Académique Documents

Professionnel Documents

Culture Documents

Tax Matrix - Special Rates 2010

Transféré par

Charlotte Gallego0 évaluation0% ont trouvé ce document utile (0 vote)

36 vues2 pagestax

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documenttax

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

36 vues2 pagesTax Matrix - Special Rates 2010

Transféré par

Charlotte Gallegotax

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 2

INCOME TAXATION: SPECIAL RULES

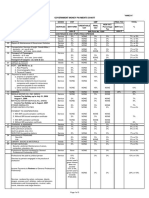

SPECIAL RATES FOR CERTAIN ALIEN INDIVIDUALS

Alien Employed by Regional or Area

15%

5% - 34%, 33%, 32% [regular tax rate]

Headquarters and Regional Operating

on gross

or

Headquarters of Multinational Companies income on

FT rate for any other income earned

[Sec 25 (C ) ]

salaries, wages,

from all other sources within the

annuities,

Philippines

compensation,

Alien Individual Employed by Offshore

remuneration

Banking Units [Sec 25 (D) ]

and other

emoluments

Alien Individual Employed by Petroleum

such as

Service Contractor and Subcontractor

honoraria and

[Sec 25(E) ]

allowances

SPECIAL RATES FOR CORPORATIONS

DOMESTIC CORPORATION

Proprietary Educational Institutions and

Hospitals

10%

35%

on taxable income

on entire taxable income, if total gross

income from unrealted trade, business,

or activity exceed 50% of total income

GOCC, Agencies and Instrumentalities

32%

same tax rate upon their taxable income

in a similar business, industry or activity

GSIS / SSS / PHIC / PCSO

Depository Banks

EXEMPT

10%

on interest income from foreign

currency transactions including interest

income from foreign loans

RESIDENT FOREIGN CORPORATION

International Air Carriers

International Shipping

Offshore Banking Units

2 1/2 %

2 1/2 %

10%

on Gross Philippine Billings

on Gross Philippine Billings

any interest income derived from foreign

currency loans granted to residents

other than offshore banking units or

local commercial banks, including local

branches of foreign banks that may be

authorized by the BSP to transact

business with offshore banking units

EXEMPT

Regional or Area Headquarters

Regional Operating Headquarters

NON RESIDENT FOREIGN

CORPORATION

Cinematographic Film Owner, Lessor or

Distributor

Owner or Lessor of Vessel Charted by

Philippine Nationals

Owner or Lessors of Aircraft, Machineries

and Other Equipment

Atty. Marissa O. Cabreros (Ateneo School of Law)

income derived by offshore banking

units authorized by the Bangko Sentral

ng Pilipinas (BSP), from foreign

currency transactions with

nonresidents, other offshore banking

units, local commercial banks, including

branches of foreign banks that may be

authorized by the Bangko Sentral ng

Pilipinas (BSP) to transact business

with offshore banking units

EXEMPT

10%

on taxable income

25%

on Gross Income

4.5%

on Gross Rentals

7.5%

on Gross Rentals

January 2010

Vous aimerez peut-être aussi

- International Taxation In Nepal Tips To Foreign InvestorsD'EverandInternational Taxation In Nepal Tips To Foreign InvestorsPas encore d'évaluation

- RR 2-98Document21 pagesRR 2-98Joshua HornePas encore d'évaluation

- Special Tax Rates For Foreign CorporationDocument4 pagesSpecial Tax Rates For Foreign CorporationPaul Anthony AspuriaPas encore d'évaluation

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesD'EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesPas encore d'évaluation

- Revenue Regs 10-98Document4 pagesRevenue Regs 10-98John Michael VidaPas encore d'évaluation

- Tax ExhibitsDocument4 pagesTax ExhibitsJM BermudoPas encore d'évaluation

- Income Taxation SummaryDocument2 pagesIncome Taxation SummaryEstudyante BluesPas encore d'évaluation

- Kind of Income Tax RateDocument2 pagesKind of Income Tax RateTJ MerinPas encore d'évaluation

- Special CorporationsDocument12 pagesSpecial CorporationsDinah BaluyutPas encore d'évaluation

- Bir 2306Document2 pagesBir 2306Caroline Sanchez90% (10)

- Table For Income Tax Summary of RatesDocument1 pageTable For Income Tax Summary of Ratesmike rapistaPas encore d'évaluation

- Income From Foreign Currency TransactionsDocument2 pagesIncome From Foreign Currency TransactionsMeghan Kaye LiwenPas encore d'évaluation

- Income Tax On CorporationDocument54 pagesIncome Tax On CorporationJamielene Tan100% (1)

- Chapter 2.1 - Income Subject To Final TaxDocument30 pagesChapter 2.1 - Income Subject To Final Taxjudel ArielPas encore d'évaluation

- 31 Taxn 2000 Income Taxation QuestionsDocument2 pages31 Taxn 2000 Income Taxation QuestionsMariela MirandaPas encore d'évaluation

- EWTDocument12 pagesEWTdawngarcia1797Pas encore d'évaluation

- Phil Income Tax Special CasesDocument1 pagePhil Income Tax Special Caseszeanit7Pas encore d'évaluation

- Form 2306 Witn Computation Electric BillDocument5 pagesForm 2306 Witn Computation Electric BillLean IsidroPas encore d'évaluation

- Lecture Notes - Atty Steve Part 1Document9 pagesLecture Notes - Atty Steve Part 1Tesia MandaloPas encore d'évaluation

- 20% 7.5% Exemp T 10% 20% 10% 6%: ExemptDocument7 pages20% 7.5% Exemp T 10% 20% 10% 6%: Exemptgoateneo1bigfightPas encore d'évaluation

- CH2 0Document1 pageCH2 0number onePas encore d'évaluation

- Income Taxation LectureDocument78 pagesIncome Taxation LectureMa Jodelyn RosinPas encore d'évaluation

- Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded) : BIR Form No. 1601-E/2307Document5 pagesMonthly Remittance Return of Creditable Income Taxes Withheld (Expanded) : BIR Form No. 1601-E/2307i1958239Pas encore d'évaluation

- Government Money Payments Chart - BirDocument3 pagesGovernment Money Payments Chart - BirVan Caz89% (9)

- Income Taxation of Individuals: Citizens: Citizens Resident Non-ResidentsDocument6 pagesIncome Taxation of Individuals: Citizens: Citizens Resident Non-Residentskirsten_bri16Pas encore d'évaluation

- Income Tax On CorporationDocument53 pagesIncome Tax On CorporationLyka Mae Palarca IrangPas encore d'évaluation

- Preferential TaxDocument2 pagesPreferential TaxattymanekaPas encore d'évaluation

- Canvas Activity 2Document10 pagesCanvas Activity 2Micol VillaflorPas encore d'évaluation

- Tax Rates - SPSPS ReviewDocument10 pagesTax Rates - SPSPS ReviewKenneth Bryan Tegerero TegioPas encore d'évaluation

- Regional Operating Headquarters (ROHQ) Shall Mean A Foreign Business Entity Which IsDocument5 pagesRegional Operating Headquarters (ROHQ) Shall Mean A Foreign Business Entity Which IsDaryl Jacob Bigay0% (1)

- 4 Income Tax Tables Final PDFDocument8 pages4 Income Tax Tables Final PDFwilliam091090Pas encore d'évaluation

- RR No. 6-2001 (Digest) PDFDocument1 pageRR No. 6-2001 (Digest) PDFFrancis GuinooPas encore d'évaluation

- Resident and Foreign CorporationDocument4 pagesResident and Foreign CorporationIris Grace Culata0% (1)

- Tax On Corporations Oct 2019 PDFDocument70 pagesTax On Corporations Oct 2019 PDFKharen ValdezPas encore d'évaluation

- Other Percentage TaxesDocument40 pagesOther Percentage TaxesKay Hanalee Villanueva NorioPas encore d'évaluation

- Income Tax of CorporationsDocument16 pagesIncome Tax of CorporationsLonjin Huang100% (1)

- Income Tax On Resident Foreign CorporationDocument6 pagesIncome Tax On Resident Foreign CorporationElaiPas encore d'évaluation

- Final Income Taxation,: As Amended by Train LawDocument29 pagesFinal Income Taxation,: As Amended by Train LawElle Vernez100% (1)

- HumRes TaxDocument3 pagesHumRes TaxJob Noel BernardoPas encore d'évaluation

- Special CorporationsDocument12 pagesSpecial CorporationsEvi100% (2)

- Corporation As A TaxpayerDocument27 pagesCorporation As A TaxpayerBSA-2C John Dominic Mia100% (1)

- RR 1-2011Document3 pagesRR 1-2011Jaypee LegaspiPas encore d'évaluation

- Income TaxDocument110 pagesIncome TaxJobeLle Marquez100% (1)

- Income Tax Table - NIRCDocument6 pagesIncome Tax Table - NIRCgoateneo1bigfightPas encore d'évaluation

- TAX Reviewer 2Document9 pagesTAX Reviewer 2Krystal MaciasPas encore d'évaluation

- Certificate of Final Tax Withheld at Source: Kawanihan NG Rentas InternasDocument2 pagesCertificate of Final Tax Withheld at Source: Kawanihan NG Rentas InternasRb GutierrezPas encore d'évaluation

- 2306 Manila WaterDocument6 pages2306 Manila WaterRegina Raymundo AlbayPas encore d'évaluation

- Classification of Individual Taxpayers:: Income Tax RatesDocument21 pagesClassification of Individual Taxpayers:: Income Tax RatesAngelica E. RefuerzoPas encore d'évaluation

- Income Tax On CorporationsDocument15 pagesIncome Tax On CorporationsJunivenReyUmadhay100% (1)

- Taxation Law Review Notes Corporation)Document9 pagesTaxation Law Review Notes Corporation)joycellemalabPas encore d'évaluation

- The Final Tax On Winnings Applies To CorporationsDocument6 pagesThe Final Tax On Winnings Applies To CorporationsYuno NanasePas encore d'évaluation

- Annex B: Income Tax Tables: Table 1 Tax Rates For IndividualsDocument9 pagesAnnex B: Income Tax Tables: Table 1 Tax Rates For Individualshaze_toledo5077Pas encore d'évaluation

- Foreign Corporations in The PhilippinesDocument3 pagesForeign Corporations in The PhilippinesRyan BalladaresPas encore d'évaluation

- In Come Tax TableDocument9 pagesIn Come Tax TablejorjirubiPas encore d'évaluation

- W14 Module 12withholding TaxesDocument7 pagesW14 Module 12withholding Taxescamille ducutPas encore d'évaluation

- Regular Income Tax: (As Amended by TRAIN LAW)Document32 pagesRegular Income Tax: (As Amended by TRAIN LAW)Elle VernezPas encore d'évaluation

- The Rest Is The Same Rules As Domestic Corporation OnDocument1 pageThe Rest Is The Same Rules As Domestic Corporation OnJoy Dela Cerna BazanPas encore d'évaluation

- Taxation of CorporationsDocument26 pagesTaxation of CorporationsjolinaPas encore d'évaluation

- Corporate TaxesDocument6 pagesCorporate TaxesfranPas encore d'évaluation

- BIR Revenue Memorandum Order 10-2014Document17 pagesBIR Revenue Memorandum Order 10-2014PortCalls100% (4)

- PNP Manual PDFDocument114 pagesPNP Manual PDFIrish PD100% (9)

- Wage Computation TableDocument1 pageWage Computation Tablecmv mendozaPas encore d'évaluation

- Roxas vs. RaffertyDocument6 pagesRoxas vs. Raffertycmv mendozaPas encore d'évaluation

- Taganito vs. Commissioner (1995)Document2 pagesTaganito vs. Commissioner (1995)cmv mendozaPas encore d'évaluation

- DOJ Circular No. 18, 18 June 2014Document2 pagesDOJ Circular No. 18, 18 June 2014cmv mendozaPas encore d'évaluation

- Umali vs. EstanislaoDocument8 pagesUmali vs. Estanislaocmv mendozaPas encore d'évaluation

- 1 - Conwi vs. CTA DigestDocument2 pages1 - Conwi vs. CTA Digestcmv mendozaPas encore d'évaluation

- Court of Tax Appeals: Republic of The PhilippinesDocument28 pagesCourt of Tax Appeals: Republic of The Philippinescmv mendozaPas encore d'évaluation

- Republic Bank V EbradaDocument9 pagesRepublic Bank V Ebradacmv mendozaPas encore d'évaluation

- Tax NotesDocument10 pagesTax Notescmv mendozaPas encore d'évaluation

- Misamis Oriental Assn vs. Dept of FinanceDocument6 pagesMisamis Oriental Assn vs. Dept of Financecmv mendozaPas encore d'évaluation

- Pecson vs. CADocument4 pagesPecson vs. CAcmv mendozaPas encore d'évaluation

- Osmena vs. OrbosDocument9 pagesOsmena vs. Orboscmv mendozaPas encore d'évaluation

- IRR of RA 9480Document7 pagesIRR of RA 9480cmv mendozaPas encore d'évaluation

- Ra 9480Document6 pagesRa 9480cmv mendozaPas encore d'évaluation

- Primer On The Tax Amnesty Act of 2007Document8 pagesPrimer On The Tax Amnesty Act of 2007cmv mendozaPas encore d'évaluation

- Tax 1 - TereDocument57 pagesTax 1 - Terecmv mendoza100% (1)

- Conwi vs. CTADocument10 pagesConwi vs. CTAcmv mendozaPas encore d'évaluation

- Republic Bank V EbradaDocument9 pagesRepublic Bank V Ebradacmv mendozaPas encore d'évaluation

- Tax Alert - 2006 - OctDocument8 pagesTax Alert - 2006 - Octcmv mendozaPas encore d'évaluation

- BIR Form No. 0618 Download: (Zipped Excel) PDFDocument6 pagesBIR Form No. 0618 Download: (Zipped Excel) PDFcmv mendozaPas encore d'évaluation

- Taxation - 7 Tax Remedies Under LGCDocument3 pagesTaxation - 7 Tax Remedies Under LGCcmv mendozaPas encore d'évaluation

- 9 - Commissioner vs. PalancaDocument1 page9 - Commissioner vs. Palancacmv mendozaPas encore d'évaluation

- Remedies Under NIRCDocument14 pagesRemedies Under NIRCcmv mendoza100% (3)

- Taxation - 8 Tax Remedies Under NIRCDocument34 pagesTaxation - 8 Tax Remedies Under NIRCcmv mendoza100% (3)

- Commissioner vs. PalancaDocument6 pagesCommissioner vs. Palancacmv mendozaPas encore d'évaluation

- Appellants Brief Tutuban CaseDocument4 pagesAppellants Brief Tutuban Casecmv mendozaPas encore d'évaluation

- Remedies Under Local Government CodeDocument15 pagesRemedies Under Local Government Codecmv mendoza100% (3)

- Tax 2 Finals ReviewerDocument19 pagesTax 2 Finals Reviewerapi-3837022100% (2)

- GSTandAustralianTaxes PDFDocument104 pagesGSTandAustralianTaxes PDFLefter Telos ZakaPas encore d'évaluation

- cOMP aPPTMNT - dEC 2014Document20 pagescOMP aPPTMNT - dEC 2014Rajesh ShuklaPas encore d'évaluation

- Gross Income Regular TaxDocument51 pagesGross Income Regular TaxElizalen MacarilayPas encore d'évaluation

- Successor Annuitant Vs BeneficiaryDocument1 pageSuccessor Annuitant Vs BeneficiaryBrenda WattPas encore d'évaluation

- Income Tax DepartmentDocument22 pagesIncome Tax DepartmentAkash GuptaPas encore d'évaluation

- DLP Deferred AnnuityDocument7 pagesDLP Deferred AnnuityVal Daryl AnhaoPas encore d'évaluation

- PWC GM Folio IrelandDocument40 pagesPWC GM Folio IrelandM Nasir ArifPas encore d'évaluation

- PerpetuityDocument22 pagesPerpetuityarif nugrahaPas encore d'évaluation

- Affidavit of UndertakingDocument1 pageAffidavit of UndertakingHaidisheena AllamaPas encore d'évaluation

- First Time Buyers Guide For Riviera Maya 1Document4 pagesFirst Time Buyers Guide For Riviera Maya 1Geoff LeePas encore d'évaluation

- Social Security AbroadDocument42 pagesSocial Security AbroadUmer MuhammedPas encore d'évaluation

- The Mathematics of FinanceDocument30 pagesThe Mathematics of FinancezahidacaPas encore d'évaluation

- Pandemic Leave Disaster Payment: Claim ForDocument8 pagesPandemic Leave Disaster Payment: Claim ForSarah VirziPas encore d'évaluation

- Form PDF 870914450231220Document8 pagesForm PDF 870914450231220Sachin KumarPas encore d'évaluation

- Life Insurance Scenario in IndiaDocument41 pagesLife Insurance Scenario in IndiaPraveen ChaturvediPas encore d'évaluation

- Css ProfileDocument28 pagesCss ProfilejjajjPas encore d'évaluation

- Swaminathan PublicationDocument4 pagesSwaminathan PublicationRishabh DevPas encore d'évaluation

- Cghs Om BSNL MTNL - 2019Document4 pagesCghs Om BSNL MTNL - 2019ChandrashekharInamdarPas encore d'évaluation

- Tax Avoidance Vs Tax EvasionDocument3 pagesTax Avoidance Vs Tax EvasionWasim Arif HashmiPas encore d'évaluation

- Latest NPS Sunny Dogra - RemovedDocument1 pageLatest NPS Sunny Dogra - Removeddinesh makwanaPas encore d'évaluation

- JPSU GuideDocument82 pagesJPSU GuideBaizePas encore d'évaluation

- Lesson7 AnnuitiesDocument51 pagesLesson7 AnnuitiesLorenaPas encore d'évaluation

- On RfaDocument14 pagesOn RfaSatheshaPas encore d'évaluation

- 1 2010-Estt.-LeaveDocument3 pages1 2010-Estt.-LeavePawan SalujaPas encore d'évaluation

- SBI-Circular DRDocument2 pagesSBI-Circular DREntirey HeroPas encore d'évaluation

- Additional Solved Problems and MinicasesDocument154 pagesAdditional Solved Problems and Minicasesashok100% (1)

- Income Taxation and Tax Rates in The PhilippinesDocument3 pagesIncome Taxation and Tax Rates in The Philippinesओतगो एदतोगसोल एहपोीूदPas encore d'évaluation

- Form CSRF Subscriber Registration FormDocument7 pagesForm CSRF Subscriber Registration FormPranab Kumar DasPas encore d'évaluation

- En Banc G.R. No. 97419, July 03, 1992: Supreme Court of The PhilippinesDocument15 pagesEn Banc G.R. No. 97419, July 03, 1992: Supreme Court of The PhilippinesJoe RealPas encore d'évaluation

- Grace Christian High School Vs Filipinas LavanderaDocument2 pagesGrace Christian High School Vs Filipinas LavanderaJessy FrancisPas encore d'évaluation