Académique Documents

Professionnel Documents

Culture Documents

Cmu Mba MSC H-T s1 Admt Assignment Aug-Nov 2014

Transféré par

ফকির তাজুল ইসলামDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Cmu Mba MSC H-T s1 Admt Assignment Aug-Nov 2014

Transféré par

ফকির তাজুল ইসলামDroits d'auteur :

Formats disponibles

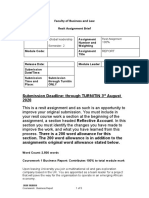

London School of Commerce

MODULE TITLE: - Accounting and Decision Making Techniques

PROGRAMME: MBA/MSc H-T

SEMESTER: 1

ACADEMIC YEAR PERIOD: August - November 2014 Semester

LECTURER SETTING ASSESSMENT: - S.A. Palan

DATE ASSESSMENT SET AND LOADED ON TO STUDENT PORTAL: DATE ASSESSMENT TO BE COMPLETED AND SUBMITTTED: SUBMISSION METHOD/MODE: - Online via turnitin

---------------------------------------------------------------------------------------------------------------Assessment Type:Individual coursework worth 50 % of the module.

Maximum word count is 3000 words

Assignment Question:

Select any TWO listed companies from within the same business sector on the London Stock

Exchange and attempt a comparative critical analysis of the following:

1. The various external sources of finance available to both companies. These sources of finance

must be clearly identified, carefully explained and distinguished.

2. The possible considerations that may have been taken into account by the management when

choosing the type of finance. All the relevant considerations explained and placed clearly in the context

of the particular circumstances of the chosen public listed companies.

3. What are your conclusions and recommendations on their respective capital structures of the

chosen companies?

Page 1 of 3

Your individual assignment:

The two companies chosen should preferably be mature companies with several

sources of long-term finance besides equity. This may also enable comparisons to be

made between them.

Gives you an opportunity to apply some of learning from the module to your chosen

companies.

May use and depend on published sources of information for the listed companies.

Must be based on your own work for your chosen public listed companies.

Assessment requirements:

The submission of your work should be organized and clearly structured.

Maximum word limit is 3000 words.

Indicate the sources of information and literature review by including all the necessary

citations and references adopting the Harvard Referencing system.

Please note that this is an individual assignment and the policy of the University on

Plagiarism and Academic Misconduct applies.

Students who have been found to have committed acts of Plagiarism are automatically

have considered to have failed the entire module.

Plagiarism involves taking someone elses words, thoughts, ideas or essays from online

essay banks and trying to pass them off as your own. It is a form of cheating which is

taken very seriously.

Assignment Structure:

Table of contents.

Introduction.

The context of your chosen listed companies.

Main body attempts at questions 1 and 2 as above.

Conclusion and recommendations on the respective companys capital structures.

References and bibliography

Appendix this may include extracts of the relevant financial statements/information of

the chosen listed companies.

Page 2 of 3

Marking Criteria:

CRITERIA

Introduction

Context of the

chosen companies

Main body

Conclusion and

recommendations

Overall

presentation

Referencing &

Citation

Total word count

& mark

CONTENT

Objectives of the assignment identified and clarified. (200

words)

Brief description/history of the two companies and the sector

selected to include the rational for the choices made. (400

words)

Question 1-The various external sources of finance clearly

identified, carefully explained and distinguished for the 2 chosen

companies.(800 words)

MARK

5%

10%

20%

Question 2-The possible considerations that may have been

taken into account by theirrespective management when

choosing the type of finance. Remember that all financing

decisions are not taken on purely financial/quantitative

considerations. Are there other factors that may have influenced

capital structure decisions e.g. the effect on cost of capital?

Numerical analysis may include gearing levels. Students should

demonstrate the ability to obtain data and use these to support

their discussion and analysis. The main emphasis of the

analysis will be the ability to interpret the results with

acomparative critical awareness along with their limitations and

underlying assumptions. (800 words)

20%

The assignment examines the ability to analyse real life

situations reflecting on your own experiences through

appropriate theories, models, techniques and frameworks. This

is an attempt to duplicate the reality of management decisionmaking where information is never complete. It is essential that

you document all assumptions underlying your analysis. In

marking the calculation elements credit will be given provided

the approach adopted is reasonable and is justified.

Ensure your comparisons, conclusions and recommendations

are justified and supported by facts. They should follow logically

from the evidence contained in the main body of the

assignment. (800 words)

20%

This should be coherent, logically organised, and clearly

expressed. They should be accurate in terms of spelling,

grammar and punctuation.

Appendices should contain material relevant to supporting the

assignment.

5%

5%

3000 words

100%

Module learning outcomes to be assessed: Upon successful completion of this module students will be able to:

Critically evaluate the most appropriate sources for financing, how to raise it, and what are the

conditioning factors within localised and global market contexts, which need to be considered when

taking decisions on these matters

Page 3 of 3

Vous aimerez peut-être aussi

- Summative Assessment Brief - Advanced Project ManagementDocument15 pagesSummative Assessment Brief - Advanced Project ManagementMehran Raza20% (5)

- Assessment Brief: - Level Five UndergraduateDocument10 pagesAssessment Brief: - Level Five UndergraduateMuhammad Shaheer SalmanPas encore d'évaluation

- MBA 1 MHCE SBLC7008 Assignment 1 and 2 Aug-Nov 2019Document15 pagesMBA 1 MHCE SBLC7008 Assignment 1 and 2 Aug-Nov 2019Aswath VpPas encore d'évaluation

- MBAA 517 SyllabusDocument7 pagesMBAA 517 SyllabusHeatherPas encore d'évaluation

- BSC Oxford BrookesDocument8 pagesBSC Oxford Brookesrizwan99pkPas encore d'évaluation

- Roadmap to Cima Gateway Success: Roadmap to help you pass your CIMA Gateway exams - A practical guide: Roadmap to help you pass your CIMA Gateway exams - A practical guideD'EverandRoadmap to Cima Gateway Success: Roadmap to help you pass your CIMA Gateway exams - A practical guide: Roadmap to help you pass your CIMA Gateway exams - A practical guidePas encore d'évaluation

- English 3430 Syllabus 29855 Fall 2019 Updated 8-27-19Document7 pagesEnglish 3430 Syllabus 29855 Fall 2019 Updated 8-27-19Sohaira ZahraPas encore d'évaluation

- De La Salle University: College of Science Chemistry DepartmentDocument4 pagesDe La Salle University: College of Science Chemistry DepartmentMoorse MaroPas encore d'évaluation

- Level 7 Assessment Specification: N. SkandakumarDocument15 pagesLevel 7 Assessment Specification: N. SkandakumarVanan MuthuPas encore d'évaluation

- SBLC7010 Assignment Task 1 and Task 2 Aug-Nov 2019Document13 pagesSBLC7010 Assignment Task 1 and Task 2 Aug-Nov 2019Aswath VpPas encore d'évaluation

- Assignment OneDocument8 pagesAssignment OneFarhana25111988Pas encore d'évaluation

- M32253 Corporate Valuation Assignment 2022-23Document27 pagesM32253 Corporate Valuation Assignment 2022-23solachristoPas encore d'évaluation

- MBA 1 MM SBLC7009 Assignment 1 and 2 Aug-Nov 2019Document16 pagesMBA 1 MM SBLC7009 Assignment 1 and 2 Aug-Nov 2019Aswath VpPas encore d'évaluation

- Managing Information: London School of Business & Finance (LSBF) Masters in Business AdministrationDocument6 pagesManaging Information: London School of Business & Finance (LSBF) Masters in Business AdministrationhiratabasumPas encore d'évaluation

- SM380 Assessment Brief 201415 S1 UK CV KapDocument7 pagesSM380 Assessment Brief 201415 S1 UK CV KapAlee LowPas encore d'évaluation

- FHEQ Level 7 Assessed Summative Assignment: Financial Markets, Institutions & Instruments (7fmi)Document3 pagesFHEQ Level 7 Assessed Summative Assignment: Financial Markets, Institutions & Instruments (7fmi)Bala Krishna ChinniahPas encore d'évaluation

- Resit - 302BSS - Global Leadership Assn - 2019 - 20Document7 pagesResit - 302BSS - Global Leadership Assn - 2019 - 20Royford Wanyoike wamaithaPas encore d'évaluation

- LCLM5004 - Assignment Specification C2 - Feb 2024Document9 pagesLCLM5004 - Assignment Specification C2 - Feb 2024gggbvfcvhcvPas encore d'évaluation

- Assessment Point 2Document4 pagesAssessment Point 2joy mbasoPas encore d'évaluation

- MHCE SBLC7008 Assignment 1Document12 pagesMHCE SBLC7008 Assignment 1Zia RaoPas encore d'évaluation

- Sem 1 Assign Brief Student QAHEDocument3 pagesSem 1 Assign Brief Student QAHEsmartwriter3651Pas encore d'évaluation

- (APPORVED) MKT306 Marketing StrategyDocument7 pages(APPORVED) MKT306 Marketing StrategyUyen TranPas encore d'évaluation

- SM4008 LD4008 Assessment Brief 2017-8 S2Document6 pagesSM4008 LD4008 Assessment Brief 2017-8 S2anushanPas encore d'évaluation

- Coursework 1 - Brief and Guidance 2018-19 FinalDocument12 pagesCoursework 1 - Brief and Guidance 2018-19 FinalHans HoPas encore d'évaluation

- Assign Brief Business Strategy QCFDocument8 pagesAssign Brief Business Strategy QCFDavid MarkPas encore d'évaluation

- MBA7061 - Operations Management - AssignmentDocument7 pagesMBA7061 - Operations Management - Assignmentrahula.sathyapriya0% (1)

- Assessment Brief: Module Code: Module Title: Distributed On: Hand in DateDocument6 pagesAssessment Brief: Module Code: Module Title: Distributed On: Hand in DatebrianPas encore d'évaluation

- ATDM Individual Assessment 2021 - 2022Document4 pagesATDM Individual Assessment 2021 - 2022NehaPas encore d'évaluation

- Coursework Brief 2 Part B Assignment BMGT7073Document4 pagesCoursework Brief 2 Part B Assignment BMGT7073Tejas G SrikanthPas encore d'évaluation

- Assignment 2 Group Business ReportDocument3 pagesAssignment 2 Group Business ReportHiranya BhagwatPas encore d'évaluation

- Level 7 Assessment SpecificationDocument12 pagesLevel 7 Assessment SpecificationVanan MuthuPas encore d'évaluation

- Level 7 Assessment Specification: Appendix Ga36DDocument9 pagesLevel 7 Assessment Specification: Appendix Ga36DKanchana PereraPas encore d'évaluation

- BM019 Entrepreneurship AssignmentDocument4 pagesBM019 Entrepreneurship AssignmentAnju SainiPas encore d'évaluation

- HRM Report - Assignment BriefDocument6 pagesHRM Report - Assignment BriefALI HYDERPas encore d'évaluation

- LD9616 Assessment Brief 2023-2024 - TaggedDocument7 pagesLD9616 Assessment Brief 2023-2024 - TaggedBeibei ShuPas encore d'évaluation

- MAR7002 Coursework 2023-2024Document9 pagesMAR7002 Coursework 2023-2024pasiya434Pas encore d'évaluation

- RMFB End Term Assignment Question Paper - Dr. NasrinDocument7 pagesRMFB End Term Assignment Question Paper - Dr. NasrinBuy SellPas encore d'évaluation

- LCBB4005 - Global Business Environment Assessment 2Document9 pagesLCBB4005 - Global Business Environment Assessment 2Guzi OvidiuPas encore d'évaluation

- BMGT7043 OM Assignment January2022Document6 pagesBMGT7043 OM Assignment January2022Viren KhotPas encore d'évaluation

- LCBB4005 - Global Business Environment Assessment 1Document9 pagesLCBB4005 - Global Business Environment Assessment 1Guzi OvidiuPas encore d'évaluation

- BUS310 Branches TMA Summer 2023Document3 pagesBUS310 Branches TMA Summer 2023adel.dahbour97Pas encore d'évaluation

- SMGT Assignment UC3F2005Document5 pagesSMGT Assignment UC3F2005William John ThangPas encore d'évaluation

- PGBM03 LC MayDocument3 pagesPGBM03 LC MayWaqas CheemaPas encore d'évaluation

- Individual Assignment Brief MMIP 2022Document6 pagesIndividual Assignment Brief MMIP 2022Yehasha HarshaniPas encore d'évaluation

- Marking As It Falls Within An Exempt Category Under The University's Anonymous Marking PolicyDocument3 pagesMarking As It Falls Within An Exempt Category Under The University's Anonymous Marking PolicyRohit NigamPas encore d'évaluation

- APPROVED Assignment Task SubmissionDocument4 pagesAPPROVED Assignment Task SubmissionThuHoàPas encore d'évaluation

- Level 7assessment SpecificationDocument12 pagesLevel 7assessment SpecificationZia RaoPas encore d'évaluation

- 1 Assignment Writ1 Iis End-ModuleDocument9 pages1 Assignment Writ1 Iis End-Modulesaleem razaPas encore d'évaluation

- MKT306 - May Assignment 2014Document6 pagesMKT306 - May Assignment 2014Rajib AhmedPas encore d'évaluation

- HI6026 Group Assignment - Requirements T1 2022ADocument6 pagesHI6026 Group Assignment - Requirements T1 2022AcyberpunkPas encore d'évaluation

- Ppa Mba Entrepreneurial Business Skills: This Module Is Assessed byDocument2 pagesPpa Mba Entrepreneurial Business Skills: This Module Is Assessed byMuntaha ZyanPas encore d'évaluation

- SM0374 2015-16 Standard Assessment Brief v1.1Document6 pagesSM0374 2015-16 Standard Assessment Brief v1.1Leah Nicole ClarkPas encore d'évaluation

- Assignment Operation ManagementDocument9 pagesAssignment Operation ManagementMoniquePas encore d'évaluation

- Sunderland Faulty of Business & Law Undergraduate Programmes MKT306 Marketing Strategy Assignment January 2012/13Document7 pagesSunderland Faulty of Business & Law Undergraduate Programmes MKT306 Marketing Strategy Assignment January 2012/13Waqas KhanPas encore d'évaluation

- London School of Commerce: Online Via Turnitin (Student Portal)Document4 pagesLondon School of Commerce: Online Via Turnitin (Student Portal)HabibPas encore d'évaluation

- IOM Resit CW July 22-23Document14 pagesIOM Resit CW July 22-23Adeena RafiqPas encore d'évaluation

- Resarch Assignment 2Document7 pagesResarch Assignment 2Krunal ShahPas encore d'évaluation

- UWBS038g Assessment Briefing For Students: Email Address: B.whitehouse@wlv - Ac.ukDocument5 pagesUWBS038g Assessment Briefing For Students: Email Address: B.whitehouse@wlv - Ac.ukZein KhanPas encore d'évaluation

- LCMB7002 FimDocument11 pagesLCMB7002 FimWriting ServicePas encore d'évaluation

- ACC 3014 CRT&P Assignment - FinalDocument6 pagesACC 3014 CRT&P Assignment - FinalSelva Bavani SelwaduraiPas encore d'évaluation

- BRM Assignment ResitDocument8 pagesBRM Assignment ResitLuis Nguyen HaPas encore d'évaluation

- Business Research Management Assignment#Document8 pagesBusiness Research Management Assignment#InfokeedaPas encore d'évaluation

- RELS 349 W21 Course OutlineDocument8 pagesRELS 349 W21 Course Outlinekandy808Pas encore d'évaluation

- UT Dallas Syllabus For cs6364.001.10f Taught by Sanda Harabagiu (Sanda)Document5 pagesUT Dallas Syllabus For cs6364.001.10f Taught by Sanda Harabagiu (Sanda)UT Dallas Provost's Technology GroupPas encore d'évaluation

- Management Decision Making Assessment 1 Brief Form 2020-21-Term 3Document27 pagesManagement Decision Making Assessment 1 Brief Form 2020-21-Term 3Harrey Kaur100% (1)

- ENGL1011 - Unit of Study OutlineDocument16 pagesENGL1011 - Unit of Study OutlineMajid MattaPas encore d'évaluation

- 2024MCR502Document37 pages2024MCR502Kashf MaqsoodPas encore d'évaluation

- UT Dallas Syllabus For Se6362.0u1.08u Taught by Jing Dong (jxd022100)Document5 pagesUT Dallas Syllabus For Se6362.0u1.08u Taught by Jing Dong (jxd022100)UT Dallas Provost's Technology GroupPas encore d'évaluation

- MCEN1000 Engineering Mechanics Semester 1 2024 Bentley Perth Campus INTDocument15 pagesMCEN1000 Engineering Mechanics Semester 1 2024 Bentley Perth Campus INTjissmon jojoPas encore d'évaluation

- Che 1315 401 51733 20083Document6 pagesChe 1315 401 51733 20083ElliotPianoPas encore d'évaluation

- POS 140 SyllabusDocument6 pagesPOS 140 SyllabusShannin MaePas encore d'évaluation

- HIST2601 HSienaDocument6 pagesHIST2601 HSienaQuinn HarringtonPas encore d'évaluation

- UT Dallas Syllabus For Musi1306.001.10s Taught by (Maryann)Document9 pagesUT Dallas Syllabus For Musi1306.001.10s Taught by (Maryann)UT Dallas Provost's Technology GroupPas encore d'évaluation

- ENS1154 Unit Plan S1 - 2013 v1.0Document11 pagesENS1154 Unit Plan S1 - 2013 v1.0Tim BrosnahanPas encore d'évaluation

- CSCI 3210: Theory of Programming Languages 3 Credit Hours: Instructor InformationDocument5 pagesCSCI 3210: Theory of Programming Languages 3 Credit Hours: Instructor InformationGES ISLAMIA PATTOKIPas encore d'évaluation

- EconS10bSyllabus Summer2020 Draft PDFDocument5 pagesEconS10bSyllabus Summer2020 Draft PDFAmir HosseinPas encore d'évaluation

- Charles - Clary@mtsu - Edu: Launching The Imagination: A Guide To Two-Dimensional Design (3 Edition), by Mary StewartDocument6 pagesCharles - Clary@mtsu - Edu: Launching The Imagination: A Guide To Two-Dimensional Design (3 Edition), by Mary StewartmkatestringerPas encore d'évaluation

- Communication Studies Academic Honor Code PDFDocument2 pagesCommunication Studies Academic Honor Code PDFStephanie TrujilloPas encore d'évaluation

- Course Outline - Introduction To Business Grade 9: Napanee District Secondary SchoolDocument7 pagesCourse Outline - Introduction To Business Grade 9: Napanee District Secondary SchoolNDSSBIzPas encore d'évaluation

- Goldsmiths, University of London 2013 Annual LetterDocument7 pagesGoldsmiths, University of London 2013 Annual LetterkatipbartlebyPas encore d'évaluation

- UT Dallas Syllabus For Se4351.001.07f Taught by Rym Mili (Rmili)Document8 pagesUT Dallas Syllabus For Se4351.001.07f Taught by Rym Mili (Rmili)UT Dallas Provost's Technology GroupPas encore d'évaluation

- 81d22aaf-58b5-4ca2-bce8-b4e21e8deaefDocument170 pages81d22aaf-58b5-4ca2-bce8-b4e21e8deaefNguyen Quang AnhPas encore d'évaluation

- Glendale High School AP-Music-Theory SYLLABUSDocument6 pagesGlendale High School AP-Music-Theory SYLLABUSdavikan1387Pas encore d'évaluation

- Netter Fina 4050 Sp13Document4 pagesNetter Fina 4050 Sp13Jesse RichPas encore d'évaluation

- spcm4326 Advpublicspeaking Fall19adDocument22 pagesspcm4326 Advpublicspeaking Fall19adMaui ManliclicPas encore d'évaluation

- Baruch Managerial Comm Spring 2023Document3 pagesBaruch Managerial Comm Spring 2023Alyeshbah FarooquiPas encore d'évaluation

- BUDT704: Data Processing and Analysis in PythonDocument9 pagesBUDT704: Data Processing and Analysis in PythonAlekya GantaPas encore d'évaluation

- UT Dallas Syllabus For Aim4336.501.07s Taught by Oktay Urcan (Oxu022000)Document7 pagesUT Dallas Syllabus For Aim4336.501.07s Taught by Oktay Urcan (Oxu022000)UT Dallas Provost's Technology GroupPas encore d'évaluation

- Fin358 - Individual Assignment - Norsyafiqah - 2019250896 - Ba1115gDocument13 pagesFin358 - Individual Assignment - Norsyafiqah - 2019250896 - Ba1115gHafiz HafiziPas encore d'évaluation

- BE1401-2 Course Outline Jan 2022Document11 pagesBE1401-2 Course Outline Jan 2022Joelle LimPas encore d'évaluation