Académique Documents

Professionnel Documents

Culture Documents

Credit Limit

Transféré par

dc12dcCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Credit Limit

Transféré par

dc12dcDroits d'auteur :

Formats disponibles

Accounting and auditing

Audit of Advance Portfolio of Banks

dvances constitute the assets of Banks

and audit of the same demands greater

efficiency and understanding of the

system. Every bank has got its own rules/

regulations, within the legal requirements under

Reserve Bank of India Act and its guidelines

for granting advances for its constituents.

These guidelines include, limit for lending to a

single entity, group exposure, sensitive sector

etc. But the core generalities remain the same

everywhere. Here an auditor is expected to

assess and comment on the qualitative and

quantitative aspects of advances. A progressive

and amenable set of rules will make the assets

of a Bank vibrant and yielding. Otherwise they

will be static and dormant.

Advances are broadly classified into Fund

based and Non-fund based credit limits. There

again the Fund based advances may be further

broken into Working Capital Funding, in the

forms of Cash Credit, Bill Discounting etc., and

Term lending. The working capital finance is

concerned with the current assets and current

liabilities and the term lending relates to Fixed

Assets and Long Term Liabilities of the borrowing unit. An audit should cover assessing the

quality of advances, provisioning requirements

and disclosure in the balance sheet. The audit

process should include the following:

A. Application:

The process of granting advances is initiated

on receipt of an application from the intending

borrower outlining his requirements and

detailing his financial strength. The auditor

should check that the application received

from the borrower is in the prescribed format

furnishing all his borrowing requirements. The

credit limits sanctioned to the borrower by

the Bank should be in line with the application

CA. B. Shanmuganathan

(The author is a Member of the

Institute. He can be reached at

bsmugan@yahoo.com)

submitted by the borrower. Along with the

application the borrower should have submitted

copies of audited financial statements and

projected profit and loss and balance sheets

and cash flow statements apart from the basic

information about the borrowers personal

profile as required by Reserve Bank of India

guidelines for Know Your Customers. He has

to draw a suitable audit programme depending

on the extent of the deficiency in this regard.

B. Processing:

A statutory auditor has to verify whether the

branch has complied with general guidelines and

procedures of the bank for lending, while processing the proposal. These guidelines includes

assessing the technical feasibility, economic viability and industry performance etc. The auditor

should verify that both the receipt of application

and processing of the same are properly recorded and documented by the branch. The auditor

should also check that the same has been sent to

the controlling/sanctioning authority within the

time-frame for sanction.

C. Sanctioning:

Every bank has got various layers of

sanctioning authorities. It is incumbent on the

auditor to test check whether the sanctions have

been made by particular sanctioning authorities

and whether the terms of sanction like margin,

rate of interest and repayment terms are

correctly conveyed to the borrower in line with

the sanction. Any advance without a valid and

current sanction advice should be enquired by

the auditor and reported appropriately. Every

sanction should also be recorded at the branch

level and banks normally prescribe periodical

returns on advances sanctioned/disbursed

by the branch to its controlling authority. The

auditor should scrutinise these returns to

have the knowledge of advances sanctioned

/disbursed during the period covered under

audit. The auditors should also verify for all

critical sanctions made during the year under

March 2007 The Chartered Accountant

1421

Accounting and auditing

audit that the credit limits and the terms and

conditions therein are conveyed and duly

accepted by the borrower.

D. Documentation:

One of the prime functions of the auditor is to

verify the documents executed by the borrowers

of loans granted during the period under review.

He has to verify whether all documents were

executed in the prescribed forms prescribed

by the bank and duly stamped. The lending is

properly secured by way of mortgage deeds/

hypothecation deeds/ guarantees etc., as per the

sanction terms. The loan documents are to be

necessarily in the printed formats of Bank. Further,

the auditor has to verify creation of charge with

ROC in case of limited companies. The signatures

in the loan documents and affixing of common

seal, if necessary, are to be in line with the

constitution of the borrowers. Normally, in case

of large advances, the documents executed by

the borrower are scrutinised by the banks legal

department or by an advocate in their panel. The

auditor may rely on the opinion of them for the

enforceability of the documents executed by the

borrower. The auditor should also ensure system

of safe custody of the documents at the branch

level.

E. Disbursement:

The fresh loans sanctioned and disbursed

during the year under audit should be ensured

for proper utilisation and end use of borrowed

funds as per sanction. In case of term loans, the

banks generally, disburse directly to the vendor

on the basis of pro forma invoices and supported

by requests of the borrower. The auditor should

verify the invoices of machinery and other

capital expenditures with proper supporting.

Further, auditor should enquire/verify about the

report submitted to the sanctioning authority

about the post disbursement inspection done

by the branch officials.

F. Monitoring:

Monitoring by the branch ensures assess the

quality of advances and each bank prescribes

1422 The Chartered Accountant March 2007

various norms for the same. These norms include, receipt of Stock/book debt statements

from the borrower, periodical physical inspection of the borrowing unit, review of account

operations and submission of review report to

sanctioning authority based on the financials of

the borrower and his operation at periodic intervals. The auditor should have a clear understanding of the process of monitoring and its

documentation by the branch. The auditor may

rely on the concurrent audit/inspection audit

reports in this regard and based on the same he

can draw his audit programme for performing

substantive checking.

In case of a running limit like Open Cash Credit (OCC), the auditor should check whether the

monthly interest has been paid regularly. There

should be sufficient credit in the account to set

off the interest debits. Every borrowal account

has got a Credit Limit beyond which drawals

are not permitted, unless under special circumstances. In case of running limits like OCC, Packing Credit etc., there is one more concept called

the Drawing Limit (DP), which should also be

checked. Drawing limit is the limit up to which

drawings are allowed to the borrower within or

equal to the sanctioned limit. This limit is arrived

at in the first week of every month. There will be

records and entries in the system to denote the

drawing limit, as distinct from the sanctioned

limit, of any borrowal account. As a general

rule the drawing limit cannot exceed the overall sanctioned limit. Any drawings over and

above the drawing limit should have specific

prior approval by the appropriate authority. In

the absence of prior approval the same should

be ratified. Otherwise the drawings are to be

classified as Clean Drawings, which will attract

penal interest. In case the auditor observes excess Drawings without ratification or delayed

reporting, the same should be brought out in

the Long Form Audit Report suitably. In the case

of consortium accounts the DP for every month

will be calculated and advised by the Lead Bank.

The communication in this regard has to be verified by the auditor.

Accounting and auditing

How is the Drawing Limit Calculated?

Generally working capital limits are sanctioned to borrowers based on inventory and

book debts. Though all current assets are reckoned for arriving at the Maximum Permissible

Bank Finance, drawing limit is arrived at based

on paid stocks and debtors only. Every borrower

is required to submit a statement of stocks as at

the last day of every month. In the case of debtors too, the sanction will stipulate the level up

to which debtors can be reckoned for DP. For

example a sanction may stipulate that debtors

up to 90 days only can be taken for fixing the

drawing limit.

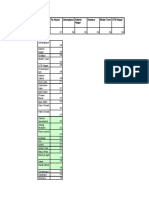

Following example will illustrate how a

drawing limit is arrived at every month in

Banks:

Inventory as on 31-12-2006 Rs. 75.00 lacs

Creditors for Purchases

Rs. 15.00 lacs

Then paid stock will be

Rs. 60.00 lacs

Margin as per Sanction (25%) Rs. 15.00 lacs

Hence Drawing Limit

against Stocks will be

Rs 35.00 lacs....(i)

Debtors as on 31.12.2006

Rs 125.00 lacs

Less: Debtors more

than 90 days

Rs 15.00 lacs

So eligible debtors will be

Rs 110.00 lacs.

Auditor should check the stock statements

at random and verify whether drawing limits

are arrived at every month and whether the

drawings beyond the DP are properly recorded

and reported to the higher authorities.

Further, to receipt of stock and book debt

statements, branch officials visit the borrowers

unit at periodical intervals for physical

verification of stocks and its performances.

The banks also have stock audits conducted

by external auditors in case of large advances.

The auditor should scrutinise these reports for

assessing the quality of the advances.

Bill Discounting:

Working capital funding includes Bills

purchased and Discounted by the banks. The

funding is made available to borrower based on

the supply of goods/services to its customers

and accepted by them. The borrower sends

the bills through the funding bank who lend

it based on supplies made. The bill may be

payable on demand or within a specific tenor.

The auditor should ensure that the branch has

sufficient internal monitoring system for follow

up of realisation of bills discounted. In case of

recovery from cash credit/overdraft account

by overdrawing, the same should be treated as

sanction of fresh loan against overdue bills.

Margin as per Sanction (30%) Rs 33.00 lacs

G. Asset Classification:

Hence Drawing Limit

against Debtors will be

In the course of verifying the quality of

advances the auditor should also confirm to the

classification of advances as Performing and

Non Performing Assets. The banks should follow

the Reserve Bank of Indias extent guidelines to

classify an advance as Non Performing Asset

(NPA) and it is the primary responsibility of the

banks management for proper classification of

advances. The auditor should assess the system

put in by the management in identifying NPA

and various returns submitted by the branch

in this regard to the sanctioning authority

during the year under audit. On scrutiny of

these returns the auditor comes to know the

weak advances and specifically identify these

accounts for further verification. The auditor

should also check the movement of NPA during

Rs 77.00 lacs...(ii)

Total DP for the month of January 2007 will

be (i) + (ii) = Rs. 112 lacs. Accordingly the total

drawings on any day in January 2007 cannot

exceed Rs. 112 lacs. If it exceeds, it should

be with permission and the portion of the

drawings beyond the DP should be charged

penal interest. Auditor should check that penal

interest is automatically charged by the system

in a computerised environment, whenever

the actual drawings by the borrowers exceed

the DP. The auditor may cross verify the stock

statement submitted for the month of March

and that reported in the audited balance sheet

submitted by the borrower.

March 2007 The Chartered Accountant

1423

Accounting and auditing

the year, such accounts that are upgraded and

recovered etc. for proper classification.

From the Asset Classification angle the

auditor should also verify the following:

1. Every sanction should be current and live.

If any sanction has expired there should

be proper extension or renewal. If any

borrowal account remains in the expired

limit category for more than 3 months, (as

on 31st of March) then it has to be classified

as NPA.

2. Similarly non-receipt of stock statements

from the borrower for 3 months (as on

31st of March) and/or not arriving at DP

continuously for a period of 3 months (as at

31st of March) will make the account NPA.

3. If any borrowal account remains

continuously irregular for a period of 90

days it will be classified as NPA.

4. Any credit of round sums in the account

during the last few days of March should

cause further enquiries by the auditor. He

has to verify the operation in the account

during the subsequent month also. He

should also probe the source of credit and

satisfy himself that they are genuine.

What are Term Liabilities?

Usually term loans are sanctioned by Banks to

create fixed assets like land, building, machinery

etc. These loans carry fixed repayment schedule

besides stipulations as to margin, rate of interest etc. In most of the loan accounts the repayments are now through EMI apart of servicing of

interest as and when charged. The auditor has

to verify the account and find out whether any

installment has become due beyond 30 days. If

repayments are through EMIs then repayment

may be in any day of the month till the last day.

Hence, the auditor has to look for installments,

which are due and not paid for 30 days from the

end of the month in which they became due.

For example, if ABC has to repay Rs. 2 lacs every

month. If he has not remitted Rs. 2 lacs in the

month of January and further he has not remitted that January installment even up to 29th day

1424 The Chartered Accountant March 2007

of following February then the installment has

become due as on 30th of January and on 1st of

March, the account will become NPA if the installment is not paid up to 31st March also.

All Banks have got specific schemes for

lending to various sections of society like

Housing Loans, Home Improvement Loans,

Traders Loans, loan against Rent receivables,

Education loans etc. Auditor has to familiarise

himself with the covenants of such schemes

before drawing up an audit programme. In all

those loans, provisions as to margin, rate of

interest and repayment schedules should be

carefully studied and verified for compliance.

In the case of term loans, the terms may

stipulate repayment holiday for commencement

of commercial production or from the date of

first disbursement. Auditor should under stand

the terms of sanction clearly and verify the loan

account for compliance of sanction terms and

for proper classification.

Provisioning Requirements:

Reserve Bank of India has prescribed well defined rules for making provisions in the case of

advances. The provisions are normally calculated at the branch level for Non performing assets

and duly verified by the auditors. In case of Standard Assets, the bank normally makes provision

globally at the Head Office level. Auditor should

go through these guidelines carefully before

checking the provision calculations. Since the

provision for advances is related to the security,

auditor should carefully compare the security

available vis--vis the security stipulated in the

sanction advice. Moreover he should also verify

the mortgage/hypothecation documents and

ensure that the securities stipulated are in fact

available legally to the Bank. Similarly valuation

of the fixed assets like land, building and machinery etc., are critical item in the calculation

of provision requirements. Banks normally obtain valuation reports once in three years in case

of immovable properties. If the available valuation is more than 3 years old, then the auditor

should insist for a fresh valuation to arrive at the

deficiency in the value of securities. In case of

stocks, auditor should verify whether there are

Accounting and auditing

unmoving or dead stocks which cannot form

part of security and in case of machineries, necessary depreciations may be considered.

If the securities are to be shared by different

banks that have financed a borrower in

consortium the value of the securities should

be allocated on pari passu basis.

In the case of loans against its own deposits,

banks need not make any provision. However,

the auditor should ensure that proper lien has

been marked for the loans granted and verify

whether the properly discharged deposit

receipt is available with the Bank. If the deposit

has expired, auditor should carefully verify

whether the deposit has been repaid to the

customer without closing the loan account. In

some cases, the depositor requests the bank

to issue duplicate deposit receipts while the

original deposit receipt (against which loan has

been sanctioned to the depositor) is with the

custody of the Bank. Hence the auditor should

verify the records of duplicate deposit receipts

and compare the same with the deposits against

which loans have been permitted.

In case of export advances, which have been

identified as NPA, the auditor should verify

the ECGC cover considered by the branch and

enquire about the correspondence with ECGC

for enforceability of claim. If in the opinion of the

auditor, the claim is under dispute, the auditor

should treat it properly while making provisions.

Non Fund Based Limits:

These are so called since banks do not part with

funds immediately on issuing a Letter of Credit or

a Bank Guarantee. These are guarantees in writing

issued by a bank guaranteeing the repayment of

the loan or completion of performance by the

borrower. These letters of credit and Guarantees

should be studied as on 31st of March every year.

There may be cases of huge Letters of Credit

having been devolved on the last week or the

last day of the financial year, which if paid, will

substantially alter the provisioning requirements

of the bank. Auditor should carefully verify the

registers of Letters of Credit and Guarantees to

ensure that there is not liability that crystallises,

which were reported as contingent liability as on

31st March.

Recovery:

In case of advances, where the bank has initiated legal action and instructed the branch to

ensure recovery of advance by sale or auction of

the borrowers securities, the auditor should ensure that the branch has taken necessary steps

as directed by the controlling office. In Case of

attachment of property under SARFASI Act, the

bank should comply with servicing of notice

within the prescribed period and the auditor

should verify limitation of time prescribed. In cases, where the bank would have entered/ accepted a compromise from the borrower for one time

settlement, the auditor should study the terms of

compromise and performance of the borrower as

on the balance sheet date for proper treatment in

the books. The commitments that are fully met

by the borrower should be treated as recovery

towards principal or interest in that order as laid

down by the banks policy. The auditor should

identify the unfulfilled terms of compromise by

the borrower as on the date of balance sheet and

report in Long Form Audit Report suitably.

In case of write off of advances, which are

normally accounted at Head Office, the auditor

should verify the communication received from

Head Office, and passing of necessary entries in

the Branch Books. The banks might have followed

technical write off of advances, by keeping the

advance under memorandum of records for the

purpose of monitoring recovery and ensuring

legal recovery. The auditor should check that

these cases are not included in the gross advances

of branch.

The auditor may not be able to verify all the

transactions of the bank during the year under

audit. Hence, he has to randomly select the

cases to be covered based on size so as cover

reasonable portion of advance portfolio of the

branch and design the audit programme. The

auditor should cover all the above factors for

selected cases, properly document the basis of

selection and his findings. r

March 2007 The Chartered Accountant

1425

Vous aimerez peut-être aussi

- OHE Book Railway PDFDocument193 pagesOHE Book Railway PDFdc12dc79% (29)

- Standard 031110Document1 pageStandard 031110dc12dcPas encore d'évaluation

- Overhead Equipment Guide for 25kV AC Railway ElectrificationDocument193 pagesOverhead Equipment Guide for 25kV AC Railway Electrificationdc12dcPas encore d'évaluation

- OPGW Splicing GuidelineDocument18 pagesOPGW Splicing Guidelinedc12dc100% (1)

- ACTMDocument823 pagesACTMdc12dc86% (7)

- 2014 The Election That Changed India PDFDocument900 pages2014 The Election That Changed India PDFpodapanni19100% (15)

- Iec62217 Polymer 1Document40 pagesIec62217 Polymer 1dc12dcPas encore d'évaluation

- Guidelines For Off Line Installation PDFDocument8 pagesGuidelines For Off Line Installation PDFdc12dcPas encore d'évaluation

- Insulator For 1500kVDocument13 pagesInsulator For 1500kVdc12dcPas encore d'évaluation

- Selection of Station InsulatorsDocument7 pagesSelection of Station Insulatorsdc12dcPas encore d'évaluation

- High Press WashingDocument9 pagesHigh Press Washingdc12dcPas encore d'évaluation

- Motor HHH FundamDocument7 pagesMotor HHH FundamKi SeyPas encore d'évaluation

- Insulator For 1500kVDocument13 pagesInsulator For 1500kVdc12dcPas encore d'évaluation

- Galvanising ManualDocument199 pagesGalvanising Manualdc12dcPas encore d'évaluation

- VanDykeLebeau TAG-PGCIL Heading 111014Document2 pagesVanDykeLebeau TAG-PGCIL Heading 111014dc12dcPas encore d'évaluation

- A Guide To Surviving Ipc 498a Apr 2008ciDocument50 pagesA Guide To Surviving Ipc 498a Apr 2008ciabcdef1985Pas encore d'évaluation

- Metro FareDocument8 pagesMetro Faredc12dcPas encore d'évaluation

- Blair Lewis - Meditation - The Inward JourneyDocument42 pagesBlair Lewis - Meditation - The Inward JourneyClaudiu Trandafir100% (2)

- High Press WashingDocument9 pagesHigh Press Washingdc12dcPas encore d'évaluation

- Blair Lewis - Meditation - The Inward JourneyDocument42 pagesBlair Lewis - Meditation - The Inward JourneyClaudiu Trandafir100% (2)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Solid Builders vs. China BankDocument1 pageSolid Builders vs. China BankAngelica BernardoPas encore d'évaluation

- AGRIFINA AQUINTEY, Petitioner, Spouses Felicidad and Rico Tibong, RespondentsDocument52 pagesAGRIFINA AQUINTEY, Petitioner, Spouses Felicidad and Rico Tibong, RespondentsjrvyeePas encore d'évaluation

- Elk Consumer MathDocument7 pagesElk Consumer Mathapi-399013722Pas encore d'évaluation

- 3rd Exam Cases OBLADIDocument147 pages3rd Exam Cases OBLADIMc Vharn CatrePas encore d'évaluation

- Bankruptcy Basics: Lesson AuthorDocument29 pagesBankruptcy Basics: Lesson AuthorSamPas encore d'évaluation

- Finacle 10 CommandDocument36 pagesFinacle 10 CommandPANKAJ MAHESHWARI100% (3)

- Petitioners Vs Vs Respondents Jose P Malabanan Jose R DimayugaDocument10 pagesPetitioners Vs Vs Respondents Jose P Malabanan Jose R DimayugaJuana Dela VegaPas encore d'évaluation

- Project Report On Hardware Shop For Riyaz Hardware: ConfidentialDocument5 pagesProject Report On Hardware Shop For Riyaz Hardware: ConfidentialRafikul IslamPas encore d'évaluation

- 2017 January 15Document37 pages2017 January 15siva kPas encore d'évaluation

- Rice Mill ProjectDocument24 pagesRice Mill Projectbull88% (8)

- Time Value of Money 1: Analyzing Single Cash FlowsDocument30 pagesTime Value of Money 1: Analyzing Single Cash FlowsEdward Amoyen AbellaPas encore d'évaluation

- Money Market Overview at Rajshahi UniversityDocument17 pagesMoney Market Overview at Rajshahi UniversityFahim MalikPas encore d'évaluation

- Articles of Incorporation and By-Laws - Non Stock CorporationDocument30 pagesArticles of Incorporation and By-Laws - Non Stock CorporationnenePas encore d'évaluation

- Sources of Rural CreditDocument9 pagesSources of Rural CreditMAYANK SINHAPas encore d'évaluation

- Credit Scoring Systems HandbookDocument79 pagesCredit Scoring Systems HandbookNegovan CodinPas encore d'évaluation

- Singapore Employment Act Chapter 91 Salary Payment Termination RightsDocument5 pagesSingapore Employment Act Chapter 91 Salary Payment Termination RightsTaylor W. HickemPas encore d'évaluation

- Special Power of Attorney for Property PurchaseDocument2 pagesSpecial Power of Attorney for Property Purchasemiron68Pas encore d'évaluation

- Asses The Various Methods Through Which Organization Access Funding and When To Use Different Types of FundingDocument11 pagesAsses The Various Methods Through Which Organization Access Funding and When To Use Different Types of FundingAhmad Sheikh100% (1)

- Interest RatesDocument8 pagesInterest RatesMuhammad Sanawar ChaudharyPas encore d'évaluation

- Tally Ledger ListDocument7 pagesTally Ledger ListShaluPas encore d'évaluation

- Chapter 16Document13 pagesChapter 16Andi Luo100% (1)

- Effect of Cash Flow Management Activities On Financial Performance of Manufacturing Companies in NairobiDocument50 pagesEffect of Cash Flow Management Activities On Financial Performance of Manufacturing Companies in NairobiWycliffe Motende0% (1)

- Insurance Companies Provide Financial ProtectionDocument9 pagesInsurance Companies Provide Financial ProtectionLevi Emmanuel Veloso BravoPas encore d'évaluation

- MORBDocument840 pagesMORBcmv mendoza100% (1)

- Chase's Strategy V2.0Document33 pagesChase's Strategy V2.0Vinay Kumar100% (4)

- Loan Amortization Schedule ABC LoanDocument8 pagesLoan Amortization Schedule ABC LoanThalia SandersPas encore d'évaluation

- Personal Financial StatementDocument3 pagesPersonal Financial StatementChristopher MacLeodPas encore d'évaluation

- 2019 Safc Application FormDocument1 page2019 Safc Application FormSheredapple OrticioPas encore d'évaluation

- Companies: Key Features and Financial InstrumentsDocument10 pagesCompanies: Key Features and Financial InstrumentsSyaza AisyahPas encore d'évaluation

- SFAR 2020 21 Report No 1 of 2022 English GoUK 062396.32047192Document178 pagesSFAR 2020 21 Report No 1 of 2022 English GoUK 062396.32047192deepak777Pas encore d'évaluation