Académique Documents

Professionnel Documents

Culture Documents

Homework PDF

Transféré par

Syed AliTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Homework PDF

Transféré par

Syed AliDroits d'auteur :

Formats disponibles

Homework Assignment I

1.

Lee plans to retire in 22 years with a nest egg of $8M. He has already saved $500,000 in an investment

account that generates a nominal rate of return of 12%, compounded quarterly. However, he needs to

withdraw $150,000 from this account in 10 years to finance his sons college education.

(a)

Numerically show that whether Lees investment account balance will reach $8M in 22 years,

based on the information provided above.

<$6.12M>

(b)

The correct answer for part (a) indicates that Lees investment account will fall short of his

retirement goal of $8M in 22 years. Thus, he continues his pursuit by making additional fixed

contributions at the end of every quarter to the same investment account until he retires 22 years

later. How big should be his quarterly contribution in order to achieve his goal? <$4,522.18>

(c)

Assume now that Lee retires and has $8M in his investment account. If he wants to leave $10M

to each of his two children upon his death after enjoying 25 years of retirement. What is the

maximum annual withdrawal from the investment account Lee can make at the beginning of

every year during his retirement?

<$818,587.57>

2.

Maryanne, a baby boomer who turns 50 today, begins to save for retirement with $200,000 that she just

receives from a trust fund. She immediately invests this $200,000 in a stock fund. In addition, she

plans to contribute $10,000, $15,000, and $20,000, respectively, at the end of the next 3 years to the

same stock fund. The stock fund generates a nominal rate of return of 10%, compounded annually.

(a)

What will be the value of her stock fund when she retires at the age of 67? <$1,195,452.48>

(b)

Right after her retirement, she transfers her nest egg into a conservative investment that

compounds monthly. If Maryanne wants to withdraw a fixed monthly payment of $7,000 from

this investment indefinitely, what should be the annual rate of return of this conservative

investment?

<7.03%>

3.

Consider the following two mutually exclusive projects, X and Y, and their cash flows information,

Project

Year 0

Year 1

Year 2

Year 3

Year 4

X

($1,400)

$350

$750

$650

$650

Y

($1,000)

$300

$400

$500

$600

(a)

Assume that the discount rate is 12%, compute the payback period, the IRR, NPV and PI of

project X.

<2.46 years; 23.49%; $386.13; 1.276>

(b)

Use the McKinseys approach to compute the Modified IRR (MIRR) for project X. <19.03%>

(c)

Apply the incremental IRR analysis to compute the crossover rate for projects X and Y, and select

between these two mutually exclusive projects. <19.41%>

4.

The following are two popular approaches used by automobile dealers:

(a)

Cash Rebate Versus Low Rate Dealer Financing

You are given two mutually exclusive options from the dealer on a $20,000 car: (i) $1,500 cash

rebate or (ii) 36-month low rate loan at 3% APR. The prevailing APR on 36-month auto loan

from a typical bank is 8%. Which option is a better deal?

<$579.72;

$581.62>

(b)

Buying Versus Leasing

You are interested in a $25,000 car. A simplified leasing contract includes the following: (i) upfront cost of $3,000, (ii) $400 monthly lease payment over a 36-month period, and (iii) purchase

cost of $12,000 at the end of the lease. What are the implied APR and EAR of the lease?

Should you lease the car or buy and finance the car with a loan from the bank in (a)?

<8.45%; 8.79%>

5.

You have been asked by the president of your firm to evaluate the proposed acquisition of new

special-purpose equipment. The equipment's base price is $500,000, and another $50,000 for

its installation costs. The equipment falls into the MACRS 3-year class, and it will be sold at

the end of the projects 2-year life for $250,000. Use of the equipment will require net working

capital investment equivalent to 20% of the following years incremental revenues. The

equipment will increase annual revenues by $100,000, and save the firm $200,000 in annual

operating costs. The annual revenues and operating costs are expected to grow at an annual

rate of 10% during the 2nd-year of the project. This equipment will be placed in an unoccupied

site, which can otherwise be sold for $100,000 today. This site will be sold for the same price at

the termination of the project. The depreciation of this site that your firm owns can be ignored.

The firm's tax rate is 30 percent and the discount rate for the project is 12%.

(a)

(b)

(c)

(d)

6.

Compute the initial outlay of the project.

<-$670,000>

Compute the operating cash flows (OCF) in Years 1 and 2.

<$264,995; $304,326>

Compute the non-operating cash flows (i.e., capital spending and change in NWC) at the end of

Year 2. <$333,679>

What is your recommendation on this project according to the conceptually most correct capital

budgeting method? Why? Be concise! <$73,430>

Use the attached financial statements to compute

(a)

the cash flow from assets and its 3 components,

(b)

the cash flow to creditors/bondholders and its 2 components,

(c)

the cash flow to stockholders and its 2 components

for LEE Corporation for the fiscal year of 2014.

<$317>

<$218>

<$99>

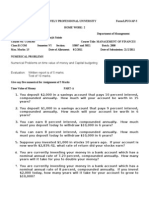

LEE Corporation (Problem #6)

Income Statement

2014

Net Sales

Cost of Goods Sold

Depreciation Expenses

Earnings Before Interest and Taxes

Interest Expenses

Taxable Income

Taxes (34%)

Net Income

$ 1,800

$ 1,080

$ 180

$ 540

$ 120

$ 420

$ 143

$ 277

Dividends Paid

$ 83

Balance Sheet

2013

2014

Total Current Assets

Net Fixed Assets

Total Assets

$ 536

$ 2,164

$ 2,700

$ 540

$ 2,160

$ 2,700

Total Current Liabilities

Long-term Debt

Common Stock & Paid-in Capital

Retained Earnings

Total Liabilities and Equity

$ 980

$ 278

$ 700

$ 742

$ 2,700

$ 900

$ 180

$ 684

$ 936

$ 2,700

NOTES:

This homework assignment is composed of a SAMPLE of past examination problems

that are pertaining to the midterm examination. Since this is just a sample, the actual

midterm examination may include other numerical problems that are not included in

this homework assignment, e.g., numerical problems from Chapter 3 and 6 such as

the use of the Pro Forma statement to estimate EFN, the EAC calculation,

Financial Ratio calculations and interpretations, etc. As such, while you will find

this homework assignment a valuable tool for your preparation for the midterm

examination, it is by no mean inclusive of all topics that are covered in the midterm

examination! Besides, I need to explicitly remind you that it takes much practice to

master the course materials. Students who only work on the homework problem sets

(without investing needed time on learning/studying course materials and practicing

suggested problems) may find themselves underprepared for the examinations.

The answers to the problems are given for your reference. Due to the degree of

similarity between these homework problems and the actual examination problems,

detailed solutions will NOT be posted. Please note that numerical illustrations similar

(but not identical) to these homework, and hence examination, problems can be found

in the online lecture notes (via Modules) for the respective chapters/topics!

Vous aimerez peut-être aussi

- Practice Test MidtermDocument6 pagesPractice Test Midtermrjhuff41Pas encore d'évaluation

- HIGGINS Chapter 7 Financial EvaluationDocument6 pagesHIGGINS Chapter 7 Financial EvaluationParul BhavsarPas encore d'évaluation

- Fin 455 SP 2017 CumulativeDocument10 pagesFin 455 SP 2017 CumulativedasfPas encore d'évaluation

- Practice Test MidtermDocument6 pagesPractice Test Midtermzm05280Pas encore d'évaluation

- Feasibility Assignment 1&2 AnswersDocument12 pagesFeasibility Assignment 1&2 AnswersSouliman MuhammadPas encore d'évaluation

- Bangladesh University exam questions on corporate financeDocument3 pagesBangladesh University exam questions on corporate financeRahman NiloyPas encore d'évaluation

- SolutionDocument6 pagesSolutionaskdgasPas encore d'évaluation

- MBA Mid-Term Exam SolutionsDocument16 pagesMBA Mid-Term Exam SolutionsSomera Abdul QadirPas encore d'évaluation

- Calculate Capital Budgeting Project NPV and IRRDocument17 pagesCalculate Capital Budgeting Project NPV and IRRFredy Msamiati100% (1)

- FINAL EXAM Winter 2014Document8 pagesFINAL EXAM Winter 2014denisemricePas encore d'évaluation

- Assignment 1Document2 pagesAssignment 1Ryan HiraniPas encore d'évaluation

- HW 2Document3 pagesHW 2Love MittalPas encore d'évaluation

- Engineering Economics Practice NumericalsDocument4 pagesEngineering Economics Practice NumericalsPhoenixRoboPas encore d'évaluation

- 5 - HI5002 Finance Tutorial Question Assignment T2 20202 Questions-AG 150920Document6 pages5 - HI5002 Finance Tutorial Question Assignment T2 20202 Questions-AG 150920ahmerPas encore d'évaluation

- FIN515 W3 Problem SetDocument3 pagesFIN515 W3 Problem Sethy_saingheng_7602609Pas encore d'évaluation

- Cash Flow Estimation Problem SetDocument6 pagesCash Flow Estimation Problem SetmehdiPas encore d'évaluation

- Quiz Week 3 SolnsDocument7 pagesQuiz Week 3 SolnsRiri FahraniPas encore d'évaluation

- CH 08Document12 pagesCH 08AlJabir KpPas encore d'évaluation

- ACF 103 Exam Revision Qns 20151Document5 pagesACF 103 Exam Revision Qns 20151Riri FahraniPas encore d'évaluation

- NPV Capital Budgeting GuideDocument8 pagesNPV Capital Budgeting GuideAnastasiaPas encore d'évaluation

- Finance Practice ProblemsDocument54 pagesFinance Practice ProblemsMariaPas encore d'évaluation

- 15-Step Tutorial on Finance ConceptsDocument15 pages15-Step Tutorial on Finance ConceptsAninda DuttaPas encore d'évaluation

- Business Finance Sample Examination PaperDocument4 pagesBusiness Finance Sample Examination PaperYeshey ChodenPas encore d'évaluation

- Corporate Finances Problems Solutions Ch.18Document9 pagesCorporate Finances Problems Solutions Ch.18Egzona FidaPas encore d'évaluation

- All Sheets ApplicationDocument86 pagesAll Sheets Applicationmido AAPas encore d'évaluation

- Practice Exercises 2Document3 pagesPractice Exercises 2Richard RobinsonPas encore d'évaluation

- Capital Budgeting Practice ProblemDocument3 pagesCapital Budgeting Practice ProblemWaylee CheroPas encore d'évaluation

- Final ExamDocument6 pagesFinal ExamOnat PPas encore d'évaluation

- Assignment 2: RemarksDocument10 pagesAssignment 2: RemarksWyatt Paxton0% (2)

- IE 360 Engineering Economic Analysis Sample TestDocument11 pagesIE 360 Engineering Economic Analysis Sample TestjohnhenryyambaoPas encore d'évaluation

- Should a Company Invest in New Computer SystemsDocument1 pageShould a Company Invest in New Computer SystemsLara Lewis AchillesPas encore d'évaluation

- Capital Budgeting: Workshop Questions: Finance & Financial ManagementDocument12 pagesCapital Budgeting: Workshop Questions: Finance & Financial ManagementJuan SanguinetiPas encore d'évaluation

- Capital Budgeting Exercises NPV PI AnalysisDocument2 pagesCapital Budgeting Exercises NPV PI AnalysisMohamed ZaitoonPas encore d'évaluation

- 3530 SU23 Final Exam - Type X - Questions (Post)Document13 pages3530 SU23 Final Exam - Type X - Questions (Post)combatapple25Pas encore d'évaluation

- Practice questions for corporate finance examDocument8 pagesPractice questions for corporate finance examSadi0% (1)

- Fin 300 Exam PracticeDocument6 pagesFin 300 Exam PracticePhillip Lee0% (1)

- MBA Financial Management and Markets Exam 1 Spring 2010Document6 pagesMBA Financial Management and Markets Exam 1 Spring 2010Anonymous JmeZ95P0Pas encore d'évaluation

- TVM ProblemsDocument4 pagesTVM Problemsshikha_asr2273Pas encore d'évaluation

- Capital Budgeting Decisions: Key Terms and Concepts To KnowDocument17 pagesCapital Budgeting Decisions: Key Terms and Concepts To Knownisarg_Pas encore d'évaluation

- Blank 3e ISM Ch06Document45 pagesBlank 3e ISM Ch06Sarmad Kayani100% (1)

- MainExam 2018 PDFDocument12 pagesMainExam 2018 PDFAnonymous hGNXxMPas encore d'évaluation

- Final ExamDocument7 pagesFinal ExamOnat PPas encore d'évaluation

- Capital Budgeting NPV Analysis for Earth Mover ProjectDocument6 pagesCapital Budgeting NPV Analysis for Earth Mover ProjectMarcoBonaparte0% (1)

- Accounting Chapter 10Document11 pagesAccounting Chapter 10Andrew ChouPas encore d'évaluation

- ÔN THI CUỐI KÌ TCDN 1-MS TRANGDocument6 pagesÔN THI CUỐI KÌ TCDN 1-MS TRANGHoàng Việt VũPas encore d'évaluation

- CH 04 EOC Solutions 4e StudentDocument15 pagesCH 04 EOC Solutions 4e StudentMary Shannon DeeringPas encore d'évaluation

- Accf 2204Document7 pagesAccf 2204Avi StrikyPas encore d'évaluation

- 2012 EE enDocument76 pages2012 EE enDiane MoutranPas encore d'évaluation

- Corporate Finance Problem Set NPV AnalysisDocument3 pagesCorporate Finance Problem Set NPV AnalysisWuhao KoPas encore d'évaluation

- Fin3n Cap Budgeting Quiz 1Document1 pageFin3n Cap Budgeting Quiz 1Kirsten Marie EximPas encore d'évaluation

- Corporate Finance Practice QuestionDocument5 pagesCorporate Finance Practice QuestionReel LeePas encore d'évaluation

- Tutorial Capital BudgetingDocument4 pagesTutorial Capital Budgetingmi luPas encore d'évaluation

- The Hang Seng University of Hong Kong Bachelor Degree Programmes 2019-2020 Semester 2 ExaminationDocument8 pagesThe Hang Seng University of Hong Kong Bachelor Degree Programmes 2019-2020 Semester 2 Examination李敏浩Pas encore d'évaluation

- CFA QuestionsDocument42 pagesCFA Questionspuntanalyst100% (2)

- FIN 514 Financial Management: Spring 2021 InstructionsDocument4 pagesFIN 514 Financial Management: Spring 2021 InstructionsAkash KarPas encore d'évaluation

- PRACTICE FINAL EXAM KEYDocument8 pagesPRACTICE FINAL EXAM KEYrahulgattooPas encore d'évaluation

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)D'EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Évaluation : 5 sur 5 étoiles5/5 (1)

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)D'EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Évaluation : 4.5 sur 5 étoiles4.5/5 (5)

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)D'EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Évaluation : 5 sur 5 étoiles5/5 (1)

- Preparing Buying PlansDocument4 pagesPreparing Buying PlansSyed AliPas encore d'évaluation

- Constitution International Society For Criminology: Article 1 Name and SeatDocument6 pagesConstitution International Society For Criminology: Article 1 Name and SeatSyed AliPas encore d'évaluation

- Running Head: Partnership 1: Assignment On Partnership Submitted by ABC DateDocument9 pagesRunning Head: Partnership 1: Assignment On Partnership Submitted by ABC DateSyed AliPas encore d'évaluation

- Security Report 2014Document41 pagesSecurity Report 2014Syed AliPas encore d'évaluation

- SSRNDocument53 pagesSSRNSyed AliPas encore d'évaluation

- M.farooq JavedDocument6 pagesM.farooq JavedSyed AliPas encore d'évaluation

- Deere Logistics Recommendations to Improve FedEx RelationshipDocument1 pageDeere Logistics Recommendations to Improve FedEx RelationshipSyed AliPas encore d'évaluation

- Deere Logistics Recommendations to Improve FedEx RelationshipDocument1 pageDeere Logistics Recommendations to Improve FedEx RelationshipSyed AliPas encore d'évaluation

- Mails From HMSNDocument1 pageMails From HMSNSyed AliPas encore d'évaluation

- Martyrs R Pride of NationDocument2 pagesMartyrs R Pride of NationSyed AliPas encore d'évaluation

- Preface: The Islamia University of BahawalpurDocument5 pagesPreface: The Islamia University of Bahawalpursyed_ali_375Pas encore d'évaluation

- Immediate Flood Report Final Hurricane Harvey 2017Document32 pagesImmediate Flood Report Final Hurricane Harvey 2017KHOU100% (1)

- Basic Etiquettes Inc IntroductionsDocument8 pagesBasic Etiquettes Inc Introductionsayesha akhtarPas encore d'évaluation

- Nation of Islam Timeline and Fact Sheet (Brief)Document6 pagesNation of Islam Timeline and Fact Sheet (Brief)salaamwestnPas encore d'évaluation

- Boscastle Family Book SeriesDocument4 pagesBoscastle Family Book SeriesChingirl89100% (1)

- Kythera S-1 Ex. 99.1Document471 pagesKythera S-1 Ex. 99.1darwinbondgrahamPas encore d'évaluation

- Ethics in Social Science ResearchDocument33 pagesEthics in Social Science ResearchRV DuenasPas encore d'évaluation

- WP (C) 267/2012 Etc.: Signature Not VerifiedDocument7 pagesWP (C) 267/2012 Etc.: Signature Not VerifiedAnamika VatsaPas encore d'évaluation

- Common Law MarriageDocument3 pagesCommon Law MarriageTerique Alexander100% (1)

- Prospects For The Development of Culture in UzbekistanDocument3 pagesProspects For The Development of Culture in UzbekistanresearchparksPas encore d'évaluation

- Taste of IndiaDocument8 pagesTaste of IndiaDiki RasaptaPas encore d'évaluation

- ___Document2 pages___kikuomahdi123Pas encore d'évaluation

- Face Reading NotesDocument8 pagesFace Reading NotesNabeel TirmaziPas encore d'évaluation

- Foucault Truth and Power InterviewDocument7 pagesFoucault Truth and Power IntervieweastbayseiPas encore d'évaluation

- Audit Independence and Audit Quality Likelihood: Empirical Evidence From Listed Commercial Banks in NigeriaDocument15 pagesAudit Independence and Audit Quality Likelihood: Empirical Evidence From Listed Commercial Banks in NigeriaIdorenyin Okon100% (1)

- The Marcos DynastyDocument19 pagesThe Marcos DynastyRyan AntipordaPas encore d'évaluation

- Survey QuestionnairesDocument4 pagesSurvey QuestionnairesSashaPas encore d'évaluation

- Power Plant Cooling IBDocument11 pagesPower Plant Cooling IBSujeet GhorpadePas encore d'évaluation

- 19 Preposition of PersonalityDocument47 pages19 Preposition of Personalityshoaibmirza1Pas encore d'évaluation

- Fundamentals of Accountancy, Business and Management 1 (FABM1)Document9 pagesFundamentals of Accountancy, Business and Management 1 (FABM1)A.Pas encore d'évaluation

- Bibliography of the Butterworth TrialDocument3 pagesBibliography of the Butterworth TrialmercurymomPas encore d'évaluation

- BP Code of ConductDocument112 pagesBP Code of ConductLuis ZequeraPas encore d'évaluation

- Macroeconomics: Ninth Canadian EditionDocument48 pagesMacroeconomics: Ninth Canadian EditionUzma KhanPas encore d'évaluation

- HCB 0207 Insurance Ad Risk ManagementDocument2 pagesHCB 0207 Insurance Ad Risk Managementcollostero6Pas encore d'évaluation

- Tiket Kemahasiswaan Makasar1Document4 pagesTiket Kemahasiswaan Makasar1BLU UnramPas encore d'évaluation

- Lupo Lupangco Vs CA G.R. No. 77372 April 29, 1988 160 SCRA 848Document2 pagesLupo Lupangco Vs CA G.R. No. 77372 April 29, 1988 160 SCRA 848Emil Bautista100% (2)

- Sutta NipataDocument164 pagesSutta NipatatantravidyaPas encore d'évaluation

- Akhtar Non IT RecruiterDocument3 pagesAkhtar Non IT RecruiterMohiddinPas encore d'évaluation

- Contemporary Management Education: Piet NaudéDocument147 pagesContemporary Management Education: Piet Naudérolorot958Pas encore d'évaluation

- Cargo Record BookDocument7 pagesCargo Record BookTusharsorte100% (1)

- Barangay SindalanDocument1 pageBarangay SindalanAna GPas encore d'évaluation