Académique Documents

Professionnel Documents

Culture Documents

4 Income Tax Tables Final PDF

Transféré par

william091090Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

4 Income Tax Tables Final PDF

Transféré par

william091090Droits d'auteur :

Formats disponibles

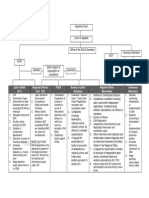

INCOME TAXATION

INCOME TAXPAYER

TAXABLE

INCOME

EXEMPTIONS ALLOWED

TAX RATES

PERSONAL

ADDITIONAL

DEDUCTIONS

ALLOWED

OPTIONAL

STANDARD

DEDUCTIONS

Rule: NO

Exception:

Premium Payments

on Health and/or

Hospitalization

Insurance

NO

INDIVIDUAL

Taxable compensation arising

from employer-employee

relationship- 5% - 32%

graduated rate

Resident Citizen (RC)

Non-Resident Citizen (NRC)

Resident Alien (RA)

Non-Resident Alien Engaged

in Trade and Business

(NRA-ETB)

All sources (within

and without the

Philippines)

Income from

sources within the

Philippines

Income from

sources within the

Philippines

Income from

sources within the

Philippines

Taxable income arising from

business and other income- 5% 32% graduated rate

Taxable compensation arising

from employer-employee

relationship- 5% - 32%

graduated rate

Taxable income arising from

business and other income- 5% 32% graduated rate

Taxable compensation arising

from employer-employee

relationship- 5% - 32%

graduated rate

Taxable income arising from

business and other income- 5% 32% graduated rate

Taxable compensation arising

from employer-employee

relationship- 5% - 32%

YES

YES

YES

YES

(NOTE:

Deductible first

from

compensation

income, the

excess from other

income)

YES

YES

YES

Rule: NO

Exception:

Premium Payments

on Health and/or

Hospitalization

Insurance

NO

YES

YES

YES

YES

YES

YES

Rule: NO

Exception:

Premium Payments

on Health and/or

Hospitalization

Insurance

NO

YES

YES

YES

YES

YES

condition:

reciprocity rule

NO

Rule: NO

Exception:

Premium Payments

NO

157

San Beda College of Law

2012 CENTRALIZED BAR OPERATIONS

YES

RATE: 40% of his

gross sales or

gross receipts

158

TAXATION LAW

Income Taxation

INCOME TAXPAYER

EXEMPTIONS ALLOWED

TAXABLE

INCOME

TAX RATES

PERSONAL

ADDITIONAL

graduated rate

Taxable income arising from

business and other income- 5% 32% graduated rate

DEDUCTIONS

ALLOWED

OPTIONAL

STANDARD

DEDUCTIONS

on Health and/or

Hospitalization

Insurance

YES

condition:

reciprocity rule

NO

YES

NO

NO

NO

NO

NO

NO

NO

NO

NO

N/A

N/A

N/A

25% on gross income derived

from business

Non-Resident Alien Not

Engaged in Trade and

Business (NRA-NETB)

Special Classes of Individual

Employees (whether Filipino

or Alien) employed by:

1) Regional Area

Headquarters or

Regional Operating

Headquarters in the

Philippines

2) Offshore banking units

established in the

Philippines;

3) Foreign service

Contractors or

subcontractor engaged

in petroleum operations

in the Philippines

Income from

sources within the

Philippines

Gross Income derived from

business equivalent to gross

sales less returns, discounts, and

allowances and cost of goods

sold.

15% on Gross income received

as salaries, wages, annuities,

compensation, remuneration and

other emoluments, such as

honoraria and allowances.

Income from

sources within the

Philippines

NOTE: For other sources within

the Philippines, income shall be

subject to pertinent income tax

(graduated tax rates, final tax on

passive income, capital gains

depending whether a citizen or

an alien), as the case may be.

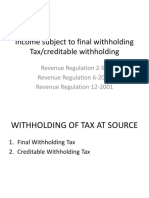

Passive Income subject to final tax

1)

RC, NRC, RA

Interest Income

20% - from any currency

deposit and yield or other

monetary benefit from

deposit substitute and from

trust funds and similar

arrangements.

N/A

INCOME TAXPAYER

EXEMPTIONS ALLOWED

TAXABLE

INCOME

TAX RATES

2)

3)

1)

2)

NRA-ETB

3)

1)

NRA-NETB

7.5% - From a depository

bank under the expanded

foreign currency deposit

system (FCDS) and an

offshore banking unit (OBU)

(exception: NRC)

From long-term deposit or

investment

a) Held for more than 5

years Exempt

b) 4 yrs less than 5 yrs

5%

c) 3 yrs less than 4 yrs.

12%

d) Less than 3 yrs. 20%

20% - From any currency

deposit and yield or other

monetary benefit from

deposit substitute and from

trust funds and similar

arrangements.

EXEMPT - From a

depository bank under the

expanded foreign currency

deposit system (FCDS) and

an offshore banking unit

(OBU)

From long-term deposit or

investment

a) Held for more than 5

years Exempt

b) 4 yrs less than 5 yrs

5%

c) 3 yrs less than 4 yrs.

12%

d) Less than 3 yrs. 20%

25% - from any currency

deposit and yield or other

monetary benefit from

deposit substitute and from

OPTIONAL

STANDARD

DEDUCTIONS

PERSONAL

ADDITIONAL

DEDUCTIONS

ALLOWED

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

159

San Beda College of Law

2012 CENTRALIZED BAR OPERATIONS

160

TAXATION LAW

Income Taxation

TAXABLE

INCOME

INCOME TAXPAYER

RC, NRC, RA, NRA-ETB

Royalties

NRA-NETB

RC, NRC, RA, NRA-ETB

1)

RC, NRC, RA

2)

3)

Cash / Property

Dividends from

Domestic

Corporations

Share in the

distributable net

income after tax

of a business

partnership,

Share in the net

income after tax

of an

association, a

OPTIONAL

STANDARD

DEDUCTIONS

PERSONAL

ADDITIONAL

DEDUCTIONS

ALLOWED

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

NOTE: Prizes less than P10,000

subject to graduated rates

25% on prizes

N/A

N/A

N/A

N/A

10% final tax

N/A

N/A

N/A

N/A

20% final tax

N/A

N/A

N/A

N/A

trust funds and similar

arrangements.

2) EXEMPT - From a

depository bank under the

expanded foreign currency

deposit system (FCDS) and

an offshore banking unit

(OBU)

3) 25% - From long-term

deposit or investment

1) 20% - Royalties in General

2) 10% - From books, literary

works and musical

compositions

1) 25% - Royalties in General

2) 25% - From books, literary

works and musical

compositions

20% on prizes exceeding

P10,000 and winnings (not

subject to the P10,000 limit).

Prizes and Winnings

NRA-NETB

NRA-ETB

EXEMPTIONS ALLOWED

TAX RATES

INCOME TAXPAYER

NRA-NETB

RC

NRC, RA

RC, NRC, RA

NRA-ETB, NRA-NETB

EXEMPTIONS ALLOWED

TAXABLE

INCOME

joint account, or

a joint venture

or consortium

taxable as a

corporation of

which he is a

member or coventurer.

Cash / Property

Dividend from

Foreign

Corporations

Cinematographic

Film and Similar

Works

OPTIONAL

STANDARD

DEDUCTIONS

PERSONAL

ADDITIONAL

DEDUCTIONS

ALLOWED

25% final tax

N/A

N/A

N/A

N/A

5%-32% Graduated rates

N/A

N/A

N/A

N/A

If considered as income within

5%-32%graduated rates

N/A

N/A

N/A

N/A

5%-32% Graduated rates

N/A

N/A

N/A

N/A

25% final tax

N/A

N/A

N/A

N/A

YES, if taxed under

NCIT otherwise,

NO

YES, if taxed

under NCIT

otherwise, NO

NO

NO

TAX RATES

TAX ON CORPORATIONS

1)

2)

3)

4)

Domestic Corporations (DC)

Income within and

without

5)

6)

NCIT - 30% (effective

January 1, 2009) on the

taxable income

Capital Gains Tax

Final tax on passive income

same rules as those

imposed on individuals

MCIT 2% Gross income

EXCEPT income exempt

from income tax and income

subject to final withholding

tax

Effective January 1, 2000,

the President through the

Sec. Finance may allow DC

the option to be taxed at

15% of gross income.

IAET 10% on improperly

accumulated taxable income

(in addition to other taxes)

N/A

N/A

Special Domestic Corporations

1)

Proprietary Educational

Institutions and Nonprofit Hospitals

Rule: 10% of the net income

except those subject to capital

gains tax and passive income

N/A

161

San Beda College of Law

2012 CENTRALIZED BAR OPERATIONS

N/A

162

TAXATION LAW

Income Taxation

INCOME TAXPAYER

EXEMPTIONS ALLOWED

TAXABLE

INCOME

TAX RATES

PERSONAL

ADDITIONAL

DEDUCTIONS

ALLOWED

N/A

N/A

NO

N/A

YES, if taxed under

NCIT otherwise,

NO

OPTIONAL

STANDARD

DEDUCTIONS

NO

subject to final tax (stock, nonprofit plus other requisites above

discussed)

Exceptions:

30% IF the gross income

from unrelated trade,

business or other activity

exceeds 50% of the total

gross income derived from

all sources;

b) Exempt if non stock nonprofit PRIVATE

educational institution and

hospital

Rule: Exempt from all taxes,

except net income from such

transactions as may be specified

by the Secretary of Finance,

upon recommendation by the

Monetary Board to be subject to

the regular income tax payable

by banks.

a)

2)

Depositary Banks

(FCDS)

Resident Foreign

Corporation engaged in

trade or business (RFC)

Income within only

Exceptions: Final tax of 10% on

interest income from foreign

currency loans granted by such

depository banks under said

expanded system to residents

other than offshore units in the

Philippines or other depository

banks under the expanded

system.

1) NCIT - 30% (effective

January 1, 2009) on the

taxable income

2) Capital Gains Tax

3) Final Tax on Passive income

4) MCIT 2% Gross income

N/A

YES, if taxed

under NCIT

otherwise, NO

INCOME TAXPAYER

EXEMPTIONS ALLOWED

TAXABLE

INCOME

TAX RATES

5)

6)

PERSONAL

ADDITIONAL

DEDUCTIONS

ALLOWED

OPTIONAL

STANDARD

DEDUCTIONS

NO

NO

NO

NO

EXCEPT income exempt

from income tax and income

subject to final withholding

tax

Effective January 1, 2000,

the President through the

Sec. Finance may allow

RFC the option to be taxed

at 15% of gross income.

BRANCH PROFIT

REMITTANCE TAX 15%

of total profit applied or

earmarked for remittance

without any deduction for tax

component thereof

Special Resident Foreign Corporations

1)

2)

3)

International Carriers

Off Shore Banking Units

authorized by BSP

Resident Depositary

Bank (FCDU)

2.5% on Gross Philippine Billings

Rule: Exempt

Exception: It is subject to final

tax of 10% on interest income

derived from foreign currency

loans granted to residents other

than offshore banking units or

local commercial banks,

including local branches of

foreign banks that may be

authorized by the BSP to

transact business with offshore

banking units.

Rule: Exempt from all taxes,

except net income from such

transactions as may be specified

by the Secretary of Finance,

upon recommendation of the

Monetary Board to be subject to

the regular income tax payable

by banks.

Exception: It is subject to final

tax of 10% on interest income

from foreign currency loans

163

San Beda College of Law

2012 CENTRALIZED BAR OPERATIONS

164

TAXATION LAW

Income Taxation

INCOME TAXPAYER

TAXABLE

INCOME

EXEMPTIONS ALLOWED

TAX RATES

PERSONAL

DEDUCTIONS

ALLOWED

OPTIONAL

STANDARD

DEDUCTIONS

NO

NO

NO

NO

N/A

NO

NO

ADDITIONAL

granted by such depository

banks under said expanded

system to residents other than

offshore units in the Philippines

or other depository banks under

the expanded system.

4)

5)

Regional or Area

Headquarters

Regional Operating

Headquarters

Non-resident Foreign

Corporation - not engaged

in trade or business (NRFC)

EXEMPT

Income within only

10% of the taxable income from

sources within the Philippines

1) 30% final tax on gross

income

2) Capital Gains Tax except

capital gains tax on sale or

disposition of real properties.

N/A

Special Non-resident Foreign Corporation

1)

2)

3)

Non-resident

Cinematographic Film

Owners, Lessors or

Distributors

25% on gross income from

sources within the Philippines

N/A

N/A

NO

NO

Non-resident Owner or

Lessor of Vessels

Chartered by Philippine

Nationals

4.5% on Gross rentals, lease or

charter fees from leases or

charters to Filipino citizens or

corporations, as approved by the

Maritime Authority.

N/A

N/A

NO

NO

Non-resident Owner or

Lessor of Aircraft and

other Equipment

7.5% on gross rental or fee

N/A

N/A

NO

NO

Vous aimerez peut-être aussi

- CIAC Form 001 Request for AdjudicationDocument10 pagesCIAC Form 001 Request for AdjudicationRaffyLaguesmaPas encore d'évaluation

- Plaintiff,: Judicial Affidavit of Demetri Jumao-AsDocument6 pagesPlaintiff,: Judicial Affidavit of Demetri Jumao-AsAthena SalasPas encore d'évaluation

- fflmtiln: Upreme LourtDocument11 pagesfflmtiln: Upreme LourtJesryl 8point8 TeamPas encore d'évaluation

- Case Assignment October 26, Friday Class 2018 First Sem SEMDocument3 pagesCase Assignment October 26, Friday Class 2018 First Sem SEMRobert Ross DulayPas encore d'évaluation

- SC upholds private ownership of Biga-Communal-Goob roadDocument11 pagesSC upholds private ownership of Biga-Communal-Goob roadElise Rozel DimaunahanPas encore d'évaluation

- Flextronics v. AliphCom Dba JawboneDocument8 pagesFlextronics v. AliphCom Dba JawboneAndrew NuscaPas encore d'évaluation

- Napocor Vs QuezonDocument26 pagesNapocor Vs QuezonGreg PascuaPas encore d'évaluation

- Practice Court II TrialDocument2 pagesPractice Court II TrialRossette AnasarioPas encore d'évaluation

- Highlights For August 2020: Supreme Court DecisionDocument6 pagesHighlights For August 2020: Supreme Court DecisionshakiraPas encore d'évaluation

- Steag State Power, Inc vs. Commissioner of Internal Revenue FactsDocument40 pagesSteag State Power, Inc vs. Commissioner of Internal Revenue FactsRyannDeLeonPas encore d'évaluation

- Zenaida D. Mendoza vs. HMS Credit Corporation, Et AlDocument11 pagesZenaida D. Mendoza vs. HMS Credit Corporation, Et AljafernandPas encore d'évaluation

- CIR vs FDC on Tax RulingsDocument18 pagesCIR vs FDC on Tax RulingsGabby ElardoPas encore d'évaluation

- Notes Contract To Sell vs. Contract of SaleDocument2 pagesNotes Contract To Sell vs. Contract of SalejunPas encore d'évaluation

- 3 - Rosete V LimDocument16 pages3 - Rosete V Limsitsee watchPas encore d'évaluation

- Tax Case DigestDocument1 pageTax Case DigestRamelo M. ToledoPas encore d'évaluation

- Sawadjaan V CADocument13 pagesSawadjaan V CAnia_artemis3414Pas encore d'évaluation

- Gutierrez V BarrettoDocument1 pageGutierrez V BarrettoSha ShaPas encore d'évaluation

- Insurance SyllabusDocument11 pagesInsurance SyllabusPaul SarangayaPas encore d'évaluation

- Important Provisions under RA 9139 on Alien Spouses and ChildrenDocument2 pagesImportant Provisions under RA 9139 on Alien Spouses and ChildrenMyn Mirafuentes Sta Ana0% (1)

- Application For Renovation PermitDocument3 pagesApplication For Renovation PermitsuremessyPas encore d'évaluation

- Citibank v. Sabeniano Case Rules on Similar Acts EvidenceDocument2 pagesCitibank v. Sabeniano Case Rules on Similar Acts EvidencelividPas encore d'évaluation

- Meralco Vs YatcoDocument4 pagesMeralco Vs YatcoArkhaye SalvatorePas encore d'évaluation

- Maralit Case DigestDocument1 pageMaralit Case DigestKim Andaya-YapPas encore d'évaluation

- Conflict of LawsDocument4 pagesConflict of LawsRufino Gerard MorenoPas encore d'évaluation

- Adrid Vs Morga 1960 FactsDocument1 pageAdrid Vs Morga 1960 FactsEunice SerneoPas encore d'évaluation

- G, Upreme Qeourt: Second DivisionDocument12 pagesG, Upreme Qeourt: Second Divisionmarvinnino888Pas encore d'évaluation

- Byblgg: Itinerary ReceiptDocument4 pagesByblgg: Itinerary Receiptcherry lyn calama-anPas encore d'évaluation

- Versus-: Republic of The Philippines 11 Judicial Region Branch - CityDocument2 pagesVersus-: Republic of The Philippines 11 Judicial Region Branch - CityRob ClosasPas encore d'évaluation

- 13) DEUTCHE KNOWLEDGE Vs CIR - J Perlas - BernabeDocument3 pages13) DEUTCHE KNOWLEDGE Vs CIR - J Perlas - BernabejdonPas encore d'évaluation

- Gallego Rule 93and94Document9 pagesGallego Rule 93and94Charlotte GallegoPas encore d'évaluation

- Memorandum of AgreementDocument2 pagesMemorandum of AgreementRodel Amante MedicoPas encore d'évaluation

- VAT Law - Pre-BarDocument37 pagesVAT Law - Pre-BarKennedy AbarcaPas encore d'évaluation

- Legaspi V CADocument7 pagesLegaspi V CAElizabeth LotillaPas encore d'évaluation

- ECC Application Form GuideDocument1 pageECC Application Form GuideJec GaguaPas encore d'évaluation

- Supreme Court Rules on Taxation of Airlines Under FranchiseDocument18 pagesSupreme Court Rules on Taxation of Airlines Under Franchisemceline19Pas encore d'évaluation

- Consuelo Metal Corporation vs. Planters Development BankDocument11 pagesConsuelo Metal Corporation vs. Planters Development BankJeliSantosPas encore d'évaluation

- Roger Weliner v. CirDocument1 pageRoger Weliner v. CirChiiPas encore d'évaluation

- Team Pacific Vs DazaDocument2 pagesTeam Pacific Vs Dazaroquesa burayPas encore d'évaluation

- Indophil Textile Mills v. Adviento G.R. No. 171212Document7 pagesIndophil Textile Mills v. Adviento G.R. No. 171212Elijah AramburoPas encore d'évaluation

- Development Bank of The Philippines v. COA (G.R. No. 247787)Document13 pagesDevelopment Bank of The Philippines v. COA (G.R. No. 247787)mjPas encore d'évaluation

- CIR v. Fisher ADocument30 pagesCIR v. Fisher ACE SherPas encore d'évaluation

- Union Bank of The Philippines vs. Alain JuniatDocument1 pageUnion Bank of The Philippines vs. Alain JuniatqwertyPas encore d'évaluation

- 39 DE LEON Vs PeaDocument2 pages39 DE LEON Vs PeaCeresjudicataPas encore d'évaluation

- 544 - Vda. de Ampil v. AlvendiaDocument1 page544 - Vda. de Ampil v. AlvendiaAiken Alagban LadinesPas encore d'évaluation

- PP Vs VirgilioDocument3 pagesPP Vs Virgiliokrizia marie floresPas encore d'évaluation

- 17Document4 pages17Mariel Joyce PortilloPas encore d'évaluation

- BSP V Legaspi Gr205966Document2 pagesBSP V Legaspi Gr205966Adi LimPas encore d'évaluation

- Procter & Gamble Asia PTE LTD., Petitioner vs. Commissioner of Internal Revenue (CIR)Document2 pagesProcter & Gamble Asia PTE LTD., Petitioner vs. Commissioner of Internal Revenue (CIR)Cessy Ciar KimPas encore d'évaluation

- Mactan v. LozadaDocument1 pageMactan v. Lozadagrego centillasPas encore d'évaluation

- Supreme Court Rules Muntinlupa City Ordinance Imposing 3% Tax on Alcohol, Tobacco Sales InvalidDocument8 pagesSupreme Court Rules Muntinlupa City Ordinance Imposing 3% Tax on Alcohol, Tobacco Sales InvalidPaul Joshua SubaPas encore d'évaluation

- Property Sale Dispute DecidedDocument2 pagesProperty Sale Dispute DecidedChrissa MagatPas encore d'évaluation

- Jacob vs. CA - 224 S 189Document2 pagesJacob vs. CA - 224 S 189Zesyl Avigail FranciscoPas encore d'évaluation

- Loan Agreement for Land CultivationDocument2 pagesLoan Agreement for Land CultivationAlbert Remollo JrPas encore d'évaluation

- Taxation Law Review Final ExamDocument5 pagesTaxation Law Review Final ExamJasperAllenBarrientosPas encore d'évaluation

- Court rules no lease contract formedDocument2 pagesCourt rules no lease contract formedCrazy MehPas encore d'évaluation

- BAR E&AMINATION 2004 TAXATIONDocument8 pagesBAR E&AMINATION 2004 TAXATIONbubblingbrookPas encore d'évaluation

- Final Income Taxation,: As Amended by Train LawDocument29 pagesFinal Income Taxation,: As Amended by Train LawElle Vernez100% (1)

- Passive IncomeDocument5 pagesPassive IncomeRandom VidsPas encore d'évaluation

- Tax Rates - SPSPS ReviewDocument10 pagesTax Rates - SPSPS ReviewKenneth Bryan Tegerero TegioPas encore d'évaluation

- Chapter 2.1 - Income Subject To Final TaxDocument30 pagesChapter 2.1 - Income Subject To Final Taxjudel ArielPas encore d'évaluation

- The Law On Alternative Dispute Resolution: Private Justice in The PhilippinesDocument13 pagesThe Law On Alternative Dispute Resolution: Private Justice in The PhilippinesJane Garcia-Comilang94% (18)

- Alternative Dispute Resolution Provisions PDFDocument13 pagesAlternative Dispute Resolution Provisions PDFwilliam091090Pas encore d'évaluation

- Taxation LawDocument191 pagesTaxation LawHarvy Brian Hao ValenciaPas encore d'évaluation

- Annexes Part 3.printableDocument1 pageAnnexes Part 3.printablewilliam091090Pas encore d'évaluation

- Enterobacter CloacaeDocument7 pagesEnterobacter Cloacaewilliam091090Pas encore d'évaluation

- Annexes Part 2.printable PDFDocument11 pagesAnnexes Part 2.printable PDFwilliam091090Pas encore d'évaluation

- The Law On Alternative Dispute Resolution: Private Justice in The PhilippinesDocument13 pagesThe Law On Alternative Dispute Resolution: Private Justice in The PhilippinesJane Garcia-Comilang94% (18)

- Enterobacter CloacaeDocument7 pagesEnterobacter Cloacaewilliam091090Pas encore d'évaluation

- History of The PhilippinesDocument13 pagesHistory of The Philippineswilliam091090Pas encore d'évaluation

- Enterobacter CloacaeDocument7 pagesEnterobacter Cloacaewilliam091090Pas encore d'évaluation

- Salient Features of Gsis and Sss LawDocument8 pagesSalient Features of Gsis and Sss LawIvan Montealegre Conchas0% (1)

- Criminal Law (Arts. 1-237)Document124 pagesCriminal Law (Arts. 1-237)MiGay Tan-Pelaez94% (18)

- Labor ReviewerDocument83 pagesLabor ReviewerChristian Francis Valdez DumaguingPas encore d'évaluation

- Requirements For RegistrationDocument2 pagesRequirements For Registrationjusang16Pas encore d'évaluation

- Alternative Dispute Resolution Provisions PDFDocument13 pagesAlternative Dispute Resolution Provisions PDFwilliam091090Pas encore d'évaluation

- The Law On Alternative Dispute Resolution: Private Justice in The PhilippinesDocument13 pagesThe Law On Alternative Dispute Resolution: Private Justice in The PhilippinesJane Garcia-Comilang94% (18)

- Alternative Dispute Resolution Provisions PDFDocument13 pagesAlternative Dispute Resolution Provisions PDFwilliam091090Pas encore d'évaluation

- 3 Income Taxation Final PDFDocument109 pages3 Income Taxation Final PDFwilliam0910900% (1)

- Mauricio Ulep Vs The Legal ClinicDocument3 pagesMauricio Ulep Vs The Legal Clinicwilliam091090Pas encore d'évaluation

- Supreme Court resolves complaint against justicesDocument11 pagesSupreme Court resolves complaint against justiceswilliam091090Pas encore d'évaluation

- Fundamental Distinctions Among TenancyDocument8 pagesFundamental Distinctions Among Tenancywilliam091090Pas encore d'évaluation

- Foreign LiteratureDocument6 pagesForeign Literaturewilliam091090Pas encore d'évaluation

- Blue Cross V Olivares GDocument12 pagesBlue Cross V Olivares Gwilliam091090Pas encore d'évaluation

- Cases On CreditDocument71 pagesCases On Creditwilliam091090Pas encore d'évaluation

- People Vs AbarcaDocument2 pagesPeople Vs Abarcawilliam091090Pas encore d'évaluation

- Nil 1Document78 pagesNil 1william091090Pas encore d'évaluation

- Chattel MortgageDocument11 pagesChattel Mortgagewilliam091090Pas encore d'évaluation

- Chattel MortgageDocument11 pagesChattel Mortgagewilliam091090Pas encore d'évaluation

- Cases On CreditDocument71 pagesCases On Creditwilliam091090Pas encore d'évaluation

- Company accounts underwriting shares debenturesDocument7 pagesCompany accounts underwriting shares debenturesSakshi chauhanPas encore d'évaluation

- World Bank Review Global AsiaDocument5 pagesWorld Bank Review Global AsiaRadhakrishnanPas encore d'évaluation

- What Does Fedex Deliver?Document17 pagesWhat Does Fedex Deliver?duckythiefPas encore d'évaluation

- Ecotourism Visitor Management Framework AssessmentDocument15 pagesEcotourism Visitor Management Framework AssessmentFranco JocsonPas encore d'évaluation

- AMULDocument27 pagesAMULSewanti DharPas encore d'évaluation

- Foreign Employment and Remittance in NepalDocument19 pagesForeign Employment and Remittance in Nepalsecondarydomainak6Pas encore d'évaluation

- How High Would My Net-Worth Have To Be. - QuoraDocument1 pageHow High Would My Net-Worth Have To Be. - QuoraEdward FrazerPas encore d'évaluation

- Soft Power by Joseph S NyeDocument19 pagesSoft Power by Joseph S NyemohsinshayanPas encore d'évaluation

- Income from House PropertyDocument5 pagesIncome from House PropertyKaustubh BasuPas encore d'évaluation

- Crop Insurance - BrazilDocument3 pagesCrop Insurance - Brazilanandekka84Pas encore d'évaluation

- Final DraftDocument47 pagesFinal Draftjaspal lohiaPas encore d'évaluation

- CMATking Innovation 35 Must Do Questions On CMAT NTA NET Innovation and Entrepreneurship ManagementDocument10 pagesCMATking Innovation 35 Must Do Questions On CMAT NTA NET Innovation and Entrepreneurship ManagementCharusat UniversityPas encore d'évaluation

- HR McqsDocument12 pagesHR McqsHammadPas encore d'évaluation

- RD Sharma Cbse Class 11 Business Studies Sample Paper 2014 1Document3 pagesRD Sharma Cbse Class 11 Business Studies Sample Paper 2014 1praveensharma61Pas encore d'évaluation

- Frame6 UserNetworks p2-30Document29 pagesFrame6 UserNetworks p2-30jasonPas encore d'évaluation

- Forest Restoration and Rehabilitation in PHDocument45 pagesForest Restoration and Rehabilitation in PHakosiwillyPas encore d'évaluation

- EdpDocument163 pagesEdpCelina SomaPas encore d'évaluation

- SEC Application of Perkins Coie TWB Investment Partnerships SEC 2008Document6 pagesSEC Application of Perkins Coie TWB Investment Partnerships SEC 2008Beverly TranPas encore d'évaluation

- (Nielsen) Macroeconomy - FMCG Q2 2021 For UNZADocument37 pages(Nielsen) Macroeconomy - FMCG Q2 2021 For UNZAalibasukiPas encore d'évaluation

- SEMINAR KERJA PRAKTIK EVALUATES CDU FURNACESDocument41 pagesSEMINAR KERJA PRAKTIK EVALUATES CDU FURNACESMuhammad AswanPas encore d'évaluation

- Humss 125 Week 1 20 by Ramon 2Document240 pagesHumss 125 Week 1 20 by Ramon 2Francis Esperanza88% (17)

- Hong, P. and Kwon, H.B., 2012. Emerging Issues of Procurement Management A Review and Prospect. International Journal of Procurement Management 4, 5 (4), pp.452-469.Document19 pagesHong, P. and Kwon, H.B., 2012. Emerging Issues of Procurement Management A Review and Prospect. International Journal of Procurement Management 4, 5 (4), pp.452-469.Anonymous BJNqtknPas encore d'évaluation

- Unit 6 Mutual FundDocument46 pagesUnit 6 Mutual Fundpadmakar_rajPas encore d'évaluation

- Renewal Premium Receipt - NON ULIP: Life Assured: Mr. Vinodkumar Sheth Assignee: N.A. Policy DetailsDocument1 pageRenewal Premium Receipt - NON ULIP: Life Assured: Mr. Vinodkumar Sheth Assignee: N.A. Policy DetailsVinodkumar ShethPas encore d'évaluation

- KarachiDocument2 pagesKarachiBaran ShafqatPas encore d'évaluation

- Indonesian Railways Law and StudyDocument108 pagesIndonesian Railways Law and StudyGonald PerezPas encore d'évaluation

- Blackout 30Document4 pagesBlackout 30amitv091Pas encore d'évaluation

- Packaged Tea Leaves Market ShareDocument22 pagesPackaged Tea Leaves Market ShareKadambariPas encore d'évaluation

- Aditya Birla Sun Life Insurance SecurePlus Plan Sales IllustrationDocument7 pagesAditya Birla Sun Life Insurance SecurePlus Plan Sales Illustrationkunjal mistryPas encore d'évaluation

- Blue and Gray Modern Marketing Budget PresentationDocument14 pagesBlue and Gray Modern Marketing Budget PresentationPPTI 40 I Gede Arinata KP.Pas encore d'évaluation