly in areas of our academic interests. He was an

inspirational colleague, a compassionate and reliable friend, and a very kind gen-

Copyright

766 Development and Financial Reform 2.indd 4

07/11/2014 16:03:25

Introduction

tleman; a rare combination of qualities to possess in modern academia. During

his productive career spanning more than twenty years at the University of Stirling, Dipak inspired many people. He published his work in various economics

journals including Manchester School, Scottish Journal of Political Economy, Journal of Post Keynesian Economics, Journal of Economic Methodology, Progress in

Development Studies, Problems of Economic Transition, Studies in Economics and

Finance, Savings and Development, Development Southern Africa, Economic and

Political Weekly, Journal of Business Finance and Accounting, Journal of Small

Business Management, Economic Notes, Australian Economic Papers, Indian Economic Journal, Central Asian Survey, Economies et Societes, Acta Oeconomica and

the Bulletin of Economic Research. He was an active member of various scholarly

associations and research centres including the Post Keynesian Study Group

(PKSG), Stirling Centre for Economic Methodology (SCEME), the Bangladesh Economic Association, Development Studies Association, International

Institution for South Asian Studies, Royal Economic Society, Scottish Economic Association, Scottish Local Government Academic Network, and South

Asian Social Research Forum. The volume presents a selection of methodological and critical essays discussing pertinent issues in development economics and

financial sector reforms in emerging economies, areas of research Dipak Ghosh

felt passionately about and contributed extensively to in his lifetime. It is to his

memory that this book is dedicated.

The critical essays collected here are organized under two broad themes: economic development; and financial sector reforms in transition and developing

economies. Part I discusses the relationship between economic development and

the development of ideas and experiences. It attempts to show how appreciation of this process can contribute to a better understanding of the working of

modern economies, advanced and developing, and as a result the prescription

of relevant policies. Included in this part are contributions by Sheila Dow and

Alexander Dow, Roy Grieve, Dipak Ghosh, David Vazquez-Guzman and Jan

Toporowski. Regarding Dipak Ghoshs two contributing chapters, the drafts of

these chapters existed at various stages of development and these were completed

by Victoria Chick and Kobil Ruziev. Part II covers financial sector reforms in

selected emerging economies, and also includes a discussion of the importance of

the role of money and finance, and that of financial regulation, in market-based

emerging economies. Contributions include those of Kobil Ruziev and Sheila

Dow, Daniela Gabor, Jens Holscher and Khurshid Djalilov, Alexandr Akimov,

Chaoyan Wang and Malay Dey, Jahangir Chowdhury and Radha Upadhyaya.

Finally, we would like to thank all our authors for their excellent contributions

and also for being patient with our demands during the editorial process, some of

which, we admit, were raised out of pure ignorance. We enjoyed reading the individual chapters immensely and remain hopeful that this will be shared by our readers.

Copyright

766 Development and Financial Reform 2.indd 5

07/11/2014 16:03:25

Vous aimerez peut-être aussi

- Gale Researcher Guide for: The Harm Principle in John Stuart MillD'EverandGale Researcher Guide for: The Harm Principle in John Stuart MillPas encore d'évaluation

- Shelley - Songs To The Men of England & England 1819 02Document3 pagesShelley - Songs To The Men of England & England 1819 02Erna DeljoPas encore d'évaluation

- Progeny-Prospero's Books, Genesis and The TempestDocument20 pagesProgeny-Prospero's Books, Genesis and The TempestmarianotavaresPas encore d'évaluation

- MR Endale Besher MA ThesisDocument78 pagesMR Endale Besher MA ThesisperezendalePas encore d'évaluation

- From Crisis to Confidence: Macroeconomics after the CrashD'EverandFrom Crisis to Confidence: Macroeconomics after the CrashÉvaluation : 4 sur 5 étoiles4/5 (1)

- Deviant Behavior in School SettingDocument9 pagesDeviant Behavior in School SettingFlorentina LucanPas encore d'évaluation

- Falling Long-Term Growth Prospects: Trends, Expectations, and PoliciesD'EverandFalling Long-Term Growth Prospects: Trends, Expectations, and PoliciesPas encore d'évaluation

- AllegoryDocument24 pagesAllegoryColin McNamaraPas encore d'évaluation

- MiraDocument4 pagesMiraMrdzakraljPas encore d'évaluation

- Textual and Contextual AnalysisDocument8 pagesTextual and Contextual AnalysisShree NayakPas encore d'évaluation

- Useful Expressions in WritingDocument2 pagesUseful Expressions in Writingsimran kalsiPas encore d'évaluation

- WordsworthDocument2 pagesWordsworthZehra HasanbegovićPas encore d'évaluation

- CV EnglishDocument257 pagesCV EnglishDedi ZainalPas encore d'évaluation

- Elective MutismDocument5 pagesElective MutismMAHIMA DASPas encore d'évaluation

- Basicsofpharmacy PDFDocument350 pagesBasicsofpharmacy PDFNagarajv NagPas encore d'évaluation

- Film Analysis 2Document1 pageFilm Analysis 2RajamanitiPas encore d'évaluation

- The End of The BeginningDocument24 pagesThe End of The BeginningpicasazaharaPas encore d'évaluation

- Questions Robinson Crusoe TeacherDocument3 pagesQuestions Robinson Crusoe TeacherRodrigo Jappe100% (1)

- Common Business VocabDocument7 pagesCommon Business VocabMarcela IvanPas encore d'évaluation

- Unit 6 Test B: Name - Class V DateDocument2 pagesUnit 6 Test B: Name - Class V DateMiron BrezevPas encore d'évaluation

- Handbook of Development Economics, Vol. 1 (1988)Document845 pagesHandbook of Development Economics, Vol. 1 (1988)nur hasanah100% (2)

- Finance and GrowthDocument8 pagesFinance and GrowthHabib UllahPas encore d'évaluation

- Ecodev Module 2 Part 1Document12 pagesEcodev Module 2 Part 1Mae VillarPas encore d'évaluation

- Research Paper Global EconomyDocument4 pagesResearch Paper Global Economynnactlvkg100% (1)

- Complex New World: Translating New Economic Thinking Into Public PolicyDocument174 pagesComplex New World: Translating New Economic Thinking Into Public PolicyJoaquín Vicente Ramos RodríguezPas encore d'évaluation

- Anti-Cyclical, Anti-Crisis and Post Crisis PolicypptxDocument10 pagesAnti-Cyclical, Anti-Crisis and Post Crisis PolicypptxNikol Vladislavova NinkovaPas encore d'évaluation

- Marglin (1988) - Lessons of The Golden Age of CapitalismDocument40 pagesMarglin (1988) - Lessons of The Golden Age of CapitalismmarceloscarvalhoPas encore d'évaluation

- Global RecessionsDocument74 pagesGlobal RecessionsboyapatisandeepkumarPas encore d'évaluation

- Danger and Opportunityv2Document62 pagesDanger and Opportunityv2이초록Pas encore d'évaluation

- Todaro Smith Theories of DevelopmentDocument35 pagesTodaro Smith Theories of DevelopmentLaura Mîndra80% (5)

- Managing Development - Globalization, Economic Restructuring and Social PolicyDocument14 pagesManaging Development - Globalization, Economic Restructuring and Social PolicysheenaPas encore d'évaluation

- Unit 2 - Growth and Development OverviewDocument16 pagesUnit 2 - Growth and Development OverviewMarvel MoviesPas encore d'évaluation

- Long-Run Economic Growth: An Interdisciplinary Approach: Aykut Kibritcioglu and Selahattin DiboogluDocument12 pagesLong-Run Economic Growth: An Interdisciplinary Approach: Aykut Kibritcioglu and Selahattin DiboogluSarah G.Pas encore d'évaluation

- SSRN Id530123Document48 pagesSSRN Id530123Abel Antonio Carrillo LoayzaPas encore d'évaluation

- REP1 FInancial-Liberalization ENDocument55 pagesREP1 FInancial-Liberalization ENDiego AzziPas encore d'évaluation

- Global Political Economy Thesis TopicsDocument4 pagesGlobal Political Economy Thesis TopicsBuyCollegePapersOnlineUK100% (2)

- Eco Assignmnet 1Document9 pagesEco Assignmnet 1227112supriyaPas encore d'évaluation

- (23445416 - Studies in Business and Economics) A Review of Finance-Growth Nexus Theories - How Does Development Finance Fits inDocument9 pages(23445416 - Studies in Business and Economics) A Review of Finance-Growth Nexus Theories - How Does Development Finance Fits inRjendra LamsalPas encore d'évaluation

- Frenkel & Rapetti - 2009 PDFDocument18 pagesFrenkel & Rapetti - 2009 PDFMartinPas encore d'évaluation

- Ciclo Di Frenkel PDFDocument18 pagesCiclo Di Frenkel PDFperosuttonePas encore d'évaluation

- WIDER The StateDocument53 pagesWIDER The StateGopika AthenaPas encore d'évaluation

- Distribution Led GrowthDocument27 pagesDistribution Led GrowthAdarsh Kumar GuptaPas encore d'évaluation

- Chapter 11Document10 pagesChapter 11I change my name For no reasonPas encore d'évaluation

- Classic Theories of Economic Growth and DevelopmentDocument16 pagesClassic Theories of Economic Growth and DevelopmentGWYNETH SYBIL BATACANPas encore d'évaluation

- Soederberg, S., Zarembka, P. - Neoliberalism in Crisis, Accumulation, and Rosa Luxemburgs Legacy (2004)Document292 pagesSoederberg, S., Zarembka, P. - Neoliberalism in Crisis, Accumulation, and Rosa Luxemburgs Legacy (2004)matic.luka.osPas encore d'évaluation

- Louis-Philippe Rochon - Introduction To Heterodox MacroeconomicsDocument30 pagesLouis-Philippe Rochon - Introduction To Heterodox MacroeconomicskkskPas encore d'évaluation

- Politics, Society and Financial Sector Reform in Bangladesh: Anis ChowdhuryDocument43 pagesPolitics, Society and Financial Sector Reform in Bangladesh: Anis ChowdhuryMehedi HasanPas encore d'évaluation

- Eco Reforms PakDocument29 pagesEco Reforms PaksadafPas encore d'évaluation

- SpasDocument7 pagesSpasmilosarPas encore d'évaluation

- 41 2 Midgleyausterity PDFDocument22 pages41 2 Midgleyausterity PDFalpar7377Pas encore d'évaluation

- Reintepreting Growth ModelsDocument11 pagesReintepreting Growth ModelsShame MukokaPas encore d'évaluation

- 2009 Jolley Economic Growth IntroductionDocument26 pages2009 Jolley Economic Growth IntroductionFrederico Sande VianaPas encore d'évaluation

- Literature Review On Global Economic CrisisDocument7 pagesLiterature Review On Global Economic Crisisafmzsawcpkjfzj100% (1)

- Felix EschenbachDocument48 pagesFelix EschenbachHugoPrieto2Pas encore d'évaluation

- Meier, Frontiers of Development Economics, 2001Document585 pagesMeier, Frontiers of Development Economics, 2001Lasan Formatações AbntPas encore d'évaluation

- International Finance - Can The System Be SavedDocument40 pagesInternational Finance - Can The System Be SavedpfelixPas encore d'évaluation

- Theoretical FrameworkDocument3 pagesTheoretical FrameworkJanella VictorinoPas encore d'évaluation

- Boyer Seminario 3 Newcomparativepoliticaleconomy Def 1Document69 pagesBoyer Seminario 3 Newcomparativepoliticaleconomy Def 1axel martinezPas encore d'évaluation

- Index To Warfare and Tracking in Africa, 1952-1990Document8 pagesIndex To Warfare and Tracking in Africa, 1952-1990Pickering and ChattoPas encore d'évaluation

- Introduction To Victorian Medicine and Popular CultureDocument8 pagesIntroduction To Victorian Medicine and Popular CulturePickering and Chatto100% (1)

- Introduction To Warfare and Tracking in Africa, 1952-1990Document9 pagesIntroduction To Warfare and Tracking in Africa, 1952-1990Pickering and ChattoPas encore d'évaluation

- Introduction To Adolphe Quetelet, Social Physics and The Average Men of Science, 1796-1874Document18 pagesIntroduction To Adolphe Quetelet, Social Physics and The Average Men of Science, 1796-1874Pickering and ChattoPas encore d'évaluation

- Index To The Rockefeller Foundation, Public Health and International Diplomacy, 1920-1945Document6 pagesIndex To The Rockefeller Foundation, Public Health and International Diplomacy, 1920-1945Pickering and ChattoPas encore d'évaluation

- Introduction To The Rockefeller Foundation, Public Health and International Diplomacy, 1920-1945 PDFDocument3 pagesIntroduction To The Rockefeller Foundation, Public Health and International Diplomacy, 1920-1945 PDFPickering and ChattoPas encore d'évaluation

- Introduction To The Rockefeller Foundation, Public Health and International Diplomacy, 1920-1945 PDFDocument3 pagesIntroduction To The Rockefeller Foundation, Public Health and International Diplomacy, 1920-1945 PDFPickering and ChattoPas encore d'évaluation

- Introduction To The Early Modern Child in Art and HistoryDocument20 pagesIntroduction To The Early Modern Child in Art and HistoryPickering and ChattoPas encore d'évaluation

- Introduction To MalvinaDocument12 pagesIntroduction To MalvinaPickering and ChattoPas encore d'évaluation

- Introduction To Victorian Literature and The Physics of The ImponderableDocument17 pagesIntroduction To Victorian Literature and The Physics of The ImponderablePickering and Chatto100% (1)

- Introduction To Indulgences After LutherDocument15 pagesIntroduction To Indulgences After LutherPickering and ChattoPas encore d'évaluation

- Introduction To The Gothic Novel and The StageDocument22 pagesIntroduction To The Gothic Novel and The StagePickering and ChattoPas encore d'évaluation

- Introduction To Secularism, Islam and Education in India, 1830-1910Document18 pagesIntroduction To Secularism, Islam and Education in India, 1830-1910Pickering and ChattoPas encore d'évaluation

- Introduction To William Cobbett, Romanticism and The EnlightenmentDocument17 pagesIntroduction To William Cobbett, Romanticism and The EnlightenmentPickering and ChattoPas encore d'évaluation

- Chapter 1 From A Cultural Study of Mary and The AnnunciationDocument15 pagesChapter 1 From A Cultural Study of Mary and The AnnunciationPickering and Chatto100% (1)

- Introduction To Scientists' Expertise As PerformanceDocument13 pagesIntroduction To Scientists' Expertise As PerformancePickering and ChattoPas encore d'évaluation

- Introduction To Henri Fayol, The ManagerDocument5 pagesIntroduction To Henri Fayol, The ManagerPickering and ChattoPas encore d'évaluation

- History of Medicine, 2015-16Document16 pagesHistory of Medicine, 2015-16Pickering and Chatto100% (1)

- Introduction To The Future of Scientific PracticeDocument12 pagesIntroduction To The Future of Scientific PracticePickering and ChattoPas encore d'évaluation

- Communicative Competence Strategies in Various Speech SituationsDocument9 pagesCommunicative Competence Strategies in Various Speech SituationsJhonnamie Senados CarbonPas encore d'évaluation

- Qad Form 45 1B Division Checklist For The Operation of A Senior High School Program For Public SchoolDocument3 pagesQad Form 45 1B Division Checklist For The Operation of A Senior High School Program For Public SchoolAdith MangaronPas encore d'évaluation

- Unofficial Score ReportDocument1 pageUnofficial Score ReportDonna Marie MoffittPas encore d'évaluation

- FMS Admissions - FAQ Document: 1. What Are The Important Dates and Deadlines For The Application Process?Document3 pagesFMS Admissions - FAQ Document: 1. What Are The Important Dates and Deadlines For The Application Process?Chakradhar DPas encore d'évaluation

- Task 2Document9 pagesTask 2AishaPas encore d'évaluation

- Stephanie Gross: 9139 Avenue Pointe Cir. Apt 106 ORLANDO, FL. 32821 4 0 7 - 5 9 1 - 8 4 8 5Document1 pageStephanie Gross: 9139 Avenue Pointe Cir. Apt 106 ORLANDO, FL. 32821 4 0 7 - 5 9 1 - 8 4 8 5Stephanie GrossPas encore d'évaluation

- Cambridge International Examinations Cambridge International General Certificate of Secondary EducationDocument6 pagesCambridge International Examinations Cambridge International General Certificate of Secondary Educationfsdfs sfsdsdfPas encore d'évaluation

- ABSTRACT Competency MappaingDocument6 pagesABSTRACT Competency MappaingAmit DeshmukhPas encore d'évaluation

- The Plans and Programs GuideDocument130 pagesThe Plans and Programs GuideMatt Stankey100% (2)

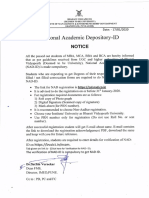

- NAD Notice For Passed Out StudentsDocument1 pageNAD Notice For Passed Out StudentsLovneet SharmaPas encore d'évaluation

- WRN Student Handbook Assignments 01Document21 pagesWRN Student Handbook Assignments 01Alli BayramPas encore d'évaluation

- Group 3 Final Printing KurikulumDocument6 pagesGroup 3 Final Printing KurikulumMaxx xxPas encore d'évaluation

- Madhya Pradesh GS NotesDocument24 pagesMadhya Pradesh GS NotesyogeshforeverPas encore d'évaluation

- Milestones Training Quizzes Answer SheetDocument16 pagesMilestones Training Quizzes Answer Sheetapi-282224914Pas encore d'évaluation

- A Paper Presentation On Inclusive Education in The PhilippinesDocument4 pagesA Paper Presentation On Inclusive Education in The PhilippinesRusielyn VillanuevaPas encore d'évaluation

- CV Leon Levstik ENG - PMDocument5 pagesCV Leon Levstik ENG - PMLeon LevstikPas encore d'évaluation

- 5083Document25 pages5083neo.foe100% (1)

- Biography AnalysisDocument21 pagesBiography Analysisenriched_swata3966Pas encore d'évaluation

- LetterofintentDocument3 pagesLetterofintentCharizza MaePas encore d'évaluation

- Rileydepaola ResumeDocument1 pageRileydepaola Resumeapi-302639360Pas encore d'évaluation

- FamilyDocument2 pagesFamilyDatu RobsPas encore d'évaluation

- The AvengersDocument2 pagesThe Avengerswww.getenglishlessons.comPas encore d'évaluation

- Sample Self Assessment GuideDocument2 pagesSample Self Assessment GuideFloregie Fugie Ticong BantilingPas encore d'évaluation

- Al Farah Izzatie Al Buhari (Resume)Document7 pagesAl Farah Izzatie Al Buhari (Resume)Khairul IshakPas encore d'évaluation

- Letter of Invitation-SpeakerDocument4 pagesLetter of Invitation-SpeakerDhel MerniloPas encore d'évaluation

- Eastern Mindoro College: Answer Sheet For Curriculum DevelopmentDocument4 pagesEastern Mindoro College: Answer Sheet For Curriculum DevelopmentJaymar Magtibay0% (1)

- Circle Sectors PDFDocument6 pagesCircle Sectors PDFavrahamsc100% (1)

- C. W. W. KannangaraDocument5 pagesC. W. W. KannangaraUdaya Max100% (1)

- Technology in Special EducationDocument7 pagesTechnology in Special Educationapi-491565788Pas encore d'évaluation

- Lesson 2: Implementing A Curriculum Daily in The Classrooms: Presented By: Elaine R. Mateo Bsed Iii-EnglishDocument41 pagesLesson 2: Implementing A Curriculum Daily in The Classrooms: Presented By: Elaine R. Mateo Bsed Iii-EnglishAlyssa AlbertoPas encore d'évaluation

- A History of the United States in Five Crashes: Stock Market Meltdowns That Defined a NationD'EverandA History of the United States in Five Crashes: Stock Market Meltdowns That Defined a NationÉvaluation : 4 sur 5 étoiles4/5 (11)

- The Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaD'EverandThe Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaPas encore d'évaluation

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassD'EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassPas encore d'évaluation

- Economics 101: How the World WorksD'EverandEconomics 101: How the World WorksÉvaluation : 4.5 sur 5 étoiles4.5/5 (34)

- Look Again: The Power of Noticing What Was Always ThereD'EverandLook Again: The Power of Noticing What Was Always ThereÉvaluation : 5 sur 5 étoiles5/5 (3)

- The Meth Lunches: Food and Longing in an American CityD'EverandThe Meth Lunches: Food and Longing in an American CityÉvaluation : 5 sur 5 étoiles5/5 (5)

- The War Below: Lithium, Copper, and the Global Battle to Power Our LivesD'EverandThe War Below: Lithium, Copper, and the Global Battle to Power Our LivesÉvaluation : 4.5 sur 5 étoiles4.5/5 (8)

- This Changes Everything: Capitalism vs. The ClimateD'EverandThis Changes Everything: Capitalism vs. The ClimateÉvaluation : 4 sur 5 étoiles4/5 (349)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingD'EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingÉvaluation : 4.5 sur 5 étoiles4.5/5 (97)

- Chip War: The Quest to Dominate the World's Most Critical TechnologyD'EverandChip War: The Quest to Dominate the World's Most Critical TechnologyÉvaluation : 4.5 sur 5 étoiles4.5/5 (228)

- Principles for Dealing with the Changing World Order: Why Nations Succeed or FailD'EverandPrinciples for Dealing with the Changing World Order: Why Nations Succeed or FailÉvaluation : 4.5 sur 5 étoiles4.5/5 (237)

- Economics 101: From Consumer Behavior to Competitive Markets—Everything You Need to Know About EconomicsD'EverandEconomics 101: From Consumer Behavior to Competitive Markets—Everything You Need to Know About EconomicsÉvaluation : 5 sur 5 étoiles5/5 (3)

- The Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumD'EverandThe Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumÉvaluation : 3 sur 5 étoiles3/5 (12)

- Anarchy, State, and Utopia: Second EditionD'EverandAnarchy, State, and Utopia: Second EditionÉvaluation : 3.5 sur 5 étoiles3.5/5 (180)

- Deaths of Despair and the Future of CapitalismD'EverandDeaths of Despair and the Future of CapitalismÉvaluation : 4.5 sur 5 étoiles4.5/5 (30)

- The New Elite: Inside the Minds of the Truly WealthyD'EverandThe New Elite: Inside the Minds of the Truly WealthyÉvaluation : 4 sur 5 étoiles4/5 (10)

- The Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall StreetD'EverandThe Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall StreetPas encore d'évaluation

- Vulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomD'EverandVulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomPas encore d'évaluation

- Narrative Economics: How Stories Go Viral and Drive Major Economic EventsD'EverandNarrative Economics: How Stories Go Viral and Drive Major Economic EventsÉvaluation : 4.5 sur 5 étoiles4.5/5 (94)

- The Technology Trap: Capital, Labor, and Power in the Age of AutomationD'EverandThe Technology Trap: Capital, Labor, and Power in the Age of AutomationÉvaluation : 4.5 sur 5 étoiles4.5/5 (46)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaD'EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (14)

- Vienna: How the City of Ideas Created the Modern WorldD'EverandVienna: How the City of Ideas Created the Modern WorldPas encore d'évaluation