Académique Documents

Professionnel Documents

Culture Documents

P&L and Balance Sheet

Transféré par

bantu121Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

P&L and Balance Sheet

Transféré par

bantu121Droits d'auteur :

Formats disponibles

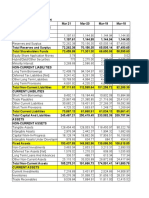

ANNEXURE

Profit & loss A/C

1SToct 2012 30th September st

1 oct 2011 30thsept 2012

2013

Operating income

2,012.00

2,092.04

Material consumed

1,470.66

1,540.01

Manufacturing expenses

47.68

50.79

Personnel expenses

202.63

204.02

Selling expenses

114.57

118.63

Administrative expenses

69.12

57.45

Expenses capitalized

Cost of sales

1,904.66

1,970.90

Operating profit

107.34

121.14

Other recurring income

0.04

20.85

Adjusted PBDIT

107.38

141.99

Financial expenses

55.93

89.78

Depreciation

42.87

44.97

Other write offs

3.32

Adjusted PBT

8.58

3.92

Tax charges

47.13

-10.89

Adjusted PAT

-38.55

14.81

Non recurring items

17.56

-21.25

Other non cash adjustments

32.86

Reported net profit

11.87

-6.44

Earnings before appropriation

-133.59

-145.46

Equity dividend

Preference dividend

Dividend tax

Retained earnings

-133.59

-145.46

BALANCE SHEET AS ON..

1ST OCT 2012- 30th SEPT 2013

1st OCT 2011 30TH SEPT 2012

Equity share capital

90.71

83.69

Share application money

Preference share capital

Reserves & surplus

645.49

563.38

Secured loans

422.63

414.04

Unsecured loans

14.44

31.10

Total

1,173.27

1,092.21

Gross block

1,415.93

1,436.96

Less : revaluation reserve

466.46

471.90

Less : accumulated depreciation

593.41

583.24

Net block

356.06

381.82

Capital work-in-progress

14.43

13.40

Investments

425.79

425.13

Current assets, loans & advances

1,131.98

1,325.61

Less : current liabilities & provisions

776.14

1,069.68

Total net current assets

355.84

255.93

Miscellaneous expenses not written

11.00

15.93

Total

1,163.12

1,092.21

Book value of unquoted investments

494.53

493.87

Market value of quoted investments

1.98

3.31

Contingent liabilities

168.40

318.74

907.09

836.94

Number of equity shares outstanding

(Lacs)

CASH FLOW STATEMENT

PARTICULAR

MARCH MARCH

(2013)

(2012)

26.14

-17.33

CASH FLOW FROM OPERATING ACTIVITIES

N.P BEFORE TAX

Adjustment for:

provision for doubtful debts , obsolescence inventory & 16.36

1.89

advances

Gain on sale of long term investment

-1.22

Gain on sale of asset

-4.8

-0.13

Depreciation

42.87

44..97

Assets w/off

11.64

8.08

Interest expense

62.2

72.22

Dividend income

0.04

-0.02

Interest income

12.93

-20.82

Operating profit before change in w.capital

141.52

87.64

Trade & receivable

-65.36

-168.61

Money in escrow account

20.09

Inventory

-43.68

13.79

Trade payable

58.02

67.05

Misc.expenditure

-3.21

-7.5

Op.profit after change in w.capital

-34.14

-95.27

Cash generated from operating activities

107.38

-7.63

Less-Direct taxes/refunds

-6.25

-17.85

Adjustment for:

NET

CASH

FLOW

FROM

OPERATING 101.13

-25.48

ACTIVITIES

CASH FLOW FROM INVESTING ACTIVITIES

Purchase of fixed assets

-7.5

0.86

Proceeds from sale of fixed. Assets

14.26

-30.95

Loss on sale of investment

-30.64

Movement in loan & advances

-3.9

-16.27

Sale of investment

-0.66

32.33

Short term deposits with schedule banks

8.58

-2.31

Interest received

3.21

20.7

Dividend received

-0.04

0.02

NET CASH FLOW FROM INVESTING ACTIVITIES

16.69

4.38

Proceeds from share capital & securities premium

40.32

114.44

Proceeds/repayment from long- term borrowings

234.09

80.6

Less:repayment of long term borrowing

-41.68

-0.54

Proceed/repayment from short-term borrowing

-46.83

-146.82

Interest paid

-66.27

-77.4

NET CASH USED IN FINANCING ACTIVITIES

-114.46

-23.72

Net increase / decrease in cash & cash equivalents

(30.03

-44.82

OPENING CASH BALANCE

60.83

105.65

CLOSING CASH BALANCE

30.8

60.83

CASH FLOW FROM FINANCING ACTIVITIES

Vous aimerez peut-être aussi

- Income Statement: RatiosDocument6 pagesIncome Statement: Ratiosyuvraj216Pas encore d'évaluation

- Financial Analysis and Ratio Comparison of Company for FY 2012 and FY 2011Document12 pagesFinancial Analysis and Ratio Comparison of Company for FY 2012 and FY 2011Shadab AshfaqPas encore d'évaluation

- New Microsoft Excel WorksheetDocument3 pagesNew Microsoft Excel WorksheetAvinash PathakPas encore d'évaluation

- Ultratech Cement Profit & Loss AccountDocument4 pagesUltratech Cement Profit & Loss Accountyogi1162891Pas encore d'évaluation

- Particulars Mar 2014 Mar 2013Document6 pagesParticulars Mar 2014 Mar 2013saboorakheePas encore d'évaluation

- Horizontal AnalysisDocument4 pagesHorizontal AnalysisAnkit RaiPas encore d'évaluation

- Income Statement: Particulars Mar-11 Mar-10Document17 pagesIncome Statement: Particulars Mar-11 Mar-10Ashish Kumar JhaPas encore d'évaluation

- Financial Statement Analysis: Du Pont ChartDocument2 pagesFinancial Statement Analysis: Du Pont ChartVikram GuhaPas encore d'évaluation

- Reformulated Profit Loss Statements 2018-2017Document10 pagesReformulated Profit Loss Statements 2018-2017Tushar KumarPas encore d'évaluation

- ExideDocument6 pagesExideRupesh LimbaniPas encore d'évaluation

- Business Valuation Cia 1 Component 1Document7 pagesBusiness Valuation Cia 1 Component 1Tanushree LamarePas encore d'évaluation

- HPCL profit and loss analysis for FY20 and FY19Document10 pagesHPCL profit and loss analysis for FY20 and FY19riyaPas encore d'évaluation

- Consolidated Balance Sheet of Steel Authority of India (In Rs. Crores) Mar-17 Mar-16 Mar-15 Equity and Liabilities Shareholder'S FundDocument4 pagesConsolidated Balance Sheet of Steel Authority of India (In Rs. Crores) Mar-17 Mar-16 Mar-15 Equity and Liabilities Shareholder'S FundPuneet GeraPas encore d'évaluation

- M16 FA Deepal SolankiDocument20 pagesM16 FA Deepal SolankiUlpesh SolankiPas encore d'évaluation

- JSW EnergyDocument15 pagesJSW EnergyShashank PullelaPas encore d'évaluation

- BMW Group reports net profit of €5.3 billionDocument8 pagesBMW Group reports net profit of €5.3 billionaudit202Pas encore d'évaluation

- Particulars For The Year Ended December 31, 2013: Eicher Motors LimitedDocument4 pagesParticulars For The Year Ended December 31, 2013: Eicher Motors LimitedShivam MehtaPas encore d'évaluation

- LB 2013-2014 Standardized Statements MinervaDocument9 pagesLB 2013-2014 Standardized Statements MinervaArmand HajdarajPas encore d'évaluation

- Bharat PetrolDocument10 pagesBharat Petroljhanvi tandonPas encore d'évaluation

- OMV Petrom S.A. Separate Financial Statements For The Financial Year Ended On December 31, 2012Document75 pagesOMV Petrom S.A. Separate Financial Statements For The Financial Year Ended On December 31, 2012MonicaPas encore d'évaluation

- ROE NI/EBT X EBT/EBIT X Sales/Total Assets X Total Assets/Common EquityDocument6 pagesROE NI/EBT X EBT/EBIT X Sales/Total Assets X Total Assets/Common Equityasadguy2000Pas encore d'évaluation

- Publications Assets Financial-Statements-2013Document2 pagesPublications Assets Financial-Statements-2013Gabriele SerpetauskytePas encore d'évaluation

- Profit & Loss - Bimetal Bearings LTDDocument2 pagesProfit & Loss - Bimetal Bearings LTDMurali DharanPas encore d'évaluation

- Financial Statement Analysis of Godrej Consumer ProductsDocument21 pagesFinancial Statement Analysis of Godrej Consumer ProductsVishal V. ShahPas encore d'évaluation

- Profit and Loss Account For The Year Ended September 30, 2012Document1 pageProfit and Loss Account For The Year Ended September 30, 2012Abdul HafeezPas encore d'évaluation

- Komprehensif KonsolidasianDocument2 pagesKomprehensif KonsolidasianABDUL AjisPas encore d'évaluation

- Tata Steel Balance Sheet and Profit & Loss AnalysisDocument6 pagesTata Steel Balance Sheet and Profit & Loss AnalysisNeel GaralaPas encore d'évaluation

- 5 Year Balance Sheet and Profit & Loss DataDocument3 pages5 Year Balance Sheet and Profit & Loss DataJay MogradiaPas encore d'évaluation

- Ford Motor Company Financial Analysis 2010-2012Document14 pagesFord Motor Company Financial Analysis 2010-2012aegan27Pas encore d'évaluation

- Varun Motors Income Statement Analysis 2015-2019Document3 pagesVarun Motors Income Statement Analysis 2015-2019AnilPas encore d'évaluation

- Particulars 2013-Mar 2012-Mar 2011-Mar 2010-Mar Income:: Reported Net Profit 9,794.32 8,065.10 4,696.10 3,779.92Document5 pagesParticulars 2013-Mar 2012-Mar 2011-Mar 2010-Mar Income:: Reported Net Profit 9,794.32 8,065.10 4,696.10 3,779.92pmchotaliaPas encore d'évaluation

- ITC standalone balance sheet and profit and loss highlights 2021-22Document7 pagesITC standalone balance sheet and profit and loss highlights 2021-22jhanvi tandonPas encore d'évaluation

- 8100 (Birla Corporation)Document61 pages8100 (Birla Corporation)Viz PrezPas encore d'évaluation

- Balan SheetDocument2 pagesBalan SheetFelix GomesPas encore d'évaluation

- Mahindra and Mahindra AnalysisDocument11 pagesMahindra and Mahindra AnalysisRaviPratapGondPas encore d'évaluation

- Attock Oil RefineryDocument2 pagesAttock Oil RefineryOvais HussainPas encore d'évaluation

- Scooter TrendsDocument107 pagesScooter TrendsRima ParekhPas encore d'évaluation

- Apollo Hospitals Financial AnalysisDocument19 pagesApollo Hospitals Financial AnalysisVishal GuptaPas encore d'évaluation

- A Comparative Study On ITC PVT LTD and HUL PVT LTDDocument18 pagesA Comparative Study On ITC PVT LTD and HUL PVT LTDVishal RoyPas encore d'évaluation

- Benchmarking Model For Dabut India LTD.: Use This Report ToDocument60 pagesBenchmarking Model For Dabut India LTD.: Use This Report Toeshug_1Pas encore d'évaluation

- Annual Report 2012 Eicher Motors Limited Revenue and ExpensesDocument3 pagesAnnual Report 2012 Eicher Motors Limited Revenue and ExpensesShivam MehtaPas encore d'évaluation

- Mini Project Financial Reporting Statements and Analysis MB20104Document11 pagesMini Project Financial Reporting Statements and Analysis MB20104KISHORE KRISHPas encore d'évaluation

- Itc LTD: Balance Sheet FY17-18 FY16-17 FY15-16Document4 pagesItc LTD: Balance Sheet FY17-18 FY16-17 FY15-16gouri khanduallPas encore d'évaluation

- Analysis of Statement of Profit or LossDocument4 pagesAnalysis of Statement of Profit or LossShehzad QureshiPas encore d'évaluation

- 3Q14 Financial StatementsDocument58 pages3Q14 Financial StatementsFibriaRIPas encore d'évaluation

- Equities and Liabilities: Shareholder'S FundsDocument9 pagesEquities and Liabilities: Shareholder'S FundsKrishna MehtaPas encore d'évaluation

- Profit & Loss Analysis 2007-2012Document57 pagesProfit & Loss Analysis 2007-2012Rupesh MorePas encore d'évaluation

- Renuka Sugars P and L AccntDocument13 pagesRenuka Sugars P and L AccntDivya NadarajanPas encore d'évaluation

- PandL Account Presentation - FinalDocument21 pagesPandL Account Presentation - Finalapi-3712367Pas encore d'évaluation

- Eicher Motors financial analysis and key metrics over 15 yearsDocument19 pagesEicher Motors financial analysis and key metrics over 15 yearsSathish KumarrPas encore d'évaluation

- Procter & Gamble Hygiene & Healthcare Ltd. - Research CenterDocument6 pagesProcter & Gamble Hygiene & Healthcare Ltd. - Research Centersaket14Pas encore d'évaluation

- Integrated Financial Statements Exercise 2013Document1 pageIntegrated Financial Statements Exercise 2013Nicholas TanPas encore d'évaluation

- Tata Steel FinancialsDocument8 pagesTata Steel FinancialsManan GuptaPas encore d'évaluation

- P&L Consolidated - Blue Dart ExpressDocument4 pagesP&L Consolidated - Blue Dart ExpressNitish BawejaPas encore d'évaluation

- HCL Technologies: Balance Sheet - in Rs. Cr.Document20 pagesHCL Technologies: Balance Sheet - in Rs. Cr.Kuldeep SinghPas encore d'évaluation

- Guj AlkaliDocument8 pagesGuj AlkalirotiPas encore d'évaluation

- Gujarat Alkalies and Chemicals Balance Sheet AnalysisDocument8 pagesGujarat Alkalies and Chemicals Balance Sheet AnalysisrotiPas encore d'évaluation

- Balance Sheet of Gujarat Alkalies and ChemicalsDocument8 pagesBalance Sheet of Gujarat Alkalies and ChemicalsrotiPas encore d'évaluation

- Solar CookerDocument22 pagesSolar Cookerbantu121Pas encore d'évaluation

- Senior Secondary School Physics Project Report: Submitted By: ToDocument7 pagesSenior Secondary School Physics Project Report: Submitted By: Tobantu121Pas encore d'évaluation

- Java File BestDocument53 pagesJava File Bestbantu121Pas encore d'évaluation

- Arcadian Public School Senior Secondary Bajana, Mathura Science, Maths, SST, Art &craft ExhibitionDocument6 pagesArcadian Public School Senior Secondary Bajana, Mathura Science, Maths, SST, Art &craft Exhibitionbantu121Pas encore d'évaluation

- Appendix 2Document5 pagesAppendix 2bantu121Pas encore d'évaluation

- Shri GroupHistoryDocument16 pagesShri GroupHistorybantu121Pas encore d'évaluation

- PHYSICS Project ListDocument3 pagesPHYSICS Project Listbantu121Pas encore d'évaluation

- Compensation Management SYNOPSISDocument94 pagesCompensation Management SYNOPSISbantu121100% (2)

- Front Goverdhan MaharajDocument5 pagesFront Goverdhan Maharajbantu121Pas encore d'évaluation

- CV Marketing Professional MBA GraduateDocument2 pagesCV Marketing Professional MBA Graduatebantu121Pas encore d'évaluation

- Executive SummarY HR4Document1 pageExecutive SummarY HR4bantu121Pas encore d'évaluation

- PraveenCover Paggirraj MaharajDocument1 pagePraveenCover Paggirraj Maharajbantu121Pas encore d'évaluation

- Acid RainDocument7 pagesAcid Rainbantu121Pas encore d'évaluation

- Format of Certificate & DeclarationDocument3 pagesFormat of Certificate & Declarationbantu121Pas encore d'évaluation

- Event ManagementDocument9 pagesEvent Managementbantu121Pas encore d'évaluation

- Q1.Response About The Support From The HR DepartmentDocument4 pagesQ1.Response About The Support From The HR Departmentbantu121Pas encore d'évaluation

- Laser JetDocument1 pageLaser Jetbantu121Pas encore d'évaluation

- Excreatory SystemDocument1 pageExcreatory Systembantu121Pas encore d'évaluation

- Circuit Diagram Mutual InductionDocument1 pageCircuit Diagram Mutual Inductionbantu121Pas encore d'évaluation

- QuestionnaireDocument3 pagesQuestionnairebantu121Pas encore d'évaluation

- Kendriya Vidyalaya Refinery Front PagesDocument7 pagesKendriya Vidyalaya Refinery Front Pagesbantu121Pas encore d'évaluation

- Circuit Diagram Mutual InductionDocument1 pageCircuit Diagram Mutual Inductionbantu121Pas encore d'évaluation

- 36 Electronics Project Circuits and SchematicsDocument2 pages36 Electronics Project Circuits and Schematicsbantu121Pas encore d'évaluation

- Thermal and Resistor. Thermistors Are Widely Used As Inrush Current LimitersDocument7 pagesThermal and Resistor. Thermistors Are Widely Used As Inrush Current Limitersbantu121Pas encore d'évaluation

- Magnetic Field of a SolenoidDocument3 pagesMagnetic Field of a Solenoidbantu121Pas encore d'évaluation

- Arc ReactorDocument1 pageArc Reactorbantu121Pas encore d'évaluation

- Diode As A Switch WorkingDocument4 pagesDiode As A Switch Workingbantu1210% (1)

- Consumer Perception Icici Bank SynopsisDocument8 pagesConsumer Perception Icici Bank Synopsisbantu121Pas encore d'évaluation

- Scope RegularDocument1 pageScope Regularbantu121Pas encore d'évaluation

- Accounting Ratios - Class NotesDocument8 pagesAccounting Ratios - Class NotesAbdullahSaqibPas encore d'évaluation

- Home Office and Branch Accounting ProblemsDocument9 pagesHome Office and Branch Accounting ProblemsMichaela QuimsonPas encore d'évaluation

- Financial Report On Civil BankDocument38 pagesFinancial Report On Civil BankSrijana BhusalPas encore d'évaluation

- Sample Chart of AccountsDocument9 pagesSample Chart of AccountsJuan FrivaldoPas encore d'évaluation

- 6727 Statement of Financial PositionDocument3 pages6727 Statement of Financial PositionJane ValenciaPas encore d'évaluation

- DuPont AnalysisDocument14 pagesDuPont AnalysisManika AggarwalPas encore d'évaluation

- Review of RatiosDocument5 pagesReview of RatiosJames AlievPas encore d'évaluation

- Midterm Exam Attempt Review PDFDocument18 pagesMidterm Exam Attempt Review PDFKRIS ANNE SAMUDIOPas encore d'évaluation

- Appendix FDocument17 pagesAppendix FD3 Pajak 315Pas encore d'évaluation

- True/False: Variable Costing: A Tool For ManagementDocument174 pagesTrue/False: Variable Costing: A Tool For ManagementKiannePas encore d'évaluation

- Bombay DyeingDocument3 pagesBombay DyeingJinal_Punjani_5573Pas encore d'évaluation

- MSQ-07 - Financial Statement AnalysisDocument13 pagesMSQ-07 - Financial Statement AnalysisMarilou Olaguir Saño0% (1)

- Tan, Ma. Cecilia ADocument20 pagesTan, Ma. Cecilia ACecilia TanPas encore d'évaluation

- 66653bos53803 cp10Document81 pages66653bos53803 cp10TECH TeluguPas encore d'évaluation

- Fa BobadillaDocument11 pagesFa BobadillaKamille ValdezPas encore d'évaluation

- BusFin12 Q1 Mod2 Financial Planning Tools and Concepts v2Document28 pagesBusFin12 Q1 Mod2 Financial Planning Tools and Concepts v2Alma A CernaPas encore d'évaluation

- Chapter 9 InvestmentsDocument19 pagesChapter 9 Investmentsjuennagueco100% (2)

- 05 Bbfa2203 T1Document26 pages05 Bbfa2203 T1Harianti HattaPas encore d'évaluation

- Profit Planning: Cost-Volume-Profit Analysis and Decision MakingDocument36 pagesProfit Planning: Cost-Volume-Profit Analysis and Decision MakingDhim PlePas encore d'évaluation

- Park Rapids Schools FY 23 Signed Final Report and Financial StatementsDocument98 pagesPark Rapids Schools FY 23 Signed Final Report and Financial StatementsShannon GeisenPas encore d'évaluation

- Definition of Standard CostingDocument18 pagesDefinition of Standard CostingHimanshu PachoriPas encore d'évaluation

- Latihan Soal Sap Finance Lengkap BLM Ada Jawaban (45 Soal)Document6 pagesLatihan Soal Sap Finance Lengkap BLM Ada Jawaban (45 Soal)Mersa NovantyPas encore d'évaluation

- Accounting Profit Vs Economics ProfitDocument5 pagesAccounting Profit Vs Economics ProfitJude Okoli100% (1)

- Chapter 1 Intro To AccoutingDocument32 pagesChapter 1 Intro To Accoutingprincekelvin09Pas encore d'évaluation

- 004 - Final SCH III - Indicative Template FinalDocument54 pages004 - Final SCH III - Indicative Template FinalAbhishek YadavPas encore d'évaluation

- Plant AssetsDocument17 pagesPlant AssetsGizaw Belay100% (1)

- CPA Review School Philippines Audit Report GuideDocument20 pagesCPA Review School Philippines Audit Report Guidemelody btobPas encore d'évaluation

- UrcDocument15 pagesUrcKarlo PradoPas encore d'évaluation

- CH 6 PDFDocument97 pagesCH 6 PDFZe Black EraPas encore d'évaluation

- Accounting EquationDocument5 pagesAccounting EquationLucky Mark Abitong75% (12)